$100M ARR pls.

Elon's OpenAI bid, Anduril, Deel, Glean, Semgrep, MagicSchool AI, XOi, Jump, Pendulum, X-energy

Today’s Sourcery is brought to you by Archer..

Learn more about how Archer is set to open a new world of opportunity for passengers by providing safe and efficient access to people, places, and events across the communities they live at archer.com

Hello from a cold NYC

Turns out when you go to Miami for two weeks you fail to pack accordingly for 20 degrees and snow. brr.

Anyways, deal flow is seemingly active & pretty interesting.. highlights include rumors around Anduril’s $2.5B round, Deel’s mega $300M secondary, StackAdapt’s $235M round for programmatic advertising, XOi’s $230M for field service tech, and X-energy’s $200M for modular nuclear reactors.

More tech-oriented M&A is surging, versus the standard inflow of boring middle market businesses, featuring Stripe’s completed $1.1B acquisition of Bridge, deals from Coinbase, Databricks, Teladoc, Rhino and more. Meanwhile IPOs might be gaining momentum with SailPoint (identity security) targeting $1.1B and some others.

Lastly, huge congrats to Sarah Guo’s Conviction Partners on their announcement for her new $230M second fund.. highly recommend her pod with Elad Gil, No Priors.

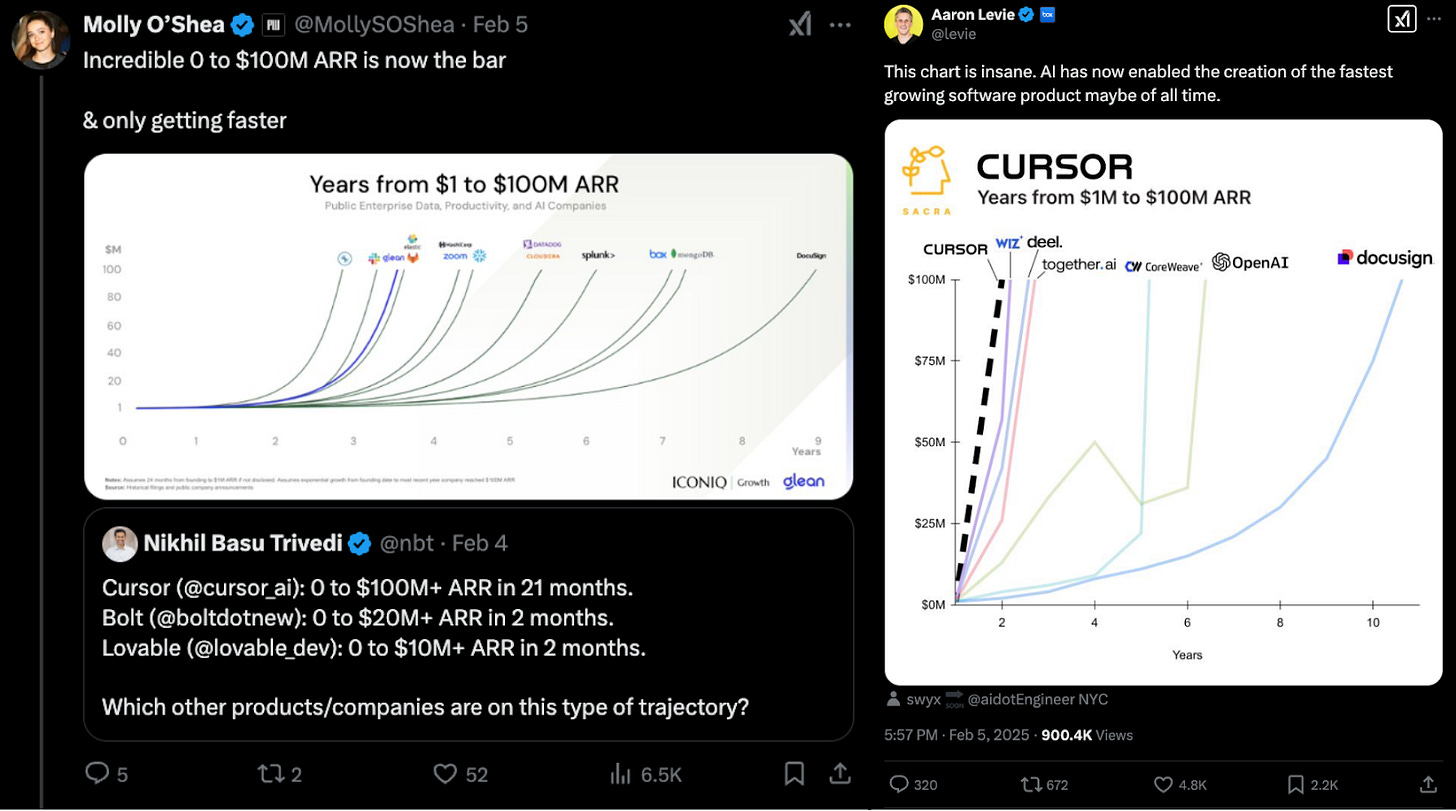

Race to $100M ARR

The goal posts have been moved. The first to get to $100M ARR in 1 month with 3 employees will win..

Last week Cursor, Deel, and Glean reenergized the X timeline with a spoonful of pure tech SaaS ARR Founder Mode energy. AI-driven products, marketing, and teams are collectively proving to hit an inflection point in this once-shaky AI economy, moving up standard expectations of growth to rapid, hyper-conversion.. and this might just change the game for VC strategies. If you’re not embracing AI in your tech & ops stacks, you’re left in the dust. Must find cracked AI-driven teams early.

Musings

Los Angeles Update

Rick Caruso launches foundation to help rebuild L.A. after wildfires

Donate → The LA Tech Community Cares Fund

Supported by Wonder Ventures / Bonfire Ventures / MaC Venture Capital / Upfront / Greycroft / HMC INC / TCG +many more

Macro

Leaving Delaware: why companies are considering reincorporating from Delaware to Nevada & Texas [Elad Gil]

Plaid working with Goldman Sachs on raising $300M to $400M in tender offer [TechCrunch]

Andreessen Horowitz just hired Daniel Penny [Fortune]

AI

AI Impact Curves [Tomasz Tunguz] + Google's Future in Search & AI [Tomasz Tunguz]

Elon Musk reportedly offers $97.4B for OpenAI, Sam Altman says 'no thank you' [Yahoo! Finance]

AI startups drive VC funding resurgence, capturing record US investment in 2024 [Reuters]

Aramco, Armada, & Microsoft Collaborate to Deploy World’s First Industrial Distributed Cloud [Armada]

Hard Tech

Founders Fund in talks to back defense firm Anduril at $28 billion valuation, sources say [Reuters]

Expected to be as much as $2.5 billion, according to the sources. The round would come only months after its last raise of $1.5 billion at a $14 billion valuation in August.

El Segundo’s Discipulus Ventures is back for their Spring Cohort - Learn more & apply

Top Interviews

Dan Wright, CEO Armada | Trae Stephens Next Big Bet

Who Will Win the AI Race? | Emergence Capital

Tomasz Tunguz, Theory Ventures | Trillion Dollar AI Opportunity, OpenAI v Hyperscalers, Inference, Energy, Product Testing

Last Week (2/3-2/7):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, IPOs, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC Deals include:

Semgrep, MagicSchool AI, XOi, Jump, Pendulum, X-energy

Acquisitions & PE

Deel, Coinbase/Spindl, Stripe/Bridge, Databricks/BladeBridge, Teladoc/Catapult Health, Rhino/Jetty

Funds

Conviction Partners, Cherry Ventures, GTM Fund

Final Numbers

The $16B LinkedInfluence

VC Deals

Fintech:

- Jump, a Salt Lake City-based AI solutions provider for financial advisors, raised $20 million in Series A funding. Battery Ventures led the round and was joined by Citi Ventures and existing investors Sorenson Capital and Pelion Venture Partners.

- Model ML, a New York City-based AI-automated financial research and due diligence platform, raised $12 million in funding. Y Combinator and LocalGlobe led the round and were joined by angel investors.

- Prior Labs, a German developer of foundation models for spreadsheets and databases, raised €9m in pre-seed funding. Balderton Capital led, and was joined by XTX Ventures, Hector Foundation, Atlantic Labs, and Galion.exe.

- Tandem, a startup that leases excess office space, raised $6.1m in seed funding from Collide Capital, 1984 Ventures, and YC.

- Rho Labs, a London-based crypto rates exchange, raised $4 million in seed funding. CoinFund led the round and was joined by Auros, Flow Traders, existing investor Speedinvest, and others.

Care:

- Berry Street, a New York City-based dietary counseling platform, raised $50 million in funding from Northzone, Sofina, FJ Labs, and angel investors.

- Fay, a SF-based digital nutritional therapy company, raised $50m in Series B funding at a $500m valuation. Goldman Sachs led, and was joined by insiders General Catalyst and Forerunner.

- Lynx, a Boston-based healthcare payments platform, raised $27 million in Series A funding. Flare Capital Partners led the round and was joined by CVS Health Ventures, McKesson Ventures, and existing investors .406 Ventures, Obvious Ventures, and Frist Cressey Ventures.

- Little Otter, a SF-based provider of pediatric mental health services, raised $9.5m from Pivotal Ventures, Torch Capital, Springbank, CRV, Next Legacy, G9, Gratitude Railroad, and Fiore Ventures.

- Miist Therapeutics, an Alameda, Calif.-based inhaled therapies developer for smoking addiction and migraines, raised $7 million in seed funding from Refactor Capital, 1517 Fund, Freeflow Ventures, and others.

- PinkDx, a Daly City, Calif.-based developer of women's health tests, raised $5m in Series A extension funding from Blue Venture Fund, Sandbox Clinical Ventures, and BEVC.

- TaxGPT, a San Francisco-based AI-powered accounting co-pilot, raised $4.6 million in seed funding from Rebel Fund, Mangusta Capital, Y Combinator, angel investors, and others.

- SimpliFed, an Ithaca, N.Y., virtual maternal care provider, raised $4m. Morningside led, and was joined by Artemis Fund, Cultivation Capital, American Heart Association Ventures, The Venture Collective, Empire State Development, and Waterline Ventures.

- Solstice Health, a New York City-based AI-powered marketing engine for life sciences, raised $3.5 million in seed funding from Twelve Below and Virtue.

Enterprise/Consumer:

- StackAdapt, a Toronto-based programmatic advertising company, raised $235 million in funding. Teachers’ Venture Growth led the round and was joined by Intrepid Growth Partners and others.

- Semgrep, a San Francisco-based application security platform, raised $100 million in Series D funding. Menlo Ventures led the round and was joined by existing investors Felicis Ventures, Harpoon Ventures, Lightspeed Venture Partners, and others.

- MagicSchool AI, a Denver-based education generative AI platform, raised $45 million in Series B funding. Valor Equity Partners led the round and was joined by Atreides Management, Smash Capital, and existing investors Bain Capital Ventures and Adobe Ventures.

- 7AI, a Boston-based agentic cybersecurity platform, raised $36 million in seed funding from Greylock Partners, Spark Capital, and CRV.

- Archive, a San Francisco-based resale services provider, raised $30 million in Series B funding. Energize Capital led the round and was joined by Woodline Partners, Frontline Growth, and existing investors Lightspeed Venture Partners, Bain Capital Ventures, G9 Ventures, and Capital F.

- Riot, a San Francisco-based employee cybersecurity platform, raised $30 million in Series B funding. Left Lane Capital led the round and was joined by existing investors Y Combinator, Base10, and FundersClub.

- Lula, an Overland Park, Kan.-based property maintenance solutions platform, raised $28 million in Series A funding. PeakSpan Capital led the round and was joined by existing investor RET Ventures.

- tvScientific, an El Segundo, Calif.-based ad tech startup, raised $25.5m in Series B funding. NewRoad Capital Partners led, and was joined by Roku, Second Alpha Partners, Norwest Venture Partners, S4S Ventures, and Progress Ventures.

- TrueFoundry, a San Francisco-based AI deployment and scalability solutions platform, raised $19 million in Series A funding. Intel Capital led the round and was joined by Jump Capital, existing investors Eniac Ventures and Peak XV’s Surge, and angel investors.

- Cognida.ai, a Lincolnshire, Ill.-based AI adoption solutions provider for enterprises, raised $15 million in Series A funding from Nexus Venture Partners.

- Ivo, a San Francisco-based AI-powered contract review platform, raised $16 million in Series A funding. Costanoa Ventures led the round and was joined by NFDG, Blackbird VC, and existing investors Fika Ventures, Uncork Capital, GD1, and Phase One Ventures.

- Tana, an embedded workspace platform, raised $14m in Series A funding. Tola Capital led, and was joined by Lightspeed Venture Partners, Northzone, Alliance VC, and firstminute capital.

- Beamable, a Boston-based open game server platform, raised $13.5 million in Series A funding. BITKRAFT Ventures led the round and was joined by Arca, Advancit Capital, 2Punks, and others.

- qeen.ai, a Dubai, UAE-based e-commerce AI agents platform, raised $10 million in seed funding. Prosus Ventures led the round and was joined by existing investors Wamda Capital, 10x Founders, and Dara Holdings.

- Lorikeet, a Sydney-based AI-powered customer support platform, raised $9 million in funding from Blackbird and existing investors Square Peg and Skip Capital.

- Largo.ai, an analytics platform for the entertainment and ad industries, raised $7.5m in Series A funding. TI Capital and QBIT Capital co-led, and were joined by DAA Capital, Atreides Management, Thomas Tippl, and Sylvester Stallone.

- &AI, a San Francisco-based AI agent developer for patent attorneys, raised $6.5 million in seed funding. First Round led the round and was joined by Y Combinator, SV Angel, BoxGroup, and angel investors.

- Warmly, a San Francisco-based AI-powered revenue orchestration platform, raised $6 million in Series A+ funding. RTP Global led the round and was joined by existing investors Felicis, NFX, and others.

- DevAI, a Palo Alto-based AI agents developer for enterprise IT, raised $6 million in seed funding. Emergence Capital led the round and was joined by Base10, Benchstrength, and existing investor Pear VC.