17x Midas List VC Navin Chaddha on The 100x AI Opportunity

$3B+ in AUM, 120 IPOs, 225+ M&A

17x Midas List Investor

Navin Chaddha, Managing Partner of Mayfield, has guided 80+ companies to positive outcomes, of which he has invested in 60+ companies, resulting in 18 IPOs & 27 acquisitions. Creating $120B+ in equity value & over 40,000 jobs.

Navin has been named to the Forbes Midas List 17 times (Top 5 in 2020, 2022, 2023, 2024), becoming one of the most respected voices in venture capital.

Stats: Mayfield has $3B+ in AUM, 120 IPOs, 225+ M&A

Of particular note. In the competitive race to $0-$100M in revenue, one of Navin’s companies hit $0-$3 Billion (!!) in rev in 14 months. He breaks this down, as well as the types of companies that are blitzscaling to the nth degree.

→ Listen on X, YouTube, Spotify, Apple

We dive into:

Why AI is a 100x opportunity vs. past tech shifts

Unpacking the $0-$100M revenue benchmark

The “Vibe” era of technology

The collaborative intelligence stack from semiconductors to AI teammates

The difference between real vs. vibe revenue

Valuations, hype cycles, & Mayfield’s investment philosophy

5 Key Takeaways

AI is a 100x wave – Unlike the PC, web, cloud, or mobile eras, AI combines conversational interfaces & reasoning/action, unlocking a truly global expansion of creators

Collaborative intelligence is the future – Humans + AI “teammates” will create a $3–6T market opportunity by augmenting knowledge workers

Valuations are overheated – Billion-dollar seed rounds are unsustainable; Mayfield stays disciplined by aligning on founder–VC win-wins

Revenue quality matters – Durable businesses need real customers, high margins, & repeatability; “vibe revenue” isn’t enough

Entrepreneur traits beat ideas – Authenticity, teamwork, EQ, mission-orientation, & persistence are the most reliable signals for long-term success

Timestamps

(00:00) Navin’s 17x Midas List Journey

(02:06) What It Takes to Build a Winning Company

(03:00) Why AI Is a 100x Opportunity

(04:00) Conversational Interfaces & Machines That Act

(06:35) The Rise of the “Vibe Era”

(06:53) AI Supercycle: Early Days, High Valuations

(09:23) Billion-Dollar Seed Rounds & Valuation Concerns

(10:45) Mayfield’s Investment Philosophy & Win-Win Model

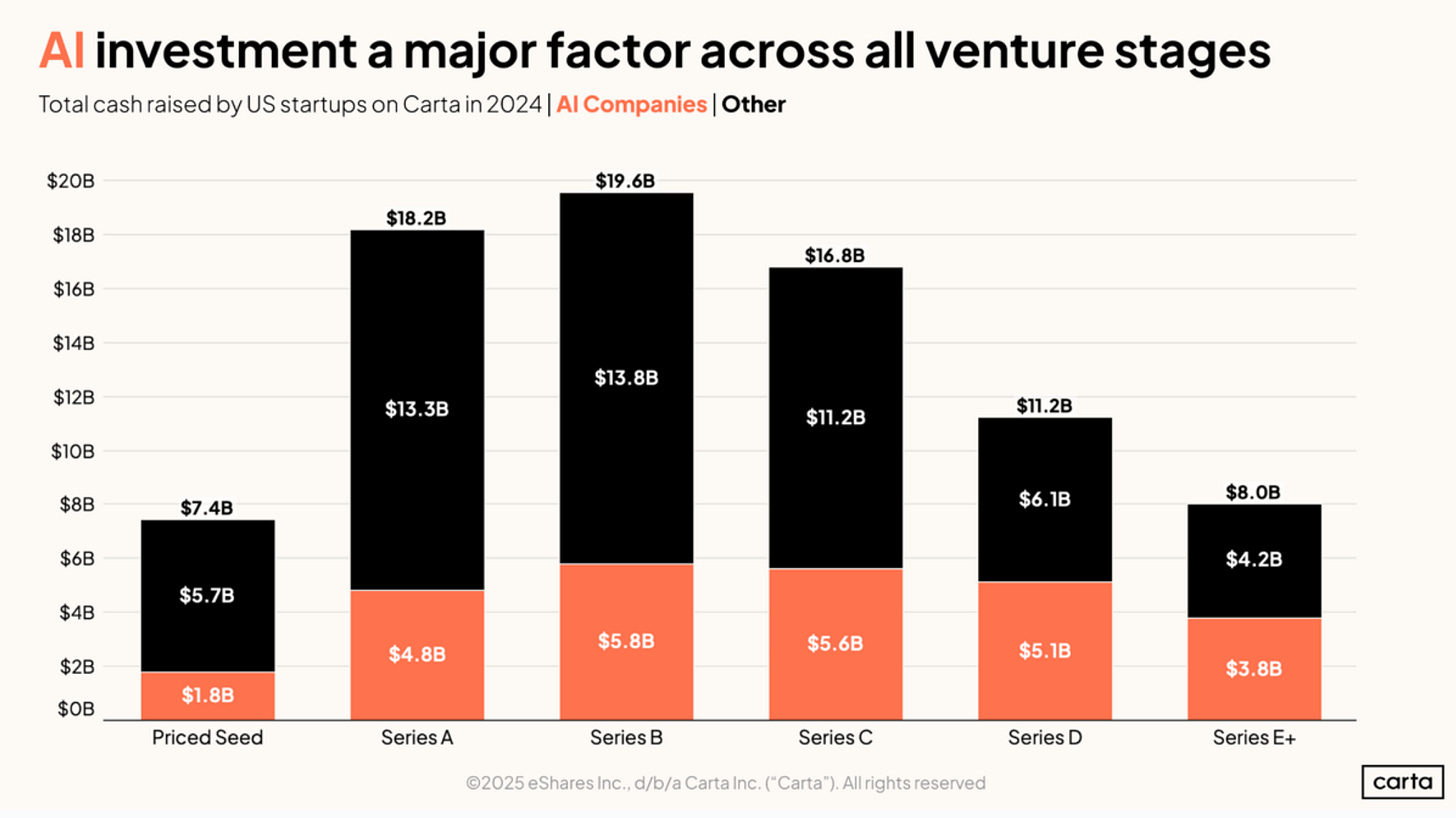

(13:42) AI Premiums in Fundraising (Carta & NVCA Data)

(18:06) Building the Collaborative Intelligence Stack

(20:40) Where Value Accrues Across Hardware, Models, Apps

(22:50) Business Models: Subscription → Consumption Based

(24:19) The Race to $100M Revenue: Hardware, Labs, Agents

(31:47) Real vs. Vibe Revenue (Margins, Repeatability)

(39:08) Founder Traits: Authenticity, EQ, Team Orientation

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit: carta.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Mayfield’s Track Record

Mayfield has been an early-stage venture capital firm for more than 50 years, with a strong track record across enterprise, consumer, semiconductors, & now AI. Some of their most notable investments include:

Enterprise & Infrastructure

HashiCorp – cloud infrastructure automation, IPO in 2021.

Couchbase – NoSQL database, IPO in 2021.

Marketo - SaaS marketing automation, IPO in 2013, Acq by Vista

ServiceMax - SaaS field service platform, acquired by GE Digital

CloudGenix - SD-WAN solution, acquired by Palo Alto Networks

Consumer & Marketplaces

Lyft – ride-sharing, IPO in 2019.

Poshmark – social commerce marketplace, IPO in 2021.

Atari - Interactive entertainment, acquired by Infogames

Frontier Tech

Amgen - Fortune 500 biotechnology pioneer, IPO in 1983

Genentech - Biotech, IPO in 1980

Mammoth Biosciences – CRISPR-based diagnostics

SolarCity – solar energy company, acquired by Tesla.

Semiconductors & Hardware

Nuvia – semiconductor company acquired by Qualcomm for $1.4B.

Funding data: Carta x Sourcery

Mayfield x Divot AI List:

The Mayfield | Divot AI List recognizes rising stars and emerging leaders shaping the future of AI. The honorees include innovators, builders, researchers, founders, policy makers, & media voices who are laying the foundation for what comes next in AI. Together, they represent the next generation of leaders driving progress in AI today & beyond.

The AI revolution is the great equalizer. You don’t need the biggest title or deepest pockets. Just vision, grit, and the courage to build.

Today, I’m proud to share the inaugural Mayfield | Divot AI List honorees with Derek Andersen, Co-founder and CEO of Startup Grind. (Navin)

We received incredible nominations from across the globe and are humbled by the enthusiasm and support for this initiative.

The honorees are emerging leaders expanding the AI frontier from:

Academic research labs pushing the boundaries of what’s possible

Early-stage startups solving real problems with AI

Industry builders making AI work at scale

Policy circles shaping how we govern this technology

Storytellers educating the world about AI’s impact

Their work proves something important — the next wave of AI leadership will look very different from the last.

And that’s exactly what the world needs. At Mayfield, we are People-First and believe investing is about relationships, not transactions. This list isn’t just recognition, it’s an invitation to build something meaningful together. It’s the beginning of a community that will shape the next decade of artificial intelligence.

View the full list here.