Apple in China: The Capture of the World's Greatest Company

Author, Patrick McGee

How China Captured Apple.

Patrick McGee, author of the infamous Apple in China: The Capture of the World’s Greatest Company, joins Sourcery to unpack how Apple went from being days away from bankruptcy to investing an estimated $800+ billion in China since the iPhone launched.

In just 20min, Author Patrick McGee covers the most dramatic learnings from his time studying Tim Cook's most critical business decision.

→ Listen on X, Spotify, YouTube, Apple

In a vital moment for Apple and under Tim Cook’s leadership, Apple pledged $275 billion over five years to China — larger than the U.S. CHIPS Act and equal to two Marshall Plans. Compounding over time, this figure is estimated to reach almost a trillion dollars in investment to date. And growing.

This strategy created the world’s most advanced supply chain, but also left Apple geopolitically dependent on America’s biggest rival.

McGee argues: this is not Apple exploiting China, but China exploiting Apple.

7 key quotes below!

Relevant Resources

China, China, China. Breaking Down China’s Tech Surge | BG2 w/ Bill Gurley & Brad Gerstner

This conversation is part of Sourcery’s “Made in America” Mini-Series recorded at the Reindustrialize 2025 Summit.

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

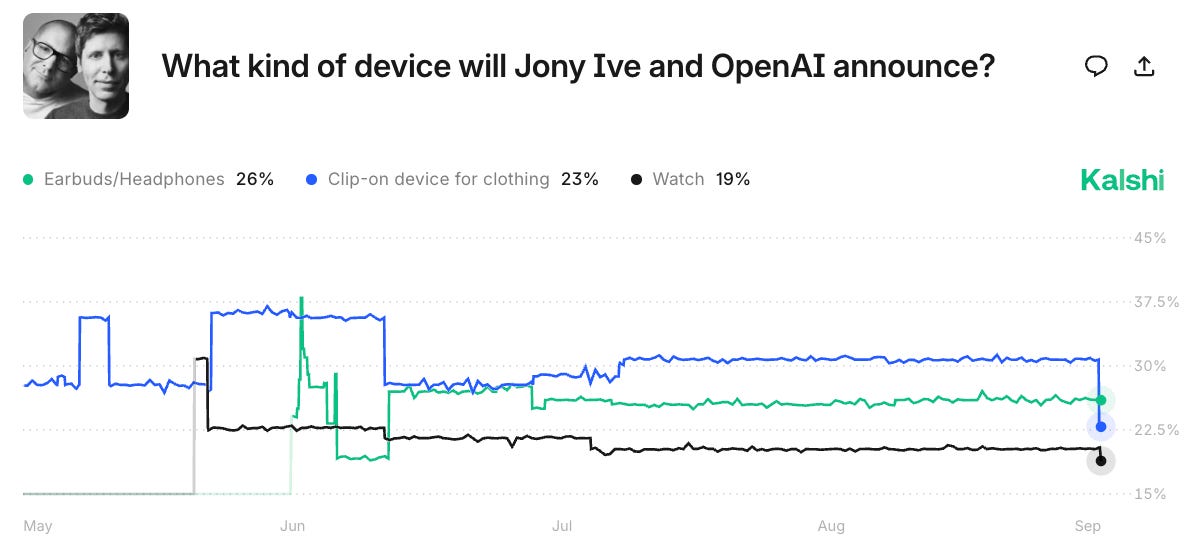

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Fourthwall—The #1 way to sell merch online — Fourthwall is the easiest way to launch a fully branded merch store—used by big brands like MKBHD, Acquired, & even the Smithsonian. 100+ products. No upfront cost.

Timestamps

(00:00) Tim Cook’s Supply Chain Blind Spot

(02:15) Apple’s Wake-Up Call

(04:30) The $275B Pledge to China

(08:00) Why Apple Moved

(10:15) Training Millions: Apple Builds China’s Workforce

(13:00) Inside Foxconn: Harsh Realities of Production

(17:00) How Apple Helped Create Its Rivals

(18:30) Chess vs. Go: Apple’s Capture Explained

(21:00) Can Ive & Altman Compete Outside China?

(23:30) Apple’s Future: Over $800B Invested, No Exit

7 Key Quotes from Patrick McGee

Being sympathetic to Apple’s early choices

“To be fair, I’m actually pretty sympathetic to why Apple is manufacturing in China at all, and why they get squeezed in the early 2010s and make those decisions. I like to say about my book that there’s no villains in the book. If it’s an indictment of anything, it’s of shareholder-first capitalism, a paradigm that goes back to Milton Friedman in the 1970s — the idea that what a business is meant to do is to make profits.

In the early 2000s when China entered the World Trade Organization, it was not just bipartisan consensus, it was the American worldview that it was perfectly okay to send your manufacturing abroad because by having that sort of trade, you were building this integrationist world where we were all working together.”

Apple’s massive financial commitments to China

“Tim Cook goes to Zhongnanhai — the White House of China — to demonstrate Apple’s impact. And then they multiply that number by five: $275 billion. They say that’s how much we’ll invest over the next five years. Those numbers are so staggeringly large that I compare them to the CHIPS Act, which is $52 billion over four years. Apple is spending a CHIPS Act per year. It’s like pledging two Marshall Plans to China.”

Tim “Mr. Spreadsheet” Cook

“Tim Cook is known as Mr. Spreadsheet. The first time he really took over a meeting that usually spent two hours going through the weekly data, it went for thirteen hours. He just had this insatiable demand for detail. He taught that to all of his underlings. When Cook arrived in 1998, not everybody on his team had glasses. Within a few years, everybody had glasses because they were going through larger sheets of paper, going through a myriad of Excel sheets of supply and demand, not just for products but intricate components.

There’s a thousand components in the iPhone, and they would be going through all of this to master the global supply chain.”

Apple training China’s workforce

“What attracted Apple to move to China in the 2000s was not tech competence — it was abundant labor, the cost of that labor, and an industrial policy welcoming to foreign investment.

Apple’s solution wasn’t to wait for them to get better. It was: why don’t we send planeloads of engineers to dozens, then hundreds of factories, to train all these people to get to our level? That’s how they got China up to speed.”

Foxconn working conditions

“You’re not allowed to speak, you’re not allowed to smile. You often have nine to eleven seconds to perform your task, and it’s grueling work — twelve hours a day, six days a week.

After the Foxconn suicides in 2010, the company’s response was to build nets around the factories and ask workers to sign pledges that they wouldn’t commit suicide.”

Apple creating its competitors

“People often say Apple killed Nokia, but Apple was never big enough. The iPhone has never been more than 20% of the global market.

It was the Chinese competitors that killed Nokia — Huawei, Xiaomi, Oppo, Vivo — and they did it with the ecosystem Apple built for them. Apple trained its suppliers, and those suppliers trained China.”

Apple being ‘captured’

“My subtitle is that Apple’s captured. They don’t have any great moves. We play chess in the West — decisive moves to knock over the king.

The Chinese play Go — encircle your opponent until they have no options. That’s where Apple is now. They can’t move to India, they can’t move to the U.S. Their plants are encircled by competitors they themselves created.”

Question for OpenAI’s Device: Manufacture in China or an Allied Nation?

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery