Atlassian Acquires 'The Browser Company of New York' for $610M

Thrive Capital + Why are bowsers so hot rn?!

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Atlassian Acquires The Browser Company of New York:

A Defining Moment in the AI M&A Boom

If the first half of 2025 has proven anything, it’s that startup M&A is back in full force. Crunchbase data shows more than $100 billion worth of startup acquisitions closed in H1, a 155% increase over last year. High-profile moves like Google’s $32 billion deal for Wiz and OpenAI’s $6.5 billion acquisition of Jony Ive–backed Io have set the tone.

Against this backdrop, Atlassian’s $610 million all-cash purchase of The Browser Company of New York fits squarely into the “AI meets enterprise” wave defining the moment.

Interesting.. all of these deals have someonee in common.. it’s Thrive Capital. (more below)

The deal is notable not only for its size, but also for its category-shaping ambition. While others are chasing AI infrastructure, Atlassian is placing a bet at the application layer: the browser itself.

It’s a recognition that the browser has become the operating system of work, and that knowledge workers need something more intelligent than the passive tab-hoarders of the past.

But Why are Browsers so Hot Right Now?

The Next Great Enterprise SaaS Play?

For more than a decade, some of the most successful enterprise SaaS companies have sprung from a simple pattern: start with a product people already love in their personal lives, reimagine it for the workplace, and distribute it bottom-up through teams until it becomes indispensable. Messaging, file storage, video calls, docs, & spreadsheets have all been transformed this way, unlocking billions in enterprise value.

At the time The Browser Company was incepted, the browser stood out as the last major frontier. Despite being the hub where modern work actually happens, it (even years later) has barely evolved beyond consumer use cases. Legacy browsers were designed for general browsing, not for the knowledge worker juggling dozens of SaaS apps, workflows, and tabs every day. That mismatch creates a massive opportunity: to build a premium browser that doesn’t just display the web, but actively accelerates work.

AI-Native Challengers

These are startups defining the “AI-first browser” category, often with cult followings among early adopters:

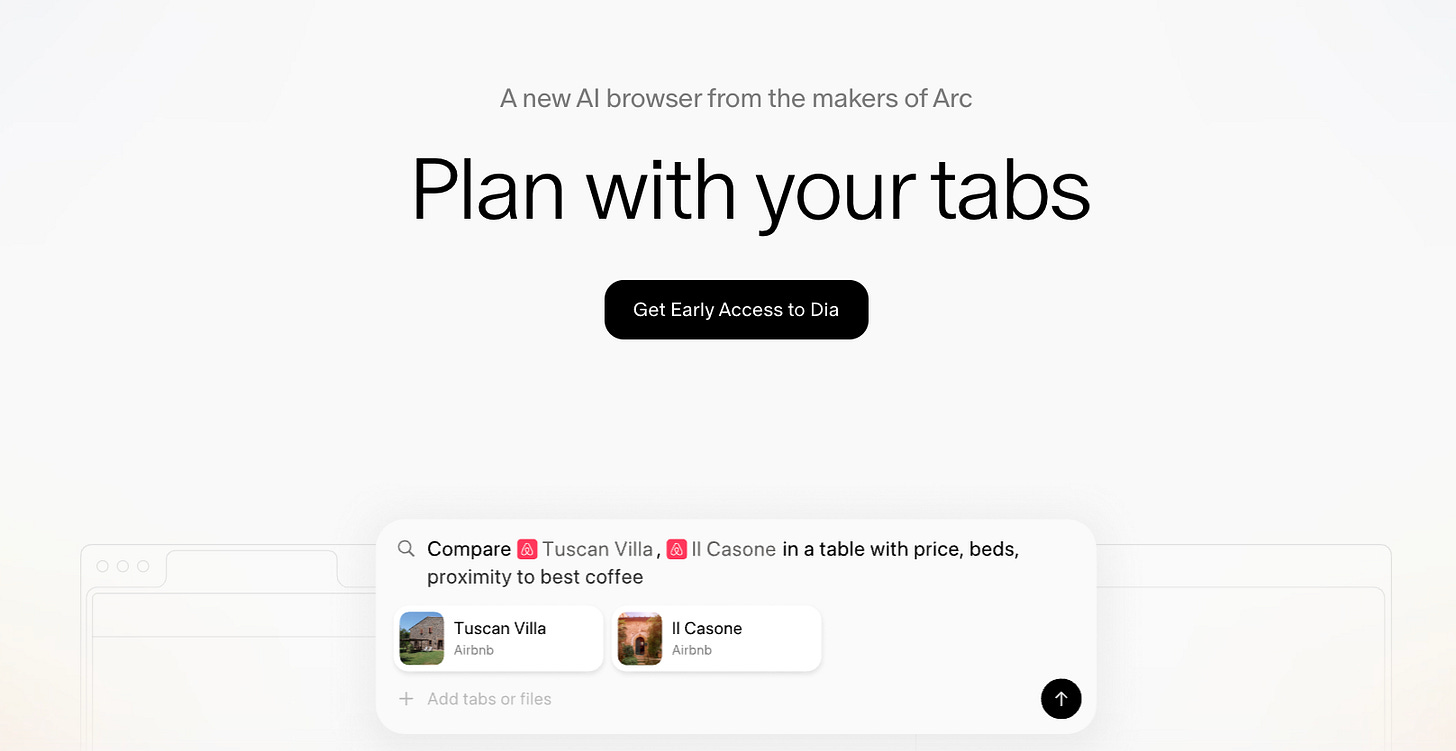

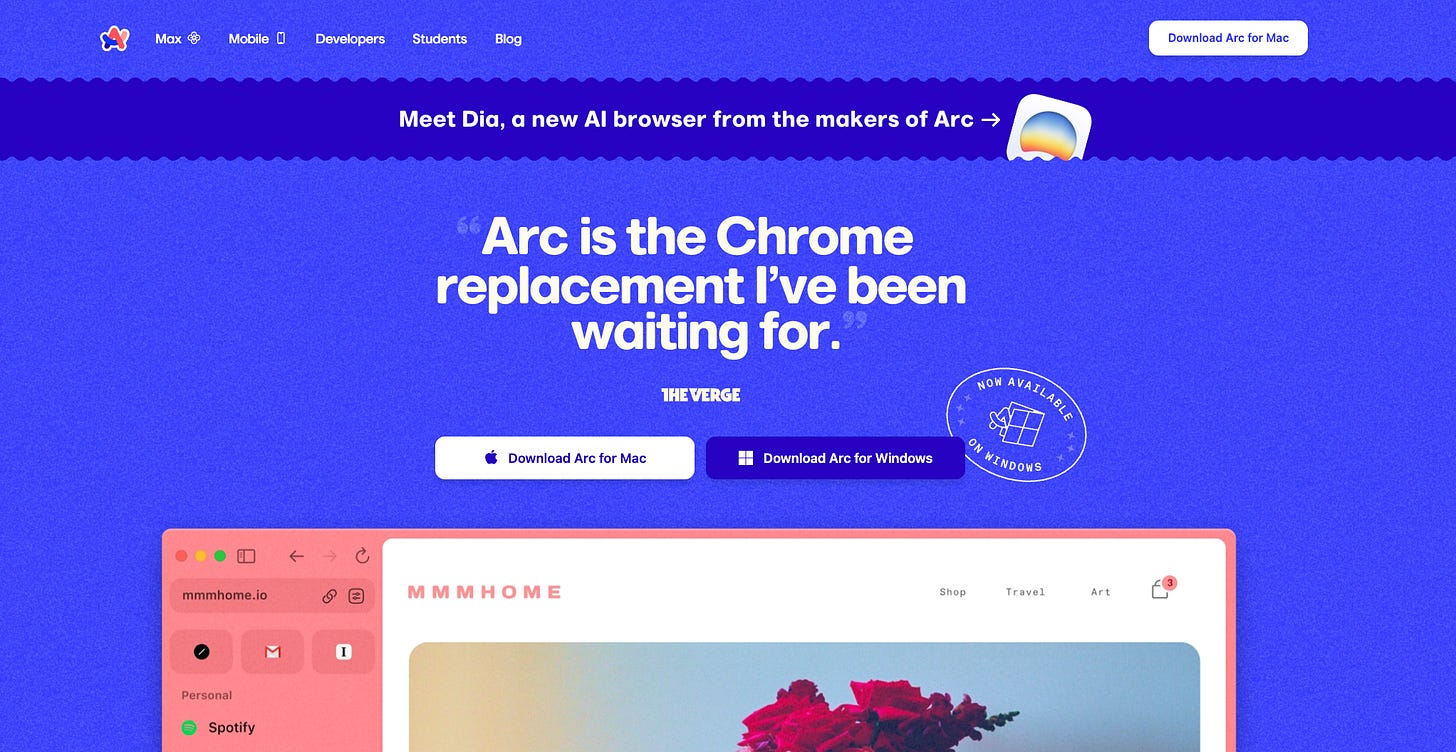

The Browser Company (Arc & Dia) – Recently acquired by Atlassian for $610M. Arc built a design-centric Chrome replacement; Dia is their AI-native browser for work.

Perplexity (Comet) – Launched 2025. Positions the browser as an AI agent, collapsing search + workflow into one. Splashy partnerships (PayPal/Venmo) and pre-install negotiations with phone makers.

Browserbase – Positioned more as an infrastructure/browser-as-an-API for developers. Lets teams automate and scale headless browser sessions for scraping, testing, and AI agent tasks.

Missing any? Comment below!

Ok.. So.. What’s the Bet?

The opportunity is compelling for other reasons too. Browsers sit at a critical distribution point in the software stack, but incumbents are focused on mass-market users with business models poorly aligned to the enterprise.

Infrastructure advances now make it possible to reimagine the browser from first principles, while secular shifts in workplace software demand more integration, automation, and context-awareness. And with the market size at near-universal scale, the upside is enormous.

Seen this way, the strategy isn’t about reinventing the internet; it’s about applying a proven SaaS playbook to one of the most overlooked yet vital tools in modern work. The bet is simple but ambitious: make the browser the next great category-defining enterprise platform.

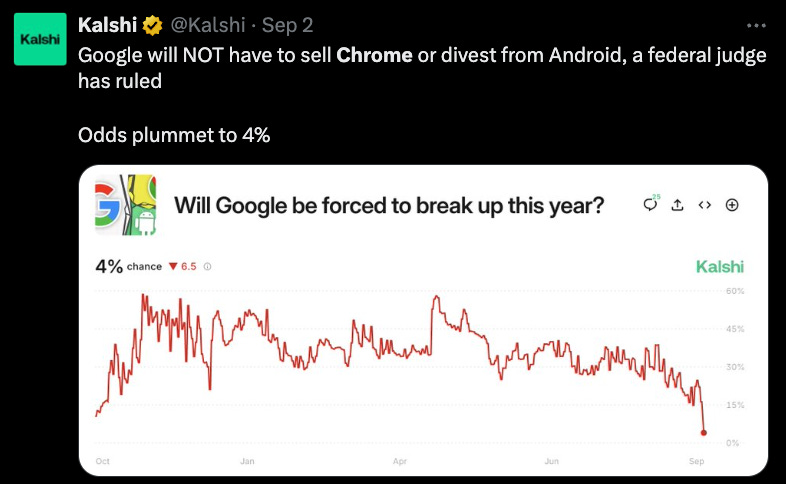

Recent Browser Headlines

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, browsers, weather, AI, etc).

An Underrated Backstory: Thrive’s Incubation

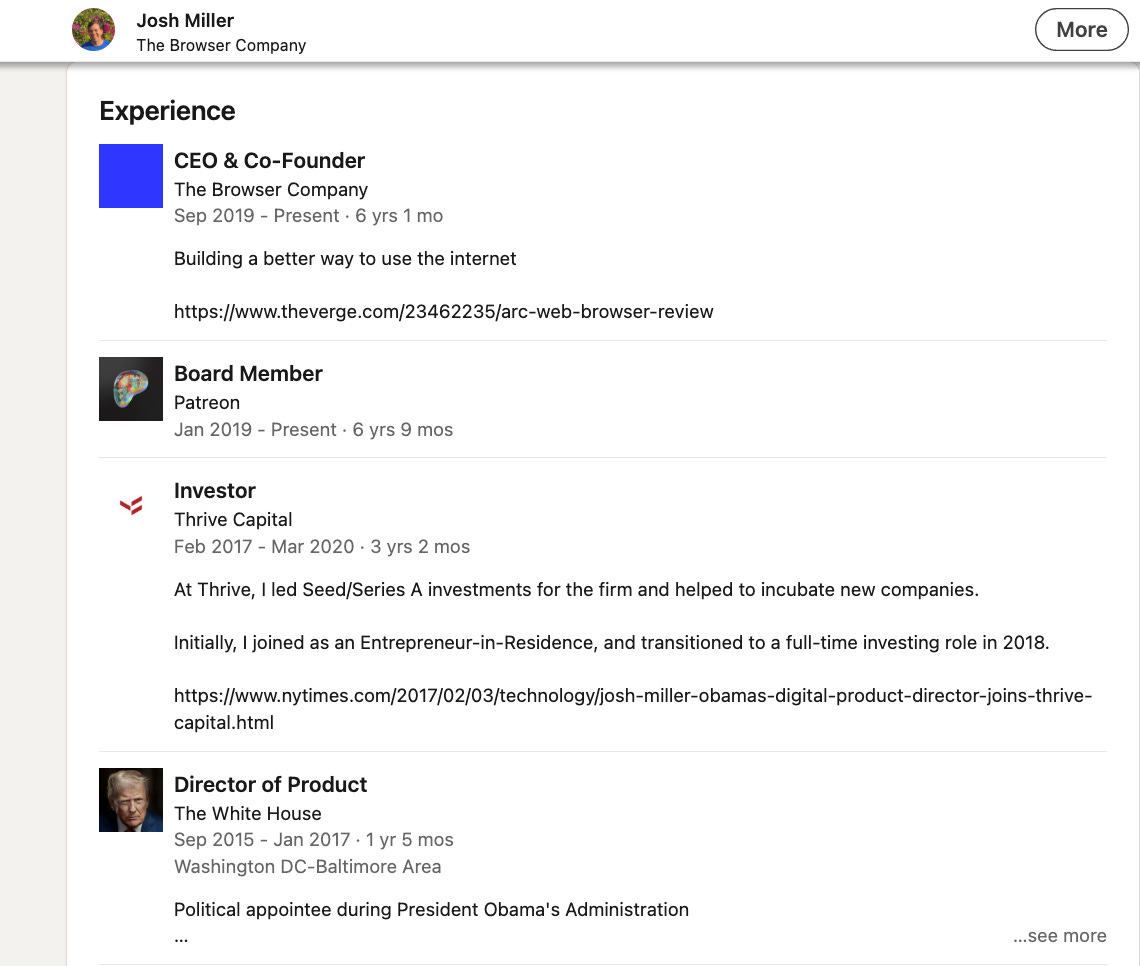

One underrated detail in this story is where The Browser Company began. The New York startup was incubated out of Thrive Capital, one of the most influential investment firms of the last decade. Thrive provided not just capital, but a launching pad for a team intent on reimagining the browser.

This matters because Thrive’s pattern has been to spot ambitious consumer-tech and productivity plays early (Instagram, Spotify, OpenAI), and Arc/Dia’s trajectory fits neatly into that lineage. The acquisition validates Thrive’s incubation strategy while giving Atlassian a product with strong cultural resonance among early adopters.

“Over its 15-year existence, Thrive Capital and its executives, including Mr. Kushner, have incubated more than a dozen companies. At least five have valuations exceeding $1 billion. Among them is Oscar Health, the health insurer driven by its use of technology, though its current market value of $3 billion is roughly a third of where it stood when it went public in 2021.

Other businesses that Thrive Capital has incubated include the health care billing company Cedar, the health benefits app Rightway Healthcare, the virtual patient care management start-up Cadence and the online pharmacy Capsule.” - Dealbook

Joshua Kushner on their incubation strategy, as profiled in Invest like the Best:

“We started over a dozen businesses. And every single person on the investment team currently has been a part of an incubation on Thrive. So every single person at the firm is building. Everyone understands the pain the founders go through. They're experiencing it themselves.

I think our view is there are big markets, there are large markets and there are infinite markets. And I think the only places that you want to play are in the infinite markets. I think no differently than our investments. Every single incubation that we create has a grand ambition, but there's usually a very specific product that we believe should be built from the beginning that ultimately creates a wedge into a much larger opportunity.

We would ultimately be dissatisfied if that larger opportunity is not captured. And ultimately, no matter how thoughtful we are about identifying that opportunity alongside the partners that we're ultimately working with, if the person who is ultimately building that business is not N-of-1, nothing is going to happen. I think the last incubations at the firm have been created by Gaurav, Vince & Kareem.

And they have just an incredible amount of humility and self-awareness around the quality of the person that they ultimately want to work with. I think they are extraordinary top-down thinkers in terms of thinking about what the opportunities are that could lead to outsized outcomes. But at the end of the day, if we're not building alongside extraordinary people, nothing is ultimately going to realize its full potential.” - Joshua Kushner

The BCNY Products.

The Browser Company built Arc and Dia, two of the most buzzed-about browsers in recent memory.

Arc, called by The Verge “a new way of using the internet,” quickly became the go-to Chrome replacement for design-forward users. Dia, described by The New York Times as “a new type of AI browser,” positioned generative AI as a daily utility rather than an experimental layer.

What makes them hot is not just design, but contextual AI. In Dia, each tab is aware of the work happening inside it - whether scheduling, design, or writing - and can connect those dots.

Atlassian plans to extend this into enterprise workflows, embedding AI skills, memory, and trust-grade security into the browsing experience. In a market where SaaS apps multiply but remain siloed, this promise of an AI-native, work-optimized browser stands out as both timely and differentiated.

Team and Talent

Equally important is the team Atlassian is bringing in. The Browser Company was founded by Josh Miller, a former Director of Product at the White House and startup veteran, quickly attracted a cult following of product designers and engineers known for building beautifully opinionated tools.

Their DNA blends consumer sensibility with technical rigor, a rare mix in enterprise software.

Atlassian’s CEO Mike Cannon-Brookes underscored this in the announcement, noting the company’s “passion for building beloved browsers” as the core complement to Atlassian’s two decades of enterprise expertise.

With more than 300,000 customers (including 80% of the Fortune 500) and 2.3 million monthly AI users, Atlassian gives this talent and vision an enormous distribution channel.

Emerging New Trend

In a frenetic M&A landscape increasingly dominated by AI, Atlassian’s move shows that application-level bets can be just as consequential as infrastructure arms races.

The acquisition also highlights a new trend: the rebundling of daily work tools inside AI-native experiences.

If Google and OpenAI are racing to own the foundation, Atlassian is trying to own the interface where work actually happens.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery