BREAKING: Bryan Kim, Partner at a16z, Reveals Why He Invested $15M Into Cluely

Portfolio: ElevenLabs, Captions, Function Health, BeReal

I’m SO excited to share our conversation with Bryan Kim, Partner at Andreessen Horowitz (a16z). Bryan (aka “BK”) focuses on early-stage investments in consumer and application-layer AI. He has invested in some of the most prolific consumer companies like: Captions, ElevenLabs, BeReal, Function Health, & more.

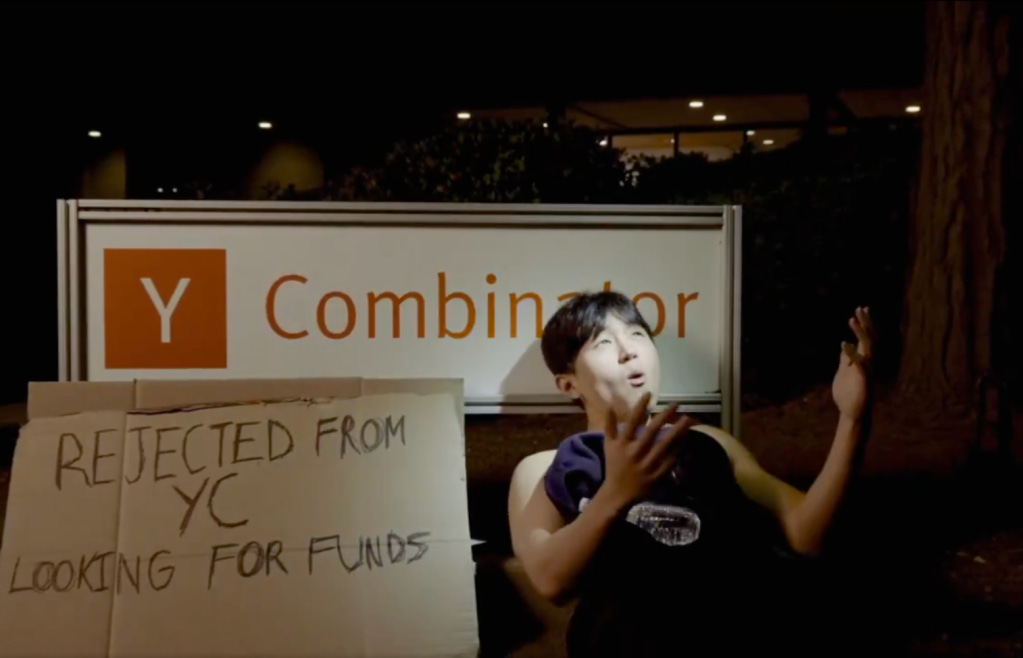

One of his recent investments is viral phenomenon, Cluely, the controversial San Francisco-based AI startup founded by Roy Lee (we recently covered). Cluely has raised over $20M to date, with their most recent $15M investment from Bryan at a16z. Cluely is building an invisible desktop assistant to help you “cheat on everything” & is causing media frenzies everywhere.

→ Listen on X, Spotify, YouTube, Apple

We talk about:

Wild backstories behind investing in Cluely & ElevenLabs

Why he calls momentum “the moat” in the AI era

What it takes to raise a Series A today

Current state of Consumer AI investing

How context makes AI products infinitely better, and harder to replace

Deep Dive Below!

Brought to you by:

Brex—The modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel. As a Sourcery listener, you can unlock up to $500 toward Brex travel or $300 in cash back, plus exclusive perks to help you move even faster.

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Fourthwall—The #1 way to sell merch online — Fourthwall is the easiest way to launch a fully branded merch store—used by big brands like MKBHD, Acquired, & even the Smithsonian. 100+ products. No upfront cost.

Highlights:

(00:00) Trailer

(01:04) Welcome Bryan Kim & Cluely Intro

(02:26) How Bryan Met Roy Lee

(07:00) The $15M Bet On Cluely

(14:18) Momentum Is The Moat

(22:26) Chasing ElevenLabs Across the Globe

(26:04) Function Health & Preventive AI

(32:39) Why Creative AI Tools Are Exploding

(34:54) Deepfakes, Risks & Regulating AI

(38:08) Startup Exits, Liquidity & What’s Changing

(43:50) Do Post-2024 Startups Scale Faster?

(49:04) OpenAI Usage beating Social Media?

(51:58) The 3 Metrics Bryan Looks For

(58:07) Growth vs. Profitability Cycles: Where We Are Now

Consumer AI, Momentum, & High-Conviction Investing

Bryan Kim (BK), Partner at Andreessen Horowitz (a16z), breaks down his high-conviction investment in viral startup Cluely. Known for backing ElevenLabs, Captions, Function Health, BeReal, and more, BK shares how he fought to win this round—and why urgency, not delegation, wins deals. (No, he didn’t loop in his assistant.) An inside look into one of the most competitive consumer + app-layer AI portfolios in venture.

Investments include:

ElevenLabs (AI-native voice infrastructure)

Captions (video editing with in-house models)

Function Health (longitudinal biomarker tracking powered by AI)

Cluely (a desktop assistant for consumer productivity)

BeReal (authentic photo sharing)

Slingshot AI (world’s first foundation model for psychology)

Raspberry (retail product design)

Partiful (group events and social coordination)

Rather than clustering around a single category, BK's portfolio reflects a broader thesis: AI is becoming embedded across the full stack of the individual from creation, health, knowledge, work, and self-optimization.

BK’s approach is all about speed. He seeks teams that can ship quickly, adapt to model improvements, and turn distribution into leverage. What used to take years to validate now unfolds in weeks. In his view, the consumer AI opportunity is not just about interface shifts, but about new company formation logic: smaller teams, more technical founders, and entirely new acquisition loops.

Bro, what’s up with Cluely?

Controversy, Risk, & Building Conviction

Three weeks ago, I met Cluely founder Roy Lee, “a very ambitious, very ambitious founder,” who walked me through how he raised $15 million from Andreessen Horowitz. Now, from the other side of the table, BK shares his POV.

Cluely didn't follow a typical fundraising script, in fact, they weren’t even raising. When BK first reached out to Roy, Roy declined to take the meeting. He just wasn't interested; not fundraising and didn’t want to waste time. So alternatively, BK offered to meet without discussing capital, simply to build the relationship. That meeting eventually led to others, and over time, metrics emerged. Enterprise interest showed up. Revenue started to build. The viral machine was taking off. And it was clear, BK had to make a move.

The deal closed just ahead of Cluely’s viral launch, which included aggressive & polarizing stunt marketing and creator-style content seeded through X.

“We are in this weird primordial soup of AI where everything's bubbling, and it's unclear, and we don't really know it's still super early. There's 7 billion devices and the number of people using more than ChatGPT are probably pretty low.

So we're still very early, which means that in order to break through the noise, in order to actually establish mind share, in order to actually start the flywheel going—in terms of attracting the best people, applying the best tech, being able to sell your product with revenue, so that you can continue that journey—requires momentum”

What if breaking the rules was the unlock?

The Cluely stunts, most of which, really pissed people off, are working. “Cheat on everything.” Provocative videos. Spicy X posts. It’s drawing severe polarization to Cluely’s brand, & with it’s recent funding announcement, is making people question: Why would anyone put $15M into this company? What will they do with it?!

“It's interesting. Venture is a little bit of triangulation art, right? It's not just, tell me exactly what you need. I'll give you that X amount plus 20 % for buffer and here you go. Because sometimes that doesn't work for a fund like us.

We do have some ownership requirements given the size of the fund and how big we need to believe the company becomes. And there's some triangulation of where that needs to work. So maybe the founder says, ‘Hey, like I have a need for $30 million,’ but that risk profile doesn't work for us. And we can only afford less. And the opposite can be true where, ‘Hey, maybe I just need $2M,’ but maybe you want $5M because you know, the ownership requirement.

That would be the only way that works for us. So there is part one. There's a little bit of triangulation.”

But what will Cluely do with all of the capital?

The round was sized to support go-to-market experiments, freemium expansion, and rapid team scaling. A core part of the thesis was that capital deployed quickly, with the right founder, could create defensibility in speed.

Talent

Marketing

Building at the problem.

“I use Brex for everything.” Roy Lee, Cluely

Is Bryan concerned about Cluely’s spending!?

Cluely’s spending has drawn attention for its bold marketing tactics and rapid team scaling, but BK isn’t concerned, as long as the fundamentals hold. He acknowledged the optics, but emphasized the company's strong margins and early profitability.

“If it was reckless, I would be,” he said. “But we know the product has good margin. He’s said a couple of times he’s profitable.”

In BK’s view, capital is being deployed strategically: to expand freemium surface area, attract top engineering talent, and amplify distribution. The flashiness is intentional, but beneath it is operational discipline.

Spend smarter. Move faster.

Brex offers founders the financial stack that scales with you - a business account, card, bill pay, and travel - all in one place.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s). Plus, white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, and access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Key Lesson From Winning ElevenLabs?

Show up.

BK heard about ElevenLabs from Captions founder Gaurav, who had used the product and declared it the best audio AI experience available. After speaking with ElevenLabs CEO Mati, BK realized the round was competitive and that he wasn't the frontrunner. He decided to take immediate action.

“I packed over two minutes and I got in an Uber, and I called my assistant and said, ‘Get me on a flight to London that is leaving in 90 minutes.’ She's like, ‘I don't know if I can.’ I said, ‘I don't care what you do. Please help me out.’ We ended up getting to terms and agreement in the next four hours I was on the ground. And then I came back.”

The move worked. ElevenLabs is now one of a16z's highest-profile AI investments. For BK, showing up in person wasn't performative. It was a reflection of urgency matching opportunity, and now it’s his gold standard.

Founders appreciate it. Roy Lee, in particular, with early fundraising experience, now won’t accept anything less. Roy emphasized, very passionately, quickly into our interview:

"There's nothing that pisses me off more than when some investor wants to talk to me, they loop in their assistant. Bro, these rounds are closing in hours. If you want to talk to the hottest startup, then you need to f*cking book time ASAP. And it needs to be you. If you've done this, you're probably not getting any allocation."

If you want to win the deal, hit their direct line. Grab a plane. And maybe show up with some steaks.

New Metrics for Early-Stage AI

As AI-native startups launch faster and funding rounds close in days, the old frameworks for evaluating early-stage companies are being reconfigured in real time. BK used to anchor his diligence around products that were carefully crafted, retention-first, and shipped with precision over time. That approach, shaped by the internet and mobile eras, now looks increasingly outdated.

“Things are moving so fast, so capturing it now, like you mentioned, is so critical. It gives you the right to fight another day and be relevant another day.

If you don't have it now, it's just harder to capture that. And that's a sentiment that I'm trying to capture where I'm not trying to craft this narrative of nothing matters, a product doesn't matter, retention doesn't matter, let's just move. That's not what I'm saying. I'm saying we're in a very specific time. And all the lessons that we had from the internet and mobile era may just be a little differently applied right now. And ultimately, you get to build a plane as it falls off the cliff.

In order to do that, you need to move very, very quickly. And that's sort of the point.”

High Velocity Execution

In a market defined by weekly model releases and fast-moving competitors, execution speed is no longer a nice-to-have, it’s the signal. “I want to look at numbers.” In his view, velocity is the most critical. The fastest teams don’t just keep pace, they breakout & they win.

BK now evaluates early-stage companies through core velocity metrics:

Growth in usage or revenue

Revenue retention and monetization quality

Shipping speed.

“Shipping 20% more each week isn’t linear, it compounds. The fastest teams often create the widest gaps.”

“That is what I mean by ‘momentum is the moat’ because it's not just distribution. That aided by actual product announcements, and people seeing that, seeing it result in revenue and you building in public and talking about that revenue momentum, that's the whole game. And that continues. That's so hard to break. And that's what makes it really also hard to catch them. If you're like a newer entrant or you're not a number one in mindshare, you better hope that the number one guy, dominant guy is like slipping in ship velocity, because if they don't, they just fly higher and higher and you're just looking at them, like, how do I do that?

“Also, if you know that there's a gap, you have a strategic advantage to go in and do something big.. You better ship twice as fast.”

This thinking shapes how he backs and supports his portfolio. The common denominator isn’t polish, it’s pace.

Positive Feedback Cycles

And with pace comes visibility. The more a team ships, the more go-to-market moments they create, whether that’s feature launches, performance benchmarks, or user stories. Each release becomes a surface for narrative, engagement, and revenue expansion. It builds a flywheel: ship fast, generate momentum, attract users & talent, and then ship even faster. Just look at OpenAI’s momentum & market dominance.

“What does this all mean? Early distribution is key. Of course, traction from distribution only sticks if your product keeps up. When you’re shipping fast, each product iteration gives you something new to show and share. The players who understand this dynamic and explicitly build for it — companies like Perplexity, Lovable, Replit, and ElevenLabs — are pulling away from the pack.”

Scaling & Liquidity

While Bryan Kim’s focus remains early stage, he’s closely tracking what happens as companies scale, especially in today’s AI-driven market, where growth can outpace traditional venture timelines. For him, the exit conversation isn’t about IPO timing or chasing M&A headlines. It's about sustained value creation.

“When I think about exit, so to speak, it's less about liquidity immediately and thinking about what size and what impact these companies are having, because that to me does loosely translate to exit ability… whether it's M&A or IPO.”

Across his portfolio, companies like Captions, ElevenLabs, Function Health, and others are reaching meaningful run rates at unprecedented speed. It’s happening before most would expect formal “product-market fit,” let alone liquidity planning.

“So when I see companies that are going from zero to $50M, zero to $100M, zero to $500M in run rate in a very short time, to me that says there's an incredible value that is being created… The market may or may not be efficient in the short term, but sure as hell it will do the right thing in the long term.”

That conviction is part of a broader sentiment shift within the venture ecosystem, especially in AI. Many early-stage investors—BK among them—no longer see IPOs as a binary outcome. Today’s largest private companies are staying private longer, with liquidity increasingly unlocked via secondaries, tender offers, or structured programs.

“There's a little bit of a misnomer now on liquidity… IPO is IPO because it gives you tradable shares, liquidity for early employees, etc. But now we're at a place where private companies are very large, and have been staying private for a long time.”

“I sort of look at this trend as larger companies have opportunities to continue building, continue that momentum to grow into gigantic companies. Whether that's done semi-private or public—I think that matters a little less right now.”

Reaching Public-Profile Metrics Earlier

Another shift is happening under the hood: the financial structure of app-layer AI companies is starting to look dramatically more efficient than past generations. BK, who previously worked as a CFO, has reviewed P&Ls from some of his portfolio companies and sees public-market quality margin structures.

“The current dynamic of the cost structure, especially for apps companies, really favor this equation of growth almost equals profitability… I used to be a CFO. I look at their P&L and I’m like, this is a public company P&L.”

“We’re in this funny stage where some of the winners that are emerging have this benefit of increasing profitability and growth, and get to actually choose to reinvest that… I still think we're in the era of growth equals profitability to some extent, and the momentum in growth actually winning out.”

The net result is a recalibration of how success is measured. Value isn’t being created on a 7-10 year IPO cycle, it’s compounding quickly, with early signs of scale, product utility, and margin expansion appearing in the first 18-24 months. For consumer AI, the outcome layer is forming faster, and on different terms, than any prior tech wave.

This is the time to be investing in consumer AI.

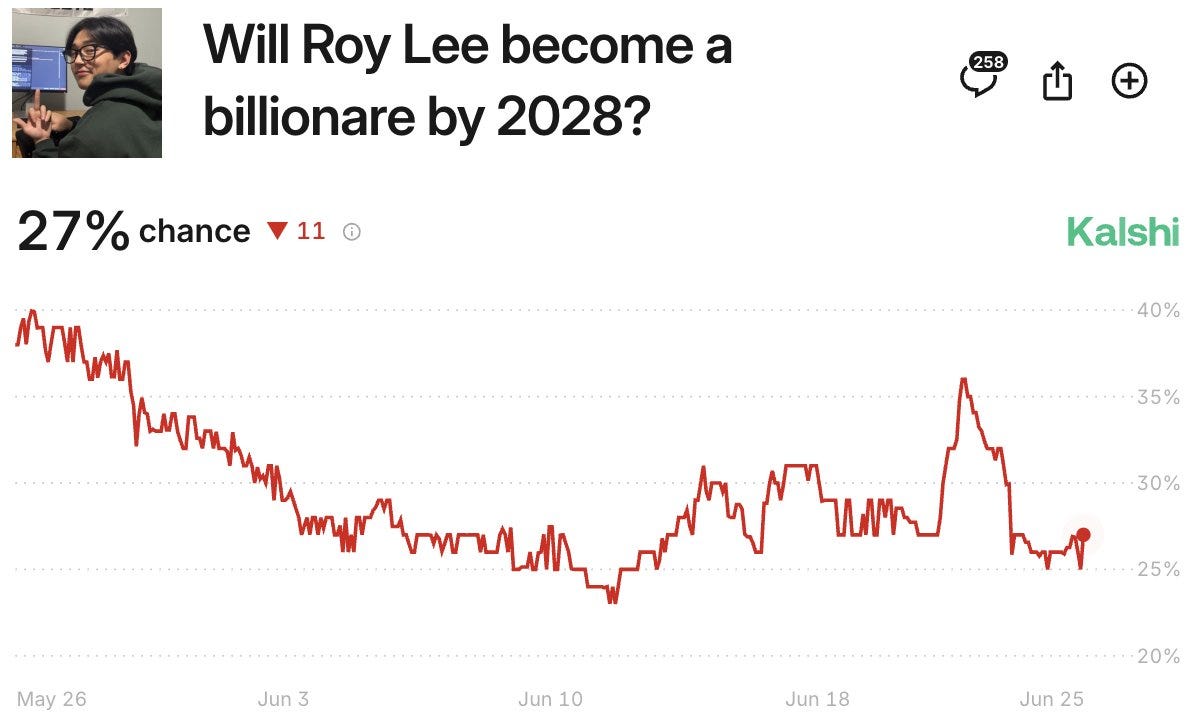

Kalshi Predictions

Will Roy Go to Jail?

Referencing Cluely's polarizing tactics, BK was direct: "No." While Roy’s stunts are boundary-pushing, BK emphasized institutional considerations: "Going to jail affects background checks, which affects next round of funding."

Will Roy Become a Billionaire?

"I sure hope so," BK said, underscoring a16z's conviction. "We bet with our wallet." The Cluely investment was sized for breakout potential, not incremental growth.

What Will the Jony Ive x OpenAI Device Be?

BK expects a minimal, always-on interface. "I think it'll be closer to AirPods than glasses. You need a form factor that can be always-on without being intrusive."

How Many Cities Will Waymo Reach?

"Even three U.S. cities could be bigger than continental Europe in terms of market opportunity," BK noted, when asked about autonomous vehicle expansion.

Should AI Be Regulated?

BK’s view is pragmatic: "Regulation tends to lag the bleeding edge. Trying to catch something once it's already moved often leads to rules that are out of step with the frontier." He supports protections for critical use cases but resists heavy-handed frameworks.

“I use Brex for everything.” - Roy Lee, CEO of Cluely

Brex is the modern finance platform, combining the world’s smartest corporate card w/ integrated expense management, banking, bill pay, & travel. Over 30K+ companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, & Wiz, use Brex.

Spend smarter. Move faster.

Brex offers founders the financial stack that scales with you - a business account, card, bill pay, and travel - all in one place. Offer details: 75,000 points after spending $3,000 on Brex card(s). Plus, white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, and access to $180k+ in SaaS discounts.

Sourcery subscribers get all of this and up to $500 toward Brex travel or $300 in cashback, plus exclusive perks (like billboards..) → brex.com/sourcery