BREAKING: Carta Acquires Accelex

AI-Powered LP Data Automation

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Carta Acquires Accelex

To Deliver AI-Driven Data Automation & Transparency for Capital Allocators

In a move that underscores its mission to bring transparency and efficiency to private markets, Carta has acquired Accelex, an AI-powered data automation platform built for institutional limited partners (LPs).

With this acquisition, Carta will integrate Accelex’s advanced technology into its fund administration platform, unlocking automation, accuracy, and portfolio analytics at scale for its global LP network.

Carta continues to build on its growing momentum and partnerships with Morgan Stanley Wealth Management & the New York Stock Exchange, while expanding its role as the connected platform of record for private capital.

AI-Powered Private Markets

For institutional investors, managing alternative assets has long been hampered by manual processes, inconsistent reporting, and data silos. Traditional approaches to document collection and portfolio analysis are often error-prone and slow.. delaying the very insights investors need to allocate capital effectively.

With Accelex’s AI-driven capabilities, Carta is addressing these challenges head-on.

The integration will enable LPs to:

Automate document collection and KPI extraction from investor portals, emails, and file transfers.

Improve accuracy with AI-powered error detection and audit-ready data outputs.

Gain instant access to analysis-ready dashboards that track key performance indicators (IRR, MOIC, EBITDA) and enable portfolio lookthroughs, exposure analysis, and cohort comparisons.

Customize workflows with full audit trails, ensuring transparency and compliance at every step.

The result: LPs save time, reduce risk, and gain unprecedented visibility into the drivers of portfolio performance.

Strategic Alignment with Carta’s Mission

Henry Ward, CEO of Carta:

“Institutional LPs are core to Carta’s network. Integrating Accelex advances our vision of a connected, transparent platform where LPs, GPs, & portfolio companies benefit from shared data and seamless reporting.

LPs don’t just need data, they need actionable analytics.

With Accelex, allocators gain instant visibility into what’s driving returns across their alternative portfolios, enabling smarter, faster decisions backed by structured, audit-ready information.”

A Step Forward for LPs

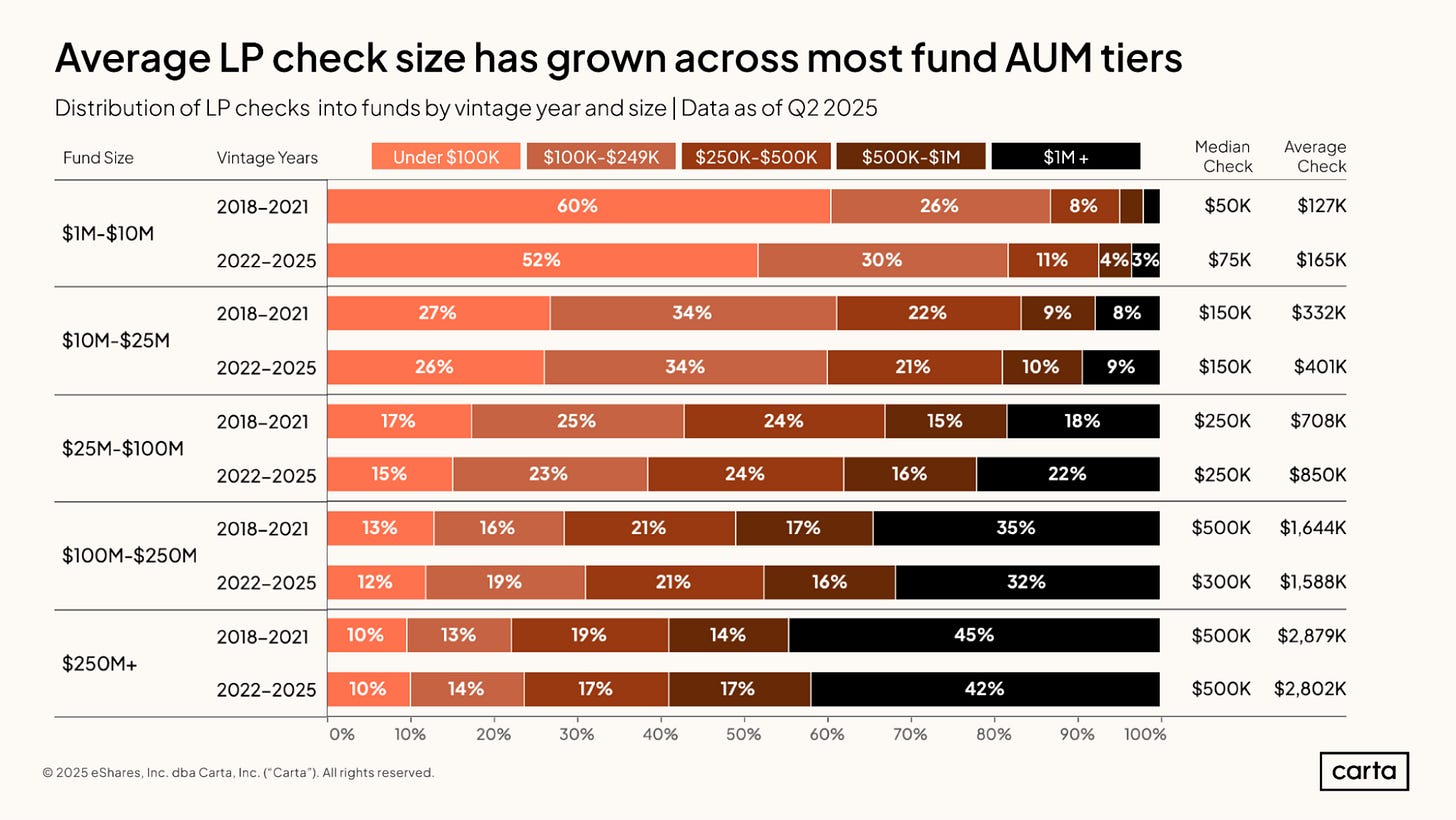

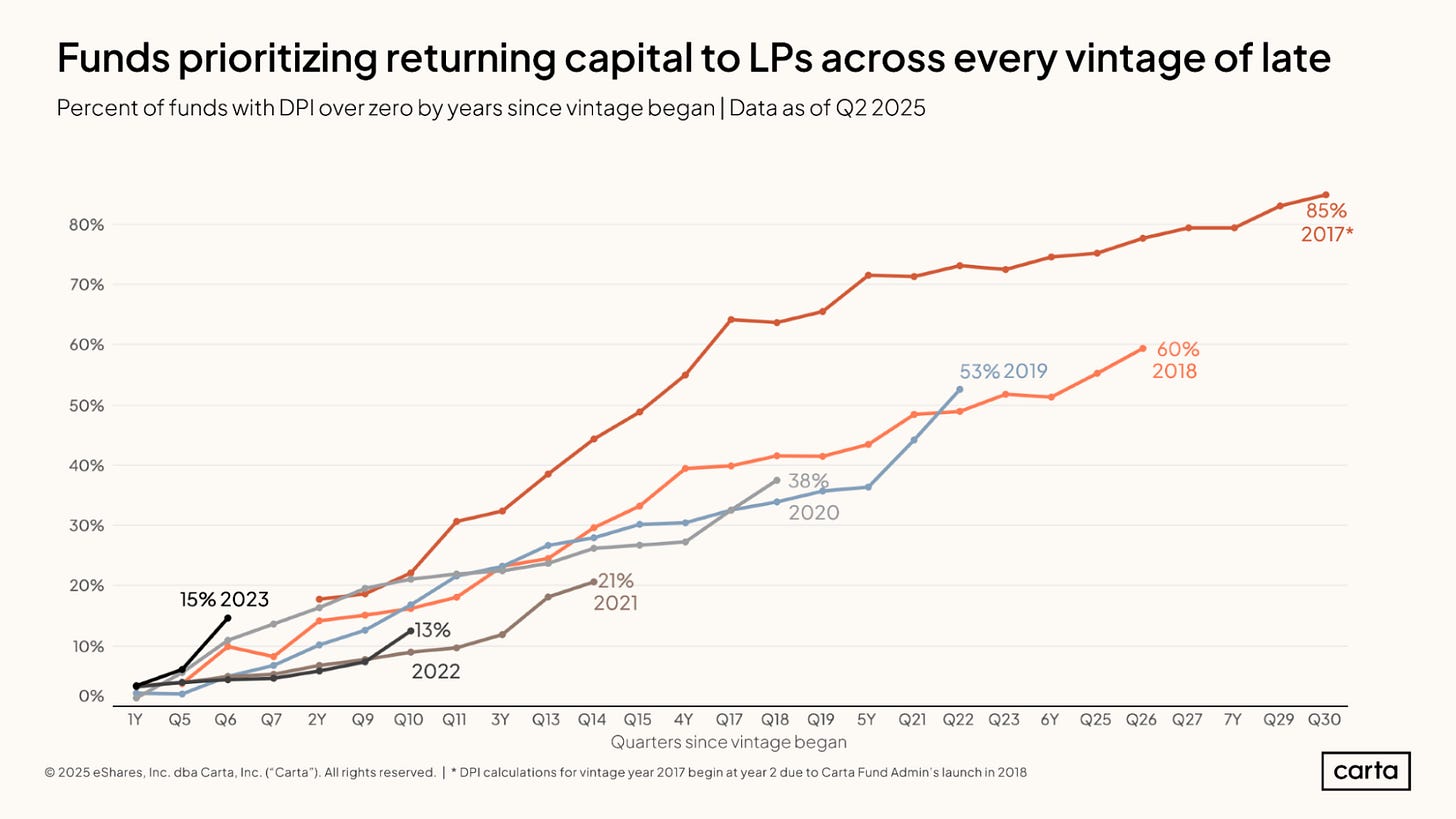

The acquisition also reflects broader shifts in private markets. With slower fundraising cycles, longer holding periods, and uncertain exit paths, LPs face intensifying pressure to extract operational efficiencies and deliver clearer reporting.

Franck Vialaron, CEO & Founder of Accelex:

“From day one, our mission has been to equip investors with the tools and insights they need to tackle complexity and achieve their investment goals.

Now with Carta, we can deliver even greater value to ensure our clients not only keep pace with the market, but stay ahead of it.”

What’s Next

Over the coming months, Accelex’s technology will be fully integrated into Carta’s ecosystem, ensuring a seamless migration for existing clients. Institutional LPs will soon benefit from a unified portfolio view across all their allocations—whether administered on or off Carta, supported by connected workflows, tax solutions, and Carta’s world-class support.

This acquisition marks a significant milestone in Carta’s journey to connect the entire private market ecosystem, empowering allocators with the automation, transparency, and insight required to navigate today’s complex investment landscape.

Accelex Funding History

In November 2023, Accelex closed a $15 million Series A funding round led by FactSet, the global financial data & analytics provider, to accelerate the expansion of its AI-powered data automation platform for institutional investors in private markets.

The financing also included strong participation from existing investors: Illuminate Financial, AlbionVC, SixThirty Ventures, and Expon Capital.

At the time of the round, Accelex’s client base already represented more than $1.5 trillion in assets across 13,000 private-market funds managed by 4,000 managers, underscoring both the scale of the opportunity and the need for efficient, AI-driven data workflows.

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, & scale with confidence. Visit: carta.com/sourcery