BREAKING: Carta's VC Fund Performance Report

a16z's DPI, M&A tear, IPO mania, Govt $$, AI bubble?

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

TLDR

Last Carta report → “Yikes? Flight to quality + which funds are crushing.”

This Carta report → “IPOs Open, M&A ↑, DPI Flowing, Dry Powder ↓”

(Power Law Winners: Founders Fund, Altimeter, Sequoia, a16z (#’s below), USV, Thrive.)

Q2 ‘25 VC Fund Performance

The venture market in Q2 2025 showed early signs of positive liquidity trends as more funds began returning capital to LPs. Distributions (DPI) are rising across vintages, even among newer funds, reflecting a strong push to satisfy LPs’ liquidity needs. Performance metrics: IRR, TVPI, & DPI, all ticked upward, lifted in part by valuation markups from the AI boom (cautiously optimistic).

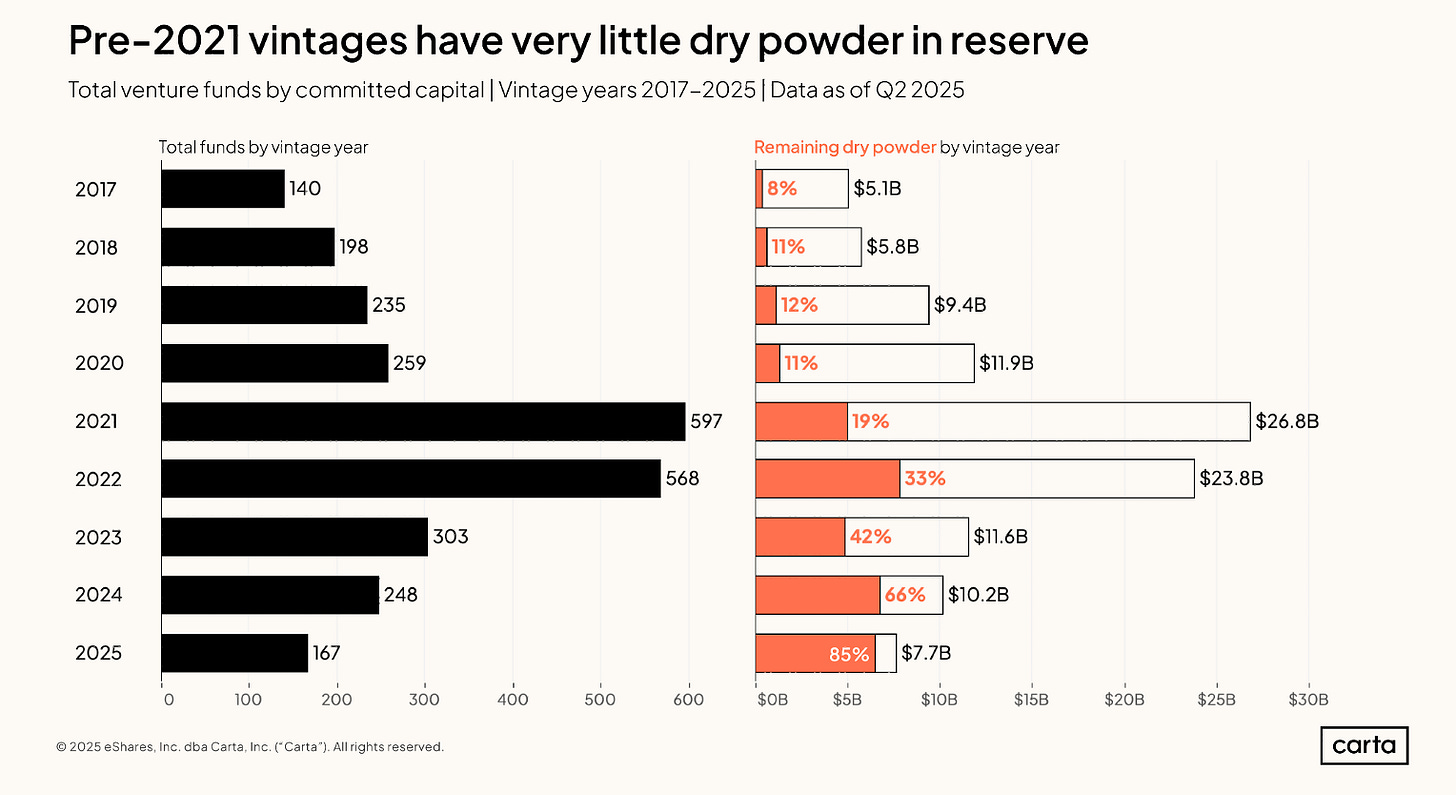

At the same time, dry powder is thinning fast, especially in pre-2021 funds. Even recent vintages are deploying capital quickly.

On the fundraising side.. the barbell effect Marc Andreessen touts is so real. Fund sizes on both ends are thriving: micro funds (<$10M) & mega funds (>$100M).. meanwhile mid-sized vehicles are shrinking in share.

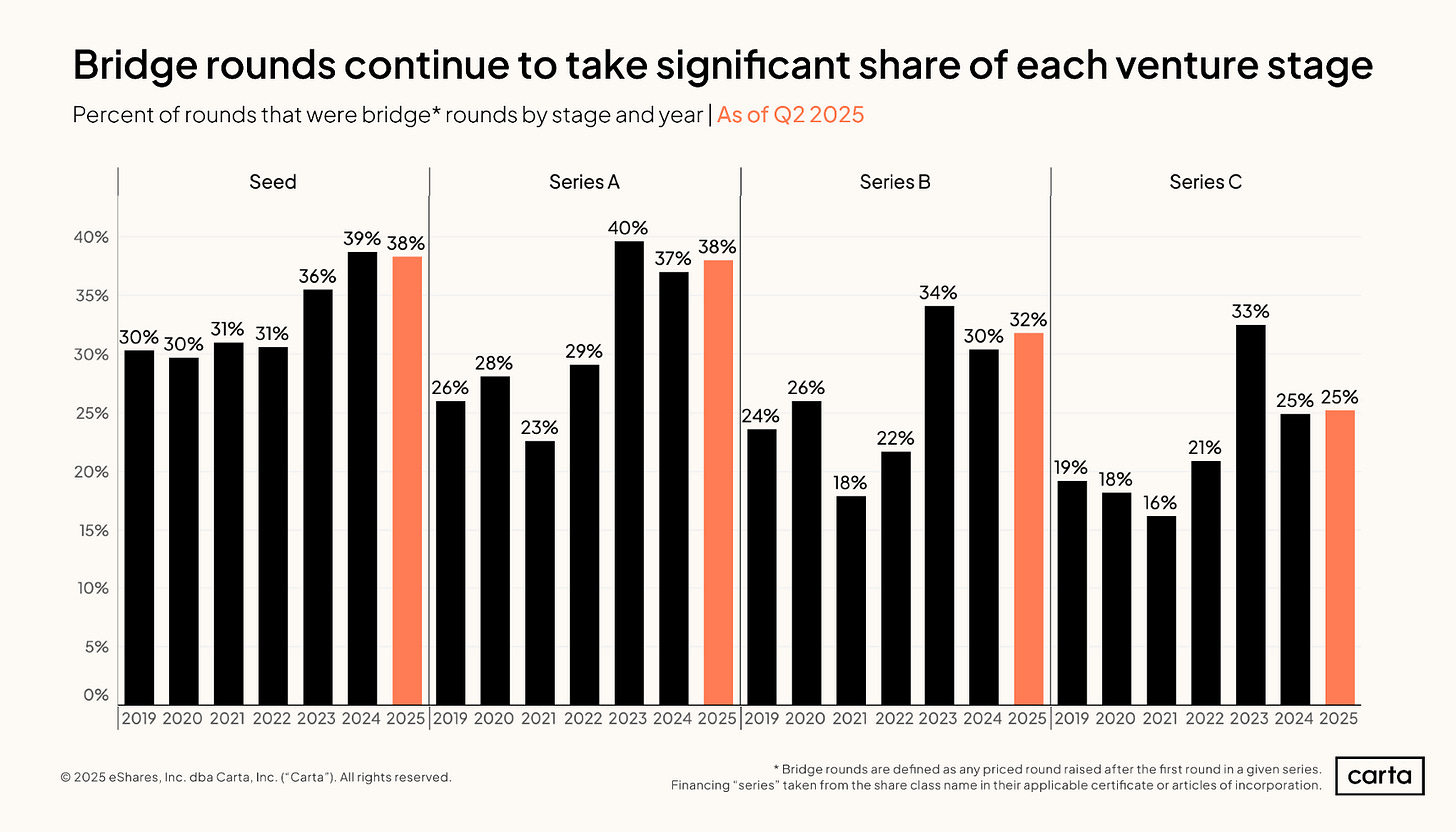

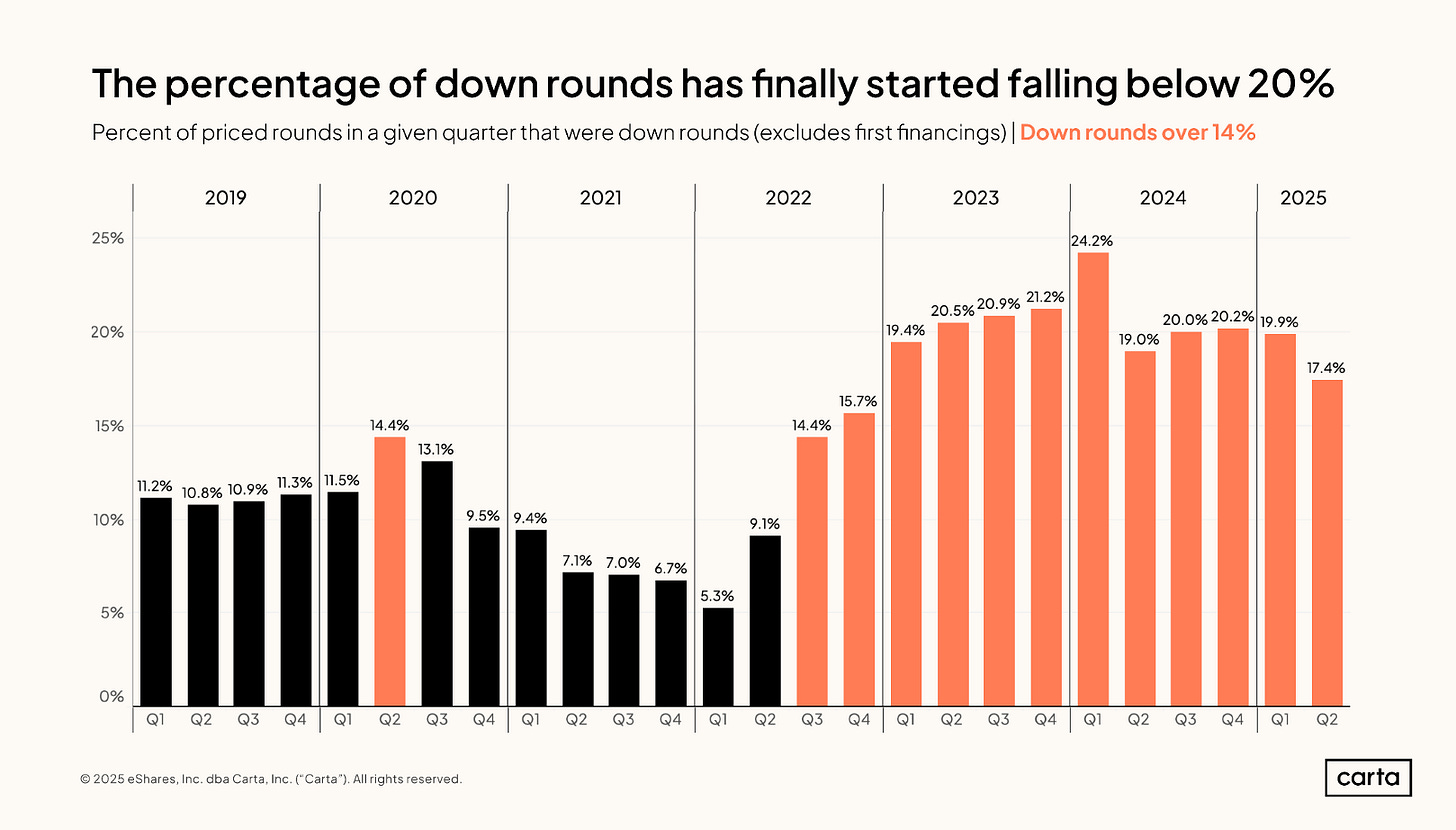

Adding to that, startup financing continues to lean on bridge rounds & extended timelines, though down rounds ticked down slightly in Q2.. a healthy signal?

Key questions

Is this the window for exits? How long will it stay open?

How many more quarters will we have an opportunity to grab ‘easy’ DPI?

What’s the biggest bubble right now?

Will Marc Andreessen debut on Sourcery’s podcast?

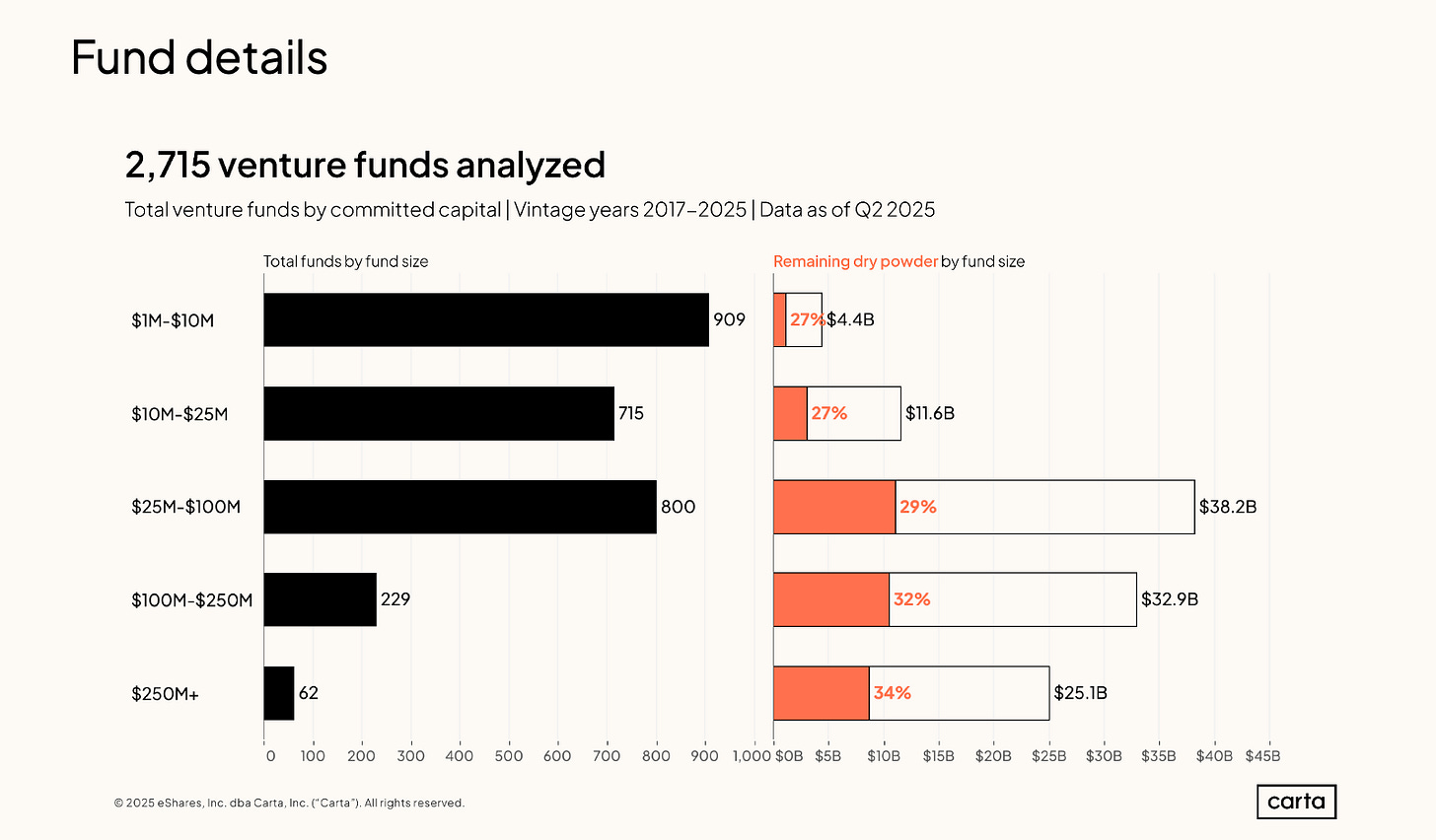

The full report includes data from 2,715 venture funds with vintage years ranging from 2017 through 2025. Across all fund sizes, these vehicles combined to raise about $112.2 billion in capital commitments. Some $38.2 billion of this capital (about 34% of the total) is managed by funds between $25 million and $100 million in size, while another $32.9 billion (29% of the total) was raised by funds between $100 million and $250 million.

IPOs Open, M&A ↑, DPI Flowing, Dry Powder ↓

Liquidity List

M&A

Google (Alphabet) → Wiz (cloud security) — $32B

Synopsys → Ansys — $35B

Meta → Scale AI (49% stake) — $14.8B (~$30B valuation)

Charter Communications → Cox Communications — $34.5B

xAI (Elon Musk’s AI company) → X (formerly Twitter) — $33B *Underrated*

Palo Alto Networks → CyberArk — $25B

Hewlett Packard Enterprise → Juniper Networks — $14B

OpenAI → Io — $8.6B

Google → Windsurf (licensing rights & exec acquihire) — ~$3B (est)

K5 Global + Bezos → HistoSonics — $2.25B

Atlassian → DX — $1B

Atlassian → The Browser Company of New York — $610M

IPOs

Figma (FIG): IPO priced at $33/share, $1.2B raised, 250% pop, currently trading ~$58/share with a market cap of $28B

Klarna (KLAR): IPO priced at $40/share, $1.3B raised, currently trading at $43/share with a market cap of $16B

Circle (CRCL): IPO priced at $31/share, $1B raised, valued at ~$8B at pricing, currently trading at $130/share with a market cap of $32B

Chime (CHYM): IPO priced at $27/share, raised $864M, valued at ~$11.6B at pricing, currently trading at ~$23/share with a market cap of $8.8B

Figure (FIGR): IPO priced at $25/share, $787M raised, valued at ~$5.3B at pricing, currently trading at $39/share with a market cap of $8.4B

Gemini (GEMI): IPO priced at $28/share, raised $425M, valued at ~$3.3 billion at pricing, currently trades down near ~$23/share at $2.8B mcap

Netskope (NTSK): IPO priced at $19/share, raised $908M, currently trading at ~$24/share with a market cap of $9.2B

StubHub (STUB): IPO priced at $23.5/share, raised $800M, valued at ~$8.6B at pricing, currently trading at ~$18/share with a market cap of $6.8B

Kalshi—Largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (IPOs, sports, politics, weather, AI, etc).

SPACs

Chamath Palihapitiya has filed for a new $250 million blank-check SPAC called American Exceptionalism Acquisition Corp. A (ticker AEXA / AEXX in filings), targeting sectors like AI, energy, DeFi, & defense.

Bonus 👀

Government Investment 👀

U.S. Department of Defense invested $400M in MP Materials (acquiring preferred equity) & extended a $150M loan, making the government the company’s largest shareholder (≈15 %) to fund rare-earth magnet manufacturing expansion.

Bullish on

U.S. government committed $8.9 billion to purchase a ~9.9 % equity stake in Intel (turning existing CHIPS/Secure Enclave grants into stock) to bolster domestic semiconductor capacity.

Under watch: TIKTOK

Top Fund Signals to Watch

Liquidity push:

The standout signal is the urgency of distributions—funds across vintages are accelerating DPI to re-engage LPs. Even 2023 funds (only six quarters old) have higher DPI adoption than any vintage from 2017–2022 at the same stage.

85% of 2017 funds have begun generating DPI

53% of 2019 funds are distributing

15% of 2023 funds already generating DPI at just six quarters

Fund performance:

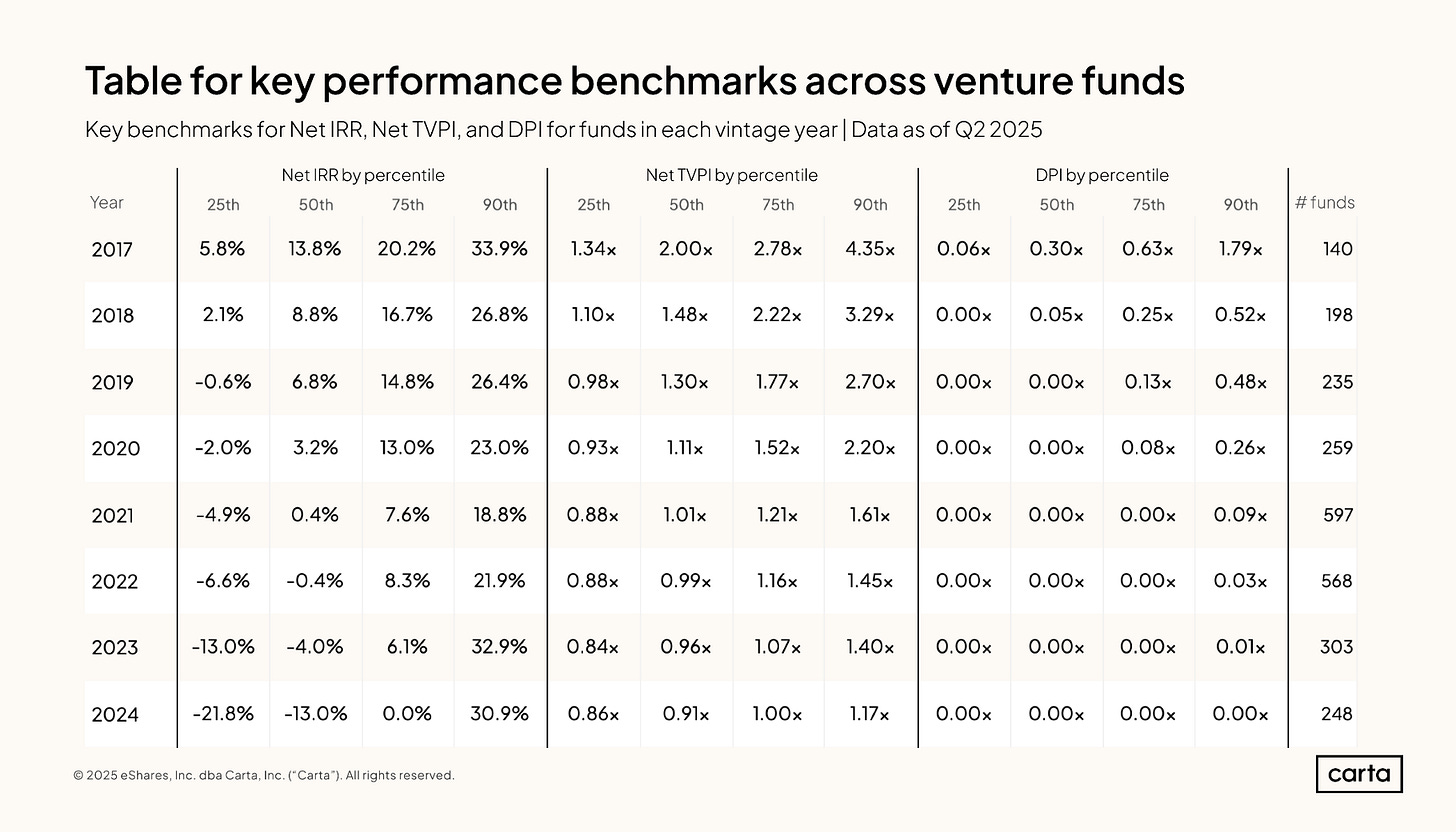

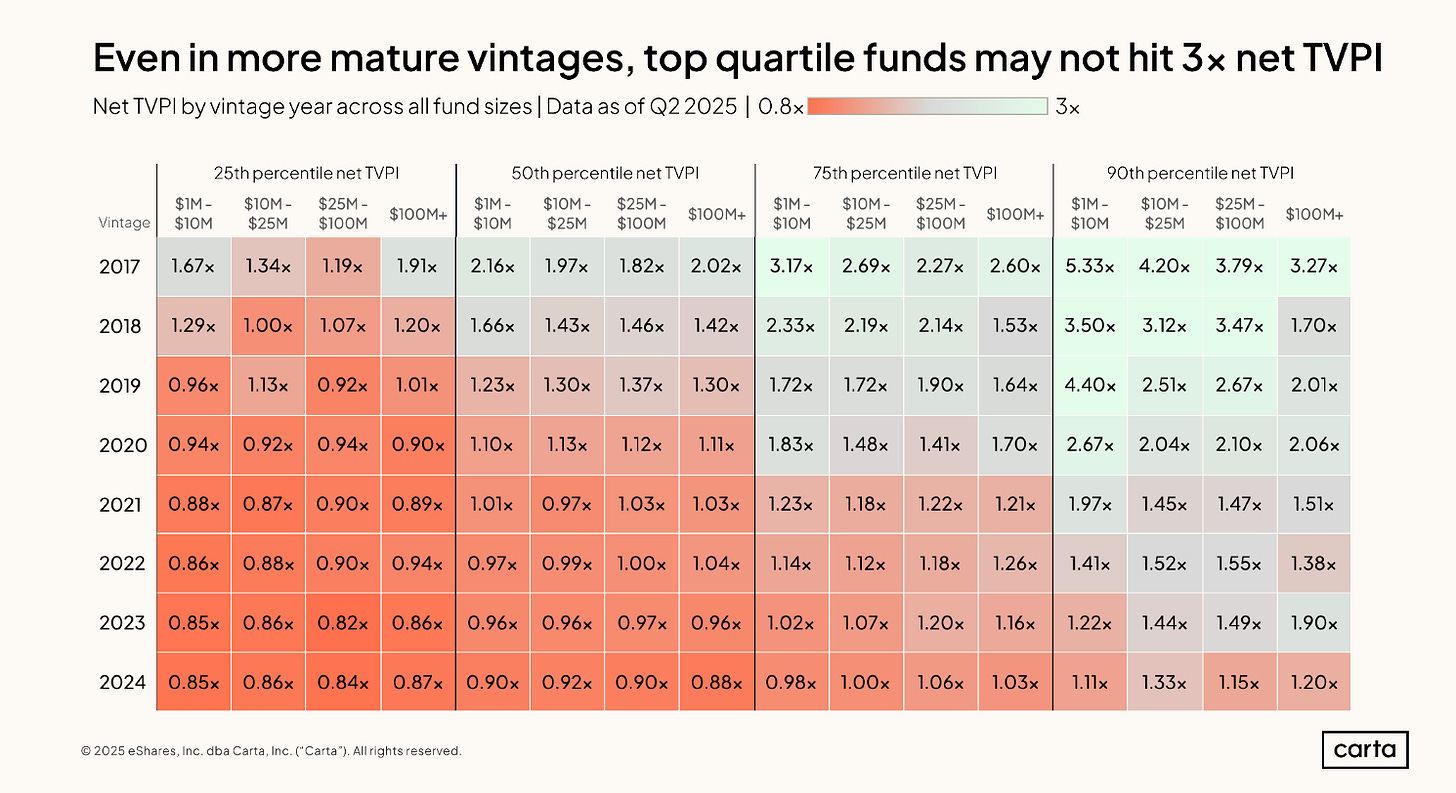

Older vintages (2017–2020) continue to show stronger baseline returns, but the outliers are 2023/2024 vintages, where AI markups are inflating top-decile IRRs above 30%. Median TVPI continues its slow climb across all vintages.

2017 vintage: Median TVPI 1.95x, Median IRR 13.5%.

2023/2024 vintages: 90th percentile IRRs >30%, fueled by AI-driven markups

Dry powder:

Capital is being put to work faster. Funds raised before 2021 are largely invested, and even fresh vintages (2023/25) are deploying aggressively—raising questions about follow-on capacity if exits remain slow.

2020 funds: only 11% uninvested

2023 funds: 42% still in reserve

2025 funds: 15% already deployed,

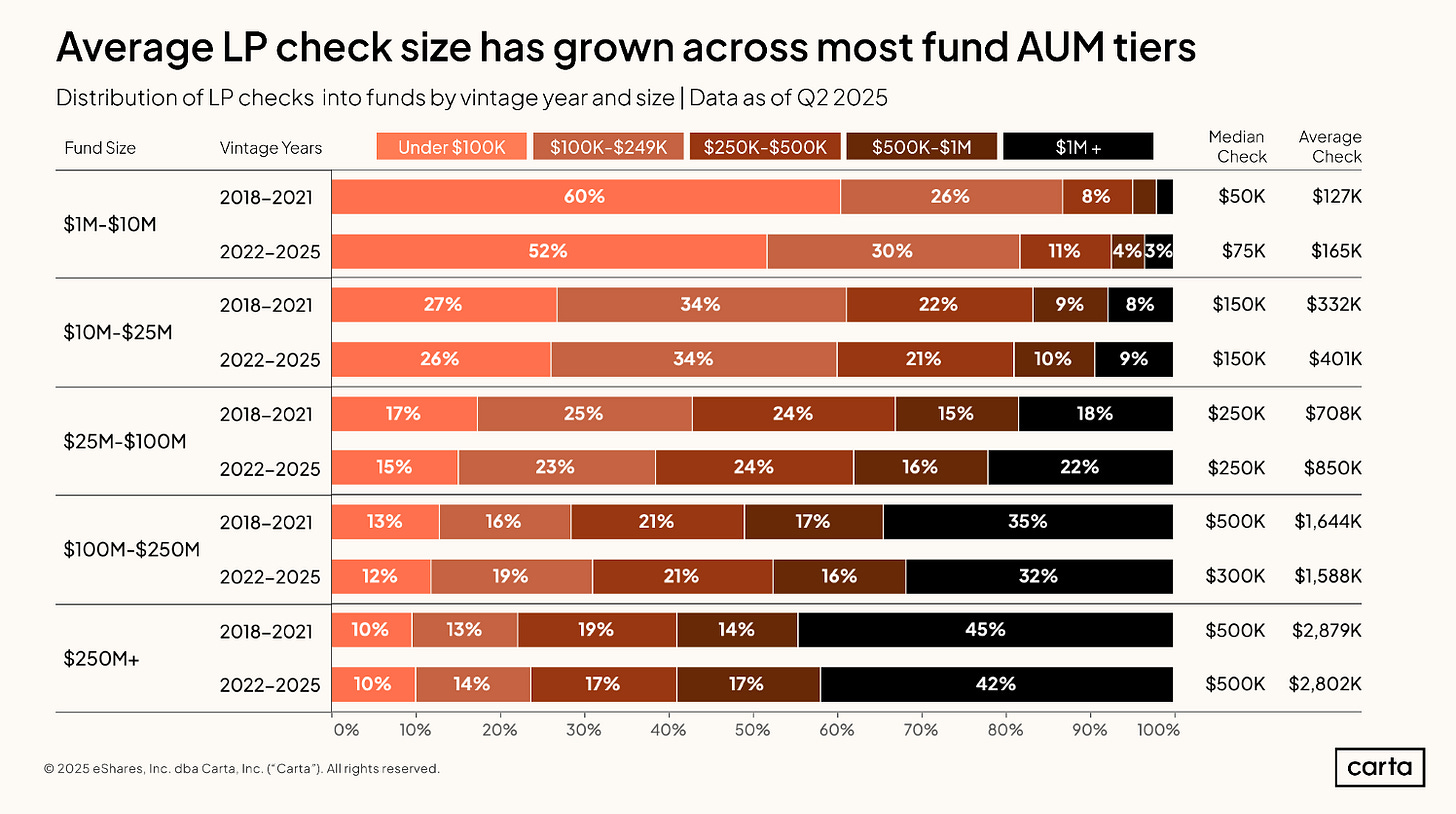

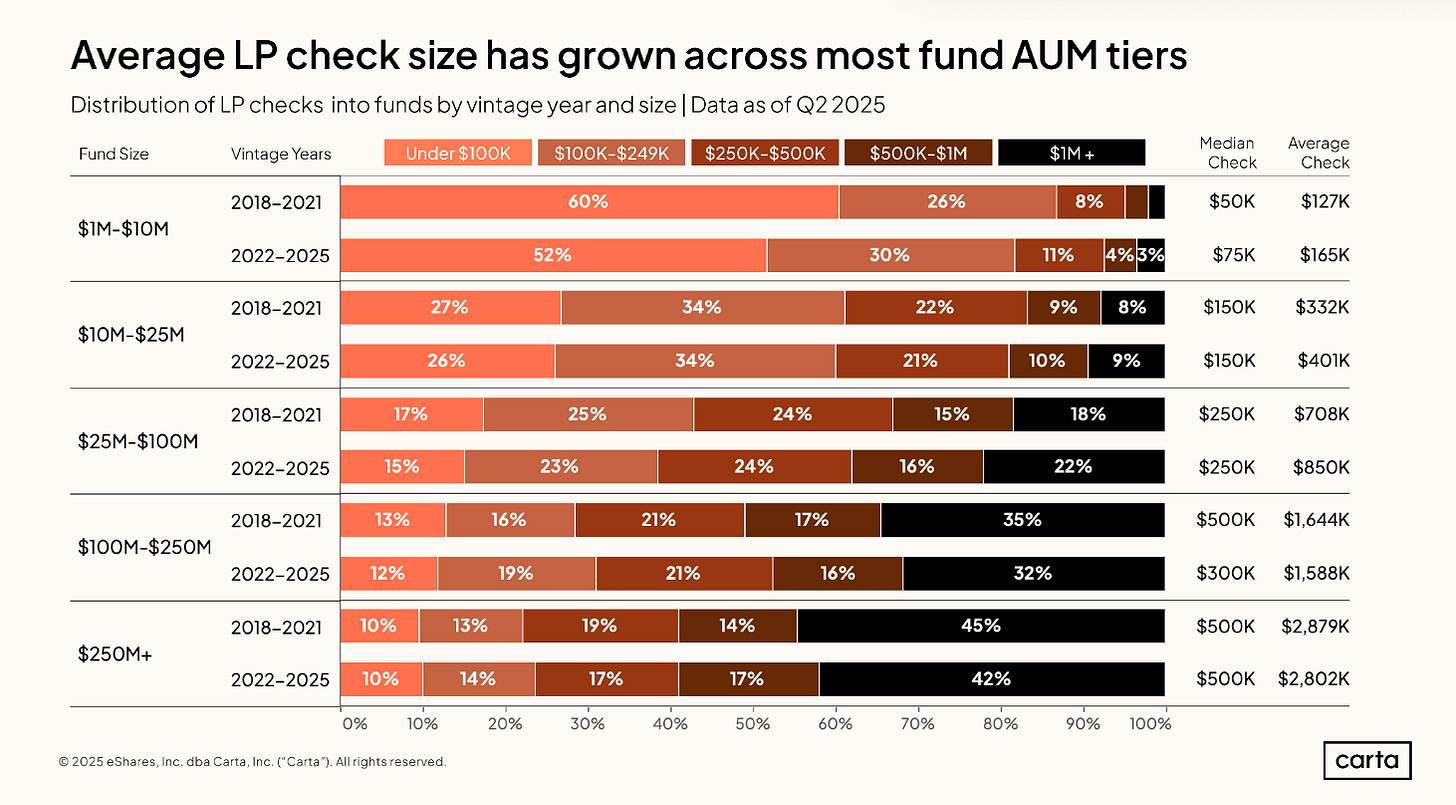

Check sizes:

<$10M funds: average LP check $165K (vs. $127K pre-2022) +30%

$25–100M funds: $850K (vs. $708K pre-2022) +20%

>$250M funds: average check $2.8M+, with over 40% of checks >$1M.

Fundraising Barbell Effect

Small and mega funds are gaining share at the expense of the middle. This barbell dynamic highlights the rise of solo GPs/emerging managers and the return of institutional-scale vehicles.

Small funds (<$10M): Now make up 40%+ of all new closes, up from 25% in 2020 driven by solo GPs and emerging managers.

Large funds ($100M+): Account for 12% of closes in H1 2025, the highest since 2020.

Mid-sized funds ($10–100M): Have fallen to a 9-year low (48% of closes)

P.S. Where are the mega-funds at? ICYMI Bucky Moore Joins $30B AUM Mega Fund Lightspeed: Trillion-Dollar Outcomes, AI, The Rise & Pushback of Mega Funds

Relevant

The firm has held its $900 million 2012 Fund III at 9.4x net TVPI.

Startup Signals

Graduation rates (startup side):

Only 21.5% of 2022 Series A companies reached Series B after three years, down from 52.1% for 2020 vintages

Market activity:

Bridge rounds and stretched runways remain common, but the dip in down rounds and shorter wait times between B/C rounds could signal an early normalization in fundraising markets.

Startups raised $26B in Q2 2025, down 4% YoY, but still 54% below 2021 peak

Bridge rounds remain elevated, especially at Series A (38%) & B (38%)

Down rounds declined 2.5pp in Q2

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit: carta.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).