BREAKING: CEO Vlad Tenev on Robinhood's Record Year

+200% Gain, $100B+ Market Cap, 11 Business Lines $100M+ in Rev

$HOOD’s Record Year

Robinhood CEO Vlad Tenev joins Sourcery from Robinhood HQ to break down the company’s record year and what powered its growth.

Landing Robinhood in the Top 5 of the Highest-Growth S&P 500 Stocks for 2025.

→ Listen on X, Spotify, YouTube, Apple

Robinhood (NASDAQ: HOOD) stock opened 2025 under $40/share and ended the year around $113/share (+200% annual gain) pushing the company to roughly $100B in market capitalization.

But as Vlad explains, the bigger story is under the hood..

Today, Robinhood has 11 separate business lines generating $100M+ in annual revenue (!!), including prediction markets, margin, Gold subscriptions, cash sweep, crypto, and institutional infrastructure via Bitstamp.

Vlad walks through Robinhood’s three long-term arcs: becoming #1 for active traders, owning wallet share for the next generation, and expanding globally into business and institutional markets.

We cover:

- Robinhood’s 11 separate business lines generating $100M+ in annual revenue (!!)

- Prediction markets start new supercycle (sports, weather, insurance)

- Tokenized stocks & 24/7 trading in Europe

- Reinventing earnings calls as live, interactive experiences

- Unlocking private markets & AI companies for retail investors

- Robinhood Cortex, an AI financial assistant with full portfolio context

- Why retail investors today look very different than in the 2021 WallStreetBets boom

𝐓𝐈𝐌𝐄𝐒𝐓𝐀𝐌𝐏𝐒

(00:00) Welcome to Robinhood HQ

(01:02) A +200% record year and what actually changed

(01:54) From IPO volatility to an "all-weather" business

(02:55) The V6 → V12 engine analogy

(03:15) 11 business lines generating $100M+ each

(04:01) Cash sweep, margin growth, and Robinhood Gold

(04:59) Gold subscriptions hit 4M users

(05:45) The three arcs of Robinhood's long-term strategy

(11:21) Why Robinhood must grow with each generation

(15:09) Prediction markets and the post-election supercycle

(15:29) Weather markets, insurance, and real-world hedging

(20:10) Retail traders today vs the 2021 meme era

(24:16) $350B in assets under custody and diversification

(27:32) Reinventing earnings calls for retail investors

(30:10) Live earnings, retail Q&A, and engagement at scale

(34:13) Tokenized stocks and 24/7 trading in Europe

(36:21) Unlocking private markets through tokenization

(38:44) Robinhood Ventures and access to private companies

(44:51) Harmonic and mathematical superintelligence

(09:35) Robinhood Cortex and AI-powered trading

(51:18) Vlad's hottest prediction for 2026

A Record Year at Robinhood, Explained by Vlad Tenev

Robinhood closed 2025 with its strongest operating and market performance since going public. In a conversation at company headquarters, Vlad Tenev, co-founder and CEO of Robinhood Markets, Inc., walked through what drove the year and how the business has changed structurally since the IPO.

The discussion centered on diversification, shifts in retail investor behavior, and the company’s longer-term expansion into new asset classes, geographies, and customer segments.

Revenue Scale & Diversification

Tenev said Robinhood now operates 11 business lines that each generate more than $100 million in annual revenue. At the time of its IPO, the company was largely associated with equities, options, and crypto trading.

“We had to bear down & pivot our business into one that was more all weather.”

Today, revenue is distributed across a broader mix that includes:

Transaction revenue from equities, options, crypto, and prediction markets

Net interest revenue from cash sweep and margin lending

Subscription revenue from Robinhood Gold

Card interchange and other platform services

Institutional revenue following the acquisition of Bitstamp

One example Tenev highlighted was cash management. Robinhood’s cash sweep product, which offers users roughly 3.5% yield, has grown from effectively zero in 2022 to tens of billions of dollars in customer cash. Even after paying customers, the spread remains meaningful at roughly 75 basis points.

Margin lending is another area of accelerated growth. After repricing and improving the product in 2024, the margin book has more than doubled year-over-year, becoming a material contributor to revenue.

Subscriptions & Wallet Share

Robinhood Gold has become a meaningful standalone business. Tenev said the platform now has approximately 4 million Gold subscribers, representing about 15% of total customers. Among newly onboarded customers, roughly 40% now choose Gold at sign-up.

Gold is already a nine-figure annual revenue business, even before international expansion or deeper bundling of services. Internally, Robinhood tracks metrics like Gold adoption & assets under custody as indicators of wallet share, not just trading activity.

The broader goal, according to Tenev, is to become the primary financial platform for the next generation as customers’ needs evolve from trading into saving, spending, borrowing, and longer-term investing.

Assets Under Custody & Retail Behavior Today

At the time of the interview, Robinhood currently holds approximately $350 billion in assets under custody. Tenev contrasted today’s activity with the COVID and zero-interest-rate period of 2020–2021.

During that earlier period, retail trading activity tended to cluster around a small number of names and themes, including bankrupt equities, stimulus-driven trades, meme stocks like GameStop, and a heavy concentration in crypto—particularly Dogecoin. Those dynamics also coincided with unusually high volatility and rapid shifts in sentiment.

By comparison, Tenev said current trading volumes are more evenly distributed across a wider range of stocks, with crypto representing a smaller share of overall activity. He attributed the change to both macro conditions and the evolution of Robinhood’s customer base alongside a more diversified product set.

In his view, the retail investor today is operating with a broader set of tools and exposures than during the peak of the ZIRP era.

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Deel—Deel is the global people platform that helps startups hire, manage, pay, and equip anyone, anywhere. Trusted by more than 35,000 fast-growing companies, Deel is the people platform that just works, so teams can scale without the chaos. Visit: deel.com/sourcery

Public-–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. With Generated Assets, you can build, backtest, refine, and invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. Try it today: public.com/sourcery

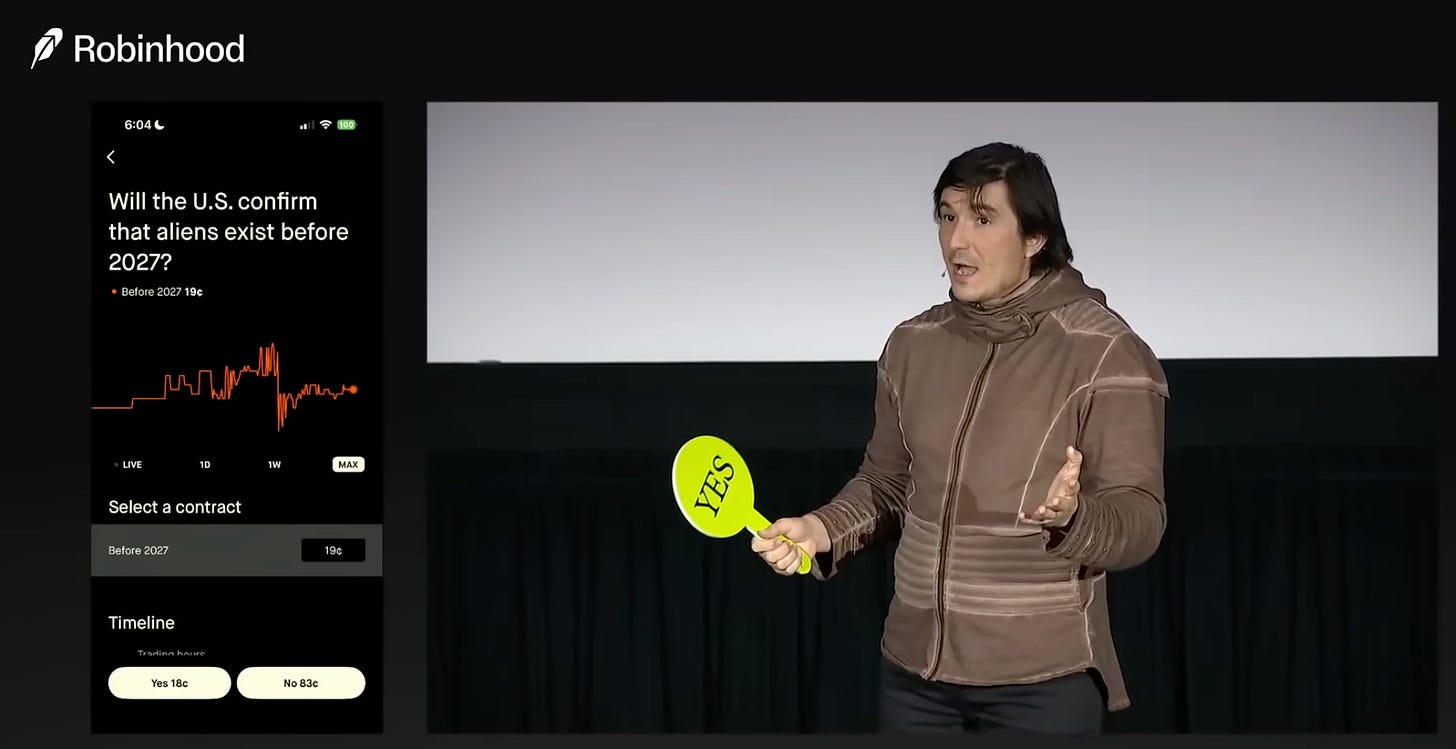

Prediction Markets

Prediction markets were one of the newer, & fastest growing in the history of the space-time continuum, business lines discussed reaching over $100M in annual revenue. Tenev described the 2024 U.S. presidential election as the point when adoption accelerated meaningfully, calling it “ground zero” for the category’s growth.

Since then, Robinhood has expanded prediction markets into sports, with features such as combination trades and individual player outcomes. The company has also introduced weather-based contracts, which Tenev sees as an early step toward more functional hedging products.

He pointed to potential applications in areas like fire risk and hurricane exposure, noting that prediction markets can sometimes offer faster, cheaper alternatives to traditional insurance-style products.

Tokenization & International Expansion

→ Read Packy McCormick’s The Great Differentiation on this iconic south of France event

Starting outside the U.S., Robinhood is moving aggressively on tokenization.

In Europe, the company now offers trading in more than 1,500 tokenized public stocks, up from roughly 400 at their Q3 ‘25 earnings call.

“If you look 10 years from now, we see a world where more than half of our revenue could be outside the US.”

Tenev outlined a multi-phase plan:

Tokenize a broad set of public equities

Integrate tokenized assets with Bitstamp to enable 24/7 trading

Enable use cases such as self-custody, collateralized lending, and DeFi interoperability

He framed tokenization as a way to combine traditional custody with crypto-native trading infrastructure, reducing friction around liquidity, settlement, and access.

In the U.S., where tokenization of private companies is not yet legal, Robinhood has launched Robinhood Ventures, including a closed-end fund structure, to give retail investors exposure to private markets within existing regulations.

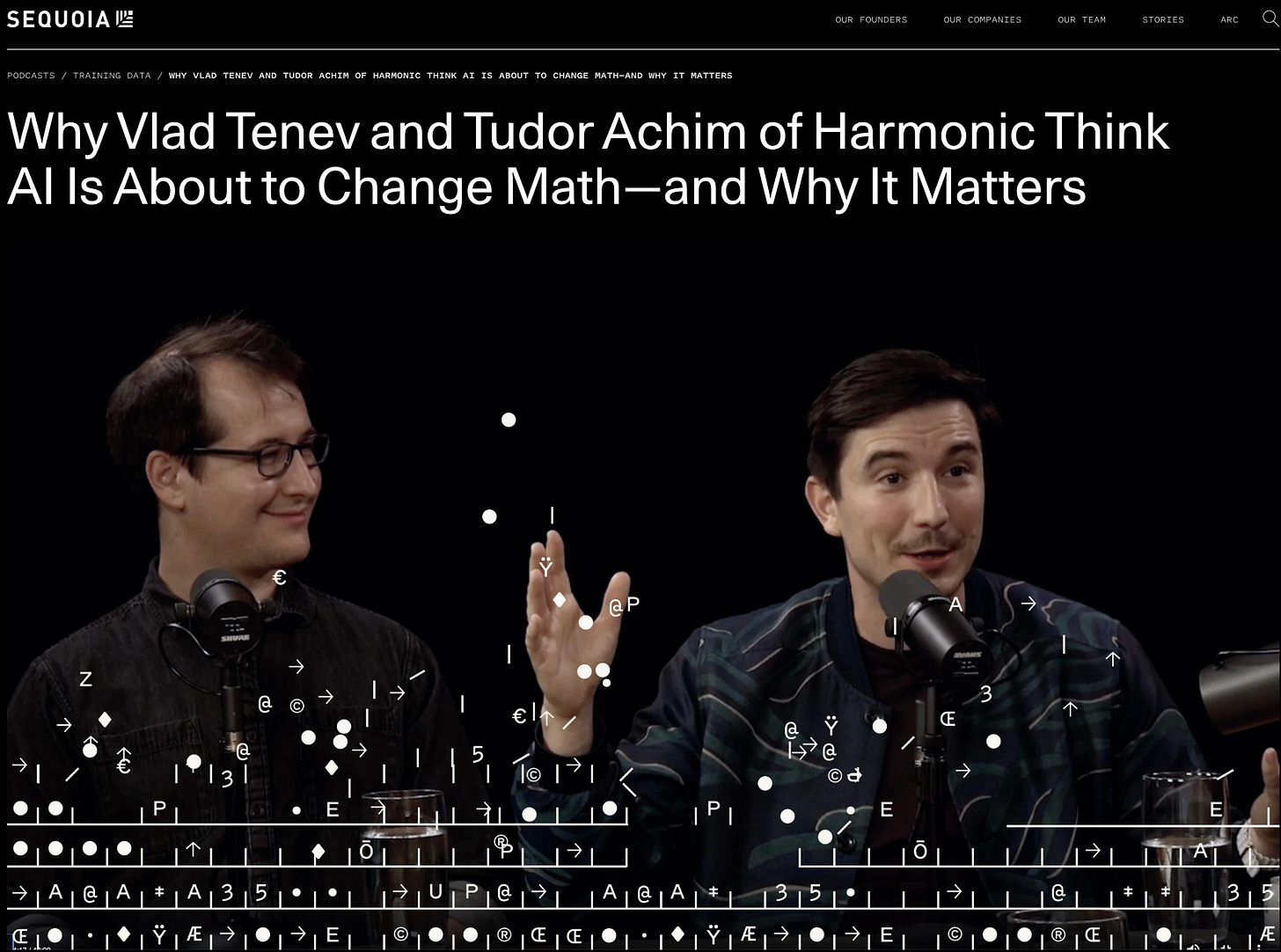

AI, Math, & Harmonic

The conversation also covered Harmonic, an AI company Tenev co-founded focused on mathematical reasoning. He described its goal as building systems that can solve advanced mathematical problems beyond human capability.. aka mathematical superintelligence.

“The child has surpassed the parent in mathematical ability, & then things get weird.”

“We’re probably a year away from actually solving unsolved math problems.”

Recent milestones include:

Gold-medal-level performance on the International Math Olympiad

Solving or assisting with multiple open Erdős problems

Correctly solving 10 out of 12 problems on the William Lowell Putnam Competition

Tenev views math as foundational to progress in physics and engineering, and sees mathematical AI as a long-term lever rather than a near-term product cycle.

Honestly, this was one of my favorite parts of the conversation, in part because we talk about time travel, but mostly because of how passionate Vlad is about mathematics, he lights up!

The Anthony Edwards of Earnings Calls

Earnings, Transparency, & Retail Engagement

Bored by scripted reporting, Tenev has completely changed how Robinhood communicates with shareholders. Over the past year, the company shifted earnings calls from traditional audio formats to live, video-based events with real-time Q&A that includes retail investors.

Audience size increased from hundreds on earlier calls to tens of thousands on recent livestreams. Robinhood has since partnered with other public companies, including Opendoor, to host earnings directly within the Robinhood app for retail shareholders.

Tenev views retail ownership as strategically important, particularly for companies operating in politically and culturally sensitive areas like crypto and AI.

Latest Earnings Report: Q3 2025

A Checkpoint, Not an Endpoint

Across the conversation, Tenev framed Robinhood’s record year as the result of structural changes rather than favorable timing. The company now operates at larger scale, across more revenue streams, and with a broader customer base than during earlier cycles.

The metrics from revenue diversification, subscription growth, assets under custody, and international expansion suggest a business that looks materially different than it did at IPO. In Tenev’s view, the year marks a checkpoint in a longer trajectory rather than a conclusion.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.