BREAKING: DreamWorks, Storytelling, & Building Companies in the AI Era

Jeffrey Katzenberg & ChenLi Wang, WndrCo

Disney → DreamWorks → WndrCo

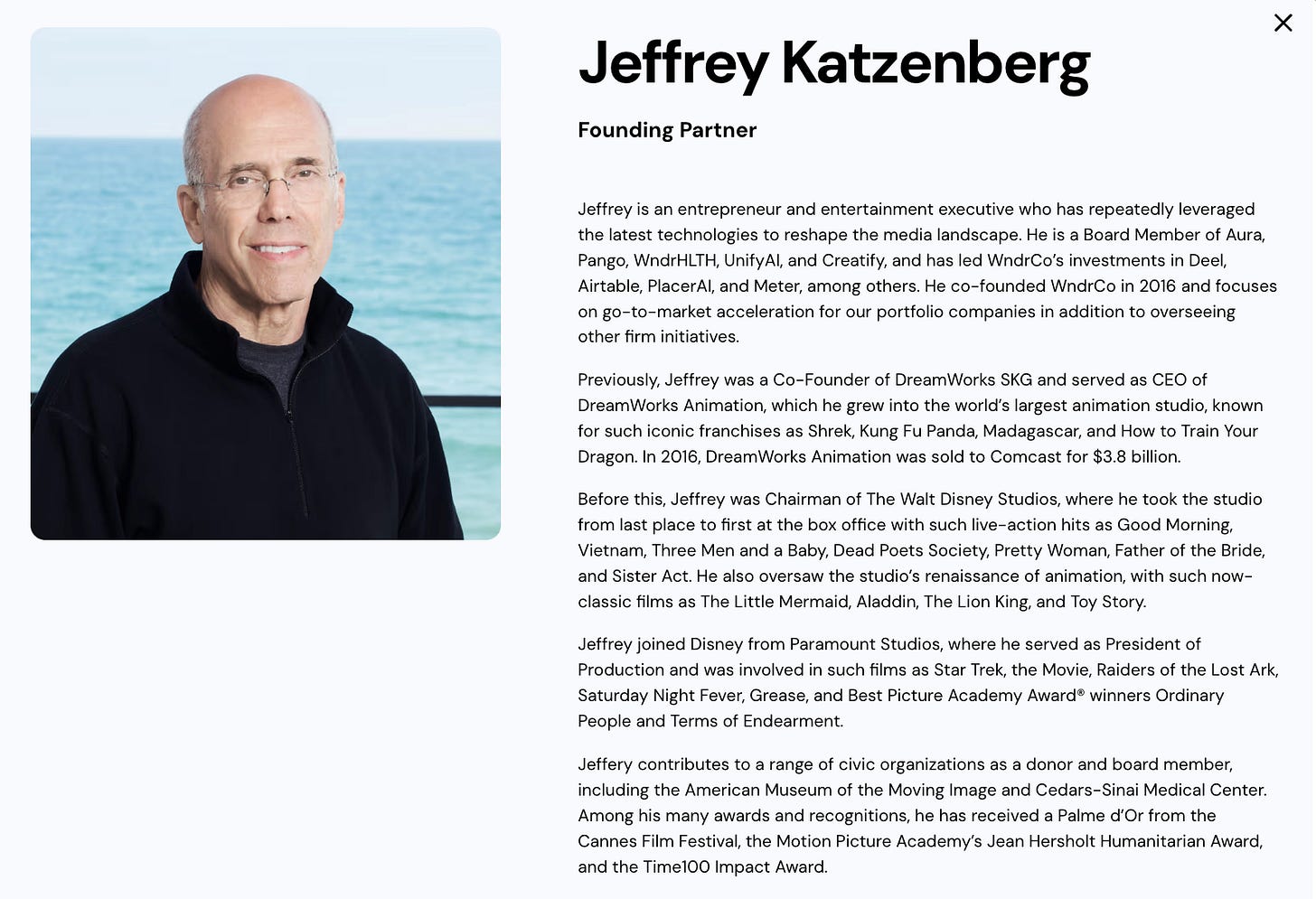

Jeffrey Katzenberg & ChenLi Wang join Sourcery to share how WndrCo, the $2.8B AUM holding company & technology investment firm was built, & how they think about investing, company-building, & storytelling in the age of AI.

→ Listen on X, Spotify, YouTube, Apple

Framed as Katzenberg’s “third act” after Disney & DreamWorks, the conversation traces a lifelong pattern of using storytelling as a competitive advantage for building.

We break down WndrCo’s hybrid model spanning builds, venture, & seed investing, and discuss how that framework has led them to back category-defining companies including Cursor, 1Password, Airtable, Figma, Harvey, Abridge, Granola, Writer, & Deel, as well as internally built platforms across consumer security, health, & the future of work.

It’s clear, storytelling emerges as a core operating discipline at WndrCo. Not just used as a “marketing” tool, but as a critical foundation for enduring execution: recruiting the right people, clearly explaining products, earning customer trust, & translating technical capability into real adoption.

The conversation also dives into the state of venture capital, an AI reckoning (?!), what happens after $700B+ in hyperscaler capex, and why only companies delivering visible ROI and real adoption will survive the next cycle.

WNDRCO

𝐓𝐈𝐌𝐄𝐒𝐓𝐀𝐌𝐏𝐒

(00:00) Welcome to Sourcery at WndrCo

(01:43) What Actually Changed in AI in 2025

(03:26) When AI Hype Meets Real Productivity

(05:01) Is an AI Bubble About to Burst?

(05:59) Companies WndrCo Is Most Excited About

(09:02) The Origin Story of WndrCo

(09:45) Technology as a Storytelling Advantage

(12:55) Why Katzenberg Chose Venture as a Third Act

(17:12) From Holding Company to Venture Platform

(18:56) How WndrCo Decides to Build vs Invest

(22:29) Why Longevity Became a New Build Theme

(26:33) "Good Storytelling, Bad Outcomes"

(29:57) What Actually Differentiates WndrCo as an Investor

(35:57) Why Benchmarks Fail in the AI Era

(40:16) How WndrCo Invests: Build, Venture, Seed

DreamWorks, Storytelling, & Building Companies in the AI Era

Jeffrey Katzenberg & ChenLi Wang

From AI hype to measurable deployment

Both Katzenberg & Wang frame 2025 as an inflection point where AI moved from novelty to tactical deployment. Wang notes that the industry has crossed from “show-your-friend” demos into real workflow adoption, while still acknowledging that meaningful transformation will take years.

Katzenberg contextualizes this shift with the scale of capital being committed at the infrastructure layer:

Roughly $700 billion of capital investment is being deployed by hyperscalers over a 24-month period.

That level of spend, he argues, creates an unavoidable reckoning (to some degree). The next phase of the AI cycle will not be judged by ambition or benchmarks, but by return on invested capital, productivity gains, & visible outcomes inside enterprises.

The takeaway is not pessimism, but selectivity: many ideas will not survive, but those that produce measurable value will compound quickly.

What WndrCo actually looks for in AI products

Rather than framing AI as a model race, the conversation repeatedly returns to products in use.

Wang describes a simple but revealing heuristic: walking through startup offices globally and observing what is actually open on people’s screens. Which tools show up in the browser tabs and system bars, and which quietly disappear, tells more about durability than any benchmark.

This lens explains WndrCo’s investments in AI-native companies embedded directly into daily work:

Cursor — increasingly ubiquitous in developer environments

Abridge — deployed in clinical documentation workflows

Harvey — used by lawyers and clients, not just technologists

Granola — adopted organically inside startup teams

1Password — a security product that has become infrastructure

The common thread is not novelty, but habit formation: AI that meaningfully reduces cognitive load and becomes part of how work actually gets done.

WndrCo’s origins: a holding company, not a VC fund

One of the most concrete sections of the episode focuses on WndrCo’s structure.

Wang explains that when the firm was formed in 2016, it was intentionally set up as an investment holding company, inspired by long-term capital stewards rather than traditional venture portfolios. That thinking was informed by studying multi-decade builders and allocators — and by the partners’ own operating backgrounds.

Katzenberg reinforces this, noting that WndrCo initially set out to do two things:

Build companies internally, from first principles

Acquire or fix businesses that had gone sideways but still addressed large markets

Since 2018, WndrCo has started eight companies internally, reflecting a deliberate bias toward creation rather than purely financial participation.

The foundation of WndrCo is partnership:

Jeffrey Katzenberg, one of the most influential builders of modern media platforms, having shaped multiple generational shifts in storytelling, distribution, and technology over four decades

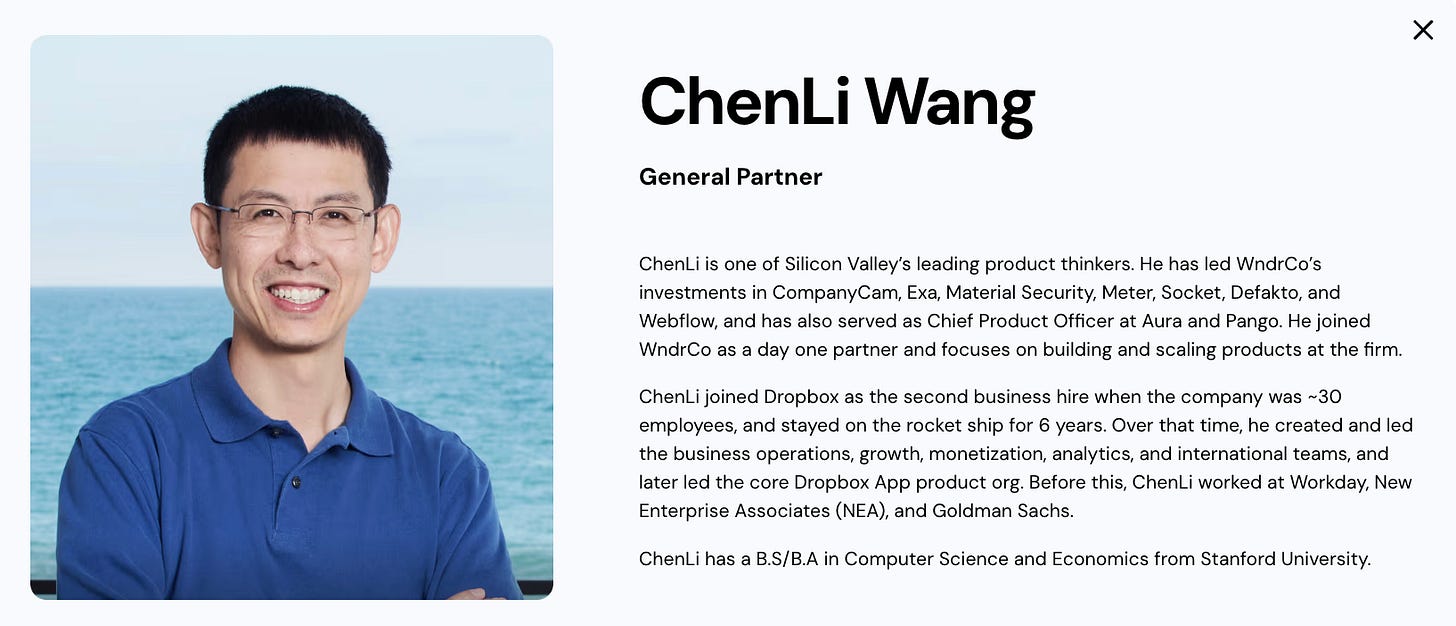

ChenLi’s technical depth and product judgment shaped by scaling Dropbox

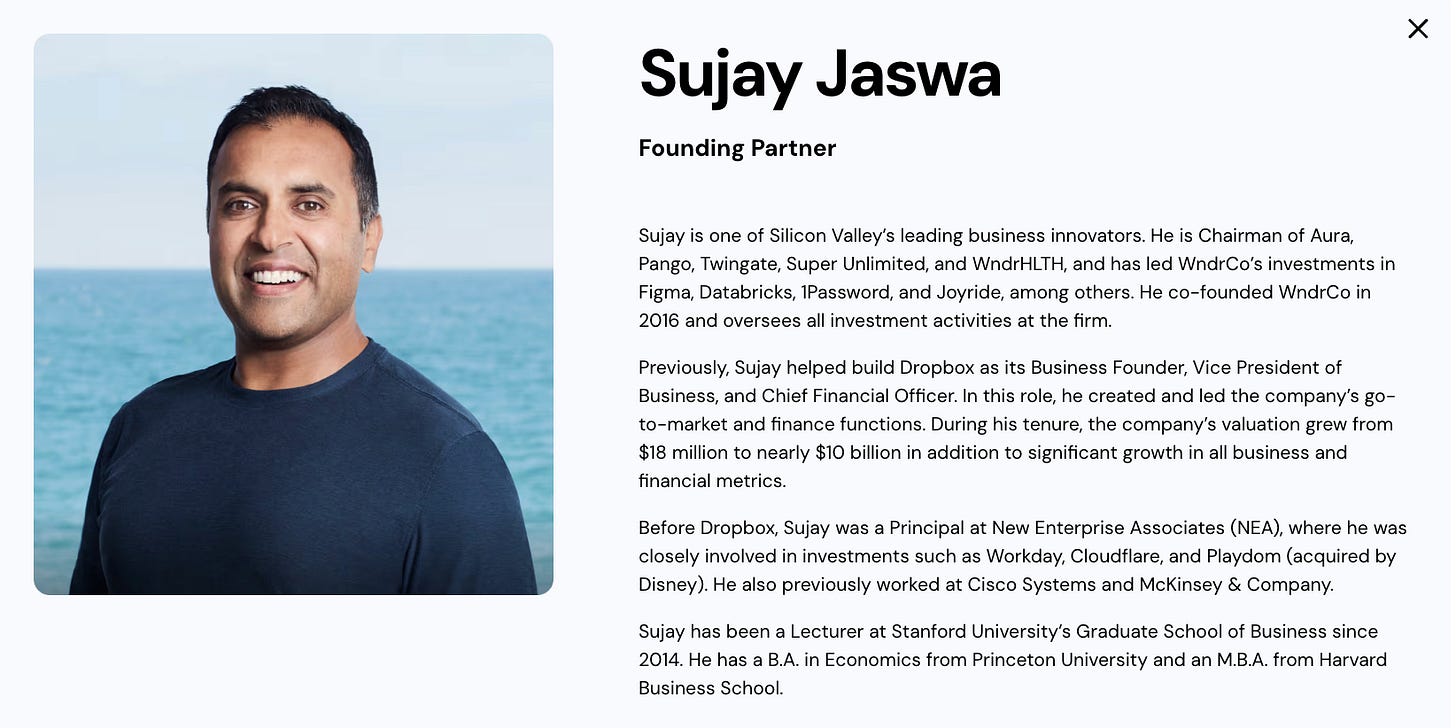

Sujay Jaswa’s role as the firm’s guiding operational force

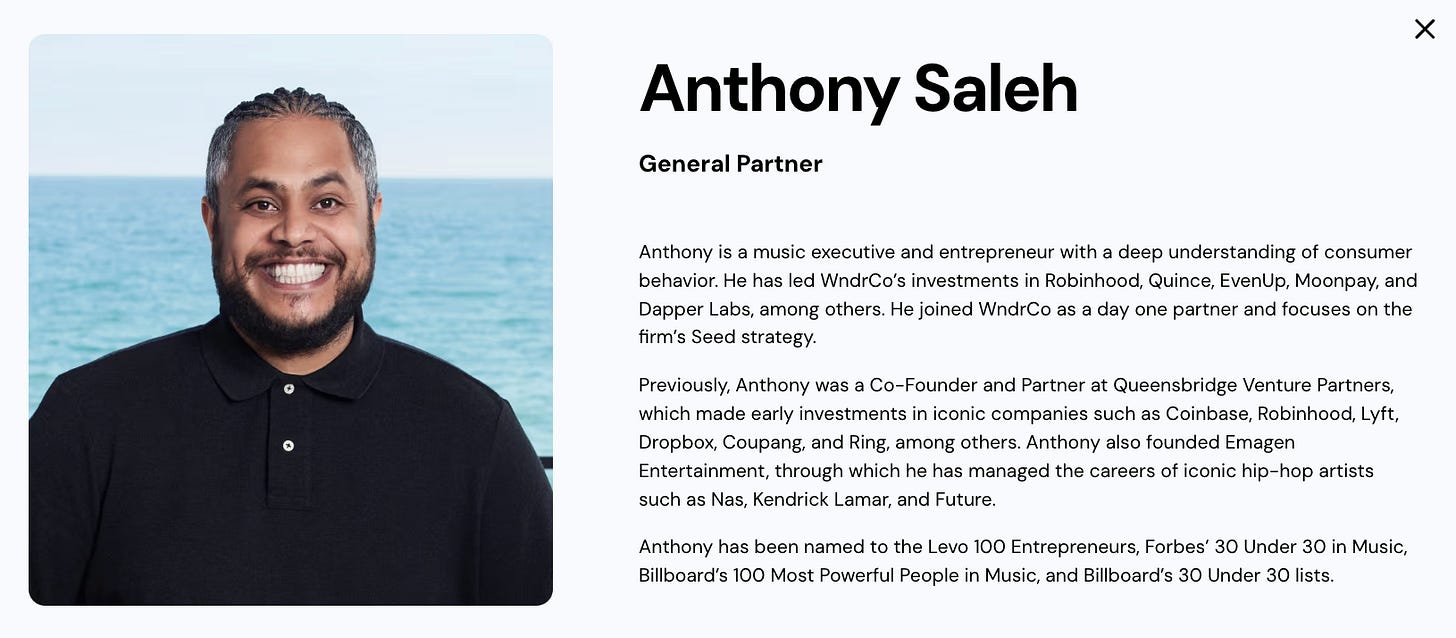

Anthony’s ability to see around corners and across networks

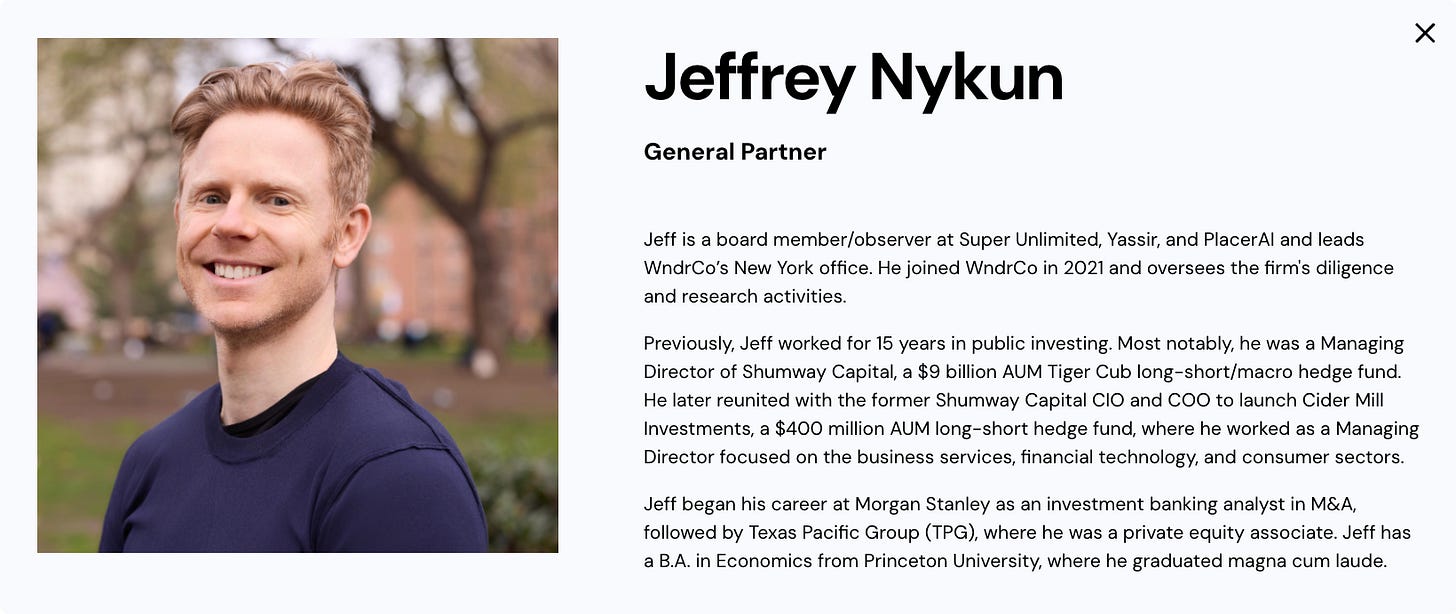

Partners like Jeff & Justin adding further depth across investing and execution.

Economics of the ‘holding co’ model

Katzenberg surprisingly states that the WndrCo ‘holding company’ is expected to generate approximately $400 million in free cash flow, driven by ownership in scaled operating businesses rather than unrealized venture marks.

Alongside that operating base, WndrCo today manages $2.8 billion in assets under management, deployed across three distinct strategies:

Build: roughly one company per year, with $50–75 million committed per build and meaningful ownership taken early due to hands-on involvement

Venture: typical check sizes of $5–15 million, focused on generational founders rather than ownership targets

Seed: a dedicated seed fund with ~$500,000 checks

The firm is currently investing out of Fund III.

Build strategy influences: builders backing builders

Katzenberg is explicit about where the Build strategy inspiration comes from.

He cites Founders Fund as a model for combining company creation with investing, pointing to firms that start companies themselves while also backing others.

He also references Andreessen Horowitz, highlighting how operator-founders built a firm around a founder’s mentality, and Josh Kushner’s Thrive Capital, whom he describes as “crushing it,” several years ahead in executing a similar hybrid approach.

Katzenberg frames the ambition for WndrCo as operating in the same lane: builder-led, conviction-driven, and comfortable with long feedback loops.

Storytelling as an operating discipline

A recurring theme throughout the episode is storytelling, but not as marketing gloss, as a core operating tool.

Katzenberg argues that no business succeeds without clear narrative alignment: recruiting talent, raising capital, and selling products all depend on the ability to articulate why something matters now.

He gives concrete examples from WndrCo’s portfolio where founders explicitly sought help with storytelling, not because the product was weak, but because distribution & adoption required clarity across multiple audiences, from enterprise buyers to end users.

In an AI landscape where technical capabilities increasingly converge, this ability to frame, explain, and position becomes a competitive advantage.

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast. visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Deel—Deel is the global people platform that helps startups hire, manage, pay, & equip anyone, anywhere. Trusted by more than 35K+ fast-growing companies, Deel is the people platform that just works, so teams can scale without the chaos. Visit: deel.com/sourcery

Public—Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. Seriously, you can type in anything, from “AI-powered supply-chain companies with positive free cash flow” to “defense tech companies growing revenue over 25% year-over-year.” With Generated Assets, you can build, backtest, refine, and invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. Try it today: public.com/sourcery

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.

What really stood out here is how consistently storytelling is treated as infrastructure, not ornamentation.

The WndrCo lens feels refreshingly grounded: less fascination with models and benchmarks, more obsession with what actually earns a permanent tab in someone’s workflow. That “what’s open on the screen” heuristic is deceptively simple, but it captures adoption, habit formation, and ROI in a way most AI narratives still miss.

I also appreciated the clarity around the holding company model. Building, fixing, and selectively investing creates a much longer feedback loop than traditional venture, but it seems far better suited to an era where AI convergence is real and differentiation comes from execution, narrative alignment, and sustained use, not novelty.

If AI is moving from spectacle to substance, this conversation makes a strong case that the winners won’t just ship technology. They’ll ship coherent stories that survive contact with reality.