BREAKING: Inside Anthropic's $100M Anthology Fund w/ Menlo Ventures

Goodfire, Glean | Menlo: $6.8B+ AUM, 80+ Public Companies, 165+ M&A

Anthropic, Glean, Goodfire, Hot Takes

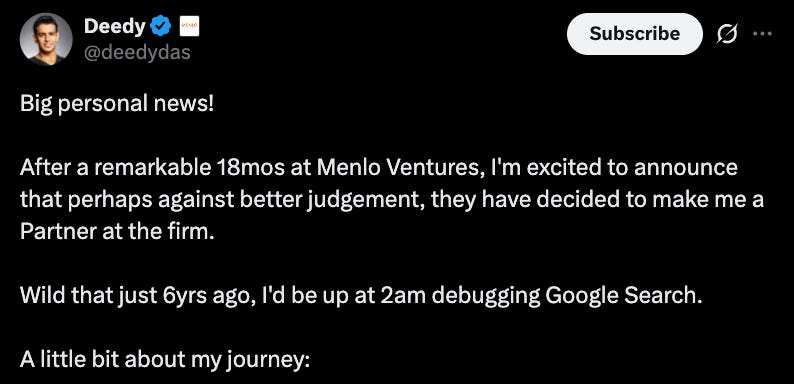

Deedy Das, Partner at $6.8B+ AUM Menlo Ventures, Anthropic’s $100M Anthology Fund, former founding team member at Glean, and very viral X-poster, joins Sourcery to unpack his investment strategy, Goodfire, ..& several hot takes:

“Almost no iconic company came from a VC thesis.”

“Most engineers don't do sh*t.”

“At Google there were like people I knew who just didn’t write code for an entire year and they’re still there.”

“I knew people who haven’t written code for 10 years.”

“Humanity has in the modern day, has never seen a extended period of time where the population has fallen systemically.”

→ Listen on X, Spotify, YouTube, Apple

We go deeper into why, with 48+ years of experience, 80+ public companies, 165+ mergers and acquisitions, and $6.8B+ under management, Menlo Ventures is partnering with Anthropic through the $100M Anthology Fund to back the next generation of AI startups.

The Menlo Anthology Fund taps expert investors from Menlo’s AI team—partners Tim Tully, Matt Murphy, Joff Redfern, Amy Wu, Deedy Das, and Venky Ganesan—who will work closely with President Daniela Amodei, CPO Mike Krieger, and the rest of the Anthropic team to support the most promising AI startups.

Drawing on his experience building at Glean and working at companies like Google and Facebook (Meta), Deedy explains how Menlo identifies infrastructure companies early, often before the broader market recognizes their importance, and why iconic outcomes rarely emerge from predefined theses.

We also explore the rapid evolution of the AI stack, from internet-scale training to reinforcement learning, agentic systems, and the pursuit of the economic Turing test, and how these shifts are redefining where long-term value will accrue.

Topics Covered:

Strategy behind Menlo + Anthropic’s $100M Anthology Fund

Goodfire: “brain surgery for AI models”

Lessons from scaling Glean into a multi-billion-dollar company

Why “anti-thesis” investing wins?

Founder traits that predict generational companies

AI infrastructure gaps still waiting to be built

Product taste as a competitive moat

The danger of overfunding + overvaluing startups

How Deedy became one of tech’s most followed voices on X

BREAKING: Goodfire’s $150M Series B

Deedy highlights Goodfire, his biggest bet right now, who just so happened to announce their $150M Series B at a $1.25B valuation today (complete luck!). Led by interpretability researchers from Anthropic, DeepMind, & OpenAI, Goodfire is building: “brain surgery for AI models.”

The round was led by B Capital, with participation from Juniper Ventures, DFJ Growth, Salesforce Ventures, Menlo Ventures, Lightspeed Venture Partners, South Park Commons, Wing Venture Capital, Eric Schmidt, and others.

“What if you could peek into the brain of a model & find out what it was actually thinking, why it was actually saying the things it said?”

Goodfire is building mechanistic interpretability technology to open the AI “black box,” aiming to explain why models behave the way they do rather than just evaluating outputs. A scientific leap that could reshape how AI is built & trusted.

𝐓𝐈𝐌𝐄𝐒𝐓𝐀𝐌𝐏𝐒

(00:00) Deedy Das, Partner Menlo Ventures

(01:06) Betting big on Goodfire AI

(04:16) Why AI still feels early: blue-collar gaps and population decline

(08:50) How X became a leverage point: “Hacking the Indian Education System”

(19:43) Inside the $100M Menlo - Anthropic Anthology Fund

(23:33) Conviction founders vs Resume founders

(28:55) How Menlo picks ideas worth betting on

(33:42) The Cluely story and the Interview Coder backlash

(36:41) Understanding the modern AI stack: Prompts → fine-tune → RL

(40:23) Capital discipline and the danger of over-raising

(48:20) When AI scaling laws start to break, RL takes over

(54:19) Reinforcement learning, bottlenecks, and what comes next

(57:14) Layoffs, efficiency, and the end of bloated teams

(1:04:50) Lessons from Glean CEO Arvind Jain

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast. visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Deel—Deel is the global people platform that helps startups hire, manage, pay, and equip anyone, anywhere. Trusted by more than 35,000 fast-growing companies, Deel is the people platform that just works, so teams can scale without the chaos. Visit: deel.com/sourcery

Public-–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. With Generated Assets, you can build, backtest, refine, and invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. Try it today: public.com/sourcery

Top Hot Takes

“It’s so hard to justify a billion. I just don’t see how people can write a billion dollar seed.”

“Almost no iconic company in the history of venture capital has come from anyone’s thesis area.”

“The number one thing I’m looking for when it comes to the founder is, are you just doing this because you think being a founder is cool? Because everyone thinks being a founder is cool and high status? I don’t care about that kind of founder.”

“There is information asymmetry between what most people in AI know and care about and things that matter in the world.”

“You almost kind of need to be a little bit of a cult leader as a founder.”

“If your enterprise product can be PLG, then it must be — otherwise a PLG company will absolutely eat your lunch and destroy you.”

Lessons From Glean

POV: CEO & Founder Arvind Jain

“Hard work is a, is a gift. And if you wake up where you are doing the job that you do, and you can work hard, you don’t know how lucky you have it.”

“I run such a cool company right now. If I get acquired, I will no longer run that cool company. Why would I want that?”

Decision Making

“At any given point, you have one question you’re trying to answer and you want to go get that answer. That’s all that you need to make something work.”

“Don’t overthink it.”

“All we need to know is do customers love this product? Is the answer yes or no?”

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.