BREAKING: Inside Archer Aviation ($ACHR)

After-hours HQ Tour w/ CEO Adam Goldstein

"All of a sudden [you're] talking about a $100 billion business”

Adam Goldstein, Founder & CEO of Archer Aviation (NYSE: ACHR) gives Sourcery a full behind-the-scenes (BTS) of Archer’s HQ.

→ Listen on X, Spotify, YouTube, Apple

In this conversation, Adam breaks down what Archer is building (a new category of aviation), why regulatory and political support matters, and how they’re thinking about scaling from early city deployments to a truly global aircraft business. We also get into why retail investors and Reddit became a major part of Archer’s story, and the market-sizing framework behind “20 aircraft x 1,000 markets.”

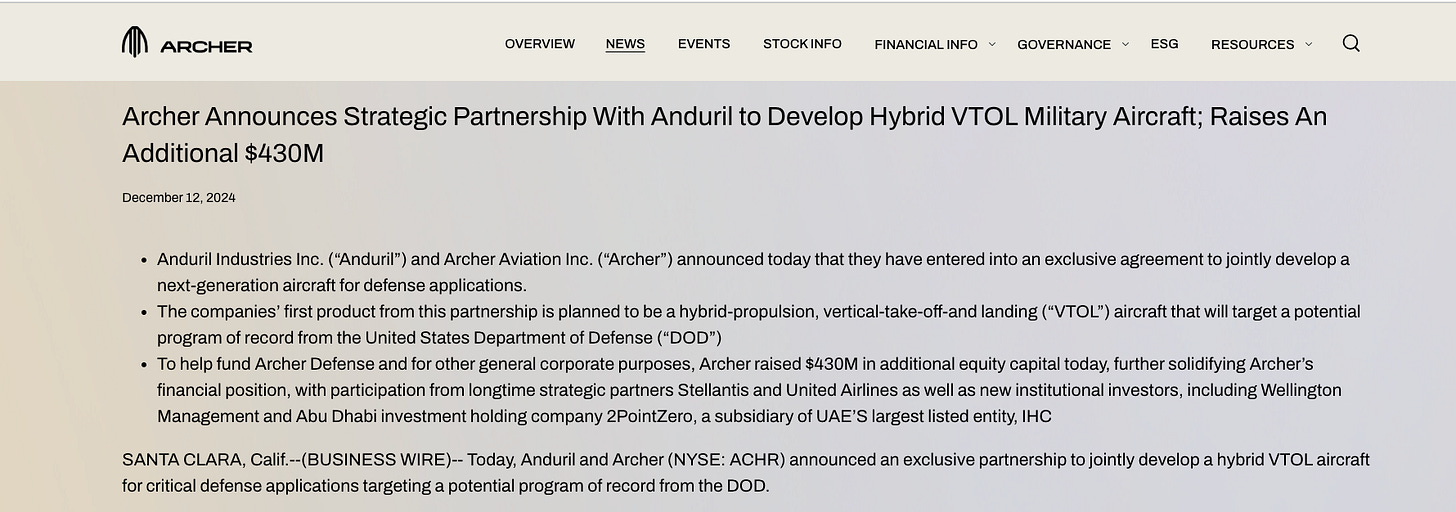

One part of Archer’s progress that’s very impressive are their significant defense and strategic technology partnerships, including Anduril (hybrid VTOL and unmanned rotorcraft concepts), Palantir (AI and data infrastructure for manufacturing, operations, and airspace systems), its role as the exclusive air taxi provider for the LA 2028 Olympics, and its early expansion partnerships across the UAE.

Plus, I try the simulators: first a helicopter-style experience (chaos), then Archer’s Midnight fly-by-wire system (way easier, way more fun).

Archer was the first sponsor of Sourcery, ever. So it was really special to finally get a full tour!

This goes back to early 2024, when I first started getting more curious about eVTOLs. As I followed Archer’s progress on the commercial side, I was genuinely impressed. It felt very sci-fi, but also practical in a way that just made sense.

So, maybe a bit boldly, I reached out and asked if they’d consider sponsoring Sourcery, which I mentioned on the podcast was “the biggest deal I’d ever signed” ..and honestly, it was.

Landing a public company as your first-ever sponsor? Not bad. It truly meant a lot early on. It’s been incredibly fun to follow their continued growth & entry into the global market.

Topics we cover:

What Archer is and how eVTOL air taxis work

The “first new category in aviation in 60 years” and what it takes to unlock it

LA28 Olympics and the path from now to 2028

EIPP and flying in US cities as soon as next year

Defense market shift toward autonomy at scale and Archer’s partnerships

Going public early, Boeing conflict, and the role of retail liquidity

Why Adam thinks this can become a $100B+ business (and eventually bigger)

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast. Visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Deel—Deel is the global people platform that helps startups hire, manage, pay, and equip anyone, anywhere. Trusted by more than 35,000 fast-growing companies, Deel is the people platform that just works, so teams can scale without the chaos. Visit: deel.com/sourcery

Public-–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. Try it today: public.com/sourcery

𝐓𝐈𝐌𝐄𝐒𝐓𝐀𝐌𝐏𝐒

(00:00) Adam Goldstein, Founder & CEO Archer Aviation

(01:18) Executive orders, EIPP, and federal backing for LA Olympics 2028

(06:21) What makes Archer’s eVTOL different from helicopters & planes

(10:21) The Anduril partnership & scalable autonomy

(13:15) Going public with 50 employees, Archer Apes, and a big pushback

(16:43) The giant candy wall that runs Archer HQ?

(18:05) Why storytelling matters as a public company

(20:34) Flying Midnight in a simulator: Mechanical vs Fly-by-wire

(25:51) Federal backing and the race against time

(28:45) Testing eVTOLs in the UAE’s extreme heat and going global

(35:31) The brutal reality of building a new-age aviation company

(41:51) “Giraffa” & a mystery phone from a politician?

Archer Aviation: After-Hours HQ Visit With Founder & CEO Adam Goldstein

Archer Aviation (NYSE: ACHR) is developing electric vertical takeoff and landing (eVTOL) aircraft, a category the company describes as the first new classification in U.S. aviation in more than 60 years.

In our special after-hours visit to Archer, Founder & CEO Adam Goldstein gave us a fun tour, including testing flight simulators (!!), and shared how the company is approaching aircraft design, regulatory coordination, public markets, and expansion across civil, defense, and international markets.

The visit took place at Archer’s operations-focused headquarters, where engineering, regulatory, policy, partnerships, flight programs, & global scaling are managed.

Aircraft Design & Simulators

Goldstein explained that Archer’s aircraft are enabled by distributed electric propulsion. Rather than a single large rotor, as in a traditional helicopter, Archer uses multiple electric engines and propellers. This configuration allows the aircraft to take off and land vertically and then transition to forward flight like an airplane.

“Instead of having one rotor that takes off and lands vertically, we have multiple sets of engines, multiple sets of propellers that allows you to take off and land vertically like a helicopter, but then transition and fly forward like an airplane.”

During the visit, Archer demonstrated two simulator environments. The first simulated helicopter-style flight, which required continuous manual correction across multiple controls. The second demonstrated Archer’s Midnight aircraft, which operates using a fly-by-wire system. In this configuration, software manages flight stability while the pilot provides higher-level directional inputs.

Goldstein said the fly-by-wire architecture reduces pilot workload and allows for higher levels of redundancy due to the use of multiple electric propulsion units.

Regulatory Coordination & Public Deployment

Goldstein emphasized that developing a new aircraft category requires sustained coordination with regulators and government agencies. Archer has worked with the FAA and Department of Transportation as part of this process.

“This is the first new category in aviation in 60 years.”

Archer was selected as the exclusive air taxi provider for the LA 2028 Summer Olympics, a designation that Goldstein described as a significant milestone.

“We were selected as the exclusive air taxi provider for the LA 28 Summer Olympics, and that was a huge, huge deal.”

In addition, to support early public exposure to eVTOL operations, Archer has participated in the development of the Electric / Advanced Air Mobility Integration Pilot Program (EIPP).

Under this framework, aircraft operations would begin in a limited number of U.S. cities, with conservative parameters including point-to-point routes, daytime flights, and high safety reserves. Goldstein compared the approach to early autonomous vehicle deployments, where gradual exposure was used to build public familiarity.

Public Markets, SPAC, & Reddit’s Retail Army

Archer went public in 2021 via a SPAC transaction advised by Moelis & Company. Goldstein said that at the time of the public listing, the company was still small.

“When we announced we were going public, we were actually 50 people and it was pretty shocking.”

Goldstein described the period immediately following the announcement as unusually intense, particularly for a hardware company entering public markets.

“Within six weeks, I had the most unbelievable experience where I had three-letter agencies coming after me. I had lawsuits. I had pretty much everybody come out of the woodwork to try to take us down.”

“It was like my welcome to the NFL moment.”

Goldstein also discussed the role retail investors have played since Archer became public, referencing Reddit specifically.

“Reddit played actually a big part in our ability to not only just go public, but also to build a huge retail following.”

He noted that retail participation has been a defining feature of Archer’s stock trading activity, and explained why trading volume matters from his perspective.

“If you look at the volume traded throughout our stock, we will often be a top 10 most heavily traded stock on the New York Stock Exchange. That will happen all the time. That is because of the retail.”

“That is a form of liquidity, meaning we are able to raise a lot of capital. And so when you have a lot of volume going through the stocks, a lot of the investors have the ability to play, meaning they can come in and out of your stock.. If you don’t have liquidity, there’s no way for investors to really acquire your shares or even get out once they do.”

PLTR, Anduril, & their Defense Partnerships

Goldstein discussed Archer’s participation in defense-adjacent initiatives, particularly its partnership with Anduril. He framed the collaboration within a broader shift in defense procurement toward autonomous and scalable systems, as opposed to large, centralized platforms.

“The entire defense industry is changing. It’s changing from these expensive, centralized, exquisite systems to much more scalable, autonomous systems.”

Archer also partners with Palantir on data & AI infrastructure, applying Palantir’s platforms to manufacturing, operations, & complex system coordination across next-generation aviation.

Archer’s involvement focuses on applying its propulsion systems, aircraft architecture, and manufacturing approach to potential hybrid VTOL and unmanned rotorcraft use cases. Goldstein noted that designing aircraft for scale from the outset could allow shared manufacturing & supply chains across civil & defense applications.

International Expansion and the UAE

Archer’s international efforts include partnerships in the United Arab Emirates, where Mubadala became an investor during Archer’s public-market phase in 2021. Goldstein said the relationship facilitated engagement with regulators, infrastructure providers, and operators across the region.

“Mubadala became an Archer investor very early, and that really kicked off a lot of the action in the UAE.”

He noted that the UAE’s climate and infrastructure environment provide useful conditions for testing aircraft performance. Goldstein added that interest has since expanded across other GCC countries and that longer-term opportunities exist in high-density markets globally, pending certification.

Market Sizing and Deployment Strategy

Goldstein outlined Archer’s approach to deployment as incremental and geographically broad. Rather than concentrating large numbers of aircraft in a single city, Archer expects early deployments to involve tens of aircraft per market across many locations.

He used an illustrative example of 20 aircraft across 1,000 markets to explain how cumulative manufacturing volume could scale without requiring immediate saturation of any individual city. Goldstein emphasized that this framework reflects how Archer is thinking about production, rather than a near-term operational plan.

An Unexpected Package.

Image: ChatGPT, NOT real

At one point, Archer received an unusual package. Inside was a note from a prominent politician requesting a meeting—and a phone, with instructions to call.

“Who sends a phone in the mail? I was like, this is definitely a trap.”

The reaction was immediate and cautious. The package was treated as a potential security issue and placed in a fire safe. Federal authorities were contacted.

Listen to the full story in our conversation.

Current Focus

Today, Archer’s attention is squarely on execution.

The company is advancing regulatory approvals, preparing for limited city deployments under pilot programs, and continuing work across both civil and defense-related initiatives. Goldstein emphasized that the capital raised to date is being used to extend time—time to certify, build, and operate within real-world constraints.

Success, as he framed it, won’t be measured by announcements or attention, but by certification progress, manufacturing readiness, and early operations that function safely and predictably in public settings.

That work is ongoing.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.

Eye-opening to consider how many different worlds ACHR has to keep in sync at once. A lot to juggle. It makes the story feel like a test case for whether a genuinely new aviation category can be pushed and willed into existence by aligning all of those stakeholders at the same time. Considering the playoffs, I appreciated the welcome to the NFL moment.

Love ACHR