BREAKING Inside Coatue: How the $70B Asset Manager Trades & Invests in Tech

Gamestop, Applovin, Meta, Google, AI, Meme Stocks

Coatue on Meme Stocks, AI & Strategy

Michael Barton, Sector Head at Coatue, joins Sourcery to unpack how one of the world’s largest hedge funds is navigating tectonic shifts in markets. From the Gamestop meme stock saga & the rise of retail investors, to Coatue’s $70B multi-strategy platform across public equities, privates, credit, & their newer fund CTEK.

CTEK is increasing access to their alpha via a $50K-minimum check fund focused on high-growth public & private tech companies, seeded with $1B from the family offices of Jeff Bezos + Michael Dell.

→ Listen on X, Spotify, YouTube, Apple

In this conversation we cover Coatue’s unique approach, sitting at the intersection of public and private tech investing. And why AI is the biggest tech wave yet, bigger than Web1, Web2, or mobile. Barton explains where he sees value accruing in the AI stack, how retail sentiment now drives price action, and why the next hedge fund edge comes from integrating data science, practitioner insights, and AI-native workflows.

This conversation reveals how Coatue is positioning itself for the future of markets, and what founders, investors, and institutions should learn from these shifts.

More below.

Michael Barton

Prior to joining Coatue, Barton was an investor at Melvin Capital, where he gained first-hand experience during the Gamestop short squeeze & the rise of retail-driven trading.

At Coatue, he has been involved in sourcing and leading high-conviction investments, including AppLovin.

KEY POINTS

Coatue’s Scale & Strategy: ~$70B AUM, with ~$25B in public equities, alongside private and credit strategies

Rise of Retail: Gamestop and Reddit proved retail investors & “meme stocks” can move markets—forcing funds to adapt new risk frameworks

Idea Generation & Investing Discipline: Successful investments at Coatue require both deep analysis, differentiated insights and the ability to distill a pitch into a few sentences that win buy-in from the team

AI’s Impact: Advertising is the first major AI use case driving revenue growth; Coatue sees AI as the largest tech wave yet, reshaping companies, investing processes, and even their own hedge fund workflows

Winners & Losers: Value will accrue differently across the AI stack (labs, agents, infrastructure, cloud); the challenge is identifying which layer ultimately dominates

PS. Did we mention we love merch!? Thank you for the CTEK hat!

The Evolution of Markets: Retail Power, AI, & the Future of Hedge Funds

The last decade in markets has been defined by two forces few could have predicted: the rise of retail investors and the acceleration of artificial intelligence. Together, they’ve reshaped how trades are made, how risk is managed, and where value ultimately accrues.

At Coatue, one of the world’s largest hedge funds with ~$70B under management, these forces are front and center. The firm spans public equities, privates, and credit, with technology at the heart of its strategy.

When Retail Changed the Game

Not long ago, retail investors were an afterthought. That changed with Gamestop & the decentralization of trading with platforms like Robinhood. One of the world’s top-performing hedge funds at the time, Melvin Capital, found itself down 50% in two weeks as retail investors on Reddit’s WallStreetBets coordinated buying pressure.

“We didn’t realize how powerful retail could be when they focused all their energy on a single stock,” Barton recalled.

Since then, funds like Coatue have adapted. Monitoring social platforms, Reddit threads, podcasts (like Sourcery) and even X (fka Twitter) sentiment has become part of the investment toolkit. Ideas no longer come solely from quarterly reports and management calls.. they emerge predominantly from the internet.

“A lot of the way we source ideas now comes from the internet,” he said. “There’s a proliferation of new data, and some of the work posted on WallStreetBets is real analysis worth paying attention to.”

Roaring Kitty | Source: WSJ

Pitching Ideas Inside Coatue

At Coatue, even the strongest research doesn’t mean much until it can be clearly communicated. Analysts and sector heads are expected to present their ideas directly to Philippe & Thomas Laffont, who lead the firm’s overall investment strategy.

“The key piece is how do you then convince Philippe and Thomas.”

The process is simple in structure but demanding in execution. A typical pitch might be the result of weeks of analysis, ie deep dives into financial models, customer calls, and competitive benchmarking, but it all has to be distilled into a concise thesis.

“You spend 95% of your time doing the analysis, but you need to be able to distill it into a three-sentence pitch.”

That discipline forces clarity on the central question: why this stock, why now, and at what price?

Strong pitches tend to combine both quantitative rigor and a differentiated insight. The AppLovin trade is one example. After initial conversations with CEO Adam Foroughi, Barton built models showing the downside case still had significant upside.

“Within five minutes, you knew there was something special here… You literally could not make a discounted cash flow model where the worst-case wasn’t a 3x,” Barton said.

When presented internally, that conviction made it through the filter and into the portfolio.

“[Thomas is] probably the best I’ve ever seen at this skill. He can take something incredibly complex and get the idea down to three sentences where you hear it and you’re like, that’s a great idea. And then you go into the model and you go into the details and show why that’s happening.

I spent a lot of time thinking about ‘how do I make a pitch very simple and get it in the book.’ ”

This structure with a bottom-up idea generation and top-level conviction checks helps Coatue balance creativity with risk management, ensuring only the highest-conviction ideas make it into the fund.

AI as the Defining Tech Wave

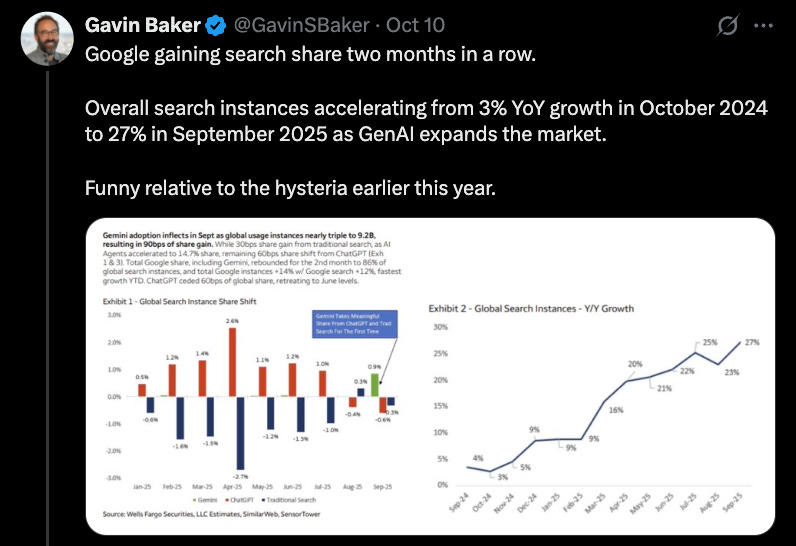

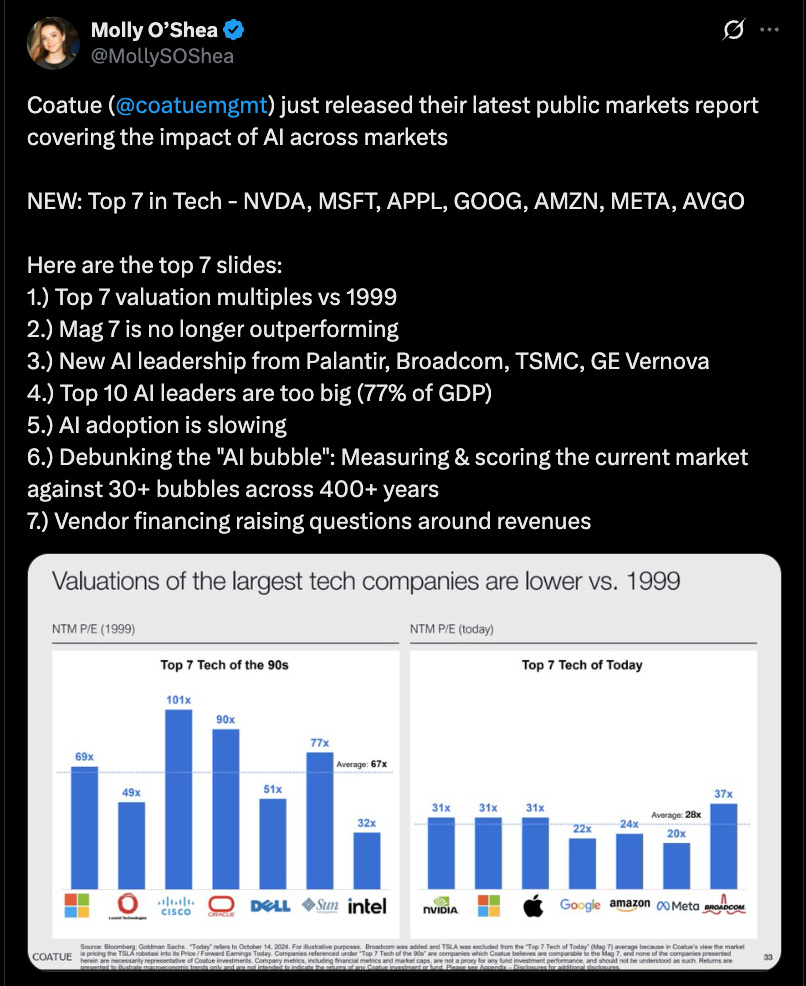

If retail trading was the shock of the last cycle, AI is the tidal wave of this one. The first clear impact has been in digital advertising. Companies like Meta and Google, once thought to be slowing, are reporting revenue growth far ahead of expectations as AI improves targeting.

“The first real use case of AI is advertising,” Barton explained. “Meta’s revenues are growing in the mid-to-high 20s when people thought they’d be closer to 15%. That incremental growth is AI.”

At the infrastructure layer, Nvidia’s GPUs have become the most critical resource in technology, with cloud providers such as Microsoft, Amazon, and Google competing to secure supply. On top of this foundation, new applications are emerging, from established platforms like Meta using AI to improve advertising, to OpenAI creating magic with Sora 2, to high-flying startups building specialized tools such as Cursor for AI-assisted coding.

“Every time tech waves inflect positively, they’re bigger than anyone predicts,” Barton noted. “And when companies get disrupted, it happens faster than people expect.”

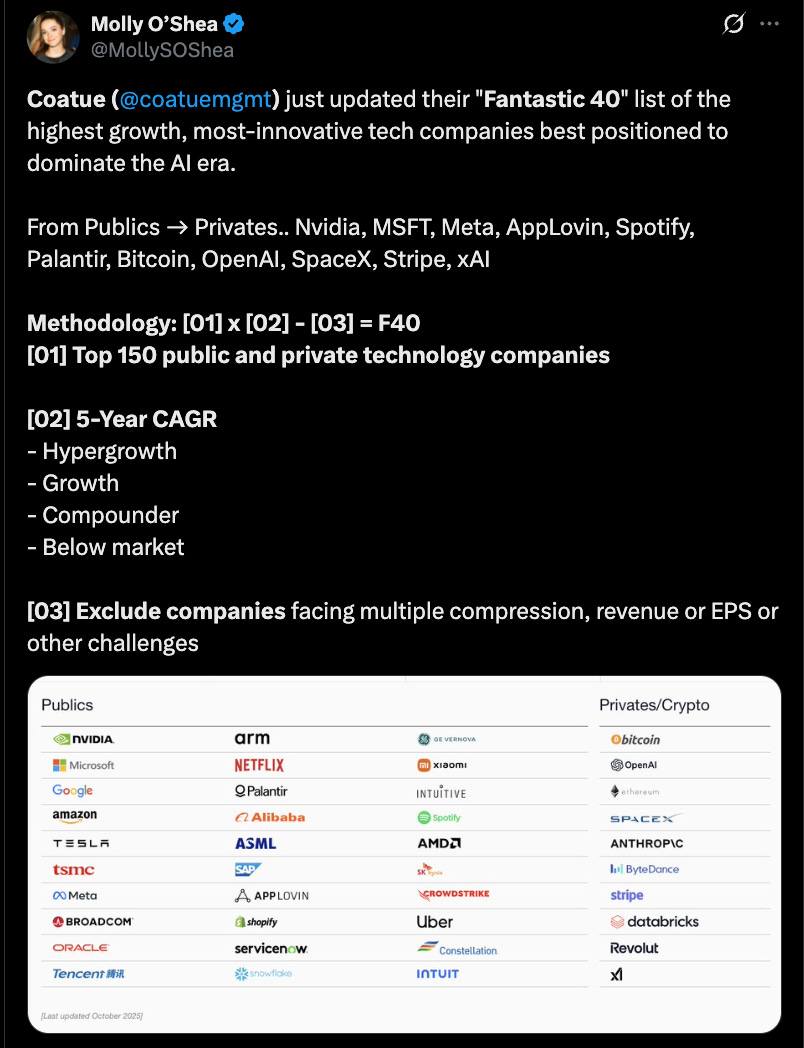

Fantastic 40: Publics → Privates

Coatue’s model is unique in that it invests deeply in both public and private markets. Insights from one side often inform the other. Conversations with researchers at OpenAI, Anthropic, and other labs are treated as just as valuable as discussions with Fortune 500 management teams.

“The best way to know what’s coming is to talk to the practitioners. They’ll tell you where things are heading because they’re building it every day.”

To benchmark performance, the firm also publishes its Fantastic 40, a quarterly ranking of the fastest-growing companies across public and private markets—a framework that helps investors spot emerging leaders before they’re obvious.

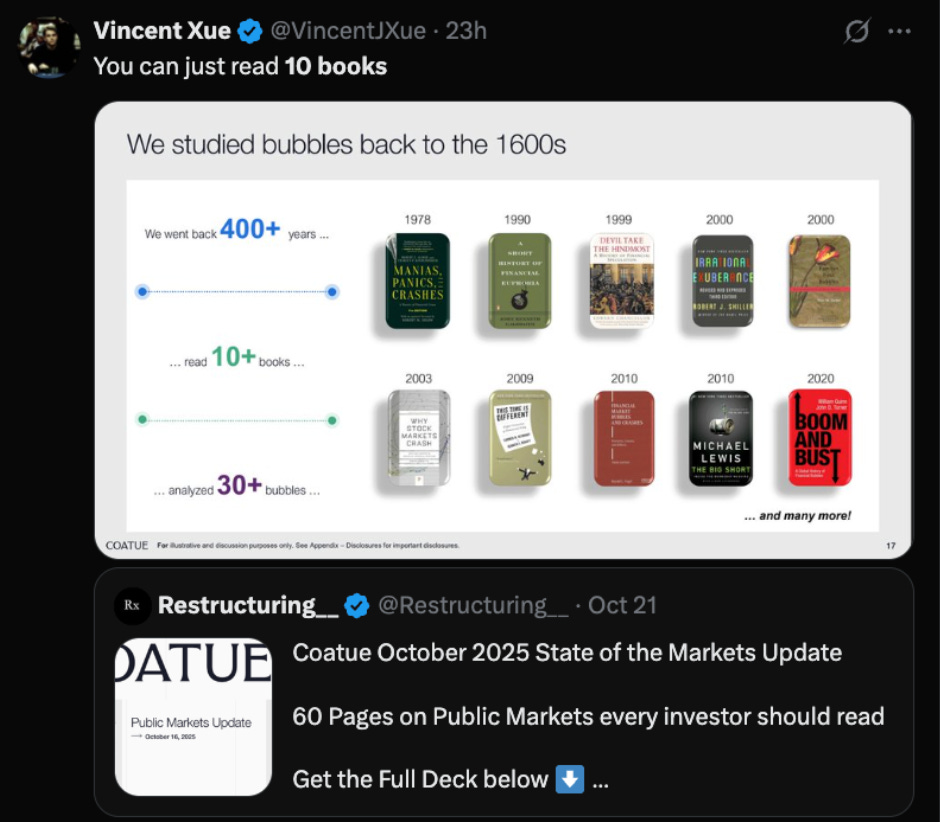

Public Markets Update

CTEK: Increasing Access for Individuals

Hedge-fund giant Coatue Management is launching a fund that invests in high-growth public and private tech companies, and requires a minimum investment of $50,000. The family offices of Amazon.com founder Jeff Bezos and PC company founder Michael Dell have committed a total of $1 billion to seed the new fund, according to Coatue.

“It’s such an obvious idea that if I don’t do it, someone else will,” Philippe Laffont, Coatue’s founder, said in an interview. He said he personally pitched Bezos and Dell, including one over dessert at lunch. (Laffont didn’t divulge which of the two.)

The new fund will invest around 20% to 50% of its assets in private investments, and the rest in public stocks, according to a pitch deck seen by The Wall Street Journal.

Access to private tech companies and other nonpublicly listed investments has historically been reserved for the super-rich and institutional investors, such as endowments and sovereign-wealth funds. But big asset managers including BlackRock and KKR have been seeking to expand by tapping into the vast pool of individual investors’ wealth.

Timestamps

(00:00) Introduction to Michael Barton & Coatue

(01:21) Early investing experiences & lessons learned from Melvin Capital

(02:50) Gamestop, Reddit & how retail “meme stocks” changed the public markets

(04:20) New data sources: Reddit, Twitter, WallStreetBets

(05:45) Coatue’s scale: $70B AUM across public & private

(07:00) Idea generation: the AppLovin story

(08:40) AI in digital advertising — Meta, Google, AppLovin

(11:42) Bubble fears vs. real AI revenue

(14:00) From ad targeting to agentic commerce

(17:13) Why things change so fast in AI & markets

(18:40) Pricing in AI winners & losers daily

(20:15) Talking to practitioners: Coatue’s edge

(26:00) How AI will reshape jobs & company margins

(34:50) Hedge fund of the future: AI-native workflows

(46:53) Valuations, privates vs. publics, and OpenAI

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit: carta.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).