BREAKING: Inside Thrive Capital

Partner, Philip Clark | OpenAI, Cursor, Wiz, Nudge, Physical Intelligence

How Thrive Capital Invests: OpenAI, Cursor, Wiz & the New Hardware Wave

Thrive Capital Partner Philip Clark joins Sourcery to break down how one of the most concentrated and influential firms in tech evaluates founders, builds conviction, and partners with companies that reshape the world.

“Josh always had a line to me when I joined Thrive, which is that the people who win deals are the ones who want to win them most.”

In this episode, we go deep on Thrive’s investments in OpenAI, Cursor, Wiz, Nudge, Physical Intelligence, and why Philip believes we’re entering a golden era for hardware — powered by cheaper sensors, software intelligence, and a new generation of engineers trained at SpaceX, Anduril, and Neuralink.

→ Listen on X, Spotify, YouTube, Apple

Philip tells the inside story of:

Seeing an early demo of OpenAI’s GPT-4 before launch

Why Thrive flew into an active war zone to close the Wiz deal

Cursor’s explosive growth from a small pivot to a multi-hundred-million ARR product

How Nudge is engineering the human brain using ultrasound

Why hardware’s barriers are falling and why the biggest companies of the next decade may be physical

If you want to understand the future of AI, hardware, and the next generation of “counterfactual companies,” this is the episode.

Philip’s Physicist Background

Philip Clark is a Partner at Thrive Capital, where he has worked on some of the firm’s most ambitious investments across AI, hardware, and frontier technology.

Since joining Thrive in 2022, he has been involved in the firm’s partnerships with OpenAI ($500B Val), Cursor ($29.3B Val), Wiz (Acq by Google for $32B), Nudge ($100M Series A), Physical Intelligence ($5.6B Val), and multiple next-generation hardware companies emerging from ecosystems like SpaceX, Neuralink, and Anduril.

A technologist at heart, Philip originally studied physics and computer science, inspired by figures like Oppenheimer, Claude Shannon, and Elon Musk. Before venture, he worked at the Department of Defense, completed research for national security leaders like Condoleezza Rice and H.R. McMaster, and led systematic geopolitical analysis at Bridgewater Associates.

“He wanted to be a physicist and the CEO of Lockheed Martin.” Fortune

Philip first connected with Thrive through a semiconductor Substack he wrote in 2021–22 — a deep technical exploration of reshoring advanced chip manufacturing — which caught the attention of founder Josh Kushner. That led to him joining the firm, where he quickly became known for rigorous technical acumen, high-conviction views, and an ability to partner closely with founders working on “counterfactual companies,” businesses where the world looks materially different if they succeed.

Today, Philip is one of the most distinctive investors in the industry: equal parts engineer, strategist, and optimist. His investment focus spans AI systems, developer tooling, security infrastructure, robotics, neurotechnology, and next-generation hardware, with a particular interest in companies that compress timelines, bend physical constraints, or unlock entirely new categories of capability.

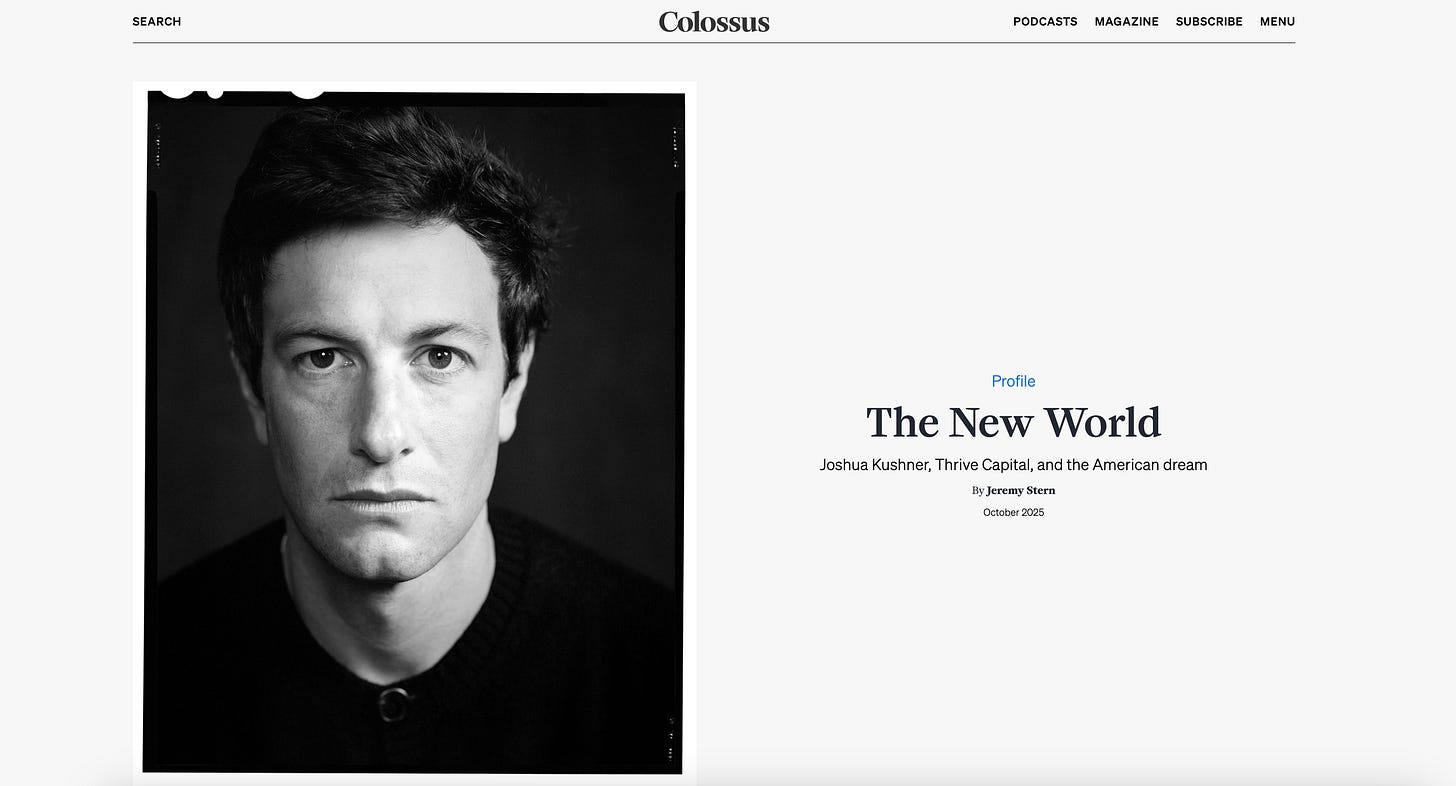

Ft. in Colossus’ Legendary Thrive Profile:

5 Key Takeaways

1. The next decade belongs to hardware + AI.

Philip argues the cost curves, sensor prices, and talent base have shifted enough that hardware companies are now capable of scaling faster and becoming more defensible than software alone.

2. Thrive only backs “counterfactual companies.”

They invest in businesses where the world looks materially different if the company succeeds — OpenAI, Wiz, Cursor, Nudge, Physical Intelligence.

3. Cursor’s growth represents the “speed-chess” of the AI era.

Cursor went from tens of thousands of users to hundreds of millions in ARR in ~18 months — a sign of how compressed AI timelines have become.

More impressively, Philip met Michael before Cursor existed, on the literal day Michael decided to pivot away from a mechanical-engineering AI tool. Their first conversation was almost entirely about possible pivots, not a company. Philip sensed Michael’s founder “energy” immediately, followed the team through their merge + formation, and became an early user, which kicked off the year-long relationship that eventually led to Thrive investing.

4. The Wiz deal shows how Thrive wins.

“We are willing to do anything for our companies, and we wanna show our companies that if we’re gonna be the right partner, they should know that we’re willing to do anything.”

“The story with Wiz… it comes down to that. We are willing to do anything.”

Clark and Josh Kushner flew into Tel Aviv through an active war zone because “the people who win deals are the ones who want to win them most.”

5. OpenAI’s moat is talent density + paradigm shifts.

The majority of major breakthroughs in large-model paradigms originated inside OpenAI, and the team continues to recruit researchers who “hold the model weights in their brains.”

𝐓𝐈𝐌𝐄𝐒𝐓𝐀𝐌𝐏𝐒

(00:00) Who is Philip Clark? How he joined Thrive Capital

(02:45) From physics to investing: becoming a technologist–optimist

(04:00) How semiconductors led him to Thrive

(06:00) Deep dive: Mesh Optical & the data center interconnect opportunity

(07:45) Inside Cursor’s explosive growth and why AI is “speed chess”

(09:15) How Philip first met Cursor’s founders during a pivot

(11:30) Path to partner & Thrive’s “full-stack investor” model

(13:45) The Wiz story: flying into an active war zone

(17:15) Why Wiz closed six-figure deals in weeks — the rare “fast + big” enterprise combo

(19:30) Why hardware is back: sensors, software, and SpaceX-trained talent

(21:45) The rise of Nudge and engineering the human brain

(26:30) Neuralink & Nudge: read to stimulate

(31:15) Why Thrive concentrates instead of “spray and pray”

(36:00) Inside OpenAI: seeing GPT-4 before launch

(40:45) What comes after SaaS — and the companies unlocked by AI

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. visit → turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. visit → Carta/Sourcery