BREAKING: Keith Rabois Returns. Lessons From Paypal Mafia, $OPEN, & Investing

Every successful company is a cult.

Keith Rabois returns.

Opendoor co-founder & Board Chair, Managing Director at Khosla Ventures, a core member of the PayPal Mafia, & a consistent Midas list name (ranking as high as #4 in the U.S. and #8 globally) Keith joins Sourcery for a masterclass on talent, culture, & contrarian thinking.

“You don’t want to be the best in the world at what you do. You want to be the only one who does what you do.” — Keith paraphrasing Jerry Garcia

→ Listen on X, Spotify, YouTube, Apple

Keith has helped build some of the largest, globally-recognized technology companies in his more than 20-year career. At Khosla Ventures, he led the first institutional investments in DoorDash, Affirm, and Faire, invested early in Stripe, and co-founded Opendoor. While a General Partner at Founders Fund, he led investments in Ramp, Trade Republic, and Aven, and before that made early personal investments in YouTube, Airbnb, Palantir, Lyft, Udemy, and Eventbrite.

He has served on multiple boards, including Reddit’s from 2012 to 2019, and on Yelp and Xoom’s boards, guiding them from their early stages through IPOs.

He started his technology career with leadership roles at PayPal, as their EVP of Business Development, Public Affairs & Policy, before joining LinkedIn as VP of Business & Corporate Development, and finally, Block (formerly known as Square), as Chief Operating Officer.

Keith has invested into 15+ companies that have gone public.

In this conversation, Keith dives deep into:

How to spot & mentor outlier talent (Square, $OPEN)

Why every successful startup begins as a cult

The Barrels & Ammunition framework for scaling teams

Building Olympian-level work cultures (Traba)

Contrarian takes on stress, sleep & performance

Conspiracy theories: Elizabeth Holmes. UFOs. Ketchup.

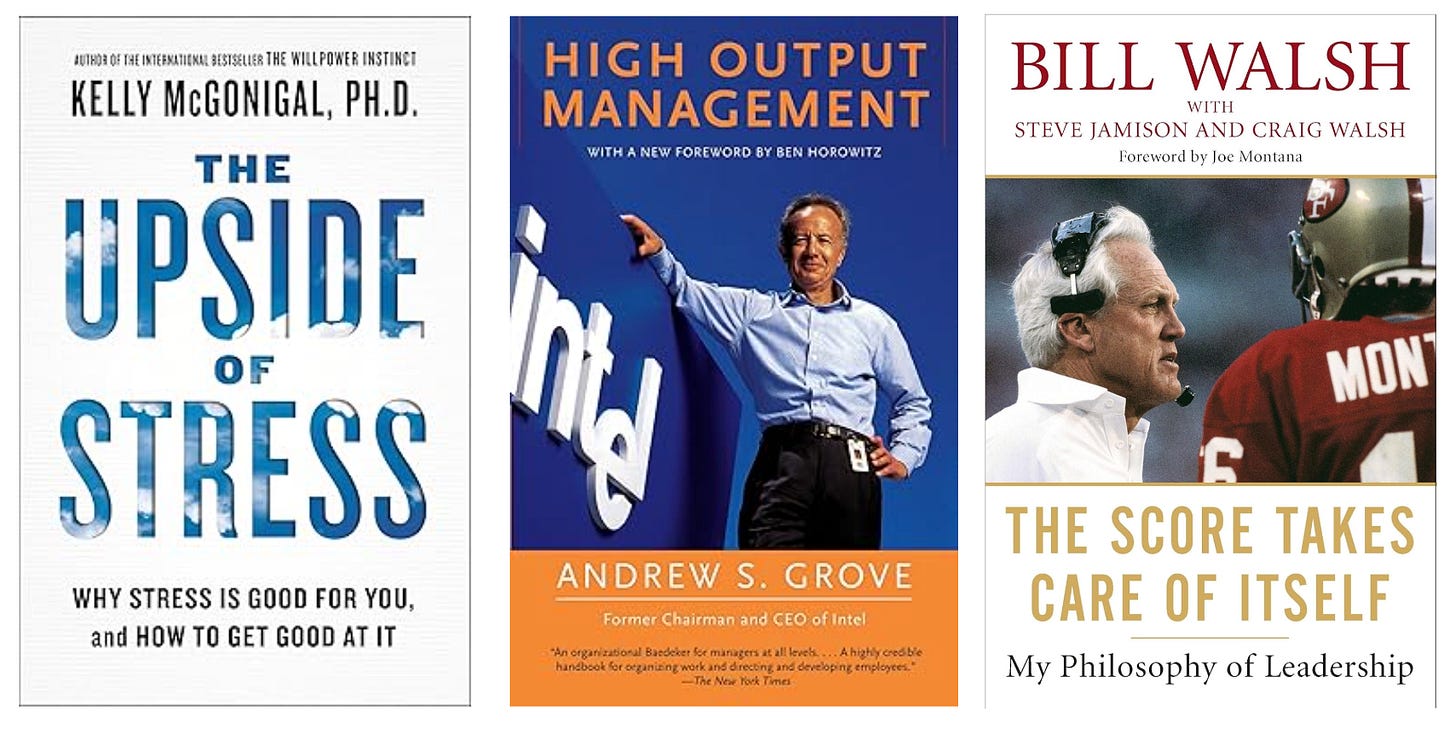

Books that influence Keith’s thinking:

📖 Upside of Stress

📖 High Output Management

📖 The Score Takes Care of Itself

Top 10 Quotes from Keith Rabois

“What you want to find is someone who has a non-zero chance of changing an industry or the world. That's it. It's really that simple.”

“You don't wanna be the best in the world at what you do. You wanna be the only one who does what you do.”

“Every successful company is a cult. And what a cult really means is you have a view about the world that's different than other normal people, & you're right.”

“The question I was encountering constantly from founders was: I raised money, I hired a bunch more people, yet I get less done. Why? The answer is barrels and ammunition. You don’t have more barrels.”

“If I can't figure out how to make you useful at Square, that's my problem, not yours.” (on hiring Ian Wong after reading his Quora posts)

“Most people are in the middle of the bell curve. Either they don’t have the skill or the ambition to be two standard deviations away. Investing is about finding those people who are.”

“Communication is only successful if the recipient understands what you’re saying. You don’t blame the recipient for fumbling the ball, you didn’t throw the pass correctly.”

“996 was lazy by my standards. At PayPal, 9–9–6 would’ve been an easy week.”

“I basically don’t believe in days off, for anything. Work, workouts.”

“Stress is not only good for you.. the more stress you have in your life and the more you embrace it, the healthier, more successful, and happier you’ll be.”

Highlights

(00:00) Keith Rabois

(01:22) Mentoring young talent (Delian Asparouhov)

(04:07) Spotting outliers: from Quora posts to Square & Opendoor

(06:38) Two formulas for talent: rare excellence or rare combinations

(09:00) Lessons from the PayPal Mafia & finding your comparative advantage

(09:48) ‘Don’t be the best, be the only one’

(10:29) Frameworks & simplifying complexity for founders

(12:16) Barrels & Ammunition metaphor for scaling teams

(13:08) Keith’s book: Dangerous Minds

(16:34) Olympian work ethic & why 996 is “lazy”

(19:13) Culture after COVID & why heroic effort matters early

(24:15) Contrarian takes: stress, sleep, Diet Coke, ketchup

(29:25) Keith’s energy hacks: Barry’s, cold plunges, red light therapy

(32:46) Why venture capital is the best job for the intellectually curious

(35:30) Favorite books: Upside of Stress, High Output Management, The Score Takes Care of Itself

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).