BREAKING: Monetizing AI Agents w/ Paid

Manny Medina, CEO (Prev. CEO of $4.4B, Outreach)

Monetizing AI Agents

Manny Medina, Co-Founder & CEO of Paid and former CEO of $4.4B Sales Tech company, Outreach, joins me in London to discuss the early development of AI agents & what this shift means for software businesses.

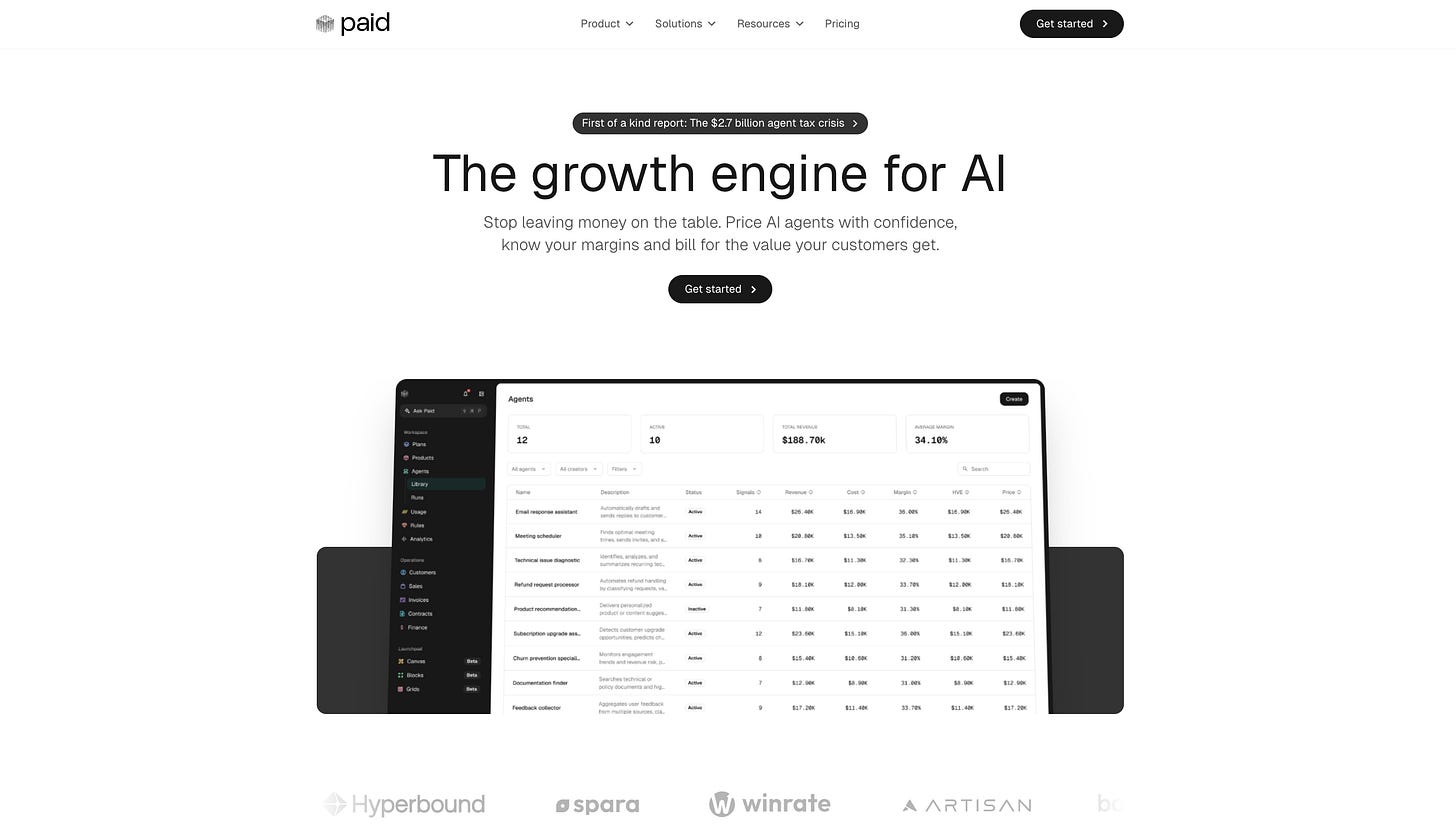

Roughly $300 billion in SaaS revenue remains “trapped” in legacy pricing and delivery models. After scaling Outreach to 6,000 customers, 220,000 active users, and $250M in ARR, Manny saw firsthand that many SaaS monetization frameworks don’t fit agentic systems, which perform full end-to-end workflows rather than individual user-driven tasks. This gap led him to build Paid, the platform designed to help companies measure, price, & manage the economics of agents.

Paid is backed by Sequoia Capital, Lightspeed Venture Partners, EQT Ventures, GTM Fund, & FUSE. (thank you to Max at GTM Fund for the intro!)

→ Watch EXCLUSIVELY on X

$33.3M to Build Infra for the AI Agent Economy

Paid has now raised $33.3 million in total funding, following its oversubscribed $21.6M Seed round in September led by Lightspeed Venture Partners, with participation from FUSE & existing investor EQT Ventures.. this fast follows the March 2025 €10M financing led by EQT & Sequoia Capital, with participation from GTM Fund, Exceptional Capital, and strategic angel investors.

This capital supports Paid’s mission to provide the economic & operational infrastructure needed for companies to price, track, & monetize AI agents effectively. Early customers have reported 20–40% revenue growth within six months of adopting the platform.

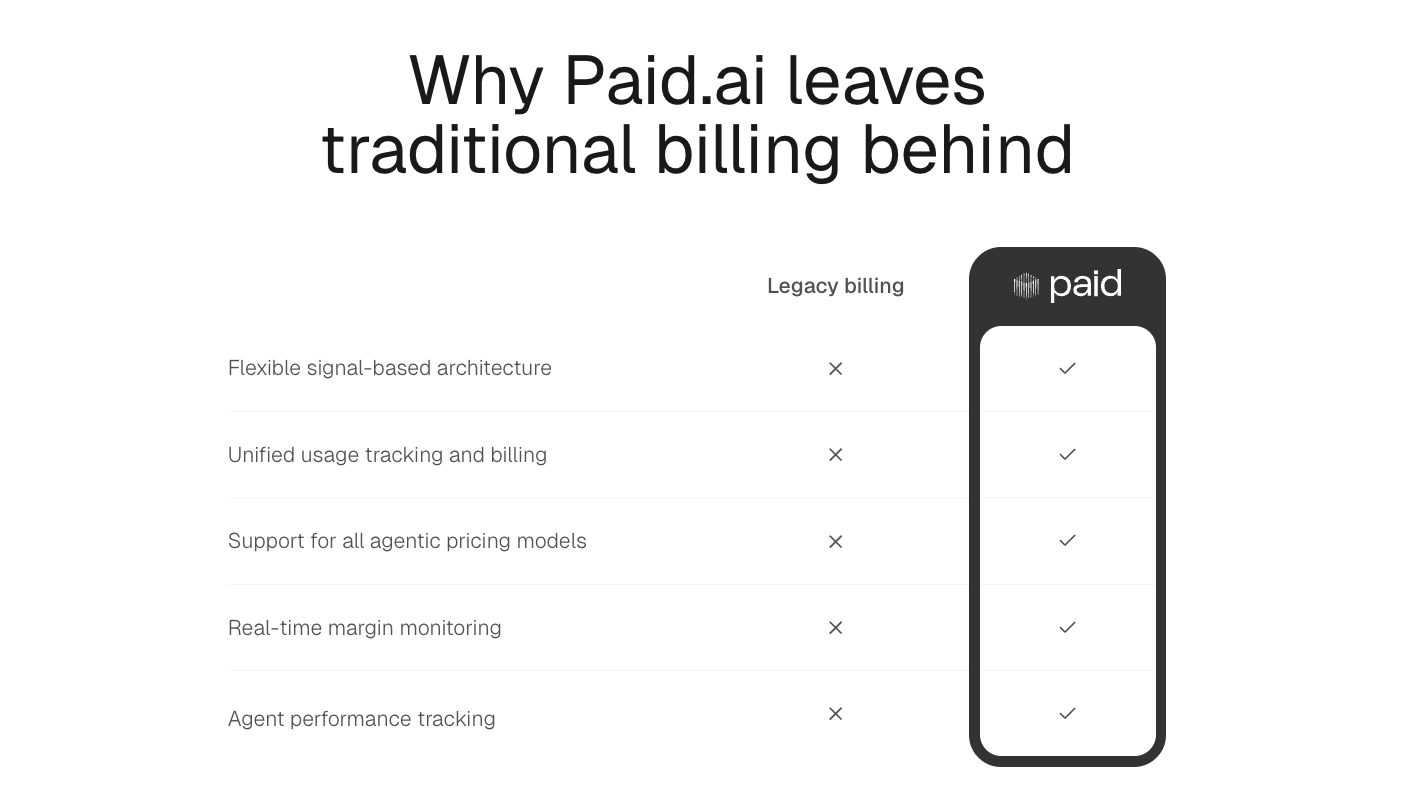

As autonomous AI agents continue to expand across industries, they are beginning to automate complex workflows, replace entire departments, and deliver outcomes traditionally handled by teams. This shift exposes limitations in the legacy per-seat SaaS pricing model, which was not built for software that performs full roles independently. Without the right tools to measure agent activity, understand cost, & structure pricing, many organizations struggle to commercialize agentic workflows.

Paid aims to solve this by giving AI agent builders, from early-stage founders to large SaaS companies, the infrastructure needed to scale sustainably in a rapidly growing market projected to reach $19.9 trillion in economic contribution by 2030.

BREAKING: Paid launches Adaptive Credits

Launching today, Paid now offers flexible credit system designed for today’s AI pricing needs. Paid has rethought credits from an opaque way of charging for AI work into a clearer, more practical model that supports real usage, consumption, & growth for AI and agent builders.

Overview of our 20 Min Conversation

Manny covers emerging patterns around how companies are adopting agents, how they think about headcount and operational budgets, and why some organizations are re-evaluating the traditional seat-based SaaS model. He also explains why Paid is based in London, how the company approaches recruiting technical talent, & how practices like high-agency work & forward-deployed engineering shape their culture.

The discussion offers a realistic view into how early agentic businesses are forming, what challenges they face in monetization and measurement, and how teams are adapting as this new category evolves.

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit: Carta/Sourcery

Public–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. With Generated Assets, you can build, backtest, refine, and invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. Try it out today: public.com/sourcery

The State of AI Agents

AI agents are emerging as a new category of software that performs full job functions rather than augmenting individual tasks. Enabled by rapid advances in large language models, agents can operate autonomously across complex workflows such as customer support, underwriting, dealership operations, and compensation systems.

This shift expands software’s scope beyond traditional productivity tools, as agents can run continuously, handle complete processes, and replace work that previously required dedicated teams. As companies begin experimenting across industries, adoption is still early, but the direction points toward agents becoming a foundational part of digital operations.

Monetizing and Operating Agentic Businesses

This evolution exposes structural gaps in traditional SaaS monetization. Seat-based and usage-based pricing models were built for software that supports human workers, not software that performs full roles independently. Companies deploying agents increasingly need frameworks to measure outcomes, understand the cost of model operations, and price against the economic value generated.

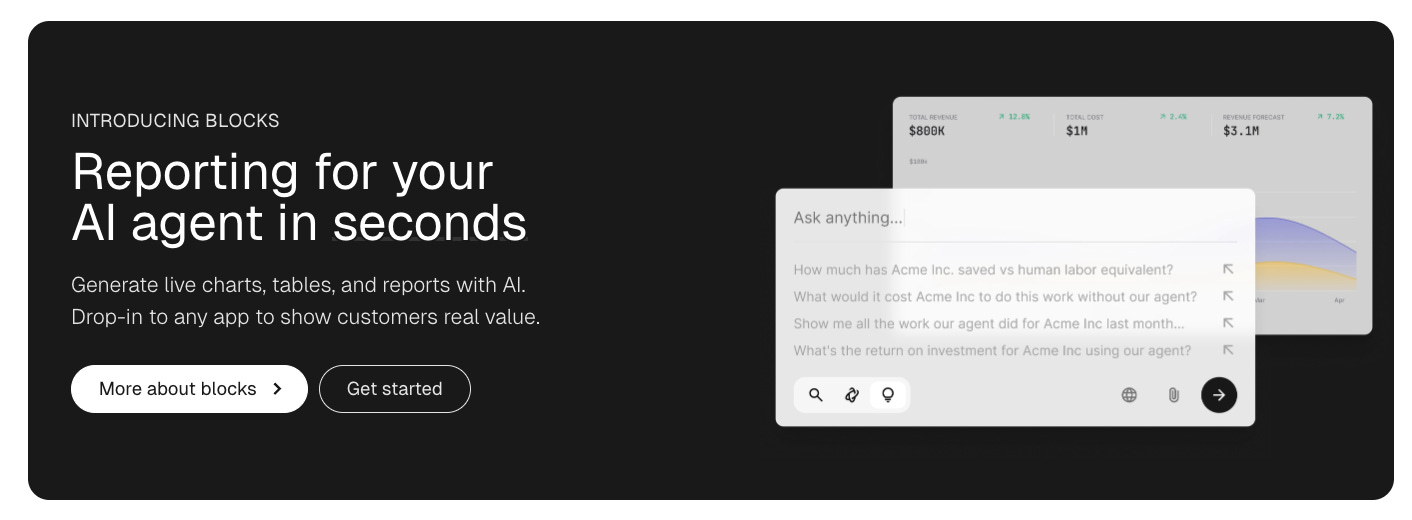

Paid is building the financial and operational infrastructure for this shift, enabling billing, margin visibility, and revenue models tied to resolved cases, reduced headcount requirements, workflow consolidation, or other objective indicators of agent performance.

A Team Culture Rooted in High Agency & FDEs

Co-Founders

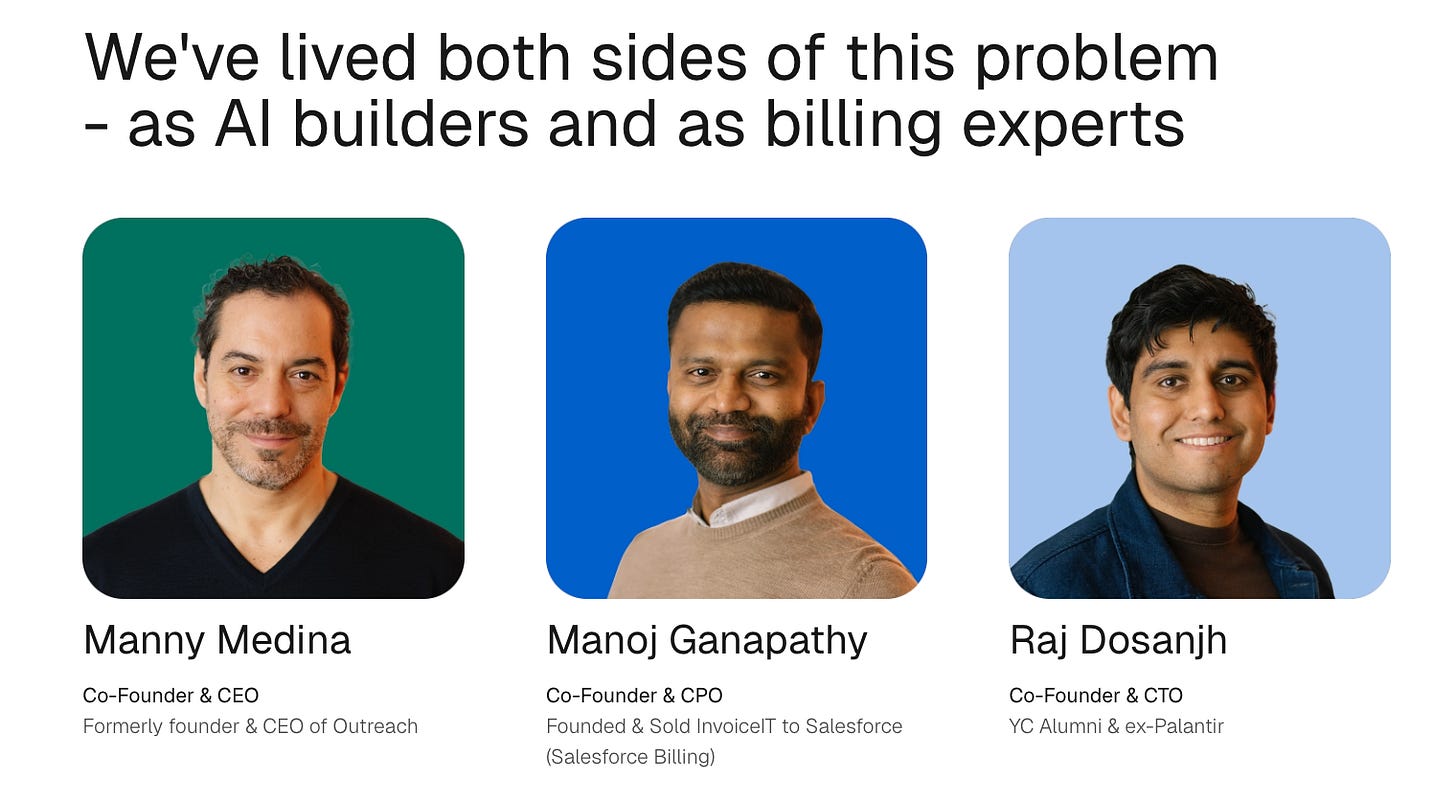

Manny Medina built Outreach from scratch to over 6,000 customers, 220,000 active users, and $250M in ARR. He experienced the AI agent pricing dilemma firsthand.

Manoj Ganapathy built InvoiceIT, which was acquired by Steelbrick and later became Salesforce Billing. He has 10+ years of experience building billing systems.

Arnon Shimoni built monetization systems at Pleo and Storytel

Raj Dosanjh YC Alumni & ex-Palantir

Paid’s team structure reflects practices commonly associated with Palantir’s engineering culture, emphasizing autonomy, direct customer engagement, and rapid iteration. Many team members operate in a forward-deployed model (even coming directly from Palantir’s London office - a hotbed for tech talent in the growing ecosystem there), embedding themselves with customers to understand real-world workflows and identify where agents can deliver measurable value.

Instead of rigid roadmaps, engineers are given problem spaces and the responsibility to determine what to build based on field insights. This high-agency approach, combined with an AI-native workforce comfortable with tools like Cursor and Code Interpreter, enables the team to move quickly in a category where both the technology and the business model are still being defined.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.