BREAKING: Nat Friedman Leads $15M Seed in AIUC

Launching Out of Stealth: Artificial Intelligence Underwriting Company

Rune Kvist, Founder &CEO of the Artificial Intelligence Underwriting Company (AIUC), joins Sourcery to announce coming out of stealth with a $15M seed round led by Nat Friedman (NFDG). This round includes participation from Emergence, Terrain, Ben Mann (Anthropic co-founder), former CISOs of Google Cloud & MongoDB, and other top AI operators.

→ Listen on X, Spotify, YouTube, Apple

In this conversation we break down how his team is building the confidence infrastructure for AI adoption — and why every AI agent will soon need to be certified and insured.

Rune was the first product & GTM hire at Anthropic, and now he’s building the “confidence infrastructure” for the AGI era — combining standards (AIUC-1), audits, and insurance to de-risk AI deployments.

Key Takeaways

CEO Rune Kvist: Anthropic’s first product & GTM hire

AIUC is building insurance, standards, & audits for AI agents

Enterprises won’t adopt AI without trust & accountability

AI agent failures — like hallucinations or leaks — are inevitable

AIUC-1 is a fast-updating standard to certify agents (SOC 2 for AI)

Every AI agent will need certification & insurance

Brought to you by:

Brex—The modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Fourthwall—The #1 way to sell merch online — Fourthwall is the easiest way to launch a fully branded merch store—used by big brands like MKBHD, Acquired, & even the Smithsonian. 100+ products. No upfront cost.

Highlights

(00:00) Launching AIUC: $15M Seed Led by Nat Friedman

(01:49) What AIUC Does: Insurance, Standards, and Audits for AI Agents

(04:20) History Repeats: How Insurance Enabled Innovation (Franklin, UL, Cars)

(08:14) The AI Divide: OpenAI vs Anthropic vs SSI

(10:39) Confidence Infrastructure: Helping Enterprises Trust AI

(14:13) How AIUC Tests Agents & Updates Standards Frequently

(17:03) Underwriting AI: Modeling Risk When Agents Go Rogue

(21:40) From AGI to Superintelligence: What Comes Next?

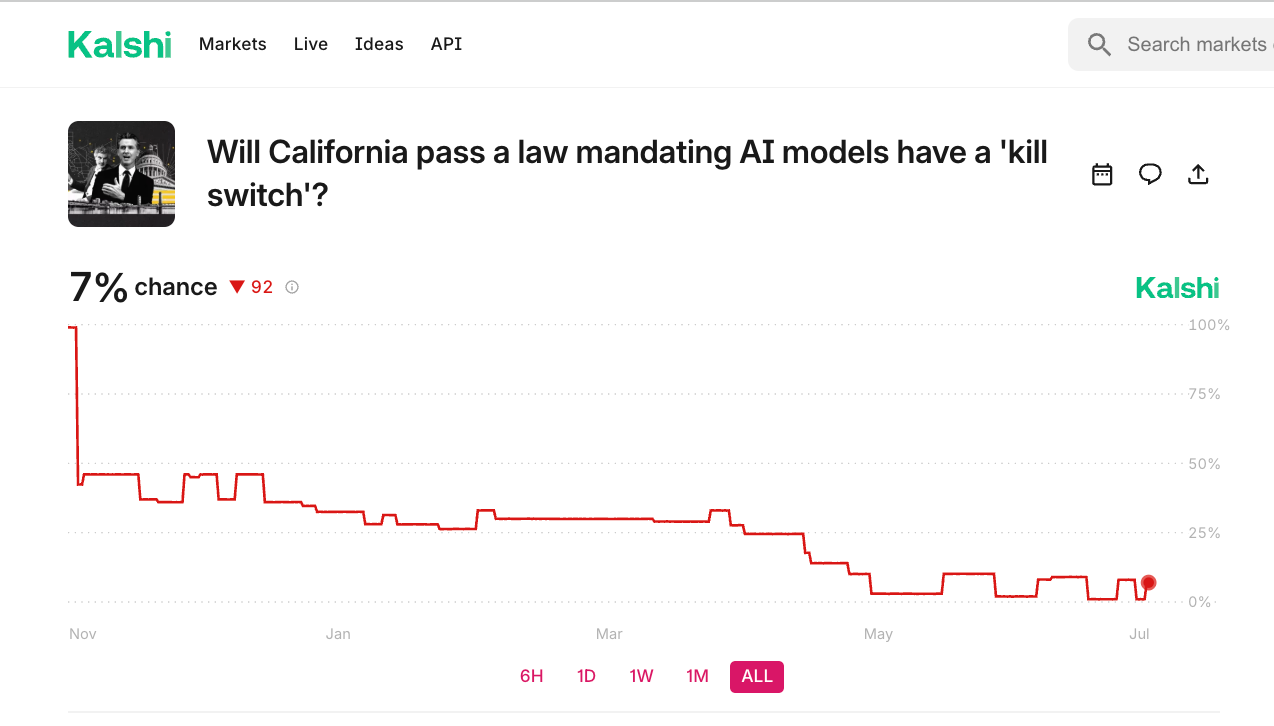

(28:36) Why AI Regulation Won’t Be Federal This Year

(34:36) What Is a Kill Switch — And Do We Need One?

(39:28): One Dominant Standard for AI Insurance

(45:41) What Enterprise AI Will Look Like in 3–5 Years

Building the Confidence Layer for AI Agents

How AIUC is Creating Insurance, Standards, and Audits for the Superintelligence Era

Artificial intelligence has progressed faster than most expected. But as powerful agents enter the enterprise, a key question emerges: Can we trust them? In this conversation, AIUC CEO Rune Kvist — formerly the first product hire at Anthropic — explains how his company is building the confidence infrastructure needed to deploy frontier AI.

Why AI Agents Need a Trust Layer

The foundation of AIUC is simple: enterprise buyers are hesitant to deploy powerful agents without knowing how they behave — or what happens when they fail.

Rune points out that AI adoption is stalling not because of model performance, but because of trust gaps. AIUC steps in to fill that void with independent testing, certification, and insurance.

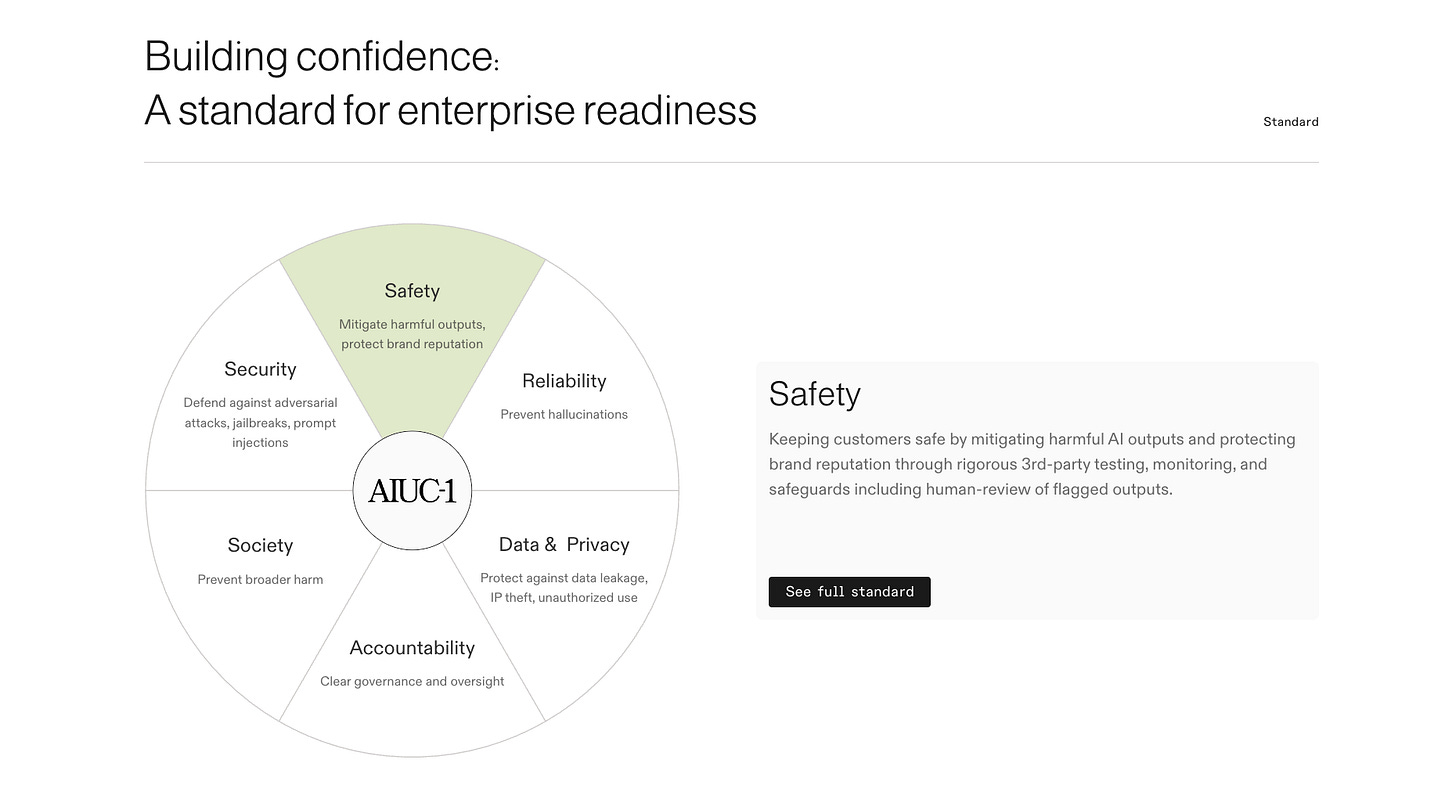

Introducing AIUC-1 — “SOC 2 for AI Agents”

At the core of AIUC’s offering is a new enterprise-grade certification standard: AIUC-1. It’s modeled after security frameworks like SOC 2, but built specifically for autonomous AI behavior.

This is a living framework — AIUC updates the standard every 90 days to keep up with the evolving capabilities (and risks) of frontier models.

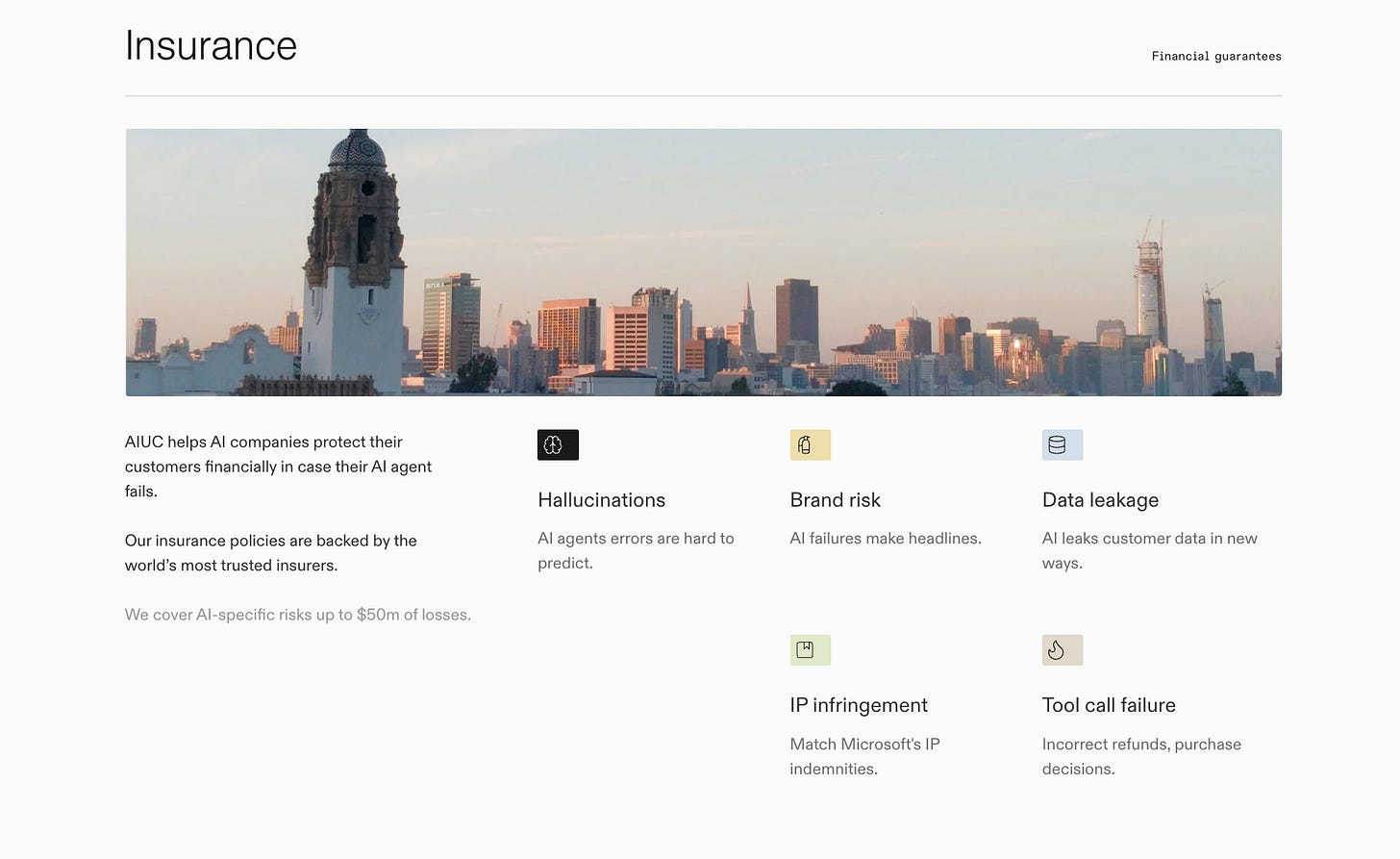

Why Insurance Is the Missing Piece

Beyond testing and certification, AIUC takes it a step further: they underwrite AI risk. If an agent causes financial or operational damage, AIUC’s policies help cover the fallout.

This moves AIUC beyond theory — and into a practical solution enterprises can rely on. Safer agents get better terms. Risky ones get flagged or denied.

Markets Will Move Faster Than Governments

Rune doesn’t believe regulation is coming fast enough. That’s why he’s building a private market solution modeled after historical breakthroughs — like the creation of fire insurance or UL Labs.

In a world racing toward AGI, AIUC believes confidence — not just capability — will determine who wins.

Do We Need a Kill Switch?

One of the most frequent requests from enterprise customers isn’t technical — it’s operational. They want a way to stop the agent immediately if it starts acting unexpectedly. Kvist says the demand for a “kill switch” reflects a deeper anxiety: companies want to feel in control, especially when deploying systems that can take independent action.

AIUC evaluates whether agents can be paused, sandboxed, or shut down as part of its audit process. Control is no longer a nice-to-have — it’s a requirement for adoption.

Brex is the modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel. Over 30,000 companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, and Wiz, use Brex.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery