BREAKING: Sequoia Launches 2 New Early Stage Funds: $200M Seed Fund VI & $750M Venture Fund XIX

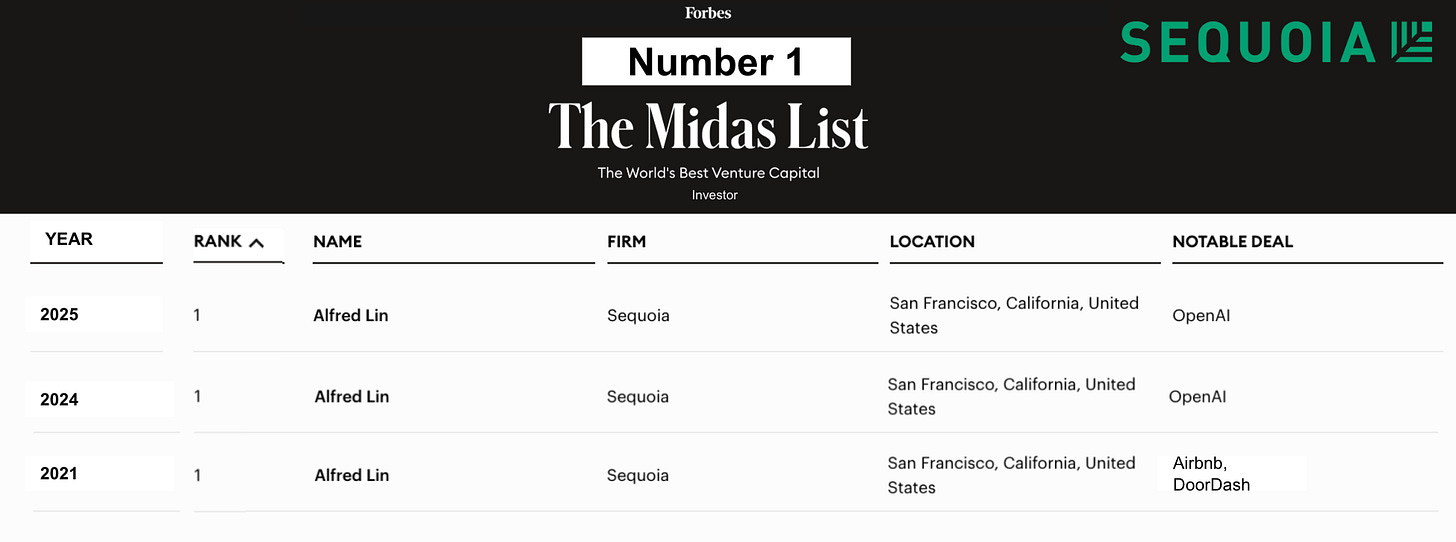

Interview with Alfred Lin, No 1 Midas List Investor (2 yrs in a row)

Sequoia Launches Seed Fund VI ($200M) & Venture Fund XIX ($750M)

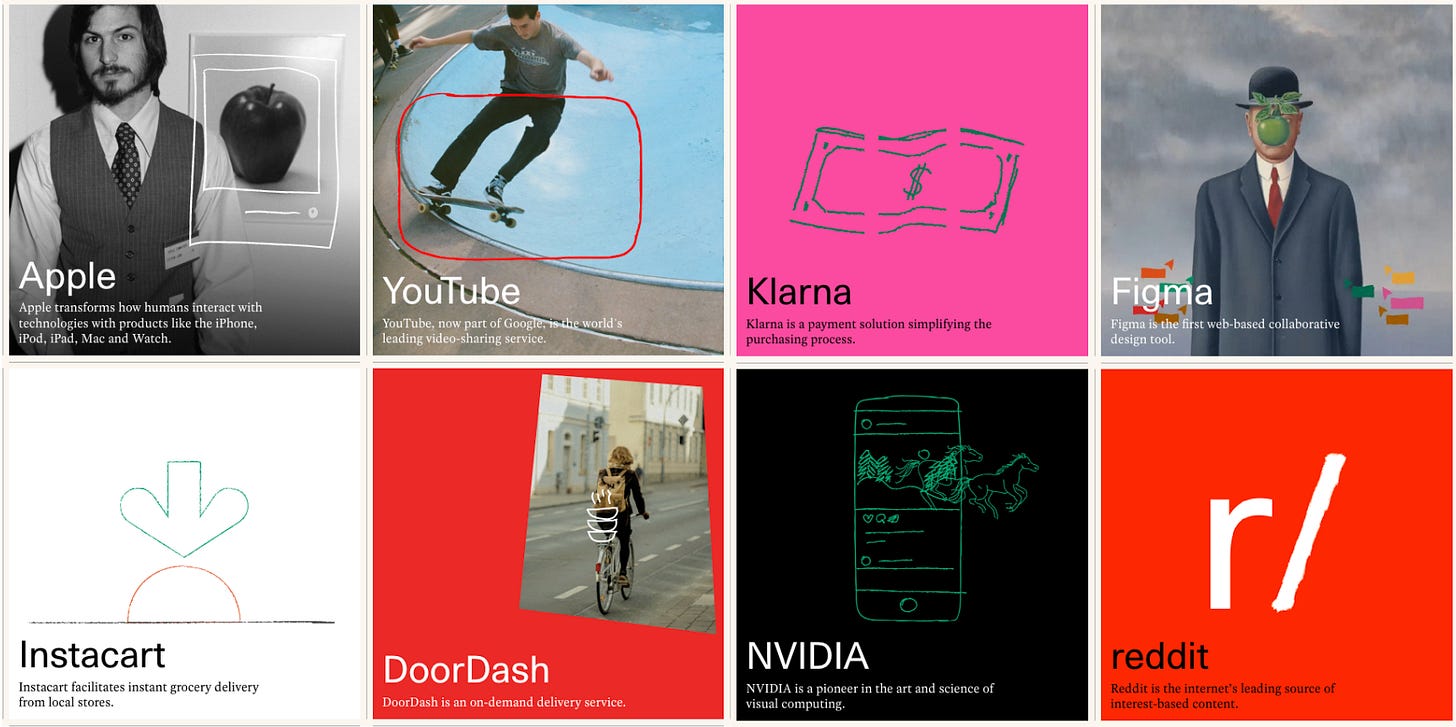

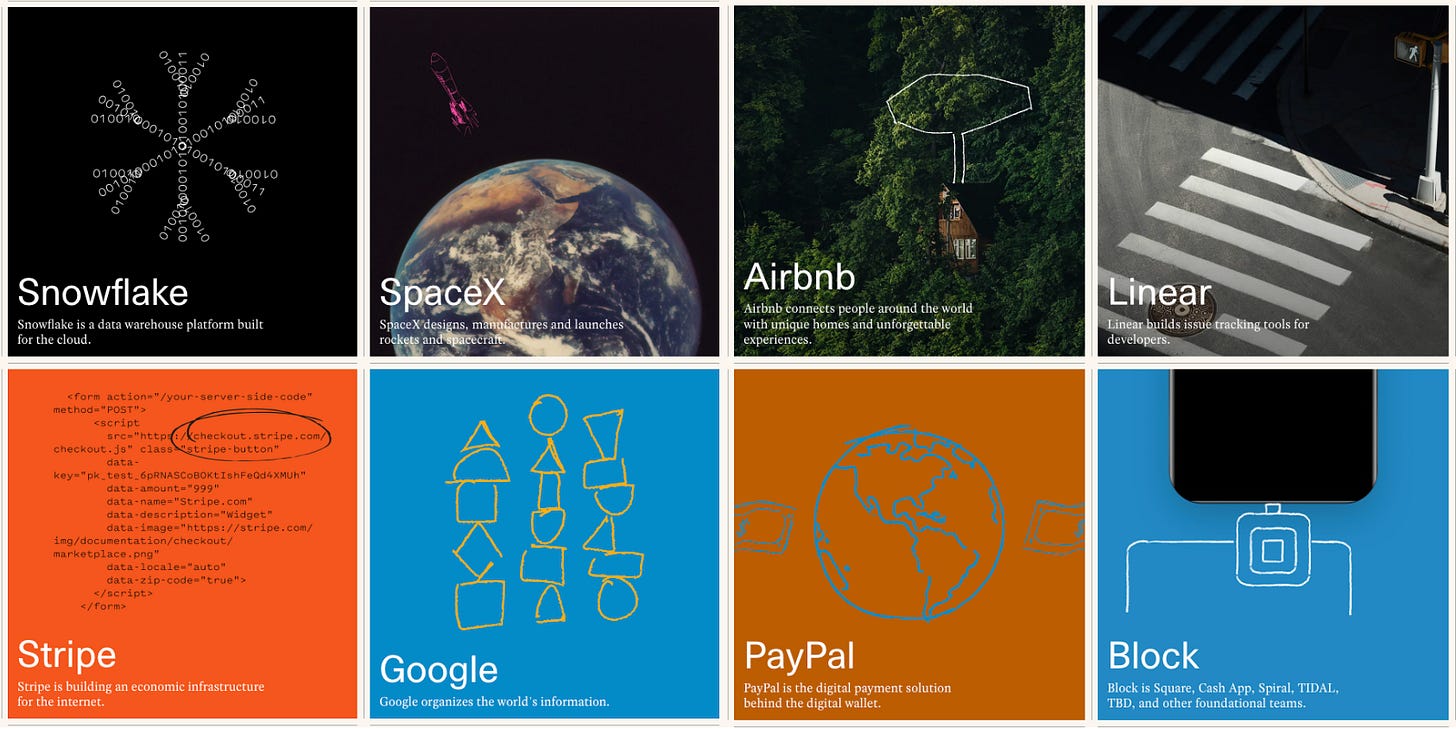

For more than fifty years, Sequoia has partnered with founders to build some of the most consequential companies in history. The scale of Sequoia’s impact is visible across markets: companies backed by Sequoia now account for more than 30% of NASDAQ’s total value, many of which were first supported at the seed or Series A stage, long before IPOs.

→ Listen on X, Spotify, YouTube, Apple

Some of Sequoia’s earliest bets have become defining companies:

The firm partnered with Apple when it was just Steve and Steve with a single-board computer, & led Nvidia’s seed round in 1993

Palo Alto Networks & YouTube incubated at Sequoia’s offices

Sequoia teamed up with Airbnb when it had only 1,000 listings, Stripe before it processed its first transaction, & Wiz when there was no clear idea or product yet

These examples capture Sequoia’s defining belief: the earliest days are when enduring companies take root. Today, as Sequoia launches Seed Fund VI ($200M) and Venture Fund XIX ($750M), the mission remains the same: to help daring founders build legendary companies from idea to IPO and beyond.

Which brings us to Alfred Lin.

Alfred joins Sourcery to share how one of the world’s most iconic venture funds, which has distributed over $43B to investors since 2020, continues to back outlier founders at the earliest stages.

Sitting at Number 1 on the Midas List two years in a row (3 years all-time, possibly 4??), Alfred goes deep to share Sequoia’s company-building philosophy with stories from OpenAI, DoorDash, Kalshi, Commure, Nominal, Zipline, & more.

Alfred explains how Sequoia thinks about partnering with founders, why efficiency matters more than capital, the role of pivots in scaling, and how to distinguish quality revenue from experimental revenue in today’s AI-driven market.

“We always start with the founders. We want people who are four standard deviations above the mean, with a unique and novel insight into the world, and the daringness and desire to go change it.”

Topics include:

Sequoia’s founder-first investing philosophy

How Alfred helped Kalshi navigate regulatory battles

DoorDash’s efficiency playbook vs. Uber Eats

Zipline’s “Big P” pivot to medical drone delivery

Revenue quality, AI hype cycles, and Sequoia’s outlook

Timestamps

(00:00) Alfred Lin, Sequoia

(02:37) What makes an “outlier founder”

(04:15) Bespoke founder support: lessons from Airbnb & DoorDash

(07:10) Stories from Kalshi: regulation, elections & more markets

(14:00) Little “p” pivots vs. Big “P” pivots

(14:17) Zipline’s dramatic pivot to medical drones

(18:00) DoorDash vs. Uber: efficiency as a weapon

(19:49) When to pour capital into growth

(20:07) Growth vs. true product-market fit

(22:19) The race to $100M revenue – healthy or not?

(25:55) Pilot/experimental revenue vs. real ARR

(27:26) Breaking down revenue quality: SaaS vs. hardware vs. services

(29:00) AI cycle, hype, and founder pressure

(31:36) Why Sequoia expects more from this generation of founders

(34:21) Closing thoughts: measuring company velocity, not just revenue

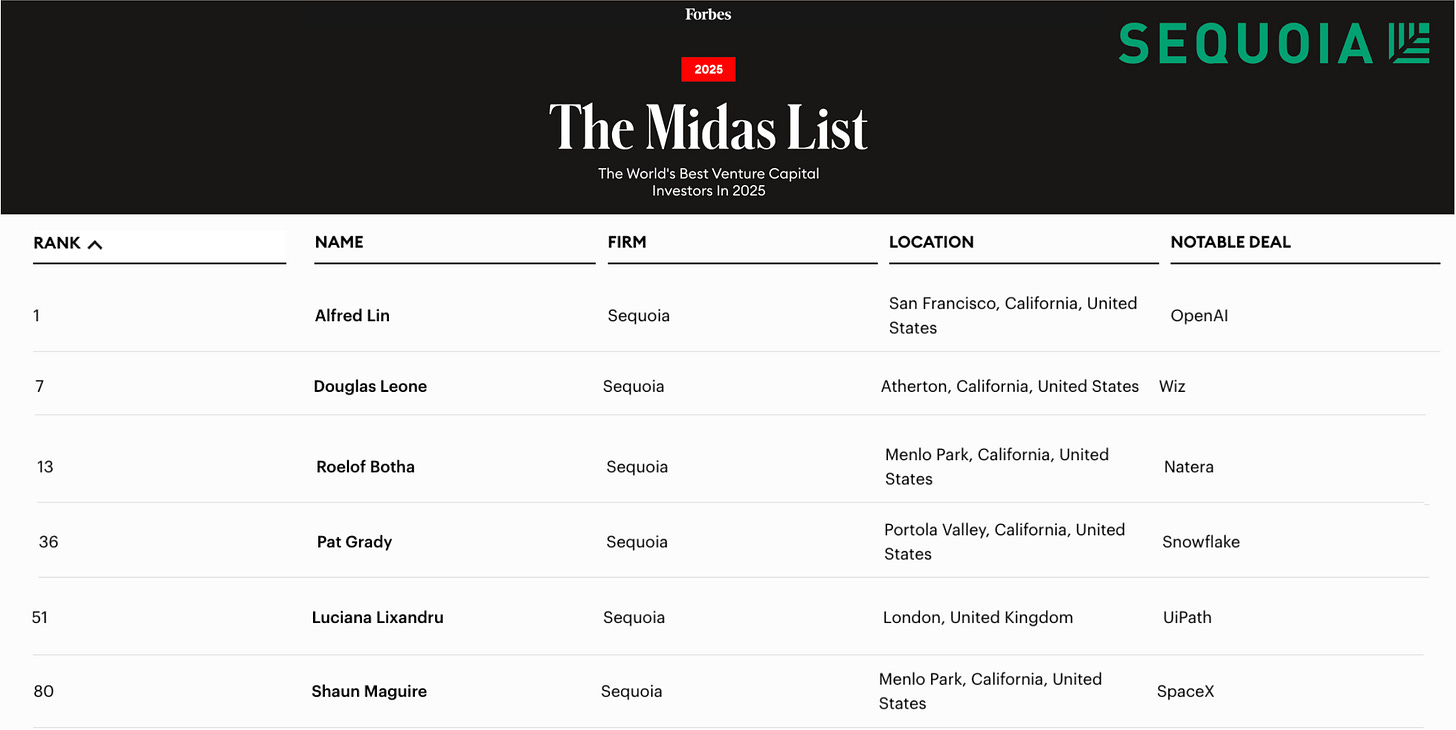

Sequoia 2025 Midas Ranking

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit: carta.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

What’s Next: Emerging Themes.

Sequoia seeks founders of any background from around the globe who see possibility where others see limits, with the unshakable grit to turn impossibility into reality. As they launched their latest seed & venture funds, their Early team shared a few emerging themes that excite them about the opportunities ahead:

Lauren Reeder, Bogomil Balkansky, Josephine Chen, Luciana Lixandru, Dean Meyer, Konstantine Buhler, George Robson, Alfred Lin, Shaun Maguire, Charlie Curnin, Julien Bek, Stephanie Zhan, & Roelof Botha.

Lauren Reeder

“Video and image models have come a long way in terms of character consistency, crisp editing and photorealism. This step change will enable a host of new applications to be built on top. I’m particularly excited about how that gets applied to the world of consumer apps. We connect better and are more engaged by videos and images than we are with text. There’s a whole new category of companies to be created around these new models.

I’m also excited about the evolving infrastructure layer of the stack. We’ve seen infrastructures reforming around LLMs. As the app layer matures, it’s becoming clearer what new primitives are needed to build the next generation of applications.”

“Security and observability are two huge, interesting domains in need of solutions. LLMs can’t effectively solve problems in these domains off the shelf, because there are no public sources of security data or observability data to train them. Since LLMs alone are not enough, these are fruitful fields for companies to innovate with other forms of AI and find new solutions.”

“We’re about to see a new world of consumer apps. Anytime there’s a platform shift, it opens up new dimensions in how people live. Stablecoins will change how consumers interact with financial services. Healthcare will transform as people take their health into their own hands with the help of LLMs. We’re also seeing step function changes in voice, video and robotics. Those changes will fundamentally shift the way people interact with technology and each other.”

Luciana Lixandru

“I am excited to meet founders who use Europe as their product and engineering hub, but who want to take over the world. Europe’s founder pool has never been stronger. A new wave of repeat entrepreneurs and alumni from breakout scaleups bring hard-won judgment, world-class product taste, and the muscle memory of going from zero to global.”

“One of the most interesting opportunities is in network security, which is going through a fundamental reset. The network itself is evolving to more distributed users across more applications and edge devices. AI is accelerating this shift, and the volume of requests is multiplying. We believe the next generation of network security will likely be identity-driven—built around users, devices, and even AI agent permissions.

Also, as more data centers come online, we’re thinking about data center security. As AI workloads concentrate in specialized hardware, the infrastructure is turning into a new attack surface. Securing the new compute layer, not just the network, is becoming critical.”

Konstantine Buhler

“E-commerce is ripe for reinvention with AI. There is a huge opportunity in usage revenue (as in, AI agents getting paid to do tasks like a person might) as well as new monetization for purchases in-app. OpenAI recently announced a service to do research and buy products in the chat app. This is just the beginning. We think there’s a multi-trillion dollar opportunity for commerce in AI, and we’re hopeful we get to back the next Amazon for the AI era.

Additionally, 2025 was the year that voice AI went mainstream. But there are so many industries based on phone calls still waiting for solutions. For example: the financial services industry, where 92% of fixed income is still traded over the phone.”

“I see a lot of potential in providing digital asset solutions to regulated financial institutions. Cryptocurrencies have existed at the periphery of financial services for a long time, but new regulations in the US and Europe mean that financial institutions can start to buy these products and sell them to their customers. Today, there’s a big mismatch between the expertise that’s long existed in crypto and the kind of expertise that exists among large banks and other institutions. We’re looking for early-stage companies to help bridge that gap.

Additionally: Most medical data is currently not being used to accurately package and price products. For example, in the UK, we’ve had longitudinal electronic data since the 1980s, but very little of it is being used to price things like medication, life insurance, etc. We’re excited for teams that will tackle those problems.”

“Almost every single industry will be disrupted by AI. If you study the history of the internet, mobile, and cloud, each of those technology waves brought business model transformations. The same will be true of AI. So far, AI has automated some of our most mundane work, but we look forward to the new creative ideas that can come out of AI. New business processes, consumer experiences we haven’t seen before, new ways to play… I think many of those experiences can be truly transformative in our lives.”

“Silicon photonics has been a holy grail idea for decades. It’s finally starting to happen, just as the use cases are exploding: The bottleneck in AI is multiplying big matrices, and you can do this efficiently with silicon photonics. I think the impact of silicon photonics in the next 50 years will be similar to the impact of silicon electronics in the last 50.

Separately, I’m interested in partnering with founders in Israel. I think the Israeli tech ecosystem has reached maturity, and that Wiz is just the beginning of many exciting companies to come. I like to back people when they’re underestimated, and I think the entire Israeli ecosystem is underestimated right now.”

“Having fun might be the most underrated use case for AI. Ten years ago, entertainment came from others making content for us: movies, music, stories, characters, worlds. Today, we make our own. From Suno to Sora, we’re seeing how AI enables more creativity, more delight, more people participating in the fun of making, remixing, sharing and consuming.”

“The physical world represents 80% of global GDP. The companies who win the new frontier of physical AI will become some of the largest companies in the world. We are entering a hardware renaissance, and we’re excited to partner with the companies pioneering this new supercycle.

I’m also interested in AI Forward Deployed Engineers. For every $1 spent on software, up to $6 are spent on services. The services industry requires more human workers than ever to deploy AI in production. This is a $500B growing labour market, where labour is supply-constrained. We need AI to help humans be more productive, initially as co-pilots and eventually as autopilots.”

“As AI becomes superintelligent, it not only automates services but also advances the frontier of what’s possible in each field. We’re seeing this in every sector, from coding to physical AI. What happens when AI transforms every industry you can imagine: consumer, engineering, product, security, sales, marketing, finance, legal, medicine, education, manufacturing? We are living through the most exciting time in history.”

“I’m drawn to dynamo founders—polymaths with a voracious appetite for learning, who blend interdisciplinary insights. These people don’t follow the conventional path. They’re defiant. They want to chart their own course. With the tools that we have available now in AI, founders like this can address problems that they spot in ways that we could never have done before.”