BREAKING: Shaun Maguire, Sequoia

How Elon Builds Trillion-Dollar Companies

Inside Elon’s Playbook: SpaceX, xAI, Neuralink & Trillion-Dollar Ambition

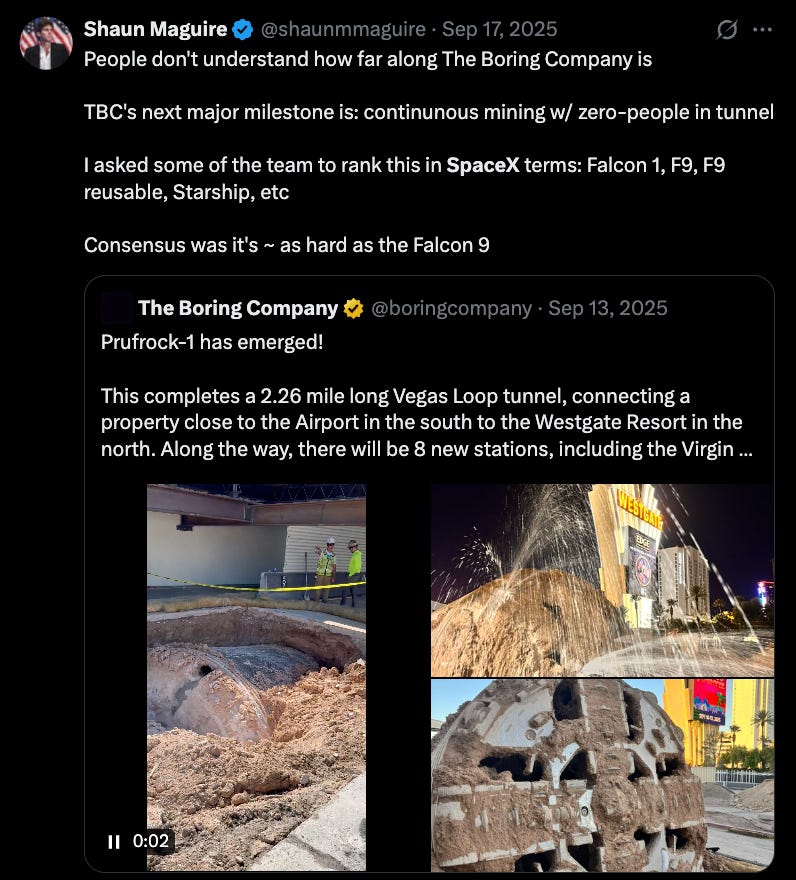

Elon Musk has built more category-defining companies than any founder alive — Sequoia Capital & Partner Shaun Maguire have backed five of them: SpaceX, xAI, Neuralink, The Boring Company, and X.

“I first invested in 2019, in cumulative invested probably $1.2 billion, & across all the different funds, that position’s worth about $12 billion today.. in the $800 billion valuation.

And so hopefully, in the IPO it’s worth a lot more than that.”

→ Listen on X, Spotify, YouTube, Apple

In this episode of Sourcery, Shaun breaks down how Elon builds trillion-dollar companies, why SpaceX may be the greatest company, largest IPO and wealth creation event of all time, and why he believes Elon is still massively underrated despite his global impact.

“I'm very privileged to be a major investor in the company, and I'm just gonna start with the caveat that I take that as a huge responsibility.”

We dive into SpaceX’s IPO, Starlink’s explosive growth, data centers in space, direct-to-cell from orbit, xAI, and the unique way Elon builds long-term potential energy before unleashing scale.

Shaun also explains why SpaceX could become the biggest wealth creation event in history, how liquidity will reshape the tech ecosystem, and why Elon’s approach to power, infrastructure, and speed gives him an unmatched edge.

This is a BTS look inside Elon’s operating system — from one of the most technically fluent investors in Silicon Valley.

𝐓𝐈𝐌𝐄𝐒𝐓𝐀𝐌𝐏𝐒

(00:00) Shaun Maguire, Partner at Sequoia Capital

(01:10) SpaceX Upcoming IPO & data centers in space

(05:00) The math behind space-based data centers

(07:05) Breaking down Starlink from first principles

(12:10) Economics of Starlink vs legacy telecom

(14:41) Starlink + self-driving cars and the future of mobility

(16:29) Starship, direct-to-cell, and the next decade roadmap

(19:38) SpaceX investment size and returns so far

(20:25) Why is Elon still underrated?

(21:33) How SpaceX went from contrarian to consensus

(25:39) Why does Elon keep a tight investor circle?

(27:06) Why does the market still underestimate xAI?

(29:47) AI capex, liquidity cycles, and why spending is rational

(32:11) Staying private vs going public: what makes more sense

(35:47) Mission-driven cultures vs post-liquidity slowdown

(37:53) Preparing founders psychologically for liquidity events

(40:33) Why this may be the healthiest wealth creation cycle

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast. visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Deel—Deel is the global people platform that helps startups hire, manage, pay, and equip anyone, anywhere. Trusted by more than 35,000 fast-growing companies, Deel is the people platform that just works, so teams can scale without the chaos. Visit: deel.com/sourcery

Public-–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. With Generated Assets, you can build, backtest, refine, and invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. Try it today: public.com/sourcery

Shaun Maguire, Sequoia

Shaun Maguire is a partner at Sequoia Capital, where he focuses on AI, defense, crypto infrastructure, and frontier technology. He has emerged as one of Sequoia’s most visible investors in the aerospace, national defense and hard-tech ecosystem, backing companies that sit at the intersection of compute, intelligence, security, and sovereign technological power. His investment style emphasizes technically exceptional founders, ambitious mission-driven teams, and companies that shape long-term strategic leverage rather than short-term consumer trends.

“I was a hacker as a kid and I approach everything with this mental model of trying to find the edge cases, trying to find the weird, where the definitions are not properly understood.”

Shaun holds a PhD in Physics, which underpins his analytical rigor and comfort operating in highly complex scientific and technical domains. This academic foundation has shaped his ability to evaluate deep-tech systems, AI research, cryptography, defense platforms, and frontier science, and contributes to his reputation as one of the more technically fluent investors in venture capital.

“I actually took graduate math classes with Vlad [Tenev, CEO of Robinhood] at Stanford when we were kids.”

Before Sequoia, Shaun built and sold Expanse, a cybersecurity company that mapped the global internet attack surface to help enterprises and governments identify exposed assets. Under his leadership, Expanse became a category-defining security platform and was ultimately acquired by Palo Alto Networks for approximately $1.25B in 2020. His experience as a founder and operator informs his reputation as a product-driven, founder-aligned investor with a strong bias toward execution and technical rigor.

Shaun also brings a background in U.S. national security and intelligence, with reported experience working alongside the CIA and broader intelligence community. This exposure to cyber operations, geopolitical risk, and defense systems has shaped both his worldview and his investment focus, driving a consistent emphasis on security, resilience, defense technology, and AI safety.

The Sequoia portfolio companies he partners with reflects this lens, spanning companies such as SpaceX, xAI, Neuralink, The Boring Company, Safe Superintelligence, Decart, Eon, Neros, Mach Industries, Irregular, Skyramp, Kela, LayerZero, Harmonic, Reflect Orbital, and Factory.

The through-line of his career is a progression from scientist → founder → security operator → intelligence-informed investor, anchored by a consistent focus on technologies that shape power, durability, and strategic advantage over decades.

→ Listen on X, Spotify, YouTube, Apple

5 Quick Takeaways

1) SpaceX = GOAT

“Look, I personally believe SpaceX is the greatest company of all time. I think the company is just getting started… I am willing to say SpaceX is on a different level of every company.”

“When you're vertically integrated it just lets you move with like a speed and flexibility that no one else has other outside of China.”

2) How Elon builds trillion-dollar companies (bottlenecks first)

“One thing for me that’s kind of been a lesson of watching how Elon builds companies is he… focuses on the bottlenecks a the most important thing. And then once that starts to clear up, then he starts to focus on kind of like what you can do with the thing.”

“Elon builds up potential energy and then he converts up potential energy into kinetic energy.”

“Elon builds Gigafactories that are not producing any cars or revenue for like five years and then immediately start making, you know, a million cars.”

3) Elon is still massively underrated?

“100%. I would say he only gets like 10% of the appreciation he deserves.”

“It just kind of blows my mind that people don't understand how fast the company is moving.”

“Elon's the best in the world at atoms, and I think atoms are gonna be a decisive factor in the AI race.”

4) Shaun’s SpaceX bet: $1.2B → $12B (IPO upside)

“I first invested in 2019… cumulative invested probably $1.2 billion… that position’s worth about $12 billion today… and hopefully, in the IPO it’s worth a lot more than that.”

“There was this weird moment in time where people were assigning basically zero credit to Starlink because prior internet constellations had been failures and were assuming that the launch market was not gonna grow. And Starship was basically being assigned zero value. There was a weird two-year period where it was underappreciated.

After Starlink got to about $1 billion of revenue, which was very fast — about 12 months after they got their first dollar of revenue — they were at about $1B of run rate. At that point it became an extremely consensus investment.

There was this weird two-year period where you could buy a lot of shares where people didn’t get it. And now it’s like, good luck finding shares. No one wants to sell, and I’m very excited for the IPO.”

5) Why SpaceX talent won’t slow down after IPO

“The SpaceX mission is one of the coolest & most pure missions of any company in history.”

“Why would you slow down or retire when we’re about to put people like humans on the moon and Mars.”

Brought to you by Brex:

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.