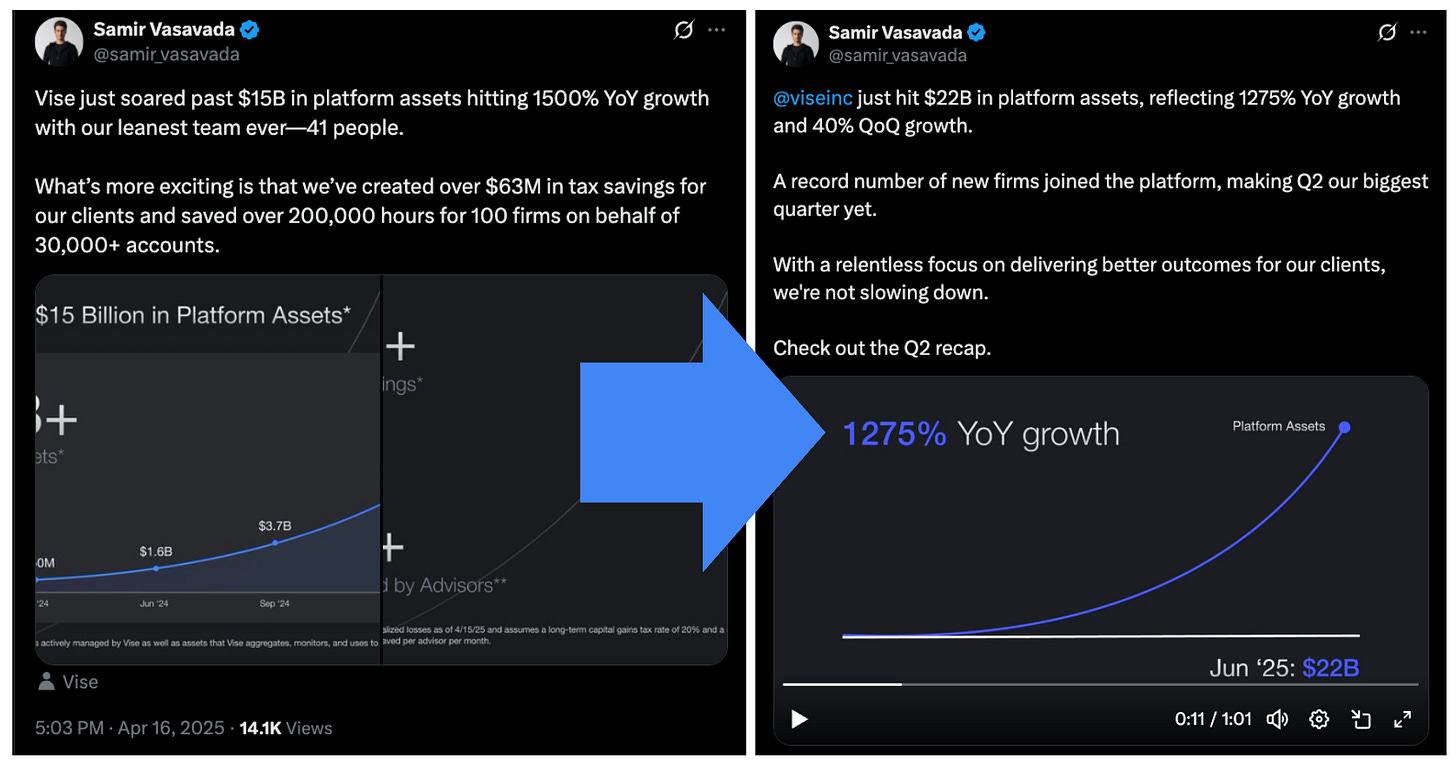

BREAKING: Vise Hits $22B in Platform Assets & 1275% YoY Growth, w/ ~40 Employees

How Vise Is Reshaping a $83T Wealth Industry

Samir Vasavada, CEO & Co-Founder of Vise, joins Sourcery to share how he & his co-founder Runik Mehrotra scaled Vise to over $22 billion in platform assets with their leanest team ever: ~40 employees. After a record-breaking Q2 & 1275% YoY growth, Vise is leading the shift to Wealth 3.0 with personalized, automated portfolios that go beyond mutual funds and ETFs.

→ Listen on X, Spotify, YouTube, Apple

Backed by $130 million in funding at a $1B valuation from Sequoia Capital, Founders Fund, and Allen & Co, Vise uses AI to help advisors build, manage, & explain portfolios across nearly every asset class and client type.

From saving clients $63M in taxes to explaining how billionaires finance mansions and jets, Samir delivers a masterclass in building through volatility, managing scale, and owning the next era of wealth.

“There needs to be one platform that is functionally the platform that powers the global multi-trillion dollar asset management industry. And it will be Vise”

On the more personal side, Samir opens up and gets candid about fundraising mistakes as a young founder, from cutting 100+ employees to managing the company. Learning from investor Keith Rabois, Samir embraced his “barrels” philosophy to rebuild a lean, high-agency team, consisting of world-class engineers, Ph.D. quant researchers, & investment strategists from top firms like Citadel, Google, Invesco, & Blackrock.

(Since this recording, Vise has grown from $15B to $22B platform assets in just a few months)

In this episode, Samir breaks down:

Bootstrapping Vise at 16: From seed to unicorn in 18 months

Raising $130M from investors like Sequoia, Founders Fund, + Allen & Co

How Vise saves clients $60M+ in taxes

What tech billionaires actually do with their equity

The $10T RIA opportunity—& why the legacy wealth stack is broken

Retail demand for private credit, real estate, & alternative assets

Global wealth shifts from London to Dubai, Milan, & Southeast Asia

Why scaling back from 150+ employees to 40 made the company stronger

Brought to you by:

Brex—The modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Fourthwall—The #1 way to sell merch online — Fourthwall is the easiest way to launch a fully branded merch store—used by big brands like MKBHD, Acquired, & even the Smithsonian. 100+ products. No upfront cost.

Timestamps

(00:00) $83T Market → Vise Hits $22B platform assets, 1275% YoY Growth

(01:30) Founding Vise at 16 & Becoming a Unicorn in 18 Months

(03:04) Pivoting to $10T Enterprise RIA Market

(05:28) Lean 40-Person Team → Fastest Growth Ever

(06:23) What Vise Actually Does

(10:23) State of Retail Market: $83T in wealth, $2T+ in Access to Alts

(22:45) $63M+ Saved via Daily Tax-Loss Harvesting

(24:38) Servicing Clients from $200 to $150M Accounts

(30:45) Why Zuckerberg & Elon Take “$0 Salaries”

(32:42) Billionaire Playbook: Financing Homes & Jets via Stock Loans

(39:21) Scaling to 150 FTE to “Refounding” w/ “Barrels” (Keith Rabois Strategy)

(43:20) Vision: World’s Biggest Tech-Powered Asset Manager

Redefining Wealth Management for the $83T Market

The U.S. wealth market is massive, and Vise is targeting one of its fastest-growing segments: enterprise RIAs.

“The wealth market in the US alone is $83 trillion in assets... If you segment it to the enterprise RIA market, it's today around $2 trillion in assets. Over the next five to seven years, that market will go from $2 trillion in assets to $10 trillion in assets.”

Rather than focusing on small RIAs, Vise evolved to serve large firms backed by private equity—those managing billions and needing automation and scale. “We are right now the only purpose-built platform that is focusing on that enterprise RIA segment.”

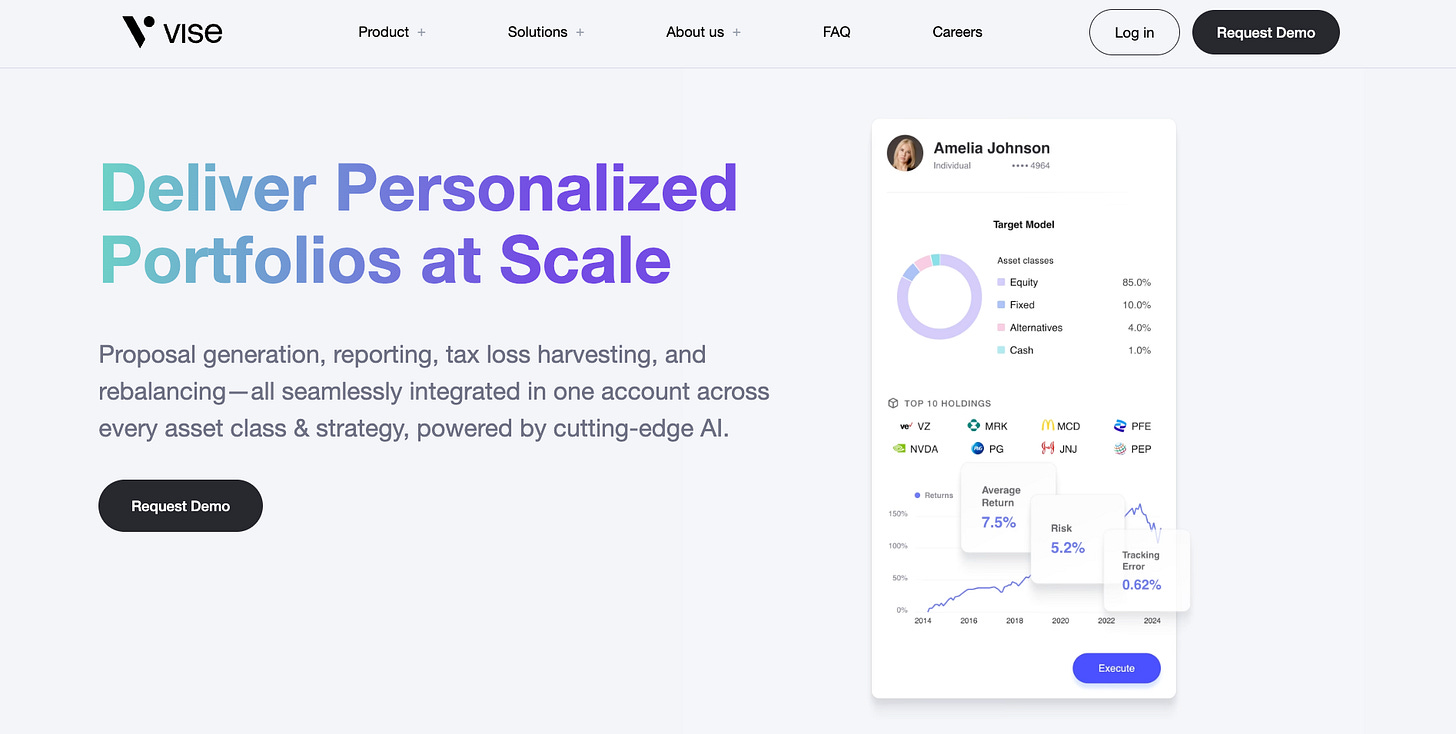

The Shift to Wealth 3.0: Personalized, Automated Portfolios

Samir believes the era of mutual funds and static ETFs is ending. Wealth 3.0—hyper-personalized, tech-powered investing—is rising in its place.

“You can almost think about it as your central operating system, your central nervous system for all things portfolio management... to build a personalized portfolio of individual stocks, bonds, and alternative assets that are uniquely personalized to that end client.”

Vise not only builds these portfolios but actively trades and optimizes them for tax efficiency, risk, and long-term goals. “We’re aspiring to build... a total portfolio solution.”

Why Lean Teams Outperform

Vise once scaled to over 150 people—then cut back dramatically to just 45. That reset became a turning point.

“The alpha was in hiring a small amount of people that are high agency, that are high ownership... as Keith Rabois says, your barrels.”

Samir made the hard call to refound the company with a smaller, sharper team.

“We did it and we were better off for it. Yes, it was hard for the two months we did it, but... we actually turned it into something that made the overall organization much better.”

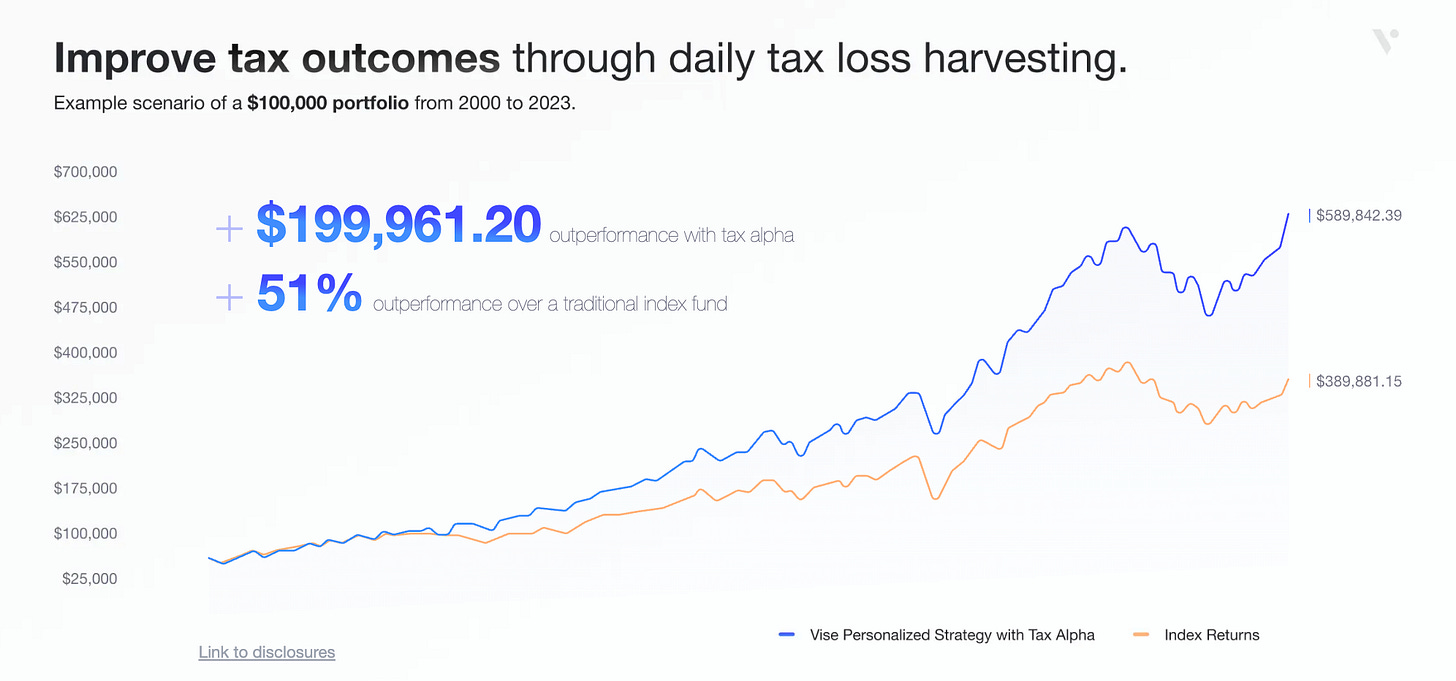

Tax Efficiency as a Differentiator

One of Vise’s biggest value drivers? Daily tax-loss harvesting—done at scale through automation.

“We've created over $63 million in tax savings for our clients... We have algorithms that are looking at thousands and thousands of client accounts every single day looking for these opportunities.”

Historically, this type of tax strategy was reserved for ultra-high-net-worth clients. Vise has brought it to investors with as little as $10,000. “Functionally you're kind of bridging the wealth access gap.”

Billionaire Playbooks: No Salary, Loans on Stock

In one of the most talked-about segments, Samir explains how the ultra-wealthy structure their compensation and spending to minimize taxes.

“It's very tax inefficient to just get a paycheck every two weeks... What's more tax efficient is you get stock. Then with that stock in their portfolio, you can do all kinds of fun things. You can take loans against that stock.”

That’s how $100 million homes and private jets get financed—not with cash, but with leverage.

“When you read those stories... tech billionaire buys $50 million house, $100 million house, all cash paid—they're not paying in all cash. They're going to their guy at Morgan Stanley or Goldman Sachs... and pulling a loan against their shares.”

The Long Game

At just 24 years old, Samir is building for the long term.

“We want to build the world's largest asset manager entirely powered by technology... Part of the bet is because I'm 24 years old, right? I can go work on this for the next two or three decades and still be a considerably young person.”

With the rise of Wealth 3.0, the explosion in alternative assets, and the need for next-gen infrastructure, Vise is positioning itself as a defining company in modern finance.

“I use Brex for EVERYTHING.” - Roy Lee, Cluely

Brex is the modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel. Over 30,000 companies, including ServiceTitan, Anthropic, Scale AI, DoorDash, & Wiz, use Brex.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery