BREAKING: Wander Raises $50M Series B

Founder & CEO, John Andrew Entwistle | Led by QED Investors & Fifth Wall

Wander’s $50M Series B To Reinvent Luxury Travel

Today Wander announces their $50 million Series B led by QED Investors and Fifth Wall, with participation from Redpoint Ventures, Uncork, Starwood Capital, and Breyer Capital. This financing brings their total funding to over $100M. We had the fortunate opportunity to interview Founder & CEO John Andrew Entwistle barely 48 hours after signing the initial term sheet. Since then, the round grew in demand, ultimately reaching the $50M total.

This milestone fuels Wander’s ambition to dominate one of the fastest-growing categories in consumer: the short-term rental market, which is projected to exceed $200 billion globally by 2030. Within that, the top 5% of luxury vacation homes—Wander’s target segment—accounts for an estimated $35 billion in gross booking value.

→ Listen on X, Spotify, YouTube, Apple

FWIW: This is one of my favorite conversations to date. John Andrew, while tired from not sleeping for a week preparing for his round, happily came in to record at our LA studio to share everything he’s built with Wander. John Andrew is a gem of a human, incredibly authentic, relentlessly hardworking, & a top-tier founder.

Special thank you to Joshua Browder of Browder Capital & DoNotPay for the introduction.

If you have a fundraise announcement coming up & want to be featured on Sourcery, DM me directly! We operate under strict embargos & would love to share your next big milestone.

Highlights:

0:00 - John Andrew Entwistle Introduction

1:00 - Series B Benchmark: $5M–$15M ARR

3:32 - What is Wander? + Maintaining a High NPS

8:15 - Building the First Vacation Rental REIT

11:48 - Market Size: $35B in Top 5%

13:42 - Customer Experience Philosophy

17:00 - Solving the Marketplace Cold Start Problem

25:30 - Favorite Properties and Hidden Gems

28:51 - Brex: B2B Opportunities

32:34 - The Technology Stack

36:18 - John Andrew’s Background

43:53 - Team Structure & Hiring

51:04 - Demand Generation Strategy + Activation Over Growth

55:27 - Business Model Deep Dive + Raising $100M+

1:00:13 - What to Look for in Investors

1:02:20 - Life Philosophy: The Four Rules

Brought to you by:

Brex—The modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel. As a Sourcery listener, you can unlock up to $500 toward Brex travel or $300 in cash back, plus exclusive perks to help you move even faster.

Kalshi—The largest prediction market and the only legal platform in the US where people can trade directly on the outcomes of future events.

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Reimagining the Model: Owning the Guest Experience End-to-End

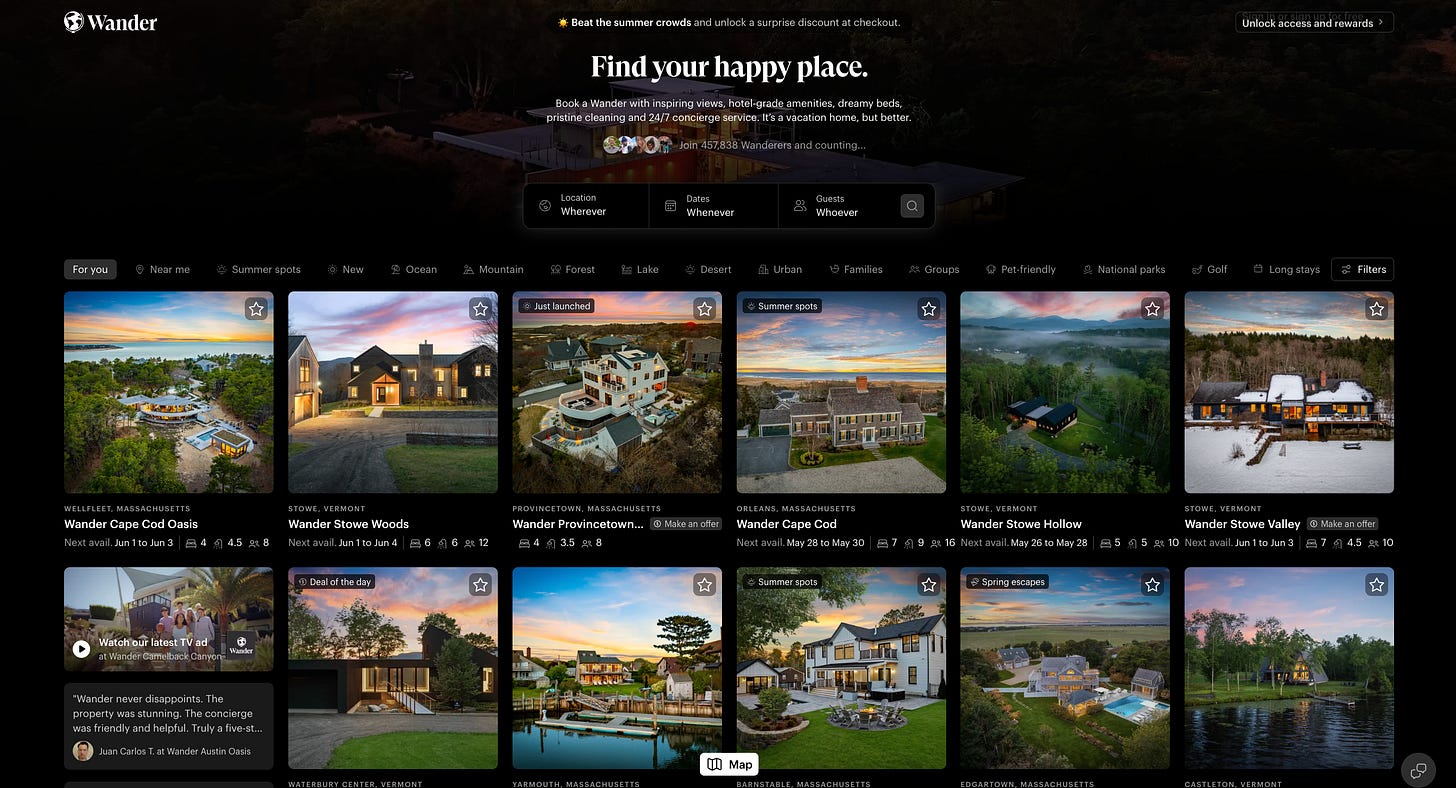

Wander operates as a vertically integrated travel marketplace. Unlike traditional online travel agencies that serve as listing aggregators, Wander controls the entire customer journey—curating its property inventory, maintaining brand-level standards across every location, operating its own booking engine, and delivering a premium guest experience. “Wander is a company whose entire purpose is to solve a problem,” said CEO John Andrew Entwistle. “It’s not just a SaaS wrapper around someone else’s infrastructure—we control the platform, the homes, and the experience.”

Rather than targeting the entire market, Wander zeroes in on the top 5% of vacation rentals—homes that already drive roughly 30% of the industry’s revenue. The company makes these properties even more valuable through its proprietary platform and operational excellence. Revenue is generated from booking fees charged to guests and management fees paid by property owners, but unlike others in the space, Wander avoids hidden markups or upsells. “We align our monetization with guest and owner success,” Entwistle emphasized.

Scale & Satisfaction: Growth Metrics That Signal Real Momentum

In just two years, Wander has grown from a concept to a category contender. As of May 2025, the platform has over 1,000 properties live—a 14x increase year-over-year—and more than 35,000 nights booked. The company is currently operating at a $40 million GMV run rate with a year-end target of $80 million. Even more impressively, Wander has maintained an industry-leading Net Promoter Score (NPS) of 85 and a 9.3/10 average trip rating, rare levels of satisfaction in hospitality.

Investor support reflects this strong product-market fit. “Wander has built a world-class brand with industry-leading software,” said Chuckie Reddie, Partner at QED Investors. “In just one year, the company has signed over 1,000 homes and looks to continue adding coverage to the map.” From both consumer and capital perspectives, Wander is proving that high-quality, high-retention hospitality can scale.

From REIT to Asset-Light Platform

Wander’s early strategy was unconventional. To overcome the cold start problem—demand without supply—the company bought and operated its first few homes outright. “We had to prove the model,” Entwistle explained. “Buying homes gave us full control to test and refine the experience quickly.” This capital-intensive approach laid the foundation for Wander’s brand and operational playbook.

Next, the company built the first institutional-grade vacation rental REIT, partnering with firms like Latham & Watkins, Ernst & Young, and Phoenix American. This allowed Wander to scale supply with investor-owned assets while maintaining quality control. Eventually, as trust in the brand grew, Wander transitioned to an asset-light model—managing homes owned by third parties but operated through Wander’s software and service standard. The result is a fast-scaling supply engine that doesn’t require the company to hold real estate on its balance sheet.

WanderOS & the Path to Full Automation

Behind Wander’s guest-facing platform lies a sophisticated backend operating system: WanderOS. This proprietary tool powers everything from dynamic pricing to vendor coordination, guest vetting, ticketing, and concierge support. “People assume we have on-site managers, but 100% of operations are coordinated remotely through WanderOS,” Entwistle said. “It’s really a software problem—and we’re solving it at scale.”

Built primarily in TypeScript for efficiency, WanderOS allows a small team to manage hundreds of properties. Today, the system handles 60% of operational tasks autonomously. Wander’s goal is to reach 95% automation within the next 18 months, using AI agents to coordinate cleanings, repairs, guest communications, and more. In a category defined by human error and inconsistency, this software-first strategy is a major differentiator.

Marketing, Activation, & Brand Loyalty

Wander’s demand generation strategy is balanced between performance marketing and organic channels. Roughly 35% of bookings come from paid media (Google, Meta), while the rest are driven by SEO, influencer marketing, podcasts, and word-of-mouth. More important than growth, however, is customer activation. “We already have 400,000 users,” Entwistle noted. “The question isn’t how do we grow that—it’s how do we activate?”

Wander reports an average customer lifetime value of $10,000 over three years, signaling strong retention and frequent repeat bookings. The company’s high NPS and immersive customer experience—think stocked fridges, concierge booking for chefs and jets, and flawless check-ins—drive long-term loyalty. Internally, Wander applies the same discipline to its brand as it does to its product. Its latest launch video, produced entirely in-house, cost 35% less than its 2021 debut, underscoring the company’s culture of operational efficiency.

John Andrew Entwistle’s Entrepreneurial Journey

At just 27, John Andrew Entwistle has already spent nearly a decade as a venture-backed founder. He started his first software company, Coder, at age 18 and scaled it through his early twenties. “My college years weren’t spent in school—they were spent building enterprise software and learning the hard parts of company-building,” he reflected. He is also a 2019 Thiel Fellow and credits the program with helping him find like-minded peers at a critical time in his development.

After stepping away from Coder, Entwistle sought a reset—and what he found was a poor vacation rental experience. That disappointment inspired Wander. “It wasn’t just about travel,” he said. “It was about how much time we spend working, and how rare and precious those moments of escape can be. I wanted to build something that honored that.”

Wander isn’t just a business to him—it’s a mission. “If this fails, it won’t be because the idea was wrong. It’ll be because I failed to execute. And I’m committed to not failing.”

Building a Brand That Lasts

Wander is not another listing site—it’s a vertically integrated hospitality brand built for long-term trust. With over 1,000 properties, 35,000+ nights booked, and $50 million in fresh capital, Wander is scaling fast—but carefully. By combining a software-first mindset, high-touch service, and a strong cultural core, the company is positioned to define the next era of premium travel.

As Entwistle puts it, “The world is a little bit happier with Wander in it.”

Find you happy place 😊 🌎

Today’s Sourcery is brought to you by Brex..

Brex’s modern finance stack including the world’s smartest corporate card, expense tracking, banking, bill pay, and travel tools helped fuel Scale AI’s ascent from a 2016 startup to an impending $25 billion valuation (currently rumored tender offer: Founders Fund, Greenoaks Capital & Coatue plan to participate).

Starting with autonomous vehicle data, Scale AI pivoted to power AI models for OpenAI and Microsoft, growing 2024 revenue to $870M on a projected $1.5B annualized run rate. Scale AI is on path to 2x that this year, estimating $2B in revenue. Brex’s real-time spend visibility and integrations kept pace with their global expansion. Over 30,000 companies, including ServiceTitan, Anthropic, Mercor, DoorDash, and Wiz, use Brex to spend smarter and move faster.