BREAKING: Who is Elad Gil? State of Tech Investing + Lessons from 1999 IPO Boom

$B Solo-GP Fund, 200+ Investments ~40 valued $1B+ each, Monuments

Enigma Global

Elad Gil, of Gil Capital + Gil & Co, (aka one of Silicon Valley’s most influential investors) sits down with Sourcery to unpack who he is, what he invests in & the state of private technology markets.. from the 1999 IPO boom → the AI bubble, and what it really takes to build durable companies across cycles.

→ Listen on X, Spotify, YouTube, Apple

Elad has invested in more than 200+ companies, ~40+ valued at $1B+ each, from Stripe, Airbnb, Brex, Deel, & Coinbase to next-gen AI leaders like Perplexity, Harvey, & Decagon.

His firm, Gil Capital is a multi-stage investment fund that invests from inception & incubation (with Jared Kushner) through $500M growth rounds (ie. Anduril Raises $450 Million in Series D Funding led by Elad Gil). In 2023, the firm raised a $1B solo-GP fund, though, rumors suggest Gil may now be managing billions with a new fund—though unannounced.

Portfolio includes:

Abridge, Airbnb, Airtable, Anduril, Applied Intuition, Base Power, Brain Co, Braintrust, Brex, Character, Checkr, Coinbase, dbt Labs, Deel, Decagon, Figma, Flexport, Gitlab, Gusto, Harvey, Instacart, Mistral, Navan, Notion, Opendoor, PagerDuty, Perplexity, Pika, Pinterest, Retool, Rippling, Samsara, Saronic, Square, Stripe, etc.

Nov, 2023: “Elad Gil, one of the most closely watched investors currently operating in venture capital, has secured over $1 billion for his third, and largest, fund to date. The fresh capital further cements Gil as the most well-funded solo VC in Silicon Valley.

Cosmic — Aleph 3 has received commitments of nearly $1.1 billion from 54 investors after initially targeting $820 million, according to securities filings. The new fund is 77% larger than its predecessor, which closed on $620 million in 2021.”

BTW - Did we mention Elad’s a bit of an “enigma”?

Degrees in Math & Biology (including a PhD from MIT)

Worked on AI & mobile at Google

Started two companies (Mixerlabs, bought by Twitter & Color Health)

Recently incubated / helped start Braintrust & Brain Co with Jared Kushner

Wrote the best-selling High Growth Handbook - tactical advice for post-product market fit companies (hiring, product, M&A, sales, HR issues, fundraises etc).

AI podcast No Priors with Sarah Guo

Personally identified a gene involved in lifespan

Billion-dollar Solo-GP Fund

Building massive inspiring monuments with Monumental

Creating a chain of new K-12 schools inspired by ancient Greece

Am I missing anything??

In this conversation, Elad reflects on:

Lessons from the 1999 IPO Boom: 2,000 internet companies went public, and only a handful remain. What does that mean for today’s AI rush?

AI Bubble? Why Elad believes technology waves are always “overhyped and underhyped” at the same time.

How to Spot the Next Amazon or Stripe in AI: What separates short-term success from long-term durability.

When Founders Should Sell: The four real reasons companies get acquired, and why sometimes it’s the smartest move.

Bottlenecks in AI: Why energy and regulation may shape where global training hubs are built.

Forever Private Companies: Stripe, SpaceX, and the new trend of companies that never go public.

Building a Trillion-Dollar Company: The markets, founder traits, and timing needed to reach that scale.

Timestamps

(00:00) Elad Gil

(02:00) Career arc: Google, Twitter, Color, angel investing

(02:30) Technology as a force for good

(03:20) Why Elad is building monuments

(09:09) From angel investing to a $2B fund

(11:03) Inside Gil Capital’s small but focused team

(11:45) Thesis-driven vs. opportunistic investing

(12:43) Backing 200+ companies across waves

(15:15) Stripe, Airbnb, Figma, Instacart & investing across competition

(17:08) Why every software company is now an AI company

(18:47) AI’s biggest bottleneck: energy & geopolitics

(22:10) Policy, crypto regulation, and AI’s political risks

(26:14) Lessons from the 1999 IPO boom & what it means for AI

(34:29) What it takes to build a trillion-dollar company

Notes:

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

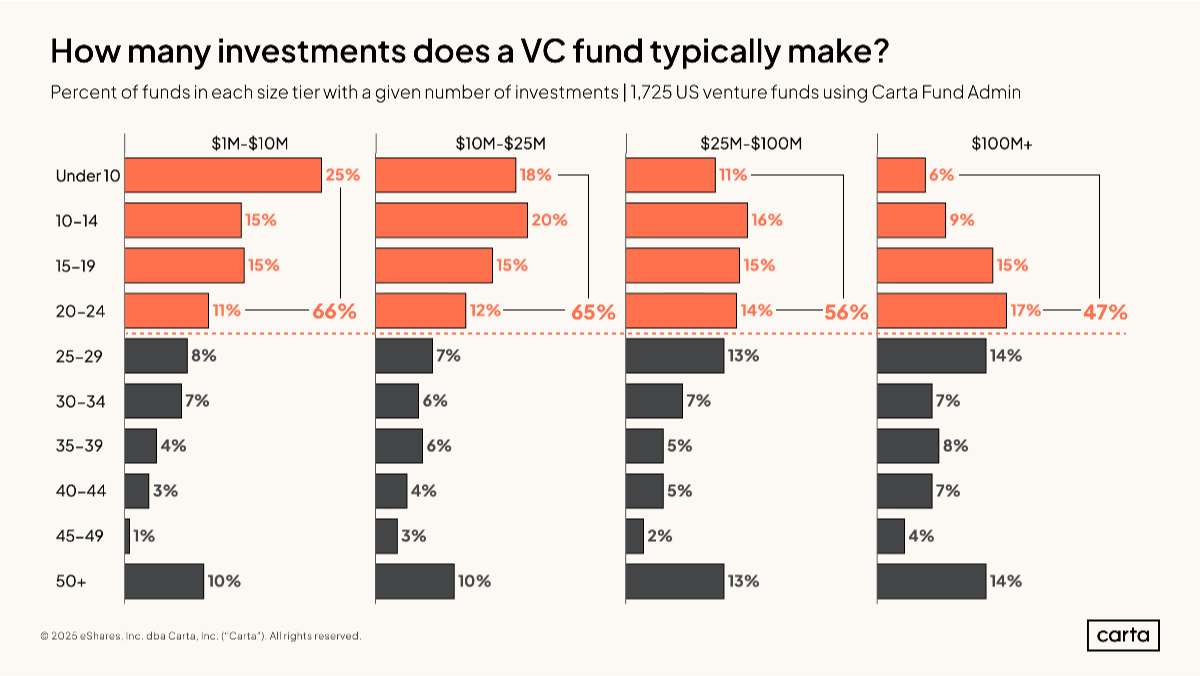

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit: carta.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).