Chamath is SPAC

Vulcan Elements, Cohere, Cognition, Bullish, Cerebras, Perplexity $34.5B Chrome Bid

Brought to you by Brex..

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Spend smarter. Move faster. Sourcery subscribers get: 75,000 points after spending $3,000 on Brex card(s). Plus, white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, and access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Hello from Palo Alto

That’s all. Can’t share anymore at this time.

Musings

AI

SPAC King is BACK. Chamath Palihapitiya’s Newest SPAC “American Exceptionalism Acquisition Corp” Targets AI & Crypto

Perplexity makes bold $34.5 billion bid for Google's Chrome browser

Watch

Italy’s Bending Spoons raises over €500 million to turbocharge tech acquisitions

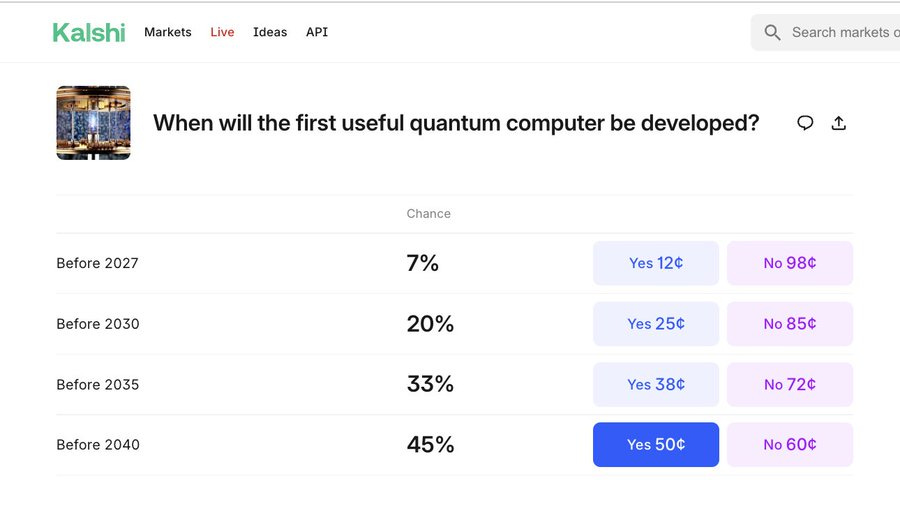

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, IPOs, weather, AI, etc).

Top Interviews

How to Build a $100M+ Cult Brand. Sophia Amoruso | Nasty Gal, GirlBoss, Trust Fund, Business Class

AI-Powered Cloud Seeding | Augustus Doricko, CEO of Rainmaker x Alex Levy, CEO of Atmo

The Rarest Company On Earth (*Vulcan Elements*) Raises $65M from Altimeter

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (8/11-8/15):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Appcharge, a Tel Aviv, Israel-based mobile game payments platform, raised $58 million in Series B funding. IVP led the round and was joined by Playrix, Creandum, Moneta VC, Play Ventures, Gilot Capital Partners, Smilegate Investment, and others.

- Novig, a sweepstakes-based sports prediction market, raised $18m in Series A funding. Forerunner Ventures led, joined by YC, NFX, Perceptive Ventures, and Gaingels

- Transak, a Miami, Fla.-based developer of fiat-to-crypto infrastructure, raised $16 million in funding. Tether and IDG Capital led the round and were joined by others.

- Confido, a New York-based AI financial operating system for consumer brands, raised $15 million in Series A funding. Footwork led the round, with participation from Watchfire Ventures, Barrel Ventures, Liquid 2, Boulder Food Groups, and Y Combinator.

- Cache, a San Francisco-based developer of a platform designed to let investors swap concentrated stock positions for diversified portfolios while deferring capital gains taxes until they sell, raised $12.5 million in Series A funding. Bill Trenchard at First Round Capital led the round and was joined by others.

- Bumper, a British BNPL for car repairs, raised $11m in Series B extension funding. Autotech Ventures led, joined by InMotion Ventures, Suzuki Global Ventures, Porsche Ventures, and Shell Ventures.

- Inclined Technologies, an SF-based fintech that lends against whole life insurance policies, raised $8m in Series B funding. HSCM Ventures led, joined by Northwestern Mutual.

- Coverd.us, a New York City-based fintech platform designed to gamify financial wellness, raised $7.8 million in seed funding. Yolo Investments led the round and was joined by a16z speedrun, Volt Capital, WndrCo, Arbitrum Gaming Catalyst, Tusk Ventures, and others.

- Dealops, a San Francisco-based developer of pricing infrastructure for revenue teams, raised $7 million in funding. Pear VC and General Catalyst led the round and were joined by Depth VC, Elsa Ventures, Weekend Fund, Flex Capital, Allison Pickens, 20 Sales, and others.

- Drivepoint, a Boston-based finance platform for consumer brands, raised $7m in Series A finding. Vocap Partners led, joined by Bling Capital, Vinyl VC, and Las Olas Venture Capital, and Jefferies' Family Office

- Infinity Loop, a New York City-based AI-powered deal analysis platform, raised $5 million in seed funding. Glasswing Ventures and TIAA Ventures led the round and were joined by Plug and Play, Restive Ventures, and angel investors.

- HoneyCoin, a Nairobi, Kenya-based cross-border payments platform, raised $4.9 million in seed funding. Flourish Ventures led the round and was joined by Visa Ventures, TLCom Capital, Stellar Development Foundation, Lava, Musha Ventures, 4DX Ventures, and Antler.

- Levr Bet, a Costa Rica-based decentralized sports betting platform, raised $3 million in funding. Blockchain Capital and Maven 11 led the round.

- Riva, a London-based global payments firm, raised $3 million in funding from Project A and others.

Care:

- Gameto, a New York City-based cell engineering company focused on women’s reproductive health, raised $44 million in Series C funding. Overwater Ventures led the round and was joined by Insight Partners, RA Capital, Two Sigma Ventures, and others.

- Citizen Health, a rare disease data advocacy startup, raised $30m in Series A funding. 8VC led, joined by Headline and Transformation Capital Partners.

- Tahoe Therapeutics, an SF-based developer of a foundational dataset for training "virtual cell models," raised $30m. Amplify Partners led, joined by Databricks Ventures, Wing Venture Capital, General Catalyst, Civilization Ventures, Conviction, Mubadala Capital Ventures, and AIX Ventures.

- Arintra, an Austin, Texas-based AI-powered medical coding automation platform, raised $21 million in Series A funding. Peak XV Partners led the round and was joined by Endeavor Health Ventures, Y Combinator, Counterpart Ventures, and others.

- Fountain Life, a longevity startup, raised $18m in Series B funding led by EOS Ventures

- Isaac Health, a New York City-based health technology company for brain health and dementia care, raised $10.5 million in Series A funding. Flare Capital led the round and was joined by Industry Ventures, Black Opal Ventures, Meridian Street Capital, B Capital, and Primetime Partners.

Enterprise/Consumer:

- Cohere, a Toronto-based LLM model developer, raised US$500m at a $6.8b valuation. Radical Ventures and Inovia Capital led, joined by AMD Ventures, Nvidia, PSP Investments, Salesforce Ventures, and Healthcare of Ontario Pension Plan

- Cognition, a New York-based AI coding startup, raised nearly $500m in Series C funding at a $9.8b valuation led by Founders Fund,

- Lambda, a San Jose, Calif.-based cloud infrastructure company backed by Nvidia, is in talks to raise at a $4b-$5b valuation,

- EliseAI, a New York developer of chatbots for the housing industry, raised around $200m led by a16Z at a valuation north of $2b, per The Information.

- Titan, a New York-based IT services company, raised $74m led by General Catalyst and announced its acquisition of managed service provider RFA

- 1Kosmos, an Iselin, N.J.-based passwordless authentication platform, raised $57m in Series B funding. Forgepoint Capital and Oquirrh Ventures led, joined by NextEra Energy Ventures and Gula Tech Adventures

- Profound, a startup that helps businesses control how they appear in AI responses, raised $35m in Series B funding. Sequoia Capital led, joined by insiders Kleiner Perkins, Khosla Ventures, Saga VC, and South Park Commons

- Kustomer, a New York City-based AI-powered CX platform, raised $30 million in Series B funding. Norwest led the round and was joined by Battery, Redpoint, and Boldstart.

- Topline Pro, a Boston, Mass. and Brooklyn, N.Y.-based developer of AI software designed for service professionals, raised $27 million in Series B funding. Northzone led the round and was joined by Tactile Ventures, Industry Ventures, Forerunner Ventures, Bonfire Ventures, TMV, Flybridge, and BBG Ventures.

- Casap, a San Francisco-based developer of automation technology for dispute and fraud cases, raised $25 million in Series A funding. Emergence Capital led the round and was joined by Lightspeed Venture Partners, Primary Venture Partners, SoFi, and others

- Protege, a New York City-based developer of data sets designed for AI training, raised $25 million in Series A funding. Footwork led the round and was joined by CRV, Bloomberg Beta, Flex Capital, Liquid 2 Ventures, Shaper Capital, and others.

- Jump, a Los Angeles, Calif.-based fan experience platform for sports, raised $23 million in Series A funding. Alexis Ohanian and Seven Seven Six led the round and were joined by Courtside Ventures, Will Ventures, Forerunner, and others.

- Evertune, a New York City-based AI marketing platform, raised $15 million in Series A funding. Felicis Ventures led the round and was joined by Eniac Ventures, NextView Ventures, and angel investors.

- VibeCode, a San Francisco-based app designed for building other apps, raised $9.4 million in funding from 776 Fund, Long Journey Ventures, Neo, First Harmonic, Afore Capital, and others.

- Mako, a a maker of agents to generate and optimize GPU kernels, raised $8.5m in seed funding. M13 led, joined by Torch Capital and Parable VC

- Create, maker of an AI coding app agent Anything, raised $8.5m in seed and Series A funding led by Bessemer Venture Partners

- Palabra AI, a London-based speech translation engine, raised $8.4m in pre-seed funding. Seven Seven Six led, joined by Creator Ventures.

- Continua, a developer of AI agents for group chats, raised $8m in seed funding. GV led, joined by Bessemer Ventures Partners.

- Thread, a New York City-based developer of an AI service desk for managed service providers, raised $8 million in funding. Integr8d Capital and David Bellini led the round and were joined by Headline, Adam Slutskin, Vince Kent, and others.

- Dealops, a provider of AI pricing infrastructure for enterprise sales teams, raised $7 million in seed and pre-seed funding. Pear VC and General Catalyst led, joined by Depth VC, Elsa Ventures, Weekend Fund, Flex Capital, Allison Pickens, and 20Sales.

- Refold, a San Mateo, Calif. and Bangalore, India-based developer of AI agents for integrating enterprise software systems, raised $6.5 million in seed funding. Eniac Ventures and Tidal Ventures led the round and were joined by Better Capital, Ahead VC, Karman Ventures, Z21, and angel investors.

- Infinity Loop, a New York City-based AI-powered contract intelligence platform, raised $5 million in seed funding. Glasswing Ventures and TIAA Ventures led the round and were joined by Plug and Play, Restive Ventures, and angel investors.

- Studio Atelico, a San Francisco and London, U.K.-based developer of an AI engine for video games, raised $5 million in seed funding from Air Street Capital and angel investors.

- Studio Atelico, a San Francisco- and London-based developer of an AI engine for video games, raised $5 million in seed funding from Air Street Capital and angel investors.

- Archestra, a London, U.K.-based platform designed to enable companies to securely use AI agents and connect them to internal data sources safely, raised $3.3 million in pre-seed funding. Concept Ventures led the round and was joined by Zero Prime Ventures, Celero Ventures, RTP Global, and others.

- Cuttable, a Melbourne, Australia-based AI creative agency, raised AU$4.5 million ($2.9 million) in seed funding. Square Peg led the round and was joined by Rampersand and Brand Fund.

HardTech:

- Cerebras, a Sunnyvale, Calif.-based AI chipmaker that filed for an IPO last fall, is in talks to raise $1b led by Fidelity

- Vulcan Elements, a Durham, N.C.-based maker of rare-earth magnets, raised $65 million in Series A funding at a $250 million valuation. Altimeter led the round, joined by One Investment Management.

- Squint raises $40 million at $265 million valuation to modernize manufacturing for companies like Pepsi and Michelin. The Westly Group and TCV led, joined by insiders Sequoia Capital and Menlo Ventures

- GoodShip, a Bellevue, Wash.-based operating system for the freight industry, raised $25 million in Series B funding. Greenfield Partners led the round and was joined by Bessemer Venture Partners, Ironspring Ventures, Chicago Ventures, and FUSE VC.

- Softwear Automation, an Atlanta-based autonomous sewing tech company, raised $20m in Series B1 funding. Bestseller led, joined by CTW Venture Partners, SRI Capital, and MacDonald Ventures.

Sustainability:

- BinSentry, a Kitchener, Ontario-based AI-powered agriculture technology company, raised $50 million in Series C funding. Lead Edge Capital led the round.

- Waterly, a Crystal Lake, Ill.-based developer of software for water data collection, raised $4 million in Series A funding. Burnt Island Ventures led the round and was joined by Emerald Technology Ventures.

Acquisitions & PE:

- Affinity Partners, led by Jared Kushner, is buying an 8% stake in British digital lender OakNorth

- Proterra Investment Partners acquired AcreTrader, a Fayetteville, Ariz.-based farmland investment platform. Financial terms were not disclosed.

- SentinelOne agreed to acquire Prompt Security, a New York City-based AI-powered cybersecurity platform, from Jump Capital.

- 10x Genomics agreed to acquire Scale Biosciences, a San Diego, Calif.-based single-cell analysis company. Financial terms were not disclosed.

- Cardinal Health agreed to acquire Solaris Health, a Fort Lauderdale, Fla.-based health care platform, from Lee Equity Partners for $1.9 billion.

- Bending Spoons, owner of Evernote, Meetup and Brightcove, secured more than €500m in debt to buy more tech companies.

- Landbase, an agentic AI startup that automates go-to-market workflows, acquired Adauris, a Toronto-based inbound marketing startup. Landbase recently raised $30m from firms like Sound Ventures and Picus Capital, while Adauris was seeded by a Morgan Stanley fund and Founders Inc

IPOs:

- Bullish, a crypto exchange and owner of media outlet CoinDesk, raised $1.1b in its IPO. The company priced at $37 per share, above both its original and revised ranges, and will list on the NYSE (BLSH).

Funds:

- H.I.G. Capital raised $5.9b for its fourth direct lending fund.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

A blessing to my Substack feed.