Cluely's Mega-Viral Launch

Founders Fund's $4.6B Growth Fund, Hammerspace, Revel, Doss, General Matter, Conductor AI; Checkr/Truework, Infinite Reality/Touchcast, Databricks/Fennel

Today’s Sourcery is brought to you by Archer..

Learn more about how Archer is set to open a new world of opportunity for passengers by providing safe and efficient access to people, places, and events across the communities they live at archer.com

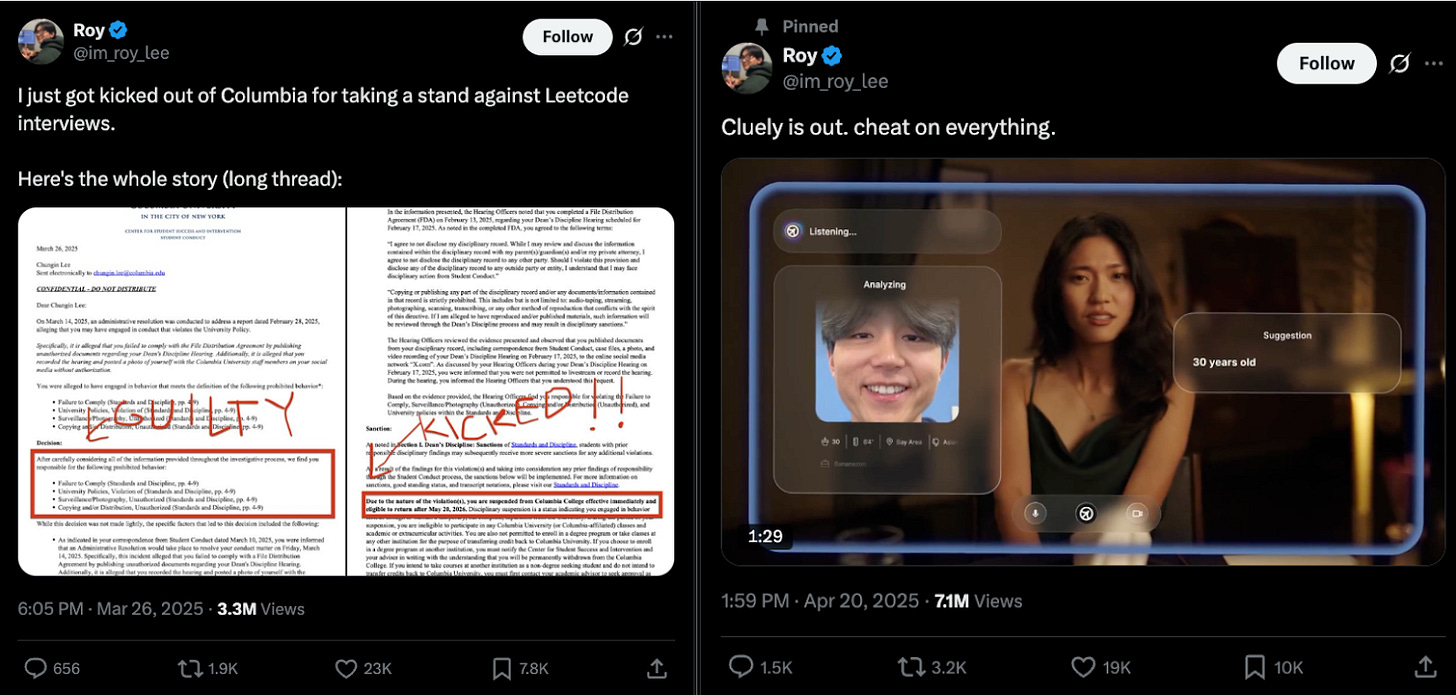

With over 7M+ views.. Cluely’s launch goes viral. Cheat on everything.

Roy Lee, a Columbia student who was suspended over an interview cheating tool raises $5.3M from Abstract Ventures and Susa Ventures to ‘cheat on everything’ [TechCrunch]

Cluley is a completely undetectable AI that sees your screen, hears your audio, and gives you real-time assistance in any situation.

Musings

Macro

Q1'25 venture fundraising numbers are out [Beezer Clarkson, Sapphire]

The state of VC in 2025. Where we are, where we are going, and where to invest .. [Sam Lessin, Slow Ventures]

OpenAI in talks to buy coding assistant company Windsurf for more than $3 billion. [Bloomberg]

AI

New NYC AI map just dropped [Grace Isford, Lux Capital]

More

Agency Is Eating the World [Pirate Wires]

A solo operator can now launch a $1b business powered by ai. our economy's critical dividing line is no longer skill or education — it's will.

Erik Torenberg joins a16z as a General Partner, a16z acquires Turpentine [Erik Torenberg]

Top Interviews

Insider Trading 101 | Autopilot: $500M AUM, $2B in volume, 9M trades, $6B in connected assets

Base Power's $200M Series B | Co-Led by Lee Fixel of Addition, A16Z, Lightspeed, & Valor Equity Partners

LIVE FROM VARDA: Delian Asparouhov, Founders Fund & Varda | Stranded Astronauts, Eric Schmidt, Varda, Hill & Valley Forum, Investing Strategy

Last Week (4/14-4/18):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Auradine, a Santa Clara, Califl.-based blockchain and AI infrastructure sustainable solutions provider, raised $153 million in Series C funding. StepStone Group led the round and was joined by Maverick Silicon, Premji Invest, Samsung Catalyst Fund, and others.

- Marshmallow, a British insurance startup for migrants, raised $90m at a valuation north of $2b. Portage Capital led, joined by BlackRock and Columbia Lake Partners

- Luma Financial Technologies, a Cincinnati-based structured products and insurance solutions provider, raised $63 million in Series C funding. Sixth Street Growth led the round and was joined by existing investors Bank of America, Morgan Stanley, UBS, and TD Bank Group.

- Stitch, a Cape Town, South Africa-based payments infrastructure platform, raised $55 million in Series C funding. QED Investors, Glynn Capital, Flourish Ventures, and Norrsken22 led the round and were joined by Ribbit Capital, PayPal Ventures, Firstminute Capital, and angel investors.

- Crux, a New York City-based capital markets technology company for the clean economy, raised $50 million in Series B funding. Lowercarbon Capital led the round and was joined by Liberty Mutual Strategic Ventures, MassMutual Ventures, OMERS Ventures, existing investors a16z, Ardent Venture Partners, CIV, and others.

- Toku, a Santiago, Chile-based accounts receivable SaaS platform, raised $48 million in Series A funding. Oak HC/FT led the round and was joined by existing investors Gradient Ventures, F-Prime, Clocktower, and others.

- Onfly, a Belo Horizonte, Brazil-based travel expense management platform, raised $40 million in Series B funding. Tidemark led the round and was joined by Endeavor Catalyst and existing investor Left Lane Capital.

- Tapcheck, a Plano, Texas-based on-demand pay platform for employees, raised $25 million in Series A extension funding from existing investor PeakSpan Capital.

- Meadow, a New York City-based student financial services provider, raised $14 million in Series A funding. Matrix Partners led the round and was joined by existing investors Susa Ventures, Giant Ventures, Treble Capital, and GoGlobal Ventures.

- Vinyl Equity, a Chicago-based transfer agent for public companies, raised $11.5 million in seed funding. Index Ventures and Spark Capital led the round and were joined by Infinity Ventures, Cambrian Fintech, and angel investors.

- Optimum, a Boston-based decentralized memory layer for blockchains, raised $11 million in seed funding. 1kx led the round and was joined by Robot Ventures, Finality Capital, Spartan, and others.

- Blue Onion, a New York City-based subledger for retail and ecommerce brands, raised $10 million in Series A funding. Viola FinTech led the round and was joined by existing investors Y Combinator, Entrée Capital, Green Visor, and Vinyl Capital.

- Midnite, a London-based sportsbook and casino, raised $10 million in Series B funding. Discerning Capital, The Raine Group, and Play Ventures led the round and were joined by Venrex and Big Bets.

- 1Fort, a New York City-based AI-powered business insurance platform, raised $7.5 million in funding. Bonfire Ventures led the round and was joined by Draper Associates, Karim Atiyeh, existing investors Village Global, Operator Partners, 8-Bit Capital, and others.

- Glider, a New York City-based crypto investment company, raised $4 million in funding. a16z CSX led the round and was joined by Coinbase Ventures, Uniswap Ventures, First Commit, and others.

Care:

- Chapter, a NYC-based Medicare navigation company, raised $75m in Series D funding led by Stripes with participation from insiders XYZ Venture Capital, Susa Ventures, Addition, Narya Capital, and Maverick Ventures

- Assort Health, an SF-based provider of voice AI agents for health care, raised $22m in Series A funding. First Round Capital and Chemistry co-led, joined by Quiet Capital.

- Skin Analytics, a London-based AI-powered skin cancer detection company, raised £15 million ($19.9 million) in Series B funding. Intrepid Growth Partners led the round and was joined by existing investors Hoxton Ventures, Crista Galli Ventures, and Mustard Seed Ventures.

- Phantom Neuro, an Austin-based neurotechnology company, raised $19 million in Series A funding. Ottobock led the round and was joined by Actual VC, METIS Innovative, e1 Ventures, existing investors Breakout Ventures, Draper Associates, LionBird Ventures, and others.

- Brellium, a New York City-based AI-powered clinical compliance platform, raised $13.7 million in Series A funding. First Round Capital and Left Lane Capital led the round and were joined by Menlo Ventures, Digital Health Venture Partners, Necessary Ventures, and angel investors.

- Cofertility, a Los Angeles-based egg freezing and donation fertility company, raised $7.3 million in Series A funding. Next Ventures and Offline Ventures led the round and were joined by Initialized, Arkitekt, Foreground, and others.

- Doctronic, a New York City-based AI-powered healthcare assistant, raised $5 million in seed funding. Union Square Ventures led the round and was joined by Tusk Ventures and HF0.

- Youlify, a Campbell, Calif.-based revenue cycle management startup, raised $4.3m in seed funding. Bonfire Ventures led, joined by Top Harvest Capital.

- RISA Labs, a Palo Alto-based AI-powered oncology workflow platform, raised $3.5 million in seed funding. Binny Bansal led the round and was joined by Oncology Ventures, General Catalyst, z21 Ventures, and others.

- Trellis Health, a Seattle and San Francisco-based women’s lifetime health platform, raised $1.8 million in pre-seed funding from Palette Ventures, Swizzle Ventures, NEXTBLUE, and others.

Enterprise/Consumer:

- Hammerspace, a San Mateo, Calif.-based AI data platform, raised $100 million in funding from Altimeter Capital, ARK Invest, and others.

- Krea, a San Francisco-based platform developer for creatives, raised $83 million in funding. Bain Capital Ventures led the $47 million Series B round and was joined by existing investors. Andreessen Horowitz led the $33 million Series A round and was joined by existing investors. Pebblebed led the $3 million pre-seed/seed round and was joined by angel investors.

- Exaforce, a San Jose-based SOC AI agents developer, raised $75 million in Series A funding. Khosla Ventures and Mayfield led the round and were joined by Thomvest Ventures, Touring Capital, EDB, and others.

- Goodfire, an AI interpretability research company, raised $50m. Menlo Ventures led, joined by Lightspeed, B Capital, and Anthrolpic.

- LiveKit, a San Jose-based voice AI platform, raised $45 million in Series B funding at a $345 million valuation. Altimeter Capital led the round and was joined by Redpoint Ventures and Hanabi Capital.

- Virtue AI, a San Francisco-based AI security company, raised $30 million in funding. Lightspeed Venture Partners and Walden led the $23 million Series A round and were joined by Perspective7. Factory led the $7 million seed round and was joined by Lip-Bu, Chris Re, Amarjit Gill, and Osage University Partners.

- Doss, a San Francisco-based AI-powered enterprise resource planning solutions provider, raised $18 million in Series A funding from Theory Ventures.

- Capsule, a Los Angeles-based AI-powered video editor for brands, raised $12 million in Series A funding. Innovation Endeavors led the round and was joined by Swift Ventures, Hubspot Ventures, and others.

- Cy4Data Labs, a San Jose-based data protection cybersecurity company, raised $10 million in funding from Pelion Venture Partners.

- Pillar Security, a Miami and Tel Aviv-based AI software security company, raised $9 million in seed funding. Shield Capital led the round and was joined by Golden Ventures, Ground Up Ventures, and angel investors.

- Bauplan, a San Francisco-based serverless data platform, raised $7.5 million in seed funding. Innovation Endeavors led the round and was joined by Wes McKinney, Aditya Agarwal, and Chris Re.

- Nexad, a San Francisco-based AI‑native advertising platform, raised $6 million in seed funding. a16z speedrun and Prosus Ventures led the round and were joined by Point72 Ventures, Carya Ventures, Umami Capital, Sequoia Capital Scout Fund, and others.

- Mindset AI, a London-based embedded AI agent platform, raised £4.3 million ($5.7 million) in funding. Edge VC and Pembroke VCT led the round and were joined by existing investors.

- Arcana Labs, a Los Angeles-based AI-powered production studio, raised $5.5 million in funding from SEMCAP AI.

- Spur, a New York City-based AI-powered quality testing company, raised $4.5 million in funding from First Round, Pear VC, Neo, angel investors, and others.

- ClearCOGS, a Chicago-based AI-powered predictive analytics provider for restaurants, raised $3.8 million in seed funding. Closed Loop Partners' Venture Group led the round and was joined by Myriad Venture Partners and Level Up Ventures.

- Noto, a New York City-based AI-powered operations platform for lesson-based businesses, raised $3.8 million in seed funding from Base10 Partners.

- telli, a Berlin-based AI voice agents developer, raised $3.6 million in pre-seed funding. Cherry Ventures and Y Combinator led the round and were joined by angel investors.

- Octolane, a San Francisco-based AI-powered CRM, raised $2.6 million in seed funding from Y Combinator, Lan Xuezhao, General Catalyst Apex, and angel investors.

- NoScrubs, an Austin-based laundry delivery service, raised $2 million in pre-seed funding. Initialized Capital led the round and was joined by Frontier VC.

- Graze, a Portland, Ore.-based Bluesky custom feed builder, raised $1 million in pre-seed funding. Betaworks and Salesforce Ventures led the round and was joined by Factorial, Apertu Capital, Skyseed, and angel investors.

HardTech:

- Mainspring Energy, a Menlo Park, Calif.-based maker of linear generators, raised $258m in Series F funding. General Catalyst led, joined by Amazo's Climate Pledge Fund and Temasek.

- General Matter, an enriched uranium startup, raised $50m led by Founders Fund. The startup was formed by FF partner Scott Nolan, and Peter Thiel has joined its board

- Revel, a software platform for hardware development, raised $23m in Series A funding led by Thrive Capital. It also disclosed a $7m seed round co-led by Felicis Ventures and Abstract Ventures.

- ConductorAI, a Biddeford, Maine-based provider of government approvals software, raised $15m in Series A funding. Lux Capital led, joined by Altman Capital, Haystack Ventures, Sunflower Capital, Humba Ventures, Also Capital, Forward Deployed VC, and Abstract Ventures.

- Scout AI, a Sunnyvale, Calif.-based AI maker for defense applications, raised $15m in seed funding led by Align Ventures and Booz Allen Ventures,

- Blue Water Autonomy, a Boston-based autonomous ship developer for the U.S. Navy, raised $14 million in seed funding from Eclipse, Riot, and Impatient Ventures.

- NetRise, an Austin-based software supply chain security platform, raised $10 million in funding. DNX Ventures led the round and was joined by existing investors Miramar Digital Ventures, Sorenson Capital, Squadra Ventures, and Talons Ventures.

- Hexium, an Austin-based isotope enrichment technology developer, raised $9.5 million in seed funding. MaC Venture Capital and Refactor led the round and were joined by R7 Partners, Overture VC, Humba Ventures, Julian Capital, and others.

- Xaba, a Toronto-based synthetic brains developer for industrial robots, raised $6 million in seed funding. Hitachi Ventures led the round and was joined by Hazelview Ventures, BDC Capital, Exposition Ventures, and Impact Venture Capital.

- Collide, a Houston-based GenAI platform for the energy industry, raised $5 million in seed funding. Mercury Fund led the round and was joined by Bryan Sheffield, Billy Quinn, David Albin, and others.

- Cosmic Robotics, a San Francisco-based AI-powered robot developer for critical infrastructure, raised $4 million in funding. Giant Ventures led the round and was joined by MaC Venture Capital, HCVC, and angel investors.

- Atomic, a New York City-based AI-powered supply chain planning platform, raised $3 million in seed funding from DVx Ventures and Madrona Ventures.

Sustainability:

- Crux, a provider of financing software for clean energy companies, raised $50m in Series B funding. Lowercarbon Capital led, joined by Liberty Mutual Strategic Ventures, MassMutual Ventures, OMERS Ventures, Acrew Capital, Giant Ventures and insiders a16z, Ardent Venture Partners, CIV, New System Ventures, and The Three Cairns Group.

- IUNU, a Seattle-based AI and machine vision technology developer for agriculture, raised $20 million in funding. S2G Investments led the round and was joined by Farm Credit Canada and Lewis and Clark Partners.

Acquisitions & PE:

- Infinite Reality, valued at $15.5 billion, agreed to acquire Touchcast, a New York City-based agentic AI company for $500m. Touchcast's backers included VU Venture Partners and Accenture Ventures.

- Checkr, a background check provider valued by VCs at $5b, agreed to acquire Truework, an income and employment verification startup, per Axios Pro. Truework had raised around $125m from firms like Sequoia Capital, Activant Capital, Khosla Ventures, G Squared, and TransUnion.

- Strava, an SF-based workout app that's raised $180m, acquired Runna, a British provider of running coaching and training plans that had raised around $10m from firms like Eka Ventures and JamJar Investments.