Sourcery (1/28/2020)

Future of Living Well

Deals of the day

Sources: TS, Pro Rata, FinSMEs, Fitt Insider

Spring Health, a mental health solution for employers, closed a $22M investment.

WholyMe, makers of “natural relief” products to manage chronic pain, announced £500K in seed funding.

NutriDrip,intravenous nutrition and hydration service known for its presence in Clean Market and backed by Equinox executives Jeffrey Weinhaus and Harvey Spevak, is reported to be raising its Series A funding round ahead of expanding in 2020.

SuperAwesome, a London-based developer of “kid-safe” digital marketing tools, raised $17 million led by M12. http://axios.link/EB0w

Wheel, an Austin, Texas-based developer of virtual healthcare infrastructure, raised $13.9 million in Series A funding. CRV led, and was joined by Tusk Venture Partners and Silverton Partners. www.wheel.com

Shipamax, a London-based provider of back-office automation to freight forwarders, raised $7 million. Mosaic Ventures led, and was joined by Crane Venture Partners and YC. http://axios.link/NlWC

Teller, a UK-based open banking startup, raised $4 million in seed funding from Lightspeed Venture Partners, Founders Fund, and SciFi. http://axios.link/bqqH

Encantos, a Culver City, Calif.-based children's entertainment brand, raised $2 million in seed funding. Kapor Capital led, and was joined by Boston Meridian Partners, Chingona Ventures, Human Ventures, and MathCapital. http://axios.link/qZj6

ActiveCampaign, a Chicago-based provider of email marketing solutions, raised $100 million in Series B funding. Susquehanna Growth Equity led the round, and was joined by investors including Silversmith Capital Partners.

Aquant, a New York-based service intelligence platform, raised $30 million in Series B funding. Insight Partners led the round, and was joined by investors including Lightspeed Venture Partners, Angular Ventures, and Silvertech Ventures.

Roambee, a Santa Clara, Calif.-based on-demand shipment and asset monitoring platform company, raised $15.2m in additional Series B financing (read here)

Justworks, a NYC-based HR technology company, closed a $50m Series E funding (read here)

PestRoutes, a McKinney, Texas-based provider of software for pest control companies, received a majority investment from Gryphon Investors (read here)

Stasher, a London, UK-based luggage storage startup, raised $2.5m in funding (read here)

loop+, an Australian health technology startup, raised $3m in seed funding (read here)

M&A:

Chopt Creative Salad Co. is buyingDos Toros Taqueria in a deal financed by L Catterton.

Keurig Dr Pepperacquired caffeinated sparkling water maker LIMITLESS.

Colgate acquired Hello, a premium oral care brand.

. . .

Headlines

Sources: MorningBrew, Axios

U.S. markets: With the coronavirus dominating headlines, U.S. stocks had their worst day in over three months. But if you think the whole thing is overblown as an economic risk...you’d have history on your side. In 2003, the S&P gained more than 10% from the start of the SARS outbreak to when it was contained.

Oil: The price of Brent crude is down roughly 10% since China confirmed the death of a second person from the virus. Investors are worried that the virus will slow the global economy and reduce demand for fuel.

Casper Sleep is no longer a unicorn. According to new IPO docs, the mattress startup would be valued at $768 million if it went public at the top of its price range. It was worth $1.1 billion last March.

Jargon alert: A "unicorn" is a privately held company valued at $1 billion or more. The term was coined by venture capitalist Aileen Lee in 2013.

A company—such as Casper—that loses its $1 billion valuation is called an "undercorn."

Zoom out: Casper was the most typical 2019 unicorn you've ever met. In the nine months ending Sept. 30 revenue grew really fast (up 20% to $312 million), but losses also widened (to $67 million).

As it prepares to IPO, Casper will have to convince investors it has a path to profitability. Because if not, we have two words smushed awkwardly together for you: WeWork.

Looking ahead...the IPO market is starting to heat up with big offerings. Pantry staple Reynolds Consumer Products is hoping to raise $1.3 billion this week.

Growing worry over the widespread outbreak of the Wuhan coronavirus is compounding an already jittery market and flipping the switch from risk-on to risk-off, as investors sell stocks and buy bonds.

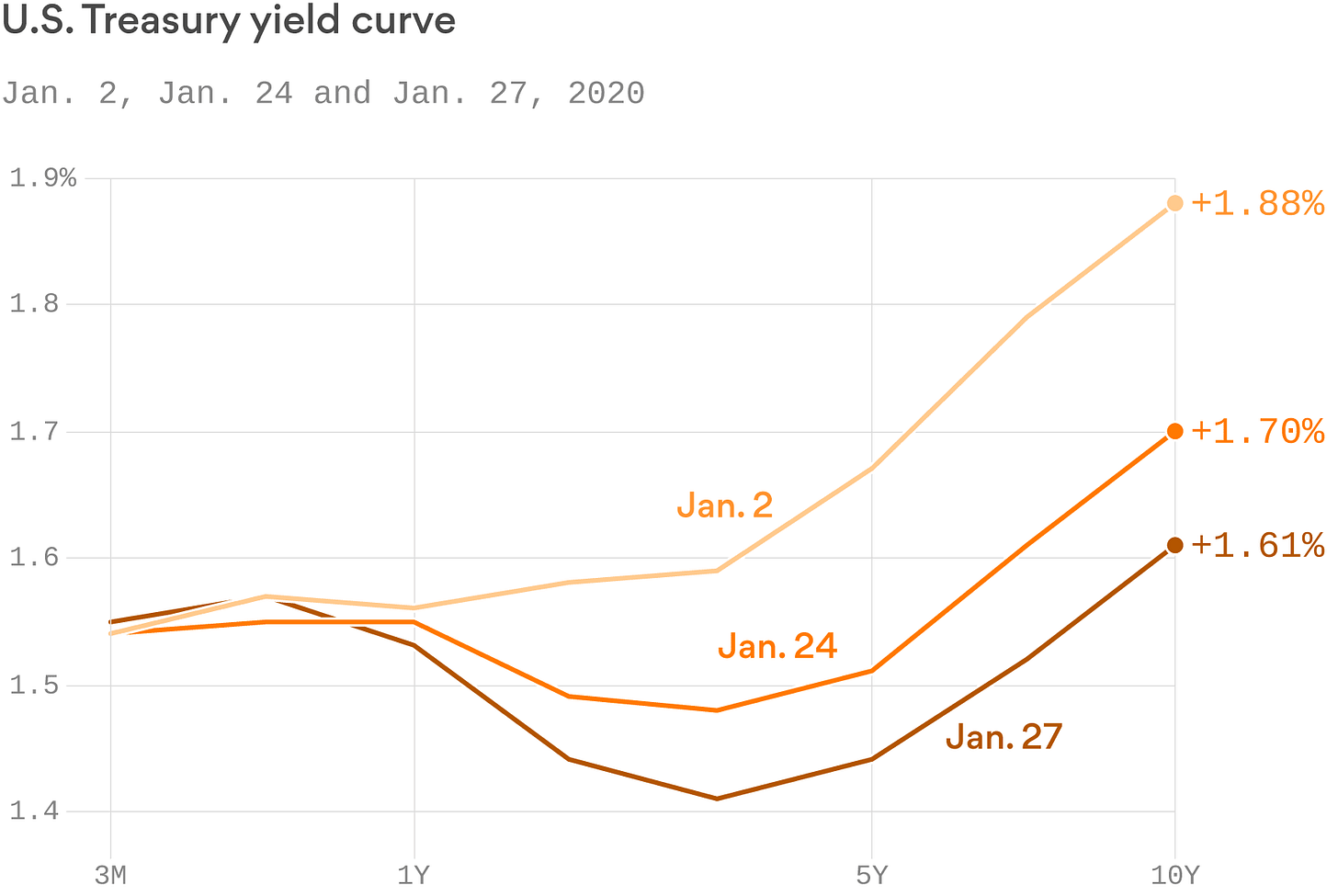

The S&P 500 posted its biggest single day percentage loss since October and long-dated U.S. Treasury yields fell, putting yields on Treasury bills that mature in three months just 6 basis points below Treasury notes maturing in 10 years.

Why it matters: The yield curve already has inverted out to seven years and is within spitting distance of the 3-month/10-year inversion that economists at the Fed call the "best summary measure" of economic downturn for the second time in less than a year.

The spread between the yields on the 3-month bill and 10-year note is the smallest since October when the curve first returned to positive territory after about four months of inversion.

What's happening: The death toll from the coronavirus reached 107 in China and the number of confirmed diagnoses rose to over 4,000, with confirmed infections in almost 20 countries or regions.

The virus is spreading and concern is growingright as stock euphoria looks to have peaked and a swath of risks have again reared their heads.

Details: President Trump's impeachment trial took an unexpected turn when the New York Times reported former national security adviser John Bolton's claim that Trump told him aid to Ukraine was dependent on the country investigating Joe and Hunter Biden.

Middle East tensions have again risen as rockets reportedly hit the U.S. embassy in Baghdad Sunday.

A growing number of market analysts and major investment banks have issued warnings about the increasingly bloated prices of U.S. equities.

What we're hearing: "We're ... getting pretty nervous that we'll see another inversion," Ian Lyngen, head U.S. rates strategist at BMO Capital Markets, tells Axios. "'Recessionary fear' headlines will surely make the rounds again."

"If you were on the negative side, the interpretive view of the inversion would be that a recession is closer than not," Ellis Phifer, market strategist at Raymond James, adds.

"The last few days are all about safe haven buying of Treasuries just in case the Wuhan virus becomes a worst case scenario," Lou Brien, rates strategist at DRW Trading, says in an email. "It is not likely this situation is resolved quickly, so the inversion likely has further to go."

Apple has asked suppliers to make up to 80 million iPhones in the first half of the year, 10% more than the previous year's output, but suppliers are concerned the coronavirus outbreak could dampen output. (Nikkei)

Automakers have banned travel to China, are withdrawing employees from the country and weighing whether to suspend manufacturing there entirely. (CNBC)

SuperAwesome, a platform used to power kid-safe technology, has raised $17 million in a strategic financing round led by M12, Microsoft’s venture fund.

Why it matters: It represents a growing investment in kid-safe content and kids privacy compliant technology.

Microsoft is one of the first major U.S. tech firms to take a stake in a kids tech company.

Be smart: The raise is more of a strategic strengthening of ties between SuperAwesome and Microsoft than it is a financial lifeline.

According to SuperAwesome CEO Dylan Collins, SuperAwesome was profitable in 2019. "Our revenues are growing pretty quickly," he told Axios. "We're currently at a $75 million run-rate."

To date, SuperAwesome has raised a total of $37 million. The company now powers over 12 billion kids digital transactions every month.

Investments in kid-safe content and tech are growing. On Monday, Encantos, a children's entertainment brand, closed a $2 million seed round led by Kapor Capital with participation from Boston Meridian Partners, Chingona Ventures, Human Ventures, and MathCapital.

The big picture: Countries around the world are doubling down on digital privacy and safety for children, which is a huge part of what's making investments in kid-friendly and kid privacy-safe content and tech attractive to big companies.

The streaming wars have also spurred a kids content arms race, which has driven up investment in kids content.

. . .

More headlines…

Sources: MorningBrew, Pitchbook, Fitt Insider

Has VC Become So Big It Must Be Disrupted? Tomasz Tunguz

The science of how humans dispose of bodies is progressing much faster than the laws that govern such things. That means the future of death tech is still very much being written. [Wired]

GM said it will invest $2.2 billion in a Detroit plant to make electric cars and SUVs.

The NBA postponed tonight's game between the Lakers and the Clippers following Kobe Bryant's death.

Bird, a big name in e-scooters, confirmed it's acquiring European competitor Circ.

The coronavirus has been helping one sector: companies that make cleaning products.

Atari-branded hotels are coming to a U.S. city near you.

India wants to sell its 100% stake in Air India, the national carrier.

Keto ramen is coming.

Layoffs hit DNA testing company 23andMe.

Sexual wellness startup Maude launched the “nightcap kit”.

MINDBODY and F45 Training signed a new global agreement.

Small Door, the One Medical for pets, opened its NYC location.

Calm is hiring its first-ever creative director, aspires to be “Nike of the Mind”.

Trail Mix Ventures General Partner Soraya Darabi on Fitt Insider Podcast.