$FIG 250% IPO Pop + Bill Gurley

Missed Figma? We Found the Next One..

Brought to you by Brex

The modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Figma’s IPO + Bill Gurley

Missed the IPO? We Found the Next One.. (watchlist below)

Figma ($FIG), the incredibly fun & gorgeous design software company, went public yesterday, July 31, 2025, debuting on the New York Stock Exchange under the ticker ($FIG). The IPO marks a significant moment for tech’s long-awaited IPO market, following a period of volatility & a slow stretch for venture-backed listings.

“The IPO was one of the most successful of the year [250% pop], beating out the performance of the previous 2025 IPO darling, Circle Internet Group (CRCL), which popped by 168% in its first day of trading in June. Circle is up more than 490% since its IPO. AI play CoreWeave (CRWV) has also seen its shares rise more than 190% since its debut in March.” Yahoo! Finance

To celebrate, we breakdown $FIG’s big W, alongside Bill Gurley’s highly anticipated sentiment on broken IPO markets.

Quick recap of the key details

IPO:

Figma raised $1.2 billion by pricing its shares at $33, above the revised range of $30–$32 and the initial range of $25–$28.

>30x oversubscribed demand from roadshow (#1 indicator in mispricing)

The stock opened at $85 and soared to an intraday high of $124.63

Closing at $115.50, a 250% pop from the IPO price.

Shares were halted more than once Thursday afternoon due to volatility as traders rushed in.

“The first-day trading gives Figma a market value of $56.3 billion, based on the outstanding shares listed in its filings. Accounting for employee stock options and restricted stock units, and restricted stock units for Chief Executive Officer Dylan Field, which are subject to vesting conditions,

the fully diluted value is roughly more than $65 billion.” Bloomberg

Biggest VC winners? (based on ownership %)

Index Ventures 16.8%

Greylock Partners 15.7%

Kleiner Perkins 14.0%

Sequoia Capital 8.7%

Figma Stats & Financials:

13 million monthly active users

95% of Fortune 500 use Figma

78% of Forbes 2000 use Figma

Revenue hit $749M for the year ending December 31, 2024 (48% YoY growth)

Revenue hit $228M in Q1 (up 46%)

Net income tripled to $44.9M.

Net dollar retention rate of 132% as of March 31, 2025

17% operating margin

18% non-GAAP operating margin

Bonus: In addition to their May 2024 RSU Release & 2024 Stock Options Grant, they also received a $1 billion termination fee in 2023 in connection with the Abandoned Merger with Adobe

FYI: Since 2019, 70% fewer new startups chose Adobe for design. It’s a generational reset in design workflows. (Link to Chart)

Full stats in their S-1: Figma

Market Sentiment:

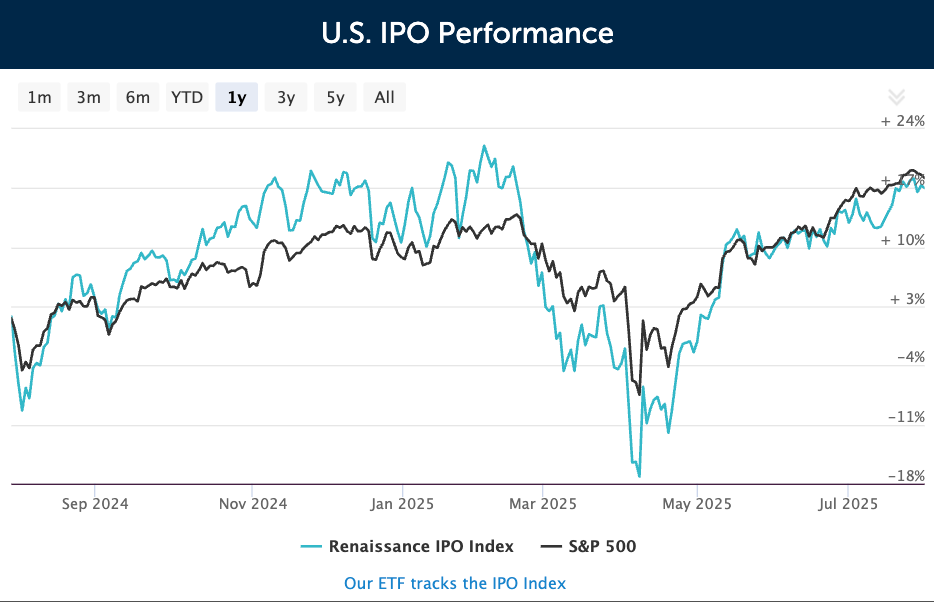

The debut was part of a broader tech IPO recovery, with 123 IPOs priced in 2025 through July 31, a 48% increase from the prior year, though proceeds were down 15% to $19.7 billion. Figma’s strong performance, alongside other successful IPOs like CoreWeave and Circle, signaled significant investor demand for high-growth tech stocks, particularly those with AI exposure.

Okay, now turning to Bill Gurley..

Bill Gurley, Former General Partner of Benchmark, Co-Host of the popular BG2, & long time critic of IPO mispricings.. dutifully chimed in on this one. Someone pls get BG2 to live-stream the next tech IPO. 🙏

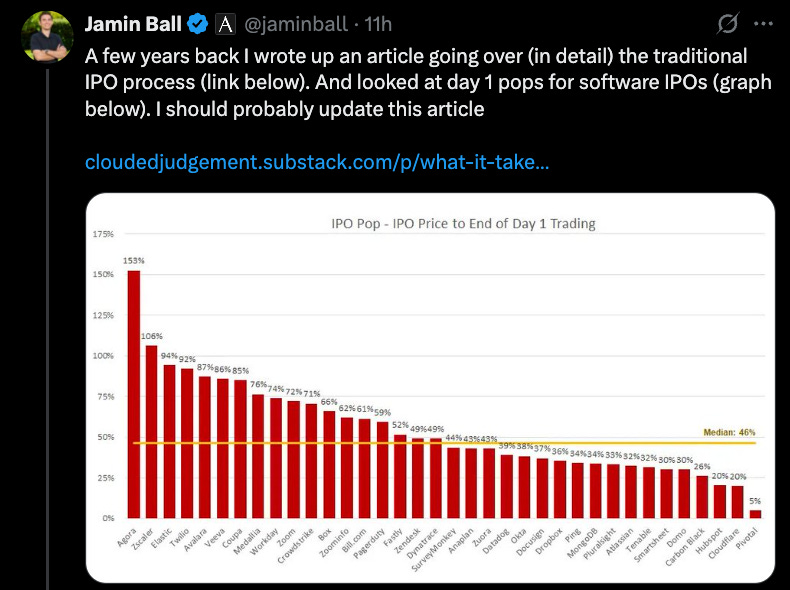

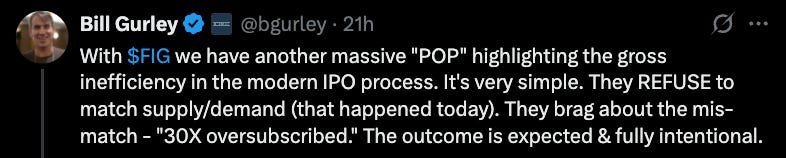

The significant first-day pop, with shares tripling from $33 to over $100, indicated that underwriters underpriced the stock, leaving billions on the table that could have benefited Figma, its founders, employees, and early investors.

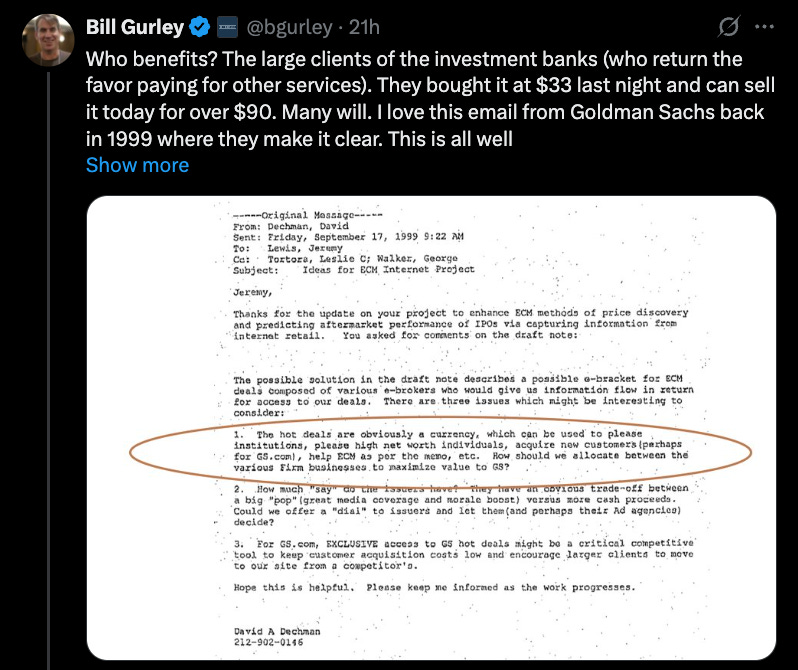

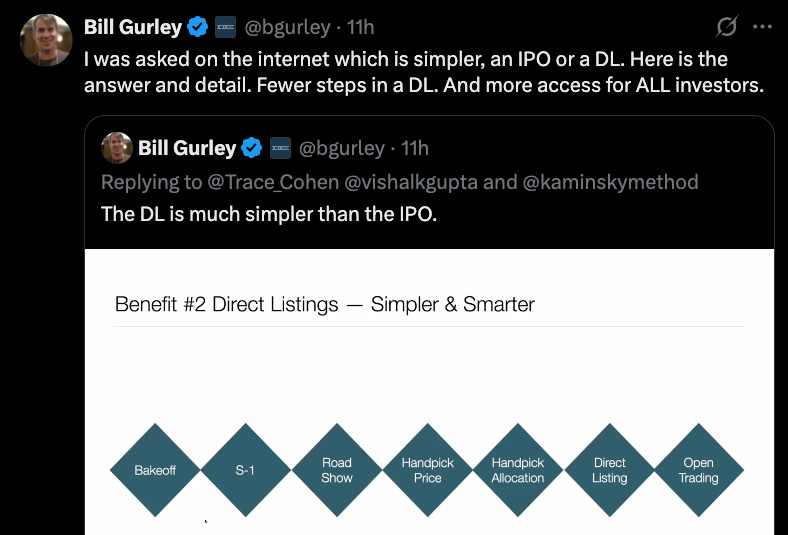

In posts on X, Gurley called the outcome “expected & fully intentional,” suggesting that investment banks deliberately set low IPO prices to favor their large clients, who bought shares at $33 & could sell them at >$90 on the first day. He described this as part of a “deeply broken” IPO process, a critique he has made for years, advocating for alternatives like direct listings to avoid such wealth transfers to institutional investors.

“Let's talk numbers. 42.5mm shares were sold for $33. That's roughly $2.6B "left on the table." Selling shareholders lost out on $1.7B. Over half of the selling shares were from the aptly name "MCF Gift Fund." This charity missed out on $808mm.”

Gurley’s sentiment reflects continued frustration with the traditional IPO system, viewing Figma’s massive pop as a case study in how companies lose out on potential capital while banks’ clients reap outsized gains. His perspective does contrast a bit with the broader market’s enthusiasm for Figma’s debut, which was celebrated as a much-needed win for Silicon Valley’s venture ecosystem. Still a W for tech in our book.

The alternative? A direct listing.

Which companies have gone direct?

Oh, I’m glad you asked.. look no further than P/E darling, $PLTR.

And a bunch of others including: Spotify (2018), Slack (2019), Asana (2020), Roblox (2021), and Coinbase (2021).

“A select group of high-profile names eventually followed the Spotify formula. Palantir, Coinbase, gaming platform Roblox Inc. and eyeglass retailer Warby Parker Inc., were among the companies that used direct listings in 2020 and 2021 alongside record volumes in the period for both traditional IPOs and alternatives such as SPACs.” Bloomberg

Missed Figma’s IPO?

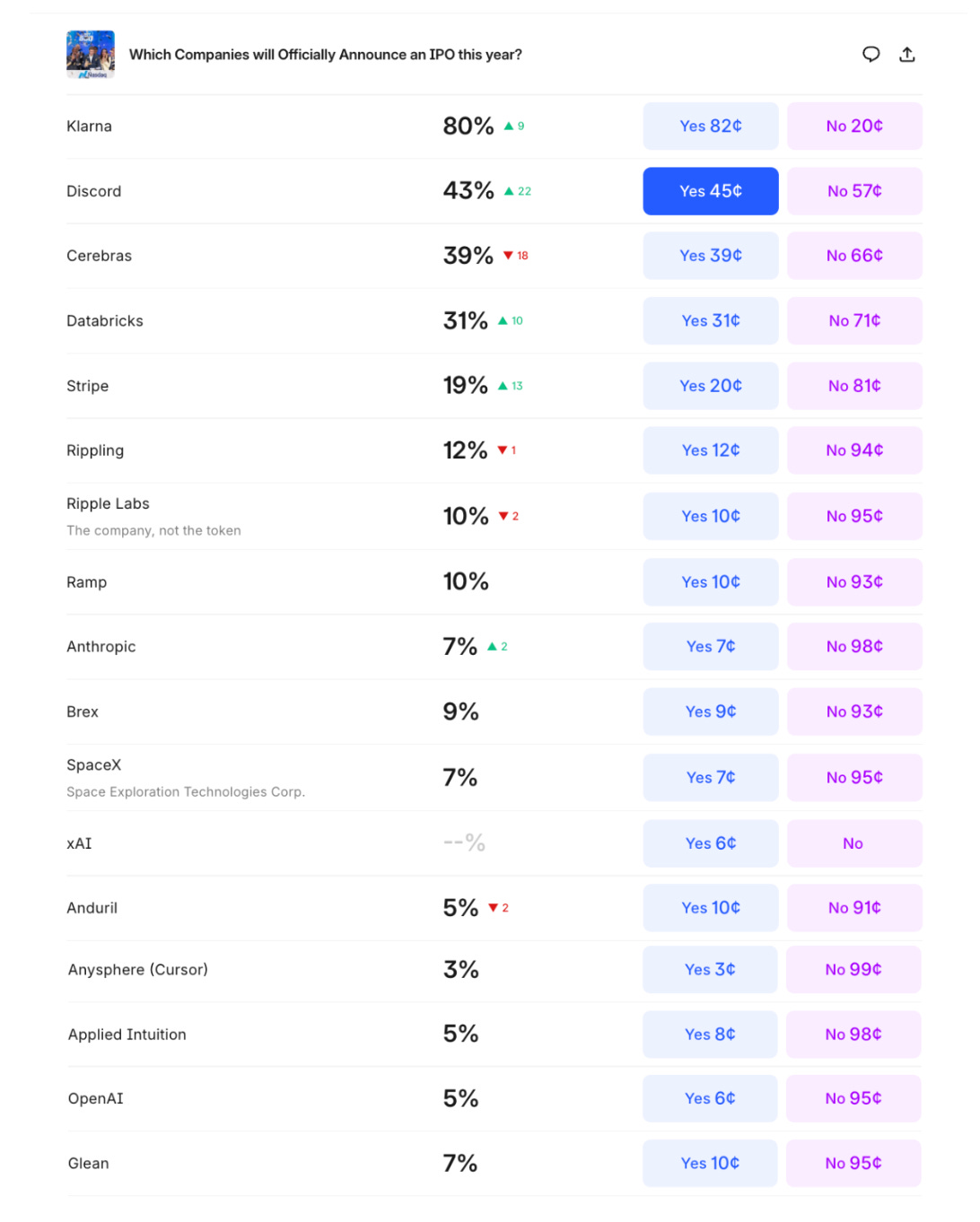

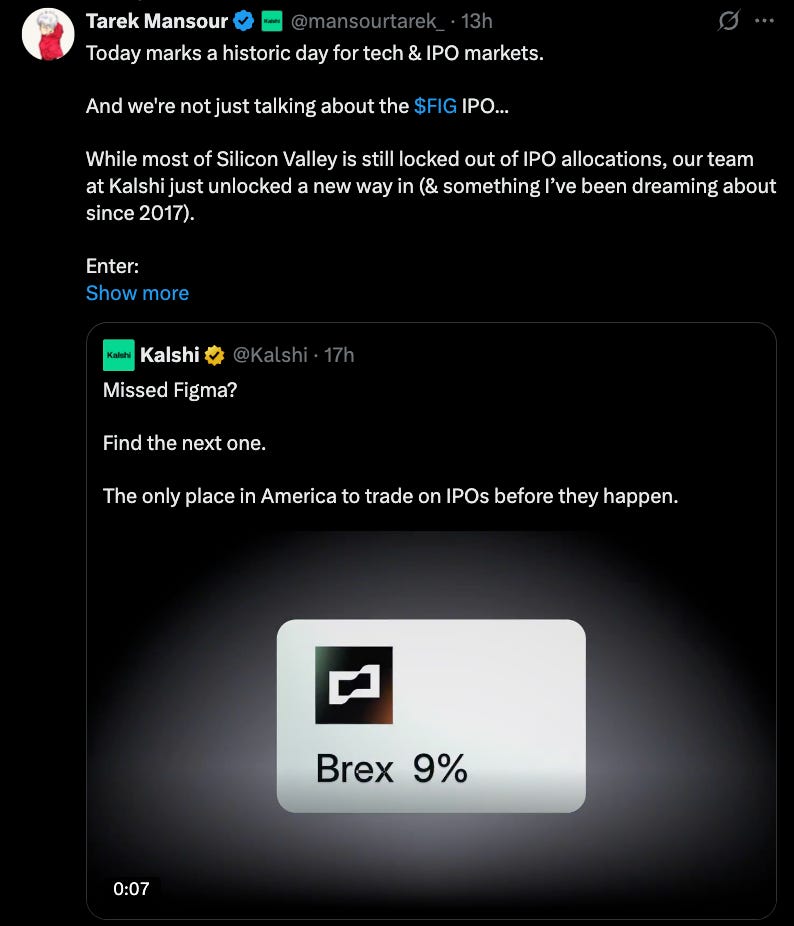

We found the official watchlist of the hottest soon-to-be S-1 filings for tech on Kalshi’s new IPO Prediction Market.

Extremely underrated.

Bullish on any impending IPO filings? DM us.

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

What a debut!