How 8VC Builds Billion-Dollar Companies | Palantir, Addepar, Saronic

Drew Oetting, Founding Partner

With $6B+ AUM, 8VC Has Redefined VC

They don’t just fund companies—they build them.

Palantir ($370B)

Addepar (managing $7T+)

OpenGov ($1.8B acquisition)

Drew Oetting, Founding Partner of 8VC joins Sourcery to unpack how 8VC’s founder DNA, shaped by Joe Lonsdale’s relentless drive to found companies, evolved into their Build Program where nearly 30% of the firm’s capital is invested in startups they create internally.

Plus, we finally get an honest take on aliens.

→ Listen on X, Spotify, YouTube, Apple

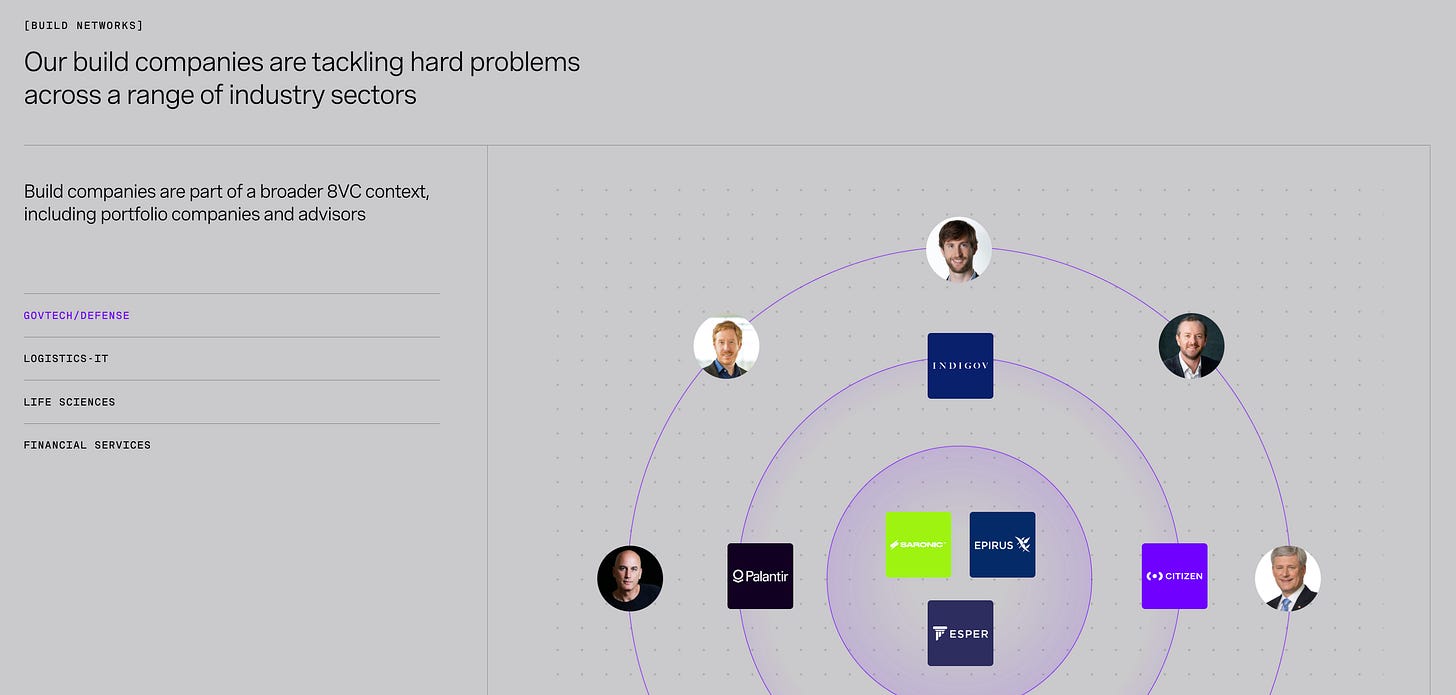

To date, 8VC has built 28 companies, including:

Affinity: Relationship-intelligence CRM for venture and growth investors, born from Drew’s pain managing 8VC’s network.

Anduin: Software addressing complex financial/back-office workflows.

Standard Metrics: Platform for startup metrics and investor reporting.

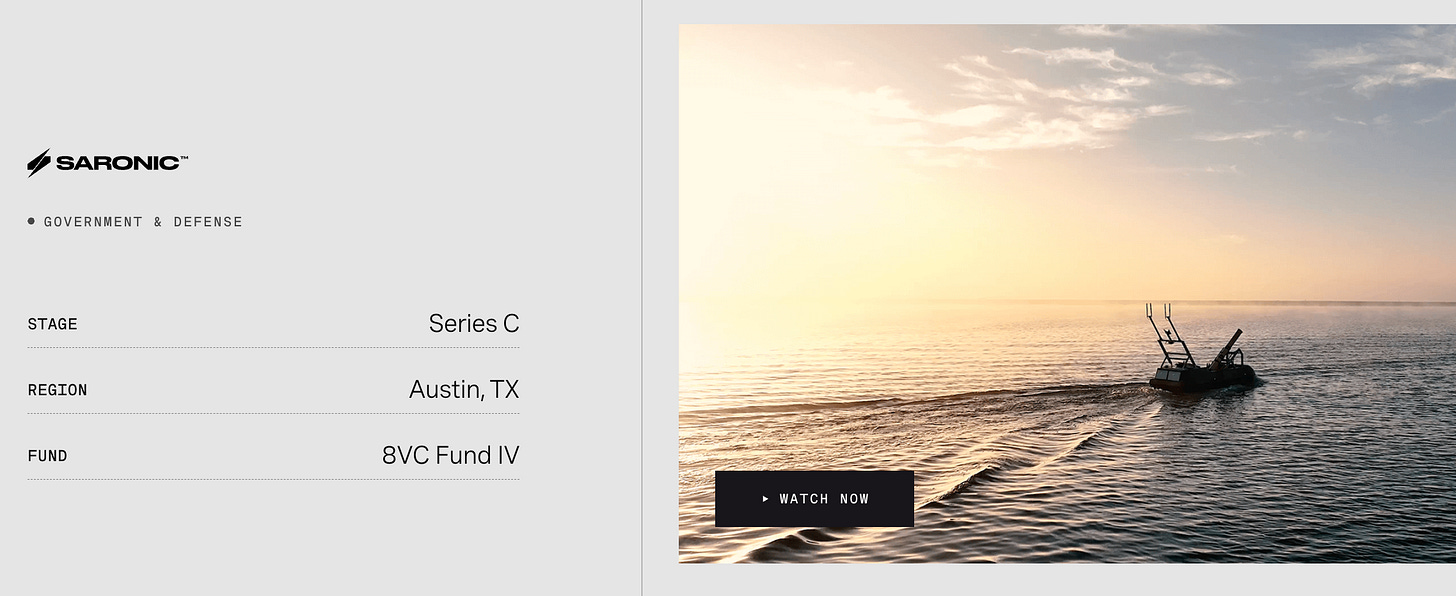

Saronic: Building autonomous naval vessels, reviving U.S. shipbuilding capacity.

Resilience: U.S.-based CDMO reshoring critical pharmaceutical manufacturing with a flagship plant in Ohio.

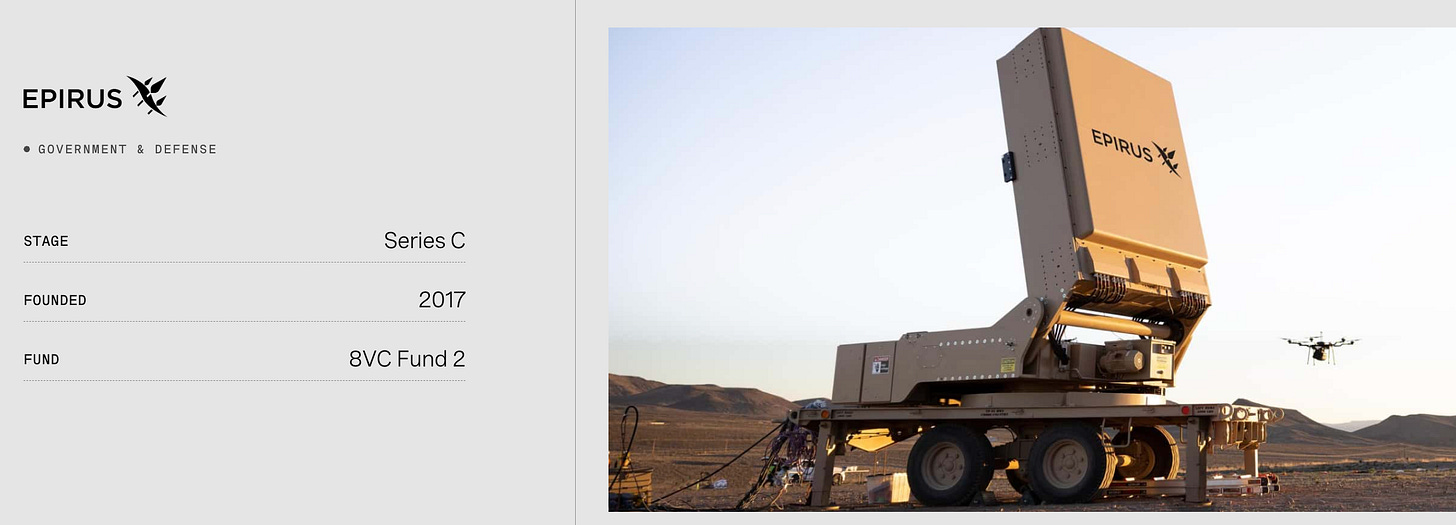

Epirus: Defense technology company developing high-power microwave systems to disable drones and protect against emerging aerial threats.

Top 8 takeaways below + we dive into:

How 8VC identifies opportunities worth building in-house

Why structuring incentives & culture is key to balancing venture + company creation

Case studies from OpenGov, Saronic, and Resilience

8VC’s perspective on biotech, AI, defense, & reindustrialization

The role of public & private collaboration, startups, & capital in rebuilding America

This conversation is part of Sourcery’s “Made in America” Mini-Series recorded at the Reindustrialize 2025 Summit.

Brought to you by:

Brex—The modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Fourthwall—The #1 way to sell merch online — Fourthwall is the easiest way to launch a fully branded merch store—used by big brands like MKBHD, Acquired, & even the Smithsonian. 100+ products. No upfront cost.

Highlights

(00:00) Intro: Drew Oetting, Founding Partner 8VC

(03:33) Origins Of 8VC & Lessons From Joe Lonsdale’s Founder DNA

(05:48) Early Experiments In Building Companies Inside 8VC

(07:03) Formalizing The Build Program (30% Of Capital)

(08:33) How 8VC Works With EIRs To Co-Found Startups

(10:33) Why Most VC Firms Fail At In-House Company Building

(13:03) Portfolio Highlights: OpenGov, Saronic, Epirus, Affinity

(17:03) Case Study: Resilience & Biotech Manufacturing

(27:03) American Reindustrialization, Policy, & Capital Allocation

(39:03) The Future Of AGI & Its Real-World Impacts

(45:33) Rapid-Fire Round: Recession Odds, National Debt, Aliens

(54:03) Closing Thoughts On Building America’s Future

Top 8 Takeaways

1. 8VC’s Build Program Turns Problems Into Startups

“When we formalized the BUILD program, it built the infrastructure really to be able to invest a lot of resources in Build. It’s now 30% of what we do. All of our capital deploys and 30% of it goes into companies we co-founded.”

“We ended up starting Affinity… we started two more companies off problems we had: Anduin and Standard Metrics.”

Nearly a third of 8VC’s $6B AUM is dedicated to companies they build themselves, often born from real problems the team faces.

2. Culture & Incentives Decide Success Or Failure

“If you don’t intentionally design the incentives, the culture, and even the staffing… then it’s very hard to do both [investing and building] well.”

Most funds fail at “venture building” because they can’t align their structures to support both investing and company creation.

3. Palantir DNA Sparked A New Wave Of Builders

“The Palantir DNA, I think, has laid the groundwork for much of what’s going on here at Reindustrialize.”

Alumni of Palantir (and SpaceX) are fueling the next generation of defense and infrastructure companies — many incubated by 8VC.

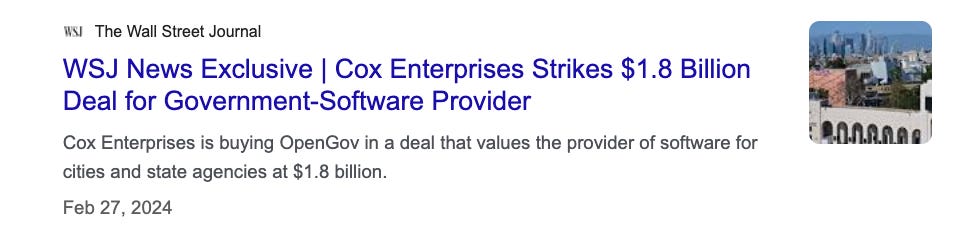

4. OpenGov Proved The Critics Wrong

“Having like a nearly $2 billion exit for state and local government software is probably equivalent to a Palantir type outcome.”

While most VCs dismissed govtech, OpenGov’s billion-dollar exit validated 8VC’s contrarian bets in overlooked markets.

5. Saronic’s Autonomous Ships

“Saronic is building basically the autonomous future of the Navy… and figuring out how to build ships in the United States again.”

Saronic is reviving America’s shipbuilding base while delivering autonomous naval vessels that could redefine U.S. defense. It’s both a moonshot in autonomy and a bet on restoring industrial capacity.

6. Resilience Shows The Biotech Opportunity

“We co-founded a company called Resilience, a U.S.-based CDMO… we have over a thousand folks in our flagship plant in Ohio.”

Resilience is scaling U.S.-based pharmaceutical manufacturing, bridging biotech innovation with national security. Proving it’s possible to onshore pharmaceutical manufacturing & not rely on foreign countries.

7. Patriotism Is Part Of 8VC’s DNA

“Patriotism is no longer like some four-letter word… it’s always one of our core values on our website.

I’d rather have people be irrationally patriotic than rationally unpatriotic.”

8VC grounds its investing and building strategy in patriotism, tying company creation directly to America’s future.

8. Hard Tech Needs New Financing Models

“There really needs to be basically infrastructure financing or project financing for growth-stage businesses that’s a little bit more willing to take risk.”

Traditional venture and credit markets don’t work for shipyards, factories, or robotics — new capital structures are required.

Working with Joe Lonsdale

Drew Oetting first met Joe Lonsdale right out of college, when Joe was simultaneously serving as CEO of Addepar (the second company he co-founded after Palantir) and launching a venture fund. Drew recalls asking how he could possibly do both, and Joe’s answer captured his ethos:

‘VCs are pretty lazy. So I’m pretty sure I can just work a few more hours every day and seven days a week and then it won’t be a problem.’

That relentless energy and willingness to simply outwork everyone left a deep impression on Drew. Over the course of his career, Drew has worked alongside Joe across multiple ventures, describing him as “the highest energy, highest pain tolerance person that I know.” Joe’s ability to combine big ideas, whether co-founding companies, starting a university, or scaling a media platform, with hands-on execution has been a defining influence on 8VC’s culture and its Build Program.

For Drew, a key learning from Joe has been that venture isn’t just about investing, it’s about having the drive and resilience to build institutions and companies that others might see as too hard or too unconventional to attempt.

Check out our other 8VC episodes

Exclusive | Alex Kolicich, 8VC: Exodus of Venture Capital, AI Predictions

Alex Kolicich, 8VC | AI & Defense Tech Renaissance: Palantir, Anduril, SpaceX, OpenAI

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Insightful 🔥💎

Great episode!!