How OffDeal’s Viral ‘$12M Series A’ Broke Wall Street’s Brains

2.5M+ Views, First AI-Native Investment Bank

Brought to you by Brex

Brex, the modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, & travel. Over 30,000+ companies, including ServiceTitan, Anthropic, Scale AI, Vise, DoorDash, & Wiz.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

How OffDeal’s Viral ‘$12M Series A’ Broke Wall Street’s Brains

First AI-Native Investment Bank

OffDeal has raised a massively viral $12M Series A round led by Radical Ventures, with participation from Y Combinator, Rebel Fund, and Centre Street Partners, bringing its total funding to $17M. The financing, which values the company at roughly $100M, cements OffDeal’s position as the first AI-native investment bank, designed from the ground up to rethink how deals get done.

On just X alone, OffDeal has received 2.5M+ impressions from their announcement (more on their go-direct strategy below... Turns out you don’t need super scandalous content to go viral, you could also just have a really great product & mission)

Note: Ori and I talked about a launch interview but my travel schedule was too heavy to fit in - Series B is already scheduled. Lesson learned. I definitely feel the fomo from this one!!!

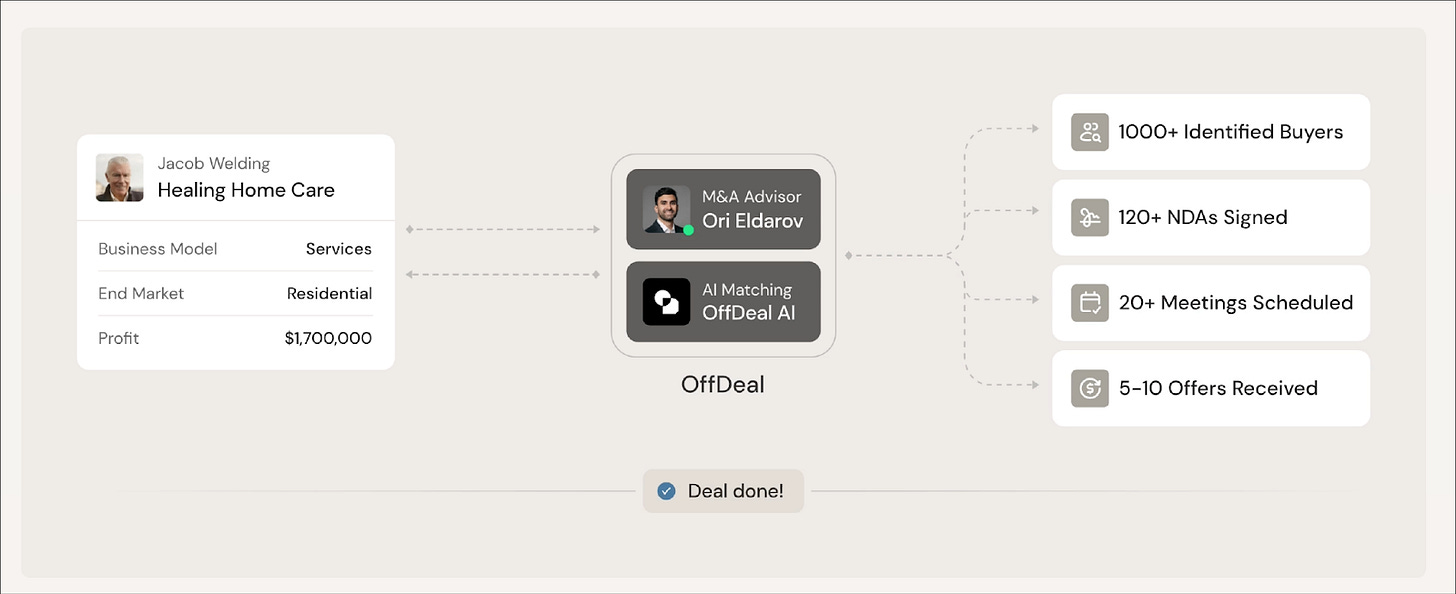

Co-Founded by CEO Ori Eldarov (ex-Wall Street banker) & CTO Alston Lin (fmr Meta engineer), OffDeal’s nextgen tech approach is breaking Wall Street’s brains: using their own custom AI software to automate analyst-level workflows. From pitch deck creation to buyer list building and outreach, OffDeal allows its lean in-house team to focus exclusively on high-value activities like negotiation, competitive bidding, and closing. As Eldarov, OffDeal’s Co-Founder & CEO, puts it:

“We’re building what Goldman Sachs would look like if it were started today.”

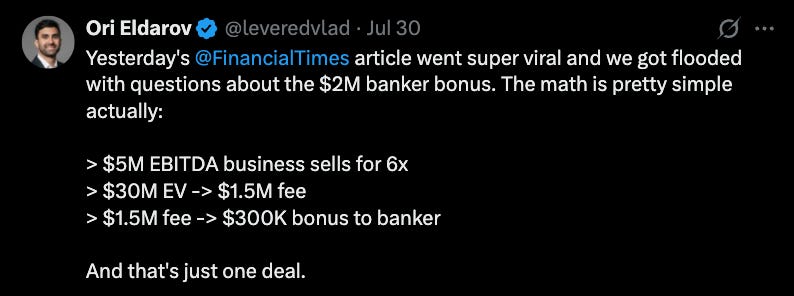

The Shock Factor: Banking $2M AI Bonuses

OffDeal bankers are incentivized with a 20% of the firm’s 5% success fee for every transaction they close. With AI handling the grind, bankers can run 7–10 deals simultaneously, leading to earnings that rival traditional Wall Street MDs, without the political hierarchy.

The Problem OffDeal Solves

Wall Street’s playbook is built for billion-dollar transactions, but it “breaks” below that level. Smaller deals, often in the $10M–$100M range, are typically overlooked by legacy investment banks because the traditional deal team structure: analyst, associate, VP, director, MD, doesn’t scale economically.

As the founders wrote in their funding note:

“Millions of small business owners have nowhere to turn for the most important sale of their lives… Until now.”

Traction: Deals and Targets

In under a year since its Seed round, OffDeal has launched over 30 deals - only with a handful of bankers - spanning industries from HVAC services to Montessori schools to waste management. One client, Steve Barnes, sold his Arizona-based Montessori school for 40% more than his own efforts had initially attracted, thanks to OffDeal’s buyer-matching engine.

The firm is now targeting $100M in revenue by 2027, aiming to run 100+ deals annually with an AI-assisted process that averages just four months from start to close.

An ‘AI Edge’ Reinventing The Banking Org Chart

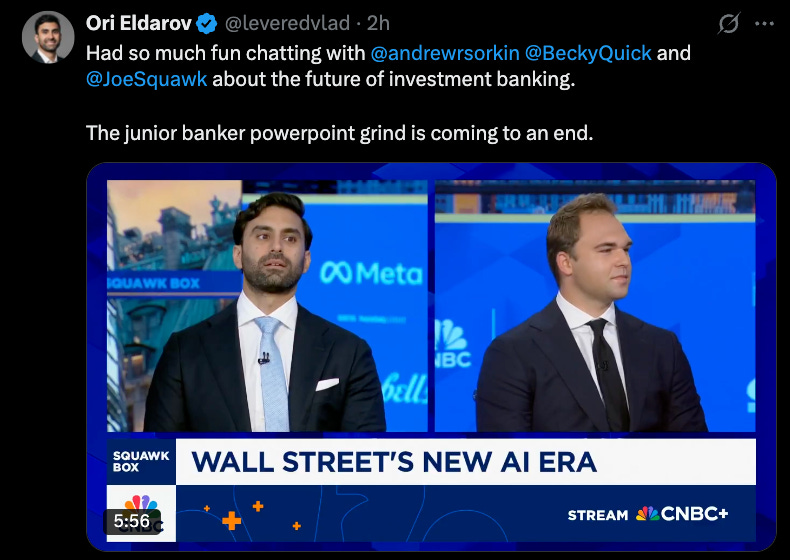

OffDeal’s approach is pure automation-meets-human judgment. Custom-built AI software handles the repetitive back-office work that used to require teams of junior analysts. It’s often joked or memed about how excruciating investment banking work is. Junior bankers routinely spend 80+ hour workweeks on menial tasks like data pulls, formatting power points, moving logos around a slide, and endless revisions – none of which help you become a more effective deal maker.

By automating the 80% of tasks that don’t require deep relationship work, OffDeal lets its lean in-house bankers focus purely on negotiation, valuation strategy, & closing.

As a result, this allows OffDeal to reinvent this outdated & agonizing banking org chart (they work under two person ‘deal pods’ consisting of one junior ‘BD’ banker + one senior ‘execution’ lead). In most banks, one of the scarcest resources is senior bankers’ time, leaving junior talent with limited opportunities to ask questions or receive meaningful training, often held back by fear of appearing uninformed.

→ If you follow the Keith Rabois formula for startup success: “find large highly fragmented industry w low NPS; vertically integrate a solution to simplify value product.” Well, then, this might fit right in.

This not only frees up time for deeper human mentorship, but also acts as an on-demand educational tool, allowing junior bankers to explore concepts, ask unlimited questions, and build real deal fluency without judgment. It’s a powerful enabler for learning and growth, bringing life back into what was long positioned as a soul-sucking desk job.

Macro Moment: SMB Exits on the Rise

The lower middle market (LMM) is heating up. More small business owners are seeking exits due to generational transitions, industry consolidation, and heightened private equity demand. Yet the economics of these deals historically pushed business owners into subpar advisory services—or left them to fend for themselves.

“The unit economics don’t stretch to the long tail of the market,” explained Ryan Shannon of Radical Ventures, which has now backed OffDeal twice.

OffDeal’s AI-driven model flips this logic on its head by compressing transaction costs and timeframes, making even a $5M deal profitable and scalable.

The Technology Engine

OffDeal’s proprietary tech stack is designed from the ground up to augment every part of the M&A workflow with AI:

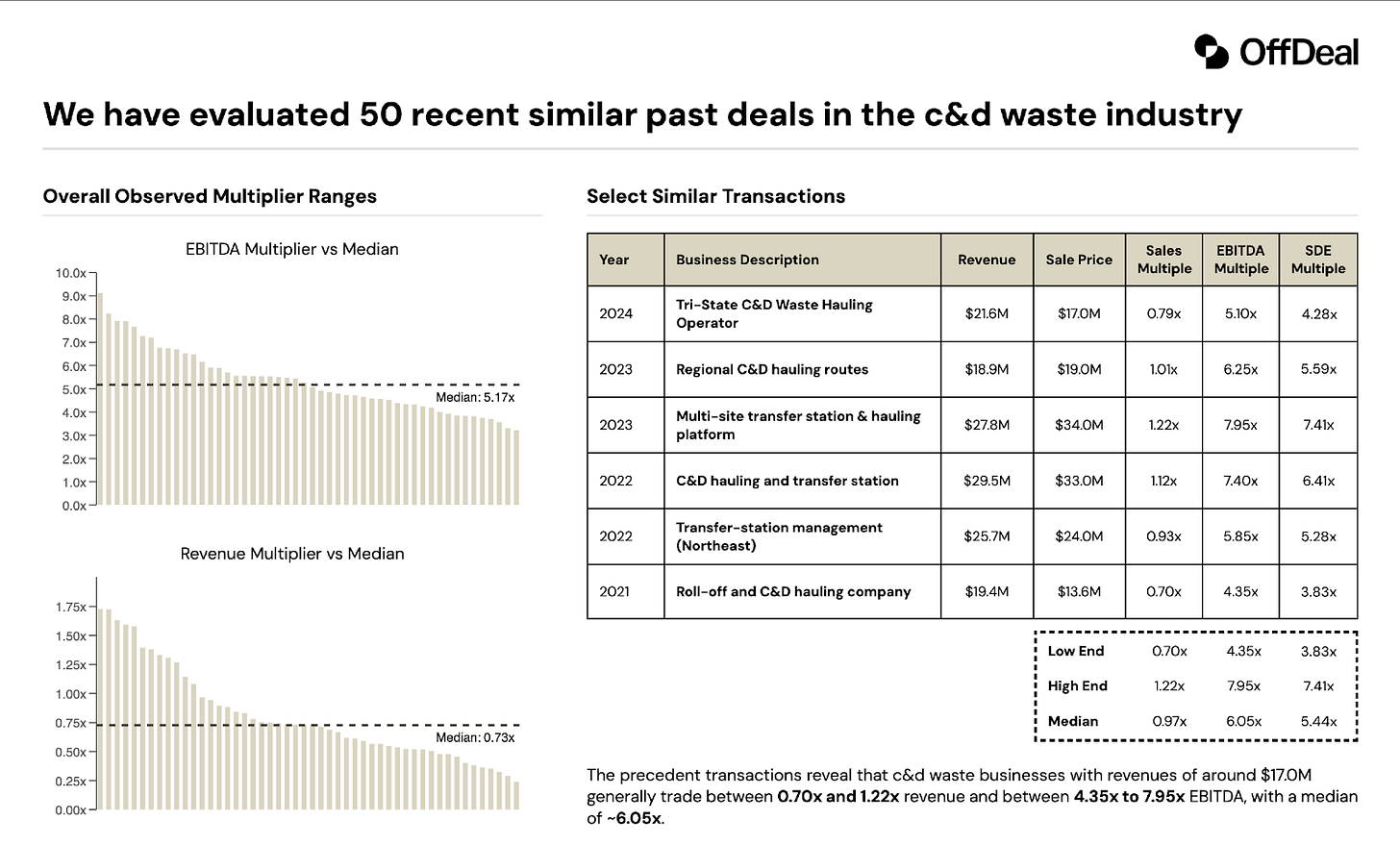

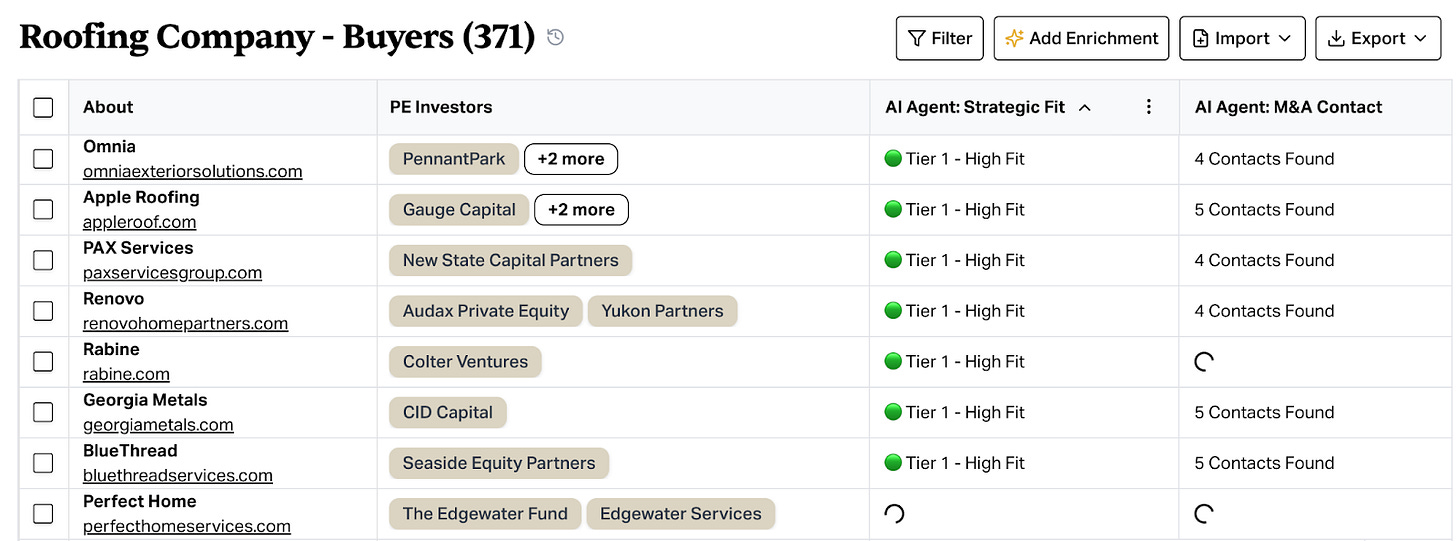

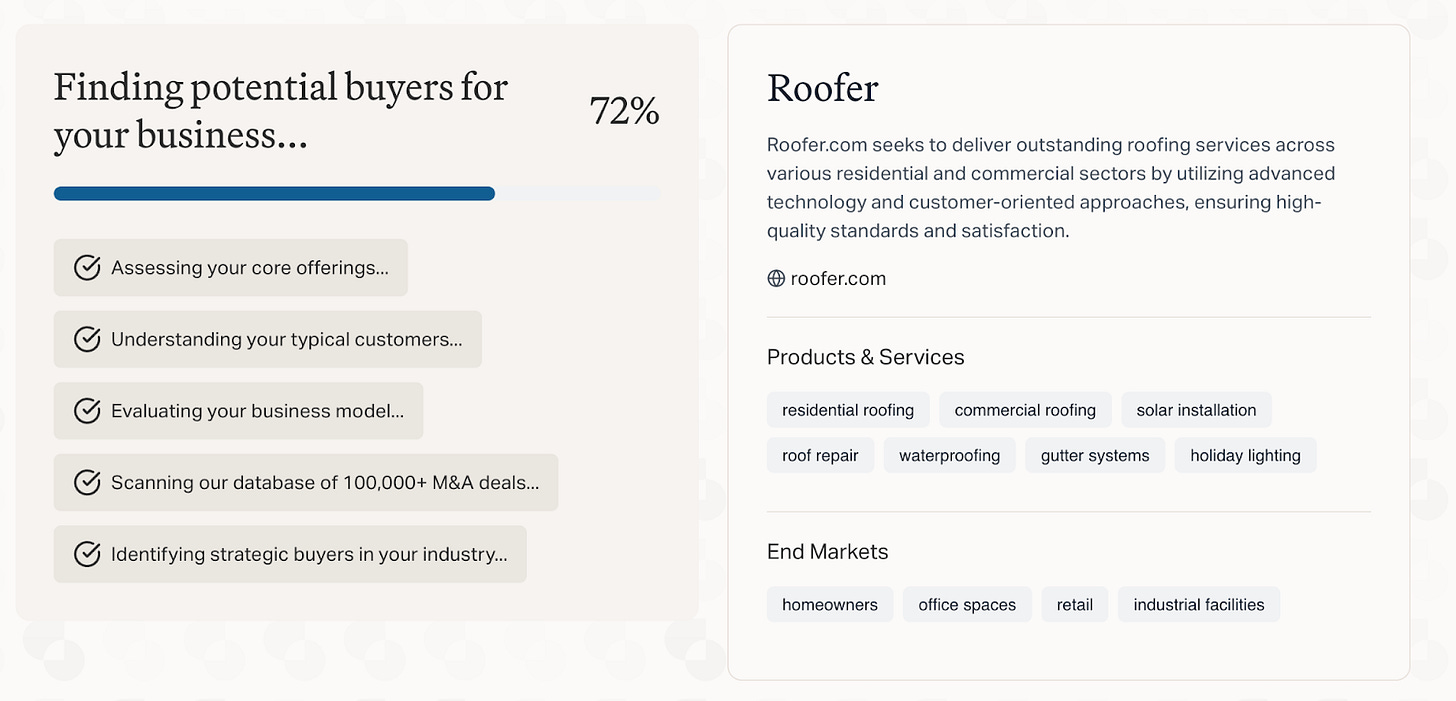

Buyer list agents leverage OffDeal’s proprietary recommendation engines and scour through its database of 2.5M+ businesses (each with 200–400 structured fields) to match and vet strategic and PE buyers—saving weeks of manual research.

AI-generated pitch decks - full, 30+ page Wall Street-caliber decks with comps, valuation models, and positioning, as well as marketing materials like CIM and teasers.

AI Deal CRM + Task Manager - LLMs continuously monitor all seller and buyer interactions / activity and flags tasks for bankers in real time to ensure no deliverables / deal deadlines slip through the cracks.

Internal AI Ops Agents - automatically generates deep research on every lead/client/buyer ahead of banker call, provides post-call scorecards (so bankers can get real-time feedback on how they did), helps bankers draft preliminary answers to buyers’ exhaustive due diligence questions

As Eldarov puts it:

“Yes, you’re spending hundreds or thousands of dollars in compute, but guess what - it’s still cheaper today than the banker’s time.”

Team and Recruiting

Founded by Ori Eldarov (CEO), who spent six years at RBC before Harvard Business School, & Alston Lin (CTO), a former Meta engineer, OffDeal built its culture around speed and tight feedback loops. The business is set up to follow Sam Altman’s famous advice to founders: Bet on the models getting better & better & ride that wave.

OffDeal prides itself on their engineering team, one they keep intentionally lean. They focus on hiring builders who can own products end-to-end and respond to banker feedback in real time, working with the most cutting edge tools, striving to always stay on top of the next best technological AI advancement.

To be frank, the team sounds a lot like Palantir’s ‘Forward Deployed Engineer’ model: entrepreneurial, technically fluent problem-solvers who embed with clients to rapidly build and iterate mission-critical software with full ownership and deep user empathy.. and btw, they sit five feet away from bankers, so “the second something breaks, engineering knows about it.”

Recruiting is overflowing. OffDeal is flooded with applications from elite Wall Street firms drawn to its pay structure, cutting-edge tech, and opportunity to run their own deals. As Eldarov says:

“We’re drowning in deal flow & need help.. If you’re a banker interested in running your own deals & using the most cutting-edge AI,

The Future of Investment Banking

OffDeal is targeting a massive market, small businesses represent 45% of U.S. GDP and are collectively worth trillions, with each one eventually facing a transition of ownership at some point.. But that’s just the starting point: OffDeal aims to evolve into a full-service investment bank, expanding into adjacent verticals like wealth management, buy-side advisory, loan origination, and beyond.

The team is not trying to replicate Wall Street, it’s rebuilding the model from the ground up. By pairing high-touch advisory with AI automation, the company is providing access to world-class M&A services for founders and business owners who have long been underserved.

Go-Direct Media Strategy

“PR agencies are a scam”

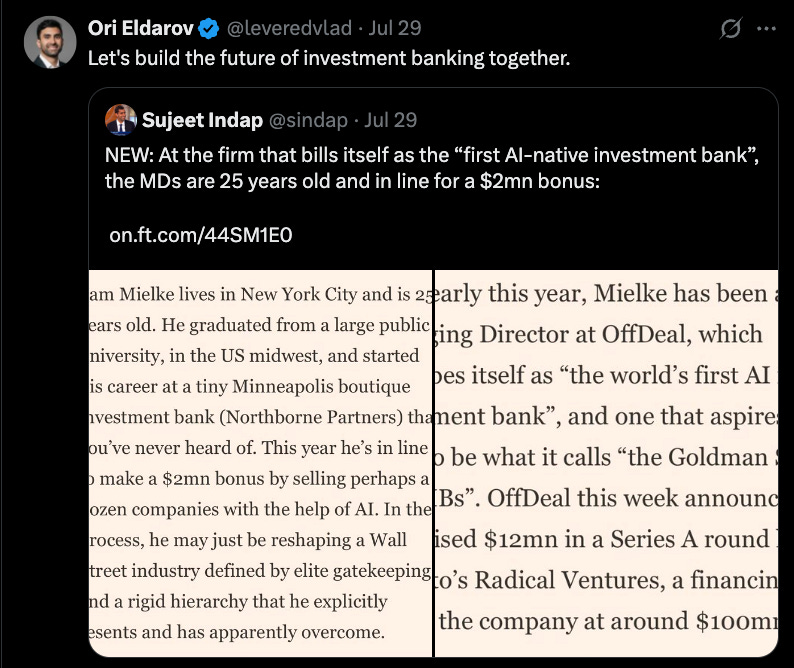

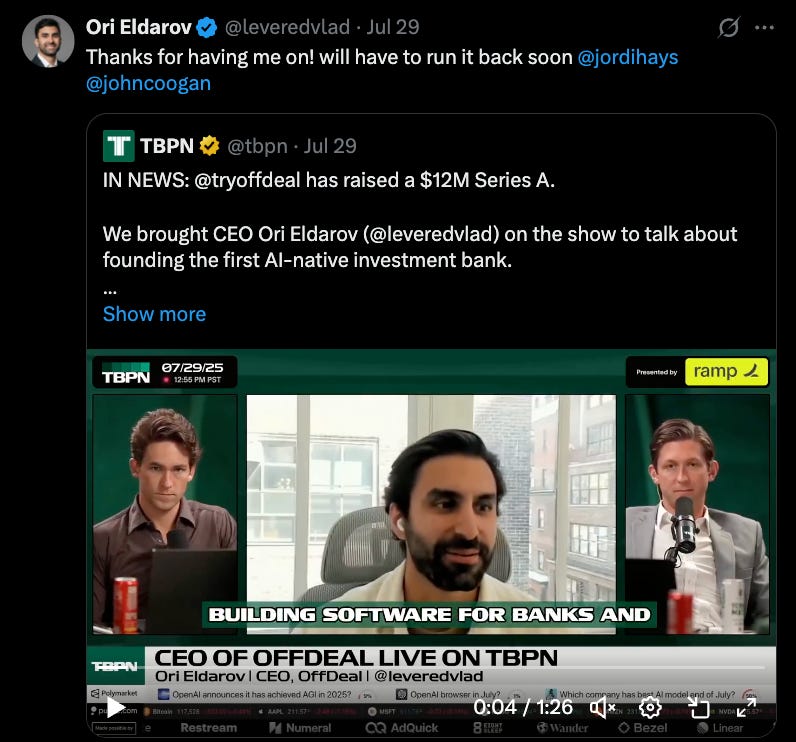

Perhaps as an indication of how OffDeal runs internally, the team did not rely on an outsourced PR agency to execute its viral announcement. The team pulled it off all in-house with Ori and his growth lead Jacob directly reaching out to reporters and influencers all on their own.. The messaging of “selling work instead of software” and incredibly high comp structure seems to have resonated within the finance and tech communities. OffDeal picked up coverage from both traditional media outlets like Financial Times and CNBC, as well as some of the most popular tech podcasts like TBPN and Anthony Pompliano.

What’s interesting is who they did NOT target directly: their customers, small business owners. In hindsight, this was probably the right move, many companies within their ICP are probably not digitally native and do not spend their time on X and LinkedIn, which probably would have resulted in lower overall exposure.

It will certainly be interesting to see how OffDeal will capitalize on the buzz it generated.. we’ll be watching 👀

Financial Times:

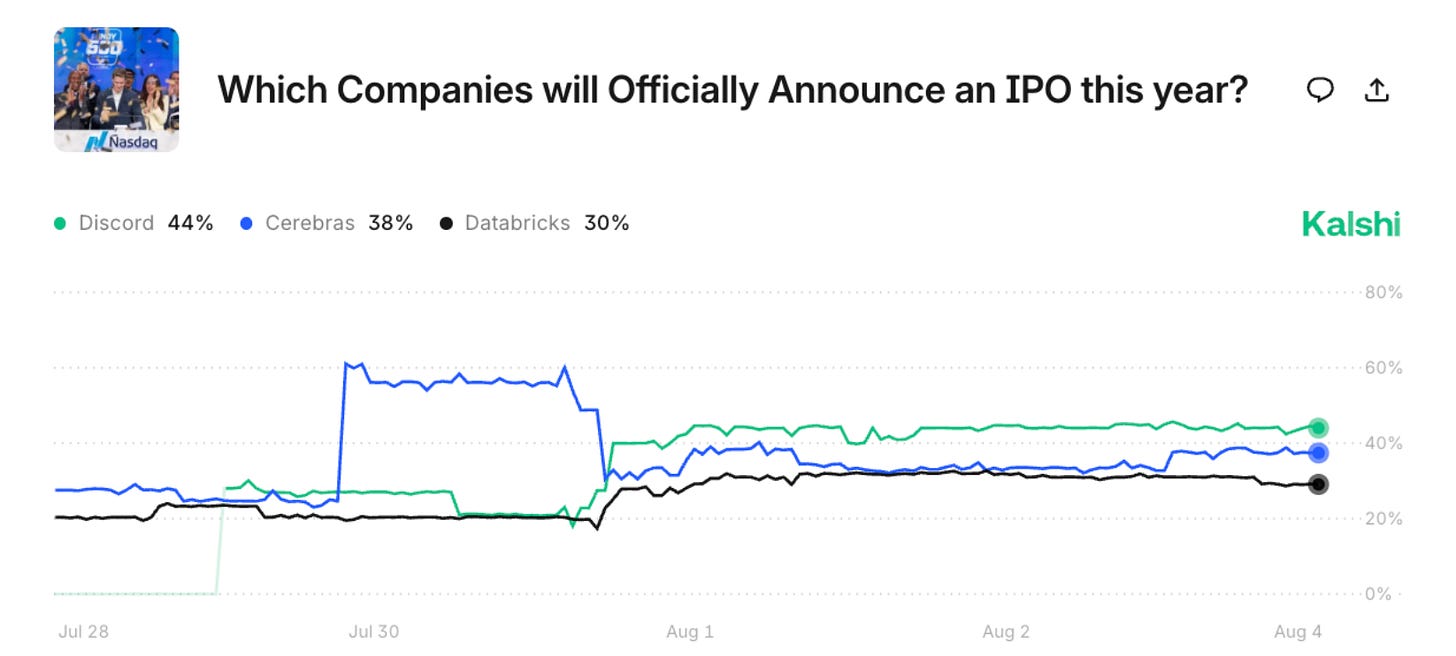

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

之前看YC的公司列表里有看到过这家公司,当时感觉这个业务很难做,没想到还能继续融到A轮的钱……

Fantastic breakdown Molly! Very excited to see how the big banks will change with AI