IPO Week: Klarna, Gemini, Figure Markets

Anthropic $183B, Databricks $100B, Cognition $10.7B, Kalshi NFL Volume

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Spend smarter. Move faster. Sourcery subscribers get: 75,000 points after spending $3,000 on Brex card(s). Plus, white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, and access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Hello from Times Square

Where I’ll be rotating all week every 6 minutes Monday - Sunday between the hours of 12pm-1pm, 8pm-9pm, and 4am-5am.

This is going to be a BUSY week.. with upcoming IPOs, large fundings, and some extra fun news from Sourcery.. Buckle up.

Musings

IPOs

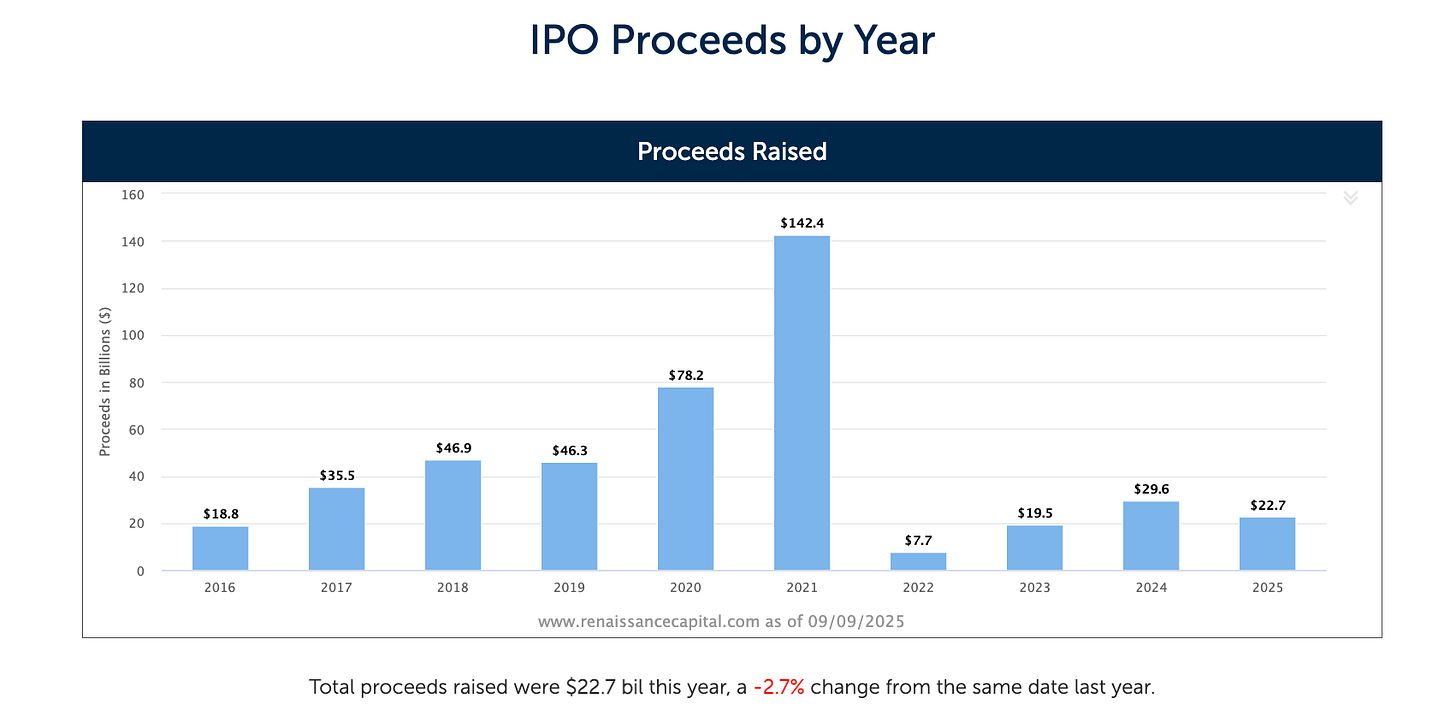

Klarna leads busiest week for big IPOs in four years. Will newly public stocks stay hot?

Topped by the $1.24 billion in expected proceeds for Klarna's (KLAR) IPO scheduled to be priced on Tuesday with a trading debut on Wednesday, underwriters at Wall Street's largest investment banks plan to float six IPOs with $250 million or more in proceeds, including a wave of four closing out the week on Friday.

The IPOs include a $500 million stock sale by stablecoin issuer Figure Technology Solutions (FIGR) for pricing late Wednesday and trading on Thursday, followed by Friday's scheduled IPO quartet: heating and ventilation company Legence Corp. (LGN) ($702 million in IPO proceeds), traffic-management company Via Transportation Inc. (VIA) ($450 million), cryptocurrency exchange Gemini Space Station Inc. (GEMI) ($300 million) and coffee chain Black Rock Coffee Bar Inc. (BRCB) ($250 million).

Fundings

Databricks closing $1 billion Series K at $100B valuation co-led by Andreessen Horowitz, Insight Partners, MGX, Thrive Capital, and WCM Investment Management. Databricks Surpasses $4B Revenue Run-Rate, Exceeding $1B AI Revenue Run-Rate

Cognition has raised over $400M at a $10.2B post-money valuation led by Founders Fund. Other existing investors are similarly doubling down including Lux Capital and 8VC (who jointly led our previous round), Neo, Elad Gil, Definition Capital, and Swish VC.

More

Make No Mistake, Brex & Ramp Are Fintechs, Not Software Firms

Thrive Capital’s Philip Clark is promoted to partner

Since joining Thrive from 8VC in 2022, Clark has also worked on the firm’s investments in OpenAI, Cursor, Wiz, Nudge, & Physical Intelligence.

Atlassian Acquires 'The Browser Company of New York' for $610M | Thrive Capital + Why are bowsers so hot rn?!

Top Interviews

Ashlee Vance: Stories from Elon, Palmer Luckey, Bryan Johnson & Priscilla Chan | BTS: Core Memory → Listen on X, Spotify, YouTube, Apple

Meme Lord CEO Fired by Elon, Meta, & Wendy’s, Alex Cohen Raises $22.5M Series A for Hello Patient → Listen on X, Spotify, YouTube, Apple

Ketryx Raises $39M Series B from Transformation & Lightspeed to Scale AI in MedTech | $57M Total Funding → Listen on X & in Sourcery

Kalshi hits $441M in volume since NFL Kickoff.. Imagine the volume by the time of the Super Bowl.

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, Cluely, politics, weather, AI, etc).

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (9/2-9/5):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Kapital, a Mexican commercial fintech, raised $86m at a $1.3b valuation, per Bloomberg. Tribe Capital and Pelion Ventures led, joined by YC, Marbruck Ventures, and True Arrow

- Lead Bank, a Kansas City-based lender, raised $70m at a $1.47b valuation from a16z, Khosla Ventures, Ribbit Capital, Coatue Management, Zeev Ventures, Iconiq Capital, and Greycroft

- Allocate, an SF-based provider of private markets software, raised $30.5m in Series B funding. Portage Ventures led, joined by a16z, M13, and Fika Ventures.

- ModernFi, a NY-based provider of deposit-management infrastructure for community and regional banks and credit unions, raised $30m in Series B funding. Canapi Ventures led, joined by a16z, Curql, Remarkable Ventures, and Intercontinental Exchange.

- Utila, a New York-based digital asset ops platform for stablecoins, raised $22m in Series A extension funding. Red Dot Capital Partners led, joined by Nyca, Wing VC, DCG, Cerca Partners, Funfair Ventures, and SilverCircle.

- Kite, a crypto AI startup, raised $18m in Series A funding. PayPal Ventures and General Catalyst led, joined by 8VC, Samsung Next, Alumni Ventures, SBI US Gateway Fund, Vertex Ventures, Dispersion Capital, Avalanche Foundation, GSR Markets, LayerZero, Hashed, HashKey Capital, Animoca Brands, Essence VC, and Alchemy.

- Reggora, a Boston, Mass.-based real estate appraisal platform, raised $18 million in funding. Centana Growth Partners led the round and was joined by others.

- Dispatch, a Miami-based provider of data orchestration software for financial advisories, raised $18m in Series A funding. Brewer Lane Ventures led, joined by New York Life Ventures, MassMutual Ventures, Perceptive Ventures and existing backers F-Prime, Flyover Capital, and Fika Ventures.

- Advisor.com, a marketplace connecting consumers with financial advisers, raised $9m in Series A funding led by Walkabout Ventures

- Plural, a San Francisco-based tokenized asset management platform, raised $7.1 million in seed funding. Paradigm led the round and was joined by Maven11, Volt Capital, and Neoclassic Capital.

- Elysian, a Nashville, Tenn.-based AI-powered third-party administrator for commercial insurance, raised $6 million in seed funding. Portage led the round and was joined by American Family Ventures and TenOneTen Ventures.

Care:

- Ketryx, a safety compliance platform for life sciences, raised $39m in Series B funding. Transformation Capital led, joined by Lightspeed Venture Partners, MIT's E14 Fund, Ubiquity Ventures, and 53 Stations

- Hello Patient, an Austin, Texas-based developer of conversational AI for patient communications, raised $22.5 million in Series A funding. Scale Venture Partners led the round and was joined by 8VC, Bling Capital, Max Ventures, Remus Capital, and FirstLook Partners.

- Flex, an HSA and FSA payment service provider, raised $15m in Series A funding. First Round and Core VC led, joined by Rethink Impact, Cameron Ventures, YC, and Liquid2.

- Welcome Tech, an LA-based health-care platform for immigrant workers, raised $7.5m from TTV Capital, CityRock Ventures Partners, Mubadala Capital, Next Legacy Partners, BTN Ventures, and Westbound Equity Partners.

- NewDays, a Seattle-based developer of cognitive health treatments for mild cognitive impairment and dementia, raised $7m in seed funding from General Catalyst and Madrona.

- Neon Health, an SF-based AI tool to help patients obtain specialty drugs, raised $6m. NFX led, joined by DigiTx, Olive Capital, Ascend, Village Global, and Digital Health Venture Partners.

- Meroka, a New York City-based platform designed to help independent physicians transition ownership of their practices to their employees, raised $6 million in seed funding. Better Tomorrow Ventures and Slow Ventures led the round and were joined by 8VC and others.

Enterprise/Consumer:

- Anthropic, a San Francisco-based developer of AI models, raised $13 billion in Series F funding at a $183 billion post-money valuation. ICONIQ, Fidelity Management & Research Company, and Lightspeed Venture Partners led the round and were joined by Altimeter, Baillie Gifford, affiliated funds of BlackRock, Blackstone, Coatue, and others.

- Baseten, an SF-based AI inference infrastructure startup, raised $150m in Series D funding at a $2.15b valuation. Bond led, joined by CapitalG, Premji, Scribble and insiders Conviction, 01a, IVP, Spark Capital, and Greylock.

- You.com, a Palo Alto, Calif.-based developer of digital infrastructure for agentic AI, raised $100 million in Series C funding. Cox Enterprises led the round and was joined by existing investors Georgian, Salesforce Ventures, and Norwest.

- Augment, a San Francisco-based AI productivity platform for logistics, raised $85 million in Series A funding. Redpoint Ventures led the round and was joined by 8VC, Shopify Ventures, Autotech Ventures, and others.

- Exa, a San Francisco-based AI search infrastructure company, raised $85 million in Series B funding. Benchmark led the round and was joined by Lightspeed, YCombinator, and NVentures.

- ID.me, a McLean, Va.-based digital identity company, raised $65m in Series E funding at a valuation north of $2b led by Ribbit Capital

- Cato Networks, an Israeli cloud security platform for remote workforces, raised $50m in Series G extension funding from Acrew Capital. It also Aim Security, which had raised $30m from firms like Canaan Partners, Proofpoint, GV, StoneMill Ventures, CCL, Operator Partners, Valley Capital Partners, Mercer Ventures, and YL Ventures.

- HappyRobot, a San Francisco-based developer of custom AI enterprise workers, raised $44 million in Series B funding. Base10 Partners led the round and was joined by existing investors a16z and Y Combinator and others.

- ProRata.ai, a smartly named chatbot that shares revenue with media publishers, raised $40m in Series B funding. Touring Capital led, joined by Mayfield, MVP Ventures, Revolution Ventures, SBI Investment, BOLD Capital, XPV-Exponential Ventures, and Idealab Studio.

- Sola Security, a Tel Aviv, Israel-based AI assistant designed for cybersecurity, raised $35 million in Series A funding. S32 led the round and was joined by M12, New Era Capital Ventures, and others.

- Kite, a San Francisco-based developer of digital infrastructure for AI agents, raised $18 million in Series A funding. PayPal Ventures and General Catalyst led the round and were joined by 8VC, Samsung Next, Alumni Ventures, SBI US Gateway Fund, Vertex Ventures, Dispersion Capital, Avalanche Foundation, GSR Markets, LayerZero, and others.

- Fiveonefour, a Portland, Ore.-based data and analytics AI and developer tooling, raised $17 million in funding. Dimension Capital led the round and was joined by Stage 2 Capital, Flybridge Capital Partners, Ridge Ventures, Tokyo Black Venture Capital, and Vermillion Cliffs.

- Throxy, a San Francisco-based outbound sales platform, raised $6.2 million in seed funding. Base10 Partners led the round and was joined by Y Combinator.

- LightTable, a Denver-based peer review platform for real estate development, raised $6m in seed funding. Primary Venture Partners led, joined by Innovation Endeavors and Banter Capital.

- Alpic, a Paris, France-based MCP-native cloud platform, raised $6 million in pre-seed funding. Partech led the round and was joined by K5 Global, Irregular Expression, Yellow, Drysdale, Kima Ventures, and Galion.exe, others.

- Supersonik, a Barcelona, Spain and San Francisco-based developer of a multilingual AI agent for sales demos, raised $5 million in seed funding. Andreessen Horowitz led the round and was joined by angel investors.

- Loman AI, an Austin, Texas-based Voice AI platform for restaurants, raised $3.5 million in seed funding. Next Coast Ventures led the round and was joined by TenOneTen Ventures and Antler.

- Artificial Societies, a London-based AI startup that "simulates human societies," raised $3.35m in seed funding led by Point72 Ventures.

HardTech:

- Quantinuum, a quantum computing group, raised $600m at a $10b valuation. Backers include Honeywell, Quanta Computer, NVentures, JPMorgan, Mitsui, and Amgen.

- Fermi America, an Amarillo, Texas-based developer of an AI private grid campus, raised $100 million in Series C funding. Macquarie Group led the round.

- Mojo Vision, a Cupertino, Calif.-based micro-LED platform, raised $75m in Series B funding. Vanedge Capital led, joined by Edge Venture Capital, NEA, Fusion Fund, Knollwood Capital, Dolby Family Ventures, Khosla Ventures, imec.xpand, Keymaker, Ohio Innovation Fund, and Hyperlink Ventures

- Phasecraft, a Bristol, U.K.-based quantum algorithms company, raised $34 million in Series B funding. Playground Global, Plural, and Novo Nordisk led the round and was joined by LocalGlobe, AlbionVC, and Parkwalk Advisors.

- Orchard Robotics, a San Francisco-based developer of technology designed to automate farming processes, raised $22 million in Series A funding. Quiet Capital and Shine Capital led the round and were joined by General Catalyst, Contrary, Mythos, Valyrian, Ravelin, and others.

Sustainability:

- Xampla, a Cambridge, U.K.-based manufacturer of plant-based alternatives to single-use plastic, raised $14 million in Series A funding. Emerald Technology Ventures, BGF, and Matterwave Ventures led the round and were joined by existing investors Amadeus Capital Partners and Horizons Ventures.

Acquisitions & PE:

- Atlassian agreed to acquire The Browser Company, the New York City-based developer of the Dia and Arc web browsers, for $610 million in cash.

- McLaren Racing was valued at more than $5 billion in a recent stake sale, an all-time record for an F1 team. The selling group is led by MSP Sports Capital, which is generating around a 10x return on its investment, while the buyers are sovereign wealth funds from Bahrain and Abu Dhabi (which already had stakes, but now get control).

- Evernorth, a unit of Cigna Group (NYSE: CI), will invest $3.5b into Shields Health Solutions, a specialty pharmacy group spun out as a standalone business when Sycamore Partners last week completed its Walgreens acquisition.

- CoreWeave (Nasdaq: CRWV) acquired OpenPipe, a Seattle-based that helps developers create application-specific LLMs. OpenPipe had raised around $7m from firms like Costanoa Ventures

IPOs:

- Black Rock Coffee Bar, a Scottsdale, Ariz.-based chain with 158 locations, set IPO terms to 14.7m shares at $16-$18. It reports a $2m net loss on $95m in revenue for the first half of 2025, and plans to list on the Nasdaq (BRCB). Backers include Cynosure Partners.

• Figure, a consumer lending platform led by Mike Cagney (ex-SoFi), set IPO terms to 26.3m shares at $18-$20. It would have a $4.5b fully diluted value, were it to price in the middle, and reports $29m of net income on $191m in revenue for the first half of 2025. The company plans to list on the Nasdaq (FIGR), and has raised around $425m, most recently in 2021 at a $3.2b valuation, from backers like DST Global Partners, Ribbit Capital, DCM, and Morgan Creek Digital.

• Gemini, a crypto exchange platform led by the Winklevoss twins, set IPO terms to 16.67m shares at $17-$19. It reports a $282m net loss on $68m in revenue for the first half of 2025, and plans to list on the Nasdaq (GEMI). Backers include Morgan Creek Digital.

• Klarna, a Swedish buy-now-pay-later company, set IPO terms to 34.3m shares at $35-$37. It will trade on the NYSE (KLAR), and had raised over $4b from firms like Sequoia Capital, SoftBank, Silver Lake, Dragoneer, Ant Group, Visa, Atomica, Northzone, GIC, TCV, BlackRock, Commonwealth Bank of Australia, Mubadala, and Canada Pension Plan Investment Board.

- Via, a New York City-based rideshare platform for local governments, plans to raise up to $470.8 million in an offering of 10.7 million shares priced between $40 and $44. The company posted $381 million in revenue for the year ended June 30. Exor, 83North, Kelvin Investments, Pitango, and Ramot Trust back the company.

- Rolls-Royce (LSE: RR) is weighing an IPO and other financing options for its nuclear reactor unit

Funds:

- The Carlyle Group raised over $20 billion for private equity secondaries, including $15 billion for its eighth AlpInvest fund. Carlyle also secured $3.2 billion in co-investment commitments for secondaries, plus $2 billion for similar vehicles via its private wealth channel.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.