Josh Kushner on Building Thrive

Inside the Quiet $50B Machine | Patrick O'Shaughnessy, Invest Like the Best

Josh Kushner on Building Thrive

Inside the Quiet $50B Machine

Nearly 3 years after his first interview with Patrick O’Shaughnessy, Josh Kushner returns to ILTB (now managing $50B AUM) reflecting on discipline, ambition, responsibility, founders, & perspective.

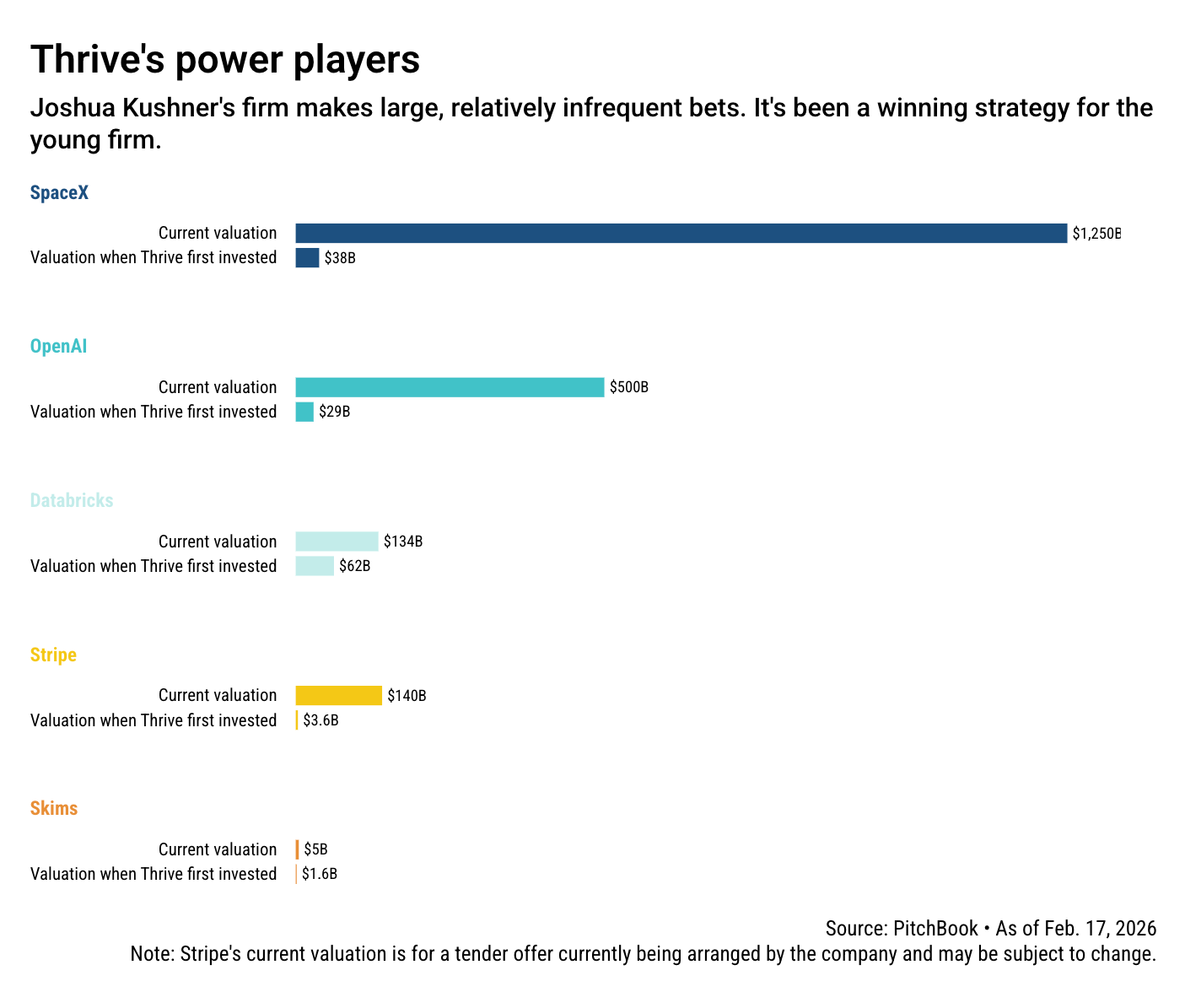

Strip away the headlines Stripe, OpenAI, billion-dollar checks and a different story emerges.

At its core, Thrive is built around discipline, perspective, and restraint.

“We’re building a company. That company just happens to be Thrive.”

Kushner doesn’t describe Thrive as a fund. He describes it as an operating company whose product is partnership.

“The company has a product and it is to invest and be the most meaningful partner to those that we’re fortunate enough to partner with.”

That orientation shows up repeatedly in how they allocate capital, structure the team, and define success.

https://colossus.com/article/joshua-kushner-thrive-new-world/

Discipline Over Distortion

“External validation can distort even the most disciplined minds.”

Thrive spent years being criticized for concentration, check size, and strategy. Success, Kushner suggests, carries its own risks.

“I think it’s really important that we ignore the noise, keep our heads down.”

The goal is insulation from both praise and criticism.

Enabling Founders

“Our founders are heroes. We’re not Da Vinci. We’re Medici… our opportunity is to enable the artists that we’re fortunate enough to support to create their masterpieces.”

The framing is deliberate. Thrive sees itself as an enabler, not the protagonist.

“We think of ourselves as a service provider.”

That posture explains some of Thrive’s most consequential decisions. The firm’s largest investments weren’t abstract strategy plays they were responses to founder need.

“It was more bottom up, it was more company specific.”

“Stripe needed to raise $6 billion… and it was our job to find a way to get them that capital.”

“OpenAI is a very capital intensive business. It was our job to get them that capital.”

“Our general framing was we’re living in a time in which there are multi-trillion dollar companies, $3-$4 trillion, and those companies will likely by the end of this decade be $7 to $10 trillion companies. So the idea that there would be private companies today that could be worth half a trillion or a trillion dollars is not inconceivable.”

Concentration as Conviction

“Concentration is core to what we do.”

Kushner argues that deep conviction requires immersion.

“The only way to truly develop context on businesses is to spend meaningful time… to really understand every aspect of everything that we’re a part of in a very intimate way.”

That time investment informs their underwriting philosophy.

“There will be bad quarters, there’ll be bad years, but if you believe in the people who are running the business, ultimately everything will end up okay.”

https://pitchbook.com/news/articles/thrive-raises-10b-as-its-lps-anticipate-mega-ipo-windfall

Long-Term Anchoring

“It’s much easier to predict what is going to happen in the long term than it is in the short term.”

During Stripe’s 2022 round, at a significant discount to its prior valuation, the firm focused on inevitabilities.

“If there’s one thing that I could predict between now and the day that I die, it’s that people buy more stuff on the internet every year.”

The same framing applied to OpenAI.

“I just couldn’t unsee it one night.”

“The combination of research, talent, density, access to compute, but more importantly, a product that I thought could reach distribution… gave us the confidence.”

What Not to Do

“This industry is not just about the deals that you do, but it’s also about the things that you don’t do.”

Restraint is as important as aggression.

“ The ethos of the firm is never sell against anyone else.

There are truly a lot of firms that we respect deeply, and we will never compare ourselves to anyone else. What we like to do is just express to people that this is who we are.”

Ethics, loyalty, and consistency are structural choices, not tactical ones.

“Kindness without toughness, falters and toughness without kindness.”

Craft Over Activity

”I’ve always been fascinated by A24 because there have been a lot of analogs to Thrive story. They have captivated Hollywood by being based in New York. They keep to themselves. They’re very focused on the director, the actor. In the same ways in which I think we’re very focused on the founder.

It’s very input driven around how do you create the best work? How do you support the people who are actually the creators in this ecosystem? I’ve learned a lot from him and the team as they have gone on to make extraordinary art by supporting the people that are making.”

“Frank Ocean is an inspiration for me because he hasn’t created an album in 13 years, and if there’s nothing for us to create, then we won’t create.”

“But if there’s something really extraordinary for us to create, we’ll make sure that there’s deep intentionality around it.”

The preference is clear: intentionality over volume.

Perspective

“The thing that my grandmother provides the most for me is just perspective.”

“There’s no amount of pain that I can ever experience that will ever amount to what she has.”

“There’s nothing I will ever accomplish in life that will be greater than what she pulled off.”

That perspective underpins risk tolerance, patience, and emotional discipline.

Building Defensibility

“Disruption will happen from inside out.”

Through Thrive Holdings, the firm is buying businesses and applying AI internally — aiming to “hold them in perpetuity.”

“We set up this permanent capital vehicle…”

It’s an attempt to make the firm itself less copyable.

“One of my greatest insecurities with Thrive is that we fundamentally look very different than the businesses that we try to invest in.”

The Quiet Edge Behind Thrive

They are not trying to be the most famous firm.

They are trying to be the most structurally durable firm.

That’s different.

Thrive is built for durability, not noise.

. . .

Listen to @Patrick_O’Shaughnessy’s full conversation with Josh Kushner on Spotify:

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Deel—Deel is the global people platform that helps startups hire, manage, pay, and equip anyone, anywhere. Trusted by more than 35,000 fast-growing companies, Deel is the people platform that just works, so teams can scale without the chaos. Visit: deel.com/sourcery

Public-–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. With Generated Assets, you can build, backtest, refine, and invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. Try it today: public.com/sourcery

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.