Joshua Kushner, JPMorgan, Industry Ventures/Goldman

Base Power, Stoke Space, Kalshi, Crosby, Thermopylae Aerospace Corp

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Hello from LA

Clear your schedule. New Colossus profile on Joshua Kushner & Thrive Capital just dropped.

Interview coming soon..?

Musings

AI

Capital Markets

JPMorganChase Launches $1.5 Trillion Security and Resiliency Initiative to Boost Critical Industries

Fast (?) following the VC ranks of a16z’s American Dynamism fund, General Catalyst’s Global Resilience thesis.. American Reindustrialization has now reached the the fortress of Jamie Dimon.

The firm will make direct equity investments of up to $10 billion as part of the $1.5 trillion initiative to address pressing needs in key sectors from critical minerals to frontier technologies:

Supply Chain and Advanced Manufacturing, including critical minerals, pharmaceutical precursors and robotics

Defense and Aerospace, including defense technology, autonomous systems, drones, next-gen connectivity and secure communications

Energy Independence and Resilience, including battery storage, grid resilience and distributed energy

Frontier and Strategic Technologies, including AI, cybersecurity and quantum computing

Goldman Sachs Announces Acquisition of Industry Ventures

Industry Ventures currently manages $7 billion of assets under supervision (AUS)² and has made more than 1,000 secondary and primary investments since the company’s founding in 2000. Industry Ventures calculates its realized performance across its platform as an attractive net IRR of 18% and net realized MOIC of 2.2X since its inception³.

The transaction consideration will consist of $665 million in cash and equity payable at closing; and additional contingent consideration of up to $300 million, payable in both cash and equity, based on Industry Ventures’ future performance through 2030.

EA: The Biggest LBO Ever → A record $55 billion bet on blockbuster franchises & recurring revenue.

Ray Dalio on Life, Debt & Global Crisis | Leaders with Francine Lacqua

State Street & Franklin Templeton CEOs on Market Outlook

Jenny Johnson, CEO of Franklin Templeton: “There’s a reason why there’s this massive proliferation in alternatives and private assets, right? So, in the case of private credit, we already talked about it on the bank lending rules and capital requirements, I think has pushed post the financial crisis into private credit. And I think in private equity. companies are waiting longer to go public.

You just saw yesterday.. Electronic Arts just went private at a $50 billion valuation. You can’t imagine in the past that there was enough private capital for that. Well, why? Because it won a lot of the rules around public companies and quarterly earnings and things for CEOs in a time of great technological innovation, there’s a fear that to meet those quarterly earnings, they are not making the investments that they need to ensure the company’s position for the future.. So companies are choosing to not go public and going private from being public. I don’t think that trend changes, and if anything in this time with the technological advances, as I said, actually there’s even a greater reason to stay private.”

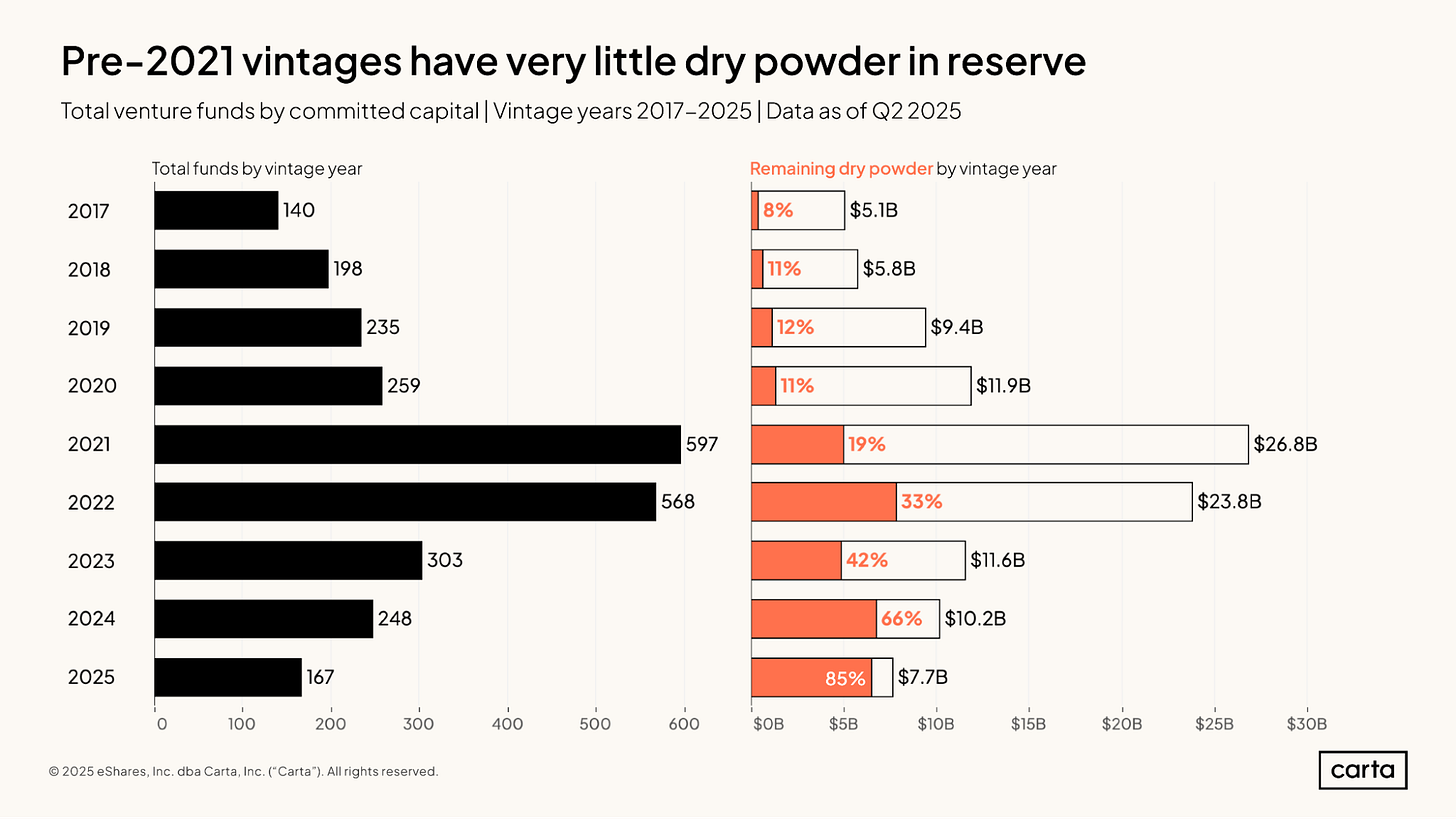

Dry powder thinning: Older funds are nearly fully deployed (the 2020 vintage has just 11% left), while even newer vintages are spending faster than usual—42% of 2023 capital remains, and the 2022 vintage still has 33% left to invest.

From Seed to Series A: What Gets You Funded

Investors from leading early-stage funds Mayfield, 500 Global, & Felicis break down the new rules of fundraising in AI—traction, defensibility, GTM, and red flags.

Top Interviews

Zach Dell, CEO of Base Power on Raising $1 Billion Series C Led by Addition | $200M Series B → $1B Series C in <6 months → Listen on X, Spotify, YouTube, Apple

Vulcan Elements, The most advanced rare earth magnet factory in America, fully decoupled from China → Listen on X, Spotify, YouTube, Apple

Peter Thiel’s $50M Bet on American Nuclear Fuel w/ General Matter, Scott Nolan, Founder & CEO (& Partner at Founders Fund) → Listen on X, Spotify, YouTube, Apple

Inside The $2.2B AI Research Accelerator | Turing → Listen on X, Spotify, YouTube, Apple

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (10/6-10/10):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Intercontinental Exchange (NYSE: ICE), the New York Stock Exchange’s parent company, agreed to invest $2 billion for around a 20% stake in Polymarket, valuing the company at $9 Billion. Polymarket previously raised over $250 million, including this past summer at around a $1 billion valuation. Backers include Founders Fund, Polychain Capital, General Catalyst, and 1789 Capital. It also paid $112 million to acquire derivatives exchange QCEX, which has a CFTC license that will let Polymarket enter the U.S. market.

- Kalshi, a New York-based prediction markets, raised over $300m in Series D funding at a $5b valuation led by Sequoia and Andreessen Horowitz. Paradigm, CapitalG, Coinbase Ventures, General Catalyst, and Spark Capital

- Meanwhile, a Bitcoin life insurer, raised $82m. Haun Ventures and Bain Capital Crypto led, joined by Pantera Capital, Apollo, Northwestern Mutual Future Ventures, and Stillmark

- Routefusion, an Austin, Texas-based financial infrastructure provider, raised $26.5 million in Series A funding. PeakScan Capital led the round and was joined by Silverton Partners.

- FurtherAI, a San Francisco-based AI workspace designed for insurance, raised $25 million in Series A funding. Andreessen Horowitz led the round.

- CipherOwl, a San Francisco-based institutional cryptocurrency compliance platform, raised $15 million in seed funding. General Catalyst and Flourish Ventures led the round and were joined by Coinbase Ventures, Sancus Ventures, Enlight Capital, and others.

- Akua, a Dover, Del. and Bogotá, Colombia-based operating system for payments in emerging markets, raised $8.5 million in seed funding. Flourish Ventures and Cathay Latam led the round and were joined by Atlantico and others.

- Agio Ratings, a London, U.K.-based risk insights platform for digital assets, raised $6 million in funding. AlbionVC led the round and was joined by Portage Ventures and MS&AD.

- PAVUS AI, a Santa Clara, Calif.-based platform designed to help procurement teams manage their data, raised $5.3 million in funding. Sentinel Global led the round.

Care:

- Heidi Health, a New York-based medical scribe, raised $65m in Series B funding. Point72 led, joined by Goodwater Capital, Headline, Blackbird VC, LG Technology Ventures, and Alumni Ventures.

- Sensi.AI, an Austin, Texas-based AI-powered copilot for senior care, raised $45 million in Series C funding. Qumra Capital led the round and was joined by Insight Partners, Zeev Ventures, Entrée Capital, Flint Capital, and Jibe Ventures.

- Affinia Therapeutics, a Waltham, Mass.-based drug developer for cardiovascular and neurological diseases, raised $40 million in Series C funding. New Enterprise Associates led the round and was joined by Eli Lilly and existing investors.

- Remedy Robotics, a developer of robotic interventions for stroke and cardiovascular care, raised $35m in seed and Series A funding. DCVC led, joined by Blackbird, KdT Ventures, and Tony Fadell’s Build Collective.

- Simple Life, a London-based weight loss app, raised $35m in Series B funding led by Kevin Hart’s HartBeat Ventures

- Lumen Bioscience, a Seattle, Wash.-based developer of orally-delivered biologics, raised $30 million in a Series C extension. WestRiver Group led the round and was joined by the Gates Foundation and others.

- Foundation Health, a San Francisco-based developer of AI technology for pharmacy operations, care coordination, and direct-to-patient delivery, raised $20 million in Series A funding. Define Ventures led the round and was joined by Vanderbilt University, Intermountain Ventures, and existing investors.

- Attuned Intelligence, a developer of hospital call center agents, raised $13m in seed funding led by Radical Ventures and Threshold Ventures

- Zingage, a New York City-based AI-powered automation platform for home health care agencies, raised $12.5 million in seed funding. Bessemer Venture Partners led the round and was joined by TQ Ventures, South Park Commons, and others.

- Peer AI, a provider of FDA drug approval documentation software, raised $12.1m in pre-seed and seed funding. Flare Capital Partners and SignalFire led, joined by Greycroft, Atria Ventures, Alumni Ventures, Gaingels, and Mana Ventures

- Hipp Health, a San Francisco-based clinical platform for behavioral health, raised $6.2 million in seed funding. RTP Global led the round and was joined by Swift Ventures, Rackhouse Venture Capital, and Difference Partners.

- Onos Health, a San Francisco-based behavioral health platform, raised $6 million in seed funding. Haystack and Pathlight Ventures led the round and were joined by Bertelsmann Healthcare Investments and Nebular.

- Previvor Edge, a New York City-based cancer prevention and early detection platform, raised $3.3 million in pre-seed funding. CoFound Partners and Max Ventures led the round and were joined by Humbition Capital, Red Swan Ventures, and Designer Fund.

- Parallel, a Lehi, Utah-based AI-powered finance platform for startups, raised $2.3 million in seed funding. Night Capital and Tokyo Black led the round and were joined by Penny Jar Capital, Background VC, and others

Enterprise/Consumer:

- Anysphere, the company behind of coding assistant Cursor, is weighing investments that value it at $30b

- Reflection, a Brooklyn, N.Y.-based open-source superintelligence lab, raised $2 billion in Series B funding from Nvidia, Disruptive, B Capital, Citi, and others.

- n8n, a Berlin-based AI orchestration platform, raised €154.9m in Series C funding, valuing it at €2.15b. Accel led, joined by Meritech, Redpoint, Evantic, Visionaries Club, NVentures, T.Capital, Sequoia, HV Capital, Highland Europe, and Felicis Ventures.

- EvenUp raises $150 million Series E at $2 billion valuation as AI reshapes personal injury law led by Bessemer Venture Partners. With participation from B Capital, SignalFire, Lightspeed, HarbourVest, Adams Street, Broadlight Capital, and Lexis Nexis owner RELX.

- 1Password, a Toronto-based password management business, sold $100m in secondaries. The Halo Fund, founded by Utah Jazz owner Ryan Smith and Accel partner Ryan Sweeney, bought $75m of that.

- David AI Labs, an audio data company for training AI models, raised $50m at a $500m valuation. Meritech Capital led the round, joined by NVentures, First Round Capital, Y Combinator, Alt Capital and Amplify Partners.

- EQT Growth invested €50 million ($58.6 million) in Harvey, a San Francisco-based developer of AI technology for legal and professional services.

- Spellbook, a Toronto-based AI contract reviewer, raised $50m in Series B funding led by Khosla Ventures’ Keith Rabois, with participation from Threshold Ventures, Inovia Capital, Bling Capital, Moxxie Ventures, Path Ventures and Jean-Michel Lemieux. It values the company at $350m.

- Kernel, which makes browser infrastructure for AI Agents at scale, raised $22m. Accel led, joined by Y Combinator, along with Paul Graham (YC), David Cramer (Sentry), Solomon Hykes (Docker), Zach Sims (Codecademy), and Charlie Marsh (Astral),

- Crosby, a NYC-based AI law firm, raised $20m in Series A funding co-led by Bain Capital Ventures, Index and Elad Gil, with participation from Sequoia, Cooley LLP and Patrick Collison

- HiOctave, a San Francisco-based provider of AI technology to help small and medium-sized businesses automate and personalize customer experiences, raised $15 million in funding. Vinod Khosla and Khosla Ventures led the round and were joined by Celesta Capital, Anthology Fund, and others.

- Northbeam, an El Segundo, Calif.-based video marketing tech startup, raised $15m from HighPost Capital

- Realm.Security, a Boston-based data security startup, raised $15m in Series A funding. Jump Capital led, joined by Glasswing Ventures and Accomplice.

- TransCrypts, a blockchain-based digital identity startup, raised $15m in seed funding. Pantera Capital led, joined by Lightspeed, Alpha Edison, Motley Fool Ventures, California Innovation Fund, and Tomer London.

- Price.com, an LA-based shopping platform, raised $12m in seed funding. Waterbridge Capital led, joined by TRAC VC, Founders Fund, and Social Capital

- Benable, a horizontal recommendation platform, raised $11m in seed funding. Footwork led the round and was joined by Jack Altman, Third Prime, PJC, Scott Belsky, Walker Williams, and Cat Lee.

- Vulcan Technologies, an Austin-based company for streamlining government policy, raised $10.9m in seed funding co-led by General Catalyst and Cubit Capital,

- AnyTeam, a San Francisco-based AI-powered sales operating system, raised $10 million in seed funding. SignalFire and Crosslink Capital led the round and were joined by angel investors.

- Knapsack, a Portland, Ore.-based AI-powered digital product creation, raised $10 million in Series A funding. Builders VC led the round and was joined by Crosslink Capital, Epic Ventures, and others.

- Sitehop, a London, U.K.-based encryption platform designed for defense against quantum-powered cyber attacks, raised £7.5 million ($10 million) in funding. Northern Gritstone led the round and was joined by Amadeus Capital Partners, Manta Ray, and others.

- Arcjet, a San Francisco-based codebase security platform, raised $8.3 million in Series A funding. Plural and Ott Kauver led the round and was joined by Andreessen Horowitz, Seedcamp, and angel investors.

- Smallest.ai, a San Francisco-based platform for building AI voice agents, raised $8 million in seed funding. Sierra Ventures led the round and was joined by 3one4 Capital and Better Capital.

- Nozomio, a San Francisco-based developer of a context augmentation toolkit, raised $6.2 million in seed funding from CRV, LocalGlobe, Y Combinator, and angel investors.

- Tato, a Montreal, Québec-based AI-native project platform purpose-built for system integrators, raised $5 million in seed funding. Ridge Ventures led the round and was joined by Myriad Ventures, Betaworks, and RRE Ventures.

- Supermemory, a memory solution for AI, raised $2.6m from Susa Ventures, Browder Capital, and SF1.vc.

- Gullie, a Claymont, Del.-based AI relocation platform, raised $2 million in seed funding. B Capital led the round and was joined by Gold House Ventures and angel investors.

HardTech:

- Base Power, an Austin-based home power backup company, raised $1b in Series C funding led by Addition. Trust Ventures, Valor Equity Partners, Thrive Capital, Lightspeed, Andreessen Horowitz, Altimeter, StepStone, Elad Gil, 137 Ventures, Terrain, Waybury, Ribbit, CapitalG, Spark, BOND, Lowercarbon, Avenir, Glade Brook, Positive Sum, and 1789 joined.

- Stoke Space Technologies, a Kent, Wash.-based reusable rocket maker, raised $510m in Series D funding led by Thomas Tull’s US Innovative Technology Fund.

- Tigris, a provider of localized data storage centers, raised $25m in Series A funding led by Spark Capital. Andreessen Horowitz joined.

- Quilter, an LA-based developer of autonomous PCB layout, raised $25m in Series B funding. Index Ventures led, joined by Benchmark, Coatue, and Root Ventures

- Energy Robotics, a Darmstadt, Germany-based developer of robots and drones for autonomous inspection of critical infrastructure, raised $13.5 million in Series A funding. Blue Bear Capital and Climate Investment led the round and was joined by Futury Capital, Hessen Capital, Kensho VC, and TADTech.

- ConCntric, a San Francisco-based AI-powered preconstruction platform, raised $10 million in Series A funding. 53 Stations led the round and was joined by Argonautic Ventures and others.

- Tycho.AI, a Cambridge, Mass.-based developer of navigation and AI systems for unmanned vehicles, raised $10 million in Series A funding. FirstMark led the round and was joined by Pillar VC.

- Nexcade, a London-based provider of automation AI for freight forwarders, raised $2.5m in pre-seed funding. Connect Ventures led, joined by MMC Ventures, Entropy Industrial Capital, and Inovia.

- Thermopylae Aerospace Corp is a Hawthorne-based startup developing novel, rapidly deployable autonomous interceptors against drones. The company was founded earlier this summer and recently completed a pre-seed fundraise led by Naval Ravikant. Thermopylae is founded by a Ukrainian refugee and a team with backgrounds from Stanford and Penn State The company brings experience in edge autonomy, end-to-end hardware prototyping, and interceptor systems, achieving key engineering milestones within just a few months of its founding.

Sustainability:

- Membrion, a Seattle-based industrial wastewater treatment startup, raised $20m in Series B1 funding from Pangaea Ventures, PureTerra Ventures, Ecolab, W. L. Gore & Associates, The Lewis Family Office, Safar Partners, Lam Research, Indico Ventures, and Giantleap Capital.

Acquisitions & PE:

- Carta acquired Sirvatus, an Austin-based administration platform for private credit funds backed by Soul Venture Partners and Golden Section

- CoreWeave (Nasdaq: CRWV) agreed to acquire Monolith, a London-based provider of AI engineering software that had raised over $18m from firms like Insight Partners and Pentech Ventures.

- Itron (Nasdaq: ITRI) agreed to acquire Urbint, a Miami-based provider of infrastructure risk assessment software, for $325m. Urbint raised over $130m from Energize Capital, S2G Ventures, National Grid Partners, Blue Bear Capital, Climate Investment, Energy Impact Partners, and Zoma Capital

- Qualcomm (Nasdaq: QCOM) agreed to acquire Arduino, an Italian open-source hardware and software company that had raised nearly $60m from firms like CDP Venture Capital, Anzu Partners, and Arm.

- Confluent (Nasdaq: CLFT), a data streaming company with a $7.2b market cap, is exploring a sale after inbound interest

- Helsing, a German defense-tech startup valued by VCs at $13.6b, agreed to acquire Australian underwater drone maker Blue Ocean.

- SoftBank has agreed to buy the robotics unit of Swiss engineering firm ABB for nearly $5.4 billion in cash.

- Firefly Aerospace (Nasdaq: FLY) agreed to buy SciTec, a Princeton, N.J.-based defense tech company whose capabilities include missile warnings, for about $855m in cash ($300m) and stock.

- Qualtrics, owned by Silver Lake and other PE firms, agreed to buy health-care patient feedback firm Press Ganey Forsta for $6.75b (including debt) from Ares Management and Leonard Green & Partners

- Paramount Skydance, backed by RedBird Capital Partners, agreed to acquire media startup The Free Press for up to $150m in cash and stock. Naming The Free Press founder Bari Weiss as editor-in-chief of CBS. The Free Press raised around $20m, including last fall at a $100m valuation, from backers like Allen & Co., Annox Capital, Centre Street Partners, Marc Andreessen, David Sacks, and Howard Schultz.

- Apollo is among the private equity firms in conversations with Paramount Skydance about potentially joining its bid to acquire Warner Bros. Discovery, per the NYPost

IPOs:

- Cerebras Systems, an AI chipmaker on file for an IPO, withdrew IPO registration. Last week, it raised $1.1b in Series G funding at an $8.1b valuation led by Fidelity and Atreides

Funds:

- Bain Capital, a Boston, Mass.-based private equity firm, raised $14 billion for its 14th fund focused on companies in the consumer, health care, industrials, services, and technology sectors.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.