Kalshi CEO Tarek Mansour, The Future of Prediction Markets

Raising $110M. Rise of Prediction Markets. Trade on Everything.

May the odds be ever in your favor.

I’m so excited to share our conversation with Tarek Mansour, Co-Founder & CEO of Kalshi, a regulated exchange & prediction market where you can trade on the outcome of real-world events (buy and sell event contracts). Kalshi has had a huge start to the year post-election from unlocking 10x new markets, adding 2M new users, launching new products, integrating with top brokers like Robinhood and Webull, and.. yes, welcoming Donald Trump Jr. as an advisor.

We dive into the excruciating journey of navigating regulatory hurdles (like the surprising decision to sue the government), how insider trading is not outright illegal in commodity derivatives, why sports is going to be huge, building Kalshi’s edgy brand, cultivating a passionate community in their ‘Ideas’ trading pit, and more.

→ Listen on Spotify, YouTube, Apple

Highlights

Kalshi’s rapid expansion from 100 to 1,000 markets

How Kalshi unlocked all 50 states for sports trading

The maddening three-year fight to create a new asset class

“We shouldn’t have sued the government”

Kalshi’s unhinged, ‘Ideas’ online trading pit & blog

The hype around prediction markets: Coinbase, Robinhood, Polymarket

Timestamps

00:40 Welcoming Donald Trump Jr. as an Advisor

05:15 Vision for Prediction Markets

15:27 Expanding into Sports and Entertainment

23:11 The Future of Prediction Markets

30:38 Institutional Demand and Market Potential

31:52 Gambling vs. Events-Based Markets

41:37 Insider Trading in Commodity Derivatives

43:38 Entrepreneurship vs. Wall St. Trading

47:30 Business Model and Revenue Streams

52:16 Shipping Fast AF This Year

Kalshi: Revolutionizing Prediction Markets

Founded in 2019 by Tarek Mansour and Luana Lopes Lara, both MIT graduates with experience at top tier financial firms like Goldman Sachs, Citadel, and Bridgewater Associates. Kalshi is a federally regulated exchange that allows users to trade on the outcomes of real-world events, offering a novel way to translate opinions and knowledge into financial opportunities.

Kalshi has raised around $110M to date from high-profile investors, including Sequoia Capital, Y Combinator, Charles Schwab, Henry Kravis, NEO, SV Angel, and more. The platform has emerged as the first CFTC-regulated event-driven market, creating a new asset class and bridging the gap between investing, hedging, and betting.

“If you're kind of broken, you got to be a founder..

Otherwise you'd be very itchy in life.”

What Does Kalshi Do?

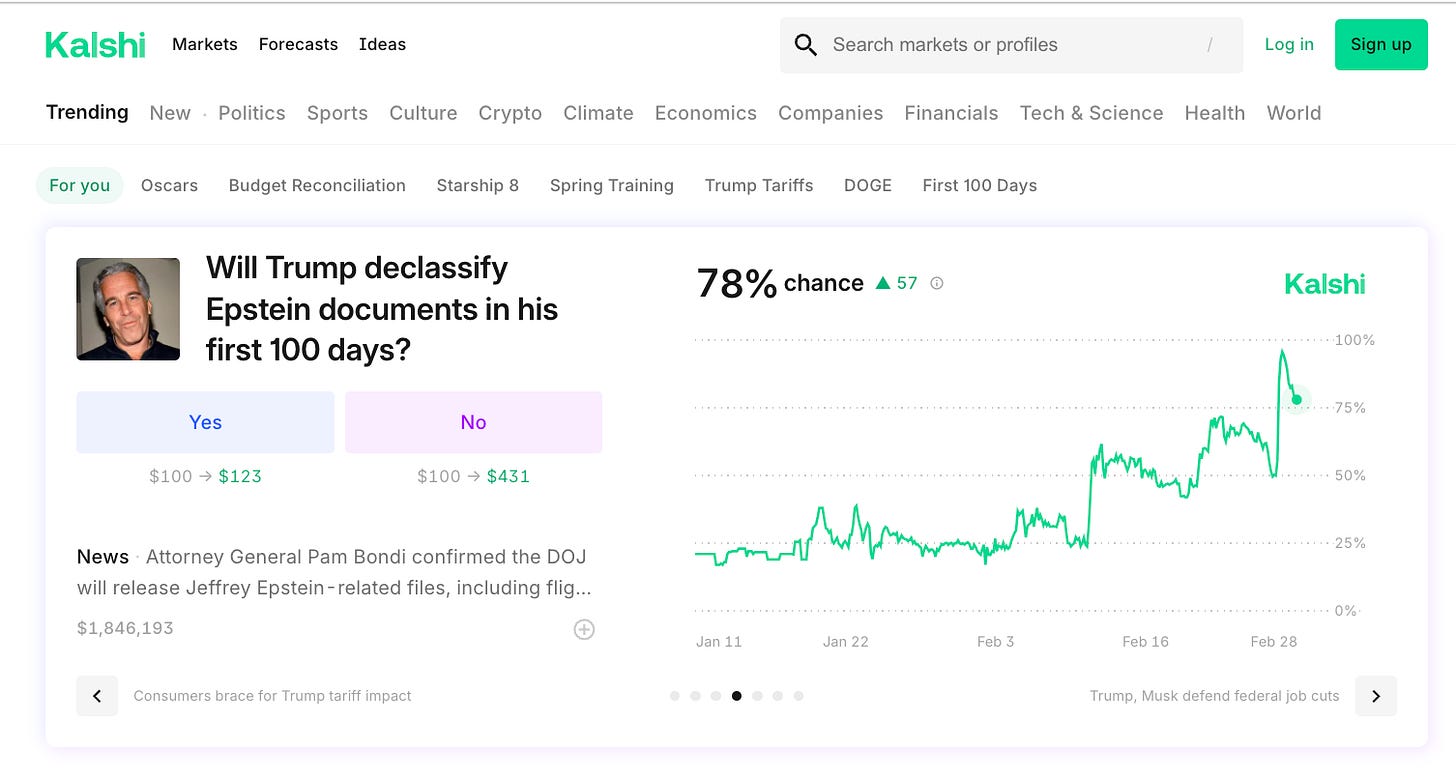

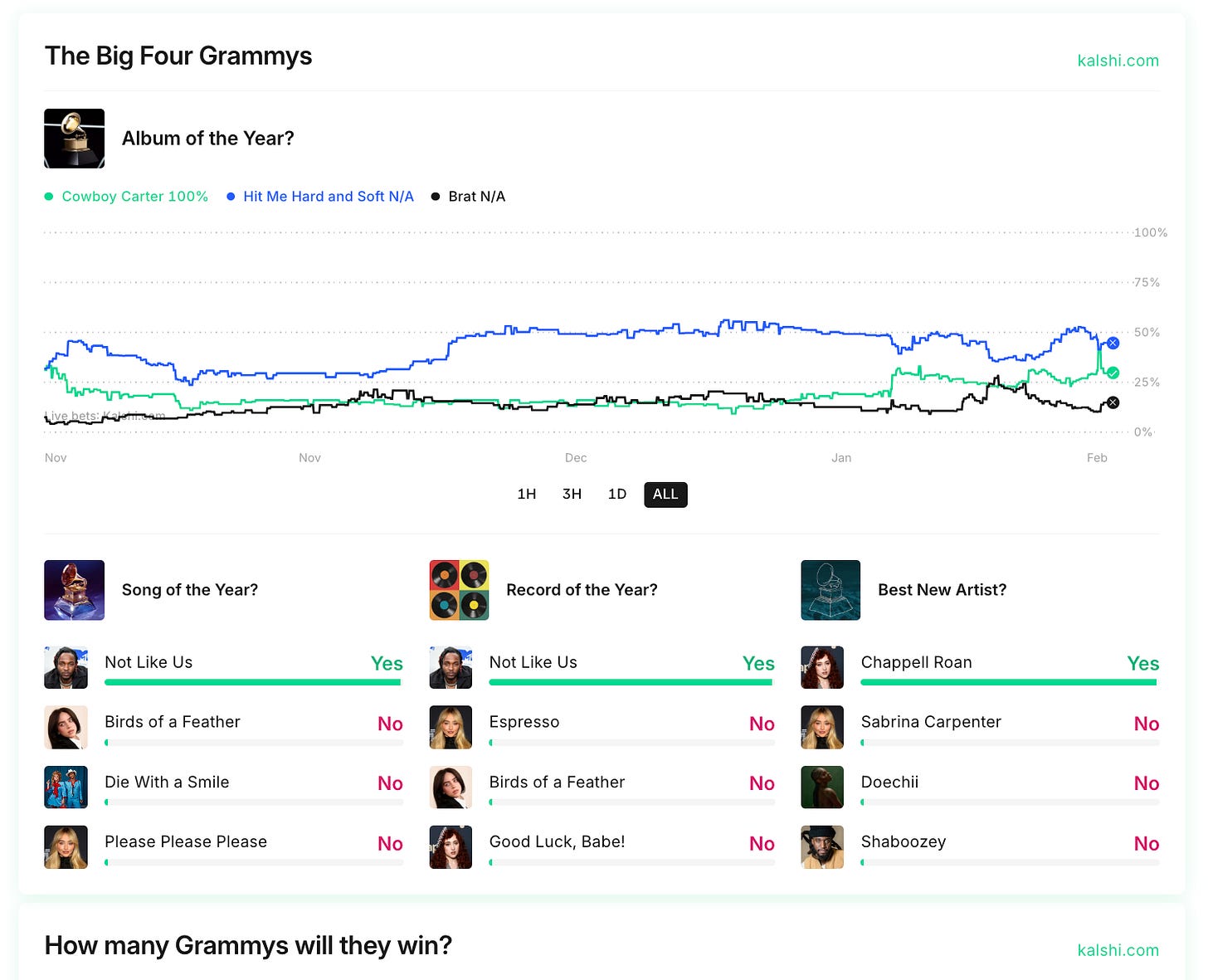

Kalshi’s platform enables users to trade on event contracts across categories such as politics, economics, sports, climate, entertainment (yes, you can trade on the Grammys), and public health. Each contract is structured as a yes-or-no question, such as "Will it rain in New York City tomorrow?" or "Will inflation exceed 5% this year?" Users can buy "yes" or "no" contracts depending on their predictions, and the contracts settle based on the actual outcome of the event. This product spans a wide range of categories, including:

Politics: Election outcomes and legislative decisions.

Sports: Super Bowl winners, player statistics, and game outcomes.

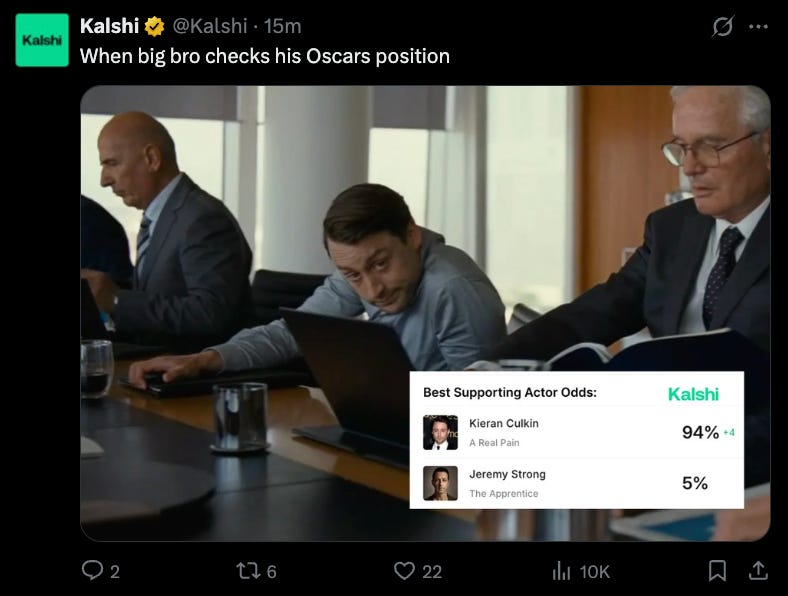

Entertainment: Oscar winners, Rotten Tomatoes scores, and top Spotify artists.

Financial Markets: Stock indices, crypto prices, and economic indicators.

Public Policy and Global Events: Climate measures, public health crises, and geopolitical events.

Unlike other prediction markets that operate in gray areas of regulation, Kalshi is fully compliant with U.S. federal law, thanks to its approval from the Commodity Futures Trading Commission (CFTC).

This regulatory milestone has allowed Kalshi to differentiate itself from competitors while reaching mainstream audiences. Kalshi aims to democratize financial markets by giving everyday people the ability to trade on events they understand and care about, such as elections, Super Bowl outcomes, or even the likelihood of a TikTok ban. Over time, Kalshi plans to rival traditional financial markets in size and impact, leveraging its innovative model.

Kalshi, Unleashed.

“What happened in like last fall is, we got unleashed. We won the lawsuit. So the universe of the set of things that we could do just got 10x. We had 100 markets back in September, we have 1,000 now. And I think that trend is going to keep going in that direction.

We got our clearinghouse, which people don't really know about, but now we own the whole thing end-to-end. We're the only tech-first entire exchange clearing ecosystem. We have the whole thing. We can list any financial market and so on.

It's like, okay.. now we have control of our destiny, so we can actually ship insanely fast.”

Recent Achievements

Game on: Kalshi brings 100% legal sports trading to all 50 states

Online Brokerage Webull Partners With Kalshi to Offer Event-Contract Wagers [Bloomberg]

[ 🔴 Live Trading ]

Watch the markets move in real time.