Klarna CEO Sebastian Siemiatkowski on Their Blockbuster IPO

$1 Billion Losses → Profit & IPO

Klarna’s Blockbuster Comeback

CEO Sebastian Siemiatkowski on AI, Leadership, & the Future of Banking

Klarna CEO Sebastian Siemiatkowski joins Sourcery on the eve of their IPO to share the ultimate redemption story. From sky-high VC valuations to $1 Billion losses in 2022 to becoming profitability in less than 3 years. Klarna’s business had an AI shot of ozempic.

→ Listen on X, Spotify, YouTube, Apple

Recorded at the NYSE, this might be one of the best Sourcery interviews to date. P.S. if you have an IPO coming up.. call me.

In this conversation, we cover how Klarna balances playful branding from pink logos, surreal fish ads, and Snoop Dogg collaborations, with serious technology that powers 111M users and global expansion. Sebastian addresses their misconceptions: Klarna isn’t just “buy now, pay later,” but a full challenger to the $1.2T U.S. credit card market.

He explains why Klarna’s business model protects them in recessions, how AI is transforming culture and efficiency, and what he gets out of coding himself at night with Cursor. A company equal parts meme factory and trillion-dollar contender, this was so much fun.

Special thank you to Filippa, Global Comms at Klarna for reaching out, Martin for the gorgeous photography, NYSE for the beautiful room, & Natalie from Sequoia :)

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

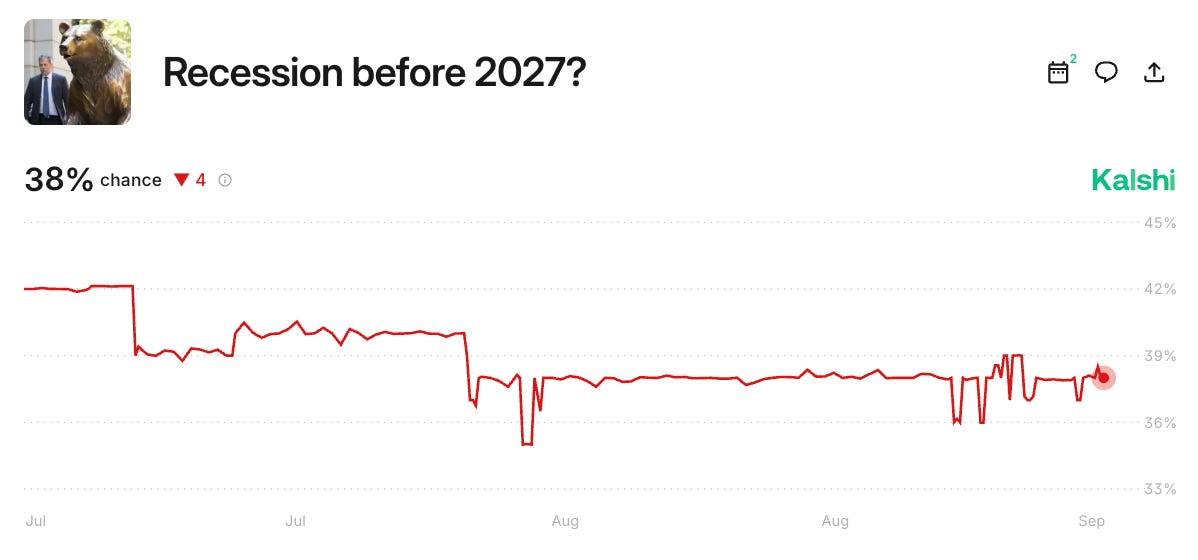

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Timestamps

(00:00) Klarna’s blockbuster comeback

(03:00) Early OpenAI partnership

(03:42) Blockbuster road trip & IPO symbol

(05:28) Can Klarna hit $1 Trillion?

(06:25) From $1B losses to profit

(09:05) Layoffs, investors & rebuilding

(11:23) AI adoption across the company

(12:47) Pitching Sam Altman & dinner at his house

(13:31) AI-first culture & employee experiments

(16:01) Breaking with legacy vendors to embrace nextgen tech

(21:13) Building an AI-driven team

(23:49) Sebastian vibe-coding with Cursor

(30:19) Why Klarna turned pink & “Smoooth” ads

(35:31) Snoop Dogg, Gaga & meme marketing

(43:09) Klarna vs. credit cards & recession resilience

The Redemption Story

From $1B Losses to Profitability & an IPO

Klarna’s redemption story could go down as one of fintech’s most historic. At the peak of the hype cycle, the company was valued at over $45B, and burning $100 million per month, to a massive turnaround in just 3 years thereafter. In 2024: Klarna hit $2.8B in revenue, $105B in GMV, $21M net profit. As Sebastian recalled:

“We were at a point where we were burning a hundred million dollars in investment every month… and then you’re like, okay, now we gotta shift this towards profitability.”

The path to profitability required restructuring, layoffs, and a complete rethink of how the company operated.

“Two years later we had turned to profit from minus a hundred million dollars a month to plus one or two million a month, which was… a pretty big swing.”

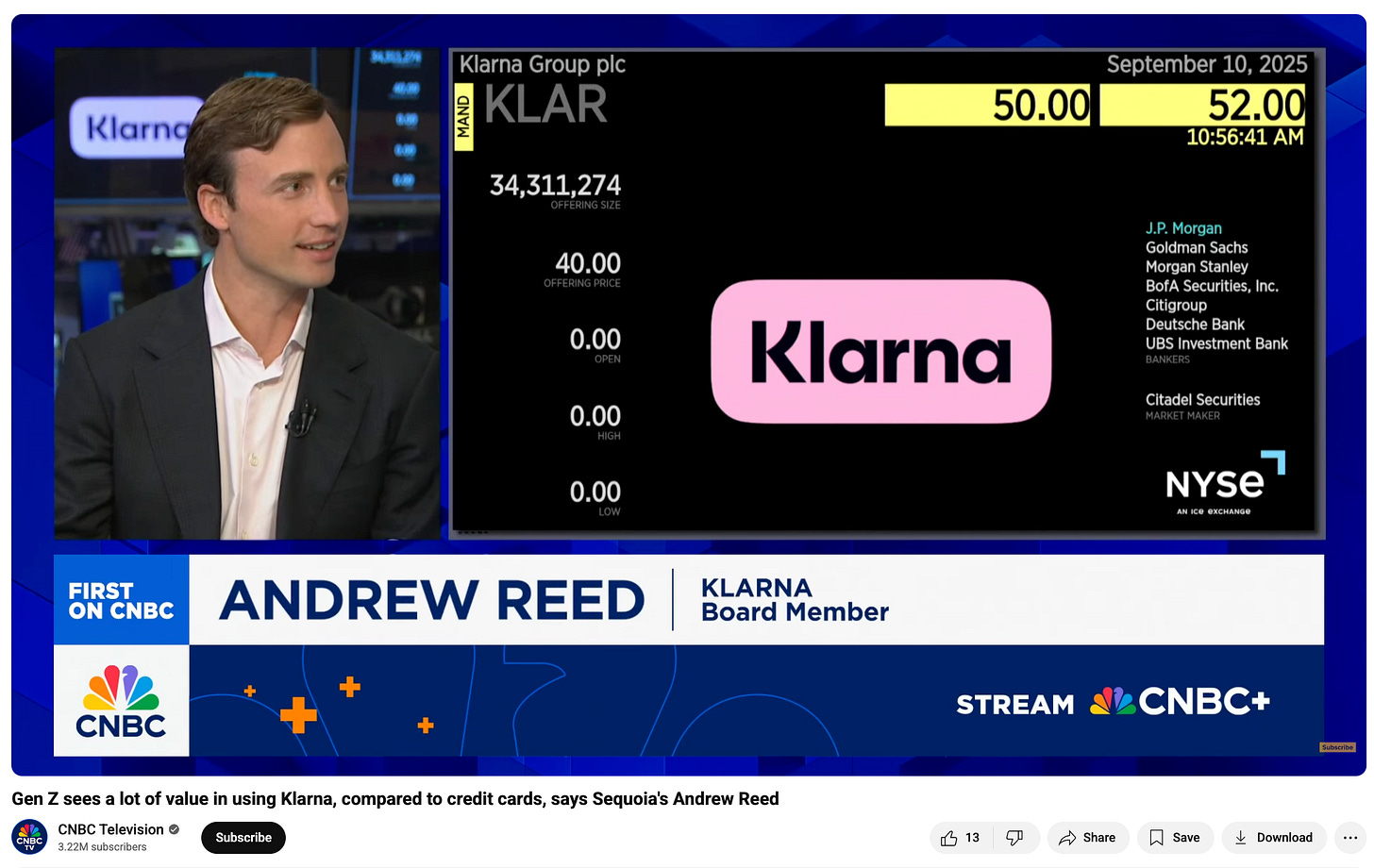

More than 20 times oversubscribed.

Shares of Klarna jumped 15% in their market debut after the Swedish fintech raised $1.37 billion in an initial public offering.

The shares opened at $52, above the IPO price of $40, and closed at $45.82 after the listing was "more than 20 times oversubscribed," according to Bloomberg. Wednesday’s trading gives Klarna a market valuation of over $17 billion.

Sebastian’s Iron Will

“When Sequoia first invested in Sebastian and Klarna, 15 or 16 years ago, the company was a fledgling upstart alternative payments company based in Sweden. And when we looked at our initial memos, the big diligence item was whether they might be able to find a modest amount of success in Germany or even the Netherlands.

So seeing them here today, with over 100 million consumers, 100 billion of GMV, 26 countries, and market leadership, it’s pretty extraordinary what the vision and iron will of someone like Sebastian can do.”

Klarna’s Market Debut Shows Wall Street’s Renewed Appetite for I.P.O.s - NYT

The company’s shares rose more than 14 percent on the first day of trading, a sign of the health of the public markets and a willingness of investors to bet on new companies.

A Hands-On CEO: Leadership in Crisis

Even as a busy CEO, Sebastian doesn’t shy away from getting his hands dirty. He stepped into Klarna’s marketing department himself, started coding with AI tools at night, and took charge to fly all the way to San Francisco from Sweden to be one of the first companies to pitch OpenAI’s Sam Altman when ChatGPT broke through.

“At that point in time, the CMO left, and I was like, okay, I’ll do the job myself. I’m gonna be both CEO and CMO for a period of time.”

On learning to code with AI tools like Cursor, he joked:

“I’ve been vibe coding my whole life. The only difference is now I’m sitting with a computer and I’m doing it with AI… and it’s coming back with a prototype in 20 minutes.”

This hands-on style helped rebuild trust with employees and investors, showing he was willing to do more than just the typical load of work.

Betting on OpenAI Early

Klarna leaned into AI faster than most financial institutions. Sebastian was one of the first CEOs to approach OpenAI directly.. and no, he isn’t related to Sam Altman, phewf.

“I gave Sam this 30-minute speech of why Klarna was the right person to work with for adopting AI… and I said, look, we wanna be your favorite guinea pig.”

Knowing how impactful AI was going to be for the turnaround of the organization, he gave his employees agency to find use cases & opportunities, encouraging them to experiment & have a little fun with it.. ultimately creating an earnings clone (see below).

“We said to all of our employees: please try this, please experiment with this and come back and show us where you’re seeing that it’s creating value.”

That shift not only accelerated adoption but also reshaped Klarna’s culture, embedding AI into workflows from customer service to internal HR tools.

The Power of Playful Branding

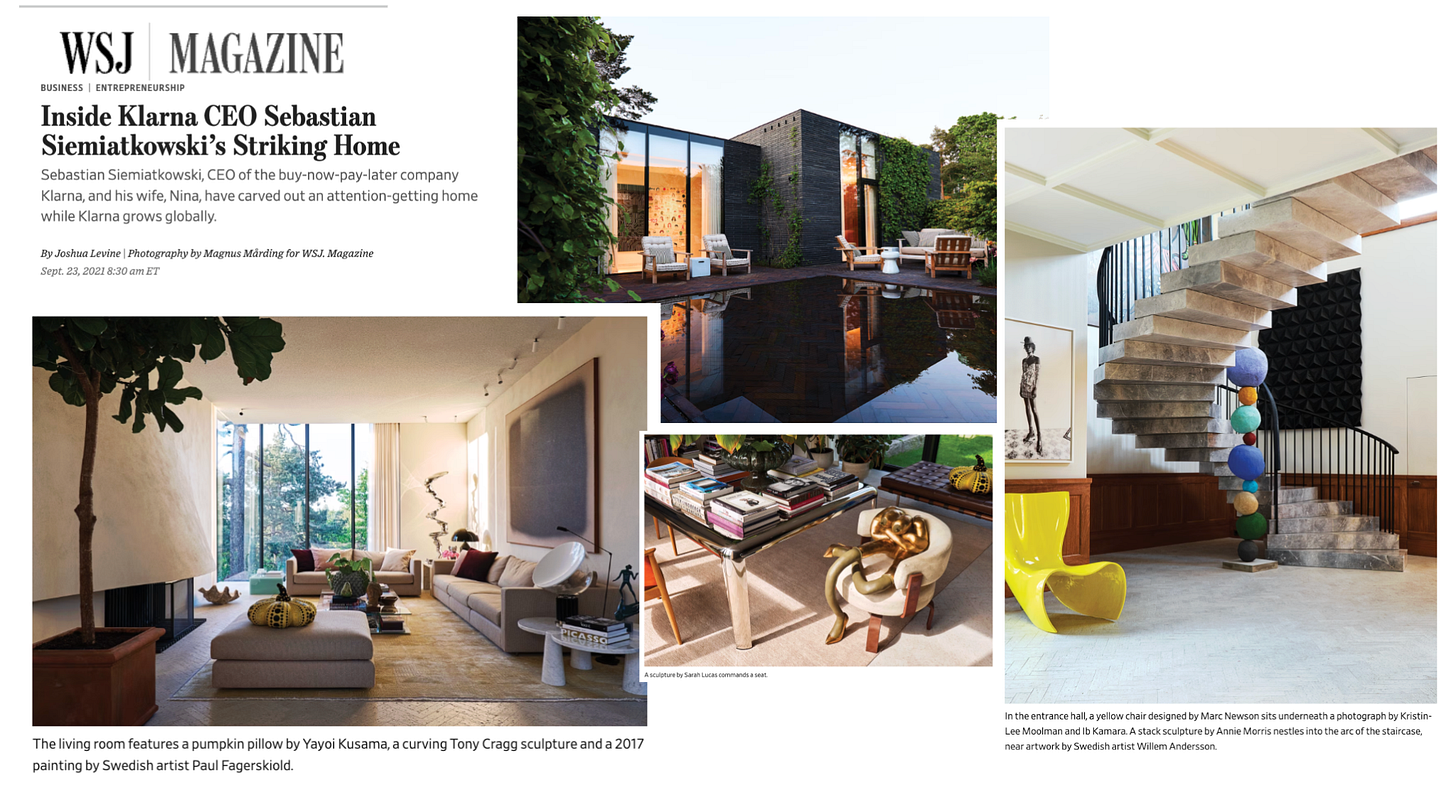

Klarna’s visual identity, the bold pink branding, surreal ads, and playful tone, is now one of the most recognizable in fintech. But the shift didn’t come from an agency brief or a top-down corporate decision. It began at home, with CEO Sebastian Siemiatkowski’s wife, Nina.

In the early years, Klarna looked like any other fintech: muted blues, standard logos, and a corporate veneer. Nina, who grew up immersed in fashion and aesthetics, wasn’t impressed.

“At that point in time, Klarna was blue… Nina would tell me, you need a brand. And I was like, what do you mean? We have a logotype. What are you talking about?”

Her insistence set Klarna on a different path. Nina brought her background in design and retail, she had worked in a Stockholm boutique that carried global luxury labels and later pursued photography, into Klarna’s conversations about the brand. While agencies dismissed the idea of making a payments company exciting, Sebastian invited Nina to advise informally.

“She came in, she didn’t get paid for it. But she said, let’s go and find and let’s do the best… we really wanted to do something different.”

The result was a complete rebrand: Klarna turned pink, embraced a playful tone, and launched campaigns that stood out in an industry built on seriousness and marble lobbies. The most iconic was the “smoooth” fish commercial, a surreal, ASMR-inspired ad that made a bank product feel like pop culture.

“We were just like, this is the most ridiculous thing we have ever heard… but there’s something amazing about it.

Smooth is nice, it’s friendly, it has a lot of fun to it.”

The bet paid off. From there, David Sandstrom took over as Chief Marketing Officer in 2017 and scaled that creative edge into a global strategy. Under his leadership, Klarna became a cultural brand as much as a financial one, securing partnerships with Lady Gaga, Snoop Dogg, A$AP Rocky, and Shaquille O’Neal, and positioning Klarna as the U.S. market leader.

“We convinced Snoop Dogg to change names and call himself Smooth Dogg… he’s even a shareholder in the company.”

More recently, Sandstrom has built the world’s first AI-powered marketing ecosystem, saving $10 million annually while massively increasing creative output. Managing a team of 800+ across brand, communications, design, and growth, he extended the playful, aesthetic DNA Nina and Sebastian sparked into a full-scale, AI-powered marketing machine.

This playful side, Sebastian argued, builds more trust with younger generations than the “marble offices and suits” of legacy banks.

“If you want to talk to young people about your economy, do you think that guy in the suit is gonna make it work? Or Snoop Dogg, who do you think they’re gonna listen to?”

Klarna’s rebrand, or as Packy McCormick calls it “Great Differentiation,” turned a payments company not only into a cultural brand, but a movement.

P.S. the Siemiatkowski’s really have exceptional taste.. especially in art.

Breaking Misconceptions

For years, Klarna has been pigeonholed as a “BNPL company.” Sebastian pushed back strongly:

“We didn’t launch with DoorDash to finance burritos. It’s really funny, but that’s unfortunately not the case.”

Instead, Klarna is aiming squarely at the U.S. credit card market, a $1.2 trillion industry.

“It’s a market ripe for disruption. Tons of excess profit, not so happy customers, low customer mobility…

everything [at Klarna] is set up for coming in & creating something better, newer, friendlier, more customer focused.”

Why Klarna Won’t Break in a Recession

With Americans holding $1.2 trillion in credit card debt and the odds of a recession debated daily, Sebastian argued Klarna’s model makes it more resilient than traditional banks:

“If you are a bank and you have that outstanding credit card debt, and you walk into a recession, you can’t just get out of it… With Klarna, we can adjust underwriting quickly. That flexibility makes us better prepared.”

A huge opportunity to disrupt credit card industry in the U.S.

“I think what's underreported a little bit is that when inflation increased & people actually spent the same amount of dollar values, but they get fewer products for it. And that's why you've seen the revenue of the companies reporting at similar levels. But actually if you look at the number of goods, it's fewer, right. So people just get less for their money.

Credit quality, I mean, we have a very different type of credit, right? Because our credit is just outstanding 40 days compared to a credit card. And that means that if we change our underwriting in just 40, 50 days, half of our balance sheet is underwriting by the new standards.

That's very different to a bank that has to heal their balance sheet for years if you go into a recession. So we have a fantastic opportunity to adapt to a recession and in a fashion that regular banks cannot.”

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

What’s Next?

Klarna’s story is a blueprint for how to combine tough leadership, early AI adoption, bold branding, and structural resilience into a modern financial institution.

Today Klarna already covers 13.4 million products. On the podcast, I joked with Sebastian about where this could go next.. from expanding cuisines outside of burritos to concert tickets and college tuition to stocks, homes, even acquiring companies (like the very hot $500B OpenAI.. now’s the right time to buy).

We laughed, because, well, student loans, shorting stocks, buying mortgages, and M&A already exist.. and Klarna already finances $15K Taylor Swift tickets with Ticketmaster. But hey. There might actually be an opportunity with housing.

If Klarna can make everyday purchases smoother, cheaper, and fairer than a credit card, what’s to stop them from disrupting categories that feel outdated, expensive, or unnecessarily complex? Not just competing with cards, but reframing how people think about credit altogether.

“We’re fighting credit with credit. We’re fighting fire with fire. And it’s a much healthier form of credit.”

Klarna is proving that a payments company can grow into a digital bank people actually trust - and that trust, paired with technology, can scale a lot further than Wall Street gives it credit for.

Want more of Klarna?

Klarna's CEO Loves Walmart, Vibe Coding With Cursor, And 'Succession' Drama

Upstarts interviewed Klarna co-founder Sebastian Siemiatkowski at NYSE during its drama-free IPO week to talk his visit to Sam Walton's grave, stablecoin adoption, his own Cursor use and much more.

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Spend smarter. Move faster. Sourcery subscribers get: 75,000 points after spending $3,000 on Brex card(s). Plus, white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, and access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery