Sourcery (1/30/2020)

Future of Living Well

Deals of the day

Sources: TS, Pro Rata, FinSMEs

Policygenius, a New York-based online marketplace for comparing and purchasing insurance, raised $100 million in Series D funding. KKR led the round, and was joined by investors including Norwest Venture Partners, Revolution Ventures, Susa Ventures, AXA Venture Partners, MassMutual Ventures and Transamerica Ventures.

Attentive, a Portugal-based developer of sales assistant software that allows users to create deals, check their status, and create tasks, raised $70 million in Series C funding. Sequoia and IVP co-led the round, and was joined by investors including Eniac Ventures and NextView Ventures.

Gabi, a San Francisco-based startup that monitors insurance rates from various carriers and provides users with pricing information on home and auto insurance, raised $27 million in Series B funding. Mubadala Capital led the round, and was joined by investors including Canvas.

Forma, a San Francisco-based computer vision company enabling the creation of photorealistic digital avatars from regular photos, raised $7 million in seed funding. Founders Fund led the round, and was joined by GSR Ventures.

HeyMama, a New York-based social network for working moms, raised $2 million in seed funding. Investors include Rebecca Minkoff, Kori Estrada, Kathryn Moos, Janna Meyrowitz Turner, Divya Gugnani, Alison Wyatt, Sari Azout, Kymberly Marciano and Karen Cahn.

Concentric, a San Jose, Calif.-based cybersecurity startup focused on protecting enterprise data, raised $7.5 million from Clear Ventures, Engineering Capital, Homebrew, and Core Ventures. www.concentric.ai

CloudTrucks, a “business in a box” startup for small trucking companies, raised $6.1 million. Craft Ventures led, and was joined by Khosla Ventures, Kindred Ventures, and Abstract Ventures. www.cloudtrucks.com

Masters of Pie, a 7.5-year-old, London-based VR/AR enterprise software company, has raised $4.7 million led by Foresight Williams, with participation from Bosch Ventures and Downing Ventures. More here.

Axle, a NYC-based financial partner for modern freight brokers, raised $1.4m in pre-seed funding (read here)

Haus, a Sonoma County, CA-based spirits brand, raised $4.5m in seed funding round (read here)

Exits:

Barstool Sports, the sports and pop culture blog founded in 2003, is selling a 36 percent stake in its business to publicly traded Penn National Gaming for $163 million ($135 million in cash and $28 million in nonvoting convertible preferred stock). Penn National's check will get it exclusive rights to use the Barstool brand in its sports-betting products. The deal values Barstool at $450 million. More here.

Funds:

Circulate Capital, a Singapore-based investment management firm dedicated to incubating and financing companies and infrastructure that prevent ocean plastic in South and Southeast Asia (SSEA), held the first close of the US$106m Circulate Capital Ocean Fund (read here)

Kleiner Perkins is in market with its 19th early-stage fund, just one year after raising $600 million for Fund XVIII, per TechCrunch. http://axios.link/IIHV

Intermediate Capital Group raised $2.4 billion for its third fund focused on GP-led private equity secondary transactions. www.icgam.com

Ribbit Capital, a Palo Alto-based VC firm focused on fintech, is raising $420 million for its sixth flagship fund, per an SEC filing. It's also raising $500 million for something it called "Bullfrog Capital."

. . .

Sources: MorningBrew, Axios

Axios' Joann Muller writes:Tesla earned $105 million in net profit in the fourth quarter, ending the year on a positive note and declaring 2019 a turning point for the volatile electric car company.

Details: Record 2019 deliveries helped drive revenues up 19% over the prior quarter, but profit margins fell because Tesla sold more of the lower-priced Model 3. Shares jumped in after-hours trading.

Why it matters: The results reflect a string of positive news at Tesla, including the recent launch of its Chinese factory.

What to watch: Tesla said it has started to ramp production of its next vehicle, the Model Y compact SUV, this month.

Here are a couple highlights of Tesla's investor call with CEO Elon Musk and CFO Zach Kirkhorn:

Tesla's annualized production rate at its Fremont, California, factory was just over 415,000 units in the fourth quarter, about the same as the 2006 peak under GM and Toyota ownership. And it expects to "significantly increase" production with the launch of Model Y, starting this month.

Demand for Tesla's Cybertruck pickup is "far more than we could reasonably make in the span of three or four years."

Beyond Meat's stock price fell by 4.3% on Wednesday after Canadian fast food giant Tim Hortons announced it was pulling Beyond burgers from its menu.

Why it matters: Beyond Meat was one of 2019's biggest success stories — at its peak the stock rose 840% from its IPO price.

Tim Hortons is less popular in the U.S., but a powerhouse in Canada and the top asset for fast food giant Restaurant Brands International, which also owns Burger King and Popeyes.

What they're saying: "Ultimately, the product was not embraced by our guests as we thought it would be," Tim Hortons said in a statement. "We may offer plant-based alternatives again in the future, but we have removed it from the menu for now.”

Yes, but: Beyond Meat's stock is still up by around 50% year to date and well above its $25 IPO price, even though it has fallen significantly from earlier highs.

Between the lines: The announcement came just two weeks after Beyond announced its Beyond D-O-Double-G breakfast sandwich collaboration with Snoop Dogg for Dunkin.

It offers a "classic Snoop twist on a plant-based hit."

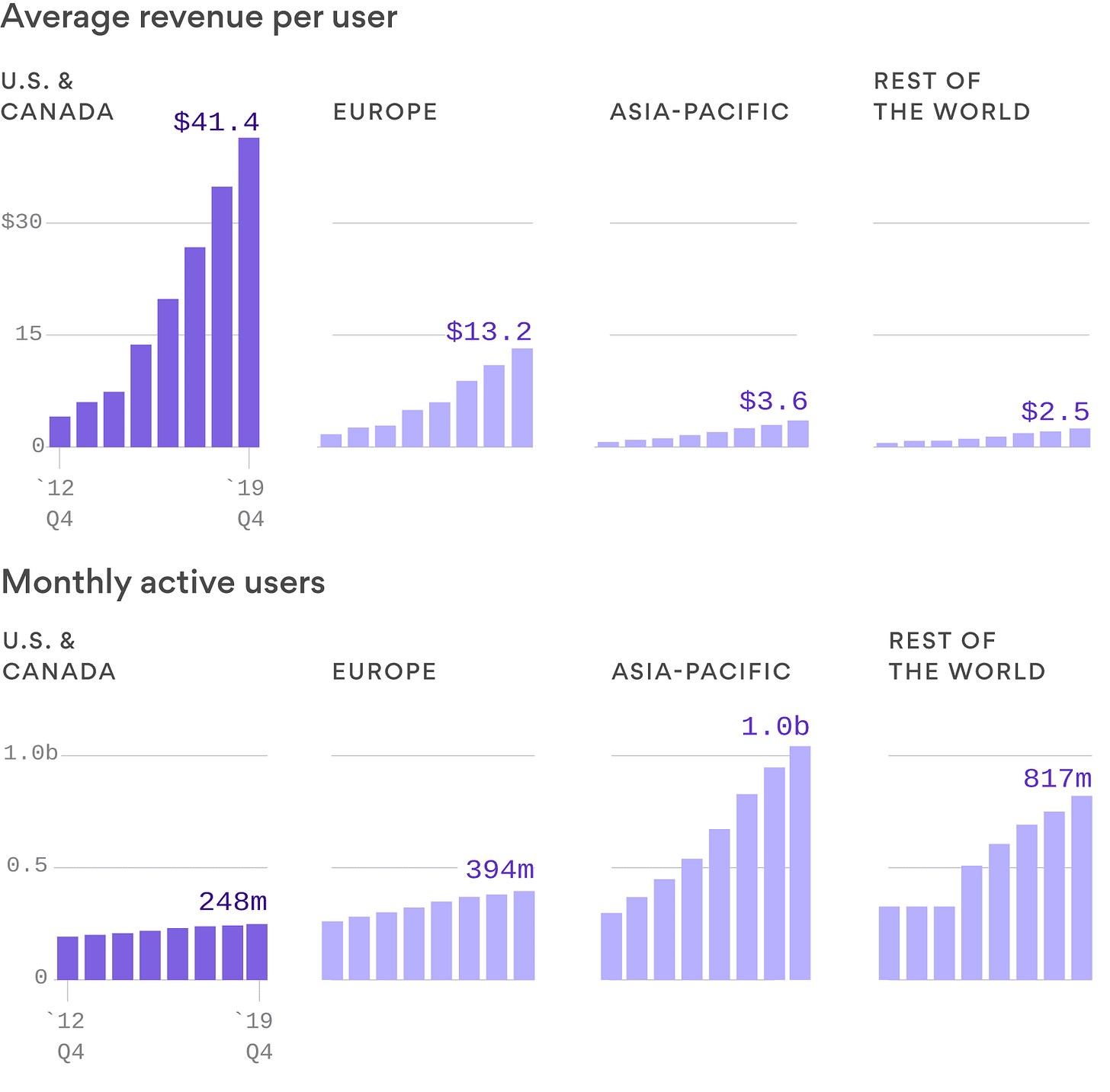

Despite an onslaught of scrutiny and scandal over the past few years, Facebook closed out the second decade of the millennium stronger than ever, Axios' Sara Fischer reports.

The tech giant brought in nearly $70 billion in revenue for 2019, up more than 25% from the year before — and up more than 1,300% from 2012, the year it went public.

For the past several quarters, Facebook has warned investors that it expects revenue headwinds in light of increased regulatory scrutiny, particularly around privacy and targeted advertising.

Why it matters: Facebook's continued ability to post double-digit revenue growth every year shows how well it has been able to innovate and adapt.

Case in point: Even in regions like North America and Europe, where the company's user growth has plateaued and privacy regulation has been introduced, Facebook has still managed to squeeze significantly more money out of each user every year.

In the U.S. and Canada, Facebook has increased its user base by less than 4% in the past two years — but it has increased its revenue per user there by more than 60%.

The bottom line: Facebook recognizes that there's a gulf between its prodigious growth and its beleaguered reputation. On an investor call following Facebook's earnings report Wednesday, CEO Mark Zuckerberg said:

We're focused on communicating more clearly about what we stand for. One critique of our approach for much of the last decade is that because we wanted to be liked, we didn't want to communicate our views as clearly, because we worried about offending people. ... Our goal for the next decade isn't to be liked, but understood. In order to be trusted, people need to know what we stand for.

U.S. Life Expectancy Rises Slightly. On average, an infant born in 2018 is expected to live about 78 years and 8 months, the CDC says in a report out today.

That's up 1 month from the year before — the first time in four years that U.S. life expectancy has risen, AP reports.

Women still live longer: For males, it's about 76 years and 2 months. For females, 81 years and 1 month.

Why it matters: The rise is due to lower death rates for cancer and drug overdoses.

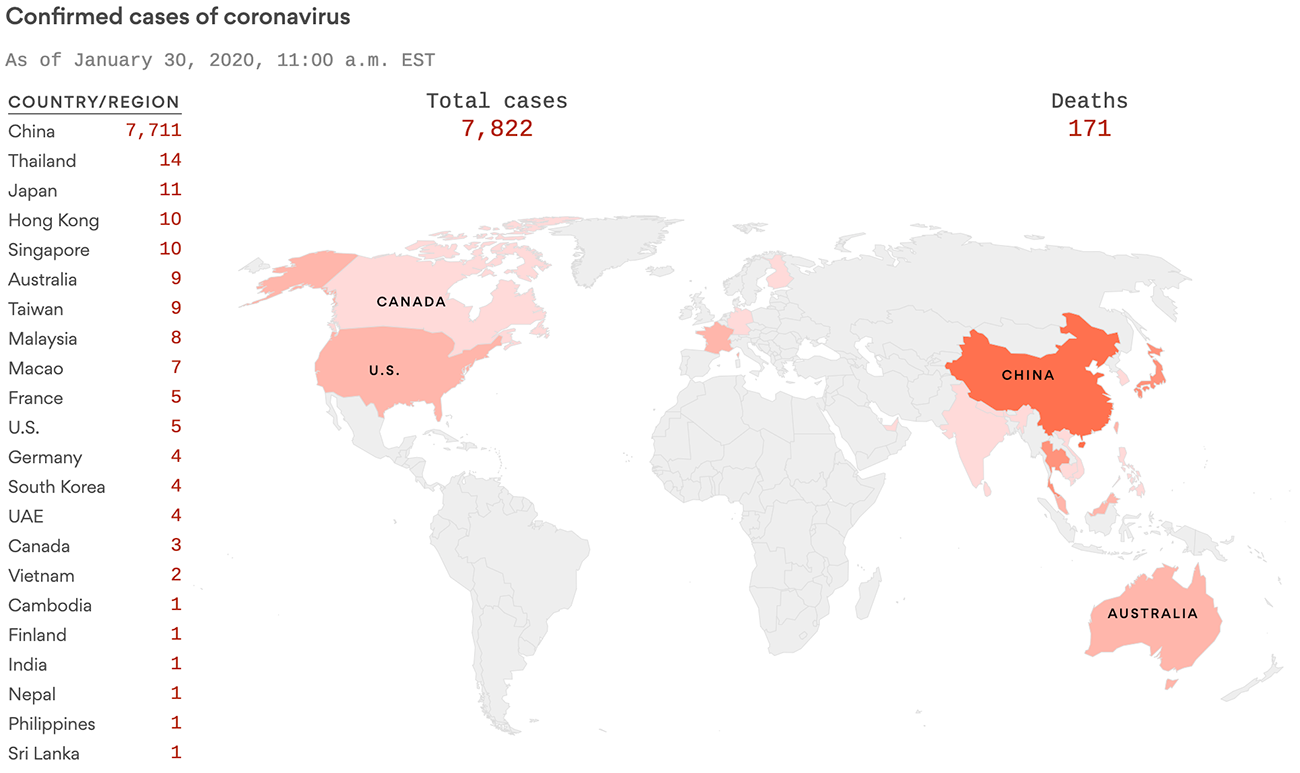

Data: The Center for Systems Science and Engineering at Johns Hopkins, the CDC and the Chinese health ministry; Map: Danielle Alberti/Axios

Public health experts say U.S. should be preparing for the worst as the Chinese coronavirus spreads, Axios' Sam Baker writes.

One big lesson from the Ebola crisis ... "They need to put someone at the White House in charge," Ron Klain, who served as then-President Obama's "Ebola czar," said this week on Axios' Pro Rata podcast.

Containing and combating a viral outbreak involves border patrol and national security officials; public health agencies at the federal, state and local levels; public and private vaccine researchers; and coordinating with individual hospitals.

Monetizing Carbon Offsets. You emit carbon. Everybody does. The houses we live in, the food we eat, the goods and services we consume — all of them have a carbon footprint. While it's possible and desirable to minimize that footprint, it's impossible to eradicate it altogether. So it's impossible for a company to really be "carbon-negative."

Driving the news: Microsoft has pledged to be carbon-negative by 2030, but the promise assumes the invention of carbon-removal technology that doesn't yet exist. For the time being, every institution claiming to be "carbon-neutral" is doing so by paying money to "offset" their emissions.

Venture capital has taken notice, with Union Square Ventures recently investing in Wren, a for-profit carbon-offsets intermediary.

How it works: Instead of making a tax-deductible donation to the Rainforest Foundation, Americans can use post-tax money to buy carbon offsets from Wren. Wren will then keep 20% of that money for itself, and give the rest to the Rainforest Foundation, or to similar projects.

Reality check: Carbon offsets are predicated on the idea that thanks to your money, the world will emit measurably less carbon than it would had you not spent that money. In reality, it's very hard to make that case, and carbon offsets often seem like little more than a way to assuage guilt, or to provide PR value.

Go deeper: Last year, ProPublica had a fantastic investigation on "why carbon credits for forest preservation may be worse than nothing." It's well worth reading before you give any money to organizations like Wren.

The economic consequences of medical decisions can be enormous. One of the most financially momentous medical decisions that any doctor can make is to deny a woman an abortion.

A new NBER report looks at the difference in financial outcomes between women who narrowly qualified for abortions and those who narrowly didn't. The report finds "a large and persistent increase in financial distress" for the latter group.

Why it matters: It's estimated that roughly one out of every four American womenwill have an abortion during her reproductive years, but the procedure remains largely taboo.

A separate report from Rhia Ventures reveals just how much ignorance around the subject reigns:

69% of women with health insurance currently do not know whether their coverage includes abortion.

Only 37% of benefits managers and human resource leaders interviewed for the Rhia report knew if their health plans covered abortion.

By the numbers: Women in the NBER study who were turned away from having an abortion were 81% more likely than their abortion-receiving counterparts to be evicted or declared bankrupt.

Of note: The NBER report was based on 1,000 women seeking abortions at 30 clinics in 21 states. Rhia based its research on different sources, including interviewing managers at 39 companies.

. . .

Keith Rabois of Founders Fund has said in the past that he wants half of his VC friends to laugh at an investment he makes, highlighting his interest in contrarian bets. I asked during yesterday's on-stage interview at Upfront Summit if he also wants half of his partners to laugh, to which he replied, "No. Maybe 25% of them."

Josh Kopelman of First Round Capital said in a separate Upfront Summit interview that his firm has looked at data for every company it's ever funded, and learned that the time from first email to term sheet has shrunk from an average of 90 days in 2014 to an average of nine days.

This sparked a lot of Twitter conversation, which you can read here, and a founder-focused analysis from fellow venture capitalist Fred Wilson.

. . .

More headlines…

Sources: MorningBrew, Bloomberg, Cambridge Associates

Venture Capital Positively Disrupts Intergenerational Investing

Boeing posted its first annual loss in over two decades. Costs from the 737 Max crisis have topped $18 billion.

GE stock jumped over 10% to a 15-month high after the company reported lots of progress on free cash flow last quarter.

UPS said it'll order 10,000 electric delivery trucks from Arrival, a U.K.-based startup, and test self-driving minivans with Alphabet subsidiary Waymo.

Airlines across the globe, including United Airlines, British Airways, and Lufthansa, suspended flights to China due to the coronavirus outbreak.

“Desperate For Profits, Lyft Announces Layoffs"