Perplexity's Numbers Leaked

Monaco, Rippling, Stord, Harvey AI, Carta's Q1 '25 Report

Today’s Sourcery is brought to you by Brex..

Brex is the modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel. Over 30,000 companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, and Wiz, use Brex to spend smarter and move faster.

As a Sourcery subscriber, you can unlock up to $500 toward Brex travel or $300 in cash back (plus exclusive perks). Start today at brex.com/sourcery

Hello from Strike Capital’s Monaco AGM

The world tour continues. This past weekend I had the pleasure of joining Strike Capital’s Annual General Meeting in Monaco. They made recent headlines for leading Stord’s $200M Mega Series E at a $1.5B valuation, with participation from Baillie Gifford, NewView Capital, G Squared, & insiders Kleiner Perkins, Franklin Templeton, Founders Fund, Bond, & Lux Capital.

Strike’s been flying a bit under the radar but running hard executing a high-conviction, multi-stage strategy—investing in early-stage to growth-stage breakouts. While others chase momentum, Strike is building durable positions in real businesses across vertical AI, SaaS, & tech-enabled sectors. A firm to watch closely.

Shout out to John, Louis, Jamal, Bruno, John, Cam, & Rohan!

Mega Deals & M&A

This week’s private market activity featured a mix of mega-deals and thematic alignment with key Q1 2025 trends highlighted in Carta’s State of Private Markets report. Despite a broader decline in deal counts, investor appetite for concentration in standout companies remains intense (aligning with our recent convo w/ Erik from Altimeter—below).

In fintech, Rippling led the way with a massive $450M round backed by Elad Gil and GIC, while Addepar followed with $230M at a $3.25B valuation. Other notable fintech rounds included Stash ($146M), Bestow ($120M), and Samaya AI ($43.5M).

In healthcare, Akido Labs and Sprinter Health raised $60M and $55M, respectively, highlighting growing interest in tech-enabled care delivery.

The AI boom continued with Harvey reportedly in talks for raising $250M at a $5B valuation, and quantum software firm Classiq securing $110M.

In hardtech, Commonwealth Fusion closed a blockbuster $1B+ Series B2, and X-Bow brought in $105M to scale rocket motor production. Sustainability saw smaller, focused rounds, like EventWood’s $15M and veritree’s $6.5M.

On the M&A front, Databricks made headlines by acquiring Neon for $1B, and Church & Dwight bought Touchland for up to $880M. Which ties into Carta’s note that Q1 2025 was the busiest M&A quarter since 2019, as investors hunt for liquidity amid a sluggish IPO market.

Musings

Macro

State of Private Markets: Q1 2025 | Carta

Competition among VCs for top deals is pushing up pre-money valuations, despite a decline in overall deal volume.

Lower dilution at every stage: Median dilution in new funding rounds has declined over the past year at every stage from seed through Series D. The median Series A round in Q1, for instance, involved 17.9% dilution, down from 20.9% just a year earlier.

Fewer deals, fewer dollars at seed: Startups on Carta combined to raise just 401 new seed rounds in Q1, down 28% year over year. And those seed rounds combined to bring in just $1.2 billion, a 37% year-over-year reduction.

Longer waits at Series B: The median company that raised a Series B round in Q1 2025 had waited 2.8 years since their Series A, the longest median interval on record. With fewer rounds taking place, companies must make the most of their existing runway.

M&A Strengthens: Startups on Carta were the target of 180 M&A transactions during Q1 2025. That’s the highest quarterly figure since the start of 2019, narrowly outpacing the 179 deals that took place in Q1 2022.

All of Jeff Bezos’s Shareholder Letters | Founders

Tech Acquisitions Are Back On** The AI dealmaking landscape | Newcomer

Deel wants Rippling to hand over any agreements involving paying the alleged spy | TechCrunch

AI

Sundar Pichai, CEO of Alphabet: Will AI kill search? | The All-In Interview

Google Challenger Perplexity, Growth Comes at a High Cost | The Information

“Perplexity had just under 260,000 paying consumer subscribers at year-end, although many users don’t pay. The company generated $34 million in revenue, including sales from business customers.”

Perplexity AI in talks for $500M funding round at $14B valuation

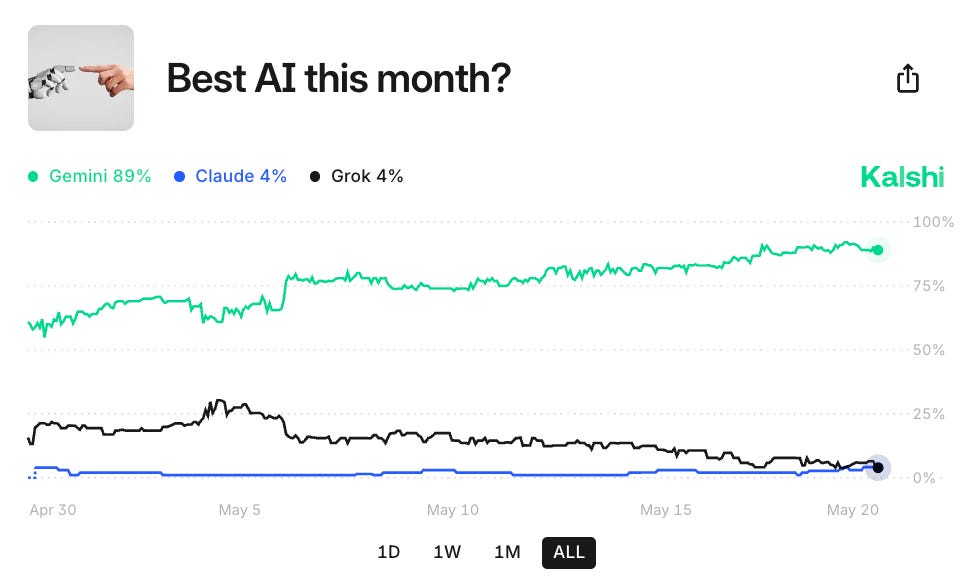

Surprisingly, Gemini is taking the lead on Kalshi for best AI this month, meanwhile Altimeter’s Erik Kriessmann has other thoughts..

→ Join our Private Sourcery dinners → sign up here

Top Interviews

How Altimeter Is Investing $100M+ Checks | Anduril, SpaceX, K2 Space

Erik Kriessmann, Partner at Altimeter

How Autopilot Hit $500M AUM, $2B in volume, 9M trades, & $6B in connected assets

Kleiner Perkins $10B+ AUM & The Rise of AI: Windsurf, Scale AI, ARR BS | Leigh Marie Braswell, Partner at KP

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (5/12-5/16):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Rippling, a San Francisco-based workforce management system, raised $450 million from Elad Gil, Sands Capital, GIC, Growth Equity at Goldman Sachs Alternatives, Baillie Gifford, Y Combinator, and existing investors.

- Addepar, a Mountain View, Calif., provider of wealth management software for RIAs, raised $230m in Series G funding at a $3.25b valuation. Vitruvian Partners and insider WestCap co-led, joined by EDBI, 8VC, and Valor Equity Partners

- Stash, a New York City-based saving and investing platform, raised $146 million in Series H funding. Goodwater Capital led the round and was joined by existing investors Union Square Ventures, StepStone Group, Serengeti, and others.

- Bestow, a Dallas-based life insurance technology company, raised $120 million in Series D funding. Growth Equity at Goldman Sachs Alternatives and Smith Point Capital led the round and were joined by Decades Holdings and AllianceBernstein.

- Samaya AI, a Mountain View, Calif.-based financial services AI platform, raised $43.5 million in funding. New Enterprise Associates led the round and was joined by Eric Schmidt, Yann LeCun, David Siegel, Marty Chavez, and others.

- FlexPoint, a New York City-based payments platform for managed service providers, raised $12 million in Series A funding. Foundry Group led the round and was joined by existing investors Haymaker Ventures, Garuda Ventures, Techstars, and others.

- Celery, a Tel Aviv-based AI-powered financial review platform, raised $6.3 million in seed funding. Team8 led the round and was joined by Verissimo Ventures, Centre Street Partners, 97212 Ventures, and angel investors.

- MarvelX, an Amsterdam-based AI-powered insurance platform, raised $6 million in seed funding. EQT Ventures led the round and was joined by angel investors.

- Haast, a Sydney, Australia-based AI-powered compliance platform, raised $6 million in seed funding. AirTree led the round and was joined by Defy.vc, Aura Ventures, and Black Sheep Capital.

- Nirvana Labs, an Indianapolis-based bare metal cloud for web3, raised $6 million in a seed extension. Crucible Capital and Jump Crypto led the round and were joined by RW3 Ventures, Castle Island, and Hash3.

Care:

- Akido Labs, a Los Angeles-based AI-powered healthcare company, raised $60 million in Series B funding. Oak HC/FT led the round and was joined by Greco, SNR, and existing investors Y Combinator, Future Communities Capital, Jeff Dean, and the Comprehensive Blood & Cancer Center.

- Sprinter Health, a Menlo Park, Calif.-based provider of at-home health services, raised $55m in Series B funding. General Catalyst led, joined by a16z, UC Regents, GV, and Accel.

- Wonderskin, a London-based beauty company, raised $50 million in Series A funding from Insight Partners.

- Clarium, a New York City-based hospital supply chain platform, raised $27 million in Series A funding from Northzone, General Catalyst, and others.

- SpotitEarly, an Englewood, N.J.-based breath-based cancer screening service, raised $20.3 million in funding from Hanaco VC, Menomedin VC, angel investors, and others.

- Intrepid Labs, a Toronto-based AI-powered drug formulation company, raised $11 million in funding. AVANT BIO led the $7 million seed round and was joined by existing investor Radical Ventures. Radical Ventures led the $4 million pre-seed round and was joined by Propagator Ventures.

- Oath Surgical, a Portland, Ore.-based tech-powered surgical care provider, raised $10 million in funding from Oxford Science Enterprises, Black Opal Ventures, Rogue VC, and others.

- Fieldstone Bio, a Boston-based AI-powered biosensors developer, raised $5 million in seed funding. Ubiquity Ventures led the round and was joined by LDV Capital and existing investor E14.

Enterprise/Consumer:

- Harvey, an SF-based legal AI startup, is in talks to raise $250m at a $5b valuation co-led by Kleiner Perkins and Coatue, per Reuters. This is just months after a Sequoia-led round at a $3b valuation.

- Stord, an Atlanta-based cloud supply chain company, raised $200m in Series E funding at a $1.5b valuation. Strike Capital led, joined by Baillie Gifford, NewView Capital, G Squared, Georgia Tech Foundation and insiders Kleiner Perkins, Franklin Templeton, Founders Fund, Bond, and Lux Capital.

- Classiq, an Israeli quantum software company, raised $110m in Series C funding. Entrée Capital led, joined by NVP, NightDragon, Hamilton Lane, Clal, Neva SGR, Phoenix, Team8, IN Venture, Wing, HSBC, Samsung Next, and QBeat

- Cart.com, a Houston, Texas-based commerce solutions provider, raised $50 million from BlackRock, Neuberger Berman, eGateway Capital, and others.

- Granola, a London-based AI-powered note taking platform, raised $43 million in Series B funding. Nat Friedman and Daniel Gross led the round and were joined by existing investors Mike Mignano, Nabeel Hyatt, and angel investors.

- Optimal Dynamics, a New York-based decision intelligence platform for logistics, raised $40m in Series C funding. Koch Disruptive Technologies led, joined by Bessemer Venture Partners, The Westly Group, and Activate

- Hedra, a San Francisco-based AI video generation platform, raised $32 million in Series A funding. a16z Infra led the round and was joined by existing investors a16z speedrun, Abstract, Index Ventures, and others.

- Forethought, a San Francisco-based agentic AI customer support platform, raised $25 million in Series D funding. Blue Cloud Ventures led the round and was joined by May Habib, Scott Wu, Karan Goel, and others.

- Origin, a London-based employee benefits management platform, raised $21m in Series A funding. Felix Capital led, joined by Acadian Ventures and Notion Capital.

- Flock, a Denver-based retirement solution for real estate owners, raised $20 million in Series B funding. Renegade Partners led the round and was joined by existing investors a16z, Primary Venture Partners, Susa Ventures, 1Sharpe Ventures, and others.

- Theom, a San Jose-based AI-powered data operations center platform, raised $20 million in Series A funding. Wing VC led the round and was joined by Sentinel One, Snowflake, and Databricks.

- Openlayer, a San Francisco-based enterprise AI governance platform, raised $14.5 million in Series A funding. Race Capital led the round and was joined by NXTP, KPN Ventures, Mindset, and others.

- Doji, a New York City-based AI-powered online shopping and virtual try-on platform, raised $14 million in seed funding. Thrive led the round and was joined by existing investor Seven Seven Six Ventures.

- Flam, a San Francisco-based mixed reality company, raised $14 million in Series A funding. RTP Global led the round and was joined by Dovetail and existing investors.

- ClearVector, a Reston, Va.-based identity-driven security platform developer, raised $13 million in Series A funding. Scale Venture Partners led the round and was joined by Okta Ventures, Inner Loop Capital, and Menlo Ventures.

- Ravio, a London-based compensation data solution, raised $12 million in Series A funding. Spark Capital led the round and was joined by Blackbird and Cherry Ventures.

- Metafoodx, a San Jose-based AI-powered food operations platform, raised $9.4 million in funding. Trustbridge Partners led the round and was joined by BlueRun Ventures and ScalableVision Capital.

- Zapia, a Montevideo, Uruguay and São Paulo-based WhatsApp-based AI personal assistant, raised $7.3 million in seed funding. Prosus Ventures led the round and was joined by Endeavor Catalyst, Anthos Capital, Factory HQ, and SnR.

- TaleMonster Games, an Istanbul-based mobile gaming studio, raised $7 million in seed funding. General Catalyst led the round and was joined by a16z Speedrun, Arcadia, and Ludus Ventures.

- Layer, a San Francisco-based AI-powered content creation platform for game developers, raised $6.5 million in seed funding. Arcadia led the round and was joined by existing investor e2.vc and others.

- Stackpack, a San Francisco-based AI-powered third-party vendor management platform, raised $6.3 million in funding. Freestyle Capital led the round and was joined by Elefund, Upside Partnership, Nomad Ventures, angel investors, and others.

- Adopt AI, a San Jose-based agentic AI solution for applications, raised $6 million in seed funding. Elevation Capital led the round and was joined by Foster Ventures, Powerhouse Ventures, Darkmode Ventures, and angel investors.

- Upscale AI, a San Francisco-based AI-powered TV advertising platform, raised $5.6 million in funding. nvp capital led the $4 million seed round and was joined by M12 and existing investors Eniac Ventures, SuperAngel.Fund and Breakpoint Capital. Eniac Ventures led the $1.6 million pre-seed round and was joined by SuperAngel.Fund and Breakpoint Capital.

- TensorStax, a San Francisco-based platform for building AI agents for data engineering, raised $5 million in seed funding. Glasswing Ventures led the round and was joined by Bee Partners and S3 Ventures.

- Schemata, a San Francisco-based 3D reality capture technology company, raised $5 million in seed funding. Owl Ventures led the round and was joined by a16z speedrun, Alumni Ventures, Anorak Ventures, and Time Zero Capital.

- Prediction Guard, a Lafayette, IN-based secure AI platform, raised $3.7 million in seed funding. Sovereign’s Capital led the round and was joined by Blu Ventures, Noblis Ventures, K Street Capital, angel investors, and others.

- Kovr.ai, a Reston, Va.-based AI automated cyber compliance platform, raised $3.6 million in seed funding. IronGate and Xfund led the round and were joined by Hack Factory, OODA Ventures, and McLean Capital.

- Pronto, a platform for booking laundry and other domestic services, raised $2m in seed funding led by Bain Capital Ventures

HardTech:

- Commonwealth Fusion Systems, a Devens, Mass.-based fusion power startup, raised over $1b in Series B2 funding led by an undisclosed data center developer. It previously raised $1.8b from VC firms like Engine Ventures, Tiger Global, Coatue, and DFJ Growth.

- Flock Freight, an Encinitas, Calif.-based shared truckload freight brokerage, raised $60m in Series E funding. O'Neil Strategic Capital led, joined by Susquehanna Private Equity Investments, SignalFire, GLP Capital Partners, and Bracket Capital.

- X-Bow, a Seattle-based provider of solid-rocket motors, raised $105m in Series B funding from Razor's Edge Ventures, Crosslink Capital, Balerion Space Ventures, and Capital Factory Ventures

- Optimal Dynamics, a New York City-based decision automation platform for trucking companies, raised $40 million in Series C funding. Koch Disruptive Technologies led the round and was joined by FM Capital.

- Realta Fusion, a Madison, Wis.-based magnetic mirror fusion startup, raised $36m in Series B funding. Future Ventures led, joined by Avila VC, GSBackers, Khosla Ventures, Mayfield, SiteGround, TitletownTech, and Wisconsin Alumni Research Foundation.

- Cognichip, a San Francisco-based artificial chip intelligence developer, raised $33 million in seed funding. Lux Capital and Mayfield led the round and were joined by FPV and Candou Ventures.

- InfinitForm, an SF-based manufacturing design software company, raised $12.7m in seed funding led by UP.Partners and is raising $25m in Series A funding

- Space Forge, a Welsh space manufacturing startup, raised £22.6m in Series A funding. NATO Innovation Fund led, joined by World Fund, NSSIF, and the British Business Bank.

- Reflect Orbital, a Hawthorne, Calif.-based space energy startup, raised $20m in Series A funding. Lux Capital led, joined by Sequoia Capital and Starship Ventures

- Adyton, a Dallas-based defense mobile software products developer, raised $11 million in funding. Venrock led the round and was joined by Khosla Ventures, Liquid 2 Ventures, Alumni Ventures, and others.

- Usul, a San Francisco-based AI-powered defense contracting platform, raised $3.3 million in seed funding. Scout Ventures led the round and was joined by BVVC, Teamworthy Ventures, True Ventures, Y Combinator, and angel investors.

Sustainability:

- EventWood, a Norwegian developer of super-strong woods, raised $15m in a first close of its Series A round. Grantham Foundation led, joined by Baruch Future Ventures, Builders VC, and Muus Climate Partners.

- veritree, a Vancouver-based nature restoration verification platform, raised $6.5 million in Series A funding. Pender Ventures led the round and was joined by Garage Capital, Northside Ventures, and Diagram.

- Lignin Industries, a Knivsta, Sweden-based greentech company, raised €3.9 million ($4.3 million) in funding. The Carrick family, the company’s founders and majority owner, led the round and was joined by others.

Acquisitions & PE:

- Databricks, valued by VCs at $62b, agreed to pay around $1b to acquire database startup Neon, a Menlo Park, Calif.-based database startup that had raised around $130m from General Catalyst, Notable Capital, Abstract Ventures, Menlo Ventures, and M12

- Church & Dwight agreed to acquire Touchland, a Miami-based hand sanitizer brand, for $700 million in cash and restricted stock at closing and a payment of up to $180 million contingent on the company’s sales.

- CookUnity, a New York-based meal delivery platform, acquired smart fridge tech company Fraîche. CookUnity backers include Endeavor Catalyst, IDCV, and Relay Ventures.

- New Home agreed to acquire Landsea Homes, a Dallas-based house building company, for $11.30 per share in an all-cash transaction at an enterprise value of approximately $1.2 billion.

- Orca Security acquired Opus, a Tel Aviv-based agentic AI-powered vulnerability management platform. Financial terms were not disclosed.

- Salesforce agreed to acquire Convergence.ai, a London-based agentic AI company. Financial terms were not disclosed.

IPOs:

- eToro Group, a Bnei Brak, Israel-based trading and investment platform, raised $620 million in an offering of 11.9 million shares (50% secondary) priced at $52 on the Nasdaq. The company posted $12.6 billion in revenue for the year ending Dec. 31, 2024. Spark Capital, BRM Group, Andalusian Private Capital & Advisory, SBT, and CM Equities back the company.

- Hinge Health, a San Francisco-based musculoskeletal care devices developer, plans to raise $438.4 million in an offering of 13.7 million shares priced between $28 and $32 on the NYSE. The company posted $432 million in revenue for the year ending March 31, 2025. Insight, Atomico, 11.2 Capital, Coatue, Tiger Global, and Bessemer Venture Partners back the company.

- Chime Financial, a San Francisco-based mobile banking services provider, filed to go public on the Nasdaq. The company posted $1.8 billion in revenue for the year ending March 31, 2025. DST Global, Crosslink Capital, Access Industries Management, General Atlantic, Menlo Ventures, Cathay Innovation, and ICONIQ Strategic Partners back the company.

Funds:

- VMG Partners, a San Francisco-based investment firm, raised $1 billion for its sixth fund focused on consumer brands.

- Denali Growth Partners, a Boston-based private equity firm, raised $400 million for its second fund focused on healthcare, life sciences, professional services, and other sectors.

- Nexa Equity, a San Francisco-based private equity firm, raised $390 million for its second fund focused on vertical SaaS companies.

- Immad Akhund, the CEO of business banking unicorn Mercury, announced a $26m VC fund that Axios first reported on in February.

- Work-Bench, a New York-based VC firm, raised $160m for its fourth fund

Want some merch? Check out our shop: sourcerymerch.com

P.S. we just got some Holographic Stickers that ship faster than the Apple Vision Pro, plus if you upgrade to an ‘annual paid’ subscription you get a free hat of your choosing.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

banger edition