Rillet Raises $70M Series B Co-Led by a16z & ICONIQ

+ Sequoia & Oak HC/FT, $100M raised to date

Brought to you by Brex..

Brex, the modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, & travel. Over 30,000 companies, including ServiceTitan, Anthropic, Cursor, DoorDash, & Wiz, use Brex.

Rillet’s $70M Series B

Rillet, the AI-native ERP platform co-founded by Nicolas Kopp & Stelios Modes, for modern finance teams, has raised a $70 million Series B co-led by Andreessen Horowitz (a16z) and ICONIQ, with participation from Sequoia, Oak HC/FT, and earlier backers. This brings total funding to over $100 million in under 12 months, marking one of the fastest capital-raising streaks in recent enterprise software history.

The round follows a $25 million Series A from Sequoia announced just 10 weeks prior and comes amid surging momentum: Rillet has 2x’d ARR in the past quarter, signed more than 200 customers, and formed partnerships with leading accounting firms including Armanino (Top 20) & Wiss (Top 50).

Andreessen Horowitz General Partner Alex Rampell & ICONIQ General Partner Seth Pierrepont will join Rillet’s board.

What’s the Fastest Capital-Raising Streak Like?

“We closed B faster than A; doubled ARR in the last quarter alone; the momentum is absolutely insane right now.

There’s no secret. We’ve built a good business and been hyper focused on taking care of our customers. It would be impossible to build a business like this without customer focus. We’re also building a platform business in the largest enterprise software category (literally every business needs an accounting system). CFOs have seen AI impact every other department in their business but are still wondering when AI is going to revolutionize finance and accounting. That’s where Rillet comes in.”

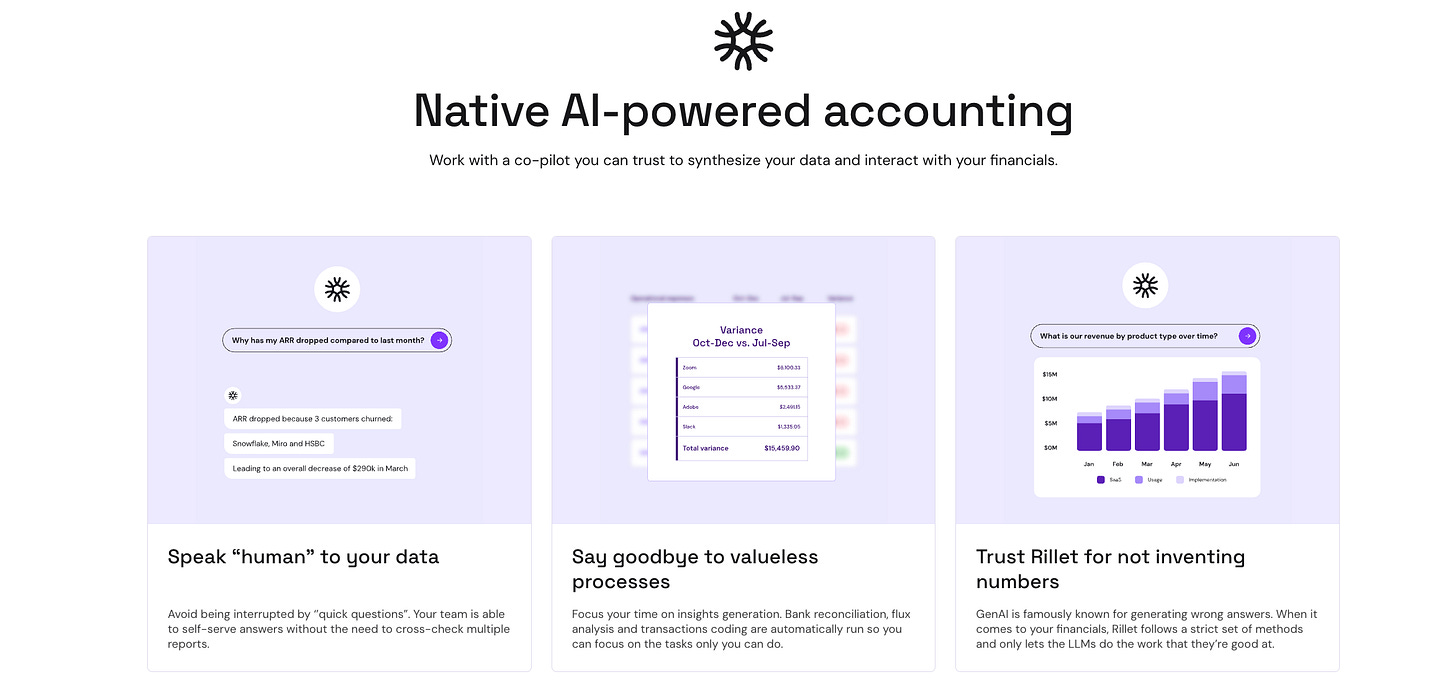

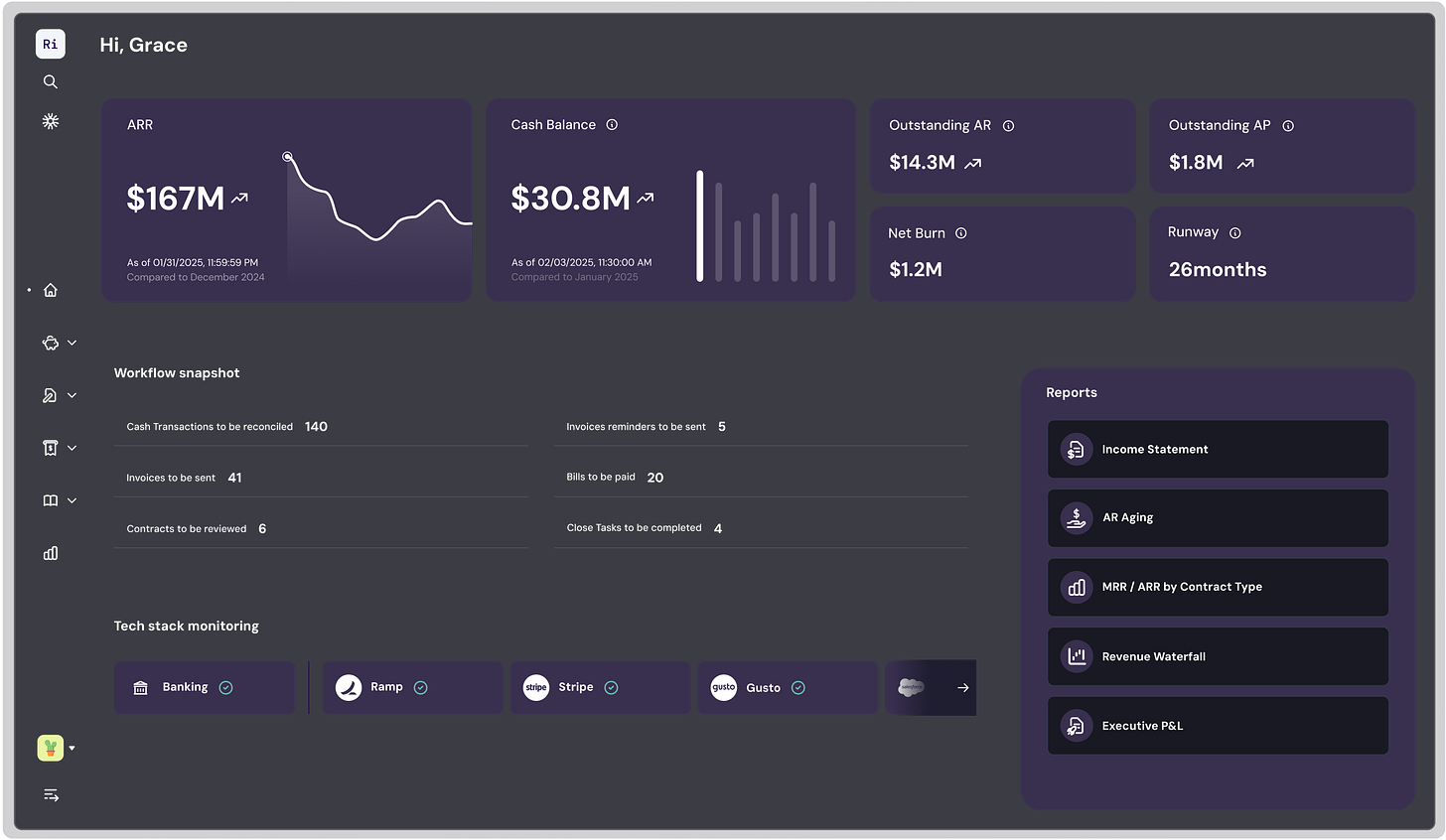

Product: AI-Native from the Ground Up

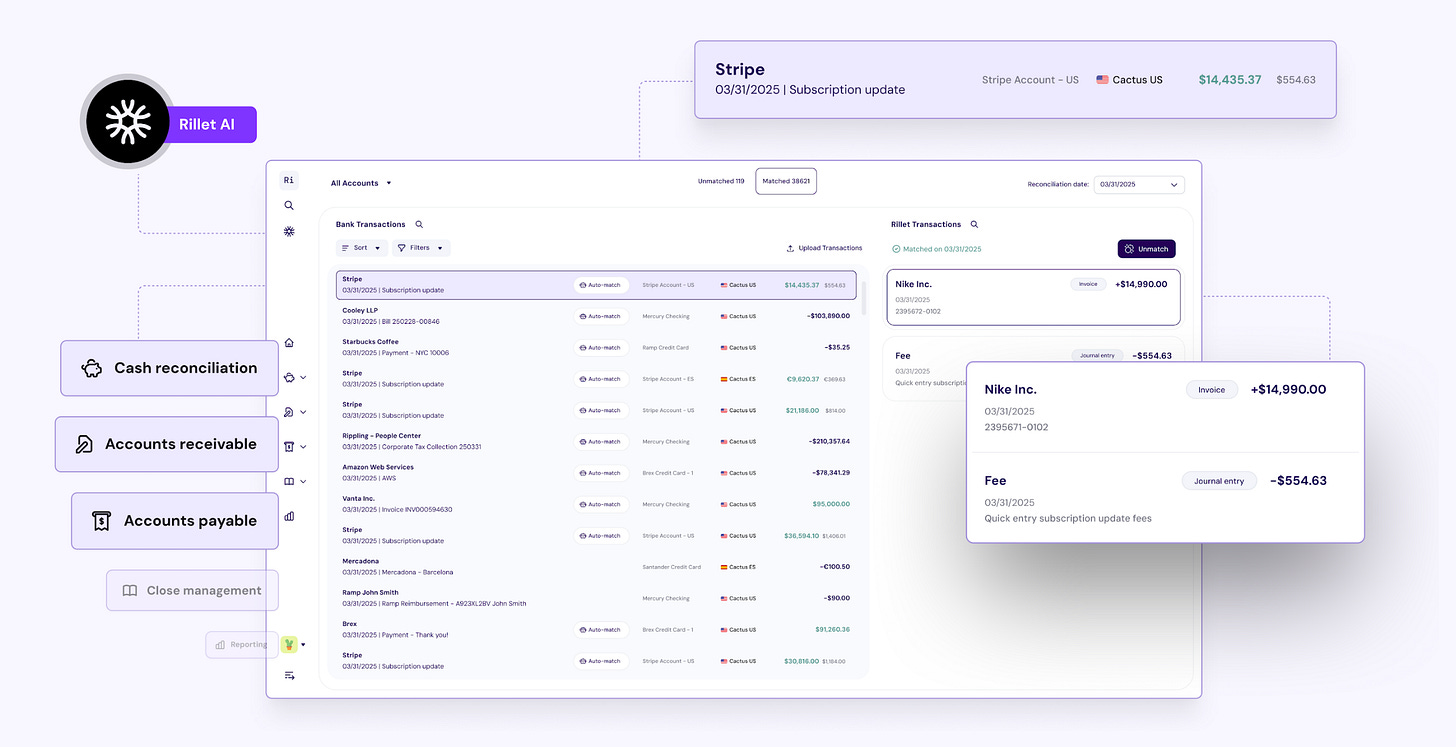

Unlike legacy ERPs such as NetSuite by Oracle, Intacct by Sage, Dynamics by Microsoft, and even more recent players like Acumatica are being folded into private equity portfolios, which operate as “dumb databases” patched together with bolt-on tools. Rillet is built for an AI-first era. The platform starts with native integrations that feed structured data into a smart general ledger, enabling:

Automated monthly close via AI agents handling cash reconciliation, flux analysis, and accruals

Audit prep and board deck generation directly inside the platform

Real-time reporting instead of weeks-long delays

Market: A $500B Category Ripe for Disruption

Accounting is the largest enterprise software category globally, yet dominated by decades-old incumbents and private equity-owned portfolios that struggle to adapt to modern workflows. The industry faces a severe talent crunch: 75% of accountants are expected to retire within 15 years, while 80% of routine operations could be automated.

“CFOs have seen AI transform every other department,” says Nicolas Kopp, Rillet’s co-founder & CEO. “Finance and accounting are next & that’s where Rillet comes in.”

Customer Impact

Rillet’s customers span fast-scaling startups to unicorns with global operations:

PostScript closes books in just three days using Rillet

Windsurf runs its finance operations with a two-person team

Implementations complete in 4 weeks vs. 12 months for legacy platforms

These gains free finance leaders to focus on strategic analysis, not manual processes.

Team: Built by Accountants, Backed by AI Expertise

Rillet’s co-founders, Nicolas Kopp (former U.S. CEO of N26) & Stelios Modes (architect of N26’s payments infrastructure), have grown the company to ~50 employees.

"As US CEO of N26, I experienced firsthand how frustrating it was to wait weeks for critical business metrics," said Nicolas Kopp, CEO and co-founder of Rillet. "My finance team was world-class, but simple requests took weeks because the systems were stuck in the past. I knew there had to be a better way."

The team is 70% engineering & implementation, 10% Customer support, and 15% Sales & Marketing, with leaders drawn from Big Four accounting firms

Chief Product Officer – former EY Controller

Head of Customer Success – former PwC

VP of Implementations – CPA and former Rillet customer

This DNA shows up in every workflow, every implementation, & every customer result.

Bonus: The company recently hired one of the world’s top AI researchers to accelerate its AI agent roadmap

They’re Hiring!

Rillet is hiring for nearly every function: engineering, solutions consulting, implementations, sales, product, operations, etc.

What are they looking for? Speed, excellence, accounting backgrounds for customer facing functions, & more.

Investors on the Vision

Alex Rampell, a16z: “Finance teams deserve the same AI advantages that have revolutionized sales, engineering, and legal.. Rillet is delivering that transformation by rebuilding ERP infrastructure specifically for the AI era. We're excited to support their vision as they scale to serve the next generation of high-growth companies.”

Seth Pierrepont, ICONIQ: “Rillet is redefining what finance teams can achieve when freed from outdated systems.. Their AI-native approach can give companies a clear edge: faster insights, leaner teams, and smarter decisions. We believe Rillet will become foundational infrastructure for the next generation of category-defining businesses.”

BTW did we mention they’re customers of Brex?

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

What’s Next? Moving Faster

With the Series B funding, Rillet will expand AI capabilities, deepen integrations across the financial tech stack, continue hiring across all functions, & go into true AI-powered accounting warpspeed.

Several customers are expected to go public using Rillet’s platform in the next 6–12 months, underscoring its ambition to become foundational infrastructure for the next generation of category-defining businesses.

“Our customers are building the companies that will define the next decade,” says Kopp. “We’re building the infrastructure that will take them there and redefine what's possible when finance teams have truly modern tools."