Sourcery (10/11-10/15)

Bolt, TradingView, Tala, Halo, Elliptic, SUMA, Bond Vet, Lively, Sprinter Health, Oshi, ScienceIO, Dutchie, TripActions, Personio, Notion, Wiz, Hibob, GRIN, SupportLogic, ResQ, Convex, Matik, LIT...

Last Week (10/11-10/15):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Bolt, TradingView, Tala, Halo, Elliptic, Atomic, FlowHub, Lendflow, SUMA, Bond Vet, Lively, Sprinter Health, Oshi, FitOn, ScienceIO, Day-J, Dutchie, TripActions, Personio, Notion, Wiz, Hibob, GRIN, Weights & Biases, Aware, Zeus Living, SupportLogic, ResQ, Convex, Tundra, Matik, Ohi, Cord, Violet, Humming Homes, LIT Videobooks, FourFront, Leap, Trusscore, WattBuy, Grounded Foods; ClassPass, Carrefour SA, Foodstorm, Vuori, Kobalt, Suede One, Kanga, VillageMD & CareCentrix; GitLab, iFIT, Nerd Wallet, Wine, UserTesting; SeatGeek

Final numbers on PE Take-Private Activity and Unicorns Per MBA at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Bolt, a San Francisco-based one-click checkout company, raised $393 million in Series D funding, valuing it at $6 billion. Investors include Untitled Investments, Willoughby Capital, and Soma Capital.

- Celsius Network, a Hoboken, N.J.-based cryptocurrency earning and borrowing startup, raised $400 million valuing it at $3 billion. WestCap led the round and was joined by investors including Caisse de dépôt et placement du Québec.

- TradingView, a Westerville, Oh.-based stock trading and charting platform and social network for traders and investors, raised $298 million. Tiger Global led the round valuing it at $3 billion.

- ConsenSys, a company that develops apps and tools based on Ethereum, is raising new funding at a $3 billion valuation, per FT. http://axios.link/c7og

- Tala, a Los Angeles-based financial services startup, raised $145 million in Series E funding. Upstart (Nasdaq: UPST) led the round and was joined by investors including Stellar Development Foundation, Kindred Ventures, the J. Safra Group, IVP, Revolution Growth, Lowercase Capital, and PayPal Ventures.

- Halo Investing, a Chicago-based financial tech company, raised over $100 million in Series C funding. Owl Capital led the round and was joined by investors including Allianz Life Ventures, Abu Dhabi Catalyst Partners, William Blair, and Alumni Ventures Group.

- Zone & Co, a Boston-based billing and revenue tech maker, raised $76 million. Insight Partners led the round.

- Alviere, a New York-based embedded finance startup, raised $70 million in Series B funding from backers like Viola Ventures, Viola Fintech, CommerzVentures and North Coast Ventures. http://axios.link/QKtl

- Elliptic, a London-based cryptoasset risk management startup, raised $60 million in Series C funding. Evolution Equity Partners led the round and was joined by investors including SoftBank Vision Fund 2, AlbionVC, Digital Currency Group, Wells Fargo Strategic Capital, SBI Group, Octopus Ventures, SignalFire, and Paladin Capital Group.

- Beacon Platform, a New York City-based maker of trading and risk management apps, raised $56 million in Series C funding. Warburg Pincus led the round and was joined by investors including Centana Growth Partners, Global Atlantic Financial Group, and PIMCO.

- FrankieOne, an Australian digital transaction fraud prevention startup, raised A$20 million in Series A funding. AirTree Ventures and Greycroft co-led, and were joined by 20VC, Reinventure, Tidal Ventures, APEX Capital and Mantis. http://axios.link/7gVg

- Atomic, a Salt Lake City-based payroll API, raised $22 million in Series A funding. Core Innovation Capital led, and was joined by insiders Portag3 Ventures and Greylock Capital Management. www.atomic.financial

- At-Bay, a San Francisco-based insurance company, raised $20 million in extended Series D funding valuing it at $1.4 billion. ION Crossover Partners was among the investors.

- Flowhub, a Denver-based cannabis retail point-of-sale company, raised $19 million, valuing it over $200 million. Headline and Poseidon led the round and were joined by investors including Shawn "Jay-Z" Carter.

- Productfy, a San Jose, Calif.-based maker of tech to build financial services apps, raised $16 million in Series A funding. CMVentures led the round and was joined by investors including Point72 Ventures, 500 Startups, and Envestnet|Yodlee.

- CAST AI, a Miami-based cost analysis company, raised $10 million in Series A funding. Cota Capital with Samsung Next led the round.

- Lendflow, a Boston-based small and medium business lending company, raised $10.8 million in Series A funding. Underscore VC led the round.

- SUMA Wealth, a Los Angeles-based Latino youth-focused fintech, raised $2 million in pre-seed funding. Chingona Ventures led the round.

. . .

Care:

- Bond Vet, a New York City-based veterinary care clinic operator, raised $170 million. Warburg Pincus led the round.

- Lark Health, a Mountainview, Calif.-based disease prevention health care company, raised $100 million in Series D funding. Deerfield Management Company led the round and was joined by investors including PFM Health Sciences, Franklin Templeton, King River Capital, Castlepeak, IPD, Olive Tree Capital, and Marvell Technology cofounder Weili Dai.

- Lively, a San Francisco-based health savings account company, raised $80 million in Series C funding. B Capital Group led the round and was joined by investors including Telstra Ventures and Costanoa Ventures.

- Sprinter Health, a Menlo Park, Calif.-based company sending nurses and phlebotomists into the home, raised $33 million in Series A funding. Andreessen Horowitz led the round and was joined by investors including General Catalyst, Accel, and Google Ventures.

- Oshi Health, a New York-based provider of virtual care for GI issues, raised $23 million in Series A funding. Flare Capital Partners, Bessemer Venture Partners and Frist Cressey Ventures co-led, and were joined by CVS and Takeda. www.oshihealth.com

- FitOn, an LA-based digital fitness startup, raised $18 million in Series B funding. Delta-v Capital led, and was joined by insiders Accel, Telstra Ventures, Crosscut Ventures, Maverick Ventures and Second Avenue Partners. http://axios.link/gSHz

- Better Health, a San Francisco-based medical supply company, raised $10 million in Series A funding. Caffeinated Capital and General Catalyst led the round and were joined by investors including Bill Ackman’s family office, Table Management, 8VC, Anorak Ventures, Tank Hill Venture Partners, Motive Science, Modern Ventures, and Unpopular VC.

- ScienceIO, a patient data startup, raised $8 million in seed funding. Investors include Section 32, Sea Lane Ventures, Lachy Groom, and Josh Buckley.

- Alloy, a New York City-based telehealth company focused on the needs of women over 40, raised $3.3 million in seed funding. Kairos HQ and PACE Healthcare Capital invested.

- Day-J, a San Francisco-based personalized coaching startup, raised $2.1 million. Raine Ventures, Fuel Capital, and Watertower Ventures.

- Pathway Medical, a New Castle, De.-based medical information app maker, raised $1.6 million. Investors included Panache Ventures, Amplify Capital, Desjardins Venture Capital, BoxOne Ventures, and Formentera Capital.

. . .

Future of Work:

- Dutchie, a Bend, Ore.-based cannabis e-commerce platform, raised $350 million at a $3.75 billion valuation. D1 Capital led, and was joined by insiders Tiger Global, Dragoneer, DFJ Growth, Thrive Capital and Casa Verde Capital. http://axios.link/bRdY

- Plume, a Palo Alto-based company looking to improve broadband connectivity in homes, raised $300 million. SoftBank Vision Fund 2 led the round valuing it at $2.6 billion.

- TripActions, a Palo Alto-based travel book company, raised $275 million in Series F funding valuing it at $7.3 billion. Greenoaks led the round and was joined by investors including Elad Gil.

- Personio, a European HR software company for small and mid-sized businesses, raised $270 million in Series E funding, valuing the company at $6.3 billion. Greenoaks Capital Partners led the round and was joined by investors including Altimeter Capital and Alkeon.

- Notion, a San Francisco-based collaboration tech maker, raised $275 million in funding at a $10 billion valuation. Sequoia and Coatue led the round and were joined by investors including Base10.

- Wiz, an Israeli cloud security platform, raised $250 million in Series C funding at a $6 billion valuation. Greenoaks and Insight Partners co-led, and were joined by Sequoia Capital and Salesforce Ventures. www.wiz.io

- Hibob, a New York City and London-based HR software company, raised $150 million in Series C funding. General Atlantic led the round and was joined by investors including Bessemer Venture Partners, Battery Ventures, Eight Roads, and Entrée Capital.

- Karat, a Seattle-based technical interviewing startup, raised $110 million in Series C funding valuing it at $1.1 billion. Tiger Global Management led the round.

- GRIN, a Sacramento, Calif.-based marketing software company focused on direct-to-consumer brands, raised $110 million in Series B funding. Lone Pine Capital led the round and was joined by investors including Danielle Bernstein (of WeWoreWhat), fitness influencer Devon Levesque, and The Chainsmokers. The deal values the business at $910 million.

- Outschool , a San Francisco-based edtech, raised $110 million in Series D funding valuing it at $3 billion. Tiger Global Management led the round and was joined by investors including BOND Capital, Lightspeed Ventures, Union Square Ventures, Reach Capital, Coatue, FundersClub, and SV Angel.

- Weights & Biases, a machine learning operations company, raised $100 million in Series C funding valuing it around $1 billion. Felicis, Insight Partners, Bond and Coatue invested.

- Hubilo, a San Francisco-based virtual events and gathering software startup, raised $125 million in Series B funding. Alkeon Capital led the round and was joined by investors including Lightspeed Venture Partners and Balderton Capital.

- Aware, a Columbus, Oh.-based collaboration governance analysis company, raised $60 million in Series C funding. The Growth Equity business within Goldman Sachs Asset Management led the round and was joined by investors including Spring Mountain Capital, Blue Heron Capital, Allos Ventures, Ohio Innovation Fund, JobsOhio, and Rev1 Ventures.

- Zeus Living, a long-term stay marketplace, raised $55 million. SIG led the round and was joined by investors including Initialized Capital, CEAS Investments, TI Platform, NFX, Opendoor’s Eric Wu and Miras.

- Juni, a Swedish e-commerce and marketing spend tracking software company, raised $52 million in extended Series A funding. EQT Ventures led the round.

- Impartner, a Salt Lake City-based partner relationship software company, raised $50 million in funding. Brighton Park Capital led the round.

- SupportLogic, a San Francisco-based customer experience company, raised $50 million in Series B funding. WestBridge Capital Partners and General Catalyst led the round and were joined by investors including Sierra Ventures and Emergent Ventures.

- Groove, a San Francisco-based sales engagement company, raised $45 million in Series B funding. Viking Global Investors led the round and was joined by investors including Capital One Ventures, Level Equity, Quest Venture Partners, and Uncork Capital.

- Space Perspective, a Cape Canaveral, Fla.-based spaceflight experience company, raised $40 million in Series A funding. Prime Movers Lab led the round.

- Convex, a San Francisco-based software company focused on commercial contractors, raised $39 million in Series B funding. Fifth Wall, Emergence Capital, and GGV led the round and were joined by investors including UP2398, 1984 Ventures, and Soma Capital. The company also raised $17 million in Series A funding last year with Emergence Capital.

- ResQ, a Toronto-based restaurant equipment repair startup, raised US$39 million in Series A funding. Tiger Global and Canvas Ventures co-led, and were joined by Homebrew, Inovia Capital and Golden Ventures. http://axios.link/9Rhh

- AiDash, a Santa Clara, Calif.-based startup that uses satellites to monitor the performance and maintenance of assets like utilities and roads, raised $27 million in Series B funding. G2 Venture Partners led, and was joined by BGV and National Grid Partners. www.aidash.com

- Tundra, a San Francisco, Calif.-based online wholesale marketplace, raised $26 million in Series B funding. Emergence Capital led the round and was joined by investors including Redpoint, Initialized, Peterson Ventures, and Background Capital.

- Rose Rocket, a Toronto-based provider of transportation management software for trucking companies and 3PLs, raised US$25 million in Series A funding. Addition Capital and Shine Capital co-led, and were joined by Ripple Ventures, Scale-Up Ventures, Kevin Mahaffey, Funders Club and YC. http://axios.link/mdrP

- Blank Street, a Brooklyn, N.Y.-based coffee company, raised $25 million in Series A funding. General Catalyst and Tiger Global led the round.

- Karma, a Tel Aviv-based shopping assistant tech maker, raised $25 million in Series A funding. Target Global led the round and was joined by investors including MoreTech Ventures, NFX, and Altair Capital.

- Mulberry, a New York City-based product protection platform, raised $22 million in Series B funding. Commerce Ventures led the round and was joined by investors including Hudson Structured Capital Management, Ally Bank, and CreditEase.

- Black Kite, a Boston-based cyber risk ratings company, raised $22 million in Series B funding. Volition Capital led the round and was joined by investors including Moore Strategic Ventures, Glasswing Ventures, and Data Point Capital.

- Shift5, an Arlington, Va.-based cybersecurity company, raised $20 million in Series A funding. 645 Ventures led the round and was joined by investors including quadra Ventures, General Advance, and First In.

- At-Bay, a San Francisco-based insurance company, raised $20 million in extended Series D funding valuing it at $1.4 billion. ION Crossover Partners was among the investors.

- Matik, a San Francisco-based maker software for creating presentations, raised $20 million in Series A funding. Andreessen Horowitz led the round and was joined by investors including Menlo Ventures, BoxGroup, and Oceans Ventures.

- Ohi, a New York City-based warehousing company focused on delivering under two-hours, raised $19 million in Series A funding. Palm Drive Capital led the round and was joined by investors including JAM Fund.

- Ambition, a Chattanooga, Tenn.-based gamified sales management platform, raised $15.5 million in Series B funding led by Primus Capital. http://axios.link/qkOh

- AmplifAI, a Plano, Tx.-based HR software company, raised $12.5 million in Series A funding. Greycroft led the round and was joined by investors including LiveOak Venture Partners, Dallas Venture Partners, and Capital Factory invested.

- Cord, a London-based company automating annotation for computer vision data, raised $12.5 million in Series A funding. CRV led the round and was joined by investors including Y Combinator Continuity, Harpoon Ventures, and Crane Venture Partners.

- Nexla, a San Mateo, Calif.-based maker of data collaboration software, raised $12 million in Series A funding. Industry Ventures led the round and was joined by investors including Liberty Global Ventures, Blumberg Capital, Engineering Capital, Storm Ventures, and Correlation Ventures.

- Flux, a San Francisco-based maker of a collaboration platform for electronics design and engineering, raised $12 million. Outsiders Fund led the round and was joined by investors including Bain Capital Ventures, 8VC, and Liquid2VC.

- Violet, a Seattle-based e-commerce API, raised $10 million in Series A funding. Klarna led, and was joined by Sugar Capital, Lachy Groom and Red Sea Ventures. www.violet.io

- SWFT, a New York City-based mobility company, raised $10 million. Investors include Martin Lauber (Managing Partner of 19 York), Mark Joseph (CEO of Mobitas Advisor), and David Zwick (Managing Director, RedCap Technologies).

- Cloudtamer.io, a Fulton, Md.-based automated multi-cloud governance and management platform, raised $9.5 million in Series A funding. Blue Heron Capital and TDF Ventures co-led, and were joined by Blu Venture Investors, Early Light Ventures and Gaingels. www.cloudtamer.io

- The Shift Network, a Petaluma, Calif.-based online education startup focused on health and wellness, raised $8.7 million in Series A funding co-led by Evolve Ventures and Bridge Builders Collective. www.theshiftnetwork.com

- Humming Homes, a New York City-based home management software company, raised $5.6 million. Greycroft led the round and was joined by investors including AlleyCorp, Thrive Capital, Sound Ventures, New Valley Ventures, and Abby Miller Levy.

- LIT Videobooks, a New York City-based company turning books into videos, raised $5 million in seed funding. MaC Venture Capital led the round and was joined by investors including Founders Fund, Noemis Ventures, Bloom VP, Pipe founder and CEO Harry Hurst, Long Journey Ventures partner Cyan Banister, Candela Partners founder Larry Braitman, Coelius Capital managing partner Zach Coelius, film producer Terry Dougas, Carbon Health vice chairman Russ Fradin, and Homebrew VC partner Hunter Walk.

- Continuum, a New York City-based hiring marketplace, raised $2.9 million in seed funding. Uncork Capital led the round and was joined by investors including Day One Ventures.

- SparkPlug, a San Francisco-based retail tech startup, raised $2.5 million in seed funding. Investors include TenOneTen Ventures, Jason Calacanis, and Argonautic Ventures.

- FourFront, a TikTok storytelling startup, raised $1.5 million in seed funding from Bam Ventures, Slow Ventures, BDMI, Alumni Ventures Group and HustleFund. http://axios.link/V9dA

. . .

Sustainability:

- Battery Resourcers, a Massachusetts-based battery recycling company, raised $70 million. Orbia Ventures and Koura led the round.

- Leap, an SF-based energy market access provider, raised $33.5 million in Series B equity and debt. Park West Asset Management led, and was joined by Foobar, Climate Capital, My Climate Journey, USV, Congruent Ventures and National Grid Partners. SVB provided the debt. www.leap.energy

- Trusscore, a Canadian developer of sustainable building materials, raised C$26 million in Series A funding led by Round13 Capital. www.trusscore.com

- WattBuy, a New York City-based clean energy company, raised $10 million in Series A funding. SE Ventures led the round and was joined by investors including MCJ Collective. Other investors include Evergy Ventures, Updater, Powerhouse Ventures, Techstars Ventures, Avesta Fund, and Yoav Lurie (former CEO and founder of Simple Energy).

- Grounded Foods Co., a California-based maker of dairy cheese alternatives, raised $2.5 million in pre-Series A funding. Investors include Big Idea Ventures and Stray Dog Capital.

Acquisitions & PE:

- Mindbody, a B2B discovery and booking engine for boutique fitness providers, agreed to buy ClassPass, a monthly subscription service for fitness classes. Mindbody was taken private by Vista Equity Partners in 2019 for $1.9 billion. ClassPass raised nearly $600 million in VC funding, most recently at a $1 billion valuation in early 2020, from firms like Apax Digital, L Catterton and General Catalyst. New investor Sixth Street is leading a $500 million investment in the combined company. No pricing terms of the all-stock deal were disclosed, but Axios has learned that Mindbody will hold between a 60%-70% in the combined business, with ClassPass valued "significantly" above that $1 billion mark.

- Auchan, a French grocer, sought to acquire Carrefour SA, the French grocery giant, for about $19 billion, per Bloomberg. Talks stalled, however.

- Chubb (NYSE: CHUBB) agreed to buy health insurer Cigna’s (N:CI) life, accident, and supplemental benefits businesses in Asia Pacific and Turkey for $5.8 billion in cash.

- Instacart acquired FoodStorm, a maker of ordering software for grocery retailers. Financial terms weren't disclosed.

- Vuori, a Carlsbad, Calif.-based activewear company, raised $400 million at a $4 billion valuation from SoftBank. http://axios.link/5S37

- KKR is nearing a $1.1 billion purchase of a song catalog, including hits from Lorde and The Weeknd, from music services firm Kobalt, per the FT. Kobalt backers include Section 32, MSD Capital, Baldterton Capital and Cape Capital. http://axios.link/I3C3

- Riot Games acquired the team from Kanga, a maker of products in the gaming space. Kanga was backed by Courtside Ventures, Tusk Ventures, Point72 Ventures, BAM Ventures, Oceans Ventures, Cassius Family, Dune Ventures, and SV Angel.

- Poshmark (NAS: POSH) acquired Suede One, a New York City-based virtual authentication platform for sneakers. Financial terms weren't disclosed.

- Walgreens (Nasdaq: WBA) said it invested around $5.5 billion to buy majority stakes in two companies: VillageMD, a Chicago-based primary health care provider, and CareCentrix, a Hartford, Conn.-based provider of follow-up home care for patients discharged from hospitals. This is new CEO Roz Brewer putting her stamp on the pharmacy and retail giant, by moving it beyond pharmacy and retail. Walgreens will have a 63% stake in VillageMD, which it first backed earlier this year. Other investors include Kinnevik and Town Hall Ventures. It will have a 55% stake in CareCentrix, a former portfolio company of Water Street Healthcare Partners.

. . .

IPOs:

- iFIT Health & Fitness, a Logan, Utah-based interactive exercise equipment maker, delayed its IPO. It previously sought to raise $646 million in the offering. iFit posted $851.7 million in revenue in 2020 and a net loss of $98.5 million. Pamplona and L Catterton back the firm.

- GitLab, a remote web-based development operations company, raised $801 million in an offering of 10.4 million shares (19% sold by insiders) priced at $77 apiece—it had previously planned to price shares up to $69. The company posted $152.2 million in revenue in the 12 months ending in Jan. 2021 and a net loss of $192.2 million. August Capital, Google Ventures, ICONIQ Capital, and Khosla Ventures back the firm.

- NerdWallet, a San Francisco-based personal finance education website, filed for an IPO. The company posted $245 million in revenue in 2020 and net income of $5 million. Institutional Venture Partners, RRE Ventures, and iGlobe Partners back the firm.

- Enfusion, a Chicago-based provider of investment management SaaS, set IPO terms to 18.8 million shares at $15-$17. It would have a $1.9 billion fully-diluted value, were it to price in the middle, and plans to list on the NYSE (ENFN). Enfusion reports $8 million of net income on $51 million in revenue for the first half of 2021. Backers include FTV Capital and Iconiq. http://axios.link/f6FQ

- The Real Good Food Co., a Cherry Hill, N.J.-based maker of low-carb high-protein packaged foods, filed for an $86 million IPO. It plans to list on the Nasdaq (RGF) and reports a $10 million net loss on $35 million in revenue for the first half of 2021. Backers include Strand Equity. http://axios.link/Qq5B

- The Vita Coco Co., a New York-based coconut water company, set IPO terms to 11.5 million shares at $18-$21. It would have a $1.1 billion fully diluted value, were it to price in the middle, plans to list on the Nasdaq (COCO) and reports $9 million of net income on $177 million in revenue for the first half of 2021. Backers include Verlinvest. http://axios.link/0HNh

- Stronghold Digital Mining, a Kennerdell, Pa.-based eco-friendly Bitcoin mining company, plans to raise up to $106 million in an offering of 5.9 million shares priced between $16 and $18 per share. The company generated $4.1 million in total operating revenue in 2020 and reported a net loss of $145,000.

- Winc, a Santa Monica, Calif.-based wine club membership company, plans to raise up to $80 million in an offering of 5 million shares priced between $14 and $16 per share. The company posted $65 million in net revenue in 2020 and reported a $7 million net loss. Bessemer Venture Partners, Shining Capital, and Cool Japan Fund back the firm.

- Lucid Diagnostics, a New York City-based chronic heartburn diagnostics company, raised $70 million in an offering of 5 million shares priced at $14 per share. The company reported a net loss of $8 million in 2020 and has yet to post significant revenue. Medical device company PAVmed and Case Western Reserve University back the firm.

- UserTesting, an SF-based provider of usability testing SaaS, filed for an IPO. It plans to list on the NYSE (USER) and reports a $24 million net loss on $66 million in revenue for the first half of 2021. Shareholders include Accel (23% pre-IPO stake), Greenspring (19.2%), Insight Partners (17.3%) and OpenView Venture Partners (7.1%). http://axios.link/7SPQ

. . .

SPACs:

- RedBall Acquisition Corp. (NYSE: RBAC), a SPAC formed by longtime baseball executive Billy Beane and investor Gerry Cardinale, agreed to buy ticket marketplace SeatGeek at a $1.35 billion valuation. The deal includes a $100 million PIPE from existing SeatGeek backer Accel, plus Ryan Smith and Durant’s Thirty Five Ventures. http://axios.link/EooO

- Rocket Lab, a Huntington Beach, Calif.-based small satellite launch company that’s going public via SPAC, acquired Advanced Solutions, a Littleton, Colo.-based aerospace engineering firm, for up to $45.5 million. www.go-asi.com

Funds:

- HarbourView Equity Partners, a Newark, N.J.-based investor in music and entertainment rights backed by Apollo Global Management, launched with about $1 billion.

- ACME Capital, a VC firm co-led by Scott Stanford and Hany Nada, is raising $225 million for a new early-stage fund and $100 million for an opportunities fund, per SEC filings. www.acme.vc

- Munich Re Ventures raised $500 million for its second fund. www.munichre.com/mrv

- Newark Venture Partners raised $85 million for its second fund focused on seed-stage B2B software startups. http://axios.link/qlVh

- Paradigm, a crypto-focused VC firm, is raising $1.5 billion for a new fund, per CoinDesk. http://axios.link/KwCA

- At One Ventures, a "planet positive" VC firm led by Google X co-founder Tom Chi, raised $150 million for its debut fund. http://axios.link/icSn

Final Numbers

Data: PitchBook report for U.S. geography, through Sept. 30, 2021.

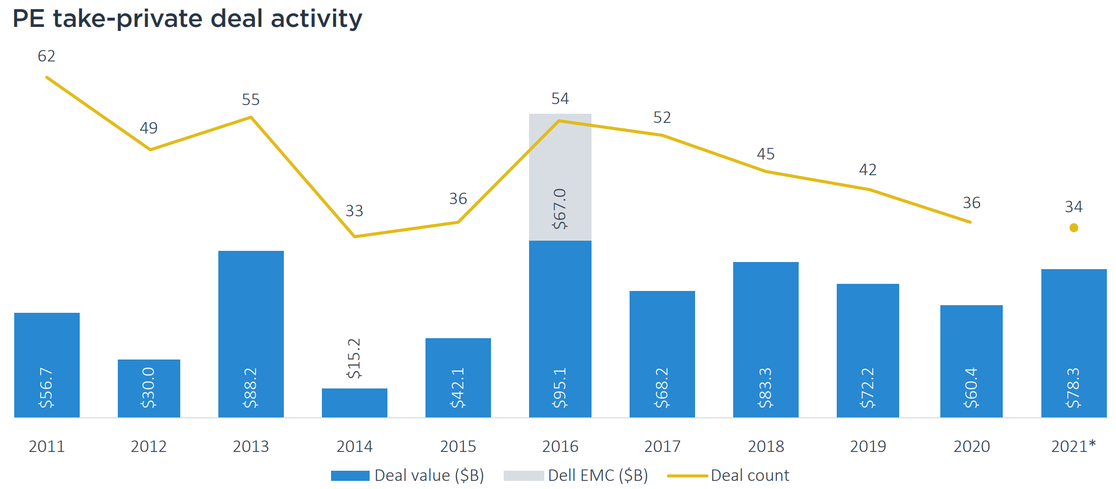

Private equity is breaking deal activity records in 2021, alongside venture capital and broader M&A.

But the vast majority of that involves privately-held target companies, as the number of "take-private" acquisitions is barely above the five-year average (if excluding Dell-EMC, and well below that average if included).

Source: Ilya Strebulaev, VC Institute, Stanford Graduate School of Business.

Stanford leads the class when it comes to producing "unicorn" founders, according to a new study by a professor at (you guessed it) Stanford's business school.

The cohort: There are 238 founders of startups valued at $1 billion or more who earned MBAs, out of 1,356 total "unicorn" founders, according to research from Professor Ilya Strebulaev. He and his team then created ratios of such founders to each school's MBA program sizes, to eliminate size bias.

The results: Stanford produced three "unicorn" founders per 1,000 MBA graduates between 2000 and 2015. That's well above runner-ups Harvard Business School (1.6) and UC Berkeley (1.4).