Sourcery (10/12-10/16)

N26, NYDIG, M1 Finance, Clair, 98point6, Osmind, Alkira, Extend, Hello Alfred, FOSSA, Argyle, Double Secret Octopus, Dataloop, Arist, River, Findem, Edgify, Claravine, Grata, Getaround, Plenty. Eargo

Last Week (10/12-10/16):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include N26, NYDIG, M1 Finance, Clair, 98point6, Osmind, Alkira, Extend, Hello Alfred, FOSSA, Argyle, Double Secret Octopus, Dataloop, Arist, River, Findem, Edgify, Claravine, Grata, Getaround, Plenty. Eargo, Didi Chuxing, Roblox.

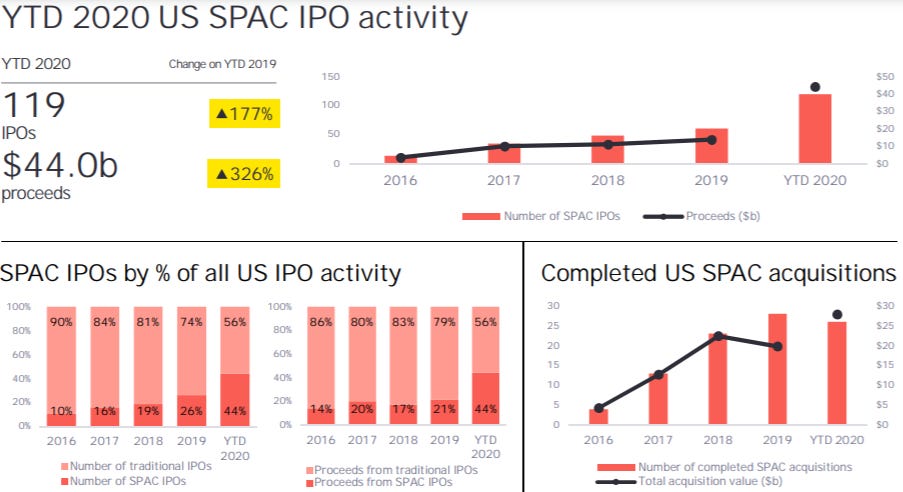

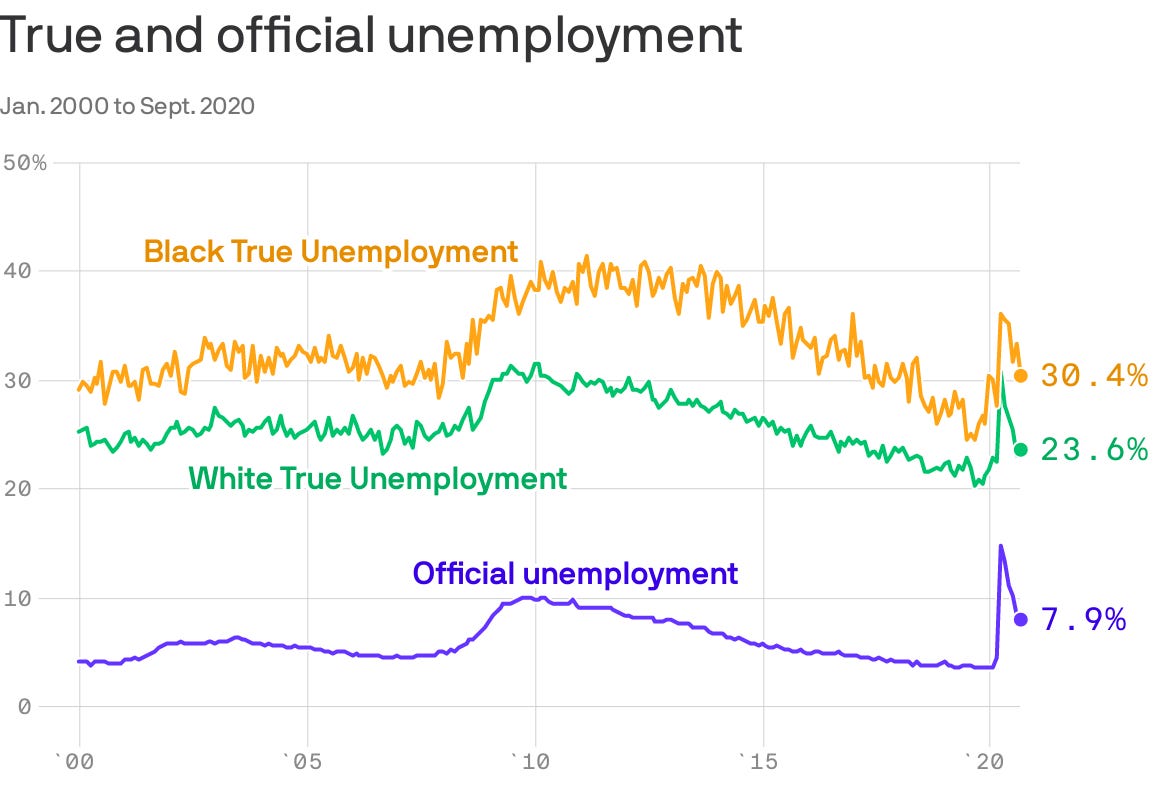

Final numbers on SPAC Activity to Date and True & Official Unemployment at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- N26, a Berlin-based fintech, is weighing another round of fundraising that would value it north of $3.5 billion next year, per Bloomberg. Read more.

- Wealthsimple, a Toronto-based online investment firm, is nearing a deal to raise about $76 million led by TCV that would value it at over $1 billion, per Bloomberg. Read more.

- Fivestars, a San Francisco-based maker of small business payments and marketing software, raised $52.5 million in funding. Salt Partners led the round and was joined by investors including Lightspeed Venture Partners, DCM Ventures, Menlo Ventures and HarbourVest Partners.Read more.

- New York Digital Investment Group(NYDIG), a subsidiary of Stone Ridge that digital asset services, raised $50 million. Fintech Collective led the round and was joined by investors including Bessemer Ventures and Ribbit Capital.

- M1 Finance, a Chicago-based automated money management platform, raised $45 million in Series C funding. Left Lane Capital led, and was joined by Jump Capital and Clocktower Technology Ventures. www.m1finance.com

- Extend, a San Francisco-based fintech focused on product warranties, raised $40 million in Series B funding. Meritech Capital led the round and was joined by investors including PayPal Ventures, Great Point Ventures and Shah Capital Partners.

- Finexio, an Orlando-based AP payments as-a-service platform, raised $23 million led by Medalist Partners. http://axios.link/R7d7

- Spendesk, a Paris-based spend management platform for small to medium sized businesses, raised $18 million in funding. Eight Roads Ventures led the round.

- Alpaca, a San Mateo, Calif.-based startup for companies to add commission-free equities trading to their platforms, raised $10 million in Series A funding. Portag3 led the round and was joined by investors including Social Leverage, Spark Capital, Fathom Capital, and Abstract Ventures. Read more.

- Hedvig, a Stockholm-based insurance carrier, raised $9 million in extended Series A funding. Investors included Obvious Ventures, Cherry Ventures, D-Ax, and CommerzVentures.

- Clair, a New York City-based fintech focused on rapid pay for hourly and gig economy workers, raised $4.5 million in seed funding. Upfront Ventures led the round and was joined by investors including Founder Collective and Walkabout Ventures.

- Aumni, a Salt Lake City-based investment analytics company for the private capital markets, raised $3 million in additional Series A funding. Investors included Donnelley Financial Solutions, DLA Piper and Orrick.

. . .

Care:

- Calm, a San Francisco-based maker of a meditation and sleep app, is seeking to raise $150 million at a $2 billion valuation, per Bloomberg. Read more.

- 98point6, a Seattle-based on-demand digital primary care service, raised $118 million in Series E funding. L Catterton and Activant Capital led the round and was joined by investors including Goldman Sachs.

- Lark Health, a Mountain View-based chronic disease prevention and management startup, raised $55 million in Series C funding. King River Capital led, and was joined by Franklin Templeton, SteelSky Ventures, Olive Tree Capital, and return backers Lightspeed Ventures and Asset Management Ventures. It also secured a $15 million debt facility from Trinity Capital and Bridge Bank.http://axios.link/MVGh

- Nym Health, a Boston-based provider of autonomous medical coding technology, raised $16.5 million in Series A funding. GV led the round.

- Savana, a New York-based startup applying big data to electronic health records, raised $15 million in Series B funding. Cathay Innovation led the round and was joined by investors including Seaya Ventures and MACSF.

- Twentyeight Health, a New York-based health tech company offering access to women’s sexual and reproductive healthcare, raised $5.1 million in seed funding. Third Prime led the round and was joined by investors including Town Hall Ventures, SteelSky Ventures, Aglaé Ventures, GingerBread Capital, Rucker Park Capital, and Predictive VC.

- WiserCare, a Los Angeles-based digital health platform, raised $3.6 million in funding. UnityPoint Health Ventures led the round and was joined by investors including Abundant Venture Partners.

- Coa, a San Francisco-based online fitness and online therapy studio, raised $3 million in seed funding. Crosslink Ventures led the round and was joined by investors including RedSea Ventures and Alpaca VC (prev. Corigin Ventures).

- Osmind, a Mountainview, Calif.-based healthcare technology startup providing software for mental health professionals, raised $2 million in seed funding. General Catalyst led the round and was joined by investors including What If Ventures, 20|20 Fund, Jeffrey Leiden MD (executive chairman of Vertex Pharmaceuticals), and Alice Zhang (co-founder of Verge Genomics).

- Genemod, a Seattle-based maker of data automation software for life scientists, raised $1.7 million in seed funding. Defy.vc led the round and was joined by investors including Omicron, Unpopular Ventures, Underdog Labs, and Canaan Partners Scout Fund.

. . .

Future of Work:

- Virgin Orbit, Richard Branson’s Long Beach, Calif.-based satellite-launch business, is seeking to raise up to $200 million in a funding that could value it at $1 billion, per The Wall Street Journal. Read more.

- Kahoot! AS , an Oslo, Norway-based education startup, raised about $215 million from SoftBank Group.

- DISCO, an Austin-based legal tech startup, raised $60 million in funding valuing it at $785 million. Georgian Partners led the round and was joined by investors including Bessemer Venture Partners, LiveOak Venture Partners, The Stephens Group, and Breyer Capital.

- Snapdocs, a San Francisco-based real estate startup, raised $60 million in funding. YC Continuity led the round and was joined by investors including Docusign and Lachy Groom. Read more.

- Alkira, a San Jose, Calif.-based cloud networking startup, raised $54 million in Series B funding. Koch Disruptive Technologies led the round and was joined by investors including Sequoia Capital, Kleiner Perkins, and GV.

- deepwatch, a Washington, D.C.-based cybersecurity startup, raised $53 million in Series B funding. Goldman Sachs led the round and was joined by investors including ABS Capital Partners.

- Hello Alfred, a New York-based building management and resident services platform, raised $42 million in Series C funding led by the family office of former WeWork CEO Adam Neumann. Return investors include Spark Capital, NEA, and real estate developer Greystar. http://axios.link/LiHW

- Armory, a San Mateo, Calif.-based software delivery company, raised $40 million in Series C funding. B Capital Group led, and was joined by New Edge Capital, Marc Benioff, and return backers Insight Partners, Crosslink Capital, Bain Capital Ventures, Mango Capital, Javelin Venture Partners, and YC.http://axios.link/752h

- Cribl, a San Francisco Bay area-based data observability company, raised $35 million in Series B funding. Sequoia Capital led the round and was joined by CRV.

- Whisper, a San Francisco-based maker of hearing aids, raised $35 million in Series B funding. Quiet Ventures led the round and was joined by investors including Sequoia Capital and First Round Capital.

- Point Pickup, a Greenwich, Conn.-based last-mile delivery startup, raised $30 million in Series A funding led by BBH Capital Partners. http://axios.link/gx8P

- apiiro, a New York-based platform that seeks to automatically remediate risk with changes in app development, raised $35 million funding. Investors include Ted Schlein (General Partner at Kleiner Parkins), Saam Motamedi and Asheem Chandna (General Partners at Greylock).

- Kasa Living, a San Francisco-based short term rental company, raised $30 million in Series B funding. Ribbit Capital led the round. FirstMark Capital led the firm’s $20 million Series A funding.

- Nuvemshop, a provider of Shopify-like marketplace software for Latin America, raised $30 million. Qualcomm led, and was joined by return backers Kaszek Ventures, FJ Labs, IGNIA, Elevar Equity, and Kevin Efrusy. http://axios.link/D3cq

- BlackSwan Technologies, a company seeking to use artificial intelligence to increase operational efficiency, raised $28 million. Investors included Prytek, FinTLV, and MS&AD Ventures.

- NinjaCat, a New York-based maker of a platform to track, store, report, monitor, and analyze marketing performance data, raised $26 million in Series A funding from Clovis Point Capital.

- Casai, a Mexico City-based short-term rental platform, raised $23 million in Series A funding. Andreessen Horowitz led the round and was joined by investors including Andreessen Horowitz’s Cultural Leadership Fund, Kaszek Ventures, Monashees Capital, Global Founders Capital, Liquid 2 Ventures, Tom Stafford (managing partner of DST Global), and founders of startups including Nova Credit, Loft, Kavak, and Runa.

- FOSSA, a San Francisco-based open source management company,raised $23.2 million in Series B funding. Investors included Bain Capital Ventures, Canvas Ventures and Costanoa Ventures.

- Argyle, a San Francisco-based maker of a way to track and verify employment records, raised $20 million in Series A funding. Bain Capital led the round and was joined by investors including Bedrock and F-Prime.

- Secret Double Octopus, a Tel Aviv-based startup focused on passwordless authentication, raised an undisclosed amount of funding from SC Ventures.

- Sonrai Security, a New York-based cloud security platform, raised $20 million in Series B funding. Menlo Ventures led the round and was joined by investors including Polaris Partners and Ten Eleven Ventures.

- Temporal, a Seattle-based maker of an open source, stateful, microservices orchestration platform, raised $18.8 million in Series A funding. Sequoia Capital led the round and was joined by investors including Madrona Venture Group, Addition Ventures and Amplify Partners.

- Vivun, an Oakland, Calif.-based presale software maker, raised $18 million in Series A funding. Accel led the round and was joined by investors including Unusual Ventures.

- Qatalog, a London-based developer of a tool to combine a company’s existing apps, raised $15 million in Series A funding. Atomico led the round and was joined by investors including Salesforce Ventures,Jacob de Geer (co-founder of iZettle), Chris Hitchen (partner at Inventures), and Thijn Lamers (former EVP at Adyen). Read more.

- Infiot, a San Francisco, Calif.-based maker of infrastructure for remote users, sites and IoT devices, raised $15 million in funding. Investors include Lightspeed Venture Partners, Neotribe Ventures, Westwave Capital, and Harpoon Ventures.

- Yotascale, a San Francisco-based cloud cost management software maker, raised $13 million in Series B funding. Felicis Ventures' Aydin Senkut led the round and was joined by investors including Crosslink Capital, Pelion Ventures, and Engineering Capital.

- Dataloop, an Israeli AI data management and annotation platform, raised $11 million in Series A funding. Amiti Ventures led, and was joined by F2 VC, NextLeap Ventures, and SeedIL Ventures. www.dataloop.ai

- GetSetup, a San Francisco-based maker of education technology for older adults, raised $10 million in funding. ReThink Education led the round and was joined by investors including AME Cloud Ventures, Work Play Ventures, and Sweat Equity Ventures.

- River, a New York-based content discovery platform, raised $10.4 million in seed and Series A funding. Investors include Founders Fund, .406 Ventures, Box Group, Scooter Braun, Josh Kushner, and Raised in Space.

- Playbook, a New York-based marketplace for fitness and athletics instructors to turn content into subscription income, raised $9.3 million in Series A funding. Investors included E.ventures, Michael Ovitz, Abstract, Aglae Ventures, Porsche Ventures and FJ Labs.

- Acceldata, a Palo Alto, Calif.-based maker of a data observability platform, raised $8.5 million in Series A funding. Sorenson Ventures led the round and was joined by investors including Lightspeed and Emergent Ventures.

- Cyberpion, a Tel Aviv-based cybersecurity startup, raised an $8.3 million in seed funding. Team8 Capital and Hyperwise Ventures co-led the round.

- Findem, a San Francisco-based maker of an HR recruiting and retention platform, raised $7.3 million in Series A funding. Wing Venture Capital.

- Navina, a Tel Aviv-based developer of a platform for primary care utilizing A.I., raised $7 million in seed funding. Grove Ventures led the round.

- Edgify, a London-based company building A.I. training frameworks, raised $6.5 million in seed funding. Investors include Octopus Ventures, and Mangrove Capital Partners.

- Claravine, a Lehi, Utah-based marketing data governance platform, raised $5 million in Series A funding. Grayhawk Capital led, and was joined by Next Frontier Capital and Peninsula Ventures. http://axios.link/RlcG

- Profitboss, a Beverly Hills, Calif.-based online ordering platform, raised $3.5 million in seed funding. Redpoint Ventures led the round and was joined by investors including Kimbal Musk, Dylan Field (Figma CEO), Naval Ravikant (AngelList cofounder), The Chainsmokers, George Bousis (Raise founder), and Sean Rad (Tinder founder).

- Grata, a New York and Boston-based maker of a search engine for discovering small to middle market private companies, raised $3.2 million in seed funding. Bling Capital led the round and was joined by investors including Accomplice and Alumni Ventures Group.

- BlackBoiler, an Arlington, Va.-based contract markup technology provider, raised $3.2 million in funding. Investors included DocuSign.

- Moment House, a ticketed digital live experiences platform connecting fans with artists, raised $1.5 million in seed funding. Forerunner Ventures led the round and was joined by investors including Scooter Braun, Jared Leto, Troy Carter, and Palm Tree Crew (Kygo and Myles Shear).

- Balsa, a San Francisco-based startup building tools for builders, raised $4.5 million in seed funding. Andreessen Horowitz led the round and was joined by investors including Operator Collective, BoxGroup, 20VC, Chapter One, Work Life Ventures, Stewart Butterfield, Drew Houston, Howie Liu, April Underwood, Scott Belsky, and Jason Warner.

- Arist, a Boston-based text message learning platform, raised $1.9 million in funding. Investors included Acadian Ventures, Global Founders Capital and Craft Ventures.

. . .

Sustainability:

- Proterra, a Burlingame, Calif.-based electric bus-maker, raised $200 million. Cowen Sustainable Advisors led, and was joined by Soros Fund Management, Generation Investment Management, and Broadscale Group. www.proterra.com

- Getaround, a San Francisco-based P2p car rental company, raised $140 million. PeopleFund led, and was joined by Reinvent Capital, Henry McGovern, Pennant Capital, and VectoIQ partners. http://axios.link/w49D

-Plenty, a South San Francisco-based vertical farming company, raised $140 million in Series D funding. Existing backer SoftBank Vision Fund led, and was joined by berry producer Driscoll’s. www.plenty.ag

- Plenty Unlimited, a South San Francisco-based farming startup, raised $140 million in Series D funding. Softbank Vision Fund 1 led the round and was joined by investors including Driscoll’s.

- LIVEKINDLY, a maker of plant-based foods, raised $135 million in funding. Blue Horizon Corporation led the round and was joined by investors including Trustbridge Partners and EQT.

- Astroscale, a Tokyo-based company removing space debris, raised $51 million in Series E funding. aStart led the round and was joined by investors including Hulic, I-Net, Shimizu and Sparx Space Frontier Fund.Read more.

- Newlight Technologies, a Huntington Beach, Calif.-based developer of ocean-degradable biopolymers, raised $45 million in Series F funding. Valedor Partners led, and was joined by return backer GrayArch Partners. http://axios.link/nPX

- Rise Gardens, a Chicago-based maker of in-home, smart hydroponic garden systems, raised an undisclosed amount of funding from the Amazon Alexa Fund.

Acquisitions:

- Twilio (NYSE: TWLO) agreed to buy Segment, aSan Francisco-based cloud customer data infrastructure company, for around $3.2 billion in stock. Segment raised over $280 million in VC funding, most recently in 2019 at a $1.5 billion valuation, from firms like Accel, Founders Circle Capital, Greycroft, GV, Meritech Capital Partners, Sapphire Ventures, Thrive Capital, and Y Combinator.

- Paladina Health, backed by NEA and Oak HC/FT, agreed to acquire Healthstat, a Charlotte, N.C.-based provider of onsite, near-site, shared and virtual employer-sponsored health centers. Financial terms weren't disclosed.

- Apax Partners acquired MyCase, a Goleta, Calif.-based provider of legal practice management software. www.mycase.com

- WellSky, an Overland Park, Kan.-based portfolio company of TPG Capital and Leonard Green, acquired CarePort Health, a Boston-based provider of patient care coordination software, from Allscripts (Nasdaq: MDRX). www.careporthealth.com

- Stripe agreed to acquire Paystack, a Nigerian digital payment startup in which Stripe had previously invested. Other backers include Visa and Tencent, while TechCrunch puts the price-tag north of $200 million. http://axios.link/yghW

- ZoomInfo (Nasdaq: ZI) acquired Clickagy, a Roswell, Ga.-based buyer intent data provider. Financial terms weren't disclosed.

. . .

IPOs:

- Eargo, a San Jose, Calif.-based hearing aids company, raised $141 million in its IPO. It priced 7.9 million shares at $18, versus plans to offer 6.7 million shares at $14-$16. The company will list on the Nasdaq (EAR), used JPM as lead underwriter, and reports an $18 million net loss on $28.6 million in revenue for the first half of 2020. Eargo raised in VC funding from firms like NEA (21.6% pre-IPO stake), Gilde Healthcare (12.8%), Future Fund (12.9%), Longitude Venture Partners (12.8%), the Charles and Helen Schwab Foundation (8.8%), and Maveron (5%). http://axios.link/GufI

- Dida Chuxing, a Chinese ride hailing company, is seeking to raise $500 million in a Hong Kong IPO. Read more.

- Roblox, a San Mateo, Calif.-based gaming platform for tweens and teens, said it filed confidential IPO docs. The company has raised $335 million since its 2004 founding, from firms like First Round Capital, Altos Ventures, Meritech Capital Partners, Andreessen Horowitz, and Index Ventures. http://axios.link/P3j0

- DoubleVerify, a New York-based digital media engagement analytics firm, could seek to raise $500 million through an IPO as soon as the first half of 2021, per Bloomberg. Providence Equity Partners backs the firm. Read more.

- McAfee Corp, the cybersecurity company carved out of Intel Capital, plans to raise $758 million in an offering of 37 million shares (16% sold by insiders) priced between $19 to $22. Read more.

- Array Technologies Inc., the solar company, raised $1.1 billion alongside shareholder Oaktree Capital in its IPO. Read more.

. . .

SPACs:

- Triller, the short-form video app rival to TikTok, is reportedly in talks to merge with a blank-check acquisition company. The company is said to be in the middle of raising a $250 million round. Read more.

- Global Knowledge Training and Skillsoft, both education tech companies, agreed to simultaneously go public via a reverse merger with Churchill Capital Corp. II (NYSE: CCX), a SPAC led by Michael Klein, per Bloomberg. GKT is a Cary, N.C.-based ed tech company backed by Rhone Capital, while Ireland-based Skillsoft was backed by Charterhouse Capital Partners before its June bankruptcy filing. The combined deal is valued at $1.53 billion.

Funds:

- Canaan Partners raised $800 million for its twelfth early-stage VC fund. www.canaan.com

- First Round Capital is raising $220 million for its eighth flagship fund, per SEC filings. www.firstround.com

- Khosla Ventures is raising $1.1 billion for its eighth early-stage fund and $400 million for a new seed-stage fund, per SEC filings. www.khoslaventures.com

-Menlo Ventures raised $500 million for its fifteenth fund. http://axios.link/3qOB

- 2045 Ventures, a Culver City, Calif.-based VC effort led by Carmen Palafox, is raising $20 million for a new fund, per an SEC filing. http://axios.link/jGcX

- Brighteye Ventures, a European VC firm focused on ed-tech, raised $54 million for a first close on its second fund. http://axios.link/Sdnm

- Altimeter Capital is raising $480 million for its fifth growth equity fund, per an SEC filing. www.altimeter.com

-Boldstart Ventures of New York is raising $155 million for its fifth fund, per an SEC filing. www.boldstart.vc

- Define Ventures, a digital health-focused VC firm led by Lynne O’Keefe, is raising $180 million for its second fund, per an SEC filing. www.definevc.com

-OpenView Venture Partners, a Boston-based firm focused on business software, raised $450 million for its sixth fund. http://axios.link/grHg

•True Ventures raised $465 million for its seventh flagship fund, plus $375 million for its fourth "select" fund. http://axios.link/GpCQ

Final Numbers

Source: EY Global IPO Trends report Q3 2020. Data: SPAC Research, SEC filings

Final Numbers

Data: Ludwig Institute for Shared Economic Prosperity; Chart: Axios Visuals

Go deeper:America's true unemployment rate