Sourcery (10/24-10/28)

Elon & Twitter ~ Bilt Rewards, ConnexPay, Vesta, Coterie, WeTravel, Limit, Fursure, Martian, HealthJoy, Navina, Wispr, Vara, Gabbi, Elion, RapidSOS, Merge, Fermyon, Unito, Keebo, Yoom...

Elon’s New Toy

Happy November!

There’s only one big deal that’s going on right now, and that’s the official turn of hands of Twitter. A lot is going to happen in the coming weeks and a lot has already shaken out (including engineering tests, RIFs, product overhauls, and a lot of stunts & tweets by Elon). Grab your popcorn, cause this is going to be a dramatic course of events.

Twitter News:

Elon Musk, Plus a Circle of Confidants, Tightens Control Over Twitter, NYT

E102: Elon closes Twitter deal, $META uncertainty, Zuck's historic bet, big tech decline & more, All-In Podcast

If you’re going to read something other than news about Twitter:

The Hype Cycles of Venture Capital, Kyle Harrison of Contrary Capital

As it relates to this new Generative AI wave…

Hyperscalers Report Quarterly Earnings, Jamin Ball

Follow us on Twitter Linkedin for just the top deals recap

. . .

Last Week (10/24-10/28):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Bilt Rewards, ConnexPay, Vesta, Coterie, WeTravel, Limit, Fursure, Martian, HealthJoy, Navina, Wispr, Vara, Gabbi, Elion, RapidSOS, Merge, Fermyon, Unito, Keebo, Yoom, Mason, Swantide, Gearflow, Storyfit, ShoppinPal, ByteBrew, Ascend Elements, Nitricity, Joro, Forsea Foods; UserTesting, Alter; Mobileye; Natural Shrimp

Final numbers on Global Terminated M&A, & VC/PE Deals and Change in Real GDP by Prev Qtr at the bottom.

Deals

Fintech:

- Bilt Rewards, a New York-based consumer brand for renters, raised $150 million in funding. Left Lane Capital led the round and was joined by investors including Smash Capital, Wells Fargo, Greystar, Invitation Homes, Camber Creek, Fifth Wall, and Prosus Ventures.

- ConnexPay, an Alpharetta, Ga. and St. Paul, Minn.-based payments technology company, raised $110 million in funding led by FTV Capital.

- Vesttoo, an Israeli insurance risk transfer platform, raised $80m in Series C funding at a $1b valuation from Mauro Ventures and an unidentified PE firm co-led, and were joined by Goldman Sachs, Gramercy Ventures, Black River Ventures and Hanaco Ventures. https://axios.link/3TTjAgD

- The Coterie, a Palo Alto, Calif.-based financial technology platform for startup founders, raised $40 million in funding led by Andreessen Horowitz.

- Finexio, an Orlando, Fla.-based accounts payable payments-as-a-service startup, raised $35m in Series B funding at a $100m pre-money valuation from JPMorgan, National Bank Holdings and insider Mendon Venture Partners. www.finexio.com

- WeTravel, a San Francisco-based business management and payments platform for multi-day travel businesses, raised $27 million in Series B funding. Left Lane Capital led the round and was joined by investors including Swift Ventures and Base10.

- Limit, a Walnut, Calif.-based digital insurance wholesale broker for the cyber market, raised $14.5m in Series A funding. IA Capital Group led, and was joined by American Family Ventures, Indicator Fund and Material V. www.limit.com

- Neat, a Paris-based embedded insure-tech for retailers, raised €10m. Octopus Ventures led, and was joined by New Alpha, Founders Future and Mundi Ventures. www.neat.eu

- Bookkeep, a New York-based accounting automation startup, raised $6.6m in seed funding. Fin Capital led and was joined by TTV Capital, Argonautic Ventures, Lerer Hippeau and Haymaker Ventures. www.bookkeep.com

- Fun, a San Francisco-based blockchain software development company, raised $3.9 million in pre-seed funding. JAM Fund led the round and was joined by investors including SOMA Capital, NOMO Ventures, Great Oaks Venture Capital, and investor Cory Levy.

- Sidekick, a London-based digital active investment management company, raised £3.33 million ($3.82 million) in pre-seed funding. Octopus Ventures led the round and was joined by investors including Seedcamp and Semantic.

- Ottr, a San Francisco-based Web3 app for holding and securing crypto, raised $3.1 million in pre-seed funding. Race Capital led the round and was joined by investors including Circle Ventures, Slow Ventures, and Kamal Ravikant.

- Vixtra, a São Paulo-based import credit fintech company, raised $3 million in pre-Series A funding. Valor Capital led the round and was joined by QED.

- Fursure, a Miami-based pet insurance marketplace and mobile banking solution for pet owners, raised $3 million in seed+ funding. MaC Ventures led the round and was joined by investors including Sure Ventures, Scrum VC, Western Tech Investment, Slope Fund, Winklevoss Capital, Streamlined Ventures, Upside Partnership, and other angels.

- Martian, a New York-based Web3 wallet, raised $3 million in pre-seed funding. Race Capital led the round and was joined by investors including FTX Ventures, Superscrypt, Jump Capital, and Aptos Labs.

- LuckyTruck, a Cincinnati-based retail platform for the trucking insurance market, raised $2.4m in seed extension funding led by Candid Insurance Investors. https://axios.link/3TxxgOC

. . .

Care:

- HealthJoy, a Chicago-based healthcare navigation platform, raised $60 million in Series D funding. Valspring Capital led the round and was joined by investors including Endeavour Vision, CIBC Innovation Banking, US Venture Partners, GoHealth co-founders Brandon Cruz and Clint Jones, Health Velocity Capital, Nueterra Capital, and Epic.

- Neocis, a Miami-based robot-assisted dental implant surgery manufacturer, raised $40 million in funding. Intuitive Ventures, DFJ Growth, Vivo Capital, Mithril Capital Management, Norwest Venture Partners, and Fred Moll invested in the round.

- SubjectWell, an Austin-based engagement platform for matching patients with chronic health conditions to new care options, raised $35 million in Series B funding. Asset Management Ventures led the round and was joined by Bertelsmann.

- Cresilon, a Brooklyn-based hemostatic medical device technologies manufacturer and development company, raised $25 million in Series A-4 funding led by Paulson Investment Company.

- Navina, an Israeli provider of assistant software for physicians, raised $22m in Series B funding. Alive led, and was joined by Grove Ventures, Vertex Ventures Israel and Schusterman Family Investments. https://axios.link/3TIOJUi

- RightMove, a New York-based virtual musculoskeletal physical therapy provider, raised $21 million in Series A funding. Hospital for Special Surgery and Flare Capital invested in the round.

- Daye, a London-based gynecological health startup, raised $11.5 million in Series A funding from MassMutual Ventures and others.

- Limber Health, a Washington, D.C.-based hybrid MSK startup, raised $11m in Series A funding. Blue Venture Fund led, and was joined by Glenview Capital. www.limberhealth.com

- Mindful Care, a West Hempstead, N.Y.-based behavioral health care startup, raised $7m in Series B funding. Sopris Capital led, and was joined by the University of Chicago, Caruso Foundation and Venkon Group. www.mindful.care

- Wispr, a San Francisco-based neurotechnology interaction company, raised $5 million in seed II funding. Neo, Triple Point Capital, MVP Ventures, NEA, 8VC, and others invested in the round.

- Vara, a Berlin, Germany-based A.I. breast cancer screening startup, raised €4.5 million ($4.45 million) in Series A extension funding. VI Partners led the round and was joined by investors including EQT Foundation, Med360, Merantix, and Think Health.

- Gabbi, a Portland, Ore.-based risk assessment and care navigation startup, raised $4.4m. Bread and Butter Ventures led, and was joined by Female Founders Fund, WR Hambrecht, Phoenix Rising, Claridge Ventures Advisors VC, Coyote Ventures and Gaingels. www.gabbi.com

- Elion, a New York-based digital health technology marketplace company, raised $3.3 million in seed funding. NEA, Max Ventures, 8VC, AlleyCorp, Charge Ventures, and Floating Point invested in the round.

- HeyRitual, a Santa Monica-based couples support company, raised $2 million in pre-seed funding. Ground Up Ventures led the round and was joined by investors including Samsung Next, Verissimo Ventures, 97212 Ventures, Fresh Fund, Homeward Ventures, and other angels.

. . .

Enterprise & Consumer:

- RapidSOS, a New York-based emergency response data platform, raised $75m in Series D funding. NightDragon led, and was joined by BAM Elevate, Insight Partners, Honeywell, M12, Axon, Citi, Highland Capital Partners, Playground Global, Forte Ventures, C5 Capital and Avanta Venture. https://axios.link/3SzwVcQ

- SiMa.ai, a San Jose-based machine learning company, raised $67 million in Series B1 extension funding. MSD Partners, Fidelity Management & Research Company, Amplify Partners, Dell Technologies Capital, Wing Venture Capital, Alter Venture Partners, +ND Capital, and Lip-Bu Tan invested in the round.

- Merge, a New York and San Francisco-based API for B2B integrations, raised $55 million in Series B funding. Accel led the round and was joined by investors including NEA and Addition.

- Classera, a San Francisco-based e-learning company focused on emerging markets, raised $40 million in Series A funding. Sanabil Investments led the round and was joined by investors including Global Ventures, Endeavor Catalyst, 500 Global, Sukna Venture, and Seedra Ventures.

- Canary Technologies, a San Francisco-based guest management system and digital authorization solutions provider for hotels, raised an additional $30 million in Series B funding. Insight Partners led the round and was joined by investors including F-Prime Capital, Y-Combinator, Thayer Ventures, Commerce Ventures, and others.

- WATI, a Hong Kong-based tool for businesses to communicate with their customers via WhatsApp, raised $23m in Series B funding. Tiger Global led, and was joined by DST Global Partners and Shopify. https://axios.link/3sPuWHj

- Fermyon, a Longmont, Colo.-based WebAssembly applications deployment and management platform, raised $20 million in Series A funding. Insight Partners led the round and was joined by investors including Amplify Partners and other angels.

- Unito, a Montréal-based workflow management company, raised $20 million in Series B funding. CDPQ led the round and was joined by investors including Bessemer Venture Partners and Rainfall Ventures.

- Odyssey Interactive, a Waterloo, Ontario-based game development studio, raised $19 million in Series A funding. Makers Fund led the round and was joined by investors including Anthos Capital, The Mini Fund, Andreesen Horowitz, and angel investor Mitch Lasky.

- SwiftConnect, a Stamford, Conn.-based provider of flexible work management software, raised $17m in Series A funding. JLL Spark and Navitas Capital co-led, and were joined by Bridge Investment Group, Crow Holdings, Cushman & Wakefield, Jamf, Nuveen, World Trade Ventures and 1414 Ventures. www.swiftconnect.io

- Keebo, a Palo Alto, Calif.-based data learning platform, raised $15 million in Series A funding. True Ventures led the round and was joined by investors including Neotribe, Pear, 406 Ventures, and Uncorrelated Ventures.

- Yoom, a volumetric capture and immersive content startup, raised $15m from such backers as Jimmy Iovine and Maverick Carter. https://axios.link/3gwjxsM

- Allstacks, a Raleigh-based predictive forecasting and risk management platform, raised $12.3 million in Series A funding. Companyon Ventures led the round and was joined by investors including Atlassian Ventures, CreativeCo, Hyperplane Venture Capital, S3, and Bala Investments.

- SGNL.ai, a Palo Alto, Calif.-based developer of enterprise authorization software, raised $12m in seed funding. Costanoa Ventures led, and was joined by Fika Ventures, Moonshots Capital and Resolute Ventures. https://axios.link/3DCGWlp

- Devtron, a Gurugram, India-based open source internal DevOps platform, raised $12 million in funding led by Insight Partners.

- Mercury, a Boston-based college sports startup, raised $7.5 million in seed funding. Multicoin Capital led the round and was joined by investors including North Island Ventures, Crosslink Capital, Brevan Howard Digital, and others.

- bit.io, a San Francisco-based Postgres database building and collaboration platform, raised $7.5 million in seed funding. Battery Ventures and GreatPoint Ventures co-led the round and were joined by Neo and Combine.

- Mason, a commerce engine for sellers that helps them avoid Amazon, raised $7.5m in seed funding. Accel and Ideaspring Capital co-led, and were joined by Lightspeed India, Mana VC, Gaingels, Core91 and VH Capital. https://axios.link/3sAGr5a

- Arnica, an Atlanta-based behavior-based solution for software supply chain security, raised $7 million in seed funding co-led by Joule Ventures and First Rays Venture Partners.

- Swantide, a San Francisco-based GTM tech stack management platform, raised $7 million in seed funding. Menlo Ventures, Scribble Ventures, Burst Capital, Neo, and Village Global invested in the round.

- Gearflow, a Chicago-based parts marketplace for heavy equipment owners, raised $5.5 million in funding. Brick & Mortar Ventures led the round and was joined by investors including Alumni Ventures, Newark Venture Partners, Watchfire Ventures, and Liquid2 Ventures.

- StoryFit, an Austin, Texas-based provider of audience insights for the entertainment market, raised $5.5m in Series A funding led by Refinery Ventures. www.storyfit.com

- Grafbase, a Stockholm-based data platform for developers, raised $5 million in seed funding. Next47 led the round and was joined by investors including Alven, Uncorrelated Ventures, and other angels.

- ShoppinPal, a Modesto, Calif.-based integration platform as a service (iPaaS) provider for the food, hospitality, and retail sector, raised $5 million in funding. Mucker Capital led the round and was joined by investors including Menlo Ventures, Pitbull Ventures, Incisive Ventures, and other angels.

- ByteBrew, a San Diego-based mobile game analytics platform, raised $4 million in seed funding led by Konvoy.

- Ciro, a San Francisco-based SMB prospecting platform, raised $3.8 million in seed funding. CRV led the round and was joined by investors including Y Combinator, SV Angel, and other angels.

- Memorable, a Boston-based A.I.-focused branding and performance advertising company, raised $2.75 million in pre-seed funding. LDV Capital led the round and was joined by investors including TenOneTen Ventures, BDMI, AperiamVentures, and other angels.

. . .

Sustainability:

- Ascend Elements, a Westborough, Mass.-based engineered materials and lithium-ion battery recycling company, raised $200 million in Series C funding. Fifth Wall Climate led the round and was joined by investors including SK ecoplant, Oman Investment Authority, Lithium Americas Corporation, New Mobility Fund, Mirae Asset Capital & LS, Shinhan GIB, Hitachi Ventures, InMotion Ventures, TDK Ventures, Orbia Ventures, At One Ventures, TRUMPF Venture, and Doral Energy-Tech Ventures.

- Nitricity, an SF-based organic nitrogen production startup, raised $20m in Series A funding. Khosla Ventures and Fine Structure Ventures co-led, and were joined by Energy Impact Partners, Lowercarbon Capital and MCJ Collective. https://axios.link/3N2EiIE

- Cruz Foam, a Santa Cruz, Calif.-based regenerative replacements provider for single-use plastics, raised $18 million in Series A funding. Helena led the round and was joined by investors including One Small Planet, Regeneration.VC, At One Ventures, and SoundWaves.

- Joro, an Oakland, Calif.-based personal carbon emissions tracking app, raised $10m in Series A funding co-led by Sequoia Capital and Amasia. https://axios.link/3zmXlb7

- Forsea Foods, an Israeli cultivated eel startup, raised $5.2m in seed funding. Target Global led, and were joined by The Kitchen FoodTech Hub; PeakBridge VC; Zora Ventures; FoodHack and Milk & Honey Ventures. www.forseafoods.com

Acquisitions & PE:

- Thoma Bravo and Sunstone Partners agreed to acquire UserTesting, a San Francisco-based video-based human insights company. The deal is valued at $1.3 billion.

- Magic Johnson is in talks to buy a minority stake in the NFL's Las Vegas Raiders, per Semafor.

- Grubbr, a Boca Raton, Fla.-based restaurant tech company backed by Aon, acquired GetNoble, a Boston-based digital commerce and marketing platform for on-site events, per Axios Pro. GetNoble backers included Ben Franklin Technology Partners. https://axios.link/3gNlVLK

- Google (Nasdaq: GOOG) acquired Alter, an AI avatar startup for around $100m, per TechCrunch. Alter had been seeded by Twitter, Play Ventures and Roosh Ventures. https://axios.link/3TKJFyM

. . .

IPOs:

- Mobileye, an Israeli self-driving software company bought by Intel, raised $861m in the year's third-largest IPO. The company priced 41m shares at $21 (above the $18–$20 range), with General Atlantic agreeing to buy an additional $100m of shares in a concurrent private placement.

. . .

SPACs:

- NaturalShrimp, a Dallas-based aquaculture company traded on the pink sheets, agreed to be acquired at an implied $275m valuation via Yotta Acquisition Corp. (Nasdaq: YOTA). https://axios.link/3zdjwAm

Funds:

- Lowercarbon Capital raised $250m for a new fund focused on nuclear fusion startups.

Final Numbers

Source: S&P Global Market Intelligence. Data through 10/12/22.

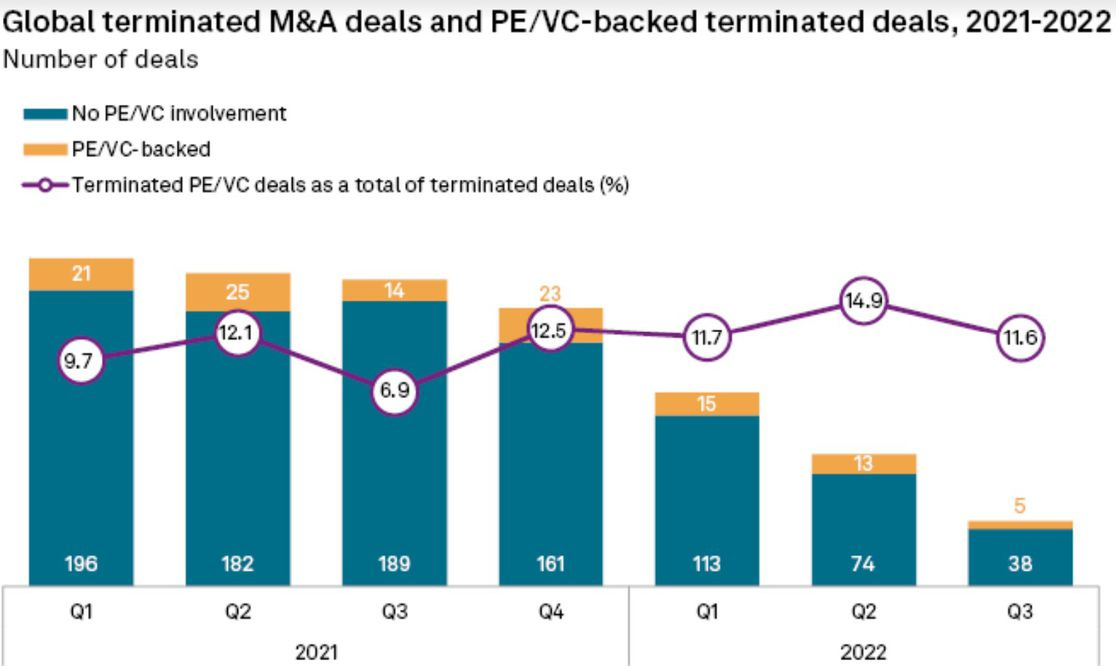

The good news for private equity is that its share of terminated M&A deals declined in the third quarter, per S&P Global Market Intelligence.

The bad news is that its share has been higher in each quarter of 2022 than in its corresponding 2021 quarter.

Data: Bureau of Economic Analysis; Chart: Axios Visuals

The U.S. economy grew by 2.6% in the third quarter, better than economist expectations and the first positive quarter of 2022.

Axios' Courtenay Brown writes: "Gross domestic product got a boost from trade dynamics, but the underlying details — including weaker housing and decelerating consumer spending — point to an economy that's slowing."

Elsewhere: The European Central Bank raised interest rates by 75 basis points.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.