Sourcery (10/3-10/7)

NFL ~ Tally, Cortex, Jiko, Railsr, Alpha Secure, EcoCart, Amplify, Zenskar, Grow Therapy, Alloy, Patronus, Katalyst, DocSpera, NetSPI, Altana, onX, Securiti, Liquid Death, The Rounds

Fall on the East Coast

This past weekend I had a classic northeast autumn trip visiting my family in beautiful Connecticut. Leaf peeping, pumpkin picking, baking, hiking, watching football, playing w my bulldog etc. The trees are turning from their summer greens to glowing gold, orange and red hues, with the amazing smell of a cold breeze and the warmth of the sun on your skin; you just can’t beat it.

Back to football. It’s just better here.

We watched the Giants play the Packers Sunday in London, with a PACKED stadium. NFL London goes way back to 2007 when the Giants took on the Miami Dolphins at Wembley Stadium. Having not seen a decent season in years the Giants were focused on extracting maximum value of Saquon Barkley to the point of having him run wildcat formation (something apt founders may have also had their top talent running as markets & valuations began tumbling). The “Cheeseheads” on the other hand, are having a midlife crisis led by Aaron Rodgers and Randall Cobb; like what’s up with Aaron’s hair?!

In between quarters they highlighted the NFL’s extension to kicking off game day for the first time in Munich, Germany (est. 19m NFL fans). Yes, Germany. The NFL is going deeper into Europe, targeting larger audiences, converting new fans, and increasing those stadium bier revenue streams. If the dollar continues to strengthen against the pound and euro, why wouldn’t you make the trip out?

Musings in Tech:

VC deal announcements are picking up momentum. You’re probably going to have to pop this newsletter out into your browser. Also, M&A activity is getting very interesting… more below.

That didn’t take long…Elon Musk Suggests Buying Twitter at His Original Price, NYT

Not the NFL... but NFT sales plunge in Q3, down by 60% from Q2, Reuters

Chamath Palihapitiya is seeking to raise billions of dollars in outside capital for his venture capital firm, four years after he effectively turned Social Capital into a family office.

Big Partner Departures:

Tiger Global’s star partner John Curtius has left the firm, far ahead of schedule, Fortune

Coatue's Matt Mazzeo leaving to start his own fund: The Information, The Block

Ray Dalio, founder of the world's biggest hedge fund manager, Bridgewater Associates, is giving up control after nearly 50 years.

. . .

Last Week (10/3-10/7):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Tally, Cortex, Jiko, Railsr, Alpha Secure, Exponential, EcoCart, Amplify, Zenskar, Grow Therapy, Alloy, Patronus, Katalyst, DocSpera, NetSPI, Altana, onX, Securiti, Liquid Death, Carbon6, Tines, The Rounds, Humaans, Xembly, Oort, Gather AI, Lightdash, Spexi, Flasso, CoRise, Loop, Trash Warrior, Anthro; Poshmark, Bswift, Duolingo, Fendi, Alert Innovation, Precor; Movella

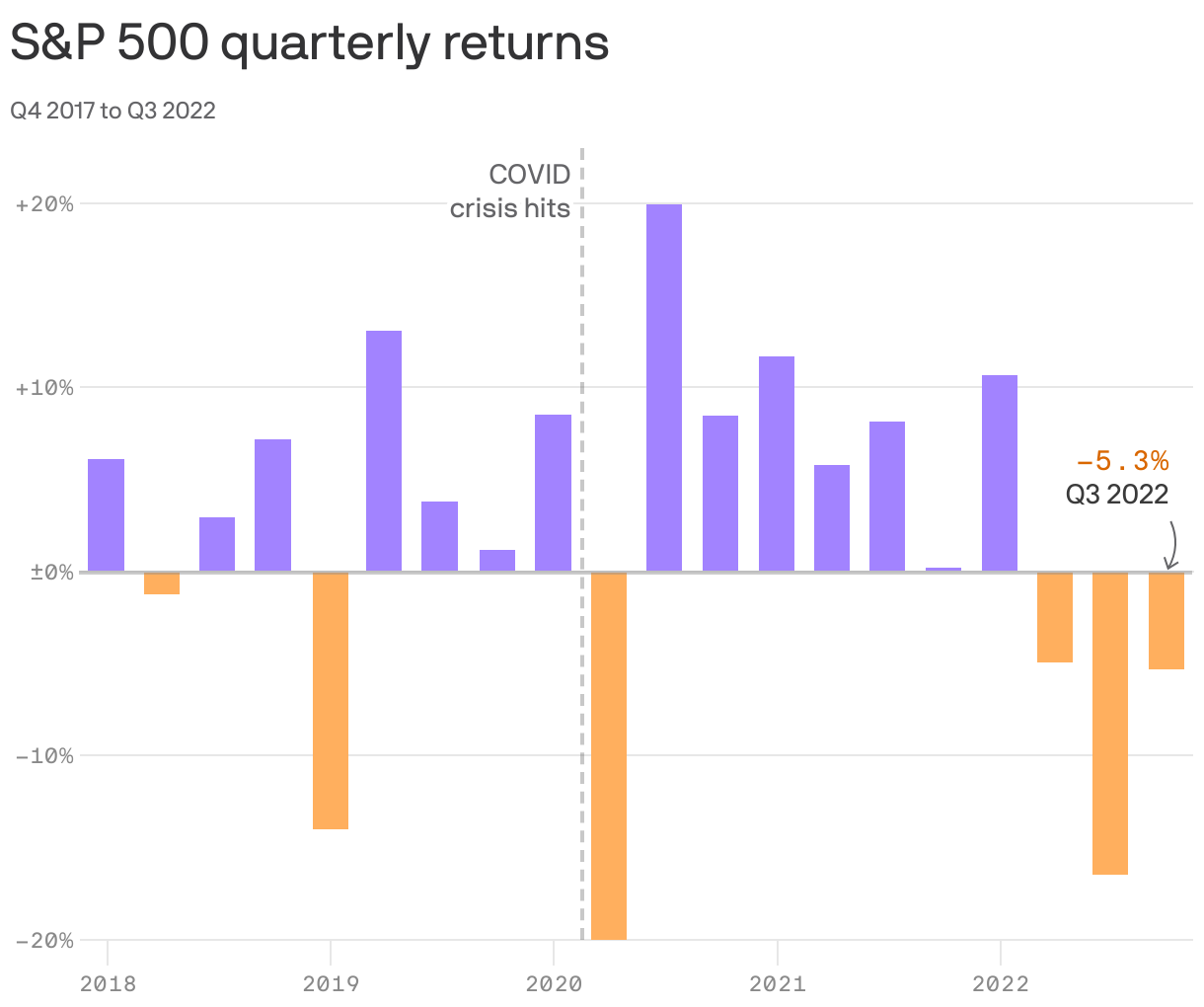

Final numbers on Tesla & Twitter Stock and S&P 500 Qtrly Returns at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Tally, a San Francisco-based financial automation company, raised $80 million in Series D funding. Sway Ventures led the round and was joined by investors including Menora Mivtachim, Kleiner Perkins, Andreessen Horowitz, Shasta Ventures, and Cowboy Ventures.

- Cortex, a Rio de Janeiro, Brazil-based big data analytics SaaS platform for sales, marketing, and communications teams, raised $48.04 million in Series C funding. Lightrock led the round and was joined by investors including SoftBank Latin America Funds, and Riverwood Capital.

- Jiko, an Oakland, Calif.-based fintech that automates T-bill investments and storage, raised $40m in Series B funding. Red River West led, and was joined by Trousdale Ventures, Owen Van Natta, Temaris & Associates, La Maison Partners, BPI France, Airbus Ventures, Anthem Ventures, Upfront Ventures and Radicle Impact. https://axios.link/3CCZfGD

- Tidal Financial Group, a Chicago, Detroit, Milwaukee, and New York-based ETF investment and technology platform, raised $32 million in funding led by FTV Capital.

- Railsr, a London-based embedded finance platform, raised $26 million in Series C funding. Anthos Capital led the round and was joined by investors including Ventura, Outrun Ventures, CreditEase, and Moneta.

- Elpha Secure Technology, a New York-based cyber insurance startup, raised $20 million in Series A funding. Canapi Ventures led the round and was joined by investors including Stone Point Ventures, AXIS Capital, State Farm Ventures, The Hartford STAG Ventures, Fermat Capital Management, and EOS Venture Partners.

- Tegus, a Chicago-based research platform for institutional investors, raised $20m from Positive Sum. www.tegus.com

- Equi, a San Francisco-based alternative investment strategies platform, raised $15 million in Series A funding. Smash Capital led the round and was joined by investors including Company Capital and Montage Ventures.

- Exponential, a San Francisco-based DeFi investment platform, raised $14 million in seed round funding. Paradigm led the round and was joined by investors including Haun Ventures, FTX Ventures, Solana Ventures, Polygon, Circle Ventures, and others.

- EcoCart, an LA-based developer of sustainable infrastructure for e-commerce, raised $14.2m in Series A funding. Fifth Wall Climate led, and was joined by Capital One Ventures, SVB Capital, Ryder Ventures and Sephora CTO Sree Sreedhararaj. https://axios.link/3EAUWNJ

- Blowfish, a remote-based Web3 wallet security company, raised $11.8 million in funding. Paradigm led the round and was joined by investors including Dragonfly, Uniswap Labs Ventures, Hypersphere, and 0x Labs.

- Amplify, an SF-based digital life insurance platform, raised $10m. Munich Re Ventures led and was joined by Crosslink Capital, Greycroft and Conversion Capital. www.getamplifylife.com

- Fintor, a Palo Alto, Calif.-based real estate investing platform, raised an additional $6.2 million in funding. Public.com, Hustle Fund, 500 Global, VU Ventures, Graphene Ventures, and other angels invested in the round.

- Solvento, a Mexico City-based payments and credit startup for truckers, raised $5m in seed funding. Ironspring Ventures led, and was joined by Quona Capital, Proeza Ventures, Dynamo Ventures, Zenda Capital, Susa Ventures, 9Yards Capital and Supply Chain Collective. https://axios.link/3V9d6vs

- Zenskar, a billing workflow automation solution for SaaS companies, raised $3.5m in seed funding. Bessemer Venture Partners led, and was joined by Shine Capital, Basecamp Fund and Converge. https://axios.link/3rqJuw6

. . .

Care:

- Grow Therapy, a New York-based mental health care group, raised $45 million in Series B funding. TCV led the round and was joined by investors including Transformation and SignalFire.

- Alloy Therapeutics, a Waltham, Mass.-based drug discovery startup, raised $42m in Series D funding. 8VC and Mubadala Capital co-led, and were joined by fellow insiders Thiel Capital, Presight Capital and Founders Fund. www.alloytx.com

- Patronus, a Berlin-based elder care startup, raised €27m in Series A funding. Singular and Adjacent co-led, and were joined by Burda Principal Investments, Calvary Ventures and UVC Partners. https://axios.link/3V3te1L

- Clearspeed, a San Diego-based provider of voice analytics for detecting fraud risk, raised $27m in Series C funding. Sanida Holdings and PilotRock co-led, and were joined by King Philanthropies. www.clearspeed.com

- Katalyst, a Las Vegas-based workout and exercise platform, raised $26 million in Series A funding. Stripes led the round and was joined by investors including Incisive Ventures, Unlock Venture Partners, and other angels.

- DocSpera, a Sunnyvale, Calif.-based developer of surgical planning and care coordination tools, raised $10m in Series B funding co-led by Pier 70 Ventures and JJDC Inc. www.docspera.com

- Index Health, a Miami-based functional telemedicine startup, raised $6m in seed funding co-led by LaunchHub Ventures and Inovo Venture Partners. https://axios.link/3EoS9a6

- Arcascope, a Chantilly, Va.-based circadian rhythm-focused health care technology company, raised $2.85 million in seed funding. Supermoon Capital led the round and was joined by investors including Inception Health, New Dominion Angels, AIoT Health, Inflect Health, the Accelerate Blue Fund, the Monroe Brown Seed Fund, HealthX Ventures, and other angels.

. . .

Enterprise & Consumer:

- NetSPI, a Minneapolis-based provider of enterprise penetration testing and vulnerability management solutions, raised $410m in growth equity funding from KKR. www.netspi.com

- Altana Technologies, a New York-based supply chain visibility platform, raised $100m in Series B funding. Activate Capital led, and was joined by OMERS Ventures, Prologis Ventures, Reefknot Investments, Four More Capital, GV, Amadeus Capital, Floating Point and Ridgeline Partners. https://axios.link/3fPHrzg

- onX, a Missoula, Mont.-based outdoor digital navigation company, raised $87.4 million in Series B funding. Summit Partners led the round and was joined by investors including Madison Valley Partners and others.

- ShopBack, a Singapore-based e-c0mmerce rewards app, raised $80m in new Series F funding led by a fund affiliated with existing investor Temasek. https://axios.link/3C5YvZ1

- Securiti, a Coyote, Calif.-based multi-cloud data protection, governance, and security company, raised $75 million in Series C funding. Owl Rock Capital led the round and was joined by investors including Mayfield and General Catalyst.

- Liquid Death, a Santa Monica, Calif.-based beverage company, raised $70 million in funding led by Science Ventures.

- Carbon6 Technologies, an e-commerce software bundler, raised $66m in Series A equity and debt funding. White Star Capital led the equity, and was joined by Kale Investment Fund and Benevolent Capital. https://axios.link/3rr3Gho

- Tines, a Dublin, Ireland-based no-code automation platform for security teams, raised $55 million of Series B extension funding led by Felicis.

- The Rounds, a Philadelphia-based zero-waste delivery and refill service company for household items, raised $38 million in Series A funding. Redpoint Ventures and Andreesen Horowitz co-led the round and were joined by First Round Capital.

- WorkSpan, a Foster City, Calif.-based ecosystem cloud platform, raised $30m from Insight Partners. www.workspan.com

- IriusRisk, a Huesca, Spain-based threat modeling automation cybersecurity company, raised $29 million in Series B funding. Paladin Capital led the round and was joined by investors including BrightPixel Capital, SwanLaab Venture Factory, 360 Capital, and Inveready.

- Eclypsium, a Portland, Ore.-based device supply chain security startup, raised $25m in Series B funding. Ten Eleven Ventures led, and was joined by Global Brain and J Ventures. https://axios.link/3M6fRtB

- Revelio Labs, a New York-based workforce intelligence company, raised $15 million in Series A funding. Elephant Partners led the round and was joined by investors including Alumni Ventures, BDMI, K20 Ventures, Techstars, and Barclays.

- Humaans, a London-based HR tech stack, raised $15m in Series A funding led by Lachy Groom. https://axios.link/3BZjYTq

- Xembly, a Seattle-based automated chief of staff for employees, raised $15 million in Series A funding. Norwest Venture Partners led the round and was joined by investors including Lightspeed Venture Partners, Ascend, Seven Peaks Ventures, and Flex Capital.

- Polco, a Madison, Wis.-based local government community engagement platform, raised $14 million in a Series A funding. Mercury led the round and was joined by investors including BAT Ventures and Royal Street Ventures.

- Oort, a Boston-based identity threat detection and response startup, raised $11.5m in Series A funding. 406 Ventures and Energy Impact Partners co-led, and were joined by Cisco Investments. https://axios.link/3SWha0i

- Blackbird, a web3 loyalty platform for the hospitality industry, raised $11m in seed funding from Union Square Ventures, Shine Capital, Multicoin Capital, Variant, Circle Ventures and IAC. https://axios.link/3V5sDMV

- Gather AI, a Pittsburgh-based supply chain robotics company, raised $10 million in Series A funding. Tribeca Venture Partners led the round and was joined by investors including Xplorer Capital, Dundee Venture Capital, Expa, Bling Capital, XRC Labs, and 99 tartans.

- Lightdash, a remote-based open-source business intelligence platform, raised $8.4 million in seed funding. Accel led the round and was joined by investors including Moonfire, Y Combinator, and other angels.

- LayerX, a Tel Aviv-based cybersecurity startup, raised $7.5 million in seed funding. Glilot Capital Partners, Kmehin Ventures, FinSec Innovation Lab, Enel X, Int3, GuideStar, and other angels.

- Spexi, a Vancouver, Canada-based drone-based aerial data platform, raised $5.5 million in seed funding. Blockchange Ventures led the round and was joined by investors including Protocol Labs, Alliance DAO, FJ Labs, Dapper Labs, CyLon Ventures, Fort Capital, and others.

- Onyxia, a New York-based cybersecurity strategy and performance platform, raised $5 million in seed funding. World Trade Ventures led the round and was joined by Silvertech Ventures.

- Fizz, a social media platform for college campuses, raised $4.5m from Lightspeed Venture Partners and Octane Venture Partners. https://axios.link/3rESIoM

- Lasso Labs, a San Mateo, Calif.-based NFT utility platform, raised $4.2 million in funding. Electric Capital led the round, and was joined by investors including Ethereal Ventures, OpenSea, Village Global, Page One Ventures, and other angels.

- Tidal Cyber, a Clifton, Va.-based cybersecurity company, raised $4 million in a seed+ funding. Ultratech Capital Partners led the round and was joined by investors including Access Ventures, Task Force X Fund, Virginia Innovation Partners, First In, BlueWing, Saas Ventures, and others.

- Fabric, a Los Angeles-based AR experiences web platform for in-person events, raised $4 million in funding from Sapir Venture Partners.

- CoRise, a San Francisco-based live online upskilling platform, raised $3 million in seed extension funding. Greylock and GSV Ventures invested in the round.

. . .

Sustainability:

- Loop, an El Segundo, Calif.-based electric vehicle charging infrastructure company, raised $40 million Series A-1 funding. Fifth Wall Climate and Agility Ventures led the round.

- Trash Warrior, an SF-based startup that matches companies with waste haulers, raised $8m in seed funding led by AltaIR Capital, as first reported by Axios Pro. https://axios.link/3EcFEOF

- Anthro Energy, a Palo Alto, Calif.-based battery creation company, raised $7.23 million in seed funding. Union Square Ventures and Energy Revolution Ventures co-led the round and were joined by investors including Ultratech Capital Partners, Voyager Ventures, Nor’Easter Ventures, and Stanford University.

- Halo.Car, a Las Vegas-based driverless electric car rental provider, raised $5 million in seed funding. At One Ventures led the round and was joined by investors including T-Mobile Ventures, Earthshot Ventures, and Boost VC.

Acquisitions & PE:

- Naver Corp. agreed to acquire Poshmark, a Redwood City, Calif.-based social e-commerce marketplace for new and secondhand items. A deal is valued at approximately $1.2 billion.

- Francisco Partners agreed to buy Bswift, a Chicago-based provider of benefits administration software, from CVS (NYSE: CVS). No financial terms were disclosed, but Axios Pro reports that Bswift was projecting around $50m in 2022 EBITDA. https://axios.link/3RrgY8c

- ZenBusiness acquired Ureeka, a remote-based growth-engine platform for small businesses to attract new customers. Financial terms were not disclosed.

- Levine Leichtman Capital Partners acquired AGDATA, a Charlotte, N.C.-based workflow and data solutions provider within the agribusiness and animal health sectors, from Vista Equity Partners. Financial terms were not disclosed.

- Duolingo acquired Gunner, a Detroit-based animation and illustration studio. Financial terms were not disclosed.

- OneDigital acquired HealthWorks, a Chicago-based insurance advisor. Financial terms were not disclosed.

- TPG closed its $2.2b acquisition of ClaimsXten, the claims editing business of Change Healthcare (Nasdaq: CHNG), per Axios Pro. https://axios.link/3rxLLWs

- Q2 (NYSE: QTWO) acquired Sensibill, a Toronto-based expense management startup that had raised over $50m from firms like Radical Ventures, NAVentures, Information Venture Partners, Fastbreak Ventures and First Ascent Ventures. https://axios.link/3UYJYr3

- ServiceNow (NYSE: NOW) agreed to buy Era Software, a Seattle-based observability startup that had raised over $20m from Playground Global, Array Ventures, Foundation Capital, Modern Venture Partners and Uncorrelated Ventures. https://axios.link/3C2WZqA

- RoadRunner Recycling, a Pittsburgh-based waste management company that recently raised $70m from General Atlantic, acquired Compology, an SF-based provider of waste and recycling smart metering tech that had raised over $30m from firms like 001 Ventures, August Capital, Draper Venture Network and Winklevoss Capital Management. www.roadrunnerwm.com

- Fendi acquired a stake in Italian knitwear specialist Maglificio Matisse. https://axios.link/3M78Ato

- Walmart (NYSE: WMT) agreed to acquire Alert Innovation, a North Billerica, Mass.-based provider of e-grocery fulfillment automation solutions. https://axios.link/3egcgN4

- Peloton (Nasdaq: PTON) is seeking to sell the Precor commercial fitness equipment business it acquired in 2020, per the WSJ. https://axios.link/3SJRlAQ

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

- Movella, a San Jose, Calif.-based maker of sensors that "digitize movement," agreed to go public at an implied $537m enterprise value via Pathfinder Acquisition Corp. (Nasdaq: PFDR), a SPAC sponsored by HGGC and Industry Ventures. Movella has raised around $140m in VC funding from firms like Eastward Capital Partners, Kleiner Perkins, CGP Investment, Keytone Ventures, iD Ventures America, DAG Ventures, Streamlined Ventures, Korea Investment Partners and SK Telecom Americas. https://axios.link/3CA3rXI

Funds:

- CRV, a San Francisco-based venture capital firm, raised $1.5 billion across two funds focused on early stage companies and follow-on Series B and C investments.

- Matrix, a Boston and San Francisco-based venture capital fund, raised $800 million for a fund focused on pre-seed, seed, and Series A companies across industries.

- Activate Capital, an SF-based climate tech venture and growth equity firm, tells Axios that it raised $500 million for its second fund. Co-founder Anup Jacob says that the firm's initial fundraise in 2018 ($157m) was dominated by strategic LPs, as institutional investors weren't sold on the climate tech category. This time around, however, he says that institutions represented most of the new investors, as "ESG has become table stakes." He adds that he expects the Inflation Reduction Act will do for climate tech "what color did for television... make everything better."

- Amazon is launching a $150m fund-of-funds for VC firms that back underrepresented founders. https://axios.link/3V6FSNg

Final Numbers

Data: Yahoo Finance; Chart: Erin Davis/Axios Visuals

Source: Axios Visuals

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.