Sourcery (10/31-11/4)

Layoffs ~ Cover Genius, ORO, Retirable, TAGS, Vesto, Valera Health, Carta Healthcare, Yes Hearing, Contraline, Guaranteed, Bright Machines, Fringe, Meez, Rewind.ai, Topline Pro, Treet

With more and more layoffs happening in big tech, what happens next?

Elon’s massive cuts (50% is much higher than the typical 10-20%) are paving the way for other large tech companies to observe and possibly follow suit as they watch for the outcomes of what a leaner team looks like on their profitability. Are all of those employees crucial to the business? Are they getting in the way of sheer productivity? It’s a hard thing to say, but in its purest form, sure. It’s also hard to say because these are people’s jobs, it’s their income and how they take care of their families. We’re going to be seeing more layoffs across the board, not just in tech, as we creep further into this downturn and likely recession. It’s unfortunate. However, it can also bring opportunity. Opportunity for growing companies to scoop up top talent, opportunity for those who’ve been curious about starting a company take a leap, and overall opportunity to begin something new.

I post about funding announcements weekly and each one of these companies bring new capital and new energy to the playing field, an opportunity to level up and create something bigger.

Tech Winter

E103: Tech layoffs surge, big tech freezes hiring, optimizing for profits, election preview & more, All-in Podcast

(1:18) Bestie updates

(9:12) "Ligma/Johnson" blunder outside of Twitter HQ

(15:38) Surge of tech layoffs at Twitter, Stripe, Lyft, Opendoor, Chime and others; preparing for a longer downturn than originally anticipated

(35:28) Macro trends, big tech freezes hiring, how founders can think about the last 3 years and the next 3 years

(54:04) Midterm election preview, understanding the shift toward populism

(1:17:32) Science corner: Understanding Meta's AlphaFold competitor

Tech Companies Are Bracing For A Winter of Layoffs, Crunchbase

Musings

Total Addressable Mirage? Or Miracle?, Kyle Harrison

Kyle does it again, great deep dive into strategies of investment with an emphasis on TAM arbitrage and deal pricing

EP 40: Peter Fenton, VC and Founder Mindsets, Current Market State and Rashad’s New Podcast, Cartoon Avatars

How Andreessen Horowitz’s Limited Partners Are Feeling These Days, The Information

Yikes

. . .

Last Week (10/31-11/4):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Arta Finance, Cover Genius, Zest AI, Loop, ORO, WalletConnect, Retirable, TAGS, Vesto, Valera Health, Carta Healthcare, Midi Health, Yes Hearing, Contraline, Guaranteed, Bright Machines, Alation, Smartex, Way, Galileo, Fringe, Meez, Rewind.ai, Topline Pro, Treet, AiPrise, Cruz Foam; Adore Me/Victoria’s Secret, Wetzel’s Pretzels, Remix/Shopify

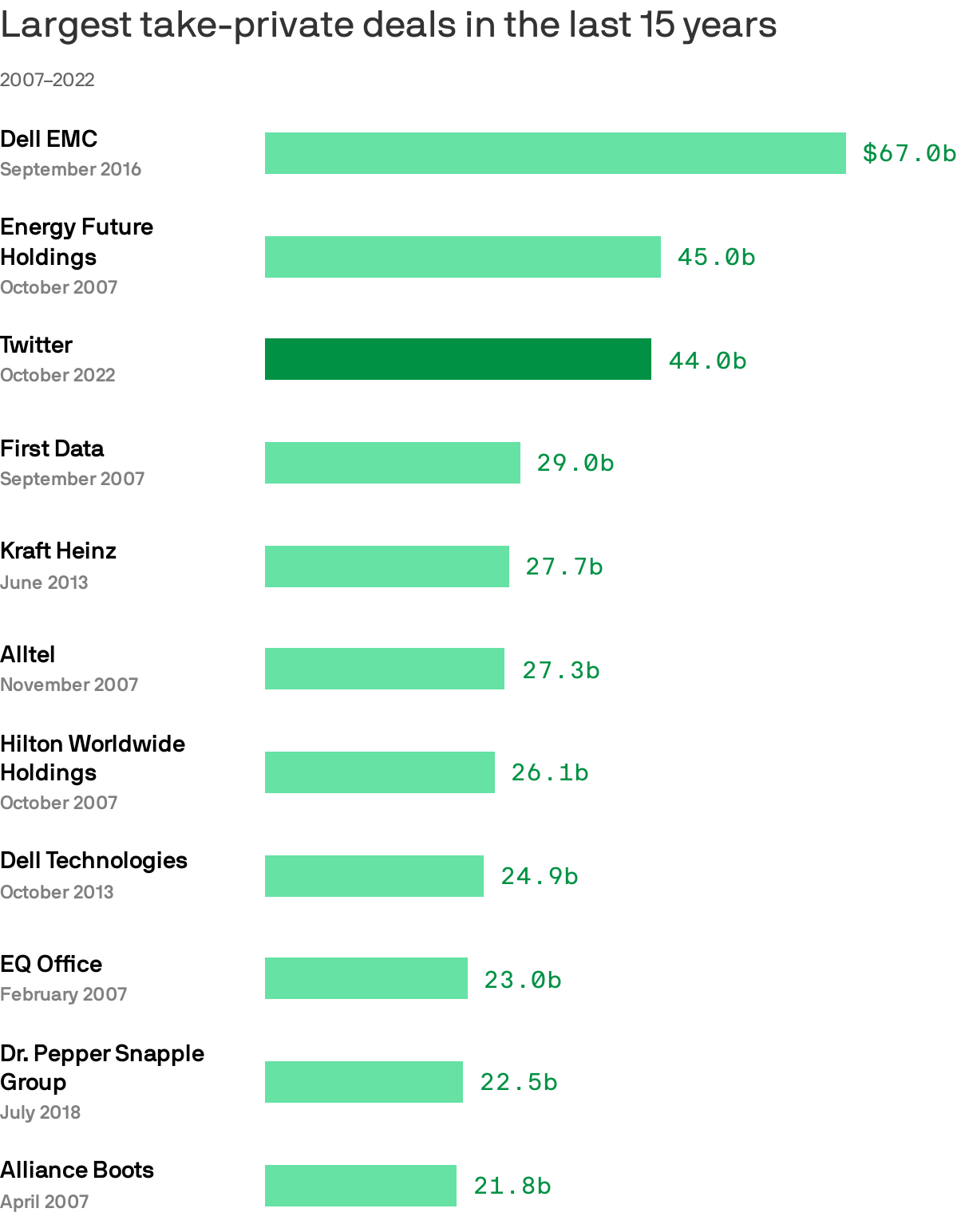

Final numbers on Largest Take-Private Deals in the Last 15 Years at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Carta, the startup equity management platform, saw its valuation jump to $8.5b earlier this year via a secondary share sale, CEO Henry Ward tells Axios Pro's Lucinda Shen. https://axios.link/3gZKsxl

- Arta Finance, a wealth management startup co-founded by ex-Google Pay chief Caesar Sengupta, raised $90m in Series A funding from Sequoia Capital India, Ribbit Capital, Coatue, Betsy Cohen and Eric Schmidt. https://axios.link/3UdeH2s

- Cover Genius, a New York-based insurtech for embedded insurance, raised $70 million in Series D funding. Dawn Capital led the round and was joined by investors including Atlas Merchant Capital, GSquared, and King River Capital.

- Zest AI, a Burbank, Calif.-based automated underwriting startup, raised $50m. Insight Partners and CMFG Ventures co-led, and were joined by CU Direct, Curql, Suncoast Credit Union, Golden1 Credit Union, Hawaii USA Federal Credit Union and NorthGate Capital. https://axios.link/3fsauZV

- Money Fellows, a Cairo-based fintech platform that digitizes money circles, raised $31 million in Series B funding. CommerzVentures, Middle East Venture Partners, and Arzan Venture Capital co-led the round and were joined by investors including Invenfin, National Investment Company, Partech, Sawari Ventures, 4DX, and P1Ventures.

- Loop, a Chicago-based payments platform for the shipping and logistics industry, raised $30m via a Series A round led by Founders Fund and a seed round co-led by 8VC and Susa Ventures. https://axios.link/3gYsVWk

- ORO, an SF-based enterprise procurement platform, raised $25m in Series A funding. Norwest Venture Partners and B Capital co-led, and were joined by XYZ VC and Array Ventures. www.orolabs.ai

- WalletConnect, a web3 communications protocol, raised $12.5m from Shopify, Coinbase Ventures, ConsenSys, Circle Ventures, Polygon, Uniswap Labs Ventures, Union Square Ventures, 1kx, HashKey and Foresight Ventures. https://axios.link/3U3guHy

- Braavos, a Tel Aviv-based smart contract-based wallet firm, raised $10 million in funding. Pantera Capital led the round and was joined by investors including Road Capital, BH Digital, DCVC, Crypto.com, Matrixport, and Starkware.

- Floreo, a Rockville, Md.-based developer of VR behavioral therapy content, raised $10m in Series A funding. Tenfore Holdings led, and was joined by the Felton Group, the Autism Impact Fund and the Disability Opportunity Fund. https://axios.link/3FR209B

- Lama AI, a New York-based business lending platform, raised $9m in seed funding. Viola Ventures and Hetz Ventures led and were joined by Foundation Capital and SixThirty. www.lama.ai

- Haven, a New York-based homeownership platform for mortgage servicers and subservicers, raised $8 million in Series A funding. Fifth Wall led the round and was joined by investors including Fidelity National Financial, RWT Horizons, 1Sharpe Ventures, Conversion Capital, BoxGroup, AME Cloud Ventures, and Operator Partners.

- InterPrice Technologies, a New York-based treasury capital markets funding platform, raised $7.3 million in Series A funding. Nasdaq Ventures and DRW Venture Capital co-led the round and were joined by Bowery Capital.

- Retirable, a New York-based retirement solution provider, raised $6 million in funding. Primary led the round and was joined by investors including Vestigo Ventures, Diagram, Portage, and Primetime.

- NiftyApes, an NFT-focused lending startup, raised $4.2m in seed funding. Variant and FinTech Collective co-led, and were joined by Robot Ventures, Polygon, Coinbase Ventures, The LAO and FlamingoDAO. https://axios.link/3WeD15L

- Centrifuge, a decentralized finance protocol for putting real-world assets on the blockchain, raised $4m from Coinbase Ventures, BlockTower, Scytale and L1 Digital. https://axios.link/3FERd1N

- TAGS Commerce, a Calabasas, Calif.-based instant checkout company, raised $3.5m from XRC Labs, Gaingels, Not Boring and Tiny Capital. https://axios.link/3sTLRrS

- iink Payments, a Tampa-based digital payments network, raised $3 million in seed funding. Grand Ventures led the round and was joined by investors including Springtime Ventures, Simplex Ventures, Motivate Venture Capital, and Green Egg Ventures.

- Vesto, a treasury management startup, raised $2.8m in seed funding. Contrary Capital led, and was joined by Susa Ventures, SV Angel and Coalition. https://axios.link/3E0iYB1

- Heylo, an SF-based payments service for events and groups, raised $1.5 million in a round from Worklife Ventures and Precursor Ventures. https://axios.link/3DTbwYo

. . .

Care:

- Valera Health, a New York-based virtual mental health provider, raised $44.5m. Heritage Group led, and was joined by Cigna Ventures and Horizon Healthcare Services. www.valerahealth.com

- MedCrypt, a San Diego-based cybersecurity solution provider for medical devices, raised $25 million in Series B funding. Intuitive Ventures, Johnson & Johnson Innovation, Section 32, Eniac Ventures, Anzu Partners, and Dolby Family Ventures invested in the round.

- Carta Healthcare, a San Francisco-based clinical data management company, raised $20 million in Series B funding. Paramark Ventures, Frist Cressey Ventures, American College of Cardiology, Asset Management Ventures, CU Healthcare Innovation Fund, Mass General Brigham, Maverick Ventures Investment Fund, and Storm Ventures invested in the round.

- Midi Health, a San Francisco-based virtual care clinic for women, raised $14 million in seed funding. Felicis Ventures and SemperVirens co-led the round and were joined by investors including Emerson Collective, Icon Ventures, Operator Collective, Muse Capital, Steel Sky Ventures, and Anne and Susan Wojcicki.

- Intus Care, a Providence, R.I.-based developer of predictive analytics tools for geriatric care, raised $14m in Series A funding led by Deerfield Management. https://axios.link/3U0LFTX

- Yes Hearing, a New York-based in-home hearing services startup, raised $10m in Series A funding, per Axios Pro. Blue Heron Capital led, and was joined by Primetime Partners, Ensemble Innovation Ventures, Maccabee Ventures and Gaingels. https://axios.link/3DXIg2y

- Contraline, a Charlottesville, Va.-based maker of contraceptive implants for men, raised $7.2m led by GV, per TechCrunch. www.contraline.com

- Guaranteed, a New York-based tech-enabled hospice care startup, raised $6.5m in seed funding. BrandProject led, and was joined by Precursor, Springbank, Lakehouse and Cake Ventures. https://axios.link/3zDEZme

- Exer AI, a Denver-based digital remote patient monitoring platform, raised $6.5 million in funding. Backstage Capital, Life Extension Ventures, Morado Ventures, Oceans Ventures, Operator Partners, Signia Venture Partners, Anne Wojcicki, and David Ko invested in the round.

- Tiny Health, an Austin-based gut health testing company focused on babies, raised $4.5 million in funding led by TheVentureCity.

- Early is Good, a renal disease diagnostics startup, raised $4m from Social Capital, per Axios Pro. https://axios.link/3FKKQKu

. . .

Enterprise & Consumer:

- Bright Machines, an SF provider of software-defined manufacturing solutions, raised $132m in Series B equity and debt funding from insider Eclipse Ventures, Silicon Valley Bank and Hercules Capital. The company late last year scrapped a SPAC merger at an implied $1.6b valuation. https://axios.link/3SO3iVu

- Alation, a Redwood City, Calif.-based enterprise data intelligence company, raised $123 million in Series E funding. Thoma Bravo, Sanabil Investments, and Costanoa Ventures led the round and were joined by investors including Databricks Ventures, Dell Technologies Capital, Hewlett Packard Enterprise, Icon Ventures, Queensland Investment Corporation, Riverwood Capital, Salesforce Ventures, Sapphire Ventures, and Union Grove.

- project44, a Chicago-based supply chain visibility platform, raised $80 million in funding. Generation Investment Management and A.P. Moller Holding co-led the round and were joined by investors including CMA CGM, Goldman Sachs Asset Management, TPG, Emergence Capital, Chicago Ventures, Sapphire, 8VC, Sozo Ventures, and Omidyar Technology Ventures.

- Qwick, a Phoenix-based staffing platform for hospitality businesses and professionals, raised $40 million in Series B funding. Tritium Partners led the round and was joined by investors including Album VC, Kickstart, Desert Angels, and Revolution’s Rise of the Rest Seed Fund.

- Roam, a remote-based cloud HQ company for distributed teams, raised $30 million in Series A funding led by IVP.

- Lodgify, a Barcelona, Spain-based vacation rental software startup, raised $30 million in Series B funding. Octopus Ventures led the round and was joined by investors including Bonsai Partners, Aldea Ventures, ICF, Intermedia Vermögensverwaltung, and Nauta Capital.

- Dropit, a London-based retailer inventory unification platform, raised $25m in Series C funding. Vault Investments led, and was joined by Tiga Investments, Axentia, Sugarbee and ex-Macy's CEO Terry Lundgren. https://axios.link/3WthRkj

- Smartex, a textile manufacturing tech startup, raised $24.7m. Lightspeed Venture Partners and Build Collective co-led, and were joined by H&M Group, DCVC, SOSV's HAX, Spider Capital, Momenta Ventures, Bombyx Capital Partners and Fashion for Good. https://axios.link/3FG0Mh3

- Way, an Austin-based brand activations software platform, raised $20 million in Series A funding. Tiger Global led the round and was joined by MSD Capital.

- Galileo, a San Francisco-based machine learning data intelligence company, raised $18 million in Series A funding. Battery Ventures led the round and was joined by investors including The Factory, Walden Catalyst, FPV Ventures, and other angels.

- Fringe, a Richmond, Va.-based lifestyle benefits startup, raised $17 million in Series A funding. Origin Ventures and Felton Group co-led the round and were joined by investors including Sovereign’s Capital, Revolution Rise of Rest, ManchesterStory Group, Anchormark Holdings, and others.

- GoCo.io, a Houston-based software solutions provider for HR, benefits, and payroll, raised $15 Million in funding led by ATX Venture Partners.

- Momento, a Seattle-based serverless cache company, raised $15 million in seed funding. Bain Capital Ventures led the round and was joined by investors including The General Partnership and other angels.

- Meez, a New York-based professional recipe tool, raised $11.5m in Series A funding. Craft Ventures led, and was joined by Struck Capital, FJ Labs, AME Cloud Ventures and Moving Capital. https://axios.link/3fwwfrq

- Rewind.ai, a remote-based search engine platform, raised $10 million in funding. Andreessen Horowitz led the round and was joined by investors including First Round Capital and others.

- Givingli, a Beverly Hills, Calif.-based online gifting service, raised $10m in Series A funding led by Seven Seven Six. https://axios.link/3Wjgd4C

- Software Defined Automation, a Boston and Munich, Germany-based industrial-control-as-a-service (ICaaS) provider for automation engineers, raised $10 million in seed funding. Insight Partners led the round and was joined by investors including Baukunst VC, Fly Ventures, and First Momentum.

- Alarhea, a startup focused on detecting and mitigating misinformation and manipulation on social media, raised $10m in Series A funding from Ballistic Ventures. www.alethagroup.com

- Vizit, a Boston-based image analytics software company for brands and retailers, raised $10 million in Series A funding. Infinity Ventures and Brand Foundry Ventures the round and were joined by investors including eGateway Capital, Lakefront Partners, Lubar & Co, and others.

- Hoken, a New York-based events-focused hotel marketplace, raised $9m. Streamlined Ventures led, and was joined by BY Venture Partners. www.gohoken.com

- Topline Pro, an online scaling service for home services businesses, raised $5m in seed funding. Bonfire Ventures led, and was joined by TMV and BBG Ventures. https://axios.link/3DqHidy

- Treet, a San Francisco-based branded resale platform, raised $3.5 million in seed funding. First Round Capital led the round and was joined by investors including Bling Capital, Techstars, Interlace, Alante Ventures, BAM Ventures, and BBG Ventures.

- Notebook Labs, a Stanford, Calif.-based identity protocol, raised $3.3 million in seed funding. Bain Capital Crypto led the round and was joined by investors including Y Combinator, Soma Capital, Abstract Ventures, Pioneer Fund, and NFX.

- Flowers Software, a Munich, Germany-based organizational management system for SMBs, raised $3.2 million in seed funding. La Famiglia VC led the round and was joined by investors including LEA Partners, Collective Ventures, and other angels.

- Reclaim.ai, a Portland-based calendar assistant and time management platform, raised $3.2 million in pre-Series A funding. Yummy Ventures, Character.vc, Flying Fish, Operator Partners, Grafana CEO Raj Dutt, and others invested in the round.

- Mozart, a San Francisco-based Web3 gaming integration platform for game developers, raised $3 million in pre-seed funding. Arcanum Capital, AG Build, Future Perfect Venture, SaxeCap, and others invested in the round.

- BuildWithin, a Washington, D.C.-based software management platform for apprenticeship and workplace training programs, raised $2.4 million in pre-seed funding. Dundee Venture Capital led the round and was joined by Black Capital.

- GoodShip, a Nashville and Seattle-based collaboration platform for the supply chain industry, raised $2.4 million in funding. FUSE led the round and was joined by investors including Cercano Management, Flexport Fund, Innovation Endeavors, Sope Creek Capital, Kindergarten Ventures, and other angels.

- AiPrise, a Santa Clara, Calif.-based customer orchestration platform, raised $2 million in seed funding. Y Combinator and Okta Ventures co-led the round and were joined by investors including Restive Ventures, Liquid2 Ventures, TwentyTwo Ventures, and Wedbush Ventures.

- Grip, a perishable shipping startup, raised $2m from Soma Capital and Western Technology Investment. https://axios.link/3NxBFij

. . .

Sustainability:

- AMP Robotics, a Louisville, Colo.-based A.I., robotics, and infrastructure company for the waste and recycling industry, raised $91 million in Series C funding. Congruent Ventures and Wellington Management co-led the round and were joined by investors including Blue Earth Capital, Sidewalk Infrastructure Partners, Tao Capital Partners, XN, Sequoia Capital, GV, Range Ventures, and Valor Equity Partners.

- Protein Evolution, a New Haven, Conn.-based carbon reduction climate tech startup, raised $23 million in funding. Collaborative Fund’s Collab SOS led the round and was joined by investors including New Climate Ventures, Eldridge, Nextrans, and Good Friends.

- Cruz Foam, a Santa Cruz, Calif.-based maker of biodegradable Styrofoam alternatives, raised $18m in Series A funding. Helena led, and was joined by One Small Planet, Regeneration.VC, At One Ventures and SoundWaves. www.cruzfoam.com

- Sunsave, a London-based solar energy subscription provider, raised £3.7 million ($4.25 million) in seed funding. Neurone Ventures, Plug & Play Ventures, and other angels invested in the round.

Acquisitions & PE:

- Victoria's Secret (NYSE: VSCO) agreed to buy DTC lingerie brand Adore Me for $400m. Adore Me previously raised over $50m from firms like FJ Labs, Blisce and Upfront Ventures. https://axios.link/3UjsrbJ

- MTY Food Group agreed to acquire Wetzel’s Pretzels, a Pasadena, Calif.-based pretzel snack franchisor, from CenterOak Partners for $207 million.

- Shopify (NYSE: SHOP) bought Remix, a developer of an open source web framework that had been seeded by OSS Capital, Naval Ravikant and Ram Shriram. https://axios.link/3DnTFHr

- A federal judge blocked Penguin Random House, America's largest book publisher, from buying rival Simon & Schuster from ViacomCBS for nearly $2.2b, in a big win for Biden antitrust officials. https://axios.link/3sLt6Hp

- Netflix (Nasdaq: NFLX) bought Spry Fox, a Seattle-based maker of "cozy" games. https://axios.link/3Dl7pCK

- Tilman Fertitta acquired a 6.1% stake in Wynn Resorts (Nasdaq: WYNN). https://axios.link/3FAdNJ5

- Google (Nasdaq: GOOG) acquired Seattle-based digital health breathing monitoring startup Sound Life Sciences. https://axios.link/3Nnj095

- Hint Health, an SF-based primary care software provider that’s raised $60m in VC funding, acquired Denver-based health record company AeroDPC, per Axios Pro. https://axios.link/3sPias1

TIAA agreed to sell most of its banking unit to a private equity group that includes Stone Point Capital, Warburg Pincus, Reverence Capital Partners, Sixth Street Partners and Bayview Asset Management. https://axios.link/3DC9Tg9

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Streamlined Ventures, a Palo Alto-based venture capital firm, raised $102 million for its fifth seed fund focused on tech startups using data science, A.I., software automation, APIs, and Web 2.5.

Final Numbers

Data: PitchBook; Chart: Axios Visuals

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.