Sourcery (10/5-10/9)

Chargebee, Bloom Credit, Atom Finance, Mira, Everlywell, goPuff, UnQork, Instacart, MessageBird, Dialpad, Cooler Screens, Airkit, Grid. Affirm, c3.ai, Ascensus, Deliveroo.

Last Week (10/5-10/9):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Chargebee, Bloom Credit, Atom Finance, Mira, Everlywell, goPuff, UnQork, Instacart, MessageBird, Dialpad, Cooler Screens, Airkit, Grid. Affirm, c3.ai, Ascensus, Deliveroo.

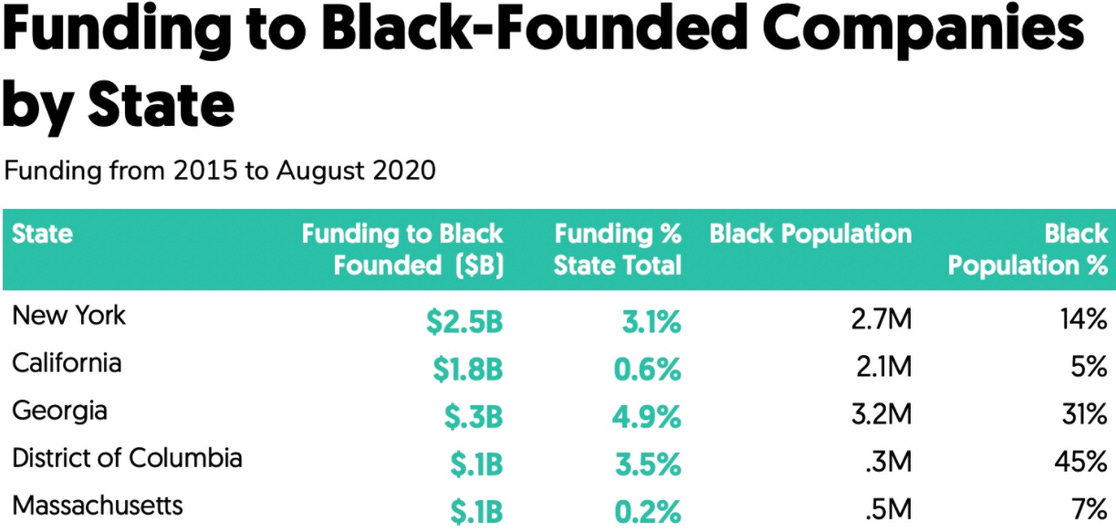

Final numbers on Funding to Black-Founded Companies by State and Quarterly Funding to Women Drops at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Tipalti, a San Mateo, Calif.-based account payables automation solution, raised $150 million at a valuation of more than $2 billion. Durable Capital Partners led the round and was joined by investors including Greenoaks Capital and 01 Advisors.

- Chargebee, a billing subscription management company with offices in India and San Francisco, raised $55 million in Series F funding. Insight Partners led, and was joined by return backers Steadview Capital and Tiger Global. http://axios.link/DKsb

- AccessFintech, a New York-based fintech focused on data and workflow collaboration, raised $20 million in Series B funding. Dawn Capital led the round.

- Bloom Credit, a New York-based API platform company that helps businesses integrate with credit bureaus for access to scores and monitoring, raised $13 million in funding. $10 million was led by Allegis NL, along with Resolute Ventures, Slow Ventures, and Commerce Ventures. Another $3 million came from angel investors.

- Hometree, a London-based Insurtech, raised £7 million in funding. Anthemis led the round and was joined by investors including DN Capital and Literacy Capital.

- Atom Finance, a startup that delivers markets-oriented information, raised $6 million in funding. Greycroft and General Catalyst were the investors. Read more.

- Mira, a New York-based alternative to health insurance, has raised $2.7 million in seed funding from FlyBridge Capital Partners, Newark Venture Partners, Precursor Ventures, Plug and Play, CityLight, and angel James Chung. http://axios.link/BZg7

. . .

Care:

- Everlywell, an Austin-based startup that sells Covid-19 home-testing kits, is in talks to raise new funding at a $1 billion plus valuation, per Bloomberg. Read more.

- Avail Medsystems, a Palo Alto, Calif.-based company focused on telemedicine for the procedure room, raised $100 million in Series B funding led by D1 Capital Partners and was joined by investors including 8VC.

- Lark Health, a Mountain View, Calif.-based chronic care platform, raised $55 million in Series C funding. King River Capital led the round and was joined by investors including Franklin Templeton, SteelSky Ventures, and Olive Tree Capital.

- Your.MD, a London-based maker of a self-care app Healthily, raised $30 million in Series A funding. Reckitt Benckiser was the investor.

- Cerebral, a San Francisco-based online mental health management platform, raised $35 million in Series A funding. Oak HC/FT led the round and was joined by investors including Liquid 2 Ventures, Gaingels, and Air Angels.

- ScriptDrop, a Columbus, Oh.-based IT solution connecting pharmacies, couriers, providers, pharmaceutical manufacturers, and patients, raised $15 million in Series A funding. Ohio Innovation Fund led the round and was joined by investors including North Coast Ventures, M25 and Rev1Ventures.

- Abridge, a Pittsburgh, Penn.-based platform for medical care and follow through on doctors’ advice, raised $15 million across seed and Series A funding. Investors include Union Square Ventures and UPMC.

- NOCD, a Chicago startup treating obsessive compulsive disorder, raised $12 million in a Series A funding. Health Enterprise Partners led the round and was joined by investors including 7Wire Ventures, Chicago Ventures and Hyde Park Angels.

. . .

Future of Work:

- goPuff, a Philadelphia-based food delivery platform, raised $380 million funding at a $3.9 billion valuation. Accel and D1 Capital Partners led the round and were joined by Luxor Capital and Softbank Vision Fund,

- Unqork, a New York-based no-code platform, raised $207 million in Series C funding, raising the company’s valuation to $2 billion. BlackRock led the round and was joined by investors including Eldridge, Fin Venture Capital, Hewlett Packard Enterprise, Schonfeld Strategic Advisors and Sunley House Capital Management. Existing investors including CapitalG,, Goldman Sachs, Broadridge Financial Solutions, Aquiline Technology Growth and World Innovation Lab also participated.

- Instacart, a San Francisco-based grocery delivery company, raised $200 million in funding. Valiant Peregrine Fund and D1 Capital Partners led the round. The funding values the firm at over $17.7 billion.

- MessageBird, a Dutch communication APIs company, raised $200 million in Series C funding at a $3 billion valuation. Spark Capital led, and was joined by, Bonnier, Glynn Capital, LGT Lightstone, Longbow, Mousse Partners and New View Capital. http://axios.link/FDOO

- Strava Inc., a San Francisco-based social network for athletes, is looking to raise at a $1 billion valuation, per Bloomberg citing sources. Read more.

- Dialpad, a San Francisco-based cloud business phone and contact center provider, raised $100 million in Series E funding. OMERS Growth Equity led the round and was joined by investors including Andreessen Horowitz, GV, ICONIQ Capital, Felicis Ventures, Section 32 and Work-Bench.

- Cooler Screens, a Chicago-based maker of screens for store coolers, raised over $80 million in Series C funding. Investors include Verizon Ventures, M12, Great Point Ventures, and Silicon Valley Bank.

- GrubMarket, a California-based produce delivery company, raised $60 million in Series D funding. Investors include BlackRock, Reimagined Ventures, Trinity Capital Investment, Celtic House Venture Partners, Marubeni Ventures, Sixty Degree Capital, and Mojo Partners. Read more.

- Onapsis, a Boston-based cybersecurity and compliance company, raised $55 million in Series D funding. Caisse de dépôt et placement du Québec led the round and was joined by investors including NightDragon,.406 Ventures, LLR Partners and Arsenal Venture Partners.

- Shogun, a Palo Alto, Calif.-based e-commerce experience platform, raised a $35 million in Series B funding. Accel led the round and was joined by investors including Initialized Capital, VMG Partners, and Y Combinator.

- Skilljar, a Seattle-based customer on-boarding platform, raised $33 million in Series B funding. Insight Partners led the funding round and was joined by investors including Mayfield, Trilogy Equity Partners, and Shasta Ventures.

- Mmhmm, a San Francisco-based startup for video presentations founded by former Evernote CEO Phil Libin raised $31 million in funding. Sequoia Capital led the round.

- Point Pickup Technologies, a Greenwich, Conn.-based last-mile delivery company, raised $30 million in funding. BBH Capital Partners led the round.

- Illusive Networks, a New York and Tel Aviv-based provider of cybersecurity solutions, raised $24 million in B1 funding. Investors inlcuded Spring Lake Equity Partners, Marker, New Enterprise Associates, Bessemer Venture Partners, Innovation Endeavors, Cisco, Microsoft, and Citi.

- Airkit, a Palo Alto, Calif.-based customer engagement platform, raised $28 million in funding. Investors include Accel, Emergence Capital, and Salesforce Ventures.

- Grid, a New York-based company for training A.I. models, raised $18.6 million in Series A funding. Index Ventures led the round and was joined by investors including Bain Capital Ventures and Firstminute.

- CoreView, an Alpharetta, Ga.-based Microsoft 365 management platform, raised $10 million in Series B funding. Insight Partners led the round.

- Evrything, a London-based provider of digital identity management solutions for consumer products, raised $10 million. IDC Ventures led, and was joined by Sway Ventures, Generation Ventures, Fernbrook Capital, You & Mr Jones, Bloc Ventures, and UK Future Fund. http://axios.link/4g6u

- NormShield, a Boston-based cyber risk rating company, raised $7.5 million in Series A funding. Moore Strategic Ventures led the round and was joined by investors including Glasswing Ventures and Data Point Capital.

- Andie Swim, a New York-based swimwear company, raised $6.5 million in Series funding. Investors include CityRock Venture Partners and Trail Mix Ventures.

- Headroom, a San Francisco-based video conferencing startup with transcripts, raised $5 million in seed funding. Gradient Ventures led the round. Read more.

- Tone, a Boston-based texting platform for brands to communicate with customers, raised $4 million in seed funding. Bling Capital led, and was joined by Day One Ventures, One Way Ventures, and TIA Ventures.http://axios.link/ffPA

- Strike Graph, a Seattle-based compliance automation startup, raised $3.9 million in seed funding. Madrona Venture Group led the round and was joined by investors including Amplify.LA, Revolution’s Rise of the Rest Seed Fund and Green D Ventures.

- Engrain, a Denver-based interactive mapping technology and data visualization software maker, raised $3.7 million in funding. RET Ventures led the round.

- Walnut, a San Francisco-based platform for sales representatives to manage sales demos, raised $2.5 million in seed funding. NFX led the round and was joined by investors including Avishay Abrahami, CEO at Wix.

- Doppler, a San Francisco-based security platform for developers, raised $2.3 million in seed funding. Sequoia Capital led the round and was joined by investors including Kleiner Perkins, Abstract Ventures and Soma Capital.

- Veritonic, a New York-based audio intelligence platform, raised $3.2 million in funding. Greycroft led the round and was joined by investors including Lerer Hippeau and Audible.

- Zira, a San Francisco-based automated management platform for shift-based workforces, raised $3.1 million in seed funding. General Catalyst and Abstract Ventures led the round.

- Nivelo, a New York-based payments fraud and cybersecurity monitoring startup, raised $2.5 million in seed funding. FirstMark Capital, Barclays and Anthemis co-led the round.

. . .

Sustainability:

- Airly, a Palo Alto, Calif.- and Poland-based air quality monitoring service, raised $2 million. Giant Ventures led the round. Read more.

- Newlight Technologies, a Huntington Beach, Calif.-based maker of an ocean-degradable biopolymer, raised $45 million in Series F funding. Valedor Partners led the round.

Exits:

- IBM (NYSE: IBM) announced plans to spin off its managed infrastructure services business into a separate public company. The unit generates $19 billion in annual revenue. http://axios.link/hOcA

. . .

IPOs:

- Affirm Holdings, the U.S. fintech lender, filed confidentially for an IPO. Investors include Thrive Capital.Read more.

- C3.ai, a Redwood City, Calif.-based predictive analytics company founded by Tom Siebel, is gearing up for an IPO next year that could value the firm at far higher than $3.3 billion, per Reuters citing sources. Current investors include BlackRock, TPG and Shell Ventures. Read more.

- Ascensus, a Dresher, Penn.-based servicer of savings plans, is preparing for an IPO next year that could value it at about $3 billion, per Reuters. Genstar and Aquiline Capital Partners back the firm. Read more.

- Deliveroo, the U.K.-based food delivery company, is planning an IPO in the U.K. that could value it at over 2 billion pounds ($2.6 billion), per Sky News. Read more.

- AppLovin, the U.S. mobile app and gaming company, is preparing for an IPO that could come in 2021. KKR backs the firm. Read more.

- Root, a Columbus, Oh.-based auto insurance tech company, filed to raise $100 million. It posted revenue of $290 million in 2019 and a loss of $283 million. Drive Capital, Ribbit Capital, and Tiger Global back the firm. Read more.

- Telos, an Ashburn, Va.-based provider of security software, filed to raise $242 million. Read more.

Funds:

- Greycroft raised $310 million for its sixth early-stage VC fund and $368 million for its third growth-stage fund. Notable portfolio companies include Axios. http://axios.link/oZQv

-ACME, a VC firm co-led by Scott Stanford (co-founder of Sherpa Capital) and Hany Nada (co-founder of GGV Capital), raised $246 million for its debut fund. It also promoted Tiffany Ho to principal. www.acme.vc

Final Numbers

Data: 2020 Crunchbase Diversity Spotlight Report. Data for state populations via 2018 U.S. Census Bureau data.

Final Numbers

Data: Pitchbook Read Pitchbook's story, "Quarterly VC funding for female founders drops to three-year low."