Sourcery 🌳 Plagiarism, Carta, NYTxOpenAI, 2024 Predictions

(1/1-1/5) Backer, Crew, Bumper, Devoted Health, Nabla, Perplexity AI, Aqua Security, Robin AI, Medallion, Intrinsic, Agorus, SolarDuck; United Launch Alliance

Keeping this intro short and sweet as we continue to catch up on work since coming back into the new year.

If you missed out on last week’s Sourcery covering the ‘best of the best’ deals & tech trends from 2023 → check it out here!

Musings

Macro

Carta, the cap table management outfit, is accused of unethical tactics by a prominent startup, TechCrunch

Predictions

2024 Predictions, Tomasz Tunguz

IPOs, M&A, AI, BTC, US VC investment falls

What Will Happen In 2024, Fred Wilson

Soft landing, AI applications, sustainable energy, VC stagnation

E160: 2024 Predictions! Markets, tech, politics, and more, All-in Podcast

OpenAI, AI AI AI, downfall of vertical SaaS

Low code/no code, AI, and co-pilots are making it SO easy for engineers to build & maintain common everyday software tools that incumbents will just replicate them internally at a very low cost.. which spells out a tough future for the existing world of vertical SaaS - Xander Oltmann of Commodity Capital

AI

Former Twitter CEO’s AI Startup Raises $30 Million in Khosla-Led Deal, The Information

OpenAI Says Times Lawsuit ‘Without Merit’, The Information

HardTech

Figure-01 Robot learns how to make coffee

This is so elegant it’s scary

More

How To Reduce Loneliness, Depression, And Distraction By Adapting Our Relationship To Social Media, The Doctor’s Farmacy

Goes deeper into the psychological engineering of social platforms and their effects from teenagers to millenials. Turns out, the answer is ‘mindfulness’

. . .

Last Week (1/1-1/5):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Backer, Crew, Bumper, Devoted Health, Nabla, Perplexity AI, Aqua Security, Robin AI, Medallion, Intrinsic, Agorus, SolarDuck; United Launch Alliance, Mimecast, Baidu/Joyy, Chartr/Robinhood; Brightspring Health Services; Blaize

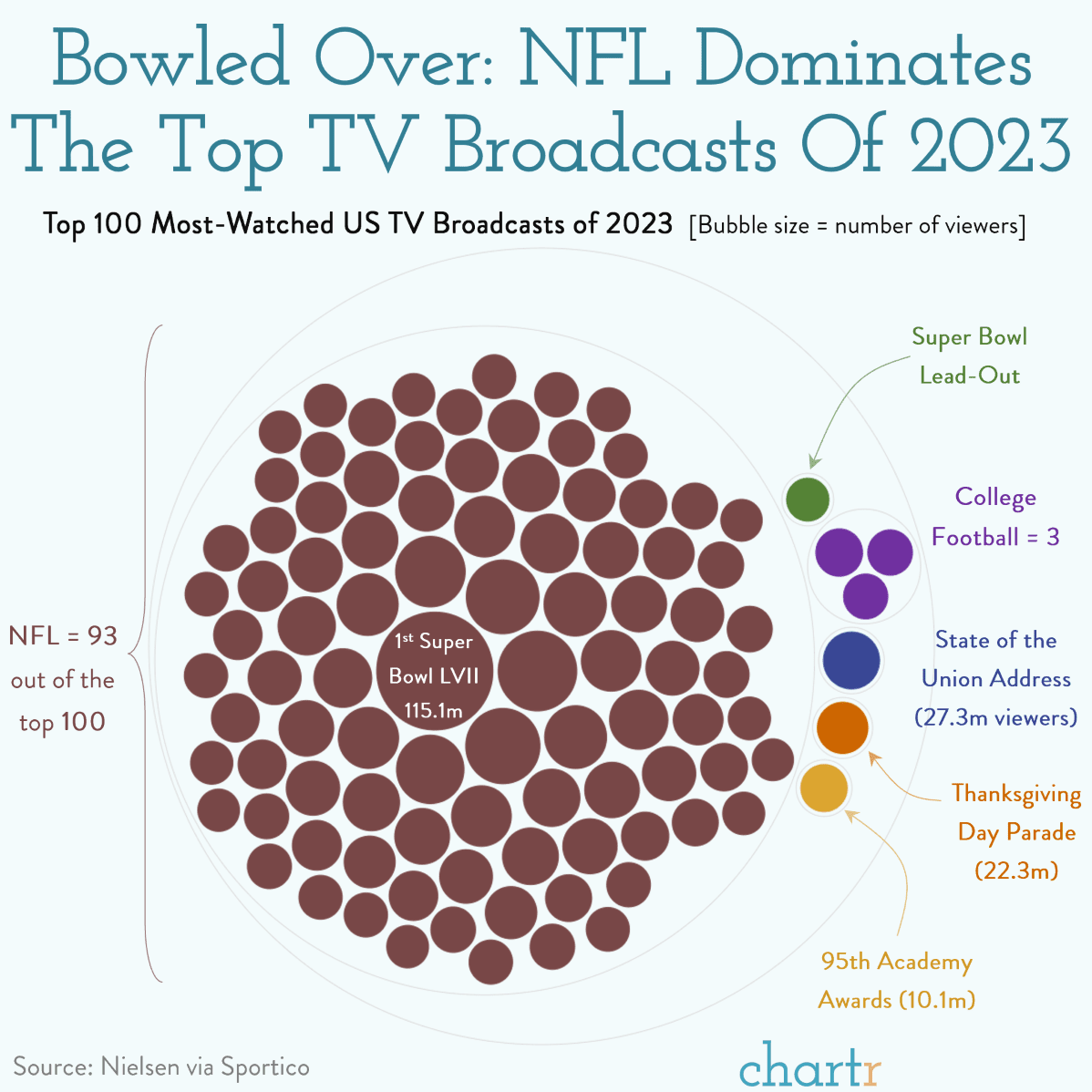

Final numbers on Wage Growth vs Inflation, NFL Dominates 2023, Stock Market x US Presidents, and M&A Trends at the bottom.

Deals

Fintech:

- Backer, an SF-based startup focused on tax-advantaged 529 savings plans, raised $9.5m in Series A funding led by WndrCo. https://axios.link/3RC5Vv7

- Crew, a Lehi, Utah-based banking startup focused on families, raised $2.5m in pre-seed funding. Kickstart Seed Fund led, and was joined by Pelion, Sepio, Signal Peak Ventures, Convoi, Spacestation, and Influence Ventures. www.trycrew.com

- Bumper, a London-based auto repair financing company, raised $18m. AutoTech Ventures led, and was joined by Shell Ventures, InMotion Ventures, Porsche Ventures, and Revo Capital. The startup also secured $30m in debt. https://axios.link/3voI4aH

. . .

Care:

- Devoted Health, a Waltham, Mass.-based health insurtech focused on Medicare Advantage, raised $175m in Series E funding at a $12.87b valuation from The Space Between, Highbury Holdings, GIC, Stardust Equity, Maverick Ventures, Fearless Ventures, and insiders Andreessen Horowitz and General Catalyst. https://axios.link/3H6o2nZ

- Nabla, a Boston-based "ambient AI assistant for practitioners," raised $24m in Series B funding. Cathay Innovation led, and was joined by Zebox Ventures. www.nabla.com

. . .

Enterprise & Consumer:

- Intel (Nasdaq: INTC) is spinning out a generative AI software business that it's calling Articul8 AI. DigitalBridge Ventures will serve as lead outside investor, and be joined by including Fin Capital, Mindset Ventures, Communitas Capital, GiantLeap Capital, GS Futures, and Zain Group. https://axios.link/3vnN3Zc

- Perplexity AI, an SF-based developer of AI-powered search, raised $70m. IVP led, and was joined by NEA, Databricks Ventures, Nvidia, Jeff Bezos, Elad Gil, Nat Friedman, and Tobi Lutke. https://axios.link/3ROXSuS

- Aqua Security, a Boston and Israel-based cybersecurity company focused on cloud-native services, raised $60m in new Series E funding at a valuation north of $1b. Evolution Equity Partners led, and was joined by insiders Insight Partners, Lightspeed Venture Partners and StepStone Group. www.aquasec.com

- Robin AI, a London-based legal copilot, raised $26m in Series B funding. Temasek led, and was joined by QuantumLight, Plural, and AFG Partners. https://axios.link/4aBQZpv

- Medallion, a platform for promoting album releases and merch drops, closed $13.7m in Series A funding co-led by Dragonfly and Lightspeed Faction. https://axios.link/3tzYJaN

- Intrinsic, a Sunnyvale, Calif.-based developer of infrastructure for trust and safety teams, raised $3.1m in seed funding from Urban Innovation Fund, YC, 645 Ventures, and Okta. https://axios.link/3S1kHga

. . .

HardTech:

- Agorus, a San Diego-based construction tech startup, is raising $20m in Series A funding led by Toyota Ventures, per Axios Pro. https://axios.link/48hYtMB

. . .

Sustainability:

- SolarDuck, a Dutch offshore floating solar developer, raised €15m from Katapult Ocean, Green Tower, Energy Transition Fund Rotterdam, and Invest-NL. https://axios.link/48cA5Mv

Acquisitions & PE:

- Cerberus and Jeff Bezos' Blue Origin each submitted buyout bids for United Launch Alliance, a Colorado-based rocket launch venture owned by Boeing (NYSE: BA) and Lockheed Martin (NYSE: LMT) that could fetch more than $2b, per the WSJ. https://axios.link/3RYOTbJ

- Mimecast, a London-based portfolio company of Permira and CPP Investments, acquired Elevate Security, an SF-based human risk management platform that had raised over $15m from Foundry Group, Cisco, Salesforce Ventures, Shasta Ventures, Costanoa Ventures, and Defy. https://axios.link/47q352b

- Baidu (Nasdaq: BIDU) no longer will pay $3.6b to buy the video live-streaming unit of Joyy (Nasdaq: YY), with the deal expiring after three years due to a failure to approve Chinese regulatory approval. https://axios.link/3tu2rmt

- Robinhood (Nasdaq: HOOD) agreed to buy Chartr, a British media startup focused on data visualization and newsletters. https://axios.link/3S0fwgv

- Warner Bros. Discovery (Nasdaq: WBD) has held preliminary merger talks with Paramount Global (Nasdaq: PARA), as first reported by Axios. https://axios.link/3tpdcq8

- SonicWall, a Milpitas, Calif.-based portfolio company of Francisco Partners, acquired Banyan Security, an SF-based provider of security service edge solutions for workforces. Banyan had raised over $50m in VC funding from firms like Shasta Ventures, Unusual Ventures, Third Point Ventures, Alter, and Susquehanna Growth Equity. www.sonicwall.com

- Etherscan bought Solscan, a Singapore-based Solana block explorer backed by Alameda, Electric Capital, and Multicoin. https://axios.link/4aL1bMa

. . .

IPOs:

- BrightSpring Health Services, a Louisville, Ky.-based home and community-based health care services provider owned by KKR, filed for an IPO. No terms were disclosed, but reports suggest it could seek to raise around $1b. BrightSpring plans to list on the Nasdaq (BTSG) and reports a $150m net loss on $4.7b in revenue for the first nine months of 2023. https://axios.link/3RCkfDO

- Smith Douglas Homes, a Woodstock, Ga.-based homebuilder, set IPO terms to 7.7m shares at $18-$21. It would have a $1b fully diluted market value, were it to price in the middle of its range, and plans to list on the NYSE (SDHC). The company reports $59.5m of net income on around $350m in revenue for the first half of 2023. https://axios.link/41HoQJv

. . .

SPACs:

- Lionsgate (NYSE: LGF) agreed to spin out its Starz studio business at a $4.6b enterprise value via Screaming Eagle Acquisition (Nasdaq: SCRM), the ninth SPAC from Jeff Sagansky and Harry Sloan. https://axios.link/3RDOk5V

- Blaize, an El Dorado Hills, Calif.-based edge computing company, agreed to go public at an implied $894m valuation via BurTech Acquisition Corp. (Nasdaq: BRKH), a SPAC led by real estate and VC investor Shahal Khan. Blaize had raised around $175m in VC funding from firms like GGV Capital, Temasek, Denso International America, TLG Capital Management, and Franklin Venture Partners. https://axios.link/3tBJUEG

Funds:

- Countdown Capital, a VC firm focused on hard-tech industrial startups, is shutting down and returning unused investor capital. Founder Jai Malik tweeted that "the future of this space favors larger firms than mine."

Final Numbers

Making gains

A Labor Department report on Friday revealed that the US job market is looking healthier than many had predicted, with the economy adding 216,000 jobs, leaving the unemployment rate unchanged at a near-record low of 3.7%.

But, of course, the number of workers is only one side of the equation; the other — arguably more important — question is whether the pay at your job is keeping up with inflation. For much of the last 2 and a half years, the answer for many was no.

Indeed, overall inflation outstripped pay rises in every month from April 2021 to early 2023. That started to change in earnest last summer, as employees’ pay packets began to outgrow inflation, resulting in “real” wage gains for the first time in 2 years. Annual wage growth hit its 2023 peak in July at 5.1%, and it hasn’t fallen below the inflation rate since, with the latest reading showing average hourly wages up 4.1% year-over-year.

The solid jobs report suggests that the US economy perhaps doesn’t need more stimulus. In the final months of last year, a consensus emerged that the Federal Reserve might embark on a series of rate cuts, following years of hikes. However, the strong economic data has tempered those expectations, with traders revising the likelihood of cuts in March from 100% to ~70% last week.

. . .

Ratings rush

As the 2023 NFL season approaches its climax, with all 272 regular-season games played and the 2023-24 playoffs set for the month-long lead-up to Super Bowl LVIII, America’s love of football is only growing stronger.

New data from Nielsen reveals that NFL league games padded out US TV viewership last year — accounting for a whopping 93 of the top 100 most-watched broadcasts, up from 82 the previous year, totaling 2.2 billion viewers. Along with college football, which accrued some 53.8m viewers over 3 games in the ranking, 2023 marks the first time that just a single sport has registered in the top 100, with not even one basketball or baseball broadcast making the cut.

Play-by-play

While political and cultural mainstays like the State of the Union Address (21st place) and the Macy’s Thanksgiving Day Parade (25th) bring in big TV viewer numbers year-on-year, NFL games have been doing the hard yards to keep linear television relevant. Even as cable TV subscriptions are canceled at an alarming rate, the NFL notched 8-year viewership highs in the recent season, averaging 17.5m viewers per game across TV and digital, with Monday Night Football alone up 24% from last year.

Despite the shift from cable to digital observed across most US sports, the NFL’s gargantuan TV deals with streamers like Amazon, as well as its success in winning fans overseas and in new demographics, leaves the league’s future looking healthier than ever.

. . .

Data: LSEG; Note: 2023 data through Dec. 26; Chart: Axios Visuals

U.S. M&A activity fell 6% to $1.36 trillion in 2023, the lowest total since 2017, but still outpaced the global market's 17% decrease, according to LSEG data.

The discrepancy was aided by a flurry of late December deals, including a $15 billion bid for U.S. Steel and a $14 billion takeover of schizophrenia drugmaker Karuna Therapeutics.

. . .

Data: Yahoo Finance; Chart: Jared Whalen/Axios

Stocks have soared under President Biden, although not by quite as much as they had at the same point in former President Trump's term.

Why it matters: Voters often feel like stock market performance is a gauge of America's economic health, and of presidential policy, even if most economists would disagree.

By the numbers: The S&P 500 climbed 25.9% between Biden's inauguration and last Friday's market close, which was the last day of 2023 trading.

It rose 42.3% during the similar period for Trump, which was shortly before the COVID-19 pandemic sent stocks into a temporary tailspin.

DJIA: Biden +21.9%, Trump +44.6%.

Nasdaq: Biden +13.8%. Trump +62%.

The bottom line: There's still a lot of trading days left before November.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Great article Molly