Sourcery ☀️ Sam Altman returns as CEO of OpenAI

(11/13-11/17) Imprint, Puzzle, Superstate, Refine Intelligence, Tenet, Tanda, Era, Petvisor, Vida Health, Sunnyside, Medmo, Nema, Layer, OfferFit, Cumulus Coffee, Keychain

Well, that escalated.. and de-escalated quickly.

Nothing like a pure panic state to make you question the future of the internet and all of humanity’s technological potential by the ousting of one single individual?! (ehem, Sam Altman)

Aandd he’s back. (link to tweet)

We are so back?

Who knows what happened, what is happening, or what will ultimately happen with OpenAI.. but they’re back. And after being so publicly hot/cold from the coup on Sam, OpenAI and their cult followings on X/Twitter must be tired? (we definitely are - insert “I can’t believe this app is free”). This has been a complete ginormous mess. The internet has been passionately filled with theories, heart emojis, & critics, and overall, they just certainly did not manage the PR crisis well (maybe we don’t need to share all things publicly in real-time on X until there’s a done deal? But wow, was that entertaining).

Their VC investors ran hard to reclaim their value & the big mission, even the more quiet of firms, Thrive’s Joshua Kushner took to X to show support for them. Meanwhile, Microsoft’s Satya (with ~$13B invested & 49% ownership of OpenAI) was kind enough to offer a bit of a delay, damage control, & positive signal for the public markets by his ‘hiring Sam’ announcement while things got sorted.

(MSFT lost ~1.6% in mcap after hours on Friday after Sam’s firing, redeemed with 2.5% bump in pre-market trading after the ‘hire’ announcement on Monday, & then hit an all-time high.. however, it’s a $2.7T company it’ll probably be okay in the long run with whatever the outcome is).

All in all, this may be one of the most tumultuous governance lessons.. ever? Highlighting the real, but unfortunate, incompetence in even the highest of places. And maybe another lesson in short-term vs long-term thinking on very large & expensive decisions with seismic implications?

Let’s just hope they’re coming back stronger than ever. Clear eyes, full heart, can’t lose. ❤️

Anyways, this makes for some juicy Thanksgiving dinner table conversation outside of politics. Hope you have fun with your family & friends 😊

Happy Thanksgiving!

Musings

Other Juicy Dinner Table Topics

Binance's Zhao pleads guilty, steps down to settle US illicit finance probe, Reuters

Binance chief Changpeng Zhao stepped down and pleaded guilty to breaking U.S. anti-money laundering laws as part of a $4.3B settlement resolving a years-long probe into the world's largest crypto exchange, prosecutors said on Tuesday.

The deal, which will see Zhao personally pay $50 million, was described by prosecutors as one of the largest corporate penalties in U.S. history. It is another blow to the crypto industry that has been beset by investigations and comes on the heels of the recent fraud conviction of FTX founder Sam Bankman-Fried.

Tiger Global chieftain Scott Shleifer transitions to advisory role after wild ride, TechCrunch

Tiger made rapid-fire absurdly large & high valued investments (with outsourced or little to no diligence) in startups for years, driving up valuations, and contributing (if not, were the sole contributor outside of ZIRP) to the very large tech bubble (especially on the growth side) that we’re going to be stuck working ourselves out of for some time.

Chase Coleman states Shleifer’s location (his $132 million Palm Beach home) as the friction point since the firm operates in-person in NYC. Whether or not that is the reason, I am highly skeptical of remote-first cultures for serious operational work, in a mansion or not.

OpenAI

Microsoft Swallows OpenAI’s Core Team – GPU Capacity, Incentive Structure, Intellectual Property, OpenAI Rump State, Dylan Patel & Daniel Nishball

Good overview of it all, though not the ultimate outcome, worth the read! Well-written timeline of events with links to the X/Twitter drama. Plus it’s technical!

The Sam Altman Episode, Moment of Zen

Dan Romero, Antonio Garcia Martinez and Erik Torenberg discuss their takes on Sam Altman's ouster from OpenAI, his legacy, and his comparative significance vis-à-vis figures like Jack Dorsey & Elon Musk.

Emmett Shear Reacts To AI Doom Theories, Logan Bartlett Show

Emmett Shear is the co-founder of Twitch (interim ex-CEO OpenAI), one of the most influential platforms in recent history. From its humble beginnings as a gaming streaming platform to becoming a cultural phenomenon, Twitch has redefined the way we connect, entertain, and build communities online.

With OpenAI Co-Founder & Chief Scientist Ilya Sutskever, No Priors: Sarah Guo & Elad Gil

Each iteration of ChatGPT has demonstrated remarkable step function capabilities. But what’s next? Ilya Sutskever, Co-Founder & Chief Scientist at OpenAI, joins Sarah Guo and Elad Gil to discuss the origins of OpenAI as a capped profit company, early emergent behaviors of GPT models, the token scarcity issue, next frontiers of AI research, his argument for working on AI safety now, and the premise of Superalignment. Plus, how do we define digital life?

Even GPT4V didn’t think the corporate structure was a good idea (link to tweet)

. . .

Last Week (11/13-11/17):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Imprint, Puzzle, Superstate, Refine Intelligence, Tenet, Tanda, Era, Petvisor, Vida Health, Sunnyside, Medmo, Nema, Layer, OfferFit, Cumulus Coffee, Keychain, VaultSpeed, Radiant Security, Retorio, Martian, Handraise, Siena AI, Tradespace, Canopy, Suger, Glencoco, BrightGo, Divergent, Element Energy, Gravity, Upway; Vesta/Fernish & Feather, GA/Joe & the Juice, Hightouch/Headsup, Airbnb/GamePlanner.ai, UpLift/Minded

Final numbers on Decline in median growth-stage valuations at the bottom.

Deals

Fintech:

- Imprint, a New York City-based provider of co-branded credit cards, raised $75 million in Series B funding. Ribbit Capital led the round and was joined by Thrive Capital, Kleiner Perkins, Lachy Groom, and Moore Specialty Credit.

- Puzzle, a generative accounting platform, raised $30m from Section32, XYZ and General Catalyst. www.puzzle.io

- Superstate, a San Francisco-based asset management firm, raised $14 million in Series A funding. Distributed Global and CoinFund led the round and were joined by Breyer Capital, Galaxy, Arrington Capital, Road Capital, CMT Digital, and others.

- Refine Intelligence, a New York City and Ness Ziona, Israel-based AI-powered monitor of money laundering, check fraud, and other scams for banks, raised $13 million in seed funding. Glilot Capital Partners and Fin Capital led the round and was joined by SYN Ventures, Valley Ventures, and others.

- Tenet, a New York City-based platform designed to provide better loan terms for electric vehicle customers, raised $10 million in Series A funding. Nyca Partners led the round and was joined by Assurant Ventures and Giant Ventures.

- Apiture, a Wilmington, N.C.-based provider of digital banking solutions, raised $10m led by T. Rowe Price. www.apiture.com

- Every.io, a San Francisco-based banking, payroll, bookkeeping, and taxes platform for companies, raised $9.5 million in seed funding. Base10 led the round and was joined by Y Combinator, Formus Capital, and Rex Salisbury.

- CFX Labs, a Chicago, Ill.-based owner and operator of a nationwide payment network designed to reduce fraud, settlement times, and remittance costs, raised $9.5 million in seed funding from Shima Capital, Decasonic, Antalpha, CMT Digital, Corazon Capital, and others.

- Pippin Title, a New York City-based provider of title, tax, and transaction information to title insurers, banks, and mortgage services, raised $8 million in funding. Deciens Capital led the round and was joined by Joe Mansueto, Caruso Ventures, NKM Capital, and the University of Chicago Endowment.

- Taproot Wizards, a remote-based collection of digital collectibles built on the bitcoin blockchain, raised $7.5 million in funding. Standard Crypto led the round and was joined by Geometry, Collider Ventures, StarkWare, UTXO Management, and others.

- TANDA, a Cupertino, Calif.-based platform where employees can communally dedicate portions of their paycheck to an emergency fund pool, raised $4.5 million in seed funding from Initialized Capital and Arc.

- Era, a personal finance management startup, raised $3.1m in seed funding, per Axios Pro. Northzone led, and was joined by Protagonist and Designer Fund. https://axios.link/466AfmS

- Heali, an LA-based developer of food-as-medicine tools, raised $3m in seed funding led by Astanor Ventures. www.heali.com

- Rho Labs, a London, U.K,-based platform designed to facilitate transparent and secure on-chain trading of interest rate derivatives, raised $2.2 million in pre-seed funding. Speedinvest led the round and were joined by Keyrock, Re7 Capital, and others.

. . .

Care:

- Petvisor, an Orlando, Fla.-based veterinary and pet services business management and client engagement software platform, raised $100 million in funding. Apax Digital led the round and was joined by Frontier Growth, PeakScan Capital, and Petvisor’s management team.

- Vida Health, an SF-based provider of virtual cardiometabolic services, raised $28.5m from insiders General Atlantic, Ally Bridge, Canvas Ventures and Hercules Capital. https://axios.link/3MKfZR8

- Sunnyside, an SF-based developer of an app that helps people build healthier habits around alcohol, raised $11.5m in Series A funding. Motley Fool Ventures led, and was joined by Will Ventures, Uncork Capital, Offline Ventures, Joyance Partners, Wisdom Ventures, Eudemian Ventures, Adjacent, Scribble Ventures, Cooley and MyFitnessPal founder Michael Lee. www.sunnyside.co

- Medmo, Medical imaging technology company, announced a $9 million funding round led by Lerer Hippeau, alongside existing investors Jerusalem Venture Partners (JVP), C2 Ventures and an array of notable angel investors participated.

- CoverSelf, a San Francisco-based healthcare claims and payment accuracy platform, raised $8.2 million in seed funding. BEENEXT and 3one4 Capital led the round and were joined by others.

- Nema Health, a Branford, Conn.-based virtual trauma therapy provider, raised $4.1m in seed funding. Optum Ventures and .406 Ventures co-led, and were joined by GreyMatter Capital. https://axios.link/4626Vhe

- Layer Health, a Boston, Mass.-based developer of AI-powered data management and task automation tools for the health care industry, raised $4 million in funding from Google Ventures, General Catalyst, and Inception Health.

- BeMe Health, a Miami, Fla.-based platform that provides mental health services to teenagers, raised $1.5 million from Blue Cross and Blue Shield of Kansas.

. . .

Enterprise & Consumer:

- OfferFit, a Boston-based automated experimentation platform for marketers, raised $25m in Series B finding. Menlo Ventures led, and was joined by Ridge Ventures, Capital One Ventures and insiders Canvas Ventures, Harmony Partners, Alumni Ventures Group, Carbide Ventures and Burst Capital. www.offerfit.ai

- Cumulus Coffee, a New York City-based developer of at-home cold brew and nitro cold brew machines, raised $20.3 million in seed funding. Valor Ventures led the round and were joined by Maveron, Howard Schultz, and others

- Keychain, a manufacturing platform for the packaged goods industry, raised $18 million in seed funding. Lightspeed Venture Partners led the round and was joined by BoxGroup, Afore Capital, SV Angel, and others.

- VaultSpeed, a Leuven, Belgium-based platform that converts, cleans, and structures data, raised $15.9 million in Series A funding. Octopus Ventures led the round and was joined by Fortino Capital, PMV, and BNP Paribas Fortis Private Equity.

- Radiant Security, an SF-based provider of security operations solutions, raised $15m in Series A funding. Next47 led, and was joined by General Advance and insiders Lightspeed Venture Partners, Acrew Capital, Uncorrelated Ventures, and Jibe Ventures. www.radiantsecurity.ai

- Virdee, an Austin, Texas-based provider of guest experience and check-in automation technology, raised $12.4 million in Series A funding. Moneta Ventures led the round and was joined by Silverton Partners, Koch Real Estate Investments, Alumni Ventures, DJR Advisors, Capital Factory, and others.

- Dotwork, a Georgetown, Texas-based software platform designed to provide unstructured data, key metrics, and software stacks for strategy management, raised $12 million in Series A funding from Jim Crane, Tim Arnoult, Hunter Nelson, Steve Elliott.

- Dwellsy, a Los Altos, Calif. rental marketplace, raised $11.5 million in seed funding. Ulu Ventures led the round and was joined by University of Chicago, Frontiers Capital, Heroic Ventures, NJP Ventures, and others.

- Bloom, a London-based professional coaching startup, raised $10m in seed funding from Octopus Ventures and MMC Ventures. www.usebloom.com

- Retorio, a German AI coaching platform, raised $10m in Series A funding. SquareOne led, and was joined by Porsche Ventures and Storm Ventures. www.retorio.com

- Martian, a San Francisco-based large language model developer, raised $9 million in seed funding from NEA, Prosus Ventures, Carya Venture Partners, and General Catalyst.

- Radicl, a Boulder, Colo.-based provider of cyber threat protection for SMBs, raised $9m. Paladin Capital Group led, and was joined by Access Ventures and DA Ventures Seed Fund. www.radicl.com

- Handraise, an Austin, Texas-based company designed to provide public relations professionals with better insights through the use of AI, raised $6.4 million in funding. Silverton Partners led the round and was joined by Floodgate, Firebrand, Bill Wood Ventures, and others.

- Siena AI, a New York City-based AI-powered customer support platform for e-commerce businesses, raised $4.7 million in seed funding from Sierra Ventures, Parri Passu Ventures, SpaceStation Investments, Village Global, The Council, OpenSky Ventures, and SuperAngel.Fund.

- Tradespace, a San Francisco-based AI-powered IP management platform designed to enable organizations to develop, evaluate and commercialize higher-quality IP, raised $4.2 million in seed funding. Eniac Ventures led the round and was joined by Abstract Ventures, Amplo VC, and Scrum Ventures.

- Canopy, a Seattle, Wash.-based real-time data composability platform, raised $4 million in seed funding. Kindred Ventures led the round and was joined by Village Global.

- Suger, a San Francisco-based platform designed to help B2B companies list and sell on cloud marketplaces, raised $3.5 million in funding from Craft Ventures, Intel Capital, Y Combinator, and others.

- Glencoco, a New York City-based platform that connects business development professionals with company campaigns, raised $3 million in funding. Felicis and Crossbeam led the round and were joined by Liquid 2 Ventures, Browder Capital, SOMA Capital, Gold House Ventures, and others.

- BrightGo, a San Francisco-based janitorial software company, raised $3 million in seed funding from Costanoa Ventures and Index Ventures.

- HockeyStack, a San Francisco-based market analytics platform for B2B companies, raised $2.7 million in seed funding from General Catalyst, YCombinator, Soma Capital, Uncorrelated Ventures, 645 Ventures, Austen Allred, Jude Gomila, and others.

- Fractl Inc., a Cupertino, Calif.-based developer of AI-powered programming platforms, raised $1 million in pre-seed funding. WestWave Capital led the round and was joined by January Capital, Arka Venture Labs, and others.

. . .

HardTech:

- Divergent Technologies, a Torrance, Calif.-based software and hardware production system for industrial digital manufacturing, raised $230m in Series D funding led by $100m from Hexagon AB. www.divergent3d.com

- Element Energy, a Menlo Park, Calif.-based developer of advanced battery management technology for energy storage and EV applications, raised $73 million in Series B funding from Cohort Ventures, Mitsubishi Heavy Industries, Drive Catalyst, FM Capital, and others.

- Gravity, a New York City-based provider of electric vehicle chargers and other EV infrastructure, raised $13 million in seed funding. Google Ventures led the round and was joined by others.

- Proxima Fusion, a Munich, Germany-based startup developing fusion power plants designed to provide emission-free energy, raised €7.5 million in pre-seed funding and a pre-seed extension from Visionaries Tomorrow, Hummingbird Collective, Plural Platform, UVC Partners, and others.

- Falcomm, an Atlanta, Ga.-based provider of power amplifiers to the wireless communication markets, raised $4 million in seed funding. Squadra Ventures led the round and was joined by Cambium Capital, Draper Cygnus, Georgia Tech Foundation, and others.

. . .

Sustainability:

- Upway, a Brooklyn, N.Y.-based e-bike marketplace, raised $30 million in Series B funding. Korelya Capital led the round and was joined by Sequoia Capital, Exor Ventures, and the European Climate Fund Transition.

- Zero Emission Industries, an SF-based developer of hydrogen solutions for maritime applications, raised $8.75m in Series A funding. Chevron New Energies led, and was joined by Trafigura and Crowley. www.zeroei.com

Acquisitions & PE:

- Thoma Bravo took NextGen Healthcare, an Irvine, Calif.-based provider of ambulatory health care technology, private for $1.8 billion.

- Vesta acquired Fernish, a Los Angeles, Calif.-based furniture and decor rental service and Feather, a New York City-based furniture and decor rental service. Financial terms were not disclosed.

- General Atlantic agreed to acquire a majority stake in Joe & the Juice, a Copenhagen, Denmark-based juice, coffee, and sandwiches chain, from Valedo Partners. Financial terms were not disclosed.

- MCCi, backed by Century Park Capital Partners, acquired GovBuilt, a Manhattan, Kan.-based provider of government software for the permitting and licensing processes. Financial terms were not disclosed.

- Sharpen Technologies, a portfolio company of TELEO Capital Management, acquired Plum Voice, a Boston, Mass.-based provider of AI-powered, voice-based customer interaction technology. Financial terms were not disclosed.

- Hightouch acquired HeadsUp, a San Francisco-based company using AI to help sales teams identify conversion opportunities. Financial terms were not disclosed.

- SplitMetrics acquired App Radar, a Graz, Austria-based marketing and analytics platform for businesses with apps. Financial terms were not disclosed.

- Airbnb (Nasdaq: ABNB) acquired Gameplanner.ai, a stealthy startup co-founded by Siri co-founder Adam Cheyer, for just under $200m, per CNBC. Gameplanner was seeded by Mayfair Global Ventures. https://axios.link/40ELtO9

- UpLift, a Sunnyvale, Calif.-based telemental health startup that's raised around $30m from firms like Ballast Point Ventures, acquired women-focused online therapy provider Minded, which raised over $25m from firms like Streamlined Ventures, Link Ventures, Unicorn Ventures and Trousdale Ventures, per Axios Pro. https://axios.link/3QHgg8o

Funds:

- Coatue Management, a New York City-based private equity firm, raised $1.4 billion in a companion fund to its VC growth fund, sources with direct knowledge told The Information.

- Interplay, a New York-based VC firm, raised $45m for its third fund. https://axios.link/3QF2gfo

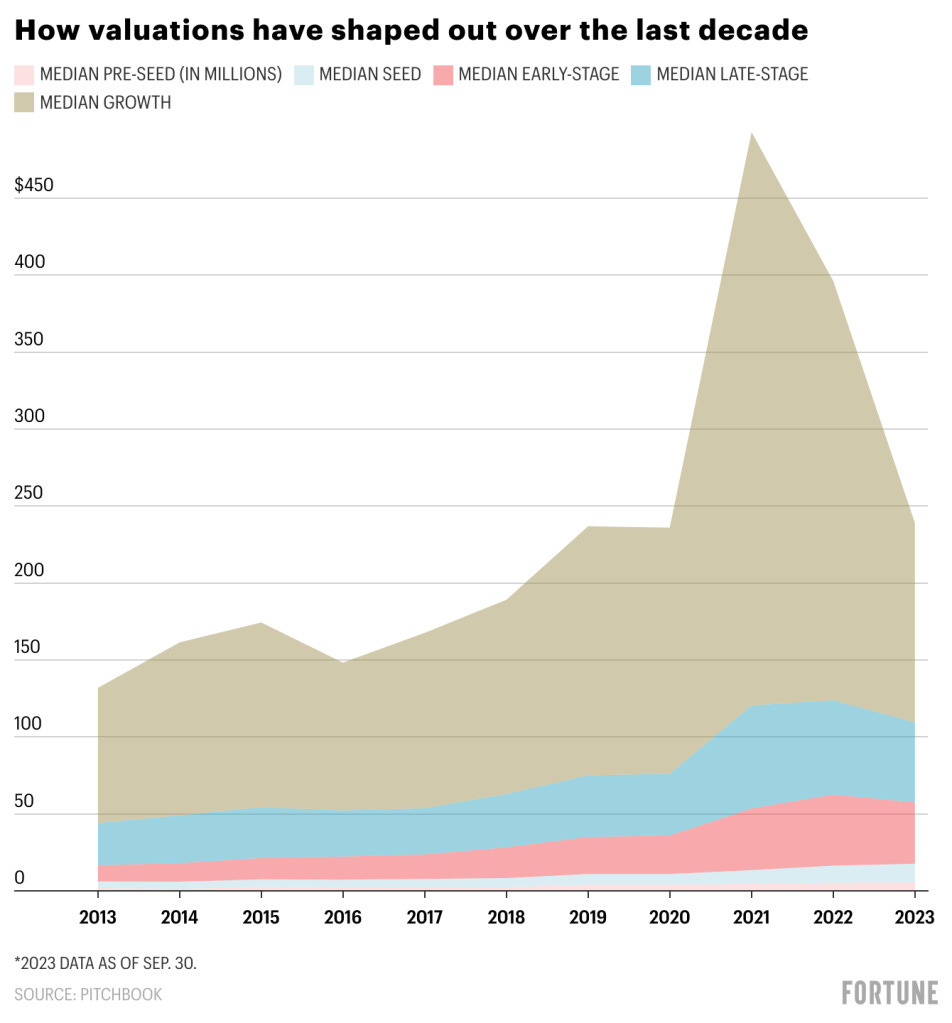

The incredible decline in median growth-stage valuations over the last two years:

That is a nosedive if I’ve ever seen one. But as of now, the valuations still aren’t lower than they were four years ago: They’ve simply come back down to earth.

As investors have regained the upper hand in the negotiations with late-stage companies, they are also taking larger equity stakes in the companies they are backing. See below:

Pitchbook

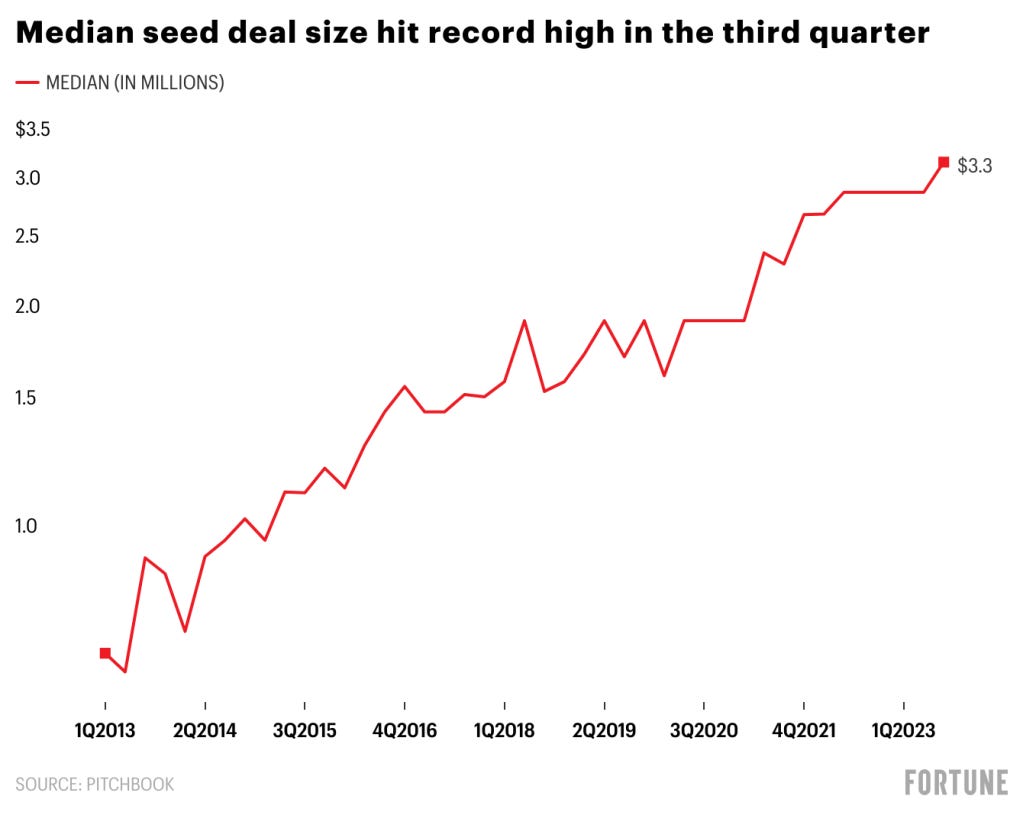

But what’s interesting is that we’re really not seeing some of these swinging market conditions across the whole ecosystem. Both pre-seed and seed valuations are actually up in 2023 (as of Sep. 30 data), compared to last year, according to PitchBook. And the size of seed deals are actually hitting record highs right now:

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Great article. Happy thanksgiving. Had to get your take on this. I can’t wait for the movie.

The Friday Night Lights reference 😂 👌🏼