Sourcery (11/14-11/18)

Thanksgiving ~ Matter Labs, Brightside, Baraka, Banked, Daylight, Valcre, Fennel, DispatchHealth, Maven Clinic, WellTheory, Ayble Health, CalmWave, Astera Labs, Akeyless, Descript, The Applied AI Co

Happy Thanksgiving!

I was hoping to keep this one light ahead of Thanksgiving but it turns out there were a fair amount of deals announced last week.

To break it down, Fintech was a bit slower than usual, Health has some notable ‘name-brand’ companies and earlier stage opportunities in gut health, Enterprise and Consumer has mostly smaller deals cooking up a majority of the storm from security to logistics, events, devops, and commerce enablement. Meanwhile, what I’d argue as one of the more fascinating sections at the bottom, Sustainability, seems to be picking up some speed with companies solving for geothermal, carbon ratings, recycling and… solar energy for space?

What to watch with your family/friends

Spirited, with Will Farrell and Ryan Reynolds on Apple TV

This movie is insane and likely to hit Broadway in its future (def not for kids)

Black Panther Wakanda Forever, in Theaters

If, for some reason, you have yet to see this one, or just see it again

Falling for Christmas, Oh, hello Lindsay Lohan on Netflix

Yellowstone, Season 5 on Paramount

The Crown, Season 5 on Netflix

Great if you want to take naps in a dark room

White Lotus, Season 2 on HBO

Apparently only one person makes it to the end… just kidding I have no idea

Love is Blind, Season 3 on Netflix

Haven’t seen this but everyone seems to be obsessed?

Readings

The Diligence That's Due, Why We Never Ask The Right Questions, Kyle Harrison

As Meta and Twitter lay off thousands in Bay Area, TikTok plans to double staff The Information

The World Cup That Changed Everything, NYT

The decision to take the World Cup to Qatar has upturned a small nation, battered the reputation of global soccer’s governing body and altered the fabric of the sport… Plus drama on David Beckham’s multi-million dollar deal

The world’s population just hit 8 billion – which countries are driving the most growth? Quartz

Follow us on Twitter Linkedin for just the top deals recap

. . .

Last Week (11/14-11/18):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Matter Labs, Brightside, Baraka, Banked, Daylight, Valcre, Fennel, DispatchHealth, Maven Clinic, WellTheory, Cradle, Ayble Health, CalmWave, Astera Labs, WekaIO, Akeyless, Descript, The Applied AI Co, Spot AI, ISEE, MotherDuck, Parallel Domain, Speak, Pickle, Buildkite, Rewst, Madkudu, EngFlow, Terzo, BoomPop, Loops.ai, Atmos, Butter, Narwhal, Scoop, TheGist, OneScheme, Relay Commerce, Recess, Supernova.io, Payload, Zest, JUKE, Clusiv, Pet’s Table, Dandelion Energy, BeZero Carbon, RoadRunner Recycling, Impusle, Anode Labs, Thalio; Tom Ford, Vox Media, Forbes Media, GoodRx Care, Hilma, Total Brain, Kahoot

Final numbers on Late Stage VC Valuations at the bottom.

Deals

Fintech:

- Matter Labs, an Ethereum scaling startup, raised $200m in Series C funding. Blockchain Capital and Dragonfly co-led, and were joined by LightSpeed Venture Partners, Variant and Andreessen Horowitz. https://axios.link/3EDGjc4

- Brightside, an SF-based financial care platform for employers, raised $33m in Series B funding. Obvious Ventures led, and was joined by Andreessen Horowitz, Trinity Ventures, Clocktower Technology Ventures and Chestnut Street Ventures. www.gobrightside.com

- Baraka, a Dubai-based commission-free investment platform, raised $20m in Series A funding. Valar Ventures led, and was joined by Knollwood. https://axios.link/3AlvRmV

- Banked, a London, U.K.-based global payment network developer, raised $15 million in Series A extension funding. Insight Partners led the round and was joined by investors including Citi, National Australia Bank Ventures, and Rapyd.

- Daylight, a New York-based banking app for the LGBTQ+ community, raised $15 million in funding. Anthemis Group led the round and was joined by investors including CMFG Ventures, Kapor Capital, Citi Ventures, Gaingels, and others

- Buynomics, a Cologne, Germany-based revenue optimization SaaS platform, raised €13 million ($13.42 million) in Series A funding. Insight Partners led the round and was joined by investors including LaFamiglia, Seedcamp, Dieter von Holtzbrinck Ventures, and Tomahawk.

- Valcre, a San Diego-based commercial real estate appraisal platform, raised $12.7m in Series A funding. Avenue Growth Partners led, and was joined by Second Century Ventures. www.valcre.com

- Fennel, a New York-based ESG-focused investing app, raised $5 million in seed funding. Founding partner of Wilson Sonsini Goodrich & Rosati Larry Sonsini, former managing director of trading at Blue River Asset Management Paul Sinsar, UC Davis professor John Rundle, and others invested in the round.

- Curavit, a Philadelphia-based virtual contract research organization, raised $5m in Series A funding. Osage Venture Partners led, and was joined by Royal Street Ventures and Narrow Gauge Ventures. www.curavitclinicalresearch.com

. . .

Care:

- DispatchHealth, a Denver-based provider of in-home medical care, raised $330m in Series E funding. Optum Ventures led, and was joined by Adams Street Partners, Olayan Group, SVB, Pegasus Tech Ventures, Blue Shield of California and insiders Humana, Oak HC/FT, Echo Health Ventures and Questa Capital. https://axios.link/3EC37sI

- Maven Clinic, a New York-based startup that connects users to virtual maternal and family health care providers, raised $90m in Series E funding, per Axios Pro. General Catalyst led, and was joined by La Famiglia, Intermountain Ventures and insiders Sequoia Capital, Oak HC/FT, Icon Ventures, Dragoneer Investment Group and Lux Capital. https://axios.link/3TEKTea

- Symend, a Calgary, Canada-based behavioral engagement technology company, raised $42 million in funding. Inovia Capital led the round and was joined by investors including Impression Ventures, Mistral Venture Partners, BDC Capital’s Women in Technology Fund, Plaza Ventures, and EDC.

- Elemental Machines, a Cambridge, Mass.-based intelligence platform developer for labs, raised $41 million in Series B funding. Sageview Capital and Omega Venture Partners co-led the round and were joined by investors including Gutbrain Ventures and Digitalis Ventures.

- Aescape, a New York-based massage therapy experience creator, raised $30 million in Series A funding. Valor Siren Ventures and Valor Equity Partners co-led the round and were joined by investors including Fifth Wall, Alley Robotics Ventures, Crosslink Capital, Alumni Ventures, and NBA athlete Kevin Love.

- Hemanext, a Lexington, Mass.-based developer of blood processing, storage and transfusion tech, raised $18m in Series B funding led by Sonenshine Fulford Group. https://axios.link/3WQwfU0

- Torigen Pharmaceuticals, a Farmington, Conn.-based animal health biologics company, raised $13 million in Series A1 funding. Werth Family Investment Associates and Connecticut Innovations co-led the round and were joined by investors including Emerald Development Managers, Gaingels, Kema Fund, University of Notre Dame, SoGal Ventures, UCONN Innovation Fund, Ironwood Capital, and Advantage Capital.

- Centivax, a South San Francisco-based vaccine platform technology developer, raised $10 million in seed funding co-led by NFX and the Global Health Investment Corporation.

- WellTheory, an Atherton, Calif.-based virtual autoimmune care provider, raised $7.2m in seed funding. Accel led, and was joined by Box Group, Lux Capital, Scribble Ventures and Rock Health. https://axios.link/3Ac3Iyl

- Cradle, a Dutch platform for designing and programming proteins, raised €5.5m in seed funding co-led by Index Ventures and Kindred Capital. www.cradle.bio

- Ayble Health, a virtual care provider for digestive diseases, raised $4.6m in seed funding co-led by Upfront Ventures and M13, per Axios Pro. https://axios.link/3TF1QVR

- CalmWave, a Seattle-based operational health platform for hospitals, raised $4 million in seed funding. Bonfire Ventures led the round and was joined by investors including Tau Ventures, AI2 Incubator, Seachange Ventures, Hike Ventures, and the co-founders of PagerDuty.

- Aide Health, a London-based long-term condition care platform, raised $1.2m in pre-seed funding. Hambro Perks led, and was joined by Fuel Ventures, 1818 Ventures and APX. www.aide-health.co

. . .

Enterprise & Consumer:

- Astera Labs, a Santa Clara, Calif.-based data and memory connectivity solutions company, raised $150 million in Series D funding. Fidelity Management and Research led the round and was joined by investors including Atreides Management, Intel Capital, and Sutter Hill Ventures.

- WekaIO, a Campbell, Calif.-based data platform provider, raised $135 million in Series D funding. Generation Investment Management led the round and was joined by investors including 10D, Atreides Management, Celesta Capital, Gemini Ventures, Hewlett Packard Enterprise, Hitachi Ventures, Key1 Capital, Lumir Ventures, Micron Ventures, Mirae Asset Capital, MoreTech Ventures, Norwest Venture Partners, NVIDIA, Qualcomm Ventures, and Samsung Catalyst Fund.

- Akeyless, a New York and Ramat Gan, Israel-based cybersecurity company, raised $65 million in Series B funding. NGP Capital led the round and was joined by investors including Team8 Capital and Jerusalem Venture Partners.

- Descript, a San Francisco-based video and audio editor company, raised $50 million in Series C funding. OpenAI Startup Fund led the round and was joined by investors including Andreessen Horowitz, Redpoint Ventures, Spark Capital, and investor Daniel Gross.

- The Applied AI Co., a London-based AI startup, raised $42m from Goldman Sachs and a group of UAE royals, per Bloomberg. https://axios.link/3OhIYve

- Yahaha, a low-code immersive gaming platform, raised $40m in Series A+ funding. Temasek and Alibaba co-led, and were joined by 37 Interactive Entertainment, 5Y Capital, HillHouse, Coatue, ZhenFund, Bertelsmann Asia Investments, BiliBili and Xiaomi. https://axios.link/3E2lllu

- Spot AI, a Burlingame, Calif.-based video intelligence company, raised $40 million in Series B funding. Scale Venture Partners led the round and was joined by investors including Redpoint Ventures, Bessemer Venture Partners, StepStone Group, MVP Ventures, and Hypergrowth Partners.

- ISEE, a Cambridge, Mass.-based self-driving technology company, raised $40 million in Series B funding. Founders Fund led the round and was joined by investors including Maersk Growth, New Legacy, Eniac Ventures, and others.

- MotherDuck, a Seattle-based data analytics platform builder, raised $35 million in Series A funding led by a16z.

- Parallel Domain, a San Francisco-based autonomous development synthetic data startup, raised $30 million in Series B funding. March Capital led the round and was joined by investors including Costanoa Ventures, Foundry Group, Calibrate Ventures, and Ubiquity Ventures.

- Speak, an English language learning platform, raised $27m in Series B funding. OpenAI Startup Fund led, and was joined by Founders Fund, Lachy Groom, Justin Mateen and Gokul Rajaram. https://axios.link/3g94dCR

- Pickle, a Cambridge, Mass.-based maker of truck-unloading robots, raised $26m in Series A funding from Ranpak, JS Capital, Schusterman Family Investments, Soros Capital and Catapult Ventures. https://axios.link/3Ahoe0S

- Soft Robotics, a Bedford, Mass.-based food industry automation startup, raised $26m in Series C funding led by Tyson Ventures. https://axios.link/3ArjfL7

- Buildkite, a remote-based software development company, raised $21 million in Series B funding. OneVentures and AirTree co-led the round and were joined by investors including General Catalyst and Up founder Dom Pym.

- Rewst, a Tampa, Fla.-based automation platform for managed service providers, raised $21.5 million in Series A funding led by OpenView.

- Gravitics, a Seattle-based maker of in-space living and working units, raised $20m. Type One Ventures led, and was joined by Draper Associates, FJ Labs, The Venture Collective, Helios Capital, Chicago-based Giant Step Capital, Gaingels, Spectre, Manhattan West and Mana Ventures. https://axios.link/3EC40RV

- MadKudu, a Mountain View, Calif.-based product-led-growth platform for B2B marketers, raised $18 million in Series A funding. Felicis led the round and was joined by investors including BGV, Alven, Techstars, and other angels.

- EngFlow, an Austin-based build acceleration company for software development teams, raised $18 million in Series A funding. Tiger Global, Andreessen Horowitz, firstminute capital, and others invested in the round.

- Terzo, an LA-based contract intelligence platform, raised $16m in Series A funding. Align Ventures led, and was joined by TYH Ventures, Engage Ventures and Human Capital. www.terzocloud.com

- Methodical Games, a Raleigh, N.C.-based game development studio, raised $15 million in seed funding led by Lightspeed Venture Partners.

- BoomPop, a San Francisco-based offsites and events company, raised $14 million. ACME Capital and Atomic invested in the round.

- ArmorCode, a Palo Alto, Calif.-based application security management company, raised $14 million in Series A funding. Ballistic Ventures led the round and was joined by investors including Sierra Ventures, Cervin, and others.

- Loops.ai, a San Francisco and Tel Aviv, Israel-based product growth platform, raised $14 million in seed funding. Scale Venture Partners led the round and was joined by investors including Cardumen Capital and other angels.

- Atmos, an SF-based online marketplace for custom home design and development, raised $12.5m in Series A funding. Khosla Ventures led, and was joined by insiders Bedrock, JLL Spark and YC. https://axios.link/3GjNVl5

- Adway, a Gothenburg, Sweden-based automated social recruitment marketing solution, raised €10 million ($10.36 million) in Series A funding from Octopus Ventures and others.

- Freshpaint, a San Francisco-based customer data activation platform, raised $9.5 million in Series A funding by Intel Capital.

- Hoken, a New York-based event-focused lodging marketplace, raised $9 million in seed funding. Streamlined Ventures led the round and was joined by BY Venture Partners.

- Butter, a management system for food distributors, raised $9m in Series A funding. Gradient Ventures led, and was joined by Uncommon Capital, Notation Capital and Jack Altman. https://axios.link/3X014FI

- Narwhal, a build system for JavaScript code, raised $8.6m in seed funding co-led by Nexus Venture Partners and Andreesen Horowitz. https://axios.link/3EFEIlL

- Virtualness, a San Francisco-based Web3 navigation platform, raised $8 million in seed funding. Blockchange Ventures led the round and was joined by investors including Polygon Ventures, F7 Ventures, Micron Ventures, Oceans Ventures, Neythri Futures Fund, and others.

- Scoop, a hybrid team enablement platform, raised $8m in Series1 funding. Haystack led, and was joined by Activate Capital, Audacious Ventures and G2 Venture Partners. www.scoopforwork.com

- Keyo, a San Francisco-based biometric identity company, raised $7 million in funding from Netflix co-founder Marc Randolph and others.

- TheGist, a workplace productivity AI startup, raised $7m in pre-seed funding co-led by StageOne Ventures and Aleph. www.thegist.ai

- Sensible, a San Francisco-based company that turns structured documents into data, raised $6.5 million in seed funding. Craft Ventures led the round and was joined by investors including Engineering Capital and Clocktower Technology Ventures.

- OneSchema, a San Francisco-based CSV importer application for developers, raised $6.3 million in funding. General Catalyst led the round and was joined by investors including Sequoia Capital, Y Combinator, Elad Gil, and Contrary Capital.

- Relay Commerce, a New York-based aggregator of e-commerce software, raised $6.25m in seed funding. Primary led, and was joined by Twelve Below, AlleyCorp, and Max. The company also secured $20m in debt from TriplePoint Capital. https://axios.link/3hL7HM7

- Recess, an LA-based experiential marketplace that connects brands with events and venues, raised $5m in Series A funding co-led by Data Point Capital and Spring Mountain Capital. www.recess.is

- Supernova.io, a Prague-based SaaS design system platform, raised $4.8 million in seed funding. Wing Venture Capital led the round and was joined by investors including EQT Ventures and Kaya VC.

- Payload, a headless open source CMS, raised $4.7m in seed funding. Gradient Ventures led, and was joined by YC, MongoDB Ventures, SV Angel, Grand Ventures and Exceptional Capital. https://axios.link/3TJj6cy

- Arey, a Los Angeles-based e-commerce business for the hair care industry, raised $4.15 million in seed funding co-led by Female Founders Fund and Greycroft.

- Zest, a New York-based gifting app, raised $4.2 million in seed funding. GV led the round and was joined by investors including BoxGroup, Character, Operator Partners, Bungalow Capital, and Company Ventures.

- SigmaOS, a London, U.K.-based web browser developer, raised $4 million in seed funding. LocalGlobe led the round and was joined by investors including Y Combinator, 7percent Ventures, Moonfire Ventures, Shine VC, TrueSight Ventures, Pioneer Fund, Venture Together, and others.

- The Eighth Notch, an Alamo, Calif.-based logistics technology platform, raised $3.5 million in funding led by Ecosystem Integrity Fund.

- JUKE, an LA-based digital collectibles startup focused on film and TV fans, raised $3m in seed funding. Castle Island Ventures led, and was joined by North Island Ventures and Multicoin Capital. www.juke.io

- Sematic, a San Francisco-based open-source continuous machine learning platform, raised $3 million in seed funding. Race Capital led the round and was joined by investors including Y Combinator, Soma Capital, Leonis Capital, Pioneer Fund, and other angels.

- Impacked, a New York-based B2B primary packaging marketplace, raised $2.5 million in seed funding led by TenOneTen Ventures.

- CloudTruth, a Boston-based cloud configuration management platform, raised $2.4 million in seed funding. UBMB led the round and was joined by investors including Glasswing Ventures, York IE, and Stage 1 Ventures.

- PlayEmber, a London, U.K.-based Web3 monetization platform for mobile games, raised $2.3 million in pre-seed funding. Shima Capital led the round and was joined by investors including Huobi Ventures, Big Brain Holdings, Hyperithm, Warburg Serres, and Lyrik Ventures.

- Clusiv, an Austin-based online vocational training and accessibility platform for individuals who are blind or visually impaired, raised $2.25 million in seed funding led by ECMC Group’s Education Impact Fund.

- Pet’s Table, a Mexico City, Mexico-based D2C pet food company, raised $2 million in seed funding. Left Lane Capital led the round and was joined by Goodwater Capital.

. . .

Sustainability:

- Dandelion Energy, a Mount Kisco, N.Y.-based residential geothermal company, raised $70 million in Series B1 funding. LENX and NGP ETP co-led the round and were joined by investors including Breakthrough Energy Ventures, NEA, GV, Collaborative Fund, and Building Ventures.

- BeZero Carbon, a London-based carbon ratings and analytics provider, raised a $50m in Series B funding. Quantum Energy Partners led, and was joined by EDF Group, Hitachi Ventures, Intercontinental Exchange and insiders Molten Ventures, Norrsken VC, Illuminate Financial, Qima and Contrarian Ventures. https://axios.link/3GiOYSe

- RoadRunner Recycling, a Pittsburgh-based waste management company, raised $20m in Series D extension funding led by Fifth Wall. https://axios.link/3VftQ3N

- Impulse, a San Francisco-based carbon reduction home appliances company, raised $20 million in Series A funding. Lux Capital’s Josh Wolfe led the round and was joined by investors including Fifth Wall, Lachy Groom, and Construct Capital.

- Solestial, a Tempe, Ariz.-based solar energy company for space, raised $10 million in seed funding. AEI HorizonX, Airbus Ventures, GPVC, Stellar Ventures, Industrious Ventures, and others invested in the round.

- BasiGo, a Kenyan electric bus manufacturer, raised $6.6m from Novastar, Trucks.vc and Toyota Tsusho. https://axios.link/3hD8VZH

- Anode Labs, an Austin-based Web3 energy system developer, raised $4.2 million in funding. Lerer Hippeau and Lattice co-led the round and were joined by investors including VaynerFund, CoinShares, and Digital Currency Group.

- Thallo, a London, U.K.-based climate tech and Web3 startup, raised $2.5 million in seed funding. Arcan and Friendly Trading Group 2 co-led the round and were joined by investors including Ripple, Allegory, Cerulean Ventures, and Flori Ventures.

Acquisitions & PE:

- Estée Lauder (NYSE: EL) is nearing a $2.8b takeover of fashion label Tom Ford, per the FT. This is lower than the $3b price tag estimated over the summer.

- CVC Capital Partners and Group Black are pursuing a joint bid to buy Vox Media, which has raised over $320m in VC funding, per Axios. https://axios.link/3X1dSMa

- Forbes Media is in exclusive talks to sell to for $800m to a consortium of investors that includes GSV Ventures and India-based SUN Group, per Axios. https://axios.link/3UU6X5C

- Wheel agreed to acquire the backend virtual care technology of GoodRx Care, the Santa Monica, Calif.-based virtual care platform of GoodRX. Financial terms were not disclosed.

- Biocodex acquired a majority stake in Hilma, a Brooklyn, N.Y.-based natural remedies company. Financial terms were not disclosed.

- SonderMind acquired Total Brain, a San Francisco-based neuroscience company. Financial terms were not disclosed.

- Apollo Global Management agreed to acquire most of Credit Suisse’s (NYSE: CS) securitized products group. https://axios.link/3X6Ngt2

- RoadSafe, a Romeoville, Ill.-based portfolio company of Trilantic North America, acquired BABS, a Concord, Calif.-based provider of job site and traffic safety products. www.roadsafetraffic.com

- Steward Health Care completed the sale of its Medicare value-based care business to CareMax (Nasdaq: CMAX) for over $130m in cash and stock. https://axios.link/3TBrDyh

- Voyager Digital, a bankrupt crypto firm that had agreed to be acquired by FTX, has relaunched its takeover auction process. https://axios.link/3Ag3RRD

- General Atlantic is seeking ways to increase its position in Kahoot, a listed Norwegian maker of education-focused games maker in which earlier this year it acquired a 15% stake from SoftBank, per Bloomberg. https://axios.link/3tCy4qd

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Energy Impact Partners, a New York-based venture capital firm, raised $485 million for a fund focused on early stage climate technology companies.

- Bling Capital, a Miami and San Francisco-based venture capital firm, raised $212 million across two funds. They raised $109 million for their seed stage fund and $103 million for their opportunity fund.

- MassMutual Ventures, a Boston-based venture capital firm, raised $100 million for a fund focused on early and growth-stage companies across the U.S. in the climate technology sector.

- Climate Adaptive Infrastructure, a San Francisco-based investment firm, raised more than $825 million for a fund focused on clean energy, water, and urban infrastructure sectors.

- Schneider Electric, a Paris, France-based energy management and automation company, invested $500 million into a second fund for its corporate venture fun, SE Ventures.

- Index Ventures, a London, New York, and San Francisco-based venture capital firm, raised $300 million for a fund focused on seed investments.

Final Numbers

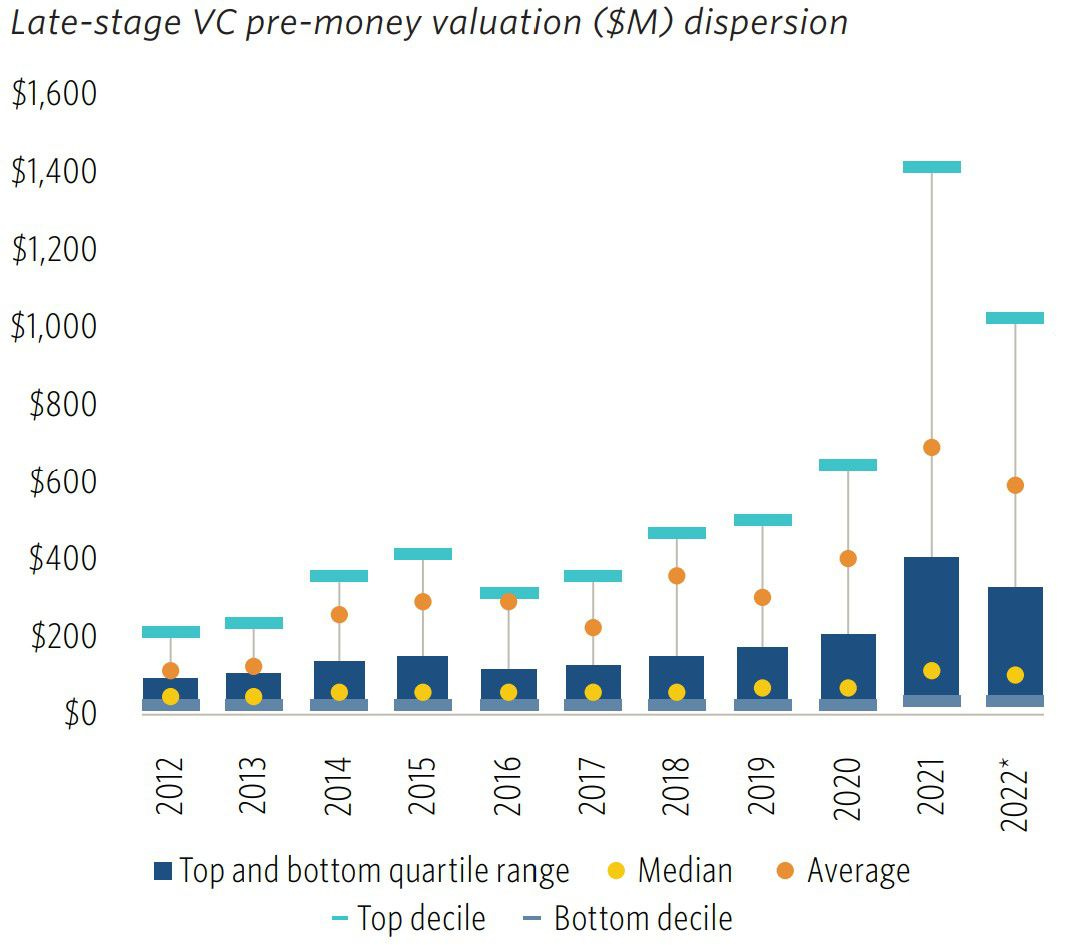

Source: PitchBook valuations report. Notes: U.S. geography. Data through Sept. 30, 2022.

Venture valuations for later-stage rounds are way down, per new data from PitchBook.

Early-stage deal valuations declined between the second and third quarters, but the 2022 median remains higher than 2021.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Happy Thanksgiving Molly!!!!!!!! Hope you enjoy with family. And thank you.