Sourcery (11/28-12/2)

ChatGPT, BlockFi, SBF ~ Teampay, Greenwood, Fleek, X1 Card, Buckzy, UpStream Healthcare, Vial, Lumen, Bionaut Labs, Almond, Anduril, Joy, Deepgram, ResortPass, GoFreight, Giraffe360, Fizz

Keeping it simple

Readings

E106: SBF's media strategy, FTX culpability, ChatGPT, SaaS slowdown & more, All-In Podcast

(1:05) Analyzing SBF's media tour: his angle, media coverage, and more

(21:09) FTX culpability: media, investors, regulators

(53:41) Challenging media coverage of other countries, China's current situation, Xi Jinping's standing

(1:10:04) What OpenAI's new ChatGPT tool means for the future

(1:26:30) David Sacks on the slowdown in SaaS, use case endgame for generative AI

Defense Tech Startup Anduril Raises Massive $1.5B Round At $8.5B Valuation, Crunchbase

The Age of Acquisition - Consolidation Is Coming In 2023, Kyle Harrison

Kim Kardashian’s Investment Firm Hires Brisske From Permira, Bloomberg

Top 10 Posts of 2022, Tomasz Tunguz

. . .

Last Week (11/28-12/2):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Keyrock, Teampay, Greenwood, Fleek, Treecard, X1 Card, Buckzy, UpStream Healthcare, Vial, Lumen, Bionaut Labs, Almond, Anduril, Joy, Deepgram, Pangea Cyber, ResortPass, GoFreight, Giraffe360, Fizz, Piñata, Frame AI, Daylight, Modern Milkman, BeeHero, Range Energy; Taboola

Final numbers on Non-Farm Payrolls at the bottom.

Deals

Fintech:

- Keyrock, a Belgian digital asset market maker, raised $72m in Series B funding. Ripple led, and was joined by Six Fintech Ventures and Middlegame Ventures. https://axios.link/3VzSbSt

- Teampay, a New York-based purchasing platform, raised $47 million in Series B funding. Fin Venture Capital led the round and was joined by investors including Mastercard, Proof Ventures, Trestle, and Espresso Capital.

- Greenwood, an Atlanta-based digital banking platform for Black and Latino individuals and businesses, raised $45 million in funding. Pendulum led the round and was joined by investors including Cercano Management, Cohen Circle, The George Kaiser Family Foundation, NextEra Energy, Bank of America, Citi Ventures, PNC, Popular, Truist Ventures, TTV Capital, and Wells Fargo.

- Fleek, a New York-based web3 developer platform, raised $25m in Series A funding. Polychain Capital led, and was joined by Protocol Labs, Arweave, Coinbase Ventures, Digital Currency Group, North Island Ventures, Distributed Global, The LAO, and Argonautic Ventures. https://axios.link/3OQMeh7

- Treecard, a London, U.K.-based debit card company that plants trees with purchases, raised $23 million in Series A funding. Valar Ventures led the round and was joined by investors including World Fund, EQT Ventures, Seedcamp, Episode 1, and other angels.

- X1 Card, an SF-based credit card startup, raised $15m led by Soma Capital. www.x1creditcard.com

- Buckzy, a Canadian real-time cross-border payments startup, raised US$14.5m in Series A funding co-led by Mistral Venture Partners and Uncorrelated Ventures. https://axios.link/3uhyCSQ

. . .

Care:

- UpStream Healthcare, a Greensboro, N.C.-based primary care services provider and technology company, raised $140 million in Series B funding. Coatue and Dragoneer co-led the round and were joined by investors including Avidity Partners, Define Ventures, and Mubadala.

- Vial, a San Francisco-based contract research organization, raised $67 Million in Series B funding. General Catalyst led the round and was joined by investors including Byers Capital, BoxGroup and others.

- Lumen, a New York-based metabolic health company, raised $62 million in Series B funding. Pitango Venture Capital led the round and was joined by investors including Hanwha Group, Resolute Ventures, RiverPark Ventures, Unorthodox Ventures, Almeda Capital, and Disruptive VC.

- Bionaut Labs, a Los Angeles-based microscale robotics company treating central nervous system diseases and disorders, raised $43.2 million in Series B funding. Khosla Ventures led the round and was joined by investors including Deep Insight, OurCrowd, PSPRS, Sixty Degree Capital, Dolby Family Ventures, GISEV Family Ventures, What if Ventures, Tintah Grace, Gaingels, Upfront Ventures, BOLD Capital Partners, Revolution VC, and Compound.

- Cloud Health Systems, a Seattle-based medical consulting startup led by Instacart founder Apoorva Mehta, raised $30m at a $200m valuation. Thrive Capital led, and was joined by Greenoaks Capital. https://axios.link/3EQ4q63

- Zoe, a British nutrition and health tracking app, raised £25m. Accomplice led, and was joined by L Catterton and insiders Balderton Capital, Ahren and Daphni. https://axios.link/3gRAEpC

- Medical Informatics, a Houston-based virtual care and analytics provider, raised $17 million in Series B funding. Catalio Capital Management and Intel Capital co-led the round and were joined by investors including TGH Innoventures, Notley, DCVC, TMC, and nCourage.

- Almond, an LA-based virtual and in-person reproductive health care startup, raised $7m in seed funding led by True Ventures. https://axios.link/3iayEc7

- The Lanby, a New York-based concierge primary care startup, raised $2.7m in seed funding. Female Founders Fund led, and was joined by Launch, Goodwater Capital and Magic Fund. www.thelanby.com

. . .

Enterprise & Consumer:

- Anduril, a defense tech company led by Oculus founder Luckey Palmer, raised $1.48b in Series E funding at a $7b pre-money valuation led by insider Valor Equity Partners. Other backers include Founders Fund, Andreessen Horowitz, General Catalyst, 8VC, Lux Capital, Thrive Capital, DFJ Growth, Elad Gil, Lachy Groom, Human Capital, Marlinspike, WCM Investment Management, MVP Ventures, Lightspeed Ventures and US Innovative Technology Fund. https://axios.link/3H2Gi2T

- Joy, a San Francisco-based wedding planning and registry platform, raised $60 million in Series B funding led by General Catalyst.

- Deepgram, an SF-based speech-to-text platform, raised $47m in Series B extension funding. Madrona led, and was joined by Alkeon. Insiders include Tiger Global, Wing VC, Citi Ventures, SAP.io and Nvidia. www.deepgram.com

- Saltbox, an Atlanta-based co-warehousing and small business logistics company, raised $35 million in Series B funding. Cox Enterprises and Pendulum co-led the round and were joined by investors including Playground Global, XYZ Capital, Fundrise, Kapor Capital, Wilshire Lane Capital, Colliers, Lincoln Property Company, Flexport, Overline, and others.

- OneRail, an Orlando, Fla.-based transportation visibility solution, raised $33 million in Series B funding. Piva Capital and Arsenal Growth Equity co-led the round and were joined by investors including American Tire Distributors, Trimble Ventures, Ironspring Ventures, Las Olas Venture Capital, Bullpen Capital, Triphammer Ventures/Alumni Ventures Group, Gaingels, and Mana Ventures.

- Zylo, an Indianapolis-based SaaS management company, raised $31.5 million in Series C funding. Baird Capital’s Venture Team led the round and was joined by investors including Spring Lake Equity Partners, Bessemer Venture Partners, Menlo Ventures, High Alpha, and Coupa Ventures.

- SPHERE Technology Solutions, a Newark, N.J.-based cybersecurity company, raised $31 million in Series B funding. Edison Partners led the round and was joined by Forgepoint Capital.

- Pangea Cyber, a Palo Alto, Calif.-based security services provider for cloud and mobile app developers, raised $26 million in Series B funding. GV led the round and was joined by investors including Decibel and Okta Ventures.

- ResortPass, a New York-based hotels and resorts access provider, raised $26 million in Series B funding. Declaration Partners and 14W co-led the round and were joined by investors including CRV and other angels.

- CommonGround, a Los Altos, Calif. and Tel Aviv, Israel-based virtual communications and online collaboration company, raised an additional $25 million in funding. Marius Nacht led the round and was joined by investors including Grove Ventures, Matrix Partners, and StageOne Ventures.

- HYPR, a no-password authentication startup raised $25m in Series C1 funding. Advent International led, and was joined by insiders .406 Ventures, RRE Ventures, Top Tier Capital and Comcast Ventures. www.hypr.com

- GoFreight, an LA-based freight forwarding startup, raised $23m in Series A funding. Headline led, and was joined by LFX Venture Partners, Palm Drive Capital and insiders Mucker Capital, Cornerstone Ventures and Red Building Capital. https://axios.link/3EutYGZ

- Shield, a Tel Aviv, Israel-based workplace intelligence platform, raised $20 million in Series B funding. Macquarie Capital led the round and was joined by investors including UBS Next, Mindset Ventures, and OurCrowd.

- Pearpop, a Los Angeles-based creator marketing and collaboration platform, raised an additional $18 million in Series A funding. Sound Ventures, Seven Seven Six, Blockchange Ventures, Avalanche’s Blizzard Fund, and C2 Ventures invested in the round.

- Giraffe360, a London-based property security camera maker, raised $16m in Series A funding led by Founders Fund. www.giraffe360.com

- FrankieOne, a Melbourne, Australia-based API platform for identity verification and fraud detection, raised an additional$15.55 million in Series A+ funding. Greycroft and AirTree Ventures co-led the round and were joined by investors including Reinventure, Tidal Ventures, Apex Capital Partners, Binance Labs, and Kraken Ventures.

- Roboto Games, a San Mateo, Calif.-based game development studio, raised $15 million in Series A funding. a16z led the round and was joined by Animoca Brands and others.

- Fizz, a San Francisco-based social media platform for college students, raised $12 million in Series A funding. NEA led the round and was joined by investors including Lightspeed Venture Partners, Rocketship VC, Owl Ventures, Smash Ventures, and New Horizon.

- Pinata, a New York-based maker of software for frontline workers, raised $10m in Series A funding led by M13 and Bullpen Capital. https://axios.link/3Vsq7zC

- Acerta Analytics, a Canadian analytics startup, raised C$10.4m in Series B funding led by BDC Capital’s Industrial Innovation and Thrive Venture Funds, with OMERS Ventures and StandUp Ventures also participating. https://axios.link/3VxChaF

- Frame AI, a New York-based customer intelligence platform, raised $7.6 million in funding. G20 Ventures led the round and was joined by investors including FirstMark, Greycroft, Velvet Sea Ventures, ValueStream Ventures, Twilio, and LiveRamp.

- Clerk, a San Francisco-based authentication and user management solution for React, raised $6.2 million in seed funding. Andreessen Horowitz led the round and was joined by investors including S28 Capital, Fathom Capital, and South Park Commons.

- Nucleo, a New York-based crypto infrastructure security startup, raised $4m in seed funding led by Bain Capital Crypto and 6th Man Ventures, with Aztec Network, Aleo and Espresso Systems also participating. https://axios.link/3XEC1s3

- Burn Ghost, a Boston-based Web3 game platform, raised $3.1 million in funding. BITKRAFT Ventures and Drive by DraftKings co-led the round and were joined by Pillar VC.

- Daylight, a New York-based Web3 applications aggregator, raised $3 million in seed funding. Framework Ventures and Chapter One co-led the round and were joined by investors including OpenSea, 6th Man Ventures, Eniac Ventures, Seed Club Ventures, Tomahawk, Spice Capital, Uncommon Projects, Very Serious Ventures, and other angels.

- Upollo, a Sydney, Australia-based customer conversion company, raised $2.75 million in seed funding led by Index Ventures.

- Saasguru, a Sydney, Australia-based cloud skills and workforce development edtech platform, raised AUD $4 million ($2.68 million) in seed funding led by Square Peg Capital.

. . .

Sustainability:

- Modern Milkman, a British sustainable grocery delivery startup, raised £50m in Series C funding. Insight Partners and ETF Partners co-led, and were joined by Praetura Ventures and Avery Dennison. https://axios.link/3u7kJq1

- BeeHero, a Fresno, Calif.-based apiculture startup, raised $42m in Series B funding. Convent Capital led, and was joined by General Mills, Cibus Capital, Rabobank, MS&AD, Firstime, J-Ventures, Plug&Play, iAngels, Gaingels and UpWest. www.beehero.io

- Range Energy, a Mountain View, Calif.-based powered trailers provider to the commercial trucking market, raised $8 million in seed funding. UP Partners, R7, and Yamaha Motor Ventures invested in the round.

- Buzz Solutions, a Palo Alto, Calif.-based energy infrastructure inspection platform, raised $3.3 million in funding. GoPoint Ventures led the round and was joined by MaC Venture Capital.

Acquisitions & PE:

- Yahoo, backed by Apollo, acquired Taboola, a New York-based content recommendation firm. Financial terms were not disclosed.

- Dropbox (Nasdaq: DBX) acquired “key assets” of German cloud security company Boxcryptor, which had been seeded by Agile Partners. https://axios.link/3UiuWuG

- Cred, an Indian credit card payment app valued at $4b by VC firms like Ribbit Capital, agreed to acquire Indian underwriting tech firm CreditVidya, which raised $15m from firms like Matrix Partners India, Bharat Innovation Fund and Kalaari Capital. https://axios.link/3EL5pnV

- Binance, the largest global crypto exchange by volume, acquired locally licensed Japanese exchange Sakura Exchange BitCoin. https://axios.link/3GViwpt

- ClearCourse, a London-based portfolio company of Aquiline Capital Partners, acquired Sellerdeck, a provider of scaling solutions to e-commerce businesses. www.clearcourse.co.uk

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Adams Street Partners of Chicago raised $1.1b for its latest private markets fund, which makes primary, secondary and co-investments. www.adamsstreetpartners.com

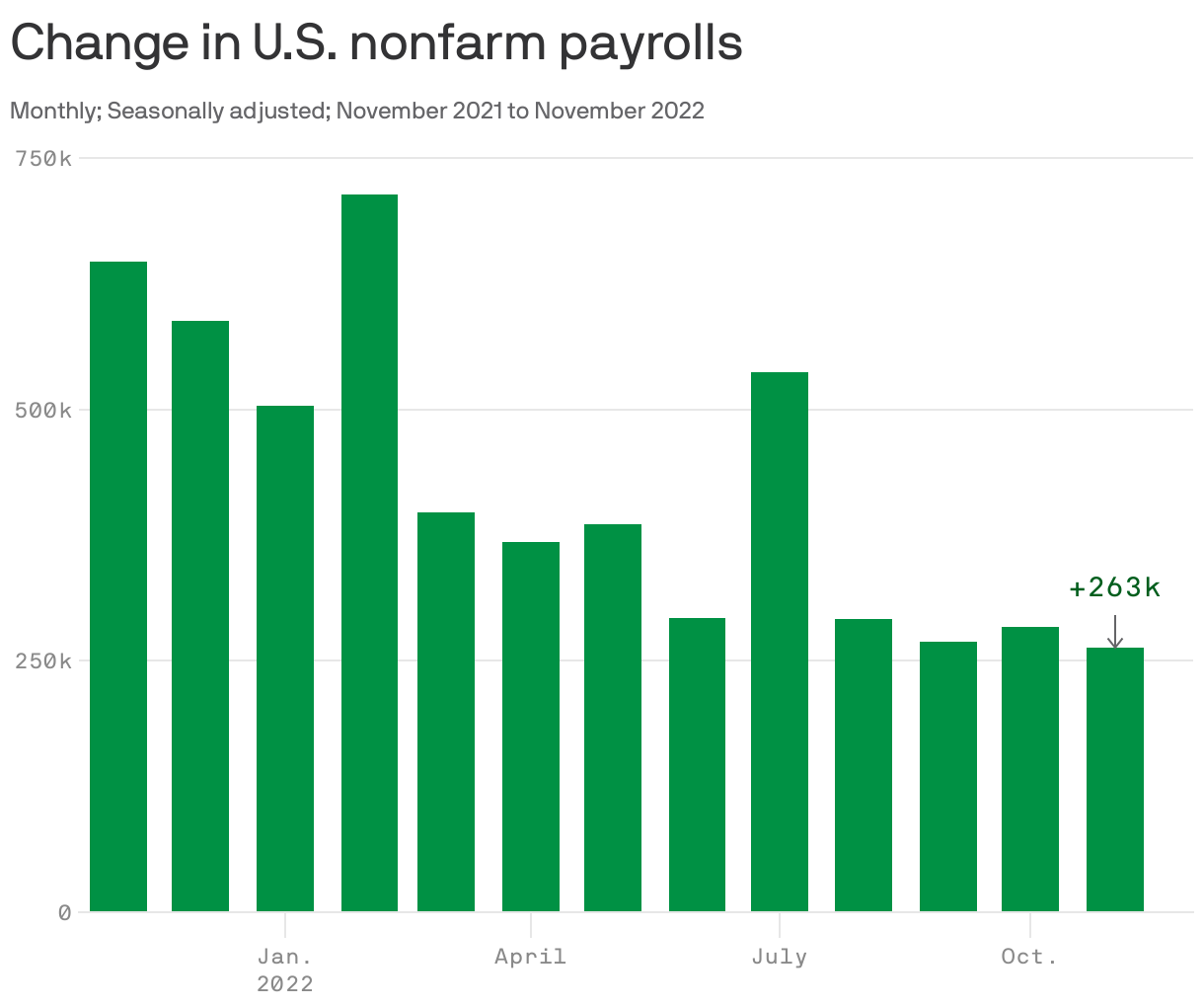

Data: Bureau of Labor Statistics; Chart: Axios Visuals

The U.S. economy added 263k jobs in November, topping economist estimates, while the unemployment rate remained steady at 3.7%. Go deeper.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.