Sourcery (11/29-12/3)

Thought Machine, Kueski, Certik, Mr Yum, Abacum, P00LS, Pepper, Anchor, Butter, Jump, Algofi, Droplette, Babyscripts, Wispr AI, CareAlign, Wave, Armis, JOKR, Motorway, Cloudtrucks, 100 Thieves..

Last Week (11/29-12/3):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Thought Machine, Kueski, Certik, Mr Yum, Abacum, P00LS, Pepper, Anchor, Butter, Jump, Algofi, Droplette, Babyscripts, Wispr AI, CareAlign, Wave, Armis, JOKR, Motorway, Lessen, Smartling, Cloudtrucks, Shiftsmart, Klue, 100 Thieves, Cycode, Quince, Quinyx, Life House, ThreeFlow, Glorify, Fable, Raycast, Procurated, Via, Clarity AI, StormSensor, Demex Group, Forum Mobility, Upway; Busuu, Giphy, Sneaker Con Digital, Egoditor GmbH, Welcome; Nu Holdings, HashiCorp, Open English; Selina, Buzzfeed, Amex Global Business Travel, Grab

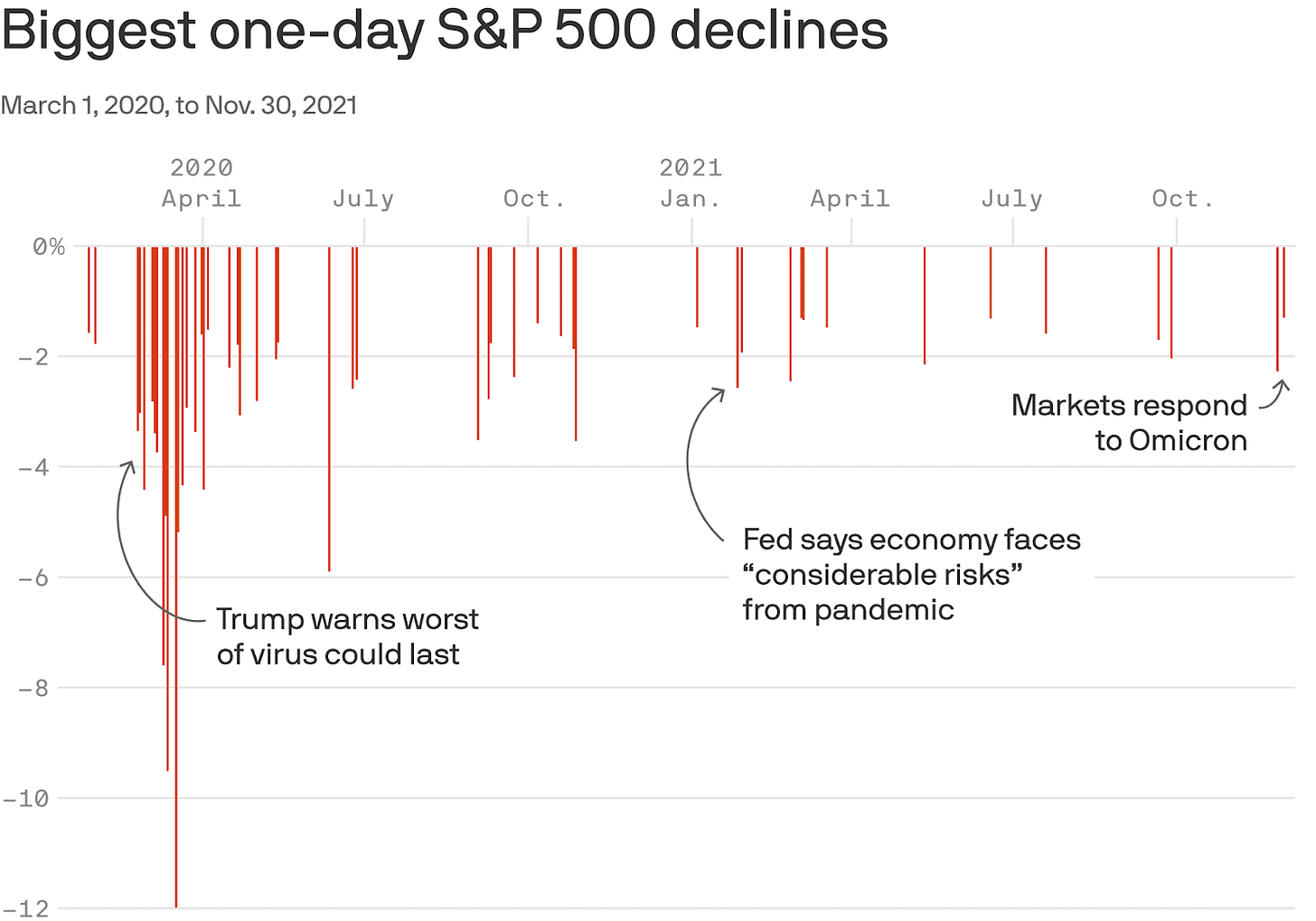

Final numbers on Global Private Capital Investment Growth and Biggest One-Day S&P 500 Drops at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Thought Machine, a London-based banking technology firm, raised $200 million in Series C funding. The round was led by Nyca Partners and was joined by ING Ventures, JPMorgan Chase, and Standard Chartered Ventures.

- Kueski, a Mexico City-based BNPL startup, raised $102 million in equity funding. StepStone Group led, and was joined by One Prime Capital, Glisco, Altos Ventures, Cathay Innovation, Richmond Global Ventures, Rise Capital, Tuesday Capital, Angel Ventures and Cometa. The company also secured $100 million in debt financing led by Victory Park Capital. http://axios.link/7vil

- Fundbox, a San Francisco-based financial platform for small businesses, raised $100 million in Series D funding led by the Healthcare of Ontario Pension Plan and was joined by investors including Khosla, Allianz X, and BNY Mellon.

- CertiK, a New York City-based blockchain security firm, raised $80 million in Series B2 funding. Sequoia led the round and was joined by investors including Tiger Global, Coatue Management, and GL Ventures.

- Mr Yum, a Melbourne-based payments platform for hospitality and entertainment companies, raised $65 million in Series A funding. The funding was led by Tiger Global and was joined by Commerce VC, VU Venture Partners, Skip Capital, Patty Mills, Rüfüs Du Sol, TEN13 and AirTree.

- Abacum, a New York-based provider of FP&A software for tech finance teams, raised $25 million. Atomico led, and was joined by Creandum and S16VC. http://axios.link/LBhI

- P00LS, a Miami-based decentralized exchange creator cryptocurrencies, raised $18 million in seed funding. Global Founders Capital led the round and was joined by investors including L2 Ventures, Shift, Maven, and Kim Ventures.

- Pepper, a New York-based ordering system for food distributors, raised $16 million in Series A funding. Index Ventures led, and was joined by Greylock, Imaginary Ventures, BoxGroup and Moving Capital. http://axios.link/Sgpl

- Anchor, a New York-based B2B autonomous billing startup, raised $15 million in seed funding. Rapyd Ventures and Entrée Capital co-led, and were joined by Riskified and Tal Ventures. http://axios.link/LhCh

- Mendel, a Mexico-based corporate spend management tech maker, raised $15 million in Series A funding. ALLVP and Infinity Ventures led the round.

- Goalsetter, a New York-based fintech platform and family financial education tool company, raised $15 million in Series A funding led by Seae Ventures and was joined by investors including Fiserv, Mass Mutual, Sterling National Bank, Citizens Financial Group, Cuna Mutual Financial Group, and Astia Fund.

- 24 Exchange, a Bermuda-based trading platform, raised $14.25 million led by Point72 Ventures. http://axios.link/9Sbm

- Butter, a payments failure prevention company, raised $7 million from founding investor Atomic.

- Jump, a Paris-based benefits provider for freelancers and gig workers, raised $4.5 million in seed funding led by Index Ventures and was joined by investors including Kima Ventures, BlaBlaCar CEO Nicolas Brusson, Personio CEO Hanno Renner, and Voodoo co-founder Laurent Ritter.

- Algofi, a New York-based decentralized finance lending market and stablecoin protocol, raised $2.8 million in seed funding led by Union Square Ventures, Arrington Capital, and Pillar VC and was joined by investors including Y Combinator, Formulate Ventures, and Shine VC.

- Structure, a crypto and DeFi investment startup, raised $2 million in seed funding. Polychain Capital led the round and was joined by investors including Bixin Ventures and Ascensive Assets.

. . .

Care:

- Droplette, a Boston-based consumer skincare tech startup, raised $15.4 million in Series B funding. Victress Capital and Spark Capital co-led, and were joined by Bolt and Amplifyher Ventures. www.droplette.io

- Babyscripts, a Washington, D.C.-based virtual maternity care platform, added $7.5 million to its Series B funding round from investors including Cigna Ventures, Texas Medical Center Venture Fund and Atlantic Health. The firm has now raised $19 million in the round.

- Wispr AI, a San Francisco-based neurotechnology company, raised $4.6 million in seed funding co-led by NEA and 8VC and was joined by investors including CTRL-Labs co-founder Josh Duyan, Warby Parker CEO Dave Gilboa, and others.

- CareAlign, a Philadelphia-based compliance task management system for health care providers, raised $2.3 million in funding from investors led by Hofmann Associates, Gaingels, and Harvard Angels and was joined by investors including Tech Council Ventures, Boston Millennia Partners’ Founders Fund, Front Row Round and DreamIt.

- Wave, an emotional care company for teens and young adults, raised $2 million in seed funding led by Hannah Grey VC and was joined by investors including Tribe Capital, k50 Ventures, Alumni Ventures Group/Basecamp, Conscience VC, Verissimo Ventures and others.

. . .

Future of Work:

- Armis, a Palo Alto, Calif.-based security platform company, raised $300 million in funding from One Equity Partners and other investors..

- JOKR, a New York City-based instant grocery delivery company, raised $260 million in Series B funding. The deal values the business at $1.2 billion. Investors include Activant Capital, Balderton, Greycroft, GGV Capital, G-Squared, HV Capital, Kaszek, Mirae Asset, Monashees, Moving Capital, and Tiger Global.

- Motorway, a U.K.-based used car marketplace, raised $190 million in Series C funding. The round was led by Index Ventures and ICONIQ and was joined by investors including Latitude, Unbound, BMW, and i Ventures.

- Lessen, an Scottsdale, Ariz.-based property services platform, raised $170 million in Series B funding led by Fifth Wall and was joined by Khosla Ventures, General Catalyst and Navitas Capital.

- Smartling, a New York-based cloud translation technology platform company, raised $160 million from Battery Ventures.

- CloudTrucks, a "business in a box" startup for small trucking companies, raised $115 million in Series B funding at an $850 million post-money vauation. Tiger Global led, and was joined by Menlo Ventures and Flexport. http://axios.link/2C9E

- Shiftsmart, a New York City-based labor management software maker, raised $95 million in a Series B funding. D1 Capital led the round and was joined by investors including Imaginary Ventures, Spieker Partners, and S12F.

- Reibus, an Atlanta-based metals marketplace, raised $75 million in Series B funding. SoftBank led, and was joined by Canaan Partners, Nosara Capital, Battery Ventures, Bowery Capital, Initialized Capital and FJ Labs. http://axios.link/CBCR

- Hotel Engine, a business travel booking startup, raised $65 million in Series B funding valuing it at $1.3 billion. Telescope Partners led the round and was joined by investors including Blackstone.

- Klue, a Vancouver-based competitive enablement platform, raised $62 million in Series B funding led by Tiger Global and was joined by Salesforce Ventures.

- 100 Thieves, a Los Angeles-based clothing brand & gaming company, raised $60 million in Series C funding. Green Bay Ventures led the round and was joined by investors including Breyer Capital, Aglae Ventures, Tao Capital, Willoughby Capital, and Artist Capital Management. The deal values the business at $460 million.

- Cycode, a Tel-Aviv-based software supply chain security company, raised $56 million in Series B funding led by Insight Partners and was joined by YL Ventures.

- Quince, a San Francisco-based retailer, raised $50 million in Series A funding led by Insight Partners and was joined by investors including Founders Fund, Basis Set Ventures, Lugard Road/Luxor Capital and 8VC.

- Quinyx, a Stockholm-based workforce management company, raised $50 million in funding led by Battery Ventures.

- Life House, a New York-based hotel technology platform, raised $50 million in Series C funding led by KAYAK and Inovia Capital and was joined by investors including Tiger Global, Derive Ventures, JLL, Trinity Ventures, Sound Ventures, Cooley, and others.

- ThreeFlow, a remote benefits placement system for brokers and carriers, raised $45 million in Series B funding led by Accel and was joined by investors including Emergence Capital, Equal Ventures, and First Trust Capital Partners.

- Glorify, a London-based Christian worship and wellbeing app, raised $40 million in Series A funding led by a16z and was joined by investors including SoftBank Latin America Fund, K5 Global, Kris Jenner, Michael Bublé, Jason Derulo, and others.

- Sounding Board, an Aliso Viejo, Calif.-based leadership coaching platform, raised $30 million in Series B funding led by JAZZ Venture Partners and was joined by investors including Canaan, Bloomberg Beta, Correlation Partners, Gaingels, Engage.vc, and others.

- Uniform, a San Francisco-based developer platform, raised $28 million in Series A funding. Insight Partners led the round and was joined by investors including Elad Gil and Array Ventures.

- Solutions by Text, a Dallas, Tex.-based compliant text messaging platform for consumer finance companies, raised $28 million in funding led by Edison Partners and was joined by investors including Stifel Venture Bank.

- Gradle, a San Francisco-based software and automation tool company, raised $27 million in Series C funding led by Triangle Peak Partners and was joined by investors including True Ventures, DCVC, Bain Capital Ventures, Harmony Partners, and StepStone Group.

- Fable, a Palo Alto, Calif.-based social platform for book clubs and stories, raised $20 million in Series A funding led by Tiger Global and was joined by investors including Redpoint Ventures, Gaingels, Breyer Capital, and defy.vc.

- Raycast, a developer productivity platform, raised $15 million in Series A funding led by Accel and Coatue and joined by investors including Hopin CEO Johnny Boufarhat, Stripe’s Jeff Weinstein, former GitHub CTO Jason Warner, and others.

- Procurated, a Washington, D.C.-based supplier ratings and review platform, raised $10 million in Series A funding. Greycroft led the round and was joined by investors including Tribeca Venture Partners, TDF Ventures, and Limerick Hill.

- Strivacity, a Herndon, Va.-based customer identity and access management provider, raised $9.3 million in Series A funding led by Ten Eleven Ventures and was joined by investors including Toba Capital.

- NuBrakes, an Austin, Tex.-based mobile auto maintenance platform, raised $9 million in Series A funding led by Canvas Ventures and was joined by investors including Contrary Capital, Bling Capital, and Automotive Ventures.

- Voyager Portal, a Houston-based marine supply chain logistics startup, raised $8.4 million in Series A funding. Phaze Ventures led, and was joined by ScOp Venture Capital, Waybury Capital and Flexport. www.voyagerportal.com

- Inspectify, a Seattle, Wash.-based property inspection marketplace and software platform, raised $8 million in Series A funding led by Nine Four Ventures and was joined by investors including Foundation Capital, the HSB Fund of Munich Re Ventures, and Redfinand Socially Financed.

- Hologram, a Chicago-based global cellular platform for IoT (Internet of Things) connectivity, raised an additional $6.8 million in Series B funding from investors including Founders Circle Capital, Mindset Ventures, Chingona Ventures, and Converge. The firm has now raised $67 million in the round.

- Returnmates, a Venice, Calif.-based online returns company, raised $5 million in funding led by LightShed Ventures and was joined by investors including Good Friends, Chris Homer, and V1.VC.

- Trustpage, a Detroit-based team collaboration platform, raised $5 million in seed funding led by Bonfire Ventures, Ludlow Ventures, and Detroit Venture Partners and was joined by investors including Entrée Capital, Basement Fund and GTMfund.

- Blockade Games, an Indianapolis, Ind.-based game studio built on blockchain, raised $5 million in seed funding. The round was led by Animoca Brands and Digital and was joined by Drew Austin from Redbeard Ventures, Flamingo DAO, Galaxy Interactive, Roham Gharegozlou from Dapper Labs, Keith Grossman from TIME, and Meltem Demirors from Coinshares.

- Cerbos, a London-based open source software startup, raised $3.5 million in seed funding led by Crane and was joined by investors including Earlybird Digital East, Seedcamp, 8-Bit Capital, Connect Ventures, OSS Capital, Acequia Capital, HelloWorld, Tiny, Guillaume Pousaz, Paul Forster, and others.

- AdeptID, a workforce development and talent search startup, raised $3.5 million in seed funding. Zeal Capital Partners led the round and was joined by investors including Better Ventures and JFF's Employment Technology Fund.

. . .

Sustainability:

- Commonwealth Fusion Systems, a Cambridge, Mass.-based clean energy company, raised $1.8 billion in Series B funding led by Tiger Global and was joined by investors including Bill Gates, Coatue, DFJ Growth, Emerson Collective, Google and others.

- Via Transportation, a New York-based public transport app, raised $130 million at a $3.3 billion valuation. Janus Henderson led, and was joined by BlackRock, ION Crossover Partners, Koch Disruptive Technologies and insider Exor. http://axios.link/0T8g

- Clarity AI, a New York-based sustainability data platform, raised $50 million. SoftBank led, and was joined by Fifth Wall and insiders BlackRock, Deutsche Boerse, Kibo Ventures, Mundi Ventures, Seaya Ventures and Founders Fund. http://axios.link/QHXf

- Sortera Alloys, a Fort Wayne, In.-based product waste reuse company, raised $10 million in funding led by Breakthrough Energy Ventures.

- StormSensor, a Seattle, Wash-based climate technology data tracking company, raised $10 million in funding co-led by Orbia Ventures and Buoyant Ventures and was joined by investors including Burnt Island Ventures, Gratitude Railroad, Portland Seed Fund, the American Family Institute for Corporate and Social Impact, and others.

- The Demex Group, a Washington D.C.-based climate risks company, raised $9 million in Series A funding. Anthemis Group, Blue Bear Capital, and QBE Ventures invested.

- Forum Mobility, an SF-based zero-emission fleet and infrastructure provider, raised $7.5 million in seed funding co-led by Obvious Ventures and Homecoming Capital. www.forummobility.com

- Upway, a Paris-based refurbished e-bike marketplace, raised €4 million ($4.6 million) from Sequoia and Global Founders Capital.

Acquisitions & PE:

- Chegg agreed to acquire Busuu, a Moorgate, England-based language learning company backed by Profounders Capital, McGraw-Hill, and others, for $436 million in cash.

- U.K. antitrust regulators have directed Meta (Nasdaq: FB) to sell Giphy, which it bought last May for $400 million. http://axios.link/hHZI

- Bluebell Capital Partners is calling on Glencore (LSE: GLEN) to spin off its thermal coal business. http://axios.link/iXWD

- eBay (Nasdaq: EBAY) acquired Sneaker Con Digital’s authentication business. http://axios.link/a4q6

- Bitly, owned by Spectrum Equity, acquired Egoditor GmbH, a Bielefeld, Germany-based QR code platform. Financial terms were not disclosed.

- Optimizely, owned by Insight Partners-backed Episerver, agreed to acquire Welcome, a New York-based marketing team collaboration platform. Financial terms were not disclosed.

- EQT Infrastructure acquired Covanta, a Morristown, N.J.-based sustainable waste and energy solution company backed by Equity Group Investments, for $5.3 billion.

- Athene (NYSE: ATH), backed by Apollo Global Management, agreed to buy a control stake in consumer lending platform Aqua Finance for around $1 billion from Blackstone (which retains a minority stake). http://axios.link/Svd4

- Jana Partners has asked Zendesk (NYSE: ZEN) to scrap its $4.13 billion acquisition of Momentive (Nasdaq: MNTV), the parent company of SurveyMonkey, per the WSJ. http://axios.link/Codr

- The FTC sued to block the chipmaker Nvidia's (Nasdaq: NVDA) $40 billion cash and stock acquisition of British rival Arm from SoftBank. BFD flashback.

. . .

IPOs:

- Nu Holdings, a holding company for Brazilian neobank Nubank, and its shareholders now plan to raise up to $2.6 billion in an offering in the U.S., Brazil, and other countries of 289.2 million shares priced between $8 and $9 per share—insiders had previously planned to sell shares, and the company had formerly planned to price its shares at up to $11. The company reported $737 million in total revenue in 2020 and a loss of $172 million. Sequoia Capital, DST Global, Tencent Holdings, and Tiger Global back the firm.

- HashiCorp, a San Francisco-based cloud workflow platform, plans to raise up to $1.1 billion in an offering of 15.3 million shares priced between $68 and $72 per share. The company posted total revenue of $222 million in the year ending in Jan. 2021 and reported a net loss of $84 million. Mayfield, GGV Capital, Redpoint Ventures, and True Ventures back the firm.

- Open English, a Coral Gables, Fla.-based English learning platform for Spanish speakers in Latin America, is planning for an IPO in the U.S. next year, per Bloomberg.

. . .

SPACs:

- Griid Infrastructure, a Bitcoin mining company, confirmed plans to go public via a merger with Adit EdTech Acquisition Corp., a SPAC. A deal values the firm at $3.3 billion.

- Selina, a London-based accommodation and co-living space company for remote workers, plans to go public via a merger with BOA Acquisition Corp., a SPAC. A deal would value the company at approximately $1.2 billion.

- BuzzFeed, the new media company, will raise roughly $16 million from merger with a SPAC after a wave of investor withdrawals. The SPAC previously raised $287.5 million.

- American Express Global Business Travel, said it would go public via a merger with Apollo Strategic Growth Capital, a SPAC backed by Apollo Global Management.

- Grab shares got crushed in their first day of trading after its record-breaking SPAC merger, closing down 20.5% at $8.75 per share.

- Sportsman’s Warehouse Holding canceled its merger with Bass Pro Shops, an outdoor sports retailer, after the Federal Trade Commission indicated it would nix the deal.

- FAST Acquisition Corp. (NYSE: FST) declined to end its $6.6 billion acquisition of Fertitta Entertainment, the parent company of gaming business Golden Nugget and restaurant chain operator Landry’s. Fertitta on Wednesday moved to kill the transaction because the closing date has passed, but FAST says that’s because Fertitta hasn’t yet provided the requisite financials. http://axios.link/DZej

Funds:

- Differential Ventures, a New York-based seed-stage venture capital firm, raised $60 million for a new fund.

- Sapphire Ventures, an Austin, Tex.-based venture capital firm, raised $2 billion across its growth funds.

- Borderless Capital, a Miami-based venture capital firm, launched a new $500 million fund.

- Bessemer Venture Partners, a San Francisco-based venture capital firm, raised $220 million for a new fund focused on India.

- Allegion Ventures, the Carmel, Ind.-based ventures arm of Allegion, launched a second fund with $100 million.

- Speedinvest, a European venture capital firm, launched a new $90.7 million fund focused on climate.

Final Numbers

Source: Global Private Capital Association

Data: S&P Dow Jones Indices; Chart: Will Chase/Axios

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.