Sourcery (1/17-1/20)

Layoffs & GenAI ~ Anyfin, Link, iLife, Parfin, Splitero, Cypher, Suppli, Arch, Genial Care, ModifyHealth, Censinet, RX Redefined, Biohm, knownwell, Sunfish, GoodOnes, Zitti, SLAY; Gas/Discord

Readings

How Layoffs in Startupland Differ Between B2B & B2C Companies, Tomasz Tunguz

Belt Tightening Double Whammy, Jamin Ball

Podcasts

Gwyneth Paltrow x Kim Kardashian: On Routines, Family, and Marriages, Goop

Kim gets into her career and interests in investing as she recently launched PE fund Skky Partners, co-founded with Jay Sammons, a former partner at the investment firm Carlyle Group.

E112: Is Davos a grift? Plus: globalist mishaps, debt ceilings, TikTok's endgame & more, All-in Podcast

E111: Microsoft to invest $10B in OpenAI, generative AI hype, America's over-classification problem, All-in Podcast

Generative AI

StrictlyVC in conversation with Sam Altman founder of OpenAI, Connie Loizos

This second clip is focused exclusively on artificial intelligence, including how much of what OpenAI is developing Altman thinks should be regulated, whether he's worried about the commodification of AI, his thoughts about Alphabet's reluctance to release its own powerful AI, and worst- and best-case scenarios as we move toward a future where AI is ever-more central to our lives.

EP 46: Stability AI CEO Emad Mostaque, The Future of Generative AI, Creating Real-Time Movies, Societal Impact of AI, Logan Bartlett

Stability AI CEO Emad Mostaque discusses the future of AI. From being only years out from generating entire movies in real-time to how it’s revolutionizing the healthcare industry and could help identify cancer. Plus its benefits in education, charities, the potential regulations, and societal impact, and Stable Diffusion becoming the most popular open-source software in the world.

. . .

Last Week (1/17-1/20):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Anyfin, Link, iLife, Parfin, CloseFactor, Splitero, Goldenset Collective, Cypher, Suppli, Arch, Genial Care, ModifyHealth, Censinet, RX Redefined, Biohm, knownwell, Sunfish, Impel, Vennevar Labs, Outrider, Cloudian, ThriveCart, Beaconstac, Authenticx, Brightpick, Dreamscape Learn, Chord, Amberflo.io, Exodigo, Rive, GoodOnes, Zitti, SLAY, Sublime Systems, Aerones, EarthOptics, Living Carbon, Forum Mobility, Axiom Cloud; Gas/Discord, CloudOps/Aptum, Human Interest, Tactic/TaxBit

Final numbers on Big Tech Layoffs at the bottom.

Deals

Fintech:

- Anyfin, a Stockholm-based loan refinancing platform, raised €30 million ($32.46 million) in Series C funding. Northzone led the round and was joined by Accel, EQT Ventures, FinTech Collective, Quadrille Capital, Augmentum FinTech, and Citi Ventures.

- ContractSafe, a Malibu-based contract management platform, raised $27.5 million in funding from Five Elms Capital.

- Link, an SF-based provider of open banking API solutions, raised $20m in Series A funding. Valar Ventures led, and was joined by Tiger Global, Amplo, Pareto Holdings and Quiet Capital. www.link.money

- iLife Technologies, a Los Angeles-based operating system for insurance carriers and agencies, raised $17 million in funding. Foundation Capital, Brewer Lane Ventures, and SCOR Ventures co-led the round and were joined by GTMFund and OpenView Partners.

- Parfin, a London and Rio De Janeiro-based Web3 infrastructure provider, raised $15 million in seed funding. Framework Ventures led the round and was joined by L4 Venture Builder, Valor Capital Group, and Alexia Ventures.

- CloseFactor, a Palo Alto, Calif.-based go-to-market operating system for revenue teams, raised $15m in Series A funding. Vertex Ventures and Sequoia Capital co-led, and were joined by GTMFund and Neythri Futures Fund. www.closefactor.com

- Splitero, a San Diego-based home equity access provider, raised $11.7 million in Series A funding. Fiat Ventures led the round and was joined by Gemini Ventures, Joint Effects, PBJ Capital, Permit Ventures, Dream Ventures, Goodwater Capital, Spark Growth Ventures, and Oyster Fund.

- Goldenset Collective, a Los Angeles-based investment platform for digital creator businesses, raised $10 million in seed funding. A.Capital and Lerer Hippeau co-led the round and were joined by Thirty Five Ventures.

- Quasar, a remote-based capital management blockchain, raised $5.4 million in bridge funding. Shima Capital led the round and was joined by Polychain Capital, Blockchain Capital, HASH CIB, and Osmosis founder Sunny Aggarwal.

- Cypher, a Palo Alto-based crypto wallet, raised $4.3 million in seed funding co-led by YCombinator, Samsung Next Ventures, Orange DAO, Tribe Capital, GoodWater Capital, Rebel Fund, Picus Capital, and others.

- Suppli, an Austin-based digital accounts receivable platform, raised $3.1 million in seed funding. Equal Ventures led the round and was joined by Audacious Ventures, Dash Fund, Built Technologies CEO Chase Gilbert, and Wrapbook CEO Ali Javid.

- Arch, a New York-based lending platform, raised $2.75 million in pre-seed funding co-led by Castle Island Ventures and Tribe Capital.

- SphereOne, an Austin-based crypto payment platform, raised $2.5 million in seed funding. Distributed Global led the round and was joined by Newark Venture Partners, Zero Knowledge, and other angels.

. . .

Care:

- Genial Care, a São Paulo-based autism care company, raised $10 million in Series A funding led by General Catalyst.

- ModifyHealth, an Atlanta-based provider of medically tailored meals, raised $10m in Series B funding. RRC Capital led, and was joined by Nashville Capital Network. https://axios.link/3Hffhch

- Censinet, a Boston-based provider of health care risk management tools, raised $9m. MemorialCare Innovation Fund, Rex Health Ventures and Ballad Ventures co-led, and were joined by LRVHealth, HLM Venture Partners, Schooner Capital, Excelerate Health Ventures and Cedars Sinai. www.censinet.com

- Rx Redefined, an Oakland-based medical supply services provider for group practices, raised $8 million in Series A funding. Crosscut Ventures Management led the round and was joined by Tusk Venture Partners, Silverton Partners, Pisgah Fund, former General Electric CEO Jeff Immelt.

- Biohm, a Cleveland-based microbiome startup, raised $7.5m. VTC Ventures led, and was joined by Felton Group, Jobs Ohio Growth Capital Fund, Aztec Capital Management, Cleveland Life Science Advisors, Valley Growth Ventures and Jump Start. www.poweredbybiohm.com

- Posterity Health, a Denver-based digital male fertility center, raised $7.5 million in funding. Distributed Ventures led the round and was joined by FCA Venture Partners and WVV Capital.

- knownwell, a Boston-based weight-inclusive health care company, raised $4.5 million in seed funding. Flare Capital Partners led the round and was joined by the Flybridge LTV Operator Fund, Oxeon, and others.

- Sunfish Technologies, a Santa Monica, Calif.-based fertility financing support startup, raised $3.8m in seed funding, per Axios Pro. Walkabout Ventures led, and was joined by Hannah Grey VC and Fiat Ventures. https://axios.link/3XDDYo6

- Cari Health, a San Diego-based developer of wearables for remote medication monitoring, raised $2.3m in seed funding. San Diego Angel Conference led, and were joined by NuFund Venture Group, Cove Fund, Chemical Angel Fund and Medical Devices of Tomorrow. www.carihealth.com

. . .

Enterprise & Consumer:

- Impel, a Syracuse, N.Y.-based provider of digital engagement software for automakers, raised $104m from Silversmith Capital Partners. www.impel.io

- Vannevar Labs, a Palo Alto-based technology provider for national security, raised $75 million in Series B funding. Felicis led the round and was joined by DFJ Growth, Aloft VC, General Catalyst, Point72, Costanoa Ventures, and Shield Capital.

- Outrider, a Golden, Colo.-based autonomous yard operations company, raised $73 million in Series C funding. FM Capital led the round and was joined by the Abu Dhabi Investment Authority, NVentures, Koch Disruptive Technologies, and New Enterprise Associates.

- Cloudian, a San Mateo, Calif.-based hybrid cloud data management and storage provider, raised $60m in Series F funding from Digital Alpha, Eight Roads Ventures Japan, INCJ, Intel Capital, Japan Post Investment Corporation, Silicon Valley Bank, Tinshed Asia and Wilson Sonsini Investments. https://axios.link/3XntbOX

- ThriveCart, an Austin-based shopping cart, sales funnels, and educational course creation technology company, raised $35 million in funding from LTV SaaS Growth Fund. (is this an actual fund name.. lol)

- Carry1st, a Cape Town, South Africa-based mobile games publisher, raised $27 million in funding. BITKRAFT Ventures led the round and was joined by a16z, TTV Capital, Alumni Ventures, Lateral Capital, Kepple Ventures, and Konvoy.

- Beaconstac, a New York-based QR code customer engagement platform, raised $25 million in Series A funding. Telescope Partners led the round and was joined by Accel.

- Authenticx, an Indianapolis-based conversational intelligence platform for the health care industry, raised $20 million in Series B funding. Blue Heron Capital led the round and was joined by Beringea, Indiana Next Level Fund/50 South Capital Advisors, High Alpha, Mutual Capital Partners, Signal Peak Ventures, Allos Ventures, Elevate Ventures, and M25.

- Brightpick, an Erlanger, Ky.-based automated fulfillment company, raised an additional $19 million in Series B funding. Taiwania Capital led the round and was joined by IPM Group, Alpha Intelligence Capital, H&D Asset Management, Venture to Future Fund, and Kolowrat Group.

- Dreamscape Learn, a Culver City, Calif.-based VR-assisted learning and education company, raised $20 million in Series A funding. Bold Capital Partners, GSV Ventures, Verizon Ventures, and Cengage Group invested in the round.

- Chord, a New York-based commerce platform, raised $15 million in Series A extension funding. Bright Pixel Capital and Eclipse co-led the round and were joined by GC1 Ventures, TechNexus Venture Collaborative, Anti Fund VC, Imaginary Ventures, Foundation Capital, and White Star Capital.

- Amberflo.io, a San Francisco-based usage-based pricing company, raised $15 million in Series A funding led by Norwest Venture Partners.

- Exodigo, a San Francisco and Tel Aviv-based subsurface mapping company, raised $12 million in seed extension funding. Zeev Ventures and 10D Ventures co-led the round and were joined by SquarePeg Capital, JIBE Ventures, Tidhar Construction, Israel Canada, and WXG.

- Rive, a San Francisco-based animation software provider, raised $10 million in Series A funding led by Two Sigma Ventures.

- SYKY, a Brooklyn-based fashion platform, raised $9.5 million in Series A funding. Seven Seven Six led the round and was joined by Brevan Howard Digital, Leadout Capital, First Light Capital Group, and Polygon Ventures.

- Liberate Innovations, a Palo Alto-based SaaS platform, raised $7 million in seed funding led by Eclipse.

- Akia, a San Francisco-based customer experience automation platform, raised $6 million in Series A funding. Altos Ventures led the round and was joined by GSR Ventures.

- Scenario, an AI platform for generating gaming art assets, raised $6m in seed funding. Play Ventures led, and was joined by backers like Anorak Ventures, Founders Inc. and The VR Fund. https://axios.link/3IYk7f6

- Cypris, a New York-based research platform for research and development teams, raised $4 million in Series A funding. York IE led the round and was joined by Activate VP, K20 Fund, and BlueTree Capital.

- GoodOnes, a San Francisco-based photo selection app, raised $3.5 million in seed funding. TLV Partners led the round and was joined by Liquid2 Ventures, former Android co-founder Rich Miner, and Carousel founder Peter Welinder.

- Zitti, a food supply chain management platform for restaurants, raised $3.5m in seed funding. Oceans Ventures and Serena Ventures co-led, and were joined by Crossbeam. https://axios.link/3XohO9E

- MarketReader, a New York-based market analytics startup, raised $3.1m in seed funding from former OppenheimerFunds CEO Art Steinmetz and Michael Smith of Oakridge Management Group. marketreader.com

- SLAY, a Berlin-based social media network for teenagers, raised €2.5 million ($2.7 million) in pre-seed funding. Accel led the round and was joined by 20VC and other angels.

. . .

Sustainability:

- Sublime Systems, a Somerville, Mass.-based decarbonized cement producer, raised $40 million in Series A funding. Lowercarbon Capital led the round and was joined by The Engine, Energy Impact Partners, Siam Cement Group, and others.

- Aerones, a Riga, Latvia-based wind turbine maintenance and inspection company, raised $30 million in funding. Lightrock and Haniel co-led the round and were joined by Blume Equity, Change Ventures, Mantas Mikuckas, Metaplanet, Pace Ventures, and Future Positive Capital.

- EarthOptics, an Arlington, Va.-based soil data provider, raised $27.6m. Conti Ventures led, and was joined by Rabo Food & Ag Innovation Fund, CNH Industrial, Louis Dreyfus Company Ventures, CHS and Growmark's Cooperative Ventures. www.earthoptics.com

- Living Carbon, a San Francisco-based plant-based carbon capture and storage company, raised $21 million in Series A funding. Temasek led the round and was joined by Lowercarbon Capital, Toyota Ventures, Felicis Ventures, and others.

- Forum Mobility, an Oakland-based zero-emission trucking solutions provider, raised $15 million in Series A funding. CBRE Investment Management, Amazon Climate Pledge Fund, Homecoming Capital, Elemental Excelerator, Obvious Ventures, Edison International, and Overture invested in the round.

- Axiom Cloud, a San Jose-based refrigeration management software company, raised $7.4 million in Series A funding. Blue Bear Capital led the round and was joined by Frontier VC, Artifact Capital, Leadout Capital, Momenta Ventures, Ulu Ventures, Powerhouse Ventures, and Vela Partners.

Acquisitions & PE:

- Discord acquired Gas, a compliments-based social media app. Financial terms were not disclosed.

- Aptum acquired CloudOps, a Montreal-based cloud consulting, managed services, and software company. Financial terms were not disclosed.

- PetMeds Express acquired PetCareRx, a Lynbrook, N.Y.-based pet medications and supplies provider. The deal is valued at $36 million.

- BlackRock acquired a minority stake in Human Interest, an SF-based provider of 401(k)s for small and midsized businesses that’s raised over $330m in VC funding from firms like SoftBank and TPG Rise Fund. https://axios.link/3GKPCqf

- Lessen, a Scottsdale, Ariz.-based property services platform, acquired Chicago-based facilities maintenance software provider SMS Assist for $950m. Lessen has raised over $200m in VC funding from firms like Fifth Wall, Khosla Ventures and General Catalyst, while SMS Assist raised over $250m from firms like Goldman Sachs, HDS Capital, Insight Partners and Pritzker Group VC. https://axios.link/3H70Gzw

- TaxBit, a Draper, Utah-based provider of crypto tax and accounting software, acquired New York-based rival Tactic. TaxBit has raised over $200m from firms like PayPal Ventures, Tiger Global, Insight Partners, IVP, Paradigm and Haun Ventures. Tactic had raised over $13m from backers like FTX Ventures, Founders Fund, Ramp, Coinbase Ventures, Definition Capital and Lux Capital. https://axios.link/3wafx5W

- Vice Media, which once was valued by VCs at $5.7b, is restarting its sales process with expectations that it will fetch less than $1b, per CNBC. Backers include TPG, The Raine Group, Disney and TCV. https://axios.link/3WygWy4

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- B Capital, a Los Angeles-based investment firm, raised approximately $2.1 billion for a fund focused on investments in U.S. and Asia-based companies.

- Sony Ventures Corporation, the Tokyo-based venture capital arm of Sony, raised 26.5 billion yen ($206.2 million) for a fund focused on all stages of emerging technology companies and environmentally-focused startups.

- Courtside Ventures, a New York-based venture capital firm, raised $100 million for a fund focused on sports, gaming, and lifestyle companies.

Undoing

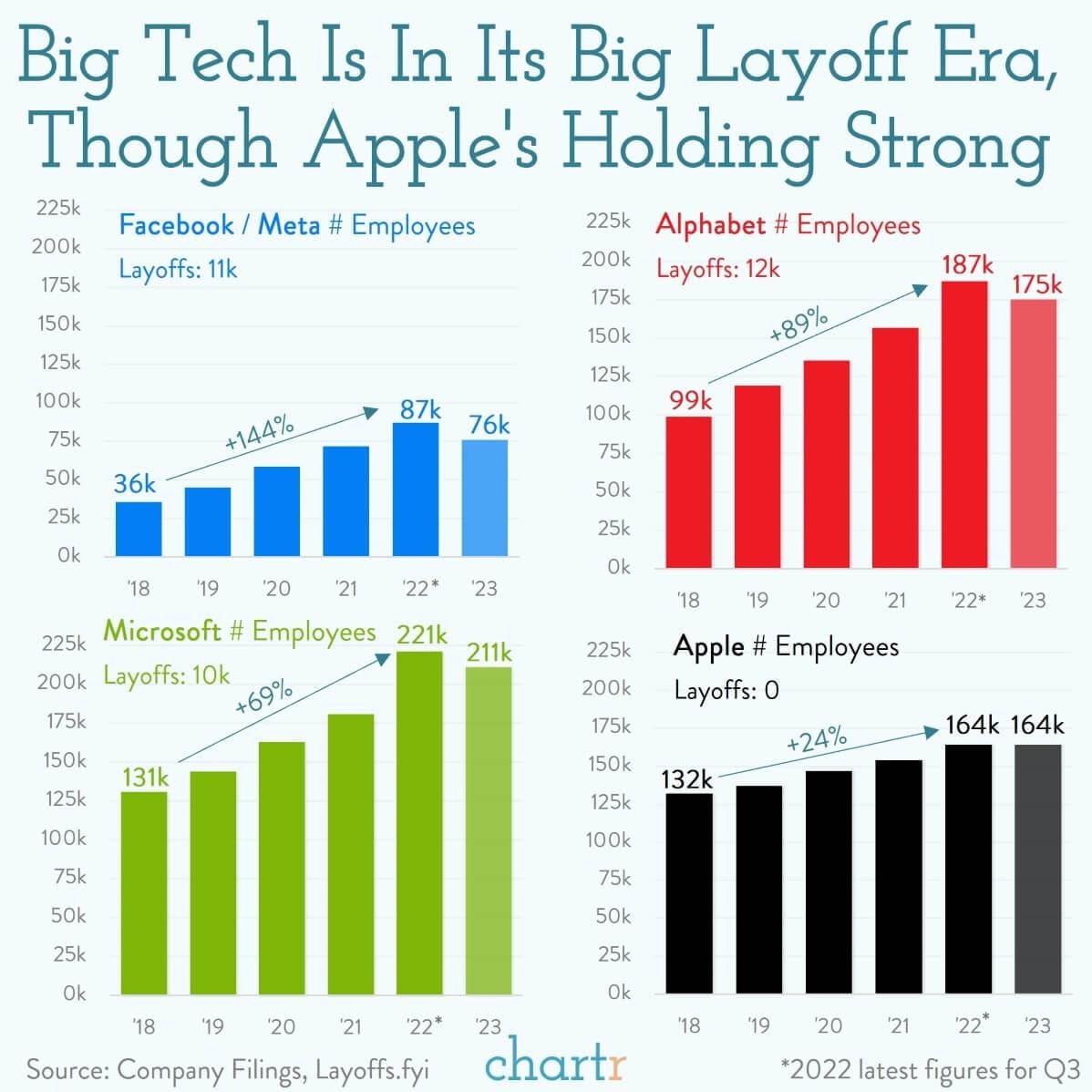

The tech world was rocked by another round of layoff announcements last week after Microsoft and Google’s parent company Alphabet both confirmed they’d be slashing 10,000 and 12,000 jobs, respectively.

Across the wider tech sector, some ~46,000 workers have now reportedly been laid off this year — that’s 2,000 jobs axed every day of January so far at the time of writing.

Apple’s sweet

Big tech companies used 2022 to bolster workforces, but those headcount expansions have started to look overly-optimistic as the economy has turned.

Indeed, Alphabet upped its workforce by some 17% in 2022 compared to 2021. Meta and Microsoft went even further with their new hires, adding 19% and 20% to their workforces, respectively, in the same time frame. On a proportional basis, Meta has gone on both the largest hiring spree, and has announced the largest cuts, with the 11,000 lost jobs at Meta accounting for 13% of its workforce.

The only company in tech’s “big five” not to have announced layoffs in the last three months is Apple. That’s perhaps down to a more prudent “slow-but-steady” hiring policy over the last few years, which has ensured that the iPhone giant remains a firing-free haven in the technology sector… at least for now.

Final Numbers

Data: U.S. Census Bureau; Chart: Axios Visuals

U.S. retail sales in December fell 1.1%, representing the largest monthly dip of 2022, but remained up 5.2% year-over-year. Go deeper.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.