Sourcery (1/18-1/21)

Animoca Brands, Clari, iTrustCapital, Lukka, Spendesk, Rain, Pinwheel, Lyra Health, Topography Health, 1Password, Handshake, 6sense, Lattice, Autograph, Ironclad, Parallel Systems, Activision Blizzard

Last Week (1/18-1/21):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Animoca Brands, Clari, iTrustCapital, Lukka, Spendesk, Rain, Pinwheel, Arc, Routefusion, Burnt Finance, Lyra Health, Wheel, Big Health, Topography Health, Faeth, Yuvo Health, 1Password, Dream Games, Handshake, 6sense, Lattice, Autograph, Ironclad, Pixis, Curbio, Atom Computing, Clockwise, Spekit, Nowsta, Walnut, Cana, Banyan Security, Proton.ai, Rocketlane, Turing Labs, Honeycomb, Permiso, Chatdesk, Codesee, Filmhub, Cloaked, Wrangle, Parallel Systems, Colossus, Submer, Doconomy, Aigen, Rebundle; Activision Blizzard, Inkbox, Dharma Labs; Acorns, ProKidney, Eleusis, Petsmart

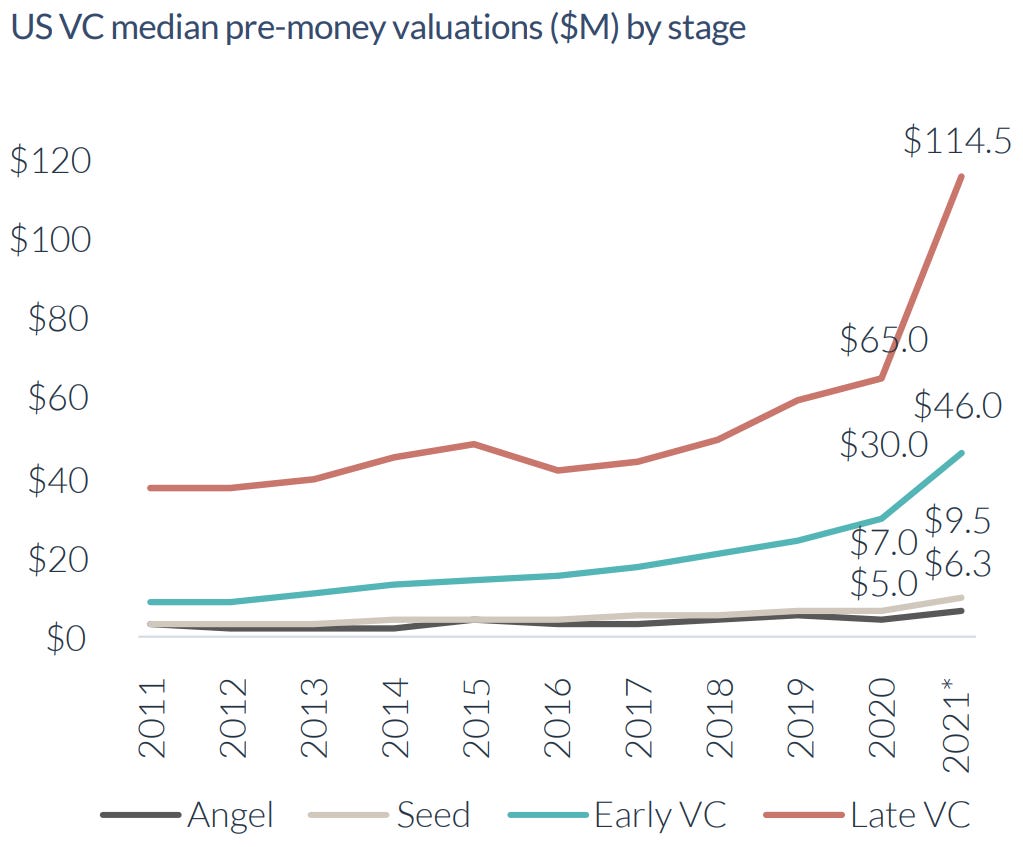

Final numbers on VC Valuation Inflation at the bottom. Fun times.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Animoca Brands, a Hong Kong-based digital property rights company for the metaverse that utilizes NFTs and gaming, raised $358.9 million in funding led by Liberty City Ventures and was joined by investors including 10T Holdings, C Ventures, Delta Fund, Gemini Frontier Fund, Gobi Partners Greater Bay Area, Kingsway, and L2 Capital.

- Clari, a Sunnyvale, Calif.-based revenue operations platform, raised $225 million in Series F funding led by Blackstone Growth and was joined by investors including Light Street Capital, Maverick Capital, B Capital Group, Bain Capital Ventures, Madrona Ventures, Northgate Capital, Sapphire Ventures, and Sequoia Capital.

- iTrustCapital, a Long Beach, Calif.-based platform for buying cryptocurrencies via IRAs, raised $125m in Series A funding at a valuation north of $1.3b led by Left Lane Capital. http://axios.link/MPzK

- Lukka, a New York-based crypto-asset software and data provider, raised $110 million in Series E funding led by Marshall Wace and was joined by investors including Miami International Holdings, Summer Capital, SiriusPoint, Soros Fund Management, Liberty City Ventures, S&P Global, and CPA.com.

- Spendesk, a French corporate spend management platform, raised €100m in Series C funding at a valuation north of €1b. Tiger Global led, and was joined by General Atlantic, Eight Roads Ventures, Index Ventures and eFounders. http://axios.link/mbsM

- Rain, a cryptocurrency brokerage and custodian for the Middle East, raised $110 million in Series B funding co-led by Paradigm and Kleiner Perkins and was joined by investors including Coinbase Ventures, Global Founders Capital, MEVP, Cadenza Ventures, JIMCO, and CMT Digital.

- Facet Wealth, a Baltimore, Md.-based subscription financial advisory company, raised $100 million in Series C funding led by Durable Capital Partners and was joined by investors including Warburg Pincus, Telesoft Partners, and Green Cow Venture Capital.

- INDmoney, a Gurgaon, India-based AI and machine learning-based wealth management and advisory app, raised $75 million in Series D funding from investors including Steadview Capital, Tiger Global, and Dragoneer Investment Group.

- Canalyst, a Vancouver, Canada-based leading financial data and analytics provider, raised $70 million in Series C funding led by Dragoneer Investment Group and was joined by investors including the Canada Pension Plan Investment Board, Alta Fox Capital, HighSage Ventures, Vanedge Capital, and ScaleUP Ventures.

- Pinwheel, a New York-based API platform developer that helps employers reduce payroll taxes, raised $50 million in Series B funding led by GGV Capital and was joined by investors including Coatue, First Round Capital, Upfront Ventures, AMEX Ventures, Indeed, Kraken Ventures, and Franklin Templeton.

- BlockFills, a digital asset trading and fintech company, raised $37 million in Series A funding from investors including Susquehanna Private Equity Investments, Simplex Holdings, and Nexo.

- Asaak, a Ugandan asset financing startup, raised $30m in equity and debt funding from Resolute Ventures, Social Capital, HOF Capital, Founders Factory Africa, End Poverty Make Trillions and Decentralized VC. http://axios.link/U35L

- Arc, a Menlo Park, Calif.-based financial services platform that offers non-dilutive growth capital, raised $11 million in seed funding led by NFX and was joined by investors including Y Combinator, Bain Capital Ventures, Clocktower Technology Ventures, Torch Capital, Dreamers VC, Soma Capital, and Alumni Ventures.

- Routefusion, an Austin, Texas-based provider of cross-border payments software, raised $10.5m. Canvas Ventures led, and was joined by Haymaker Ventures and insiders Silverton Partners and Initialized Capital. http://axios.link/ZHFV

- Payflow, a Spanish salary advance startup, raised $9.1m in Series A funding. Seeya Ventures and Cathay Innovation co-led, and were joined by Force Over Mass Capital, Y Combinator and Rebel Fund. http://axios.link/rA2t

- Burnt Finance, a decentralized NFT auction protocol built on Solana, raised $8 million in Series A funding led by Animoca Brands and was joined by investors including Multicoin Capital, Alameda Research, DeFiance Capital, Valor Capital Group, Figment, Spartan Capital, and Tribe Capital.

- Float, a Ghanaian provider of business cashflow solutions, raised $7m in equity co-led by Tiger Global and JAM Fund. It also secured $10m in debt from Cauris. http://axios.link/Qjqs

- Vartana, an S.F.-based provider of checkout and BNPL options for businesses, raised $7m led by Audacious Ventures and secured $50m in debt from i80 Group. http://axios.link/YbaZ

- SOMA Finance, a decentralized marketplace for digital assets, compliant digital securities, and NFTs, raised $6.5 million in seed funding led by Animoca Brands and was joined by investors including Kenetic Capital, Griffin Gaming Partners, GSR, Token Bay Capital, Mind Fund, UNKNOWN VC, FOMOcraft, BCW Group, Tai Ping Shan Capital, Gate Ventures, and 0x Ventures.

. . .

Care:

- Lyra Health, a Burlingame, Calif.-based provider of mental health care benefits for employers, raised $235 million in Series F funding at a $5.3 billion pre-money valuation. Dragoneer led, and was joined by Coatue, Emerson Collective and Salesforce Ventures.

Behavioral health is no longer the VC backwater it was when former Facebook CFO David Ebersman founded Lyra in 2015, with annual funding continuing to set new records. Lyra also announced its acquisition of London-based ICAS Worldwide, which gives Lyra access to mental health providers in more than 150 countries, and the addition of Workday co-president and CFO Robynne Sisco to its board.

- Wheel, an Austin, Texas-based virtual healthcare recruiting platform, raised $150m in Series C funding. Lightspeed Venture Partners and Tiger Global co-led, and were joined by Coatue, Salesforce Ventures and insiders CRV, Tusk Venture Partners and Silverton Partners. http://axios.link/bF2X

- Big Health, a San Francisco-based digital healthcare portal focused on mental health, raised $75 million in Series C funding led by SoftBank and was joined by investors including ArrowMark Partners, Octopus Ventures, Gilde Healthcare, Kaiser Permanente Ventures, and Morningside Ventures.

- Topography Health, a Los Angeles-based clinical trials startup focused on community physicians, raised $27.5M in Series A funding led by Bain Capital Ventures and was joined by a16z.

- Faeth Therapeutics, an Oakland, Calif.-based healthcare company that uses machine learning-driven precision nutrition solutions and treatment regimens to enhance cancer therapy, raised $20 million in seed funding co-led by Khosla Ventures and Future Ventures and was joined by investors including S2G Ventures, Digitalis, KdT Ventures, Agfunder, Cantos, and Unshackled.

- FitLab, a Newport Beach, Calif.-based fitness studios and at-home event platform, raised $15 million in Series A funding, bringing total capital raised to more than $15 million from investors including Two Styx Capital, CAVA Capital, Snoop Ventures, Audie Attar of Paradigm Sports Management, and Courtney Reum of M13.

- Yuvo Health, a New York-based administrative and managed-care solution for community health centers, raised $7.3 million in seed funding led by AlleyCorp and was joined by investors including AV8 Ventures, New York Ventures, Brooklyn Bridge Ventures, and Dr. Melynda Barnes.

- Mustard, an Aliso Viejo, Calif.-based AI sports coaching application, raised $3.8 million in seed funding led by the Lake Nona Sports & Health Tech Fund and was joined by investors including Mark Cuban, OneTeam Partners, Ronnie Lott, Justin Rose, the Major League Soccer Players Association, the United States Women's National (Soccer) Team Players Association, and Global Rugby Ventures.

- BirchAI, a Seattle, Wash.-based AI platform for healthcare customer support, raised $3.1 million in seed funding led by Radical Ventures.

- Inflow, a London-based developer of an app to treat ADHD, raised $2.3m in seed funding led by Hoxton Ventures. http://axios.link/8fRh

. . .

Enterprise & Consumer:

- 1Password, a Toronto, Canada-based password management software company, raised $620 million in Series C funding led by ICONIQ Growth and was joined by investors including Tiger Global, Lightspeed Venture Partners, and Backbone Angels.

- Exotec, a Croix, France-based global warehouse robotics company, raised $335 million in Series D funding led by Goldman Sachs Asset Management and was joined by investors including 83North and Dell Technologies Capital.

- Dream Games, an Istanbul, Turkey-based studio behind Royal Match, raised $255 million in Series C funding led by Index Ventures and was joined by investors including Makers Fund, IVP, BlackRock, Kora, and Balderton Capital.

- Handshake, an S.F.-based career network for U.S. college students, raised $200m in Series F funding at a $3.5b valuation. Coatue and Valiant Peregrine Fund co-led, and were joined by Base10. http://axios.link/DPLy

- 6sense, a San Francisco-based predictive intelligence platform for B2B organizations to generate revenue growth, raised $200 million in Series E funding co-led by Blue Owl and MSD Partners and was joined by investors including SoftBank, Franklin Templeton, Harmony Partners, Insight Partners, Tiger Global, D1 Capital Partners, and Sapphire Ventures.

- Lattice, a San Francisco-based employee performance management software company, raised $175 million in funding from Thrive Capital, Elad Gil, Tiger Global, and Dragoneer.

- Autograph, a Santa Monica, Calif.-based NFT platform for brands and names in sports, entertainment, and culture, raised $170 million in Series B funding co-led by a16z and Kleiner Perkins and was joined by investors including Lightspeed and Katie Haun’s firm.

- Ironclad, a San Francisco-based digital contracting platform, raised $150 million in Series E funding led by Franklin Templeton and was joined by investors including BOND, YC Continuity, Emergence, Lux, Haystack, Accel, and Sequoia Capital.

- Pixis, a Burlingame, Calif.-based AI-based cloud marketing platform, raised $100 million in Series C funding led by SoftBank and was joined by investors including General Atlantic, Celesta Capital, Premji Invest, and Chiratae Ventures.

- Curbio, a Potomac, Md.-based pay-at-closing home improvement solution for real estate agents, brokerages and home sellers, raised $65 million in Series B funding led by Revolution Growth and was joined by investors including Camber Creek, Comcast Ventures, Brick & Mortar Ventures, Second Century Ventures, Kayne Partners, and Masco Ventures.

- Atom Computing, a Berkeley, Calif.-based quantum computer developer, today announced closure of a $60 million in Series B funding led by Third Point Ventures and joined by investors including Primer Movers Lab, Innovation Endeavors, Venrock, and Prelude Ventures.

- Virtru, a Washington, D.C.-based data protection platform, raised $60 million in funding co-led by ICONIQ Growth and Foundry Capital and was joined by investors including Tiger Global, MC2, Bessemer Venture Partners, and NEA.

- Ambient.ai, a Menlo Park, Calif.-based visual intelligence platform operator, raised $52 million in funding led by a16z and was joined by investors including Ron Conway and Ali Rowghani from Y Combinator, Okta co-founder Frederick Kerrest, Crowdstrike CEO George Kurtz, and Microsoft CVP Charles Dietrick.

- Clockwise, an SF-based time management and calendar tool, raised $45m in Series C funding. Coatue led, and was joined by Atlassian Ventures and insiders Accel, Greylock Partners and Bain Capital Ventures. http://axios.link/vFsR

- Spekit, a Denver-based platform for onboarding and training remote teams, raised $45m in Series B funding. Craft Ventures led, and was joined by Felicis Ventures, Operator Collective, Matchstick Ventures, Renegade Partners, Foundry Group and Bonfire Ventures. www.spekit.com

- Nowsta, a New York-based work management platform for hourly, gig, and flex workers, raised $41 million in Series B funding led by GreatPoint Ventures and was joined by investors including VMG Catalyst, Rally Ventures, Tribe Capital, Green Visor Capital, Compound Ventures, and Clocktower Technology Ventures.

- Walnut, an Israeli sales and marketing demo experience platform, raised $35m in Series B funding led by Felicis Ventures. http://axios.link/FbPB

- Flex, a South Korean HR management platform, raised $32m in Series B funding at a $287m valuation. Greenoaks led, and was joined by DST. http://axios.link/YqFC

- The Wanderlust Group, a marine and outdoor travel tech company, raised $30 million in Series C funding led by Thursday Ventures.

- Cana, a Redwood City, Calif.-based molecular beverage printer startup, raised $30 million in seed funding from The Production Board.

- Banyan Security, a Zero Trust Network Access (ZTNA) solutions provider, raised $30 million in Series B funding led by Third Point Ventures and was joined by investors including SIG, Alter Venture Partners, Shasta Ventures, and Unusual Ventures.

- Radian Aerospace, a Renton, Wash.-based space systems transportation developer, raised $27.5 million in seed funding led by Fine Structure Ventures and was joined by investors including EXOR, The Venture Collective, Helios Capital, SpaceFund, Gaingels, The Private Shares Fund, Explorer 1 Fund, and Type One Ventures.

- Capacity, a St. Louis, Mo.-based AI-powered support automation platform, raised $27 million in Series C funding from investors including TMC Emerging Technology Fund and Rice Park.

- Prophecy, a Palo Alto, Calif.-based low-code data engineering platform, raised $25 million in Series A funding led by Insight Partners and was joined by investors including SignalFire, Berkeley Skydeck, and Dig Ventures.

- Smartcar, a Mountain View, Calif.-based API developer platform that connects vehicles with mobile apps, raised $24 million in Series B funding led by Energize Ventures and was joined by a16z and NEA.

- Juro, a London-based contract automation platform for legal counsel, raised $23 million in Series B funding led by Eight Roads and was joined by investors including Union Square Ventures, Point Nine Capital, Seedcamp, and Wise co-founder Taavet Hinrikus.

- Carry1st, a Cape Town, South Africa-based mobile games publisher, raised $20 million in Series A funding led by Andreessen Horowitz, and was joined by investors including Avenir, Google, Nas, and Sky Mavis.

- Proton.ai, a Boston-based growth platform for wholesale distributors, raised $20m in Series A funding led by Felicis Ventures. www.proton.ai

- Rocketlane, a Walnut, Calif.-based customer onboarding platform, raised $18 million in Series A funding led by 8VC and was joined by investors including Nexus Venture Partners, Matrix Partners India, and Gokul Rajaram.

- Turing Labs, a New York-based SaaS for CPG formulations, raised $16.5m in Series A funding. Insight Partners led, and was joined by insiders YC and Moment Ventures. www.turingsaas.com

- Honeycomb, a San Francisco-based full-stack observability software company, raised $15.4 million in Series A funding led by Ibex Investors and was joined by investors including SiriusPoint, Phoenix Insurance, Distributed Ventures, IT-Farm, and Sure Ventures.

- Zuper, a Seattle-based provider of field service management and customer engagement software, raised $13m in Series A funding. Fuse led, and was joined by Sequoia Capital India, Prime Venture Partners and HubSpot. http://axios.link/KzQP

- Verica, a Fairfax, Va.-based continuous verification system developer, raised $12 million in Series A funding led by Intel Capital, and was joined by investors including True Ventures and Mango Capital.

- ValueBlue, a Utrecht, Netherlands-based SaaS collaboration platform provider for business process management, raised $11 million in Series B funding led by Octopus Ventures and Newion and was joined by ABN AMRO.

- Permiso, a Palo Alto, Calif.-based startup that provides cloud identity detection and response for cloud infrastructures, raised $10 million in seed funding led by Point72 Ventures and was joined by investors including Foundation Capital, Work-Bench, 11.2 Capital, Rain Capital, former Netflix VP of Information Security Jason Chan, and Hashicorp Chief Security Officer Talha Tariq.

- StructionSite, an Oakland, Calif.-based intelligent project tracking software for the construction industry, raised $10 million in new funding from 500 Global, PCL Construction, GS Futures, and other investors.

- Polar Security, a San Jose, Calif.-based cloud-native data security company, raised $8.5 million in seed funding led by Glilot Capital Partners and was joined by investors including IBI Tech Fund, Cloud Security Alliance CEO Jim Reavis, and former RSA CTO Tim Belcher.

- Chatdesk, a New York-based customer experience app developer, raised $7 million in Series A funding led by Cultivation Capital and was joined by investors including Harlem Capital, Serena Ventures, Menlo Ventures, Stormbreaker, and Fika Ventures.

- CodeSee, a San Francisco-based cloud-based data visualization software platform, raised $7 million in funding led by Wellington Access Ventures, Plexo Capital and was joined by investors including former CEO of Heroku Adam Gross and former Chief Security Officer of Square Window Snyder.

- Filmhub, a Santa Monica, Calif.-based solution for modern filmmakers to distribute their titles to streaming services without relinquishing rights, raised $6.8 million in seed funding led by a16z and was joined by investors including 8VC, FundersClub, Eleven Prime, Rupa Health CEO Tara Viswanathan, and Candid CEO Nick Greenfield.

- Diversio, a New York-based DEI platform, raised $6.5m in Series A funding from First Round Capital, Golden Ventures and Chandaria Family Holdings. http://axios.link/ouLT

- Castiron, an Indianapolis, In.-based e-commerce platform for independent food businesses, raised $6 million in seed funding from Bowery Capital, Foundry Group, and High Alpha.

- Stan, a New York-based creator monetization tool, raised $5 million in seed funding led by Forerunner Ventures and was joined by investors including Norwest Venture Partners and Pear VC.

- True Tickets, a Boston, Mass.-based mobile ticket distribution company, raised $5 million in seed funding from Logitix, which is backed by ZMC.

- Zowie, a Dover, Del.-based no-code customer service solution for e-commerce companies, raised $5 million in seed funding co-led by Gradient Ventures and 10x.

- Cloaked, a Boston-based privacy software developer, raised $4 million in seed funding led by Human Capital and was joined by investors including General Catalyst, Peter Thiel, Lux Capital, Index Ventures, Next Play Ventures, All Turtles, and the Mantis Fund.

- Anonybit, a Wilmington, Del.-based biometric identification platform, raised $3.5 million in funding led by Switch Ventures and was joined by investors including NextGen Venture Partners, Industry Ventures, and Preceptor Capital.

- STILRIDE, a Stockholm, Sweden-based electro-mobility device developer, raised £2.5 million ($3.4 million) from investors including Gustaf Hagman, Saeid Esmaeilizadeh, Sam Bonnier, and Andreas Adler.

- Wrangle, a Durham, N.C.-based ticketing and workflow product for chat platforms like Slack, raised $2 million in pre-seed funding led by Bloomberg Beta and Eniac Ventures and were joined by investors including Liquid 2 Ventures, Hustle Fund, and TDF Ventures.

. . .

Sustainability:

- Parallel Systems, a Culver City, Calif.-based electric vehicle manufacturer, raised $49.6 million in Series A funding led by Anthos Capital and was joined by investors including Congruent Ventures, Riot Ventures, and Embark Ventures.

- Fermata Energy, a Charlottesville, Va.-based vehicle-to-everything (V2X) technology services provider, raised $40 million in funding led by Carlyle Strategic investors and was joined by investors including Verizon Ventures.

- Colossus, a Boston-based provider of software to solar energy providers, raised $36m in Series A funding led by BuildGroup led, and was joined by Capital Creek, RTP Global, CEAS and Poplar Ventures. www.colossus.com

- Exergyn, a Dublin-based solid-state technology developer for waste heat recovery, heating, and cooling, raised €30 million ($35 million) in Series A funding led by Mercuria and Lacerta Partners and was joined by McWin.

- Vertical Future, a London-based vertical farming system developer, raised £21 million ($29 million) in Series A funding from Pula Investments, Gregory Nasmyth, Nickleby Capital, Dyfan Investment, and SFC Capital.

- Submer, a Spanish provider of data center cooling solutions, raised $34m. Planet First Partners led, and was joined by insiders Norrsken VC, Alma Mundi Ventures and Tim Reynolds. http://axios.link/hj08

- Doconomy, a Swedish provider of climate impact-focused credit cards, raised $19m. CommerzVentures led, and was joined by Ingka Group, Citi Ventures and insiders Mastercard and Ålandsbanken. www.doconomy.com

- Botanical Solution, a Davis, Calif.-based provider of botanical materials for ag and pharma applications, raised $6.1m in Series A funding led by Otter Capital. www.botanical-solution.com

- Aigen, a Kirkland, Wash.-based solar-powered robotics platform for agriculture and soil regeneration, raised $4m in seed funding. NEA led, and was joined by AgFunder, Global Founders Capital and ReGen Ventures. www.aigen.io

- Rebundle, a St. Louis-based maker of plant-based hair extensions, raised $1.4m led by M25. http://axios.link/Jk0a

Acquisitions & PE:

- Microsoft (Nasdaq: MSFT) agreed to buy Activision Blizzard (Nasdaq: ATVI) for $68.7 billion in cash, or $95 per share (45% premium to Friday's closing price). This is the largest-ever acquisition of a video game maker, by dollar amount. It's also the largest purchase ever by Microsoft, topping the $26.2 billion it paid for LinkedIn in 2016 (let alone the $2.5 billion it paid in 2014 for Minecraft maker Mojang). Expect antitrust regulators to take a hard look, even though Microsoft has avoided much of the political PR aimed at its Big Tech peers. "Microsoft's move puts into new light recent comments from Xbox gaming chief Phil Spencer about Activision's workplace problems, and his reticence to explicitly criticize Activision CEO Bobby Kotick. It also bolsters Microsoft's growing all-you-can-play Game Pass service, which the company says now has 25 million subscribers and to which will now add Activision Blizzard titles." — Stephen Totilo, Axios Gaming

- Carlyle invested in NineDot, a New York-based clean-tech developer that designs and deploys community-scale energy generation and battery storage projects. Financial terms were not disclosed.

- Mars agreed to acquire Nom Nom, a Nashville, Tenn.-based pet subscription meal plan company. Financial terms were not disclosed.

- Unilever (LSE: ULVR) said it will continue to pursue a takeover of GlaxoSmithKline's (LSE: GSK) consumer unit, which includes Advil painkillers and Sensodyne toothpaste, after being rejected on three bids — the last of which was worth around $68 billion. GSK, meanwhile, still says it plans to list the unit this year. http://axios.link/AJe6

- BIC agreed to acquire Inkbox, a Toronto, Canada-based semi-permanent tattoo brand. Financial terms were not disclosed.

- OpenSea acquired Dharma Labs, a San Francisco-based DeFi wallet company. Financial terms were not disclosed.

. . .

SPACs:

- Acorns, an Irvine, Calif.-based savings and investing app, and Pioneer Merger Corp. (Nasdaq: PACX) have scrapped the $2.2 billion merger announced last May. Acorns will receive a $17.5m termination fee and plans to return to the private fundraising market. To date, it's raised over $330 million from firms like Greycroft, e.ventures, NBC Universal and Rakuten Ventures. http://axios.link/JYxt

- ProKidney, a Winston-Salem, N.C.-based medical technology company, agreed to go public via a merger with Social Capital Suvretta Holdings Corp. III, a SPAC backed by Social Capital and Suvretta Capital. A deal values the company at $2.6 billion.

- Eleusis, a London-based psychedelic drug therapy developer, agreed to go public via a merger with Silver Spike Acquisition Corp. II, a SPAC backed by Silver Spike Capital. A deal values the company at $446 million.

- PetSmart, the pet supply retailer backed by BC Partners, is weighing a public offering via a merger with KKR Acquisition Holdings I Corp., a SPAC backed by KKR, per Bloomberg. A deal could value the company at approximately $14 billion.

Funds:

- ByteDance, the Beijing-based owner of TikTok, is dissolving its internal venture capital and startup investing team, per Bloomberg.

- 2048 Ventures, a Princeton, N.J.-based venture capital firm, raised $67 million for a second fund focused on pre-seed investments.

- Blossom Capital, a London-based venture capital firm, raised $432 million for its third fund, which is focused on Series A investments in European founders.

- Energy Impact Partners said it secured more than $200m of a $300m-targeted decarbonization fund. www.energyimpactpartners.com

- Entrée Capital, an Israeli VC firm, raised $250m for its sixth fund and promoted Adi Gozes to partner. http://axios.link/C7Ew

- Crypto.com said that it’s expanded its corporate VC arm to $500m from $200m. http://axios.link/qPXn

- Cowboy Ventures has secured around $76m for its $125m-targeted fourth fund, per an SEC filing.

- Decibel Partners, an independent VC firm formed in partnership with Cisco, is raising $275m for its second fund, per an SEC filing.

- FTX, the crypto exchange recently valued at $25b by venture capitalists, announced a $2b VC fund. http://axios.link/nmTC

- Lerer Hippeau Ventures is raising $140m for its eighth flagship fund and $100m for its fourth "select" fund, per SEC filings. www.lererhippeau.com

- NextView Ventures of Boston is raising $125m for its fourth fund, per an SEC filing.

- A* Capital quietly raised $300m for its debut fund. The VC firm was co-founded last year by Kevin Hartz (Eventbrite, Founders Fund), Gautam Gupta (Uber) and Bennett Siegel (Coatue).

- Andreessen Horowitz plans to target $3.5b for its next crypto fund, plus another $1b for a seed-stage crypto fund, per the FT. http://axios.link/s2Y9

- Foundation Capital, a Palo Alto-based venture capital firm, raised $500 million for its tenth fund, which will invest in early-stage companies in fintech, enterprise and frontier tech.

Final Numbers: VC valuation inflation

Source: PitchBook-NVCA Venture Monitor. * as of 12/31/21.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.