Sourcery (12/13-12/17)

NYDIG, Anchorage, Nansen, Ramp, Mesh Payments, Papaya, Cultos, Innovaccer, Restore, Cadence, Found, Ophelia, LynxMD, Parallel Learning, GoPuff, Airtable, Course Hero, Rokt, Cockroach Labs, Avantstay..

Last Week (12/13-12/17):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include NYDIG, Anchorage, Nansen, Ledn, Ramp, Mesh Payments, Papaya, Staircase, Creditbook ,Herald, Whym, Cultos, Innovaccer, Restore, Cadence, Found, Ophelia, Belong Health, Sollis Health, Akido, Pace, LynxMD, Tava Health, Parallel Learning, GoPuff, Airtable, Course Hero, Sysdig, Rokt, Sigma Computing, Cockroach Labs, Dialpad, Avantstay, Noname Security, Gtmhub, Ermetic, Forethought, Carto, Dazz, Lokalise, Guardio, Dray Alliance, Swimply, Runway, Rebag, Dedrone, Elementary, Spatial, Nuvocargo, Andie, Danvas, Jadu, thirdweb, Honeycomb, Polymer, Awesome, Future Meat, Infarm, Carbon America, Full Harvest, Sweep, Hippo Harvest, Sustaera, Sensible Weather; RTKFT, Elysium Healthcare, Betcha, Group Nine Media, Lumio, Bruce Springsteen, Cerner; Samsara; Symbiotic, Rezolve, Near

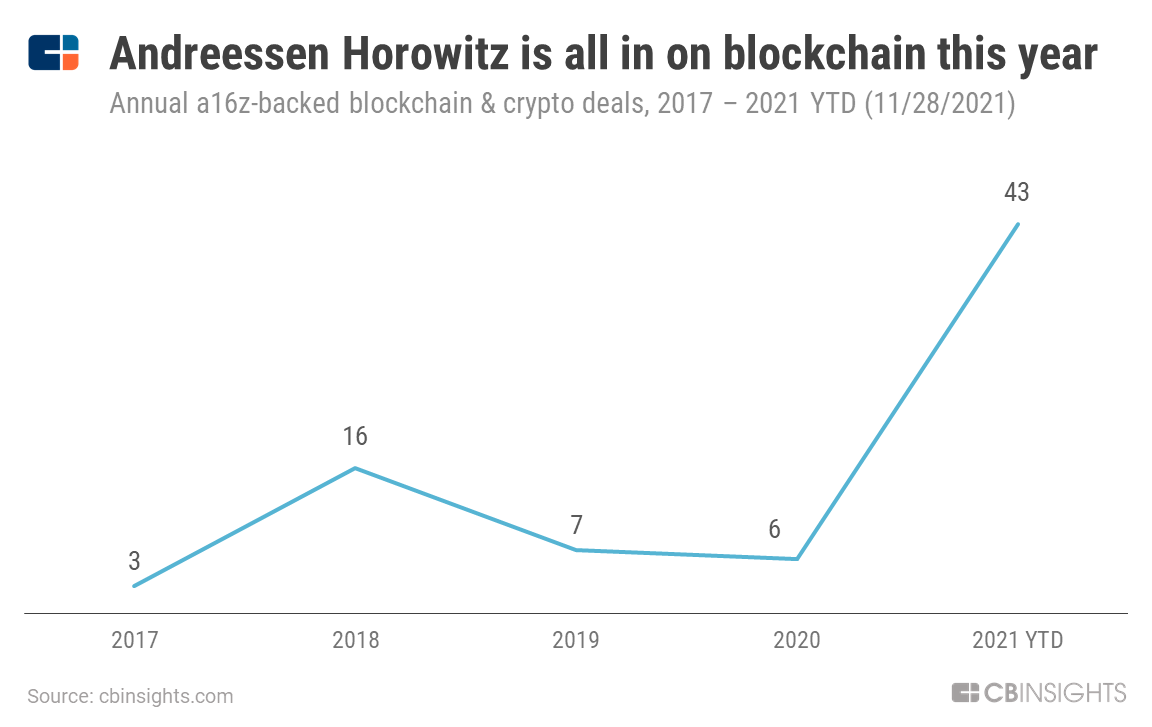

Final numbers on a16z Blockchain Deal Count at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- NYDIG, a New York-based Bitcoin financial services company, raised $1 billion in funding led by WestCap and was joined by investors including Bessemer Venture Partners, FinTech Collective, Affirm, FIS, Fiserv, MassMutual, Morgan Stanley, and New York Life.

- Anchorage Digital, a San Francisco-based digital asset platform for institutions, raised $350 million in Series D funding led by KKR and was joined by investors include Goldman Sachs, Alameda Research, a16z, Apollo, BlackRock, Blockchain Capital, Delta Blockchain Fund, Elad Gil, GIC, GoldenTree Asset Management, and others.

- Nansen, a Singapore-based Ethereum data analytics platform, raised $75 million in Series B funding led by Accel and was joined by investors including GIC, a16z, Tiger Global, and SCB 10X.

- Ledn, a Toronto-based digital asset savings and credit platform, raised $70 million in Series B funding led by 10T Holdings and was joined by investors including Golden Tree Asset Management, Raptor Group, and FJ Labs.

- Ramp, a U.K.-based crypto infrastructure company, raised a $52.7 million in Series A funding led by Balderton Capital, with NFX, Galaxy Digital, Seedcamp, Firstminute Capital, Taavet Hinrikus and Francesco Simoneschi also participating. www.ramp.network

- Mesh Payments, a New York-based corporate payment and spend management software company, raised $50 million in Series B funding led by Tiger Global, with Entrée Capital, Falcon Edge Capital, TLV Partners and Meron Capital also participating. http://axios.link/cfi7

- Papaya, a New York-based mobile bill payment application, raised $50 million in Series B funding led by Bessemer Venture Partners and was joined by investors including Sequoia Capital, Acrew Capital, 01 Advisors, Mucker Capital, Fika Ventures, F-Prime, and Sound Ventures.

- Proxymity, a London-based investor communications platform connecting issuers, intermediaries, and investors, raised $31 million in Series B funding from BNY Mellon, Citi, Computershare, Deutsche Bank, Deutsche Börse, J.P. Morgan, and State Street.

- Stocktwits, a New York-based social trading platform, raised $30 million in Series B funding led by Alameda Research Ventures and was joined by Times Bridge.

- Staircase, a Philadelphia-based digital infrastructure company for the mortgage industry, raised $18 million in Series A funding led by Bessemer Venture Partners and was joined by investors including RRE Ventures, Avid Ventures, Clocktower Technology Ventures, Metaprop Ventures, and Zigg Capital.

- CreditBook, a Pakistani financial management platform for merchants, raised $11 million in Series A funding. Tiger Global led, and was joined by Better Tomorrow Ventures, Firstminute Capital, Banana Capital, VentureSouq, Ratio Ventures and i2i Ventures. http://axios.link/uH0l

- Herald, a Boston-based commercial insurance API company, raised $8 million in seed funding led by Lightspeed Venture Partners, with Underscore and Afore Capital, Garrett Koehn, Rotem Iram, Charley Ma and others also participating. www.heraldapi.com

- Level, a Seattle-based small business funding platform, raised $7 million in seed funding led by Anthos Capital and was joined by investors including Revolution, NextView Ventures and Ascend.vc.

- JustiFi, a Minneapolis, Md.-based payment system developer, raised $6.6 million in seed funding co-led by Emergence Capital and Rally Ventures.

- Factor, a San Francisco-based payments and order management platform for the global supply chain, raised $6 million in seed funding led by Gradient Ventures and was joined by investors including Xfund, Afore, and South Park Commons.

- Whym, an El Sagundo, Calif.-based immediate point-of-sale platform that embeds into social media and messaging apps, raised $4 million in seed funding led by Deciens Capital and was joined by investors including DNX Ventures, Reciprocal Ventures, Unusual Ventures, Chaos Ventures, Magic Fund, and others.

- Philanthropi, a Philadelphia-based charity software startup, raised $4 million in funding led by Amex Ventures, with Live Oak Ventures and Darco Capital also participating. www.philanthropi.com

- Cultos, a community token and NFT platform for company customer engagement, raised $3.4 million in funding from investors including Gravity Ranch, Sparq Capital, and Jason Larian.

- Tractiv, a Chicago-based data sharing and tracing software company for financial services firms and fintech companies, raised $2.25 million in seed funding led by Nyca Partners.

- Trustate, a Tampa, Fla.-based, estate settlement platform raised $1.8 million in seed funding led by Impression Ventures and was joined by Red Bike Capital and GingerBread Capital.

. . .

Care:

- Innovaccer, a San Francisco-based data activation platform for healthcare companies, raised $150 million in Series E funding led by Mubadala Capital and was joined by investors including B Capital Group, M12 fund, OMERS Growth Equity, Dragoneer, Steadview Capital, Tiger Global Management, Whale Rock Capital Management, Avidity Partners, and Schonfeld Strategic Advisors.

- Restore Hyper Wellness, an Austin, Texas-based provider of IP drip therapy and cryotherapy solutions, raised $140 million led by General Atlantic. www.restore.com

- Cadence, a New York-based virtual patient monitoring startup, raised $100 million at a $1 billion valuation. Coatue led, and was joined by General Catalyst and Thrive Capital. http://axios.link/kSyb

- Found, a San Francisco-based weight care platform, raised $100 million in Series B funding led by WestCap and was joined by investors including IVP, The Chernin Group, G9 Ventures, Able Partners, GV, Define, and Atomic.

- Well Dot, a Chapel Hill, N.C.-based consumer-focused health improvement platform, raised $70 million in Series B funding led by Valeas Capital Partners and was joined by investors including General Catalyst and Hellman & Friedman partners.

- HealthCare.com, a Miami, Fla.-based insurance comparison services company, raised $50 million in Series C funding led by Oaktree Capital Management funds.

- Ophelia, a New York-based opioid treatment startup, raised $50 million in Series B funding led by Tiger Global, with Menlo Ventures, General Catalyst and Refactor Capital also participating. http://axios.link/Y4bi

- Belong Health, a Radnor, Penn.-based Medicare Advantage and Special Needs Plan product delivery company, raised $40 million in Series A funding led by NEA and was joined by Maverick Ventures.

- Sollis Health, a New York-based medical concierge service, raised $30 million in Series A funding co-led by Torch Capital and Denali Growth Partners. www.sollishealth.com

- Kenbi, a Berlin-based healthcare-at-home technology company, raised €23.5 million ($26.6 million) in Series A funding led by Endeavour Vision and was joined by investors including Redalpine, Heartcore, Headline, Partech, and Amino Collective.

- Akido, a Los Angeles-based healthcare application for longevity, raised $25 million in funding led by Future Communities Capital and was joined by investors including Y Combinator, Comprehensive Blood & Cancer Center, Necessary Ventures, Great Oaks, Slow Ventures, and others.

- Prellis Biologics, an SF-based maker of tools for creating 3D-printed organs, raised $14.5 million in Series B funding. Celesta Capital led, and was joined by Khosla Ventures. http://axios.link/ULEs

- Pace, a Tiburon, Calif.-based mental health support network that connects users with strangers in groups, raised $13 million in Series A funding led by Pace Capital and was joined by investors including Sequoia Capital and BoxGroup.

- ianacare, a Boston-based family caregiving tech company, raised $12 million in Series A funding led by Greycroft and was joined by investors including 8BC, SemperVirens VC, Able Partners, and Brown Alumni Group.

- Lynx MD, a Palo Alto-based healthcare AI platform for clinical and operational data collaboration, raised $12 million in seed funding led by MizMaa Ventures and was joined by investors including New York Life Ventures, Amdocs, iAngels, Triventures, and UpWest.

- Prolucent Health, a Dallas, Tex.-based enterprise-wide healthcare workforce optimization software and services company, raised $11.5 million in funding co-led by SpringTide Ventures and Health Velocity Capital and was joined by investors including UnityPoint Health Ventures.

- Tava Health, a Lehi, Utah-based healthcare technology startup for professional mental health services, raised $10 million in Series A funding led by Rose Park Advisors and was joined by investors including Peterson Partners, Toba Capital, Springtide Capital, Contrary Capital, and SaaS Ventures.

- Proov, a Boulder, Colo.-based ovulation testing startup, raised $9.7 million in Series A funding. Hambrecht Ducera Growth Ventures led, and was joined by SteelSky Ventures, WCC Partners, Lightship Capital, GingerBread Capital and Portfolia FemTech II Fund. http://axios.link/zXfS

- Iridia, a San Diego-based DNA-based data storage startup, raised $6 million in follow-on funding led by Prime Movers Lab. www.iridia.com

- Uwill, a Boston, Mass.-based mental health and wellness online therapy platform for colleges and students, raised $5.3 million in funding from investors including Bright Horizons CEO Stephen Kramer and Princeton Review and Noodle founder John Katzman.

- Parallel Learning, a New York-based psychoeducational services company for families, educators and students dealing with learning and thinking differences, raised $2.8 million in funding led by Eric Reiner and Dan Povitsky of Vine Ventures and was joined by investors including Global Founders Capital, Great Oaks, and others.

. . .

Future of Work:

- Gopuff, a Philadelphia-based instant delivery platform for everyday items, has raised $1.5 billion led by Guggenheim Partners. The deal is structured as a convertible note with a $40 billion cap. http://axios.link/lTC8

- Airtable, a San Francisco-based connected apps and collaboration platform, raised $735 million in Series F funding led by XN and was joined by investors including Franklin Templeton, J.P. Morgan Growth Equity Partners, MSD Capital, Salesforce Ventures, Silver Lake, T. Rowe Price.

- Course Hero, a Redwood City, Calif.-based online learning platform, raised $380 million in Series C funding at a $3.6 billion valuation, Axios has learned. Wellington led, and was joined by Sequoia Capital Global Equities, OMERS Growth Equity, D1 Capital and insiders GSV Ventures, NewView Capital, SuRo Capital, TPG and Valiant Peregrine Fund.

- Sysdig, a San Francisco-based container and cloud security company, raised $350 million in Series G funding led by Permira and was joined by Guggenheim Investments, Accel, Bain Capital Ventures, DFJ Growth, Glynn Capital, Goldman Sachs, Insight Partners, Next47, Premji Invest & Associates, and Third Point Ventures.

- Rokt, a New York-based e-commerce marketing company, raised $325 million in Series E funding at a $1.95 billion valuation. Tiger Global led, and was joined by Wellington, Whale Rock, Pavilion Capital and insider Square Peg. http://axios.link/2nfX

- Sigma Computing, a San Francisco-based no-code cloud analytics solution, raised $300 million in Series C funding co-led by D1 Capital Partners and XN and was joined by existing investors including Sutter Hill Ventures, Altimeter Capital and Snowflake Ventures.

- Cockroach Labs, a New York-based open source database for disaster-proof cloud services, raised $278 million in Series F funding led by Greenoaks and was joined by investors including Altimeter, BOND, Benchmark, Coatue, FirstMark, GV, Index Ventures, Lone Pine Capital, Redpoint, and Tiger Global.

- Dialpad, a San Ramon, Calif.-based AI-powered cloud communications and collaboration platform, raised $170 million in funding led by ICONIQ Capital and was joined by investors including Amasia, GV, OMERS Growth Equity, Work-Bench, Section 32, and T-Mobile Ventures.

- Snaplogic, a San Mateo, Calif.-based enterprise data integration platform, raised $165 million at a $1 billion valuation. Sixth Street Growth led, and was joined by insiders Arrowroot Capital, Golub Capital, Andreessen Horowitz, Vitruvian, Capital One, Ignition Partners and Microsoft. http://axios.link/AGES

- AvantStay, a hospitality startup focused on high-end, short-term rentals, raised $160 million in Series B funding. Tarsadia Investments and 3L Capital co-led, and were joined by insiders Plus Capital, Bullpen Capital, Convivialite and Capital One. http://axios.link/Ixq6

- Noname Security, a Palo Alto-based API security company, raised $135 million in Series C funding at $1 billion valuation led by Georgian and Lightspeed Venture Partners, with Insight Partners, Cyberstarts, Next47, Forgepoint and The Syndicate Group also participating. www.nonamesecurity.com

- Gtmhub, a Bulgarian goal management and data integration software company, raised $120 million in funding led by Index Ventures and was joined by investors including Visionaries Club, Insight Partners, Singular, and CRV.

- Ermetic, a Palo Alto, Calif.-based cloud infrastructure security company, raised $70 million in Series B funding led by Qumra Capital, with Forgepoint Capital, Accel, Glilot Capital Partners, Norwest Venture Partners and Target Global also participating. www.ermetic.com

- Forethought, a San Francisco-based AI-powered tool that embeds relevant information into employees’ daily workflows, raised $65 million in Series C funding led by STEADFAST Capital Ventures and was joined by investors including NEA, Sound Ventures, K9 Ventures, Collaborative Fund, Frontline Ventures, and others.

- STOKE Space, a Renton, Wash.-based space vehicle components manufacturer, raised $65 million in Series A funding led by Breakthrough Energy Ventures and was joined by investors including Spark Capital, Point72 Ventures, Toyota Ventures, Alameda Research, Global Founders Capital, NFX, MaC Ventures, and others.

- CARTO, a New York-based location-based service developer and visualization engine, raised $61 million in Series C funding led by Insight Partners and was joined by investors including European Investment Fund, Accel, Salesforce Ventures, Hearst Ventures, Earlybird, and Kibo.

- Dazz, a Palo Alto-based cloud security remediation startup, raised $60 million from Insight Partners, Greylock, Index Ventures and Cyberstarts. www.dazz.io

- Fresha, a London-based provider of salon and spa management software, raised $52.5 million in new Series C funding at a valuation north of $640 million. Michael Lahyani and BECO Capital co-led, and were joined by insiders General Atlantic, Partech, Target Global and FMZ Ventures. http://axios.link/umQC

- KlearNow, a Santa Clara, Calif.-based Logistics as a Service (LaaS) provider and company, raised $50 million in Series B funding led by Kayne Partners Fund and was joined by investors including GreatPoint Ventures, Argean Capital, Autotech Ventures, and Activate Capital.

- Lokalise, a Dover, Del.-based translation and localization platform, raised $50 million in Series B funding led by CRV and was joined by investors including Creandum, Dawn Capital, Chalfen VC, 3VC, S16VC, and others.

- TealBook, a Toronto-based supplier data and e-procurement technology company, raised $50 million in Series B funding led by Ten Coves Capital and was joined by investors including BDC Capital, Grand Ventures, RBC, Reciprocal Ventures, Refinery Ventures, S&P Global, Stand Up Ventures, RTP Global, Workday Ventures, and Good Friends.

- Guardio, a security-focused browser extension, raised $47 million. Tiger Global led, and was joined by Emerge, Vintage, Cerca Partners, Union and Samsung Next. http://axios.link/WJ7D

- Medal.tv, an LA-based provider of short-form video gaming clips, raised $45 million led by OMERS Ventures. www.medal.tv

- Dray Alliance, a Port of Long Beach, Calif.-based container management software and GPS-tracking and analytics company, raised $40 million in Series B funding led by venture capital firm Headline and was joined by investors including Craft Ventures, Harpoon Ventures, Matrix Partners and Quiet Capital.

- Swimply, a New York-based swimming pool sharing marketplace, raised $40 million. Mayfield led, and was joined by GGV Capital, Ensemble VC, Norwest Venture Partners and Trust Ventures. www.swimply.com

- Runway, a New York-based video editing and creative tool developer, raised $35 million in Series B funding led by David Cahn and Caryn Marooney of Coatue and was joined by investors including Amplify Partners, Lux Ventures, and Compound.

- Rebag, a New York-based second-hand luxury handbag company, raised $33 million in Series E funding led by Novator and was joined by investors including General Catalyst.

- Cyberhaven, a Palo Alto, Calif.-based Data Detection and Response (DDR) platform, raised $33 million in Series B funding led by Redpoint Ventures and was joined by investors including Forgepoint Capital, Wing, Vertex Ventures US, Costanoa, and Crane.

- Dedrone, a San Francisco-based smart airspace security platform, raised $30.5 million in Series C funding led by Axon and was joined by investors including Aqton Partners, Menlo Ventures, Felicis Ventures, Target Partners, TempoCap, and John Chambers.

- cove.tool, an Atlanta-based analyzing, drawing, engineering, and data connection platform for building design and construction, raised $30 million in Series B funding led by Coatue and was joined by investors including FootPrint Coalition, Mucker Capital, Urban Us and Knoll Ventures.

- Elementary, a Pasadena, Calif.-based AI machine vision platform for manufacturing quality and inspection, raised $30 million in Series B funding led by Tiger Global and was joined by investors including Threshold Ventures, Fika Ventures, Fathom Capital, Riot VC, and Toyota Ventures.

- FileCloud, an Austin, Tex.-based secure content collaboration platform for enterprise organizations, raised $30 million in Series A funding led by Savant Growth and was joined by Kennet Partners.

- Spatial, a New York-based holographic meeting platform, raised $25 million in funding from Pine Venture Partners, Maven Growth Partners, Korea Investment Partners, KB Investment, and others.

- Mixhalo, a provider of live event audio solutions (basically connects earbuds to sound boards), raised $24 million in Series B funding led by Fortress Investment Group led, and was joined by L-Acoustics and insiders Foundry Group, Sapphire Sport, Founders Fund, Defy Partners and Another Planet Entertainment. http://axios.link/MLVn

- Ory, an open-source cloud security software startup, raised $22.5 million in Series A funding. Insight Partners led, and was joined by Balderton Capital and In-Q-Tel. www.ory.sh

- Nuvocargo, a New York-based cross-border freight services platform, raised $20.5 million in funding led by Tiger Global and was joined by investors including The Flexport Fund.

- Andie, the New York-based women's apparel company, raised $18.5 million in Series B funding led by Marcy Venture Partners, with City Rock, Gaingles and others also participating. www.andieswim.com

- Air Mail, a New York-based subscription-based digital magazine company, raised a $17 million in Series B funding led by Standard Investments, with TPG Growth and RedBird Capital Partners also participating. http://axios.link/rFFF

- Mightier, a Boston-based bioresponsive video games developer, raised $17 million in Series B funding led by DigiTx Partners and was joined by investors including the Sony Innovation Fund and Boston-based PBJ Capital.

- Edge Gaming, a Tel Aviv-based personalized gaming and esports platform, raised $10 million in seed funding led by Playtika and was joined by investors including Stardom Ventures and AnD Ventures.

- Wonder Dynamics, a Los Angeles-based production tool development company for indie-budget content creation, raised $9 million in Series A funding led by Horizons Ventures and was joined by investors including Epic Games, Samsung Next, Founders Fund, and MaC Venture Capital.

- Danvas, a Los Angeles-based NFT art display technology company, raised $7 million in seed funding for its launch. The funding was led by VaynerX, Greycroft, Lerer Hippeau, UTA Ventures, Waverley, and others.

- Jadu, a 3D NFT company built on the Ethereum network, raised $7 million in seed funding led by General Catalyst and was joined by investors including Metapurse, LionTree, Coinbase Ventures, The VR Fund, and PKO Investments & Progression Fund.

- Qonsent, a Westport, Conn.-based data privacy enablement and consent value exchange platform for consumers and brands, raised $5 million in seed funding from investors including Zekavat Investment Group, Gary Vaynerchuk, Michael Kassan, Tom Chavez, Crosscut Ventures, Brand New Matter, and others.

- thirdweb, a web3 app development platform raised $5 million in funding for its launch from investors including entrepreneur Gary Vaynerchuk, Product Hunt founder Ryan Hoover, AppLovin co-founder Adam Foroughi, and others.

- Haystacks.ai, a New York-based data aggregation and intelligence platform for real estate investors, raised $5 million in seed funding led by Streamlined Ventures and Colle Capital.

- ManageXR, a Felton, Calif.-based enterprise device management platform for VR and AR devices, raised $4 million in seed funding from Rally Ventures.

- Honeycomb, a San Francisco-based social app for families, raised $4 million in funding led by Stellation Capital and was joined by investors including DCM, Precursor Ventures, and Bling Capital.

- Polymer, a no-code SaaS for automated data loss prevention, raised $4 million in seed funding led by Story Ventures. http://axios.link/jlDp

- Continual, a San Francisco-based customer churn prediction and inventory forecasting platform, raised $4 million in seed funding led by Amplify Partners and was joined by investors including Illuminate Ventures, Essence, Wayfinder, and Data Community Fund.

- Kayhan Space, a Boulder, Colo.-based spaceflight operations startup, raised $3.8 million in seed funding co-led by Initialized Capital and Root VC.

- Base Operations, a Washington, D.C.-based global threat-intelligence platform for enterprise security departments, raised $3 million in a second seed funding round led by Mindset Ventures and was joined by investors including Prefix Capital, Good Growth Capital, Gaingels, Inner Loop Capital, and Glasswing Ventures.

- Orgspace, a Brooklyn-based management platform for software teams, raised $2.5 million, in pre-seed funding led by Fika Ventures and Bloomberg Beta and was joined by investors including Darling Ventures, Liquid2 Ventures, Essence VC, The New Normal Fund, and The Jarosz Family Fund.

- Ark Biotech, a New York-based startup building bioreactors and software for meat cultivation, raised $2.5 million in seed funding led by Primary Ventures. www.ark-biotech.com

- Awesomic, a Stamford, Conn.-based designer marketplace, raised $2 million in funding from Y Combinator, Flyer One Ventures and SID Venture Partners, 10x Value Partners, Pretiosum and several angel investors. www.awesomic.io

- Wisdom, a social audio app for mentorship, raised $2 million in seed funding led by First Round Capital. http://axios.link/rn17

. . .

Sustainability:

- Future Meat, an Israeli cultured meat company, is raising $320 million at a $600 million valuation, with Tyson Foods and ADM participating, per Calcalist. More here.

- Infarm, a Berlin-based indoor vertical farming system company, raised $200 million in Series D funding from Qatar Investment Authority, Partners in Equity, Hanaco, Atomico, Lightrock, and Bonnier.

- Carbon America, an Arvada, Colo.-based carbon capture and sequestration (CCS) developer, raised $30 million in Series A funding from the Canada Pension Plan Investment Board, ArcTern Ventures, Energy Impact Partners, the Neglected Climate Opportunities Fund, and Golden Properties.

- Full Harvest, an SF-based B2B marketplace for “ugly” fruit, raised $23 million in Series B funding. TELUS Ventures led, and was joined by Rethink Impact, Citi Impact, Doon Capital, Stardust Equity, Portfolia and insiders Spark Capital, Cultivian Sandbox, Astia Fund and Radicle Growthand. www.fullharvest.com

- Sweep, a French carbon management platform for large enterprises, raised $22 million in Series A funding led by Balderton Capital and was joined by investors including New Wave, La Famiglia, and 2050.

- Hippo Harvest, a Half Moon Bay, Calif.-based sustainable agriculture company, raised $11 million in Series A funding led by Congruent Ventures and was joined by investors including Amazon Climate Pledge Fund, Collaborative Fund, and Energy Impact Partners.

- Sustaera, a Cary, N.C.-based direct air capture (DAC) carbon dioxide removal company, raised $10 million in Series A funding led by Breakthrough Energy Ventures and Grantham Trust’s Neglected Climate Opportunities.

- Sensible Weather, a Santa Monica, Calif.-based climate risk technology company that reimburses travelers for bad weather impacting their trips, raised $4 million in seed funding led by Wonder Ventures and Walkabout Ventures.

- SolSpec, a Denver-based geospatial analytics and collaboration platform for environmentally-conscious people, rebranded as Teren and raised $4 million in seed funding led by Allos Ventures.

Acquisitions & PE:

- Nike (NYSE: NKE) agreed to buy RTKFT, a Salt Lake City-based NFT studio that had raised around $9 million from firms like Andreessen Horowitz, C Ventures, Mantis VC and Shrug Capital. http://axios.link/y2wr

- Royal Dutch Shell (LSE: RDS) agreed to buy Savion, a Kansas City-based solar and energy storage firm, from Macquarie. http://axios.link/f03a

- Ramsay Health Care agreed to acquire Elysium Healthcare, a U.K.-based mental health services company, for $1 billion.

- Vivid Seats (Nasdaq: SEAT) acquired Betcha, a New York-based real-money sports betting app, for up to $65 million ($25m upfront). Betcha was seeded by such backers as Sharp Alpha Advisors, Sinai Ventures and Muse Capital. www.vividseats.com

- Harry’s agreed to acquire Lumē, a Salt Lake City-based deodorant company. Financial terms were not disclosed.

- Olsam Group acquired Flywheel Commerce, a Baltimore, Md.-based e-commerce aggregator. Financial terms were not disclosed.

- Alliance Animal Health, a Stamford, Conn.-based animal hospital network, is nearing an investment from L Catterton at a valuation of between $750 million and $800 million, Axios' Sarah Pringle reports.

- Vox Media agreed to acquire Group Nine Media, the digital company home to brands like NowThis, The Dodo, PopSugar, Thrillist and Seeker. This does not involve the SPAC that Group Nine formed to, in part, take itself public. http://axios.link/PACL

- White Oak and Fiera Comox invested $110 million in Lumio, a Lehi, Utah-based solar energy company.

- Gympass acquired Trainiac, a Seattle, Wash.-based 1-on-1 online personal training company. Financial terms were not disclosed.

- Bruce Springsteen agreed to sell his masters and music publishing rights to Sony Music Entertainment for more than $500 million, in what’s believed to be the largest-ever such deal. http://axios.link/Nl4H

- Canopy Growth (TSX: WEED) agreed to sell C3 Cannabinoid Compound, a German medical marijuana group, to Dermapharm. http://axios.link/ilnB

- TA Associates is considering a sale process of IPO for bubble-tea chain Gong Cha, which could be worth around $600 million, per Bloomberg. http://axios.link/3fYs

- Warner Music Group (Nasdaq: WMG) agreed to buy 300 Entertainment, a record label whose artists include Megan Thee Stallion, for around $400 million. Sellers include Alphabet. http://axios.link/xHo1

- Oracle (NYXSE: ORCL) is in talks to buy Kansas City-based electronic medical records firm Cerner (Nasdaq: CERN) for upwards of $30 billion, per the WSJ. http://axios.link/2UVs

. . .

IPOs:

- Samsara, a San Francisco-based operations cloud company, raised $805 million in an offering of 35 million shares priced at $23 per share. The company posted $250 million in revenue for the year ending in Jan. 2021 and reported a net loss of $210 million. The company raised $930 million in VC funding, most recently at a $5.6 billion valuation, from firms like Andreessen Horowitz, General Catalyst, Dragoneer, General Atlantic, Warburg Pincus and Tiger Global. http://axios.link/jGtQ

. . .

SPACs:

- Fertitta Entertainment, a Houston, Tex.-based hospitality and gaming company, terminated plans to go public via a merger with FAST Acquisition Corp. A deal had been valued at $8.6 billion.

- Harley-Davidson (NYSE: HOG) agreed to spin out its LiveWire electric motorcycle unit via a merger with AEA-Bridges Impact Corp. (NYSE: IMPX), an ESG-focused SPAC formed by AEA Investors and Bridges Fund Management, at an implied $1.77 billion enterprise value. http://axios.link/l5dQ

- Symbotic, a Wilmington, Mass.-based supply chain robotics company backed by Walmart, agreed to go public at an implied $5.5 billion valuation via SVF Investment Corp. 3 (Nasdaq: SVFC), a SPAC formed by SoftBank. http://axios.link/yIRh

- Near, a Pasadena, Calif.-based data intelligence firm, is in talks to go public via KludeIn I Acquisition Corp. (Nasdaq: INKA) at more than a $1 billion valuation, per Bloomberg. http://axios.link/csMD

- Rezolve, a London-based mobile payments and e-commerce platform, agreed to go public at an implied $2 billion valuation via Armada Acquisition Corp. I (Nasdaq: AACI). The company most recently raised VC funding at a $1 billion valuation from Lauder Partners, the U.K. government and Apeiron Investment Group. http://axios.link/bclQ

- TeleSign, an LA-based brand communications-as-a-service company owned by Belgian telco Proximus Group, agreed to go public at an implied $1.3 billion valuation via North Atlantic Acquisition Corp. (Nasdaq: NAAC). http://axios.link/ZLzA

Funds:

- Initialized Capital raised $530 million for its latest early-stage fund and $170 million for a follow-on fund. www.initialized.com

- Bessemer Venture Partners is launching a growth buyouts practice, Axios has learned. It will be led by Rob Arditi, who previously was a general partner with Norwest Venture Partners. http://axios.link/IY4u

- Chapter One has raised $50 million for a Web3-focused venture capital fund. http://axios.link/7aRA

- Anthemis Group, a London-based venture capital firm, raised $700 million for multiple funds.

And some more data… Let’s look at the growth in annual crypto deals from a16z. Happy HODLdays!

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.