Sourcery ☀️ ServiceNow, VC Downfall, Security Breaches, Mainstream Media Cracks

(1/22-1/26) Bilt Rewards, Ansel, ModernFi, Turquoise Health, Torq, Sierra, ElevenLabs, Clerk, Norm AI, TextQL, Albedo, Digs, Cargado

Is SaaS back? Dead? Or has it been quietly working on itself all along?

Too many juicy musings this week for a clever intro, sorry in advance. But we are looking forward to Taylor’s halftime performance at the Super Bowl!

Musings

Macro

- of 8VC shares his Q4 2023 State of VC Update & 2024 Outlook

Exodus & shrinking for Venture Capital, outlook on fundraising markets from IPO to Seed & an opportunity for Series As, Macro (the Fed), BioTech markets, & AI predictions

“I anticipate that AI will be over-hyped in the short term (1-3 years), a period likely marked by struggles in AI infrastructure companies and disappointments in AI deployment, which I call the '90/10 problem.' But looking ahead, I believe that in the next decade, AI will dramatically transform a significant portion of knowledge work.”

MANG VC Gone Wild, Can You Trust AI Valuations? & More, BG2

Brad Gerstner of Altimeter & Bill Gurley of Benchmark debuted their first podcast on tech markets from VC to public equities, with AI as their primary driver. Sharing their opinions on AI hype cycles, consolidation of dollars (and credits) to the heavyweights like OpenAI and Anthropic, as well as the sheer density of top talent they’ve attracted. Whether or not the key players (& the growing list of foundational models behind them) make it out to be a good investment return, the two agreed they’ve cracked the code on igniting a new innovation cycle.

P.S. This might have the potential to dethrone the All-in Pod as the #1 Business Pod? (as the Besties tend to fall into gossip & politics territory often, & less so on how to scale and evaluate a billion-dollar business).

How MIT Builds Their Venture Fund Portfolio & How MIT Approach Direct Investing,

MITIMCo’s Ryan Akkina has invested in the likes of Sequoia, Kleiner Perkins, a16z, Greenoaks, and Initialized to name a few. Ryan also leads many of MITIMCo’s direct co-investments including most notably into Coupang and Rippling.

SaaS is Back?

ServiceNow: AI Drove the Largest New Bookings of Any New Product, Tomasz Tunguz

The end of SaaS? Not so fast. Some companies have taken the initiative to compete in this GenAI world and their products are selling.. pretty well?

Maybe some VCs need to rip a page out of the good ole Tiger Global book to round up the consultants, fire up their laptops, and get them to work at scrubbing their portfolio companies down with some ‘AI-soap’ exfoliating wash (no? bad joke? I’m referring to fancy ‘Aesop’ reverence aromatique hand wash). If we haven’t been reminded enough over the last 3 years since Covid’s ‘recession’ scare, it’s really time to listen, streamline overall bottlenecks, reduce built-up ZIRP organizational bloat, consolidate services, and upgrade products & sales with some AI ‘magic’ (or consultants).

- of Altimeter

Excerpt from ServiceNow’s Earnings:

“Gartner estimates $5 trillion in tech spending in 2024, growing to $6.5 trillion by 2027.. between 2023 and 2027, $3 trillion will be spent on AI. What we have here is a strong, durable market being supercharged by a once-in-a-generation secular trend. ServiceNow has been investing, innovating and preparing for this wave for years, which is why we're catching it so early.. with regard to Gen AI, the momentum is outstanding. As I said, that SKU has outsold any other new introduction we put into the marketplace.”

Security & Data → The Fastest Growing Software Sectors in 2024, Tomasz Tunguz

Not surprised security is one of the categories with the highest expected growth, and I genuinely hope it is. After spending time in the weeds researching AI infrastructure.. it is clear this area is increasingly more vulnerable with newer & more effective tactics to hack into data repositories, impersonate individuals/PII, and scrape data.

Some of the biggest breaches in the last year:

Trello 15 million users of project management software platform Trello have their data leaked on the dark web

23andMe confirms hackers stole ancestry data on 6.9 million users

Okta threat actor ran and downloaded a report that contained the names and email addresses of all Okta customer support system users

Okta has around 18,000 business customers, according to the company’s website, including 1Password, Cloudflare, OpenAI and T-Mobile.

→ Read more here on OpenAI, MailChimp, T-Mobile, MOVEit, Twitter, Slack, etc. breaches

Media

Mike Solana’s media company Pirate Wires launches BIG as mainstream media continues to crumble

Remember when → Elon said a big GFY to advertising giants like Disney? As folks like Elon started to speak out more aggressively against the anti-tech, negativity-pumping, drama-fueled headlines, it seems some people are becoming more empowered to demand better journalism. Luckily, Mike Solana and his crew at Pirate Wires are here to deliver that.

Favorite piece so far → DON'T DIE: An Interview with Bryan Johnson

Broader view: Maybe, in the wake of its vulnerability, it’s time to reorient mainstream media content to real, objective information and data? Is that too crazy? Maybe the pressure to convert clicks amidst sinking businesses and pay, has pushed journalists to resort to less than favorable clickbait content? Or maybe they just never knew any better and they’re playing the game? I don’t know. But I do believe they should take the higher road & lead with quality journalism. Even if that means going independent, starting a Substack, or even building their own media empire like Mike Solana.

More

Reddit may be targeting a $5 billion valuation for its upcoming IPO, Bloomberg

Amazon terminates iRobot deal, Roomba maker to lay off 31% of staff, CNBC

Microsoft lays off 1,900 Activision Blizzard and Xbox employees, The Verge

iPhone Apps Secretly Harvest Data When They Send You Notifications, Researchers Find, Gizmodo

Security researchers say apps including Facebook, LinkedIn, TikTok, Twitter, and countless others collect data in surprising ways

. . .

Last Week (1/22-1/26):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Bilt Rewards, Ansel, ModernFi, Turquoise Health, Torq, Sierra, ElevenLabs, Clerk, Norm AI, TextQL, Bagel Network, ViralMoment, AiDash, Albedo, Digs, Cargado, Captura; Yieldstreet/Cadre, Autodesk/Payapps

Final numbers on US IPO Market 2014-2024 & The Magnificent 7’s Winning Streak at the bottom.

Deals

Fintech:

- Bilt Rewards, a New York City-based rewards platform for rent payments and neighborhood spending, raised $200 million in funding. General Catalyst led the round and was joined by Eldridge and existing investors Left Lane Capital, Camber Creek, and Prosus Ventures.

- DailyPay, a New York-based on-demand payments company, raised $75m at a $1.75b valuation led by Carrick Capital Partners. It also secured a $100m credit facility extension from Citi. https://axios.link/3UatIFd

- Ansel, a New York-based insurtech, raised $20 million in funding. Portage led the round and was joined by Two Sigma Ventures, Brewer Lane Ventures, SixThirty Ventures, Plug and Play Ventures, Digitalis Ventures, Symphony AI, and others.

- ModernFi, a New York City-based deposit network, raised $18.7 million in Series A funding. Canapi Ventures led the round and was joined by Andreessen Horowitz, Remarkable Ventures, and others.

- Sequence, a Tel Aviv, Israel-based personal finance management platform, raised $5.5 million in funding from Aleph

- Alphathena, a Warrenville, Ill.-based indexing platform for financial advisors, raised $4 million in funding. ETFS Capital led the round and was joined by Hyde Park Angels.

- Synonym Finance, a Toronto, Canada-based cross-chain lending platform, raised $1.5 million. Borderless Capital led the round and was joined by Robot Ventures, Big Brain Holdings, Veris Ventures, and others.

. . .

Care:

- Turquoise Health, a San Diego, Calif.-based healthcare pricing platform, raised $30 million in Series B funding. Adams Street Partners led the round and was joined by Yosemite and existing investors Andreessen Horowitz and BoxGroup.

- Isaac Health, a New York City-based virtual brain health and memory clinic platform, raised $5.7 million in seed funding. Meridian Street Capital and B Capital led the round and was joined by Primetime Partners, Co-Found Partners, VU Venture Partners, and AirAngels.

- Being Health, a New York City-based mental health care provider, raised $5.4 million in funding from 18 Park and HDS Capital.

- HEAL Security, a Menlo Park, Calif.-based cybersecurity platform designed for the health care industry, raised $4.6 million in pre-seed funding from Health2047 and others.

- Coral Care, a platform that connects parents to childhood development specialists, raised $1.3m from Reach Capital, Greymatter Capital, and Purpose Built Ventures, per Axios Pro. https://axios.link/4b1RTfb

. . .

Enterprise & Consumer:

- Silverfort, a Tel Aviv, Israel and Boston, Mass.-based provider of identity protection software, raised $116 million in Series D funding. Brighton Park Capital led the round and was joined by existing investors Acrew Capital, Greenfield Partners, Citi Ventures, and others.

- TravelPerk, a Barcelona-based business travel management platform, raised $104m. SoftBank led, and was joined by insiders Kinnevik and Felix Capital. https://axios.link/496wYWC

- Sierra, an enterprise AI company co-founded by OpenAI chair Bret Taylor, is finalizing an $85 million investment led by Sequoia Capital at a $1b valuation, per Bloomberg.

- ElevenLabs, a New York-based AI voice synthesis platform, raised $80m in Series B funding at over a $1b valuation co-led by insider a16z, Nat Friedman, and Daniel Gross. Other backers include Sequoia Capital, Smash Capital, SV Angel, BroadLight Capital, and Credo Ventures. https://axios.link/3u4u3yM

- Bastille, a Santa Cruz, Calif. and San Francisco-based provider of wireless threat intelligence technology to prevent corporate and nation-state espionage, raised $44 million in Series C funding. Goldman Sachs led the round and was joined by Bessemer Venture Partners.

- Torq, a Portland, Ore.-based no-code automation platform for security teams, raised $42m in Series B extension funding from Bessemer Venture Partners, GGV Capital, Insight Partners, Greenfield Partners, and Evolution Equity Partners. https://axios.link/3S2aa32

- Kittl, a Berlin, Germany-based developer of text-to-graphic AI technology, raised $36 million in Series B funding. IVP led the round and was joined by Left Lane Capital.

- Oleria, a Seattle, Wash.-based provider of autonomous identity security solutions, raised $33.1 million in Series A funding. Evolution Equity Partners led the round and were joined by Salesforce Ventures, Tapestry VC, Zscaler, and others.

- Anomalo, a Palo Alto, Calif.-based data quality platform, raised $33m in Series B funding. SignalFire led, and was joined by Databricks Ventures and insiders Norwest Venture Partners, Two Sigma Ventures, and Foundation Capital. https://axios.link/3Sd69Jj

- Clerk, an SF-based user authentication platform, raised $30m in Series B funding. CRV led, and was joined by a16z, Stripe, and Madrona. https://axios.link/3SrpMia

- Spellbook, a Toronto, Canada-based AI co-pilot for lawyers, raised $30 million in Series A funding. Inovia Capital led the round and was joined by Thomson Reuters Ventures, The Legaltech Fund, Bling Capital, Moxxie Ventures, Concrete Ventures, Path Ventures, N49P, and Good News Ventures.

- Axiom, a New York City-based on-chain data provider for smart contract developers, raised $20 million in funding. Paradigm and Standard Crypto led the round and was joined by Robot Ventures, Ethereal Ventures, and others.

- Norm Ai, a New York City-based provider of AI bots for compliance teams, raised $11.1 million in seed funding. Coatue led the round and was joined by Haystack Ventures, M13 Ventures, and others.

- deeploi, a Berlin, Germany-based developer of an enterprise IT management platform, raised $6.5 million in seed funding. Atomico led the round and was joined by existing investor Cherry Ventures.

- Masa Network, a San Francisco-based company building a decentralized data economy, raised $5.4 million in seed funding. Anagram led the round and was joined by Avalanche Blizzard Fund, Digital Currency Group, GoldenTree, OP Crypto, Unshackled Ventures, and others.

- UpSmith, a Dallas, Texas-based employee recruiting and productivity monitoring platform, raised $5 million in funding. Hannah Grey VC led the round and was joined by a16z, GSV Ventures, Asymmetric Capital Partners, Cubit Capital, and others.

- Prompt Security, a Tel Aviv, Israel-based provider of generative AI security for enterprises, raised $5 million in seed funding. Hertz Ventures led the round and was joined by Four Rivers and angel investors.

- Boomerang, a Miami, Fla.-based lost and found platform for stadiums, raised $4.9 million in seed funding. LightShed Ventures led the round and was joined by GGV, GoldHouse, Harlo Capital, Dream Ventures, Lake Nona Fund, SeventySix Capital, and others.

- RagaAI, a San Francisco.-based platform designed to test for issues in AI programs, raised $4.7 million in seed funding. pi Ventures led the round and was joined by Anorak Ventures, TenOneTen Ventures, Arka Ventures, Mana Ventures, and Exfinity Venture Partners.

- TextQL, a San Francisco-based AI-powered data discovery and analytics platform, raised $4.1 million in pre-seed and seed funding. Neo and DCM led the round and were joined by Unshackled Ventures, Worklife Ventures, PageOne Ventures, FirstHand Ventures, Indicator Fund, and angel investors.

- unSkript, a San Jose, Calif.-based health monitor for tech infrastructure, raised $3.8 million in pre-seed funding from Westwave Capital, First Rays Venture Partners, Scribble Ventures, Zero Prime Ventures, and angel investors.

- Krepling, a Chattanooga, Tenn.-based provider of tools and services to e-commerce businesses, raised $3.3 million in seed funding from LAUNCH, Brickyard, Front Porch Ventures, 11 Tribes Ventures, Colabora Ventures, and Broadshade Investments.

- Bagel Network, a Toronto, Canada-based machine learning platform, raised $3.1 million in pre-seed funding. CoinFund led the round and was joined by Protocol Labs, Borderless Capital, Maven 11 Capital, Graph Paper Capital, and Breed VC.

- ViralMoment, a Menlo Park, Calif.-based AI model that analyzes viral trends in short-form social media videos, raised $2.5 million in seed funding. Supernode Global led the round and was joined by Crush Ventures, Duo Partners, Carnegie Mellon University, and Techstars.

- Send AI, an Amsterdam, Netherlands-based provider of software designed to automatically read documents and extract information through the use of AI, raised €2.2 million ($2.4 million) in funding. Gradient Ventures and Keen Venture Partners led the round and were joined by angel investors.

. . .

HardTech:

- AiDash, a San Jose, Calif.-based satellite platform for infrastructure operations and maintenance, raised $50m in Series C funding. Lightrock led, and was joined by SE Ventures and insiders G2 Venture Partners, Benhamou Global Ventures, National Grid Partners, Edison International, and Shell Ventures. www.aidash.com

- Welligence Energy Analytics, a Houston, Texas-based data and analytics platform for the global oil and gas markets, greenhouse gas emissions, and carbon capture projects, raised $41 million in Series B funding. Elephant led the round and was joined by Veriten, EDG Group, and others.

- Albedo, a Dever, Colo.-based provider of high-resolution imagery from space, raised $35 million in funding from Booz Allen Ventures, Standard Investments, Initialized Capital, Y Combinator, Giant Step Capital, Republic Capital, and others.

- Bluewhite, a Tel Aviv, Israel-based developer of remote and autonomous farming technology for tractors, raised $39 million in Series C funding. Insight Partners led the round and was joined by Alumni Ventures, LIP Ventures, and others.

- CheckSammy, a Dallas-based bulk waste collection startup, raised around $22.5m in equity funding led by I Squared Capital, per Axios Pro. https://axios.link/3u4otwg

- Packmatic, a Berlin, Germany-based packaging marketplace, raised €15 million ($16.3 million) in Series A funding. EQT Ventures led the round and was joined by HV Capital, xDeck, and angel investors.

- Digs, a Vancouver, Wash.-based collaboration platform for homebuilders and owners, raised $7m in new seed funding. Oregon Venture Fund and Legacy Capital Ventures co-led, and were joined by insiders Fuse, Flying Fish, Betaworks, and PSE. https://axios.link/48M86nb

- Cargado, a Chicago, Ill.-based developer of U.S.-Mexico cross border logistics software, raised $3 million in pre-seed funding. Ironspring Ventures and was joined by Zenda Capital, Wischoff Ventures, Proeza Ventures, Sahil Bloom, and others.

. . .

Sustainability:

- Captura, a Pasadena, Calif.-based startup focused on open-ocean carbon capture, raised $21.5m in Series A expansion funding, per Axios Pro. Backers include Maersk, Eni, and EDP. https://axios.link/3SrARzC

Acquisitions & PE:

- LiveRamp agreed to acquire Habu, a San Francisco, Calif. And Boston, Mass.-based data collaboration platform, for $200 million.

- FTV Capital acquired a minority stake in BillingPlatform, a Denver, Colo.-based revenue lifecycle platform for businesses, for $90 million.

- Yieldstreet, a VC-backed multi-asset alternative investment platform, completed its purchase of Cadre, a New York-based real estate tech firm. Cadre had raised around $130m in VC funding from backers like Andreessen Horowitz, Thrive Capital, General Catalyst, Founders Fund, Spur Capital Partners, Khosla Ventures, Lakestar and Jaws Ventures. https://axios.link/47Ed8Bp

- Wasabi, a Boston-based cloud storage company valued by VCs at $1.1b, acqui-hired the team of video indexing tool Curio from GrayMeta. https://axios.link/3OhMC9r

- Synchrony (NYSE: SYF) agreed to acquire Ally Financial's (NYSE: ALLY) point-of-sale financing business, including $2.2b of loan receivables. www.synchrony.com

- Suave Brands, a portfolio company of Yellow Wood Partners agreed to buy lip balm brand Chap Stick from Haleon (LSE: HLN) for $510m (including $430m in cash). https://axios.link/3HvfC9M

- Autodesk (Nasdaq: ADSK) agreed to acquire Payapps, an Australian provider of construction payment and compliance management software. Payapps had raised over US$30m from firms like FM Investors, Primorus Investments, and Salta Capital. https://axios.link/3U9jN2P

- WaterRower, a Warren, R.I.-based maker of indoor rowing machines, acquired CityRow, a New York-based rival that had raised around $16m from firms like Everywhere Ventures. Earlier reports had linked L Catterton-backed Hydrow to CityRow. https://axios.link/3S9wKak

Funds:

- Innovations Endeavors, a Palo Alto, Calif.-based venture capital firm, raised $630 million for its fifth fund focused on companies in intelligent software, computing infrastructure, climate, and other industries.

- Propeller, a VC firm focused on climate and oceans, raised $117m for its debut fund, per Axios Pro. https://axios.link/3u3EthU

Final Numbers

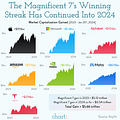

The Magnificent 7

America’s flagship stock market index, the S&P 500, closed at another record high yesterday, as a stream of solid earnings reports — including Netflix (see more below) — drove the index to a fresh high.

Gone are the stock acronyms of FANG, MANTAMAN, or FAATMAN, and in is a new moniker for companies driving the market: The Magnificent 7 — Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. Not for decades has the US stock market been so top-heavy, with 28% of the index concentrated in just these 7 names. Indeed, the two biggest components are so large that buying $100 of an S&P 500 fund now means you’ve effectively bought ~$7 in Apple stock and ~$7 in Microsoft, with the other ~$86 split among the remaining stocks in the index.

Big tech’s relentless rise has seen these companies gain $5.66 trillion in market cap since the start of last year. That’s equivalent to adding the value of 33 Walt Disney companies... in just over 12 months.

US IPO Market

Keep reading with a 7-day free trial

Subscribe to Sourcery to keep reading this post and get 7 days of free access to the full post archives.